Plasma Therapy Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Plasma Therapy Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

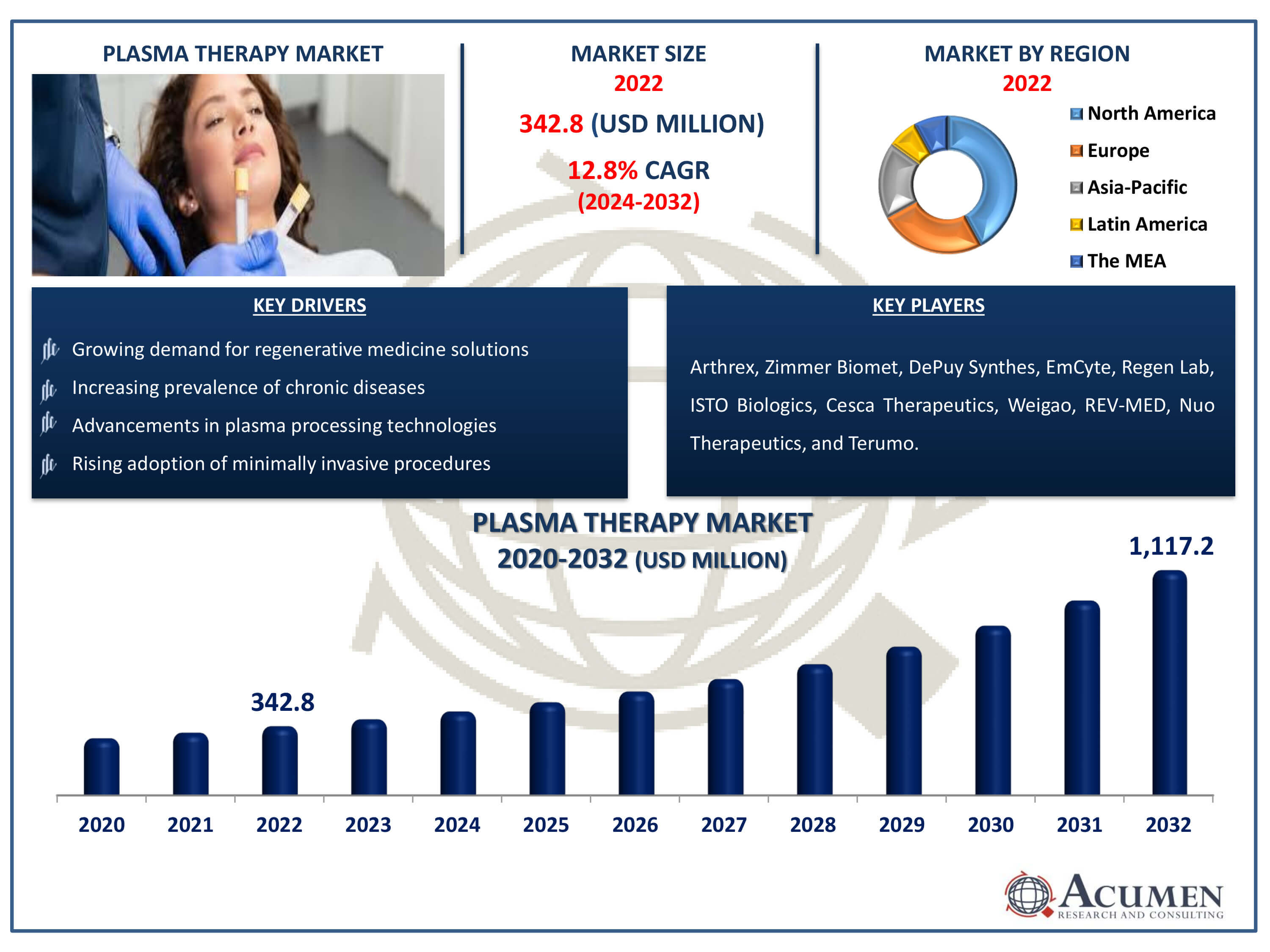

The Plasma Therapy Market Size accounted for USD 342.8 Million in 2022 and is estimated to achieve a market size of USD 1,117.2 Million by 2032 growing at a CAGR of 12.8% from 2024 to 2032.

Plasma Therapy Market Highlights

- Global plasma therapy market revenue is poised to garner USD 1,117.2 million by 2032 with a CAGR of 12.8% from 2024 to 2032

- North America plasma therapy market value occupied around USD 144 million in 2022

- Asia-Pacific plasma therapy market growth will record a CAGR of more than 13.5% from 2024 to 2032

- Among type, the pure PRP sub-segment generated more than USD 198.8 million revenue in 2022

- Based on application, the orthopedic sub-segment generated significant market share in 2022

- Growing healthcare infrastructure in developing economies is a popular plasma therapy market trend that fuels the industry demand

Blood plasma comprises autologous platelets and cytokines, which stimulate the healing of soft tissue. It is commonly used in dental, dermatological, and orthopedic procedures for wound repair, treatment of androgenetic alopecia, and facial rejuvenation. Plasma treatment harnesses physiological benefits up to 3-5 times and is injected into tissues where healing is needed. Combining advanced medical technology with the body's natural healing abilities, plasma therapy finds applications in various therapeutic fields such as orthopedics, ophthalmology, neurosurgery, and surgery. The procedure involves processing a small amount of the patient's blood in a centrifuge to isolate platelets and other materials, which are then injected into and around the injury site for accelerated healing. Since the patient's own blood is used, there is virtually no risk of contamination or allergic reactions in the recipient.

Global Plasma Therapy Market Dynamics

Market Drivers

- Growing demand for regenerative medicine solutions

- Increasing prevalence of chronic diseases

- Advancements in plasma processing technologies

- Rising adoption of minimally invasive procedures

Market Restraints

- High cost associated with plasma therapy

- Limited awareness and accessibility in certain regions

- Stringent regulatory requirements for plasma-derived products

Market Opportunities

- Expansion of applications in aesthetic and cosmetic treatments

- Rising investment in research and development

- Emergence of new plasma-based therapies

Plasma Therapy Market Report Coverage

| Market | Plasma Therapy Market |

| Plasma Therapy Market Size 2022 | USD 342.8 Million |

| Plasma Therapy Market Forecast 2032 |

USD 1,117.2 Million |

| Plasma Therapy Market CAGR During 2024 - 2032 | 12.8% |

| Plasma Therapy Market Analysis Period | 2020 - 2032 |

| Plasma Therapy Market Base Year |

2022 |

| Plasma Therapy Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Type, By Source, By Application, By End User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Arthrex, Zimmer Biomet, DePuy Synthes, EmCyte, Regen Lab, ISTO Biologics, Cesca Therapeutics, Weigao, REV-MED, Nuo Therapeutics, and Terumo. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Plasma Therapy Market Insights

The growing need for minimally invasive therapies is predicted to coincide with the incidence of orthopaedic illnesses caused by ageing and trauma, hence boosting the global growth of plasma therapy. This increase in demand is most noticeable in a variety of medical professions, including dental, dermatological, orthopaedic, cardiac, and neurological specialties. Platelet-Rich Plasma (PRP) is increasingly being used in these areas due to its regenerative qualities and efficacy in aiding tissue repair and regeneration. Also, the increasing frequency of orthopedic ailments such as arthritis, along with growing healthcare costs, is expected to drive the growth of the worldwide plasma treatment market. Technological developments in plasma processing techniques, notably the introduction of low-cost plasma protein splitting technologies, have increased the efficacy and accessibility of plasma treatment across several medical fields.

likewise, increased rates of androgenic alopecia and sports-related injuries among athletes are predicted to fuel future worldwide need for plasma treatment. Furthermore, the increasing usage of Platelet-Rich Plasma (PRP) in a variety of therapeutic applications is driving up global demand for plasma treatment. Still, several constraints impede market expansion, such as poor knowledge of platelet-rich treatment, sluggish recovery rates, and rigorous regulatory rules. Despite these constraints, ongoing advances in plasma treatment technology and rising applications across many medical specialties present significant potential for market growth throughout the plasma therapy industry forecast period.

Plasma Therapy Market Segmentation

The worldwide market for plasma therapy is split based on type, source, application, end user, and geography.

Plasma Therapy Types

- Leukocyte-Rich Fibrin

- Pure Platelet-Rich Fibrin

- Leukocyte-Rich PRP

- Pure PRP

According to plasma therapy industry analysis, the pure platelet-rich plasma (PRP) segment leader in the market due to its superior regenerative qualities and wide range of uses. Pure PRP is derived from the patient's own blood and includes a concentrated combination of platelets, growth factors, and cytokines that aids in tissue repair and regeneration. Its ease of preparation, high platelet concentration, and efficacy make it a popular choice in a variety of medical fields, including orthopaedics, dentistry, dermatology, and cosmetic medicine. Pure PRP, with its proven efficacy in wound healing, tissue regeneration, and pain management, continues to lead the plasma therapy industry, providing safe and efficient treatment alternatives for patients seeking regenerative therapies.

Plasma Therapy Sources

- Allogenic

- Autologous

The autologous category dominates the plasma treatment market because to its intrinsic benefits and extensive acceptance across numerous medical disciplines. Autologous plasma treatment uses the patient's own blood as the source of plasma, reducing the danger of immunological responses or disease transmission. This strategy provides personalized therapy alternatives based on specific patient needs, promoting safety and efficacy. Additionally, autologous plasma therapy removes the requirement for donor screening and compatibility testing, which simplifies the treatment procedure and reduces procedural complications. With a confirmed safety profile and favorable outcomes, autologous plasma treatment has grown in popularity in orthopedics, dermatology, dentistry, and cosmetic medicine, contributing to its market domination. The increased emphasis on personalized medicine, as well as the increasing need for minimally invasive treatment choices, all contributes to the autologous segment's sustained rise in the plasma therapy market.

Plasma Therapy Applications

- Cardiac Muscle Injury

- Dental

- Nerve Injury

- Dermatology

- Orthopedic

- Others

Owing to its numerous applications and the increasing worldwide occurrence of musculoskeletal disorders, the orthopedic industry emerges as the leader in plasma treatment. Orthopedic plasma therapy is a potential treatment option for individuals suffering from a variety of orthopedic injuries and degenerative disorders, including osteoarthritis, tendonitis, and ligament damage. Orthopedic therapies use plasma's regenerative capabilities to stimulate tissue regeneration, decrease inflammation, and relieve pain, thereby improving patients' mobility and quality of life. Plus, plasma treatment operations are less invasive, with positive patient outcomes and shorter recovery periods, contributing to the segment's market dominance. With an ageing population and increased engagement in sports and physical activities, the need for orthopedic plasma treatment is likely to continue rising, propelling additional expansion in the sector.

Plasma Therapy End Users

- Hospitals and Clinics

- Research Institutes

- Others

The hospitals and clinics category is predicted to be the largest end user and will have considerable expansion throughout the plasma treatment market forecast period. A variety of causes have contributed to this rise. For starters, hospitals and clinics are the principal places of treatment for patients who require plasma therapy, resulting in a steady demand for these services. Furthermore, the growing frequency of chronic illnesses and injuries necessitating plasma therapy treatments fuels demand in hospital and clinic settings. likewise, advances in healthcare infrastructure and the availability of qualified medical experts in hospitals and clinics improve access to plasma treatment services, which contributes to the segment's market growth. Overall, the Hospitals and Clinics sector is expected to continue its dominant position and increase significantly in the plasma treatment market in the coming years.

Plasma Therapy Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

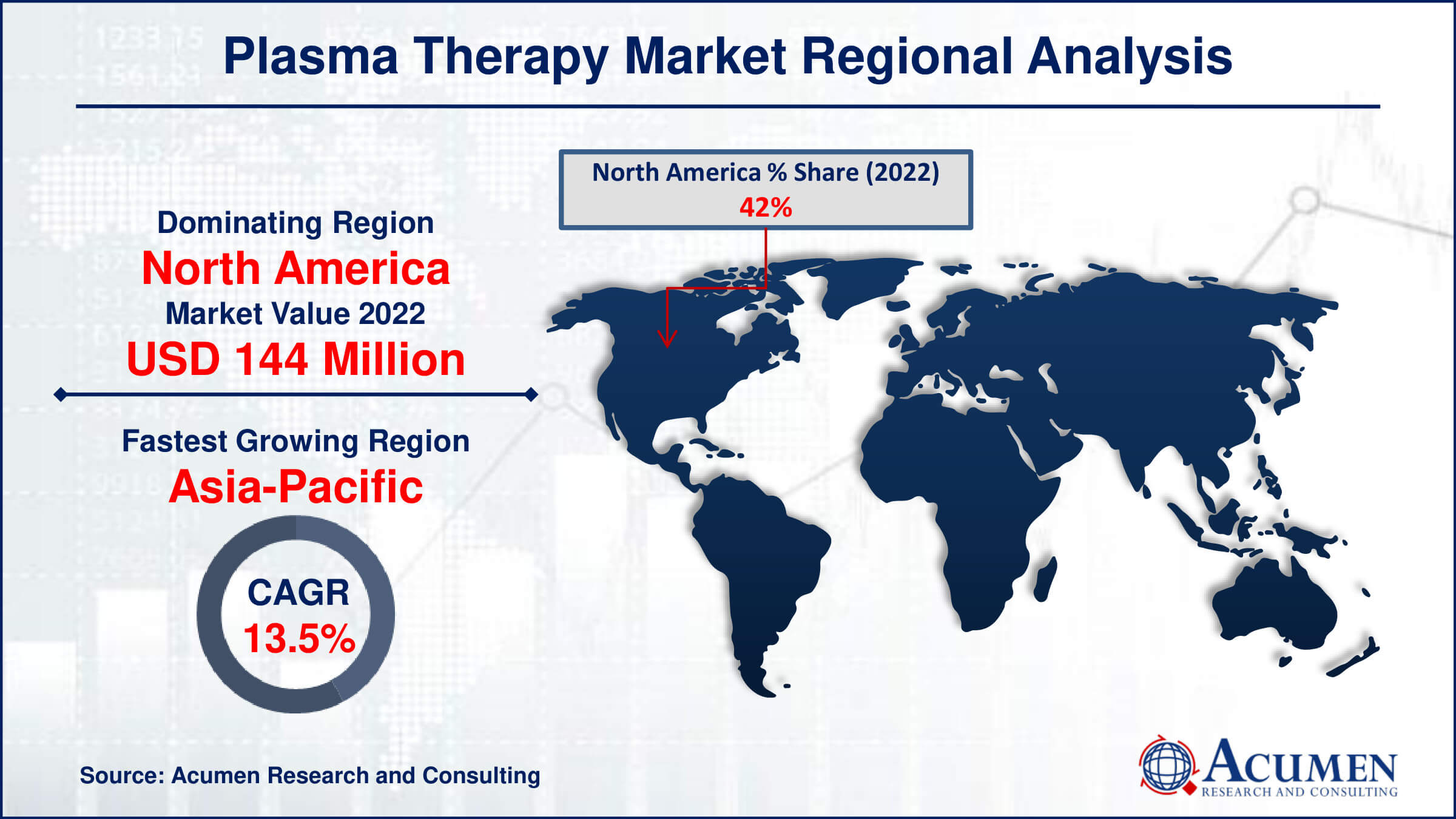

Plasma Therapy Market Regional Analysis

In terms of plasma therapy market analysis, in 2022, North America held the largest market share. This increase can be attributed largely to expand federal funding for advancements in plasma therapy. Furthermore, the rising elderly population in North America is contributing to the growth of the global economy.

However, Asia-Pacific is experiencing even higher growth rates, capturing the largest share of the market. The surge in the global plasma therapy industry in Asia-Pacific can be attributed to factors such as increasing disposable incomes among patients, the rise of medical tourism, and heightened awareness among healthcare practitioners. Additionally, technical advancements and increased policy support for the production of plasma protein medicines are driving growth in the region.

The rise in the Asia-Pacific region is expected to fuel a growing number of cosmetic procedures aimed at improving facial characteristics, particularly in countries like Korea, Thailand, and India. In fact, the expanded use of plasma therapy in these areas is anticipated to enhance the medical tourism industry in these countries.

Plasma Therapy Market Players

Some of the top plasma therapy companies offered in our report include Arthrex, Zimmer Biomet, DePuy Synthes, EmCyte, Regen Lab, ISTO Biologics, Cesca Therapeutics, Weigao, REV-MED, Nuo Therapeutics, and Terumo.

Frequently Asked Questions

How big is the plasma therapy market?

The plasma therapy market size was valued at USD 342.8 million in 2022.

What is the CAGR of the global plasma therapy market from 2024 to 2032?

The CAGR of plasma therapy is 12.8% during the analysis period of 2024 to 2032.

Which are the key players in the plasma therapy market?

The key players operating in the global market are including Arthrex, Zimmer Biomet, DePuy Synthes, EmCyte, Regen Lab, ISTO Biologics, Cesca Therapeutics, Weigao, REV-MED, Nuo Therapeutics, and Terumo.

Which region dominated the global plasma therapy market share?

North America held the dominating position in plasma therapy industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of plasma therapy during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global plasma therapy industry?

The current trends and dynamics in the plasma therapy industry include growing demand for regenerative medicine solutions, increasing prevalence of chronic diseases, advancements in plasma processing technologies, and rising adoption of minimally invasive procedures.

Which type held the maximum share in 2022?

The pure PRP type held the maximum share of the plasma therapy industry.