Epoxy Resin Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Epoxy Resin Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

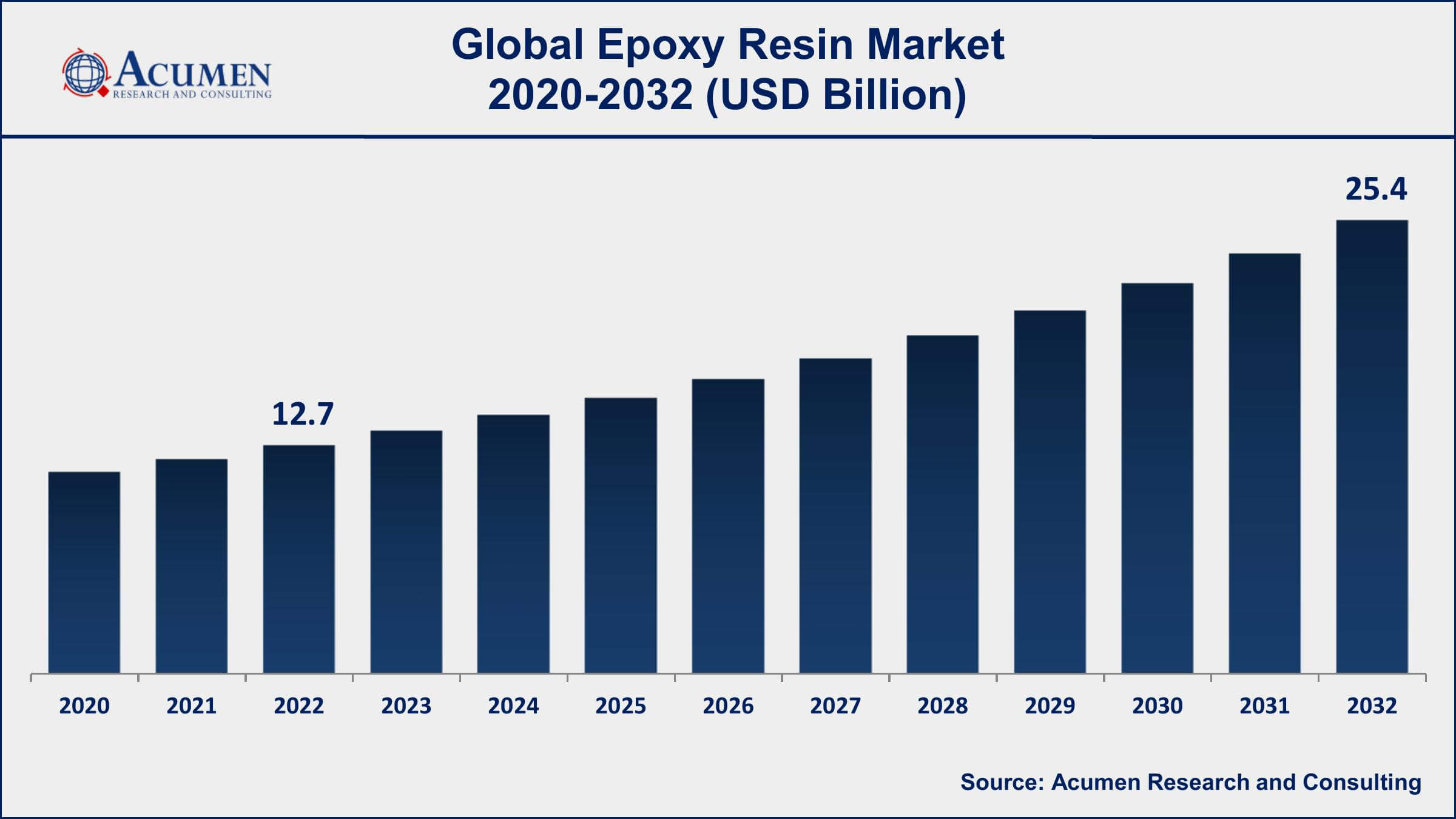

The Global Epoxy Resin Market Size accounted for USD 12.7 Billion in 2022 and is projected to achieve a market size of USD 25.4 Billion by 2032 growing at a CAGR of 7.2% from 2023 to 2032.

Epoxy Resin Market Key Highlights

- Global epoxy resin market revenue is expected to increase by USD 25.4 Billion by 2032, with a 7.2% CAGR from 2023 to 2032

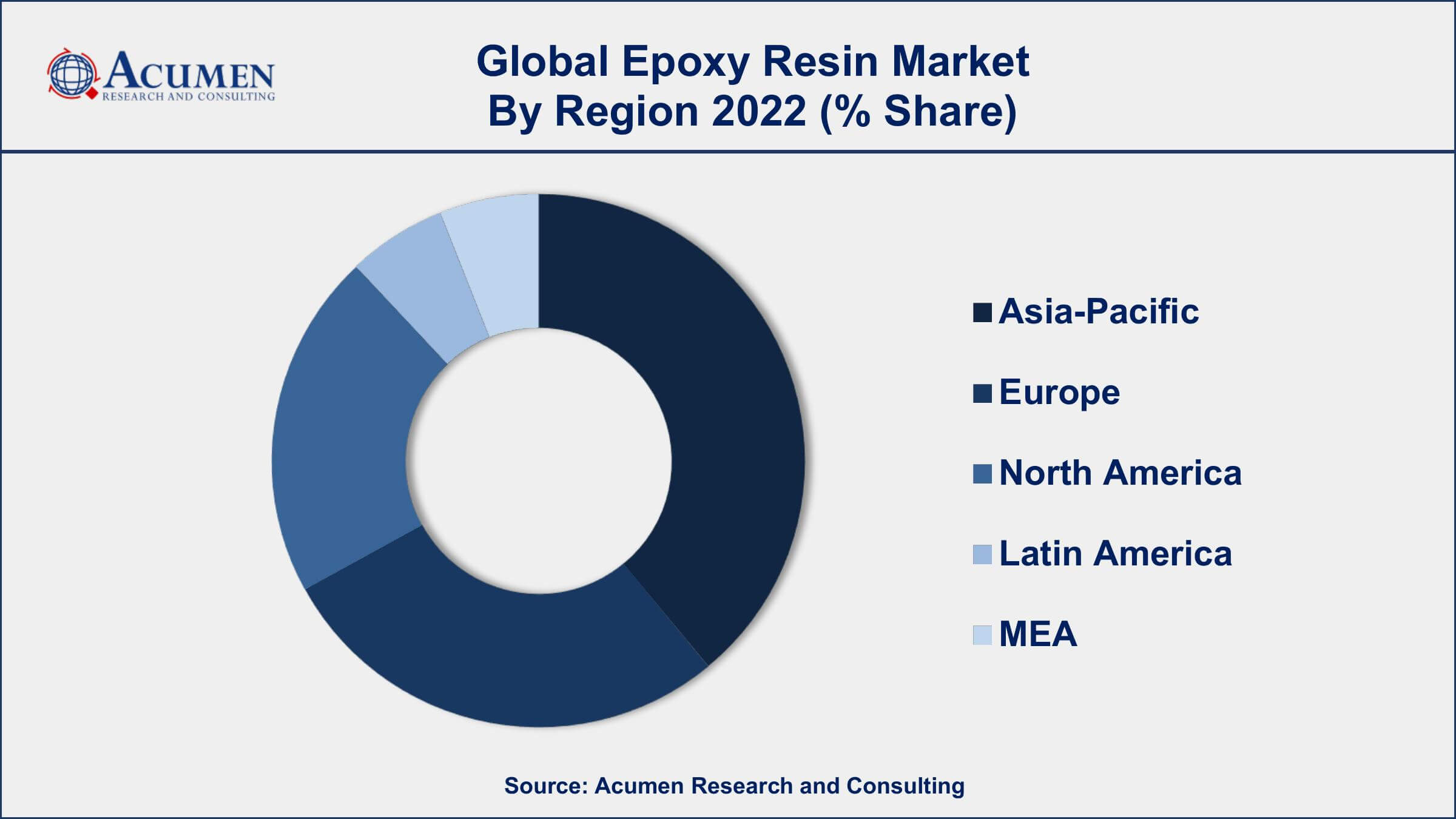

- Asia-Pacific region led with more than 60% of epoxy resin market share in 2022

- The construction industry consumes the most epoxy resin, accounting for around 36% of global usage

- The paint and coating application category led the market, accounting for more than 38% of total revenue

- In the automotive aftermarket, epoxy resin is used in the repair and restoration of automotive body panels, hoods, and bumpers

- Increasing demand for eco-friendly and sustainable materials, drives the epoxy resin market size

Epoxy resin is a type of thermosetting polymer that is created by mixing two components - an epoxy resin and a hardener. When mixed, these components undergo a chemical reaction that results in a rigid, durable and highly adhesive material. Epoxy resins have a wide range of applications, including as coatings for floors, walls, and industrial equipment, as adhesives for aerospace and automotive industries, and as composites for construction and marine applications.

The global epoxy resin market has been experiencing significant growth over the past few years and is expected to continue to grow in the coming years. This growth is driven by several factors, including the increasing demand for epoxy resins in the construction, automotive, and aerospace industries, as well as the growing trend of using lightweight and durable materials in various applications. Additionally, the increasing use of epoxy resins in the production of wind turbines, as well as the growth of the renewable energy sector, is expected to further drive the epoxy resin market growth.

Global Epoxy Resin Market Trends

Market Drivers

- Growing demand for epoxy resins in the construction industry

- Increasing demand for lightweight and durable materials in various applications

- Expansion of the renewable energy sector and the increasing use of epoxy resins in wind turbines

- Increasing demand for eco-friendly and sustainable materials

Market Restraints

- Volatility in the prices of raw materials

- Environmental and health concerns related to the use of epoxy resins

Market Opportunities

- Increasing adoption of epoxy resins in the electronics industry

- Rising demand for high-performance composites in various applications

Epoxy Resin Market Report Coverage

| Market | Epoxy Resin Market |

| Epoxy Resin Market Size 2022 | USD 12.7 Billion |

| Epoxy Resin Market Forecast 2032 | USD 25.4 Billion |

| Epoxy Resin Market CAGR During 2023 - 2032 | 7.2% |

| Epoxy Resin Market Analysis Period | 2020 - 2032 |

| Epoxy Resin Market Base Year | 2022 |

| Epoxy Resin Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, By End Use Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Dow Chemical Company, Huntsman Corporation, BASF SE, 3M Company, Ashland Inc., Sika AG, DuPont de Nemours, Inc., Hexion Inc., Momentive Performance Materials Inc., Kukdo Chemical Co., Ltd., Nama Chemicals, and Aditya Birla Chemicals. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Epoxy resins are thermosetting resins developed by the process of copolymerization of an epoxide (glycidyl or oxirane group) with other compounds having two hydroxyl groups. The market for epoxy resin has witnessed significant growth due to rising demand from various applications such as automotive & transportation, aerospace, and wind energy. The major factor driving the growth of the market includes the growing usage of epoxy resins in the construction and automotive & transportation sectors.

The increasing use of composites, investment in emerging economies (such as India, China, Brazil, South East Asia, and Mexico), and high growth in end-use industries are driving the market for epoxy resins, globally. Increased use of epoxy resins in consumer goods and the emergence of new end users of epoxy resins such as wind energy and the marine sector are expected to change the dynamics of the market in near future. However, growing opportunities across the Asia-Pacific market; as well as the emergence of the need for lightweight and fuel-efficient vehicles/aircraft are major opportunity areas for the market. The major challenges that can be attributed include stringent regulatory approvals such as Control of Substances for Hazardous health (COSH), European Union (EU), REACH, etc. required for production along with limited market opportunities in developed economies of North America and Europe. Another important factor hindering the growth of the market is volatility in raw material prices.

Epoxy Resin Market Segmentation

The global epoxy resin market segmentation is based on type, application, end use industry, and geography.

Epoxy Resin Market By Type

- DGBEF (bisphenol F &ECH)

- DGBEA (bisphenol A & ECH)

- Glycidylamine (aromatic amines & ECH)

- Aliphatic (aliphatic alcohols)

- Novolac (formaldehyde & phenols)

- Others

According to the epoxy resin industry analysis, the DGBEA (bisphenol A & ECH) segment accounted for the largest market share in 2022. DGBEA (diglycidyl ether of bisphenol A and epichlorohydrin) is one of the most widely used types of epoxy resins in the market. It is a high-performance epoxy resin that offers excellent mechanical strength, chemical resistance, and adhesion properties, making it suitable for a wide range of applications. The growth of the DGBEA segment in the epoxy resin market is being driven by several factors. Firstly, the increasing demand for high-performance coatings and adhesives in various end-use industries such as automotive, aerospace, and construction is driving the growth of the DGBEA segment. Secondly, the excellent properties of DGBEA, including its high strength, durability, and chemical resistance, make it an ideal material for use in the production of composites, which is another factor driving the growth of the segment.

Epoxy Resin Market By Application

- Paint & Coatings

- Construction

- Electrical & Electronics

- Wind Turbine & Composites

- Civil Engineering

- Adhesive & Sealants

- Others

In terms of applications, the paint & coatings segment is one of the largest and fastest-growing segments in the epoxy resin market. Epoxy resins are widely used as coatings in the automotive, aerospace, construction, and marine industries, among others, due to their excellent mechanical properties, high chemical resistance, and good adhesion to various substrates. Epoxy-based coatings offer superior performance and durability, making them ideal for use in harsh environments, such as exposure to high temperatures, chemicals, and weathering. Moreover, the development of new applications and technologies, such as water-based coatings and powder coatings, is expected to further drive the growth of the paint and coatings segment in the market.

Epoxy Resin Market By End Use Industry

- Building & Construction

- General Industrial

- Transportation

- Aerospace

- Consumer Goods

- Wind Energy

- Marine

According to the epoxy resin market forecast, the building & construction segment is expected to witness significant growth in the coming years. Epoxy resins are used in the construction industry for a wide range of applications, including flooring, adhesives, sealants, and coatings. They offer excellent mechanical properties, such as high strength, durability, and chemical resistance, making them ideal for use in various construction applications. The growth of the building and construction segment in the market is being driven by several factors. Firstly, the increasing demand for high-performance flooring and coatings in commercial and residential buildings is driving the growth of the segment. Epoxy-based flooring offers superior performance and durability, making it an attractive alternative to traditional flooring materials. Additionally, the increasing use of epoxy resins in adhesives and sealants for construction applications is creating new opportunities for the growth of the segment.

Epoxy Resin Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Epoxy Resin Market Regional Analysis

The Asia-Pacific region is dominating the epoxy resin market due to several factors, including the presence of a large number of end-use industries such as construction, automotive, electronics, and aerospace. These industries are the major consumers of epoxy resins and are experiencing significant growth in the region, which is driving the demand for epoxy resins. The increasing population and urbanization in the region are also contributing to the growth of the construction industry, which is a significant market for epoxy resins. Moreover, the availability of low-cost labor and raw materials in the Asia-Pacific region is another factor driving the growth of the epoxy resin market value. Many of the leading epoxy resin manufacturers have production facilities in the region, which enables them to offer their products at competitive prices. This has resulted in increased demand for epoxy resins from end-use industries in the region, as they seek to reduce their production costs and improve their competitiveness in the global market.

Epoxy Resin Market Player

Some of the top epoxy resin market companies offered in the professional report include Dow Chemical Company, Huntsman Corporation, BASF SE, 3M Company, Ashland Inc., Sika AG, DuPont de Nemours, Inc., Hexion Inc., Momentive Performance Materials Inc., Kukdo Chemical Co., Ltd., Nama Chemicals, and Aditya Birla Chemicals.

Frequently Asked Questions

What was the market size of the global epoxy resin in 2022?

The market size of epoxy resin was USD 12.7 Billion in 2022.

What is the CAGR of the global epoxy resin market from 2023 to 2032?

The CAGR of epoxy resin is 7.2% during the analysis period of 2023 to 2032.

Which are the key players in the epoxy resin market?

The key players operating in the global market are including Dow Chemical Company, Huntsman Corporation, BASF SE, 3M Company, Ashland Inc., Sika AG, DuPont de Nemours, Inc., Hexion Inc., Momentive Performance Materials Inc., Kukdo Chemical Co., Ltd., Nama Chemicals, and Aditya Birla Chemicals.

Which region dominated the global epoxy resin market share?

Asia-Pacific held the dominating position in epoxy resin industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

North America region exhibited fastest growing CAGR for market of epoxy resin during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global epoxy resin industry?

The current trends and dynamics in the epoxy resin industry include growing adoption in the construction industry, and increasing demand for lightweight and durable materials in various applications.

Which type held the maximum share in 2022?

The DGBEA (bisphenol A & ECH) type held the maximum share of the epoxy resin industry.