Metal Packaging Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Metal Packaging Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

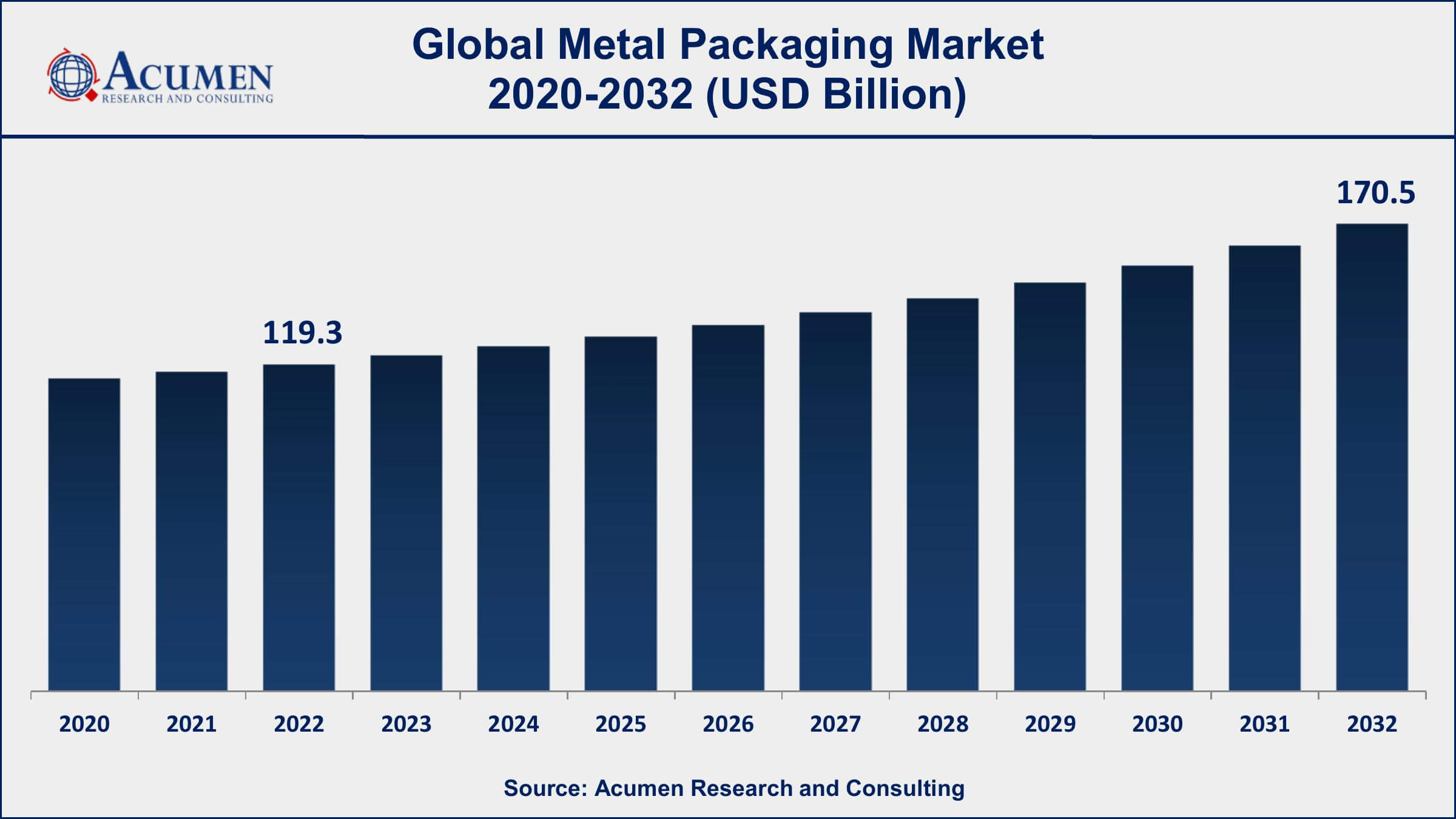

The Global Metal Packaging Market Size accounted for USD 119.3 Billion in 2022 and is projected to achieve a market size of USD 170.5 Billion by 2032 growing at a CAGR of 3.8% from 2023 to 2032.

Metal Packaging Market Highlights

- Global Metal Packaging Market revenue is expected to increase by USD 170.5 Billion by 2032, with a 3.8% CAGR from 2023 to 2032

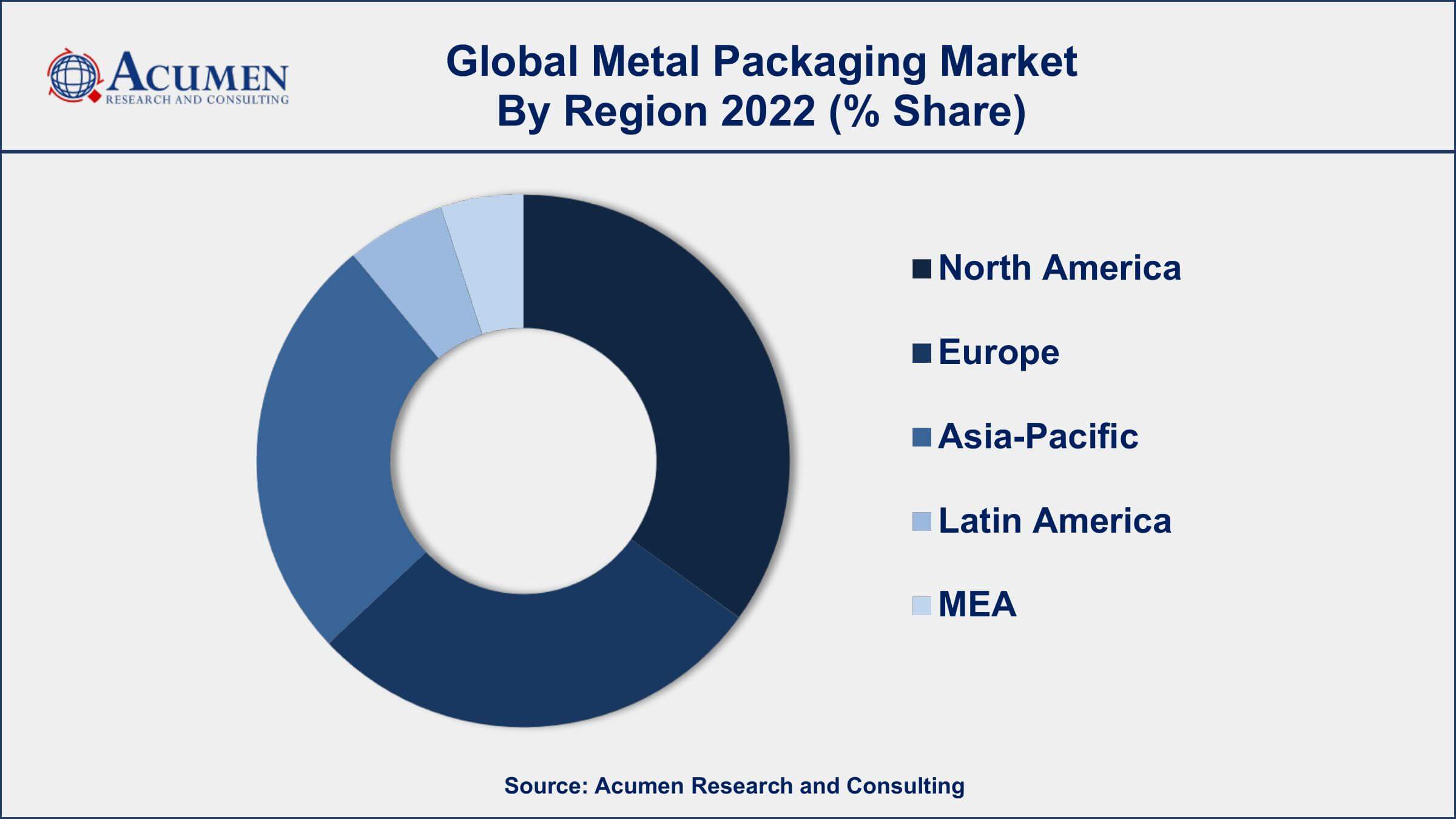

- North America region led with more than 36% of Metal Packaging Market share in 2022

- Asia-Pacific Metal Packaging Market growth will record a CAGR of around 4% from 2023 to 2032

- According to a study, aluminum cans have one of the highest recycling rates, with over 70% of all aluminum cans being recycled worldwide

- By product type, the cans segment accounted more than 41% of the revenue share in 2022

- Growing demand for sustainable packaging solutions, drives the Metal Packaging Market value

Metal packaging refers to the use of metal materials, such as steel or aluminum, to create containers or packaging solutions for various products. It is widely utilized in industries such as food and beverages, pharmaceuticals, cosmetics, and household goods. Metal packaging offers numerous advantages, including durability, strength, recyclability, and protection against external factors such as moisture, light, and air. These qualities make it an ideal choice for preserving the quality and freshness of products, extending their shelf life, and ensuring their safety during transportation and storage.

The market for metal packaging has witnessed significant growth in recent years and is expected to continue expanding in the coming years. This growth can be attributed to several factors including, increasing urbanization and a growing middle-class population have led to a rise in consumer spending, particularly on packaged food and beverages. As a result, there is a higher demand for reliable and sustainable packaging solutions, which has boosted the adoption of metal packaging. Furthermore, increasing awareness about environmental sustainability and the need for eco-friendly packaging options have driven the market for metal packaging. Metal is a highly recyclable material, with a well-established recycling infrastructure in many regions. This aligns with the growing consumer preference for sustainable and recyclable packaging, contributing to the popularity of metal packaging.

Global Metal Packaging Market Trends

Market Drivers

- Growing demand for sustainable packaging solutions

- Increasing environmental concerns and focus on recycling

- Advantages of metal packaging, such as durability and strength

- Rising preference for convenience and on-the-go products

Market Restraints

- Fluctuating prices of raw materials, such as aluminum and steel

- Intense competition from alternative packaging materials, such as plastics

Market Opportunities

- Growing consumer awareness and preference for sustainable packaging

- Expanding applications of metal packaging beyond traditional sectors, such as food and beverages

- Adoption of lightweighting and shaping techniques to reduce material usage and costs

Metal Packaging Market Report Coverage

| Market | Metal Packaging Market |

| Metal Packaging Market Size 2022 | USD 119.3 Billion |

| Metal Packaging Market Forecast 2032 | USD 170.5 Billion |

| Metal Packaging Market CAGR During 2023 - 2032 | 3.8% |

| Metal Packaging Market Analysis Period | 2020 - 2032 |

| Metal Packaging Market Base Year | 2022 |

| Metal Packaging Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Material Type, By Product Type, By End-user Vertical, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Crown Holdings Inc., Ball Corporation, Ardagh Group S.A., Silgan Holdings Inc., Toyo Seikan Group Holdings Ltd., Can-Pack S.A., CCL Industries Inc., Tata Steel Packaging, Greif, Inc., Mauser Packaging Solutions, and Sonoco Products Company |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Metal packaging involves the creation of containers, cans, bottles, closures, and other packaging forms using metal as the primary material. Metal packaging offers a range of benefits, including durability, strength, resistance to air and light, and recyclability. It is widely used in industries such as food and beverages, pharmaceuticals, cosmetics, and household goods.

In the food and beverage industry, metal packaging plays a crucial role in preserving the quality and freshness of products. Metal cans and containers provide an excellent barrier against moisture, oxygen, and light, preventing spoilage and maintaining the flavor, aroma, and nutritional value of food and beverages. Metal packaging is commonly used for canned fruits, vegetables, soups, sauces, carbonated beverages, beer, and many other perishable items. The pharmaceutical industry relies on metal packaging to ensure the integrity and safety of medicines and healthcare products. Metal containers provide a robust and tamper-evident packaging solution, protecting medications from contamination, moisture, and degradation.

The metal packaging market has been experiencing steady growth in recent years and is expected to continue expanding in the coming years. One of the key drivers of this growth is the increasing demand for sustainable packaging solutions. With growing environmental concerns, consumers and businesses alike are seeking packaging materials that can be recycled and have a lower environmental impact. Metal packaging, particularly aluminum and steel, is highly recyclable and offers a closed-loop recycling system, making it an attractive choice for eco-conscious consumers and companies. Additionally, the durability and strength of metal packaging have contributed to its market growth.

Metal Packaging Market Segmentation

The global Metal Packaging Market segmentation is based on material type, product type, end-user vertical, and geography.

Metal Packaging Market By Material Type

- Steel

- Aluminum

- Others

According to the metal packaging industry analysis, the steel segment accounted for the largest market share in 2022. One of the primary drivers of this growth is the wide range of applications and versatility of steel packaging. Steel containers, such as cans and drums, are used extensively in various industries, including food and beverages, chemicals, pharmaceuticals, and automotive, among others. Steel packaging offers excellent durability, strength, and tamper resistance, making it suitable for the protection and transportation of a diverse range of products. Moreover, steel packaging has gained traction due to its sustainability attributes. Steel is a highly recyclable material, and steel packaging can be recycled multiple times without compromising its quality. This recyclability, combined with the strong demand for eco-friendly packaging solutions, has propelled the growth of the steel segment in the metal packaging market.

Metal Packaging Market By Product Type

- Cans

- Caps and Closures

- Shipping Barrels and Drums

- Bulk Containers

- Others

In terms of product types, the cans segment is expected to witness significant growth in the coming years. One of the key drivers of this growth is the widespread adoption of metal cans as primary packaging for beverages and food products. Metal cans, typically made of aluminum or steel, offer numerous advantages such as durability, product protection, and convenience. The canning process ensures the preservation of the contents by creating a sealed and airtight environment, safeguarding the quality and freshness of the packaged goods. The beverage industry, in particular, has played a significant role in the growth of the cans segment. Metal cans are widely used for packaging carbonated beverages, juices, energy drinks, and alcoholic beverages. The demand for on-the-go and ready-to-drink beverages has been on the rise, driving the need for convenient and portable packaging solutions.

Metal Packaging Market By End-user Vertical

- Food & Beverage

- Cosmetic and Personal Care

- Industrial

- Paints and Varnishes

- Household

- Automotive

- Others

According to the metal packaging market forecast, the food & beverage segment is expected to witness significant growth in the coming years. One of the primary drivers of this growth is the increasing demand for safe and sustainable packaging solutions in the food and beverage industry. Metal packaging, including cans, containers, and closures, offers excellent protection and preservation for a wide range of food and beverage products. The durability and barrier properties of metal packaging help maintain the quality, freshness, and flavor of the packaged goods, making it an ideal choice for perishable items. Furthermore, the convenience factor has contributed to the growth of metal packaging in the food and beverage segment. Metal cans provide easy opening and resealability options, allowing consumers to consume the products at their convenience while ensuring the remaining contents are protected.

Metal Packaging Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Metal Packaging Market Regional Analysis

North America dominates the metal packaging market due to several key factors that have contributed to its leading position in the industry. One of the primary reasons is the strong presence of established metal packaging manufacturers and suppliers in the region. North America is home to several major players in the metal packaging industry who have a long history of expertise and innovation in producing high-quality metal packaging solutions. These companies have developed advanced manufacturing processes, invested in research and development, and established robust distribution networks, enabling them to cater to the diverse needs of various sectors. Additionally, North America has a large and diverse consumer market with high purchasing power. The region's population, along with its strong economy, drives the demand for a wide range of products that require reliable and sustainable packaging. Metal packaging, with its durability, strength, and protective properties, is highly favored by industries such as food and beverages, pharmaceuticals, personal care, and household goods. The demand for convenience and on-the-go products also aligns with the characteristics of metal packaging, further boosting its dominance in the market.

Metal Packaging Market Player

Some of the top metal packaging market companies offered in the professional report include Crown Holdings Inc., Ball Corporation, Ardagh Group S.A., Silgan Holdings Inc., Toyo Seikan Group Holdings Ltd., Can-Pack S.A., CCL Industries Inc., Tata Steel Packaging, Greif, Inc., Mauser Packaging Solutions, and Sonoco Products Company

Frequently Asked Questions

What was the market size of the global metal packaging in 2022?

The market size of metal packaging was USD 119.3 Billion in 2022.

What is the CAGR of the global metal packaging market from 2023 to 2032?

The CAGR of metal packaging is 3.8% during the analysis period of 2023 to 2032.

Which are the key players in the metal packaging market?

The key players operating in the global market are including Crown Holdings Inc., Ball Corporation, Ardagh Group S.A., Silgan Holdings Inc., Toyo Seikan Group Holdings Ltd., Can-Pack S.A., CCL Industries Inc., Tata Steel Packaging, Greif, Inc., Mauser Packaging Solutions, and Sonoco Products Company

Which region dominated the global metal packaging market share?

North America held the dominating position in metal packaging industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of metal packaging during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global metal packaging industry?

The current trends and dynamics in the metal packaging industry include growing demand for sustainable packaging solutions, increasing environmental concerns and focus on recycling, and advantages of metal packaging, such as durability and strength.

Which product type held the maximum share in 2022?

The cans product type held the maximum share of the metal packaging industry.