Waterborne Coatings Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

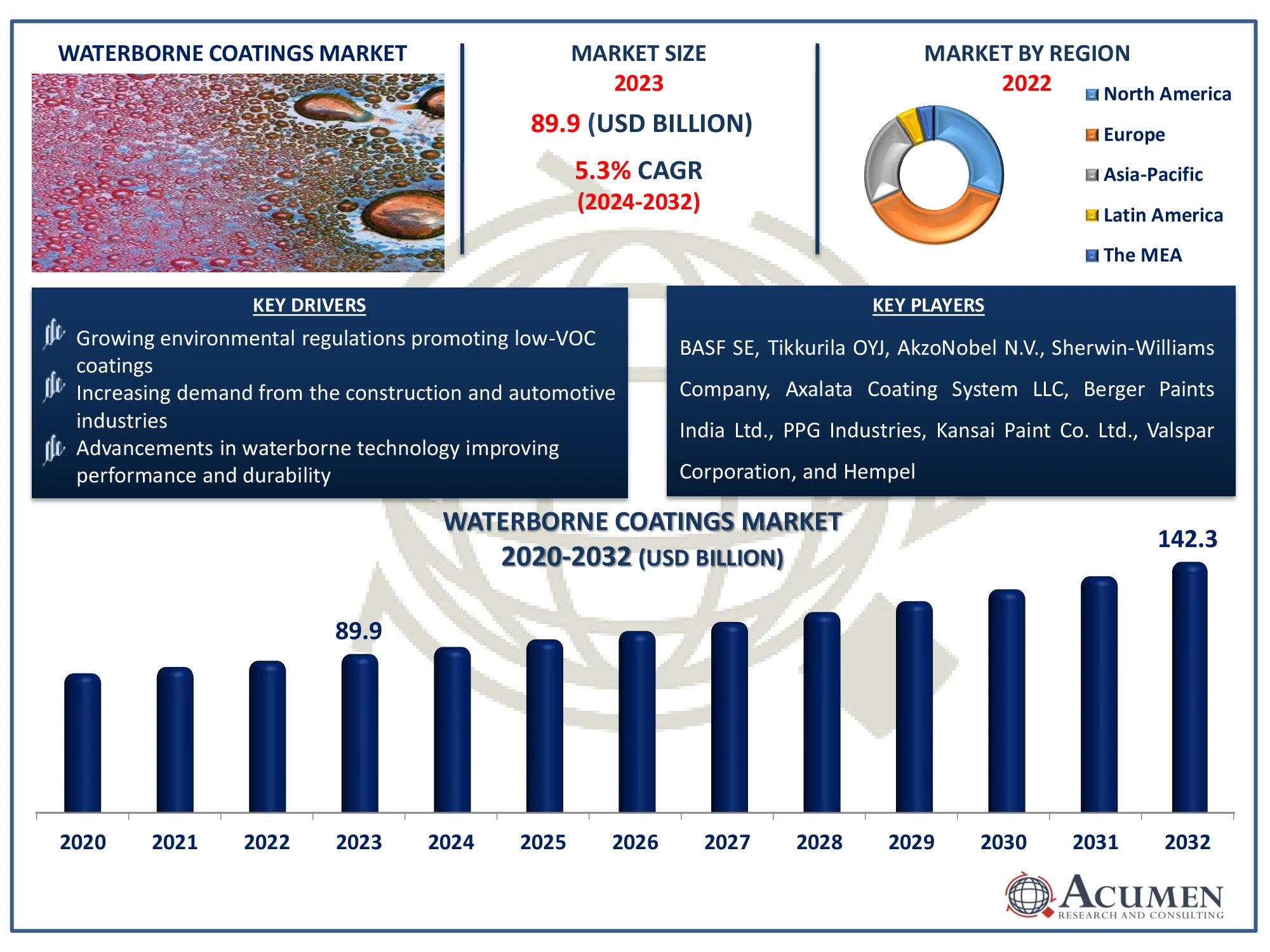

The Global Waterborne Coatings Market Size accounted for USD 89.9 Billion in 2023 and is estimated to achieve a market size of USD 142.3 Billion by 2032 growing at a CAGR of 5.3% from 2024 to 2032.

Waterborne Coatings Market (By Resin: Ambient Acrylic, Polyurethane (PU), Epoxy, Alkyd, Polyester, Polytetrafluoroethylene (PTFE), Polyvinylidene Chloride (PVDC), Polyvinylidene Fluoride (PVDF), and Others; By Application: Architectural, General Industrial, Automotive OEM, Metal Packaging, Protective Coatings, Automotive Refinish, Industrial Wood, Marine, Coil, and Others; and By Region: North America, Europe, Asia-Pacific, Latin America, and MEA)

Waterborne Coatings Market Highlights

- The global waterborne coatings market revenue is projected to reach USD 142.3 billion by 2032, growing at a CAGR of 5.3% from 2024 to 2032

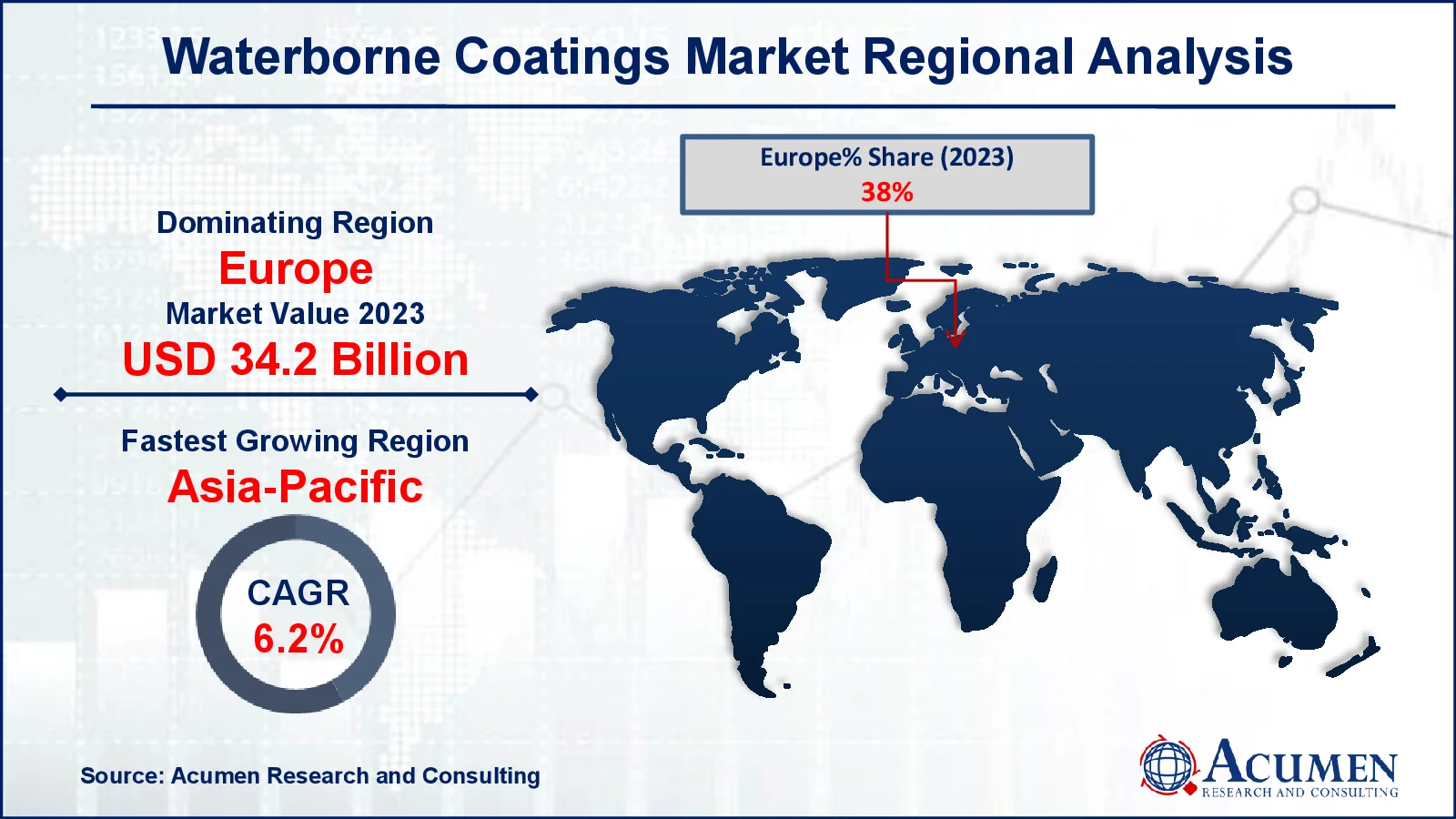

- In 2023, the waterborne coatings market in Europe was valued at approximately USD 34.2 billion

- The Asia-Pacific waterborne coatings market is expected to grow at a CAGR of over 6.2% from 2024 to 2032

- The acrylic resin sub-segment is anticipated to account for 83% of the market share in 2023

- The architectural application sub-segment exhibited 86% growth in 2023

- Increasing adoption of low-VOC and eco-friendly formulations is the waterborne coatings market trend that fuels the industry demand

Waterborne coatings are coverings that include around 80% water and trace amounts of other solvents, such as glycol ethers, and are applied to a surface to scatter a resin. Waterborne coatings are so named because they include water. Waterborne coatings offer qualities such as low VOC, low fragrance, and non-combustibility, in addition to high water content, making them environmentally friendly and easy to apply. Waterborne coatings dry incredibly quickly and can be re-coated. Waterborne coatings are used in a variety of applications due to qualities that make them a suitable foundation, such as strong abrasion and heat resistance, excellent bonding, and low toxic quality and combustibility due to low VOC levels and HAP emissions.

Global Waterborne Coatings Market Dynamics

Market Drivers

- Growing environmental regulations promoting low-VOC coatings

- Increasing demand from the construction and automotive industries

- Advancements in waterborne technology improving performance and durability

Market Restraints

- Higher cost compared to solvent-borne coatings

- Longer drying times in humid conditions

- Limited performance in extreme environmental conditions

Market Opportunities

- Rising demand for eco-friendly coatings in emerging markets

- Technological innovations in waterborne formulations

- Expanding applications in industrial and marine sectors

Waterborne Coatings Market Report Coverage

| Market | Waterborne Coatings Market |

| Waterborne Coatings Market Size 2022 |

USD 89.9 Billion |

| Waterborne Coatings Market Forecast 2032 | USD 142.3 Billion |

| Waterborne Coatings Market CAGR During 2023 - 2032 | 5.3% |

| Waterborne Coatings Market Analysis Period | 2020 - 2032 |

| Waterborne Coatings Market Base Year |

2022 |

| Waterborne Coatings Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Resin, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | BASF SE, Tikkurila OYJ, AkzoNobel N.V., Sherwin-Williams Company, Axalata Coating System LLC, Berger Paints India Ltd., PPG Industries, Kansai Paint Co. Ltd., Valspar Corporation, and Hempel. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Waterborne Coatings Market Insights

The primary factors driving market expansion are the increased adoption of waterborne coatings over dissolvable borne coatings and rapid economic development in developing countries. The primary factor projected to fuel the architectural and automotive industries is increased consumer spending and population, particularly in the Asia-Pacific area, which complements the market for waterborne coatings. When compared to dissolvable borne coatings, a less amount of aqueous covering is required to cover the same surface area. Stringent environmental regulations, as well as increasing demand from the end-user industry for low VOC, eco-friendly, and non-hazardous coatings, are likely to support the market for aqueous coatings.

The higher cost of waterborne coatings compared to solvent-borne alternatives limits market growth, particularly in cost-sensitive industries such as construction and manufacturing. Waterborne coatings frequently require specialized formulation techniques and raw materials, which can raise production costs. Furthermore, specialist application techniques and equipment may be required, increasing expenses. This price gap can inhibit uptake, especially in regions with less rigorous environmental requirements.

Waterborne formulation technological advances have considerably enhanced coating performance, addressing conventional limitations such as shorter drying times and lesser durability. New improvements have improved the coatings' adhesion, corrosion resistance, and weather ability, allowing them to compete with solvent-borne alternatives. For instance, August 2022 - PPG (NYSE: PPG) launches PPG INNOVEL PRO. This improved internal spray coating contains no bisphenol-A (BPA) or bisphenol starting ingredients, resulting in more robust application qualities for the infinitely recyclable aluminum beverage can. These advancements also enable the creation of customized coatings for a wide range of applications, including automotive and industrial industries that require high performance. As a result, the expanding capabilities of aqueous coatings create new opportunities in areas that require environmentally friendly solutions.

Waterborne Coatings Market Segmentation

The worldwide market for waterborne coatings is split based on resin, application, and geography.

Waterborne Coatings Resin

- Acrylic

- Polyurethane (PU)

- Epoxy

- Alkyd

- Polyester

- Polytetrafluoroethylene (PTFE)

- Polyvinylidene Chloride (PVDC)

- Polyvinylidene Fluoride (PVDF)

- Others

According to the waterborne coatings industry analysis, acrylic coatings dominated the industry. Acrylic coatings are likely to see increased interest from infrastructure and automotive ventures due to their unequaled color and sparkle retention in outdoor applications. Because of their excellent exterior durability, acrylic-modified polyurethane coatings are commonly used in automotive restorations. Alkyd accounted for a significant portion of the market and is expected to be the fastest growing segment. Demand for several end-use industries, such as metal packaging and industrial wood, is expected to rise over the next few years. Because of their versatility in formulation, alkyd-based coatings are used in caulks, fillers, and sealers for wood finishing.

Waterborne Coatings Application

- Architectural

- General Industrial

- Automotive OEM

- Metal Packaging

- Protective Coatings

- Automotive Refinish

- Industrial Wood

- Marine

- Coil

- Others

According to the waterborne coatings industry forecast, the architectural sector dominates market, owing to increased demand for eco-friendly and low-VOC paints in residential and commercial buildings. Waterborne coatings are frequently favored for interior and outdoor applications because they have a lower odor, faster drying times, and are easier to clean up than solvent-based paints. Stringent environmental restrictions, particularly in developed nations, encourage the use of these coatings in architectural projects.

Waterborne Coatings Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Waterborne Coatings Market Regional Analysis

For several reasons, Europe dominates the waterborne coatings market, owing to robust regulatory frameworks that promote environmentally friendly and low-VOC products. The use of waterborne coatings is driven by the European Union's severe environmental rules and an increasing customer preference for green construction solutions. Furthermore, presence of key players and their collaborations further contributes to market growth. For instance, in July 2022, PPG, in collaboration with UK airline brand and design consultant Aero brand, launched a new service that combines paint supply with unique airline livery design. This service enables airline clients to collaborate directly with PPG designers at their LIVERY LABSM locations in Burbank, California, and Shildon, United Kingdom. Customers can develop bespoke paint colors and have direct input on the design of their aircraft liveries, resulting in a tailored and collaborative approach to aircraft branding and aesthetics.

The waterborne coatings market in Asia-Pacific is expected to grow due to rapid industrialization, urbanization, increased construction, and stringent environmental regulations. For instance, China's industrial production increased steadily last year, accompanied by a higher pace of intelligent and green transformation, according to government figures. According to the National Bureau of Statistics, value-added industrial output, an important economic indicator, would rise by 4.6% year on year in 2023. Innovations in coating technology and a focus on reducing carbon footprints are also driving growth.

Waterborne Coatings Market Players

Some of the top waterborne coatings companies offered in our report include BASF SE, Tikkurila OYJ, AkzoNobel N.V., Sherwin-Williams Company, Axalata Coating System LLC, Berger Paints India Ltd., PPG Industries, Kansai Paint Co. Ltd., Valspar Corporation, and Hempel.

Frequently Asked Questions

How big is the Waterborne Coatings market?

The waterborne coatings market size was valued at USD 89.9 billion in 2023.

What is the CAGR of the global Waterborne Coatings market from 2024 to 2032?

The CAGR of waterborne coatings is 5.3% during the analysis period of 2024 to 2032.

Which are the key players in the Waterborne Coatings market?

The key players operating in the global market are including BASF SE, Tikkurila OYJ, AkzoNobel N.V., Sherwin-Williams Company, Axalata Coating System LLC, Berger Paints India Ltd., PPG Industries, Kansai Paint Co. Ltd., Valspar Corporation, and Hempel.

Which region dominated the global Waterborne Coatings market share?

Europe held the dominating position in waterborne coatings industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of waterborne coatings during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global Waterborne Coatings industry?

The current trends and dynamics in the waterborne coatings industry include growing environmental regulations promoting low-voc coatings, increasing demand from the construction and automotive industries, and advancements in waterborne technology improving performance and durability

Which Resin held the maximum share in 2023?

The acrylic expected to hold the maximum share of the waterborne coatings industry.