PVDF Membrane Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

PVDF Membrane Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

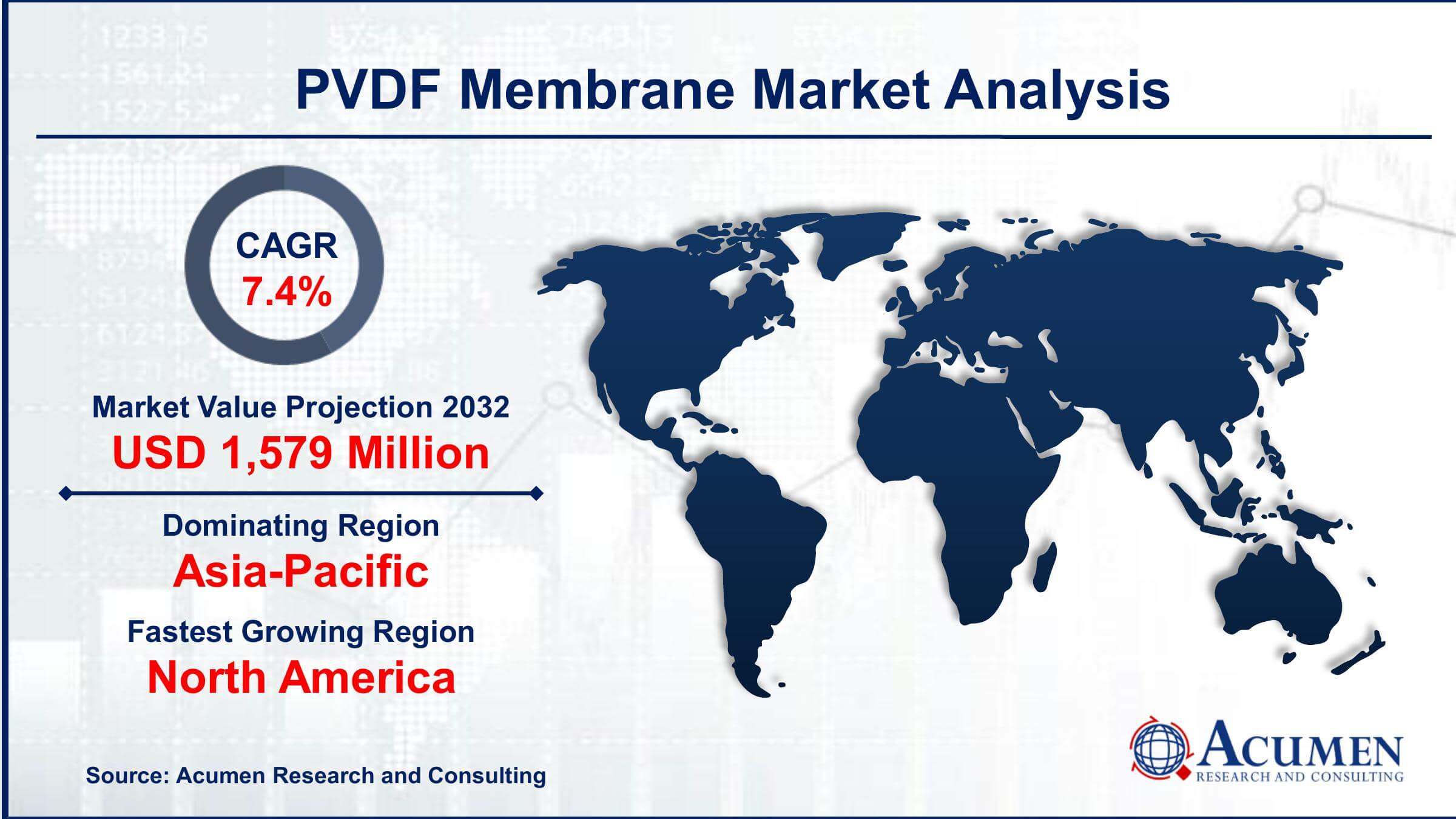

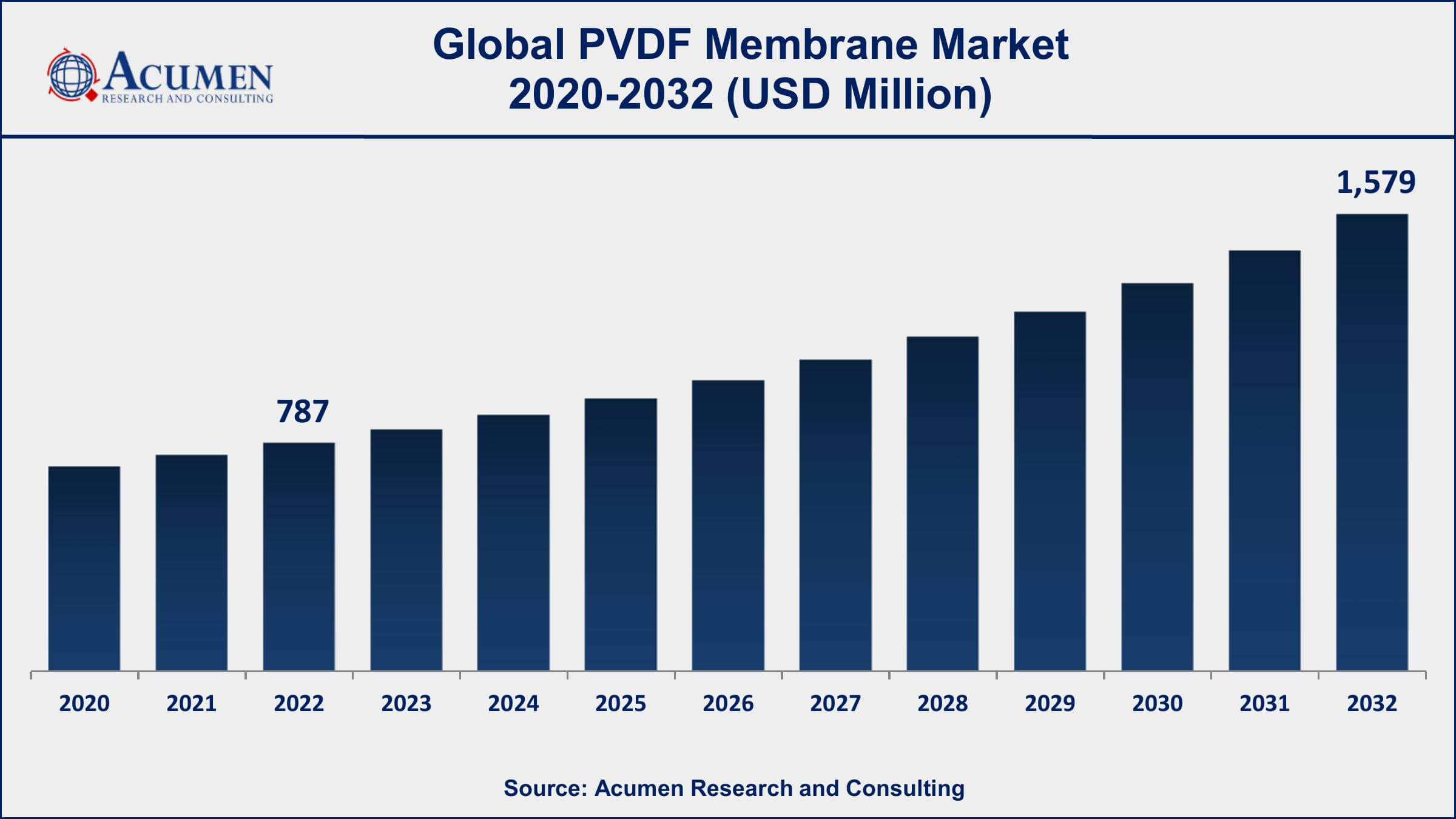

Request Sample Report

The Global PVDF Membrane Market Size accounted for USD 787 Million in 2022 and is projected to achieve a market size of USD 1,579 Million by 2032 growing at a CAGR of 7.4% from 2023 to 2032.

PVDF Membrane Market Highlights

- Global PVDF Membrane Market revenue is expected to increase by USD 1,579 Million by 2032, with a 7.4% CAGR from 2023 to 2032

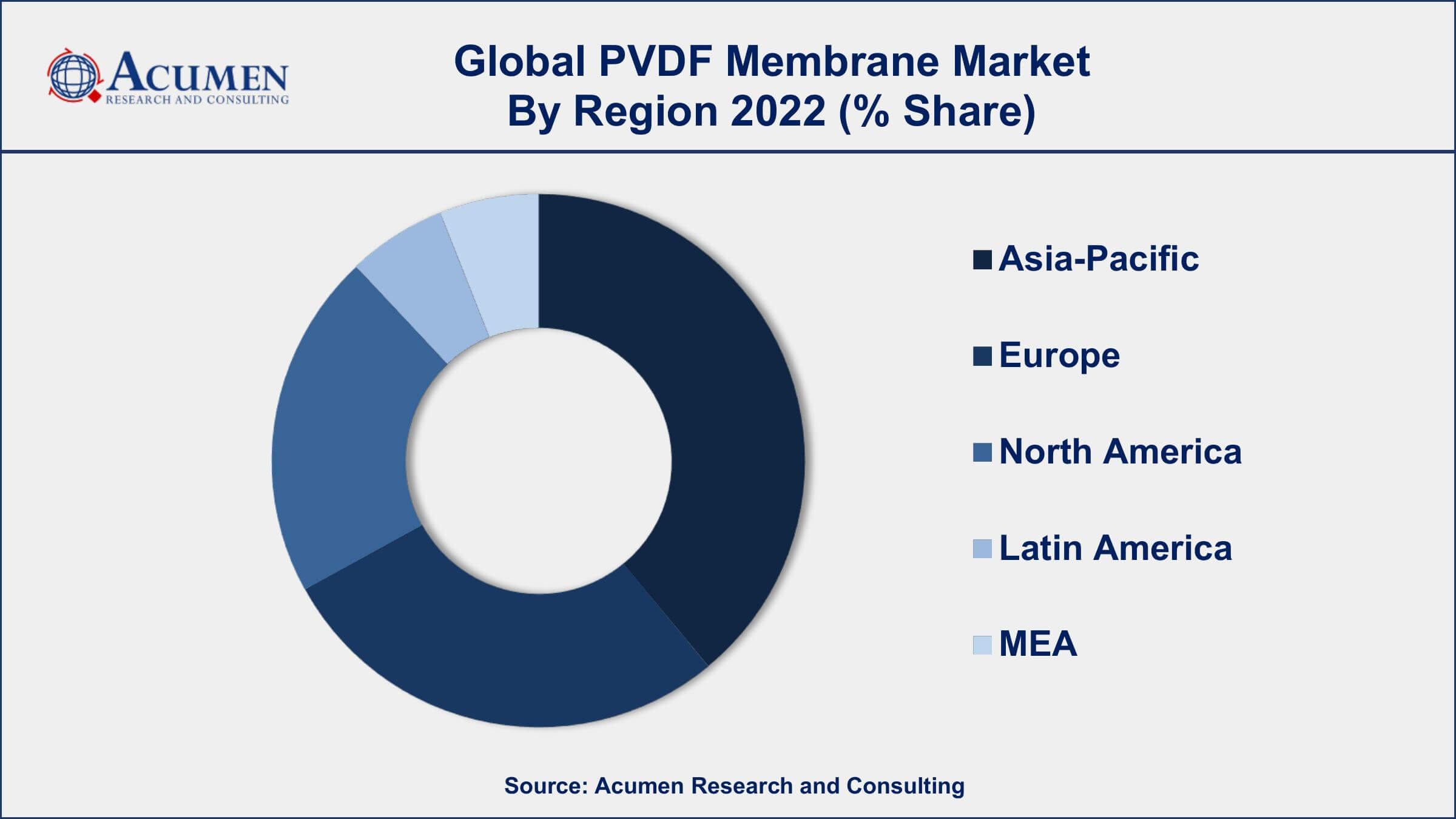

- Asia-Pacific region led with more than 35% of PVDF Membrane Market share in 2022

- North America PVDF Membrane Market growth will record a CAGR of around 8% from 2023 to 2032

- By technology, the microfiltration segment has recorded more than 39% of the revenue share in 2022

- By membrane type, the hydrophilic segment has accounted more than 71% of the revenue share in 2022

- Growing demand for advanced water and wastewater treatment solutions, drives the PVDF Membrane Market value

Polyvinylidene fluoride, commonly known as PVDF, is a synthetic polymer with exceptional chemical resistance, thermal stability, and mechanical strength. PVDF membranes are thin sheets made from this material and are widely used in various applications, primarily in the field of separation, filtration, and purification. These membranes are known for their porosity and compatibility with a wide range of solvents and chemicals, making them valuable in industries such as biotechnology, pharmaceuticals, water treatment, and electronics.

The market growth of PVDF membranes has been steadily rising over the past few years. This growth can be attributed to the increasing demand for advanced filtration and separation technologies in industries like pharmaceuticals and biotechnology, where these membranes are used for protein separation, sterile filtration, and virus removal. Additionally, the expanding global population and industrial activities have led to heightened concerns about water scarcity and environmental pollution, driving the adoption of PVDF membranes in water and wastewater treatment processes. The versatility of PVDF membranes in handling harsh chemicals and extreme conditions further broadens their applications in industries like petrochemicals and electronics.

Global PVDF Membrane Market Trends

Market Drivers

- Growing demand for advanced water and wastewater treatment solutions

- Increasing applications in biopharmaceutical and medical industries

- Rising focus on electronics manufacturing and microfiltration

- Stringent environmental regulations driving adoption in pollution control

- Expanding industrial processes requiring chemical-resistant separation materials

Market Restraints

- High production costs impacting affordability for certain applications

- Competition from alternative membrane materials like PTFE and nylon

Market Opportunities

- Expansion of membrane use in emerging economies with industrial growth

- Integration into decentralized water purification systems for remote areas

PVDF Membrane Market Report Coverage

| Market | PVDF Membrane Market |

| PVDF Membrane Market Size 2022 | USD 787 Million |

| PVDF Membrane Market Forecast 2032 | USD 1,579 Million |

| PVDF Membrane Market CAGR During 2023 - 2032 | 7.4% |

| PVDF Membrane Market Analysis Period | 2020 - 2032 |

| PVDF Membrane Market Base Year | 2022 |

| PVDF Membrane Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Technology, By Membrane Type, By Application, By End-user Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Merck KGaA (MilliporeSigma), Thermo Fisher Scientific Inc., Pall Corporation (acquired by Danaher Corporation), Sartorius AG, GE Healthcare (now part of Cytiva), Koch Membrane Systems, GVS S.p.A., VWR International, Sterlitech Corporation, Alfa Laval AB, Synder Filtration, and Advantec MFS, Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Polyvinylidene fluoride (PVDF) membrane is a type of filtration material derived from the synthetic polymer PVDF. PVDF is known for its exceptional chemical resistance, mechanical strength, and thermal stability. PVDF membranes are created by forming thin sheets of this polymer with controlled pore sizes, resulting in a versatile material that finds widespread use in various filtration, separation, and purification applications.

PVDF membranes have diverse applications across multiple industries. In biopharmaceuticals and life sciences, they are utilized for protein separation, virus filtration, and DNA purification due to their compatibility with biological fluids and resistance to aggressive solvents. In water treatment, PVDF membranes play a crucial role in microfiltration and ultrafiltration processes, removing particles, bacteria, and other contaminants from water sources. Additionally, PVDF membranes are employed in the electronics industry for tasks such as solvent and chemical filtration during semiconductor manufacturing, benefiting from their resistance to harsh chemicals and solvents.

The PVDF membrane market has witnessed substantial growth in recent years and is poised to continue expanding. This growth is propelled by a confluence of factors that underscore the material's versatile applications in separation, filtration, and purification processes across multiple industries. The increasing demand for clean and safe water, coupled with stringent environmental regulations, has spurred the adoption of PVDF membranes in water treatment systems. These membranes offer high chemical resistance and durability, making them suitable for treating a wide range of contaminants, from microorganisms to pollutants, thus driving their adoption in municipal and industrial water treatment facilities. Moreover, PVDF membranes have gained prominence in industries like biopharmaceuticals and electronics. In biopharmaceutical manufacturing, PVDF membranes play a crucial role in processes such as protein purification and sterile filtration.

PVDF Membrane Market Segmentation

The global PVDF Membrane Market segmentation is based on technology, membrane type, application, end-user industry, and geography.

PVDF Membrane Market By Technology

- Microfiltration

- Ultrafiltration

- Nanofiltration

- Others

According to the PVDF membrane industry analysis, the microfiltration segment accounted for the largest market share in 2022. Microfiltration involves the separation of particles and microorganisms from liquids, and PVDF membranes have emerged as a preferred choice for this application due to their unique properties. The inherent porosity of PVDF membranes allows them to selectively remove particles while maintaining the integrity of the filtrate, making them essential in industries like biopharmaceuticals, food and beverage, electronics, and more. In the biopharmaceutical sector, PVDF membranes are utilized for critical tasks such as clarifying and purifying proteins, enzymes, and other bioactive compounds. Their compatibility with a wide range of solvents and their resistance to aggressive chemicals make them ideal for maintaining product integrity during filtration processes.

PVDF Membrane Market By Membrane Type

- Hydrophilic

- Hydrophobic

In terms of membrane types, the hydrophilic segment is expected to witness significant growth in the coming years. PVDF membranes, inherently hydrophobic in nature, can be modified to be hydrophilic, meaning they attract and interact favorably with water. This characteristic makes hydrophilic PVDF membranes highly suitable for applications where water-based solutions need to be filtered or separated while minimizing issues like wetting or fouling. One notable industry where the hydrophilic PVDF membranes have gained traction is in the medical and biotechnology sectors. These membranes are widely used in applications such as blood filtration, protein separation, and diagnostic assays. The hydrophilic property ensures that the membranes effectively interact with biological fluids, leading to minimal protein binding and improved filtration performance.

PVDF Membrane Market By Application

- Filtration

- Purification

- Blotting

- Separation

- Others

According to the PVDF membrane market forecast, the purification segment is expected to witness significant growth in the coming years. PVDF membranes play a crucial role in this context due to their exceptional chemical resistance, mechanical strength, and versatility. They are widely utilized in purifying various substances, ranging from water and beverages to pharmaceutical compounds and industrial chemicals. In the water and wastewater treatment industry, PVDF membranes are essential for purifying water from various sources, including municipal supplies and industrial effluents. Their ability to remove contaminants such as suspended solids, microorganisms, and pollutants has positioned them as a cornerstone of modern purification systems. Additionally, in the pharmaceutical and biotechnology sectors, PVDF membranes are instrumental in purifying drugs, vaccines, enzymes, and other bioproducts.

PVDF Membrane Market By End-user Industry

- Biopharmaceutical

- Pharmaceutical

- Food and Beverage

- Others

Based on the end-user industry, the biopharmaceutical segment is expected to continue its growth trajectory in the coming years. This growth due to the critical role these membranes play in ensuring the safety, quality, and efficiency of biopharmaceutical manufacturing processes. PVDF membranes are particularly well-suited for this sector because of their exceptional chemical compatibility, high flow rates, and ability to maintain the integrity of sensitive biomolecules. These attributes have made PVDF membranes a preferred choice for applications such as protein purification, sterile filtration, and virus removal. In protein purification, PVDF membranes are utilized to separate target proteins from complex mixtures. The membranes' fine pore size and precise particle retention enable efficient separation without compromising protein structure and activity. Additionally, PVDF membranes are essential in sterile filtration, a process vital to maintaining the sterility of biopharmaceutical products.

PVDF Membrane Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

PVDF Membrane Market Regional Analysis

The Asia-Pacific region has emerged as a dominating force in the PVDF membrane market for several compelling reasons. One of the primary factors contributing to this dominance is the region's robust industrial growth and expanding manufacturing sectors. As countries in Asia-Pacific experience rapid economic development, there is an increased demand for advanced technologies, including those related to water treatment, biopharmaceuticals, electronics, and more. PVDF membranes, with their versatile applications and benefits in various industries, are a natural fit to address the diverse filtration and separation needs of these growing sectors. Moreover, the Asia-Pacific region is home to a significant portion of the global population, resulting in substantial requirements for clean water, efficient healthcare, and improved quality of life. As governments and industries in this region prioritize environmental protection, the demand for effective water treatment solutions using PVDF membranes has surged. Additionally, the presence of a thriving biopharmaceutical industry, coupled with the need for cost-effective and reliable protein purification and separation technologies, has further fueled the adoption of PVDF membranes in the region.

PVDF Membrane Market Player

Some of the top PVDF membrane market companies offered in the professional report include Merck KGaA (MilliporeSigma), Thermo Fisher Scientific Inc., Pall Corporation (acquired by Danaher Corporation), Sartorius AG, GE Healthcare (now part of Cytiva), Koch Membrane Systems, GVS S.p.A., VWR International, Sterlitech Corporation, Alfa Laval AB, Synder Filtration, and Advantec MFS, Inc.

Frequently Asked Questions

What was the market size of the global PVDF membrane in 2022?

The market size of PVDF membrane was USD 787 Million in 2022.

What is the CAGR of the global PVDF membrane market from 2023 to 2032?

The CAGR of PVDF membrane is 7.4% during the analysis period of 2023 to 2032.

Which are the key players in the PVDF membrane market?

The key players operating in the global market are including Merck KGaA (MilliporeSigma), Thermo Fisher Scientific Inc., Pall Corporation (acquired by Danaher Corporation), Sartorius AG, GE Healthcare (now part of Cytiva), Koch Membrane Systems, GVS S.p.A., VWR International, Sterlitech Corporation, Alfa Laval AB, Synder Filtration, and Advantec MFS, Inc.

Which region dominated the global PVDF membrane market share?

Asia-Pacific held the dominating position in PVDF membrane industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

North America region exhibited fastest growing CAGR for market of PVDF membrane during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global PVDF membrane industry?

The current trends and dynamics in the PVDF membrane industry include growing demand for advanced water and wastewater treatment solutions, and increasing applications in biopharmaceutical and medical industries.

Which membrane type held the maximum share in 2022?

The Hydrophilic membrane type held the maximum share of the PVDF membrane industry.