Industrial Wastewater Treatment Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Industrial Wastewater Treatment Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

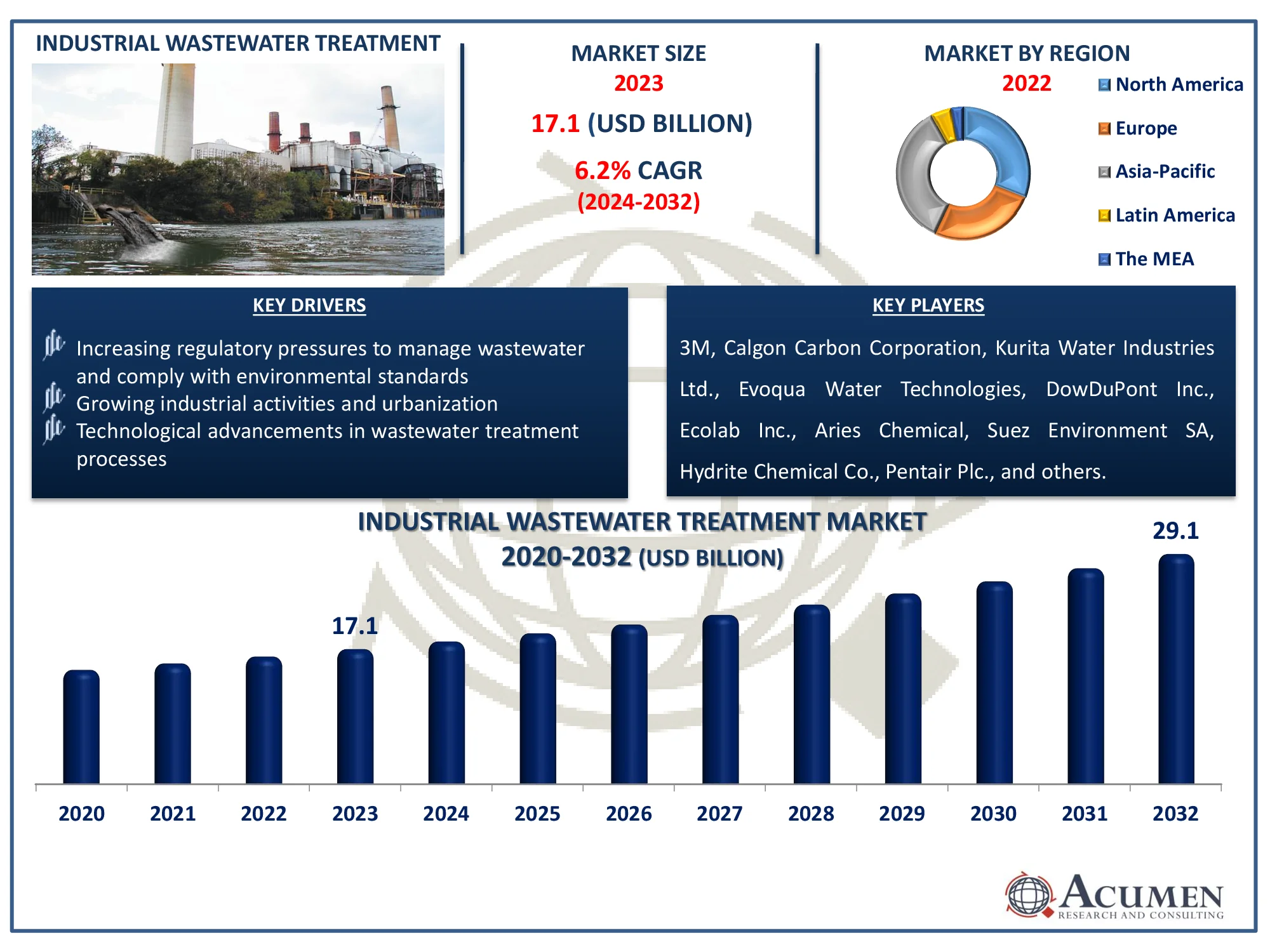

Request Sample Report

The Global Industrial Wastewater Treatment Market Size accounted for USD 17.1 Billion in 2023 and is estimated to achieve a market size of USD 29.1 Billion by 2032 growing at a CAGR of 6.2% from 2024 to 2032.

Industrial Wastewater Treatment Market Highlights

- The global industrial wastewater treatment market is projected to reach USD 17.1 billion by 2032, with a CAGR of 6.2% from 2024 to 2032

- In 2023, the North American industrial wastewater treatment market was valued at approximately USD 6 billion

- The Asia-Pacific region is expected to grow at a CAGR of over 7% from 2024 to 2032

- Coagulants accounted for 33% of the market share in 2023

- The biological treatment technology sub-segment held 29% of the market share in 2023

- Rising focus on water reuse and recycling in industries to reduce water consumption is the industrial wastewater treatment market trend that fuels the industry demand

Industrial waste management comprises a variety of sewage treatment methods that are produced by the industry as an undesired byproduct. Once therapy is completed, industrial wastewater can be reused or disposed of in the environment via sanitary sewer or ground water. Different types of wastewater contamination necessitate a variety of contamination elimination strategies. Some examples include the removal of oil and grease, acid and alkaline filters, pain relief, medicines, vitrified, and ozonated pesticides.

Increased industrialization and urbanization are major market drivers. Furthermore, the demand for industrial wastewater treatment is promoting a safe working environment in industrial operations. This development is the result of rigorous emission and treatment legislation for industrial waste, as well as the loss of freshwater reserves. However, the demand for sophisticated, environmentally friendly water treatment processes by end-user enterprises is impeding market expansion. On the contrary, increased industry due to population growth is expected to create new opportunities for producers of industrial wastewater chemicals.

Global Industrial Wastewater Treatment Market Dynamics

Market Drivers

- Increasing regulatory pressures to manage wastewater and comply with environmental standards

- Growing industrial activities and urbanization leading to higher wastewater generation

- Technological advancements in wastewater treatment processes improving efficiency and effectiveness

Market Restraints

- High capital and operational costs associated with wastewater treatment facilities

- Limited awareness and understanding of wastewater treatment technologies among small and medium enterprises

- Complex regulations and permitting processes that can delay project implementation

Market Opportunities

- Rising demand for sustainable and eco-friendly wastewater treatment solutions

- Expansion of the reuse and recycling market for treated wastewater in various industries

- Advancements in smart technologies and automation for real-time monitoring and control of wastewater treatment processes

Industrial Wastewater Treatment Market Report Coverage

|

Market |

Industrial Wastewater Treatment Market |

|

Industrial Wastewater Treatment Market Size 2023 |

USD 17.1 Billion |

|

Industrial Wastewater Treatment Market Forecast 2032 |

USD 29.1 Billion |

|

Industrial Wastewater Treatment Market CAGR During 2024 - 2032 |

6.2% |

|

Industrial Wastewater Treatment Market Analysis Period |

2020 - 2032 |

|

Industrial Wastewater Treatment Market Base Year |

2023 |

|

Industrial Wastewater Treatment Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Type, By Technology, By End-Use Industry, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

3M, Calgon Carbon Corporation, Kurita Water Industries Ltd., DowDuPont Inc., Evoqua Water Technologies, Ecolab Inc., Aries Chemical, Suez Environment SA, Hydrite Chemical Co., Pentair Plc., Feralco Group, Veolia Environnement SA. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Industrial Wastewater Treatment Market Insights

Because of rising population, industrialization, and rapid expansion, emerging markets desire for clean water is driving a significant increase in equipment acceptability. Water treatment is the process of removing volatile components and pollutants from water through chemical and physical separation. The market is predicted to drive increased demand in emerging nations, such as Asia-Pacific, for a lower global water footprint and higher quality returns. Important government agencies, such as the United States Environmental Protection Agency (EPA), the European Environment Agency (EEA), and the Central Pollution Control Board (CPCB), play a significant role in improving water quality and preventing pollution. The demand for municipal and industrial sectors has expanded as a result of tight public rules governing waste water emissions.

A number of factors influence the global industry, including the depletion of freshwater supplies and rigorous emission and processing laws for industrial waste. The chief sources of industrial wastewater include wood processing, wood preservation, oil refining, the food industry, fabric dyeing, and power plants. New and practical water recycling and process techniques are currently being developed. Some of these are sewage monitoring and control systems for membrane bioreactors, biological procedures, and granular sludge procedures with a microbial framework. Because of its advanced technologies and sophisticated processes, the United States is one of the world's largest markets for sewage treatment machinery. The growing urban population and high need for industrial aqua reuse are expected to stimulate the country's development of aqua equipment over forecast period.

The need for wastewater treatment chemicals in the power generation industry is rapidly increasing as standards and regulations for wastewater discharge are increased. The zero fluid discharge (ZLD) systems are an important contributor to improving chemical usage in wastewater treatment, in addition to the environmental benefits. These elements will drive demand for industrial sewage therapy in the energy generation industry during the forecast period.

Industrial Wastewater Treatment Market Segmentation

The worldwide market for industrial wastewater treatment is split based on type, technology, end-use industry, and geography.

Industrial Wastewater Treatment Types

- Coagulants

- Flocculants

- Corrosion Inhibitors

- Scale Inhibitors

- Biocides & Disinfectants

- Chelating Agents

- Anti-Foaming Agents

- Ph Stabilizers

- Others

According to the industrial wastewater treatment industry analysis, coagulants dominate the market because of their ability to remove suspended solids and neutralize charges in wastewater, allowing particles to aggregate and separate more easily. They are frequently employed in industries that need solid-liquid separation, including chemicals, food and beverage, and textiles. Their versatility and cost-effectiveness make them an excellent choice for both primary and secondary treatment processes. Because of this high demand, coagulants have dominated the market.

Industrial Wastewater Treatment Technologies

- Biological Treatment

- Membrane Bioreactor

- Activated Sludge

- Reverse Osmosis

- Membrane Filtration

- Sludge Treatment

- Others

Biological treatment is the most popular technology in the industrial wastewater treatment market due to its efficacy in breaking down organic contaminants with microorganisms. This procedure is frequently preferred for its cost effectiveness and environmental sustainability, as it lowers the need for toxic chemicals. Furthermore, biological treatment systems can be adapted to specific industrial applications, making them adaptable to different types of wastewater. The increased emphasis on eco-friendly practices encourages the use of biological approaches.

Industrial Wastewater Treatment End-Use Industries

- Mining

- Power Generation

- Chemical

- Oil and gas

- Pulp and Power

- Food and Beverage

- Others

According to the industrial wastewater treatment market forecast, the oil and gas end-use industry is expected to dominate the market due to the significant amount of wastewater generated during exploration, extraction, refining, and production activities. This industry must comply with rigorous environmental standards that require sophisticated treatment methods to handle impurities such as hydrocarbons, heavy metals, and salts. As the industry moves toward more sustainable practices, innovative wastewater treatment technologies are increasingly being used to recover and reuse water, hence reducing environmental effect.

Industrial Wastewater Treatment Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

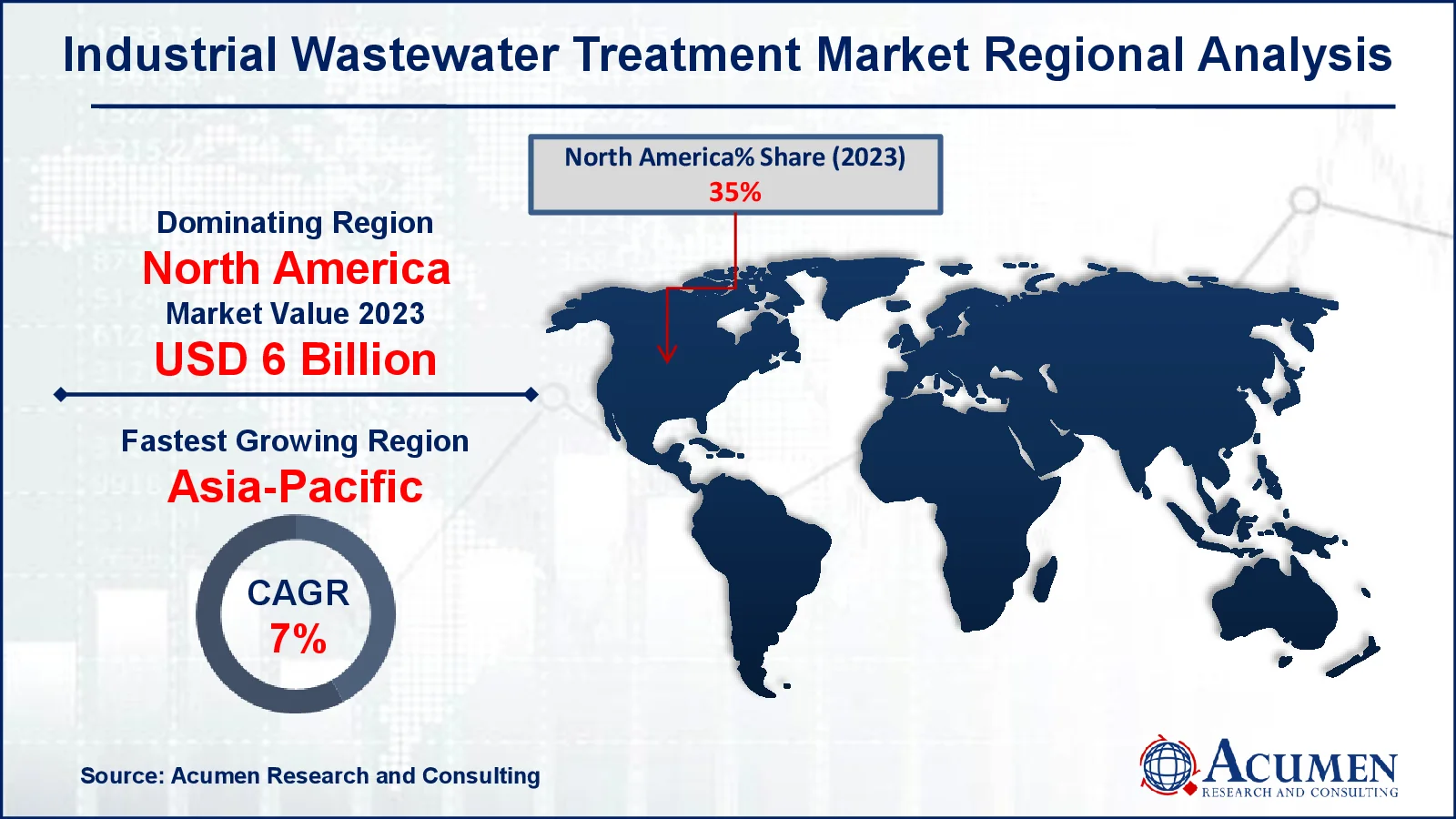

Industrial Wastewater Treatment Market Regional Analysis

For several reasons, North America is anticipated to have the largest market for industrial wastewater processing. The massive need for industrial waste water treatment in the United States and Canada is primarily driving this growth. In some countries, severe water purification requirements encourage the use of sewage chemicals. During the projection period, APAC will be the fastest-growing market. This growth is attributed to increased demand in the APAC region's electricity production, mining, food and beverage, chemical, pulp and paper, and textile industries. During the predicted period, the APAC market would be pushed by changing populations, such as improved living standards, stricter sewage treatment legislation, rapid industrialization, and an expanding population in the region.

The key drivers of regional development are the growing urban and rural populations, urbanization, and foreign investment in industrial and municipal waste water treatment. Russia, Norway, and the United Kingdom are Europe's three most important countries. Europe had the second largest income share in 2023, and is predicted to grow steadily during the forecast period. The implementation of rigorous restrictions has boosted the aquatic equipment business in the area.

The MEA region is distinguished by a lack of significant freshwater sources and a large number of water and sewage treatment plants. The regional market is expected to be driven by increased per capita water consumption and population growth as a result of increased immigration.

Industrial Wastewater Treatment Market Players

Some of the top industrial wastewater treatment companies offered in our report include 3M, Calgon Carbon Corporation, Kurita Water Industries Ltd., DowDuPont Inc., Evoqua Water Technologies, Ecolab Inc., Aries Chemical, Suez Environment SA, Hydrite Chemical Co., Pentair Plc., Feralco Group, Veolia Environnement SA.

Frequently Asked Questions

How big is the Industrial wastewater treatment market?

The industrial wastewater treatment market size was valued at USD 17.1 billion in 2023.

What is the CAGR of the global industrial wastewater treatment market from 2024 to 2032?

The CAGR of industrial wastewater treatment is 6.2% during the analysis period of 2024 to 2032.

Which are the key players in the industrial wastewater treatment market?

The key players operating in the global market are including 3M, Calgon Carbon Corporation, Kurita Water Industries Ltd., DowDuPont Inc., Evoqua Water Technologies, Ecolab Inc., Aries Chemical, Suez Environment SA, Hydrite Chemical Co., Pentair Plc., Feralco Group, Veolia Environnement SA.

Which region dominated the global industrial wastewater treatment market share?

North America held the dominating position in Industrial Wastewater Treatment industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of Industrial Wastewater Treatment during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global industrial wastewater treatment industry?

The current trends and dynamics in the industrial wastewater treatment industry include increasing regulatory pressures to manage wastewater and comply with environmental standards, growing industrial activities and urbanization leading to higher wastewater generation, and technological advancements in wastewater treatment processes improving efficiency and effectiveness.

Which type held the maximum share in 2023?

The coagulants type held the maximum share of the industrial wastewater treatment industry.