Acrylic Adhesives Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Acrylic Adhesives Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

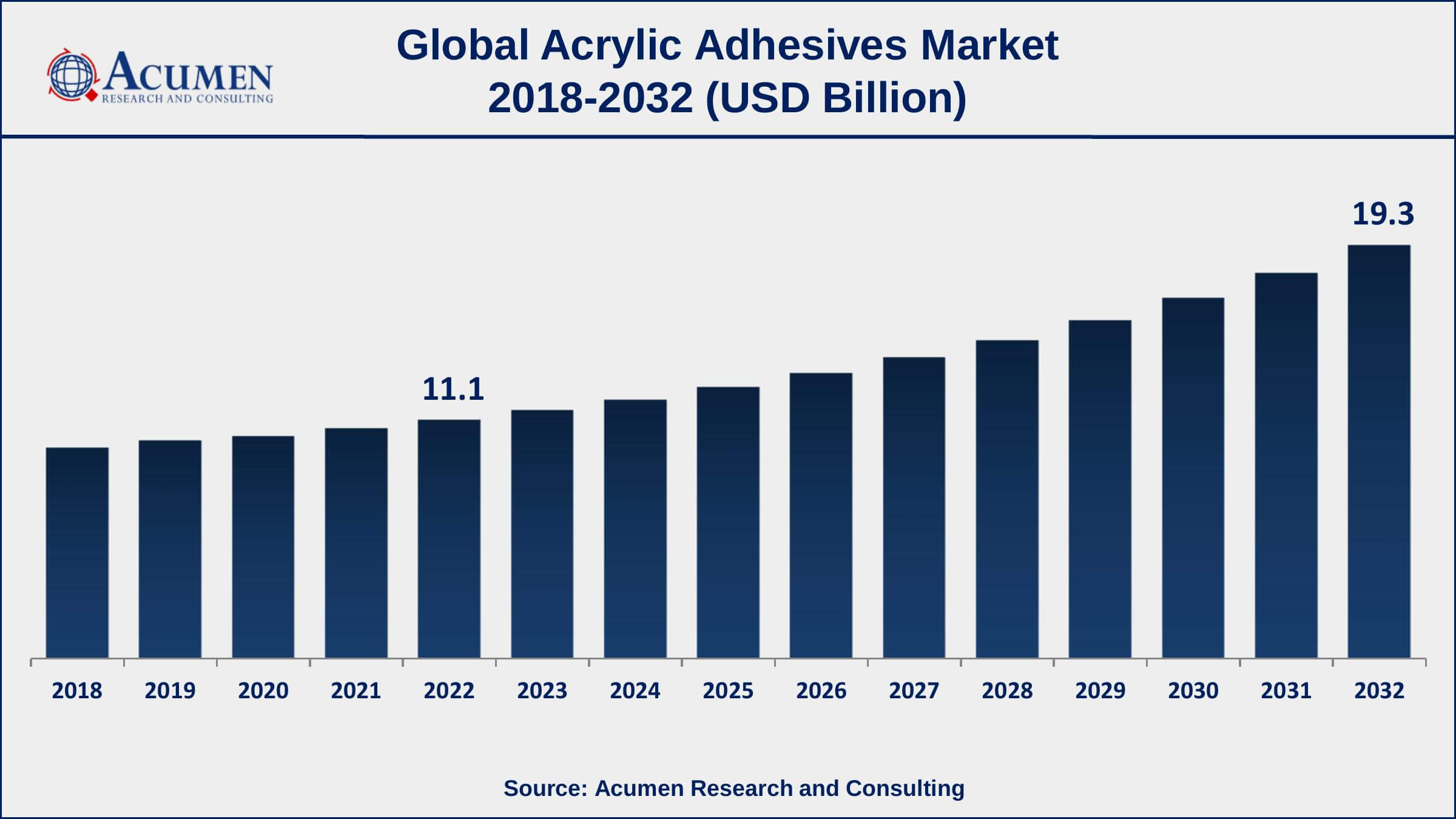

The Global Acrylic Adhesives Market Size accounted for USD 11.1 Billion in 2022 and is estimated to achieve a market size of USD 19.3 Billion by 2032 growing at a CAGR of 5.9% from 2023 to 2032. The acrylic adhesives market growth is driven by factors such as increasing demand for lightweight and high-performance adhesives in various end-use industries, such as automotive, construction, and packaging. Additionally, the growing demand for eco-friendly adhesives and the increasing use of acrylic adhesives in the medical and electronic industries are also expected to drive the acrylic adhesives market value in the coming years.

Acrylic Adhesives Market Report Key Highlights

- Global acrylic adhesives market revenue is expected to increase by USD 19.3 Billion by 2032, with a 5.9% CAGR from 2023 to 2032

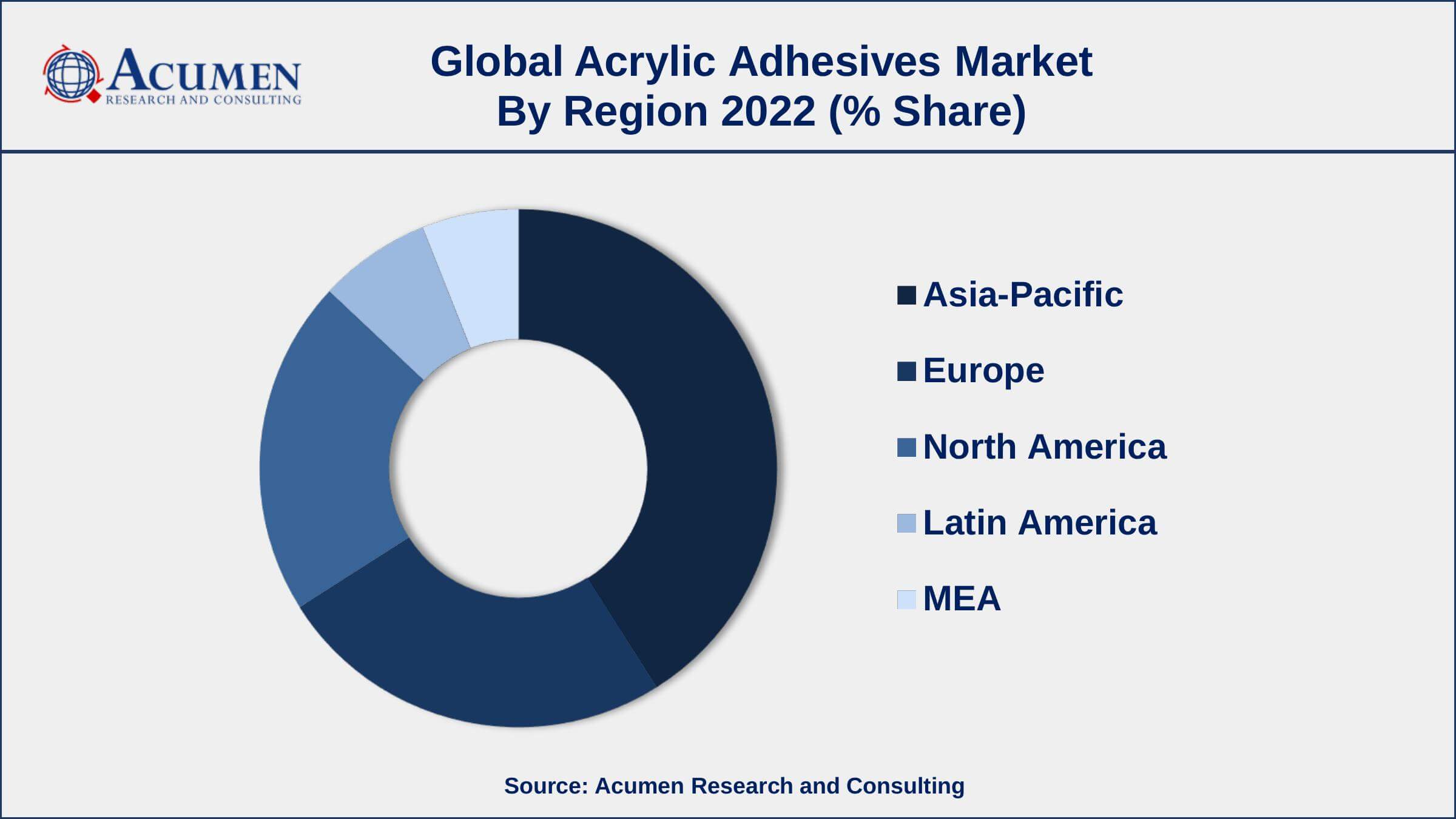

- Asia-Pacific region led with more than 41% of acrylic adhesives market share in 2022

- By application, the paper and packaing ablators segment has accounted market share of over 22% in 2022

- By technology, the water-based acrylic adhesives segment captured the majority of the market

- Henkel AG & Co. KGaA is a German multinational corporation that manufactures acrylic adhesives for a variety of uses such as construction, electronics, and packaging

- Growing adoption in packaging industry for food and beverages, drives the acrylic adhesives market size

Acrylic adhesives are also known as light-curing materials since they find wide applications in the manufacturing sector owing to their strong bond strength and rapid curing time. Acrylic adhesives are deployed in various industries for their extraordinary durability and strength. Acrylic adhesives possess fast setting and curing ability and are generally acid and solvent resistant. Acrylic adhesives find applications in a wide range of end-use industries including industrial assembly, automotive, electrical & electronics, furniture, medical, building, and construction among others. Acrylic adhesives are usually manufactured with the use of acrylate and methacrylate monomers as key feedstock. Other polymer mixtures are mixed in acrylate or methacrylate monomers and adhesive is produced as two different entities.

Global Acrylic Adhesives Market Trends

Market Drivers

- Increasing demand for lightweight and high-performance adhesives in various end-use industries

- Growing demand for eco-friendly adhesives

- Increasing use of acrylic adhesives in the medical and electronic industries

- Growing adoption of acrylic adhesives in the packaging industry for food and beverages

Market Restraints

- High cost of raw materials

- Stringent government regulations

Market Opportunities

- Growing construction and infrastructure development in emerging countries

- Increasing demand for biodegradable adhesives

Acrylic Adhesives Market Report Coverage

| Market | Acrylic Adhesives Market |

| Acrylic Adhesives Market Size 2022 | USD 11.1 Billion |

| Acrylic Adhesives Market Forecast 2032 | USD 19.3 Billion |

| Acrylic Adhesives Market CAGR During 2023 - 2032 | 5.9% |

| Acrylic Adhesives Market Analysis Period | 2018 - 2032 |

| Acrylic Adhesives Market Base Year | 2022 |

| Acrylic Adhesives Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Technology, By Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | 3M Corporation, The Dow Chemical Company, AVERY DENNISON CORPORATION, Pidilite Industries Ltd., H.B. Fuller Company, Huntsman International LLC, Henkel AG & Co. KGaA, Eastman Chemical Company, Sika AG, and Bayer Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Increasing demand for liquid adhesives especially in upholstery, carpentry, decorations, and furniture is a key factor anticipated to drive the growth of the global acrylic adhesives market over the forecast period. The vicious form of acrylic adhesives is widely used in glass, wood, waterproofing items, and metals. Moreover, the widespread use of adhesive tapes in clothing and other fabric-related applications is further expected to boost the growth of the global market over the forecast period.

In addition, increasing demand for acrylic adhesives, especially in polymers and plastics is projected to foster the growth of the global acrylic adhesives market due to increasing demand in thermoplastics. The use of acrylic adhesives in binding two surfaces makes the surface ready to be moved or handled in a short span of time and thus works efficiently on contaminated surfaces as well without affecting the aesthetics of the concerned surface. Thus, demand for acrylic adhesives is mostly driven due to the comparative advantage of acrylic over adhesives. Furthermore, rapid growth in the overall automotive industry across the globe is anticipated to fuel the demand for acrylic adhesives over the forecast period. The demand for acrylic adhesives is related to consumer markets; hence macroeconomic factors are also among the drivers of the global acrylic adhesives market.

Acrylic Adhesives Market Segmentation

The global acrylic adhesives market segmentation is based on technology, type, application, and geography.

Acrylic Adhesives Market By Technology

- Solvent-based

- Water-based

- Reactive

- Others

According to an acrylic adhesives industry analysis, the water-based segment held a significant market share in 2021. This growth is due to its environmental friendliness, low toxicity, and high performance. They are widely used in various applications such as woodworking, paper and packaging, and construction. They are also used in many non-structural applications such as bookbinding, lamination, and coating. The increasing demand for water-based acrylic adhesives in the packaging industry is expected to drive market growth. Additionally, the growing construction and infrastructure development in emerging countries is also expected to drive market growth.

Acrylic Adhesives Market By Type

- Acrylic polymer emulsion

- Cyanoacrylic

- UV curable acrylic

- Methacrylic

In terms of type, the acrylic polymer emulsion segment is expected to grow significantly in the market over the forecasting years. Acrylic polymer emulsions have excellent adhesion properties, high resistance to water and chemicals, good flexibility, and UV stability. They are also resistant to thermal aging and can withstand high temperatures. These properties make acrylic polymer emulsions suitable for a wide range of applications such as construction, woodworking, paper and packaging, and textiles. They are also used in various non-structural applications such as bookbinding, lamination, and coating.

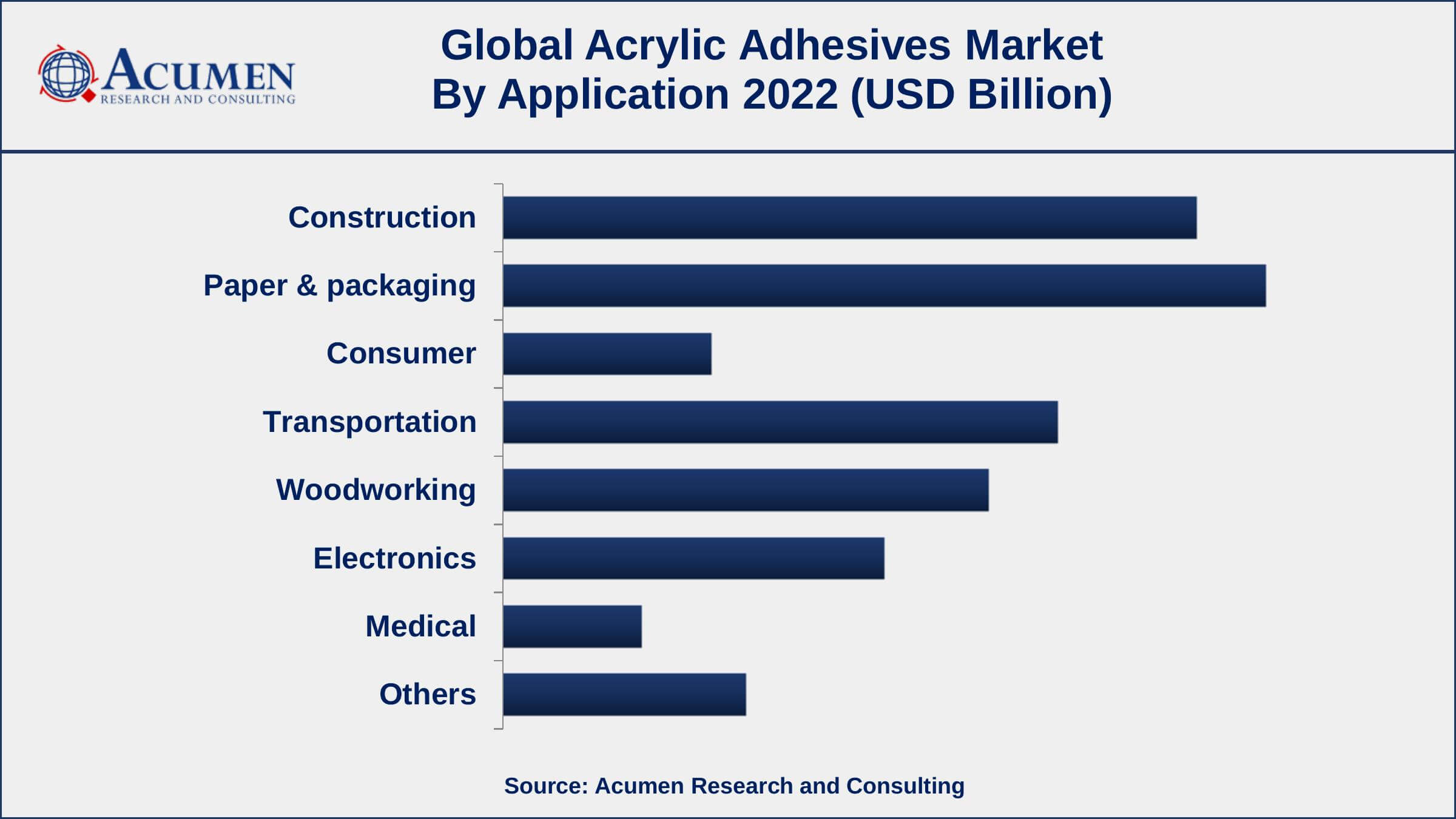

Acrylic Adhesives Market By Application

- Construction

- Paper & packaging

- Consumer

- Transportation

- Woodworking

- Electronics

- Medical

- Others

According to the acrylic adhesives market forecast, the construction segment is growing at a rapid pace in the market over the forecasting years. This growth is due to increasing demand for durable and long-lasting construction materials, as well as the growing use of acrylic adhesives in energy-efficient buildings. Acrylic adhesives are known for their strong bond strength, high-temperature resistance, and good durability, making them well-suited for construction applications. They are used to bond a variety of materials, including wood, metal, plastic, and ceramics. Additionally, the market growth is driven by the rising trend of infrastructure development projects and the construction of residential and commercial buildings.

Acrylic Adhesives Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Geographically, Asia-Pacific region is currently dominating the acrylic adhesives market. This is primarily due to the presence of large developing economies such as China and India, which have been experiencing significant growth in the construction industry. One of the main reasons is the presence of a large number of manufacturers in countries such as China, Japan, and South Korea. Another factor for the dominance of the Asia-Pacific region in the acrylic adhesives market is the increasing demand for these adhesives in various end-use industries such as construction, automotive, and electronics. The construction industry, in particular, is growing rapidly in the region due to increasing urbanization and population growth, leading to a higher demand for acrylic adhesives in the production of building materials. Additionally, the automotive and electronics industries in the Asia-Pacific region are also expanding, creating a higher demand for acrylic adhesives in the production of vehicles and electronic devices.

Acrylic Adhesives Market Players

Some of the top acrylic adhesives market companies offered in the professional report include 3M Corporation, The Dow Chemical Company, AVERY DENNISON CORPORATION, Pidilite Industries Ltd., H.B. Fuller Company, Huntsman International LLC, Henkel AG & Co. KGaA, Eastman Chemical Company, Sika AG, and Bayer Corporation.

Frequently Asked Questions

What was the market size of the global acrylic adhesives in 2022?

The market size of acrylic adhesives was USD 19.3 Billion in 2022.

What is the CAGR of the global acrylic adhesives market during forecast period of 2023 to 2032?

The CAGR of acrylic adhesives market is 5.9% during the analysis period of 2023 to 2032.

Which are the key players operating in the market?

The key players operating in the global acrylic adhesives market are 3M Corporation, The Dow Chemical Company, AVERY DENNISON CORPORATION, Pidilite Industries Ltd., H.B. Fuller Company, Huntsman International LLC, Henkel AG & Co. KGaA, Eastman Chemical Company, Sika AG, and Bayer Corporation.

Which region held the dominating position in the global acrylic adhesives market?

Asia-Pacific held the dominating position in acrylic adhesives market during the analysis period of 2023 to 2032.

Which region registered the fastest growing CAGR for the forecast period of 2023 to 2032?

North America region exhibited fastest growing CAGR for acrylic adhesives market during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global acrylic adhesives market?

The current trends and dynamics in the acrylic adhesives industry include the growing demand for eco-friendly adhesives and increasing use of acrylic adhesives in the medical and electronic industries.

Which application held the maximum share in 2022?

The paper & packaging application held the maximum share of the acrylic adhesives market.