Blood Transfusion Diagnostics Market (By Product: Reagents & Kits, Instruments, and Others; By Application: Blood Grouping and Disease Screening; By End-use: Hospitals, Blood Banks, Diagnostic Laboratories, and Others) � Global Industry Analysis, Market Size, Opportunities and Forecast 2021-2028

Published :

Report ID:

Pages :

Format :

Blood Transfusion Diagnostics Market (By Product: Reagents & Kits, Instruments, and Others; By Application: Blood Grouping and Disease Screening; By End-use: Hospitals, Blood Banks, Diagnostic Laboratories, and Others) � Global Industry Analysis, Market Size, Opportunities and Forecast 2021-2028

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

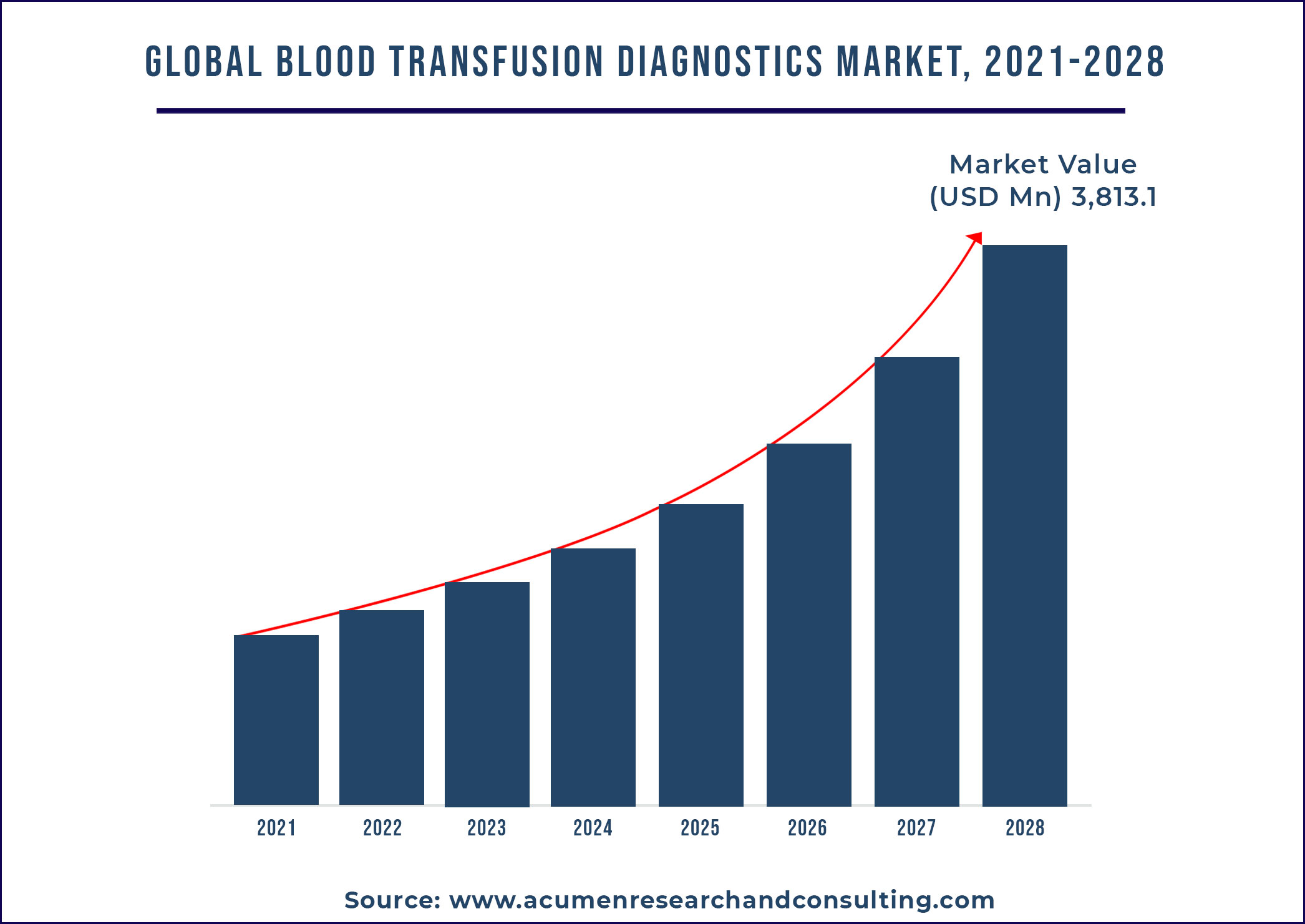

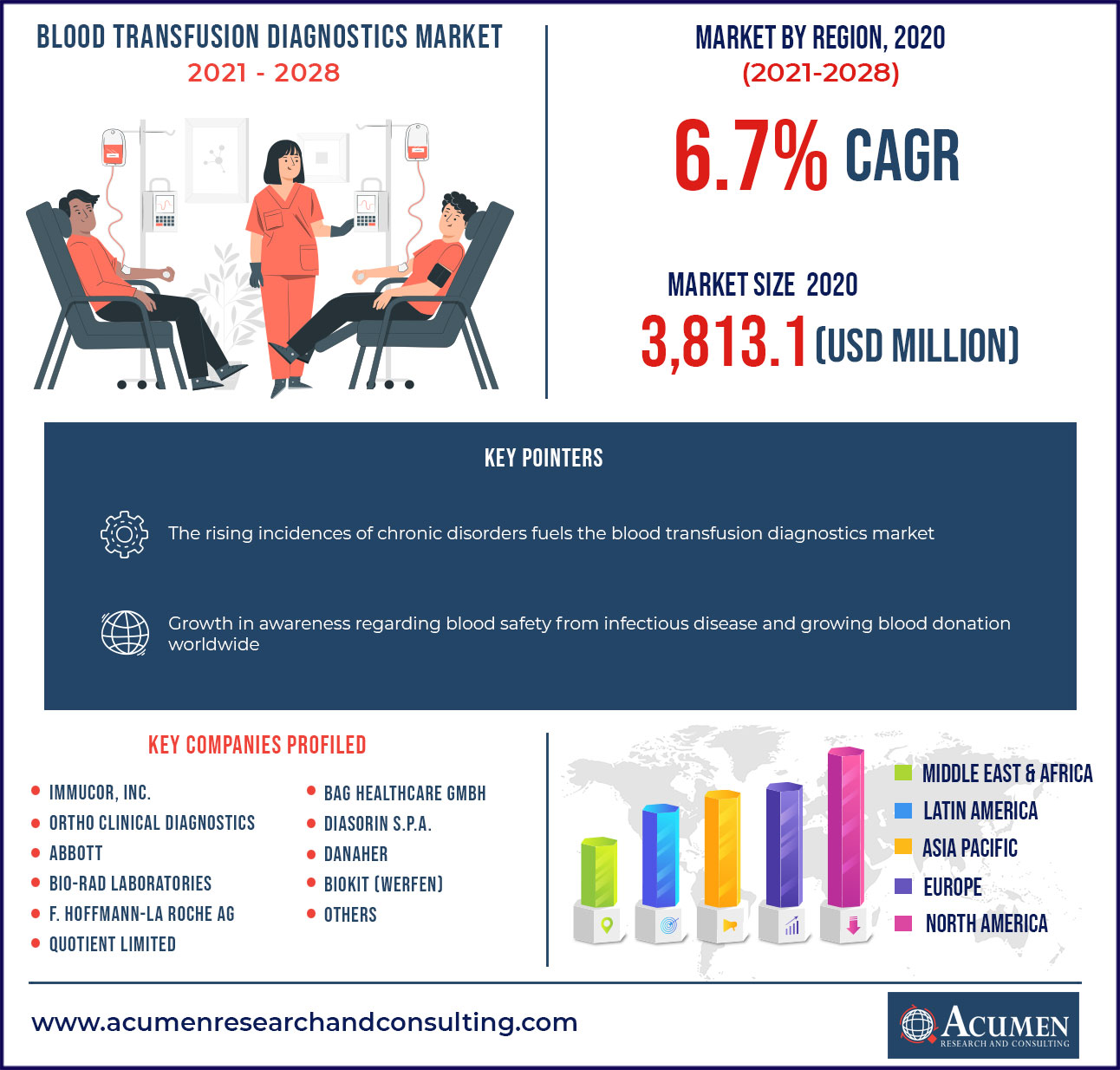

The global blood transfusion diagnostics market accounted for US$ 3,813.1 Mn in 2020 with a considerable CAGR of 6.7% during the forecast period of 2021 to 2028.

Blood transfusion is the intravenous administration of blood products or blood into the circulatory system. Blood transfusion is used in a variety of medical conditions to replace lost blood components. Previously, whole blood was used for transfusion; however, modern medical methods can only use a component of blood for transfusion. Blood transfusion is one of the most common procedures performed on hospital patients. Hence, clinicians must be aware about the proper administration of blood products, as well as symptoms, signs, and transfusion reaction management. Red blood cells, platelets, plasma, albumin, and immunoglobulin preparations are all blood products that can be transfused into the human body.

Report coverage

| Market | Blood Transfusion Diagnostics Market |

| Analysis Period | 2017 - 2028 |

| Base Year | 2020 |

| Forecast Data | 2021 - 2028 |

| Segments Covered | By Product, By Application, By End-Use, and By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Abbott, BAG Healthcare GmbH, Immucor Inc., Danaher, Quotient Limited, Bio-Rad Laboratories, Ortho Clinical Diagnostics, F. Hoffmann-La Roche AG, DiaSorin S.P.A., BIOKIT (Werfen), among others. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

| Customization Scope |

10 hrs of free customization and expert consultation |

The rising commonness of chronic and infectious ailments alike as cancer, kidney disorder, liver complaints, hemophilia, anemia, sickle cell condition, and thrombocytopenia, as well as the preface of technologically advanced products, are among the factors driving blood transfusion diagnostics market demand. Likewise, the growing number of cases suffering from anemia, which necessitates red blood cell transfusion for treatment, is anticipated to drive up demand for blood transfusion diagnostics. According to the World Health Organization, anemia is the most common blood disease, affecting further than 1.62 billion people worldwide, or24.8 percent of the population. Aplastic anemia can be treated with drugs and blood transfusions. Alternatively, the high cost of tests, instruments, and reagents, combined with a lack of skilled professionals to handle automated diagnostic solutions, is one of the factors limiting the growth of the blood transfusion diagnostics market during the forecast period.

Segmentation

Based on the product segment, the reagent and kits segments dominated the market in 2020. The key factors driving the kits & reagents segment are growing need for blood screening due to rise in surgeries globally, rise in chronic diseases that require blood transfusion in regular basis and high awareness about blood transmitted diseases. The segment's growth has been fueled by the product's easy availability and repeat purchases for screening of blood samples of donors and recipient.

Based on the application segment, the disease screening held the largest market share in 2020. For disease screening, blood transfusion diagnostics are widely used. The disease screening segment is attributed to an increase in the incidence of transfusion-transmitted diseases (TTIs), increased safety screening of given blood to maintain safe transfusion, and rising technical improvements.

Based on the end-user segment, the blood bank segment accounted for the largest market share in 2020 due to growing number of blood banks globally as well as moderate increase in the blood donation due to supportive government initiatives and programs for blood donations. Increased disease screening and blood group testing performed before transfusion therapy promote the blood bank segment.

Based on region, North America was the leading market for blood transfusion diagnostics in 2020. Growing number of blood transfusion procedures in the US and Canada drives the demand for blood transfusion diagnostic kits to eliminate the risk any complication during the use of such blood; also stringent policies regarding the safety and precautionary measures also drive the market.

Competitive Landscape

Companies in this market are constantly implementing rigorous strategies to enhance the development and manufacturing of blood diagnostic tests, increasing the market share over others. Some of the major participants in the blood transfusion diagnostics market are Abbott, BAG Healthcare GmbH, Immucor Inc., Danaher, Quotient Limited, Bio-Rad Laboratories, Ortho Clinical Diagnostics, F. Hoffmann-La Roche AG, DiaSorin S.P.A., BIOKIT (Werfen), among others.

- In June 2021, DiaSorin has introduced the LIAISON Murex Anti-HEV IgG & IgM assay for the detection of Hepatitis E (HEV). This is the first CLIA-approved fully automated high-throughput HEV test, and it is available in countries that accept the CE Mark for use on the LIAISON family platforms.

- In July 2019, Abbott announces FDA approval of the ALINITY S system, the most recent technology for screening and protecting the blood and plasma supply in the United States. This new solution will bring cutting-edge screening technology to blood and plasma centers in the US. In comparison to commercially available competitive systems, ALINITY S is designed to screen blood and plasma more efficiently in a smaller space.

Market Segmentation

Market By Product

- Reagents & Kits

- Instruments

- Others

Market By Application

- Blood Grouping

- Disease Screening

- Serological Disease Screening

- Molecular Disease Screening

Market By End-use

- Hospitals

- Blood Banks

- Diagnostic Laboratories

- Others

Market By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions

How much was the estimated value of the global Blood Transfusion Diagnostics market by 2028?

The estimated value of global Blood Transfusion Diagnostics market in 2020 was accounted to be US$ 5,873.9 Mn

What will be the projected CAGR for global Blood Transfusion Diagnostics market during forecast period of 2021 to 2028?

The projected CAGR of Blood Transfusion Diagnostics during the analysis period of 2021 to 2028 is 6.7%.

Which region exhibited the fastest growing CAGR for the forecast period of 2021 to 2028?

Asia pacific region exhibited fastest growing CAGR for Blood Transfusion Diagnostics during the analysis period of 2021 to 2028

What are the current trends and dynamics in the global Blood Transfusion Diagnostics market?

Rising prevalence of chronic and infectious diseases such as severe anemia, cancer, hemophilia, kidney disease, liver disease as well as the introduction of technologically advanced products are the prominent factors that fuel the growth of global Blood Transfusion Diagnostics market