Fluoropolymer Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Fluoropolymer Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

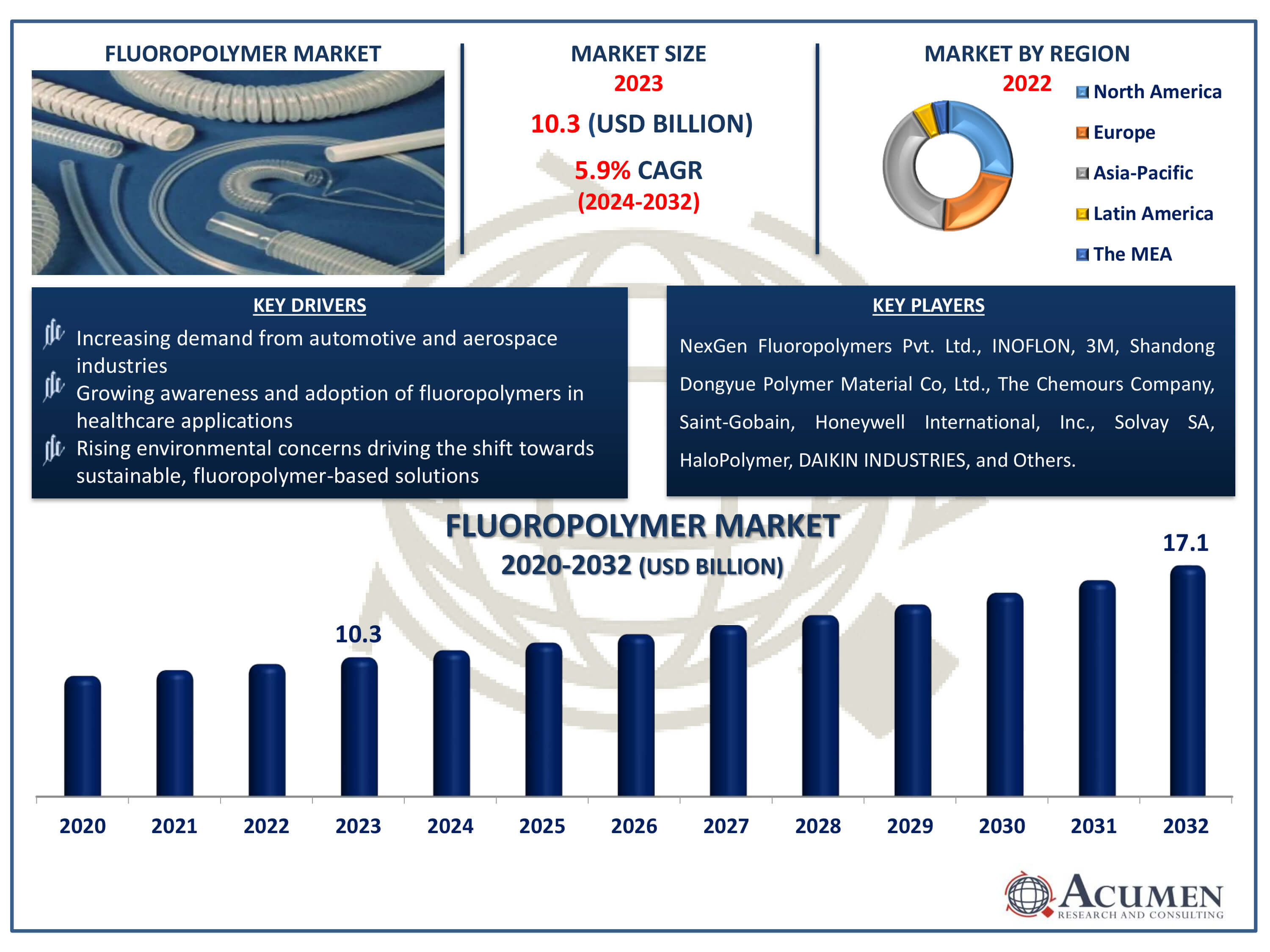

The Fluoropolymer Market Size accounted for USD 10.3 Billion in 2023 and is estimated to achieve a market size of USD 17.1 Billion by 2032 growing at a CAGR of 5.9% from 2024 to 2032.

Fluoropolymer Market Highlights

- Global fluoropolymer market revenue is poised to garner USD 17.1 billion by 2032 with a CAGR of 5.9% from 2024 to 2032

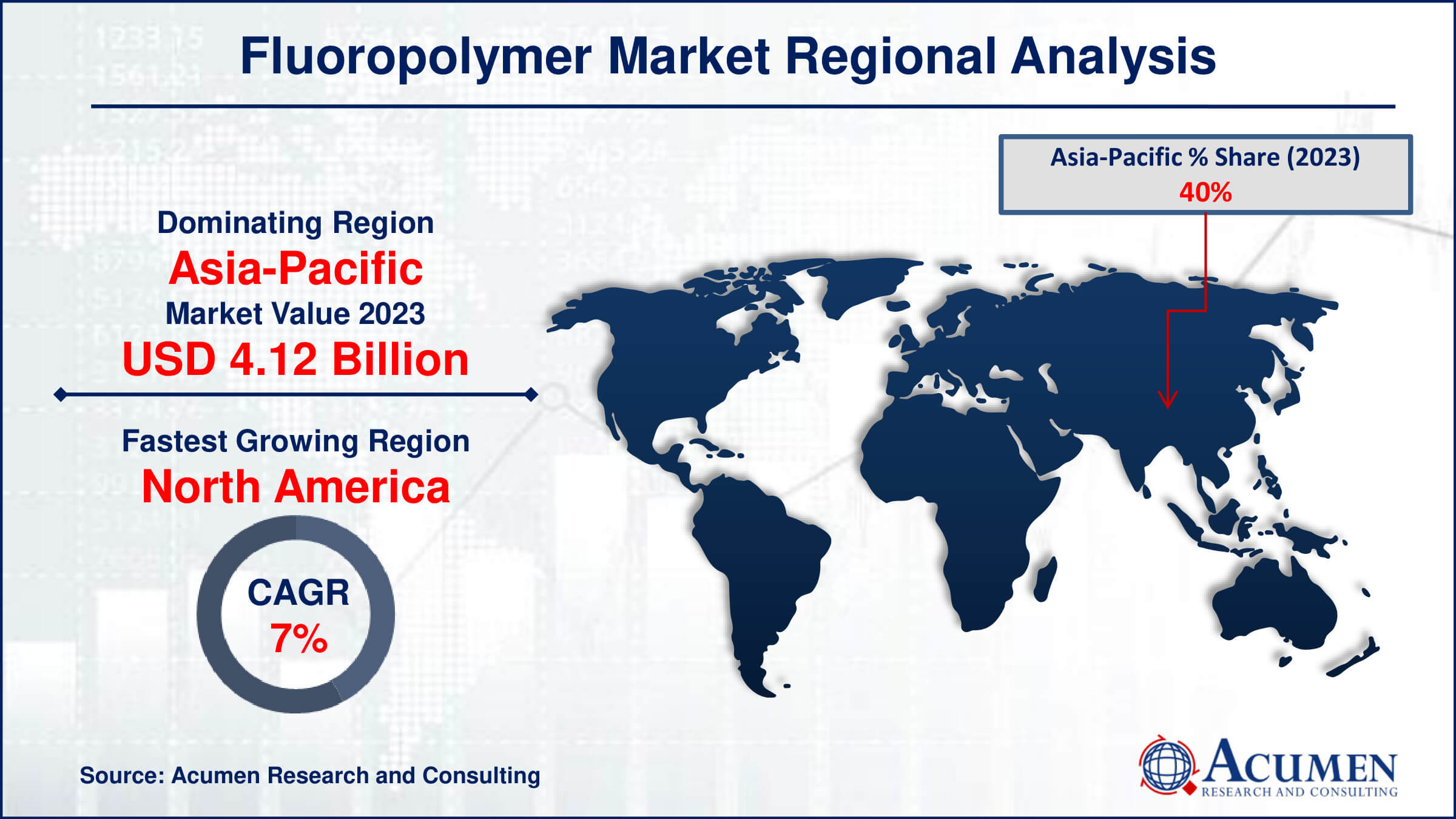

- Asia-Pacific fluoropolymer market value occupied around USD 4.12 billion in 2023

- North America fluoropolymer market growth will record a CAGR of more than 7% from 2024 to 2032

- Among type, the polytetrafluoroethylene (PTFE) sub-segment generated significant market share in 2023

- Based on end use industry, the industrial equipment sub-segment accomplished notable market share in 2023

- Growth in the use of fluoropolymers in the electronics sector for applications such as wire and cable insulation, semiconductor manufacturing, and printed circuit boards is the fluoropolymer market trend that fuels the industry demand

Fluoropolymers are a class of synthetic polymers known for their exceptional chemical resistance, high thermal stability, and low friction properties. One of the most well-known fluoropolymers is polytetrafluoroethylene (PTFE). Fluoropolymers find extensive applications across various industries due to their unique characteristics. They are widely used in non-stick coatings for cookware, where their low surface energy prevents food from sticking. In the chemical industry, fluoropolymers are employed for lining tanks and pipes due to their resistance to corrosive chemicals. Their heat resistance makes them ideal for electrical insulation in cables and wires, ensuring safety and reliability in harsh environments. Additionally, fluoropolymers play a crucial role in the automotive sector, where they are used in gaskets and seals for their ability to withstand extreme temperatures and chemicals.

In the medical field, they are utilized in catheters and other medical devices because of their biocompatibility and resistance to bodily fluids. Overall, fluoropolymers continue to be indispensable in modern manufacturing and technology, offering solutions where durability, reliability, and chemical resistance are paramount.

Global Fluoropolymer Market Dynamics

Market Drivers

- Increasing demand from automotive and aerospace industries for lightweight, high-performance materials

- Growing awareness and adoption of fluoropolymers in healthcare applications due to their biocompatibility and chemical resistance

- Rising environmental concerns driving the shift towards sustainable, fluoropolymer-based solutions

Market Restraints

- High production costs associated with fluoropolymer manufacturing processes

- Regulatory challenges and environmental considerations regarding the disposal and recycling of fluoropolymer products

- Competition from alternative materials offering comparable performance at lower costs

Market Opportunities

- Expansion in emerging economies with increasing industrialization and infrastructure development

- Innovations in fluoropolymer technologies, such as improved durability and enhanced thermal stability

- Potential applications in electronics and telecommunications sectors due to their excellent electrical properties and reliability

Fluoropolymer Market Report Coverage

| Market | Fluoropolymer Market |

| Fluoropolymer Market Size 2022 | USD 10.3 Billion |

| Fluoropolymer Market Forecast 2032 | USD 17.1 Billion |

| Fluoropolymer Market CAGR During 2023 - 2032 | 5.9% |

| Fluoropolymer Market Analysis Period | 2020 - 2032 |

| Fluoropolymer Market Base Year |

2022 |

| Fluoropolymer Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, By End Use Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | NexGen Fluoropolymers Pvt. Ltd., INOFLON, 3M, Shandong Dongyue Polymer Material Co, Ltd., The Chemours Company, Saint-Gobain, Honeywell International, Inc., Solvay SA, HaloPolymer, DAIKIN INDUSTRIES, KUREHA CORPORATION, AGC Chemicals, and Arkema SA. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Fluoropolymer Market Insights

The fluoropolymer market is experiencing a surge in demand driven by the automotive and aerospace industries, where there is a growing need for lightweight yet high-performance materials. For instance, in 2023, China ascended to the top of the global automotive production industry, with a total output of 30 million vehicles. The country also led the world in the production of new energy vehicles (NEVs), manufacturing nearly nine million units. This accounted for nearly two-thirds of the global NEV production. Fluoropolymers, known for their exceptional thermal and chemical resistance along with low friction properties, are increasingly favored for their ability to enhance fuel efficiency and durability in vehicles and aircraft. Their use in critical applications such as fuel systems, seals, and electrical components underscores their importance in modern engineering. This trend underscores a shift towards advanced materials that can meet stringent performance requirements while contributing to overall weight reduction and efficiency improvements in transportation sectors.

The fluoropolymer market faces significant hurdles due to regulatory challenges and environmental concerns associated with disposal and recycling. Fluoropolymers are known for their durability and resistance to heat and chemicals, making them difficult to break down and recycle effectively. Regulatory frameworks often lack clear guidelines for handling these materials, leading to inconsistent practices across regions. Additionally, concerns about the environmental impact of fluoropolymer burning or landfill disposal further complicate sustainable management strategies. These challenges impede market growth by raising costs and limiting options for disposal and recycling, necessitating innovative solutions and stricter regulations for sustainable fluoropolymer management.

The expansion of emerging economies, characterized by rapid industrialization and extensive infrastructure development, presents a significant opportunity for the fluoropolymer market. For instance, according to India’s Brand Equity Foundation, India's manufacturing sector is set to hit US$ 1 trillion by 2025-26, driven by significant investments in the automobile, electronics, and textile industries. This growth is spearheaded by key states such as Gujarat, Maharashtra, and Tamil Nadu. Moreover, fluoropolymers, known for their unique properties such as chemical resistance, thermal stability, and low friction, are increasingly in demand across various industries including automotive, electronics, and construction. As these economies grow, there is a heightened need for durable and reliable materials to meet stringent regulatory requirements and technological advancements. This trend not only boosts the demand for fluoropolymers but also encourages innovation and investment in manufacturing capabilities within these regions, fostering a competitive global market landscape.

Fluoropolymer Market Segmentation

The worldwide market for fluoropolymer is split based on type, application, end use industry, and geography.

Fluoropolymers Market By Type

- Polytetrafluoroethylene (PTFE)

- Fluorinated Ethylene-Propylene (FEP)

- Polyvinylidene Fluoride (PVDF)

- Fluoroelastomer

- Polyvinyl Fluoride (PVF)

- Perfluoroalkoxy Polymer (PFA)

- Ethylene Tetrafluoroethylene (ETFE)

- Others

- PCTFE

- ECTFE

- Others

According to the fluoropolymer industry analysis, polytetrafluoroethylene (PTFE) is the dominant fluoropolymer in the market due to its exceptional properties and widespread applications. Known for its non-stick surface, high chemical resistance, and thermal stability, PTFE finds extensive use in industries ranging from aerospace and electronics to cookware and medical devices. Its unique combination of low friction coefficient and robustness makes it ideal for demanding environments where durability and reliability are paramount. PTFE's ability to withstand extreme temperatures (-200°C to +260°C) further enhances its utility in diverse industrial and consumer products, solidifying its position as the primary fluoropolymer choice globally.

Fluoropolymers Market By Application

- Film

- Tube

- Sheet

- Pipe

- Membrane

- Sealant

- Roofing

- Additives

- Others

The pipe segment is the largest application category in the fluoropolymer market and it is expected to increase over the industry due to their widespread applications across various industries such as chemical processing, oil and gas, and water treatment. Fluoropolymers like PTFE, FEP, and PVDF are favored for their exceptional chemical resistance, high temperature tolerance, and low friction properties, making them ideal for conveying corrosive fluids and gases. The increasing demand for durable, non-stick, and thermally stable materials further bolsters the growth of fluoropolymer pipes. Their ability to withstand harsh environments and stringent regulatory requirements positions them as crucial components in modern industrial infrastructure, driving their anticipated dominance in the market segment.

Fluoropolymers Market By End Use Industry

- Transportation Equipment

- Automotive vehicles

- Aerospace

- Others

- Electrical and Electronics

- Wire and cable

- Photovoltaic modules

- Batteries

- Fuel cells

- Construction

- Industrial Equipment

- Others

- Cookware

- Textiles

- Lubricants

- Others

According to the fluoropolymer industry analysis, the fluoropolymer market is predominantly driven by the industrial equipment sector due to the unique properties these materials offers fluoropolymers such as PTFE (polytetrafluoroethylene) and PVDF (polyvinylidene fluoride) are valued for their exceptional chemical resistance, high thermal stability, and low friction coefficient. These qualities make them ideal for critical applications in industrial equipment, including seals, gaskets, linings, and coatings. Industries such as chemical processing, oil and gas, and semiconductor manufacturing rely heavily on fluoropolymers to enhance equipment performance and longevity in demanding environments. As technology advances and industries continue to prioritize efficiency and durability, the demand for fluoropolymers in industrial equipment is expected to grow steadily.

Fluoropolymer Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Fluoropolymer Market Regional Analysis

For several reasons, the Asia-Pacific region holds a commanding position in the fluoropolymer market due to several key factors. Firstly, rapid industrialization and urbanization in countries like China, India, and Japan drive substantial demand across various sectors including automotive, electronics, and chemical processing. Secondly, robust manufacturing capabilities and technological advancements bolster production efficiencies and innovation in fluoropolymer applications. For instance, in August 2023, the Kureha Group announced its plans to boost the production capacity of polyvinylidene fluoride (PVDF) at its Iwaki Plant in Fukushima, Japan. This expansion aims to meet the rising demand for PVDF, which is utilized as an adhesive material for lithium-ion batteries (LiB) and as an engineering plastic in various industrial applications. Thirdly, favorable government policies and investments in infrastructure further stimulate market growth. Overall, Asia-Pacific's dominance in the fluoropolymer market is underscored by its strategic economic development and expanding industrial base.

North America is experiencing rapid growth in the fluoropolymer market due to increasing demand across various industries such as automotive, electronics, and construction. Factors driving this growth include advancements in technology, rising applications in coatings, and the region's strong emphasis on research and development. For instance, in October 2021, PPG introduced its latest Lineguard line of coatings and application services, aimed at tier suppliers, industrial clients, and automotive OEMs. This initiative seeks to cut costs, save time, minimize risks, and lessen the environmental impact linked to the maintenance of various paint shop equipment. As industries seek durable and high-performance materials, fluoropolymers are becoming increasingly favored for their unique properties and versatility in demanding applications.

Fluoropolymer Market Players

Some of the top fluoropolymer companies offered in our report include NexGen Fluoropolymers Pvt. Ltd., INOFLON, 3M, Shandong Dongyue Polymer Material Co, Ltd., The Chemours Company, Saint-Gobain, Honeywell International, Inc., Solvay SA, HaloPolymer, DAIKIN INDUSTRIES, KUREHA CORPORATION, AGC Chemicals, and Arkema SA.

Frequently Asked Questions

How big is the fluoropolymer market?

The fluoropolymer market size was valued at USD 10.3 billion in 2023.

What is the CAGR of the global fluoropolymer market from 2024 to 2032?

The CAGR of fluoropolymer is 5.9% during the analysis period of 2024 to 2032.

Which are the key players in the fluoropolymer market?

The key players operating in the global market are including NexGen Fluoropolymers Pvt. Ltd., INOFLON, 3M, Shandong Dongyue Polymer Material Co, Ltd., The Chemours Company, Saint-Gobain, Honeywell International, Inc., Solvay SA, HaloPolymer, DAIKIN INDUSTRIES, KUREHA CORPORATION, AGC Chemicals, and Arkema SA

Which region dominated the global fluoropolymer market share?

Asia Pacific held the dominating position in fluoropolymer industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of fluoropolymer during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global fluoropolymer industry?

The current trends and dynamics in the fluoropolymer industry include increasing demand from automotive and aerospace industries for lightweight, high-performance materials, growing awareness and adoption of fluoropolymers in healthcare applications due to their biocompatibility and chemical resistance, and rising environmental concerns driving the shift towards sustainable, fluoropolymer-based solutions.

Which type held the maximum share in 2023?

The polytetrafluoroethylene (PTFE) type held the maximum share of the fluoropolymer industry.