Medical Tubing Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Medical Tubing Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

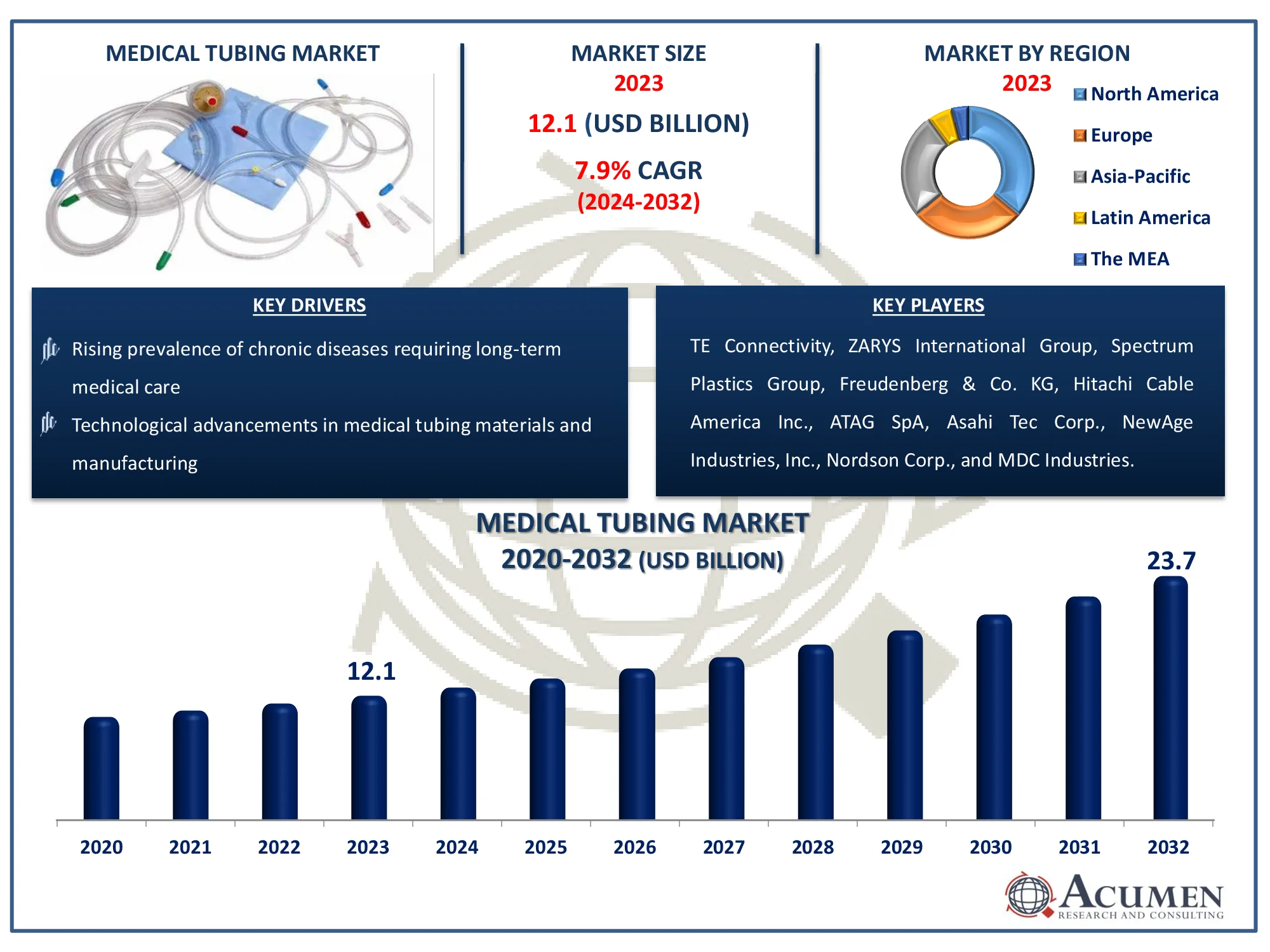

The Global Medical Tubing Market Size accounted for USD 12.1 Billion in 2023 and is estimated to achieve a market size of USD 23.7 Billion by 2032 growing at a CAGR of 7.9% from 2024 to 2032.

Medical Tubing Market (By Product: Silicone, Polyolefins, Polyvinyl Chloride, Polycarbonates, Fluoropolymers, and Others; By Structure: Single-Lumen, Co-Extruded, Multi-Lumen, Tapered Or Bump Tubing, and Braided Tubing; By Application: Bulk Disposable, Tubing, Drug Delivery Systems, Catheters, Biopharmaceutical Laboratory Equipment, and Others; and By End-User: Hospitals, Ambulatory Surgical Centers, and Others)

Medical Tubing Market Highlights

- Global medical tubing market revenue is poised to garner USD 23.7 billion by 2032 with a CAGR of 7.9% from 2024 to 2032

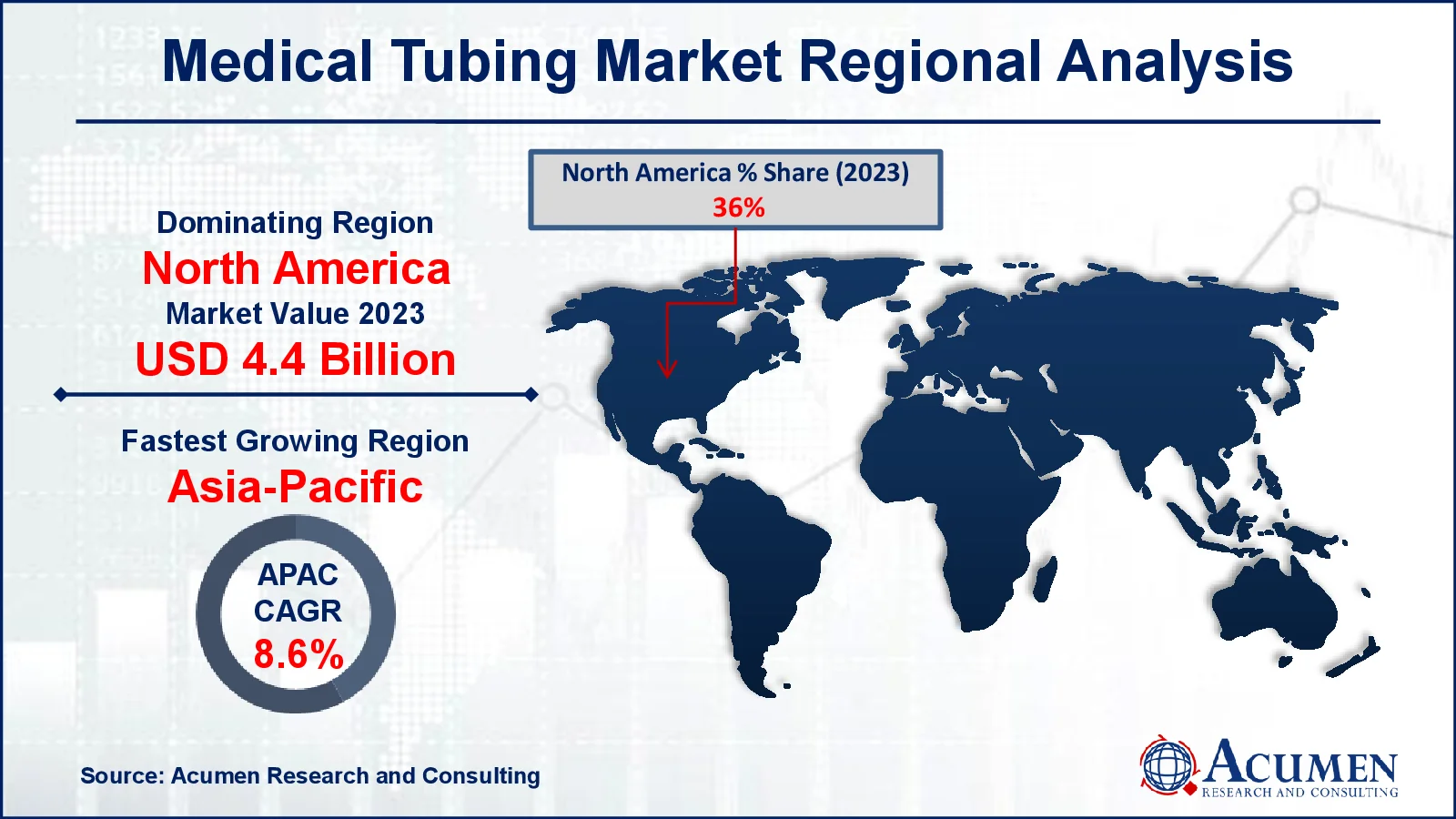

- North America medical tubing market value occupied around USD 4.4 billion in 2023

- Asia-Pacific medical tubing market growth will record a CAGR of more than 8.6% from 2024 to 2032

- Among structure, the single-lumen sub-segment generated notable revenue in 2023

- Based on application, the bulk disposable tubing sub-segment generated around 35% market share in 2023

- Growing demand for home healthcare and wearable medical devices is a popular medical tubing market trend that fuels the industry demand

Medical tubing is a vital component in healthcare, used for fluid and gas transfer in various medical devices and applications. Made from materials like silicone, PVC, and thermoplastic elastomers, it ensures biocompatibility and flexibility. Medical tubing is crucial in procedures involving catheters, IV sets, respiratory equipment, and dialysis machines. Its design prioritizes sterility, durability, and resistance to chemicals and temperature variations. The tubing's dimensions and properties are tailored to specific medical needs, supporting functions such as drug delivery, blood transfusion, and wound drainage. Advanced medical tubing also incorporates features like antimicrobial coatings and radiopaque markers, enhancing safety and effectiveness. This essential technology plays a significant role in patient care, enabling precise and reliable medical treatments.

Global Medical Tubing Market Dynamics

Market Drivers

- Increasing demand for minimally invasive surgical procedures

- Rising prevalence of chronic diseases requiring long-term medical care

- Technological advancements in medical tubing materials and manufacturing

- Growth in the geriatric population leading to higher healthcare needs

Market Restraints

- Stringent regulatory requirements for medical device approval

- High costs associated with advanced medical tubing materials

- Risks of contamination and infection with improper usage or quality control

Market Opportunities

- Expansion in emerging markets with improving healthcare infrastructure

- Development of eco-friendly and biodegradable medical tubing materials

- Increasing investment in R&D for innovative and specialized medical tubing solutions

Medical Tubing Market Report Coverage

| Market | Medical Tubing Market |

| Medical Tubing Market Size 2022 |

USD 12.1 Billion |

| Medical Tubing Market Forecast 2032 | USD 23.7 Billion |

| Medical Tubing Market CAGR During 2023 - 2032 | 7.9% |

| Medical Tubing Market Analysis Period | 2020 - 2032 |

| Medical Tubing Market Base Year |

2022 |

| Medical Tubing Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Structure, By Application, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | TE Connectivity, ZARYS International Group, Spectrum Plastics Group, Freudenberg & Co. KG, Hitachi Cable America Inc., ATAG SpA, Asahi Tec Corp., NewAge Industries, Inc., Nordson Corp., and MDC Industries. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Medical Tubing Market Insights

Continuous advancement in medical technology. Innovations in medical devices and equipment necessitate the use of high-quality, durable, and biocompatible tubing. For instance, the development of minimally invasive surgical procedures has spurred demand for tubing that can be precisely controlled and manipulated within the human body. Additionally, the rise in healthcare-associated infections has driven the need for antimicrobial and drug-eluting tubes, which require sophisticated manufacturing techniques and materials. These technological advancements ensure better patient outcomes and higher efficacy of medical procedures, thereby driving the market growth.

A significant restraint affecting the medical tubing market is the stringent regulatory framework governing medical device manufacturing and materials. Regulatory bodies, such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), impose rigorous standards to ensure the safety and efficacy of medical products. Compliance with these standards often requires substantial investment in research and development, extensive testing, and prolonged approval processes. This can be particularly challenging for smaller manufacturers, limiting their ability to enter or expand in the market. Additionally, any changes in regulatory policies can result in delays and increased costs, further restraining market growth.

The rising geriatric population globally presents a significant opportunity for the medical tubing market. Older adults typically require more medical care, including diagnostic and therapeutic procedures that utilize medical tubing. The prevalence of chronic diseases such as diabetes, cardiovascular conditions, and respiratory disorders increases with age, necessitating frequent use of medical devices that incorporate tubing. Furthermore, the aging population is driving demand for home healthcare services, which often rely on portable medical devices with specialized tubing. This demographic trend is expected to provide a sustained boost to the medical tubing market, as manufacturers develop products to cater to the specific needs of elderly patients.

Medical Tubing Market Segmentation

The worldwide market for medical tubing is split based on product, structure, application, end-user, and geography.

Medical Tubing Market By Product

- Silicone

- Polyolefins

- Polyvinyl Chloride

- Polycarbonates

- Fluoropolymers

- Others

According to medical tubing industry analysis, polyvinyl chloride (PVC) is the largest segment in the market, primarily due to its versatile properties and cost-effectiveness. PVC is highly favored for its flexibility, durability, and biocompatibility, making it suitable for a wide range of medical applications such as intravenous (IV) tubes, catheters, and drainage systems. Its inherent ability to be easily sterilized and processed enhances its utility in various medical settings. Additionally, PVC's compatibility with various additives allows for customization to meet specific medical requirements, further driving its adoption. The extensive use of PVC in disposable medical devices also contributes to its dominance in the market, ensuring patient safety and infection control.

Medical Tubing Market By Structure

- Single-Lumen

- Co-Extruded

- Multi-Lumen

- Tapered Or Bump Tubing

- Braided Tubing

The single-lumen segment is expected to take a notable share of the medical tubing market due to its simplicity, reliability, and broad applicability. Single-lumen tubes, featuring a single channel, are widely used in various medical applications such as intravenous (IV) lines, catheters, and feeding tubes. Their straightforward design ensures ease of use, making them a staple in both routine and emergency medical procedures. Additionally, single-lumen tubing is cost-effective and easier to manufacture, which supports its extensive adoption across healthcare settings. The demand for single-lumen tubing is further driven by the growing incidence of chronic diseases and the increasing number of hospital admissions, necessitating reliable and efficient medical tubing solutions.

Medical Tubing Market By Application

- Bulk Disposable Tubing

- Drug Delivery Systems

- Catheters

- Biopharmaceutical Laboratory Equipment

- Others

Bulk disposable tubing dominates the medical tubing market due to its extensive application across a wide range of healthcare procedures and its critical role in ensuring hygiene and preventing cross-contamination. These tubes are indispensable in fluid administration, blood transfusions, and respiratory therapy, among other uses. The segment's prominence is fueled by the growing emphasis on infection control and the rising incidence of hospital-acquired infections, which necessitate single-use products to maintain sterility. Additionally, the expanding healthcare infrastructure and increased medical services in developing regions drive the demand for bulk disposable tubing. Its cost-effectiveness and convenience make it a preferred choice for both hospitals and outpatient facilities, further solidifying its leading position during the medical tubing market forecast period.

Medical Tubing Market By End-User

- Hospitals

- Ambulatory Surgical Centers

- Others

Hospitals represent the leading end-user segment throught the medical tubing industry forecast period, due to their comprehensive and varied medical needs. Hospitals are equipped to handle a broad spectrum of procedures and treatments, ranging from routine to highly specialized, all of which require extensive use of medical tubing. The scale of operations in hospitals, combined with the need for consistent and reliable medical supplies, drives significant demand for various types of tubing. Additionally, the continuous influx of patients and the need for advanced medical interventions contribute to the high volume of tubing used. As hospitals expand their services and invest in new technologies, the demand for medical tubing continues to rise, reinforcing its dominant position in the market.

Medical Tubing Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Medical Tubing Market Regional Analysis

North America holds a significant share of the medical tubing market, driven by advanced healthcare infrastructure, high demand for innovative medical technologies, and substantial healthcare expenditure. The United States and Canada are key contributors, with an emphasis on quality and regulatory compliance fueling market growth. The presence of leading medical device manufacturers and research institutions further strengthens this region’s dominance.

In terms of medical tubing market analysis, the Asia-Pacific region is experiencing rapid growth due to its expanding healthcare infrastructure, rising healthcare needs, and increasing medical device production. Emerging economies such as China and India are seeing significant investments in healthcare facilities and medical technology. The region’s large population and rising awareness of advanced medical treatments further drive demand for medical tubing.

Medical Tubing Market Players

Some of the top Medical Tubing companies offered in our report include TE Connectivity, ZARYS International Group, Spectrum Plastics Group, Freudenberg & Co. KG, Hitachi Cable America Inc., ATAG SpA, Asahi Tec Corp., NewAge Industries, Inc., Nordson Corp., and MDC Industries.

Frequently Asked Questions

How big is the medical tubing market?

The Medical Tubing market size was valued at USD 12.1 billion in 2023.

What is the CAGR of the global medical tubing market from 2024 to 2032?

The CAGR of medical tubing is 7.9% during the analysis period of 2024 to 2032.

Which are the key players in the medical tubing market?

The key players operating in the global market are including TE Connectivity, ZARYS International Group, Spectrum Plastics Group, Freudenberg & Co. KG, Hitachi Cable America Inc., ATAG SpA, Asahi Tec Corp., NewAge Industries, Inc., Nordson Corp., and MDC Industries.

Which region dominated the global medical tubing market share?

North America held the dominating position in medical tubing industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of medical tubing during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global medical tubing industry?

The current trends and dynamics in the medical tubing industry include increasing demand for minimally invasive surgical procedures, rising prevalence of chronic diseases requiring long-term medical care, technological advancements in medical tubing materials and manufacturing, and growth in the geriatric population leading to higher healthcare needs.

Which product held the maximum share in 2023?

The polyvinyl chloride product held the maximum share of the medical tubing industry.