Wastewater Treatment Plant Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Wastewater Treatment Plant Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

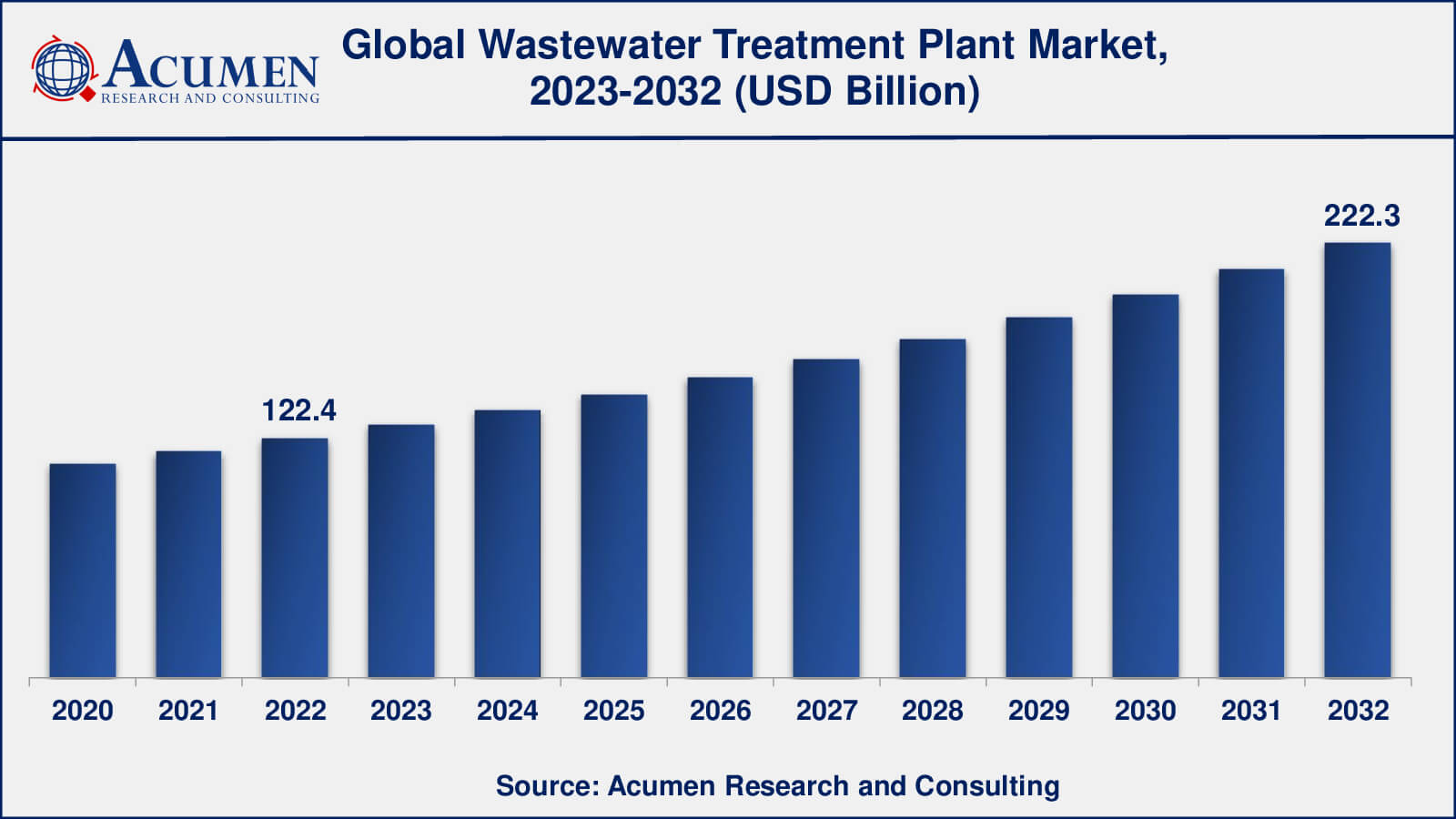

The Global Wastewater Treatment Plant Market Size accounted for USD 122.4 Billion in 2022 and is estimated to achieve a market size of USD 222.3 Billion by 2032 growing at a CAGR of 6.2% from 2023 to 2032.

Wastewater Treatment Plant Market Highlights

- Global wastewater treatment plant market revenue is poised to garner USD 222.3 billion by 2032 with a CAGR of 6.2% from 2023 to 2032

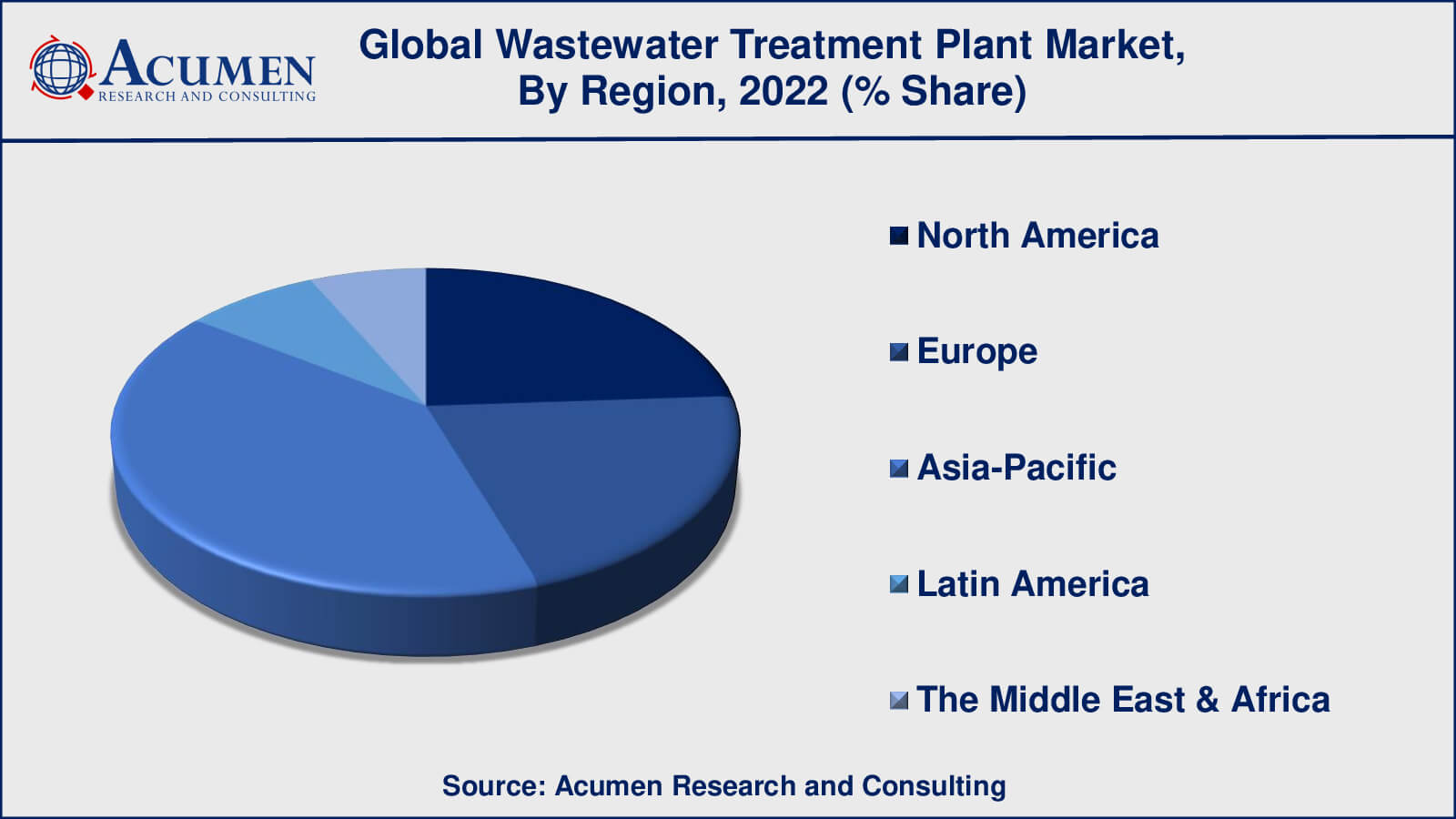

- Asia-Pacific wastewater treatment plant market value occupied around 49 billion in 2022

- Asia-Pacific wastewater treatment plant market growth will record a CAGR of more than 7% from 2023 to 2032

- Among treatment technology, the biological treatment sub-segment generated over US$ 42 billion revenue in 2022

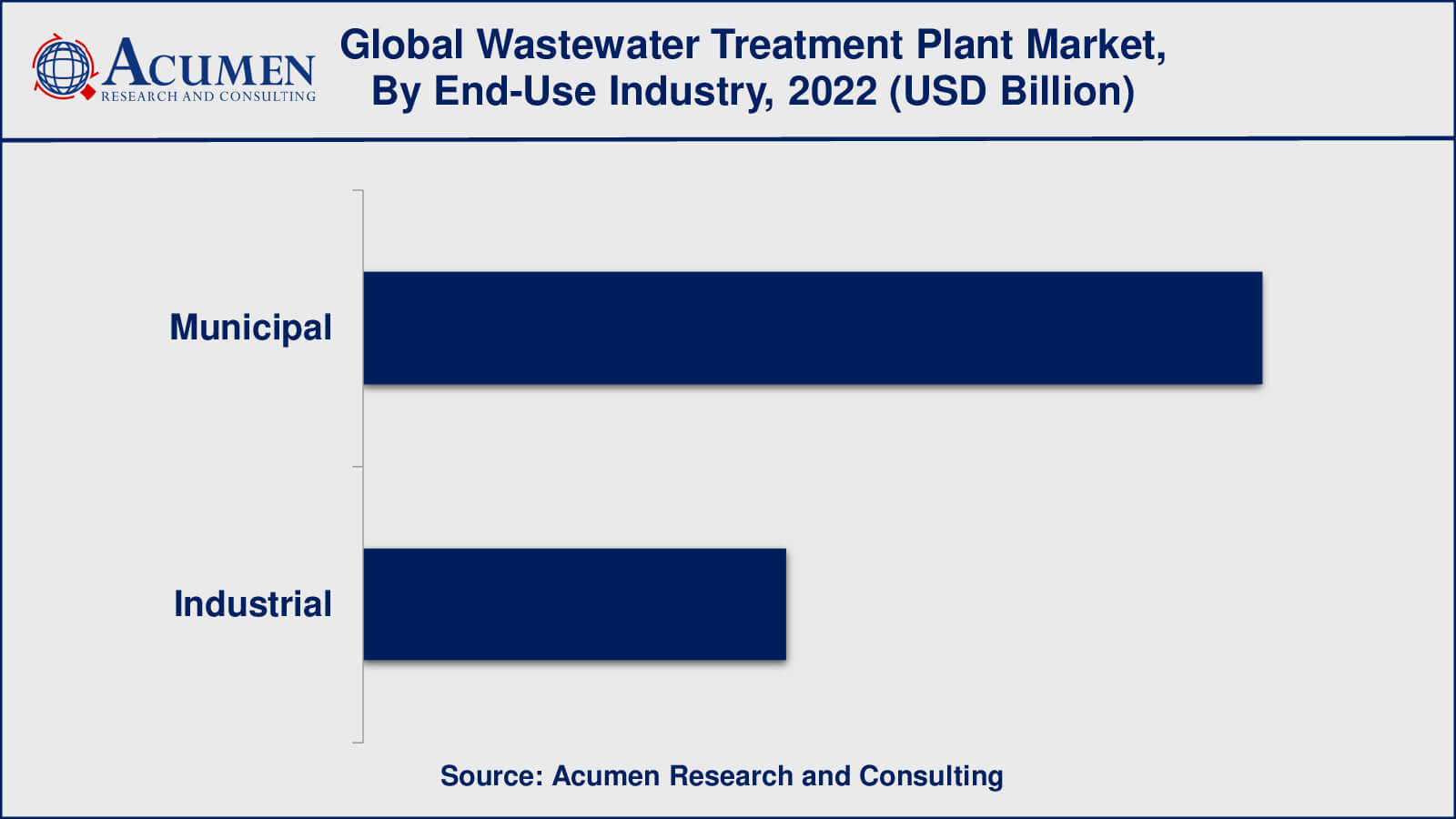

- Based on end-use industry, the municipal & sub-segment generated around 68% share in 2022

- Increasing adoption of smart water management systems is a popular wastewater treatment plant market trend that fuels the industry demand

A wastewater treatment plant (WWTP) is a facility that treats and removes toxins from wastewater before releasing it back into the environment. Water treatment's major goal is to preserve human health and the environment by eliminating pollutants and toxins from wastewater.

Wastewater treatment plants are necessary for a variety of reasons. For starters, they aid in environmental protection by eliminating dangerous contaminants from wastewater before it is released back into rivers, lakes, and oceans. This aids in the prevention of water pollution, which can harm aquatic ecosystems and public health. Second, wastewater treatment plants are crucial for supplying clean and safe drinking water, agricultural, and industrial activities. Finally, wastewater treatment plants contribute to water resource conservation by processing and reusing wastewater for non-potable applications such as irrigation or industrial cooling.

Global Wastewater Treatment Plant Market Dynamics

Market Drivers

- Increasing population and urbanization leading to higher demand for clean water

- Stringent government regulations on wastewater discharge

- Growing awareness about the need for water conservation and reuse

- Rising investments in water infrastructure

- Advancements in wastewater treatment technologies and processes

- Growing industrialization and expanding industries, which generate significant amounts of wastewater

Market Restraints

- High capital costs associated with the installation and maintenance of wastewater treatment plants

- Lack of proper infrastructure and technical expertise in certain regions

- Limited availability of funding for wastewater treatment projects in developing countries

- Environmental impact of wastewater treatment plants on the Surrounding Ecosystem

Market Opportunities

- Increasing demand for water treatment in emerging economies

- Adoption of decentralized and modular wastewater treatment systems in rural and remote areas

- Development of advanced and innovative technologies for efficient and cost-effective wastewater treatment

- Expansion of water reuse and recycling initiatives

- Increasing focus on energy-efficient and sustainable wastewater treatment practices

Wastewater Treatment Plant Market Report Coverage

| Market | Wastewater Treatment Plant Market |

| Wastewater Treatment Plant Market Size 2022 | USD 122.4 Billion |

| Wastewater Treatment Plant Market Forecast 2032 | USD 222.3 Billion |

| Wastewater Treatment Plant Market CAGR During 2023 - 2032 | 6.2% |

| Wastewater Treatment Plant Market Analysis Period | 2020 - 2032 |

| Wastewater Treatment Plant Market Base Year | 2022 |

| Wastewater Treatment Plant Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Treatment Technology, By Type, By Process, By End-Use Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Suez Environment S.A., Veolia Environnement S.A., Xylem Inc., Evoqua Water Technologies LLC, Pentair plc, Aquatech International LLC, Danaher Corporation (Hach Company), Doosan Heavy Industries & Construction Co., Ltd., Hitachi, Ltd., and Kurita Water Industries Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Wastewater Treatment Plant Market Insights

The global wastewater treatment plant market is a dynamic and rapidly evolving industry driven by a variety of factors such as rising population, urbanization, and industrialization, as well as growing awareness about water conservation and the need for sustainable water management practices.

The increasing need for clean water as a result of the world's growing population and industrialization is one of the market's primary drivers. As more people relocate to cities, the need for clean water is predicted to rise, driving the expansion of the wastewater treatment plant market. Furthermore, government restrictions aiming at limiting untreated wastewater discharge into the environment are fueling market expansion.

The industry is shifting towards modern and new technologies including membrane bioreactors, reverse osmosis, and nanofiltration, which provide increased efficiency and improved water quality. This has resulted in the creation of more sustainable, cost-effective, and energy-efficient wastewater treatment methods.

The high capital expenditures associated with the installation and operation of wastewater treatment facilities, on the other hand, are projected to limit market expansion. The business also faces substantial challenges due to a lack of finance for wastewater treatment initiatives in poor nations.

There are various market prospects that are projected to fuel growth in the next years. Rising demand for water treatment in emerging nations is likely to open up new market prospects for producers of wastewater treatment plants. Another area of potential is the use of decentralized and modular wastewater treatment systems in rural and remote locations, which can provide cost-effective and efficient wastewater treatment solutions.

Overall, the wastewater treatment plant market is likely to develop rapidly in the coming years, owing to rising demand for clean water, government restrictions, and the adoption of sophisticated and novel technologies. The market is very competitive, with many big competitors holding considerable market shares and continuously spending in R&D and strategic efforts to enhance their position.

Wastewater Treatment Plant Market Segmentation

The worldwide market for wastewater treatment plant is split based on treatment technology, type, process, end-use industry, and geography.

Wastewater Treatment Plant Treatment Technologies

- Physical Treatment

- Industrial Treatment

- Biological Treatment

According to wastewater treatment plant industry analysis, the biological treatment is the most common method utilised in wastewater treatment plants across the world. Microorganisms are used in this process to break down and remove organic debris and contaminants from wastewater. Biological treatment encompasses a number of methods, including activated sludge, sequencing batch reactors, and membrane bioreactors.

The most common biological treatment procedure in wastewater treatment facilities is activated sludge. Microorganisms are used to aerobically decompose organic materials in wastewater. In a reactor tank, wastewater is mixed with activated sludge, which is a combination of microorganisms and water. The organic stuff in the wastewater is subsequently consumed by the bacteria, who convert it into carbon dioxide, water, and other compounds.

Physical and industrial treatment are also extensively utilised in wastewater treatment plants, however they are usually combined with biological treatment. Physical treatment is the removal of suspended materials and pathogens from wastewater using physical processes such as sedimentation, filtration, and disinfection. Industrial wastewater treatment include the removal of particular pollutants such as heavy metals, organic compounds, and nutrients.

Wastewater Treatment Plant Types

- Municipal Wastewater Treatment Plants

- Industrial Wastewater Treatment Plants

The wastewater treatment plant market is dominated by municipal wastewater treatment facilities. Municipal wastewater treatment facilities are built to treat residential wastewater and remove pollutants and toxins before returning it to the environment. They are generally run by local governments or utilities and serve both urban and suburban areas.

In contrast, industrial wastewater treatment facilities are designed to handle wastewater generated by industrial operations. Chemical, food and beverage, pharmaceutical, and pulp and paper industries, among others, run them. Because they are designed to remove particular pollutants such as heavy metals, organic compounds, and nutrients, industrial wastewater treatment facilities are often more sophisticated and specialised than municipal wastewater treatment plants.

While industrial wastewater treatment plants account for a significant share of the wastewater treatment plant market, municipal wastewater treatment plants account for a lesser fraction. This is because municipal wastewater treatment plants service a bigger population and produce more wastewater than industrial wastewater treatment plants. Furthermore, most nations require municipal wastewater treatment facilities to treat their wastewater before release, whereas industrial wastewater treatment plants are often subject to environmental laws and may be compelled by law to treat their wastewater before discharge.

Wastewater Treatment Plant Processes

- Conventional Treatment

- Advanced Treatment

- Membrane Treatment

- Hybrid Treatment

As per the wastewater treatment plant market forecast, in recent years, advanced treatment and membrane treatment processes have been dominating the wastewater treatment plant market. These treatment processes are capable of achieving higher levels of contaminant removal compared to conventional treatment processes.

Advanced treatment processes typically include technologies such as activated carbon adsorption, advanced oxidation, and ion exchange. These technologies are capable of removing specific contaminants such as trace organic compounds, pesticides, and pharmaceuticals that are not effectively removed by conventional treatment processes.

Membrane treatment processes are also becoming increasingly popular in the wastewater treatment plant market. These processes involve the use of membrane filters to physically separate pollutants and contaminants from wastewater. Membrane treatment processes include microfiltration, ultrafiltration, nanofiltration, and reverse osmosis. Membrane treatment processes are highly effective in removing suspended solids, bacteria, viruses, and other contaminants from wastewater, resulting in high-quality effluent.

Wastewater Treatment Plant End-Use Industries

- Municipal

- Industrial

The municipal sector leads the wastewater treatment plant market because municipal sources create the vast majority of wastewater generated globally. Municipal wastewater treatment facilities are built to treat residential wastewater and remove pollutants and toxins before returning it to the environment. They typically serve urban and suburban populations and are run by municipal governments or utilities.

The industrial sector, on the other hand, is a significant end-user industry in the wastewater treatment plant market. Industrial wastewater treatment plants, which are run by businesses such as chemical, food and beverage, pharmaceutical, and pulp and paper, are designed to treat wastewater created by industrial operations. Industrial wastewater treatment facilities are often more sophisticated and specialised than municipal wastewater treatment plants since they are designed to remove particular pollutants such as heavy metals, organic compounds, and nutrients.

Wastewater Treatment Plant Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Wastewater Treatment Plant Market Regional Analysis

The Asia-Pacific region accounts for more than 40% of the worldwide market share for wastewater treatment facilities. This is due to a combination of causes, including growing urbanization, industrialization, and population increase in nations like China and India.

The need to enhance sanitation and water quality, satisfy environmental standards, and manage water resources sustainably has resulted in a major growth in demand for wastewater treatment facilities in the Asia-Pacific area in recent years. The region is also suffering rising water shortages, necessitating the construction of new wastewater treatment plants to treat and reuse wastewater.

Furthermore, several Asian nations are investing extensively in new wastewater treatment facilities to meet rising demand for clean water and sanitation services. To satisfy the requirements of their rising populations and economies, governments and private sector entities are working to develop novel wastewater treatment technology and build new treatment facilities.

Overall, the Asia-Pacific region is likely to be the largest market for wastewater treatment facilities in the future years, owing to strong economic expansion, urbanization, and population increase, as well as the demand for environmentally friendly water management practices.

Wastewater Treatment Plant Market Players

Some of the top wastewater treatment plant companies offered in our report include Suez Environment S.A., Veolia Environnement S.A., Xylem Inc., Evoqua Water Technologies LLC, Pentair plc, Aquatech International LLC, Danaher Corporation (Hach Company), Doosan Heavy Industries & Construction Co., Ltd., Hitachi, Ltd., and Kurita Water Industries Ltd.

Frequently Asked Questions

What was the market size of the global wastewater treatment plant in 2022?

The market size of wastewater treatment plant was USD 122.4 billion in 2022.

What is the CAGR of the global wastewater treatment plant market from 2023 to 2032?

The CAGR of wastewater treatment plant is 6.2% during the analysis period of 2023 to 2032.

Which are the key players in the wastewater treatment plant market?

The key players operating in the global market are including Suez Environment S.A., Veolia Environnement S.A., Xylem Inc., Evoqua Water Technologies LLC, Pentair plc, Aquatech International LLC, Danaher Corporation (Hach Company), Doosan Heavy Industries & Construction Co., Ltd., Hitachi, Ltd., and Kurita Water Industries Ltd.

Which region dominated the global wastewater treatment plant market share?

Asia-Pacific held the dominating position in wastewater treatment plant industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of wastewater treatment plant during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global wastewater treatment plant industry?

The current trends and dynamics in the wastewater treatment plant industry include increasing population and urbanization leading to higher demand for clean water, stringent government regulations on wastewater discharge, and growing awareness about the need for water conservation and reuse.

Which treatment technology held the maximum share in 2022?

The biological treatment technology held the maximum share of the wastewater treatment plant industry.