Antimicrobial Coatings Market | Acumen Research and Consulting

Antimicrobial Coatings Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format : ![]()

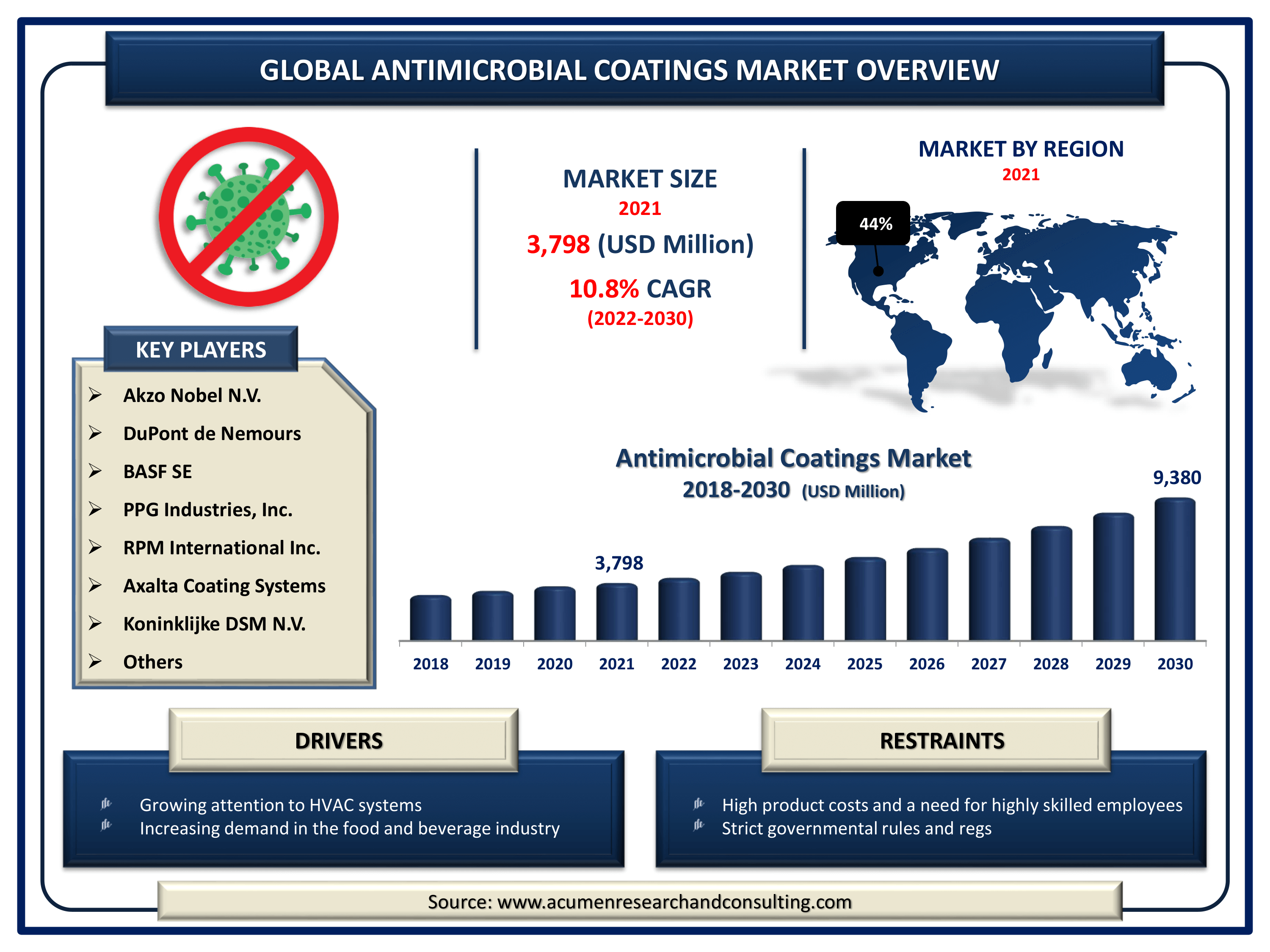

The Global Antimicrobial Coatings Market Size accounted for USD 3,798 Million in 2021 and is estimated to achieve a market size of USD 9,380 Million by 2030 growing at a CAGR of 10.8% from 2022 to 2030. Increasing healthcare-associated infections propel the global antimicrobial coatings market growth. Furthermore, increased consumer awareness about hygiene and cleanliness, stringent regulatory environment, and increasing acceptance of antimicrobial coatings in numerous industrial applications are boosting the antimicrobial coatings market value over the forecasting years.

Antimicrobial Coatings Market Report Key Highlights

- Global antimicrobial coatings market revenue is estimated to expand by USD 9,380 million by 2030, with a 10.8% CAGR from 2022 to 2030.

- North America antimicrobial coatings market share accounted for over 44% total market in 2021

- Asia-Pacific antimicrobial coatings market growth will observe fastest CAGR from 2022 to 2030

- Based on product, surface modifications and coatings segment accounted for over 53% of the overall market share in 2021

- Among application, medical device sector engaged more than 41% of the total market share

- Increasing application in the healthcare sector, boost the antimicrobial coatings market size

Antimicrobial coatings contain active molecules that kill germs such as viruses, molds, bacteria, and fungi. Antimicrobial coatings are the most typically utilized on door handles, walls, counters, as well as other surfaces where humans come into contact with them on a regular basis. Coatings enhance the worth and effectiveness of the coated product by decreasing contamination, staining, and odor resulting from bacterial development. These coatings are frequently employed in food and beverage businesses, hospitals and clinics, pharmaceutical industrial units, and construction sites.

Global Antimicrobial Coatings Market Dynamics

Market Drivers

- An increase in antimicrobial coating application in the healthcare sector

- Increased adoption in the consumer goods industry

- Growing attention to HVAC systems

- Increasing demand in the food and beverage industry

Market Restraints

- High product costs and a need for highly skilled employees

- Strict governmental rules and regs

Market Opportunities

- Increasing use in novel applications

- Rapidly increasing application of additives and coatings in plastic packaging

Antimicrobial Coatings Market Report Coverage

| Market | Antimicrobial Coatings Market |

| Antimicrobial Coatings Market Size 2021 | USD 3,798 Million |

| Antimicrobial Coatings Market Forecast 2030 | USD 9,380 Million |

| Antimicrobial Coatings Market CAGR During 2022 - 2030 | 10.8% |

| Antimicrobial Coatings Market Analysis Period | 2018 - 2030 |

| Antimicrobial Coatings Market Base Year | 2021 |

| Antimicrobial Coatings Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Product, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Akzo Nobel N.V., DuPont de Nemours, Nippon Paint Holdings Co., Ltd., BASF SE, PPG Industries, Inc., Burke Industrial Coatings LLC, RPM International Inc., Axalta Coating Systems, Koninklijke DSM N.V., and The Sherwin Williams Company. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Healthcare-associated infections (HAIs) fuel the growth of global antimicrobial coatings market

In recent years, healthcare-associated infection has been the most common adverse event in both developed and developing countries. According to World Health Organization (WHO) statistics, 7% of developed-country patients and 10% of developing-country patients were infected with at least one healthcare-associated infection during treatment. According to the Centers for Disease Control and Prevention, 1.7 million hospitalized patients annually acquire HCAIs while being treated for other health issues, and more than 98,000 of those patients (one in 17) die each year. Thus, the growing awareness program and active participation of hospitals to reduce healthcare-associated infections by using antimicrobial coatings are expected to drive growth in the global antimicrobial coatings market.

Antimicrobial Coatings Market Trend

Major factors expected to drive the growth of the antimicrobial coatings market during the forecast period include increasing demand for HVAC systems, the medical and healthcare sector leading market growth during and after the CoVid-19 pandemic, and an increase in demand from the food and beverage industry. Furthermore, the vastly integrated supply chain, the increase in construction and renovation activities, and the rise in living standards are a few of the factors expected to drive the growth of the antimicrobial coatings market over the forecast period. Furthermore, the easy availability of loans, the rise in parental concerns, and the growing need for safe environments are some of the other factors expected to support the growth of the antimicrobial coatings market.

Impact Of COVID-19 On Antimicrobial Coatings Market

The COVID-19 pandemic has focused the world's attention on contamination spread facilitated by high-touch surfaces. In response, surfaces and coatings capable of minimizing the presence of active viral pathogens are being investigated for use in a variety of settings, including healthcare centers, long-term care facilities, public transportation, schools, and various businesses, in order to reduce human exposure and mitigate the spread of infectious pathogens. Increasing government and private investment to combat COVID-19 transmission are likely to encourage the use of antimicrobial coatings. The market is expected to expand as governments and private sectors increase spending to reduce the risk of surface contact propagation. Furthermore, increased spending on hospital facility renovations to reduce the prevalence of virus outbreaks and infections is expected to boost the market.

Antimicrobial Coatings Market Segmentation

The worldwide antimicrobial coatings market segmentation is based on the product, application, and geography.

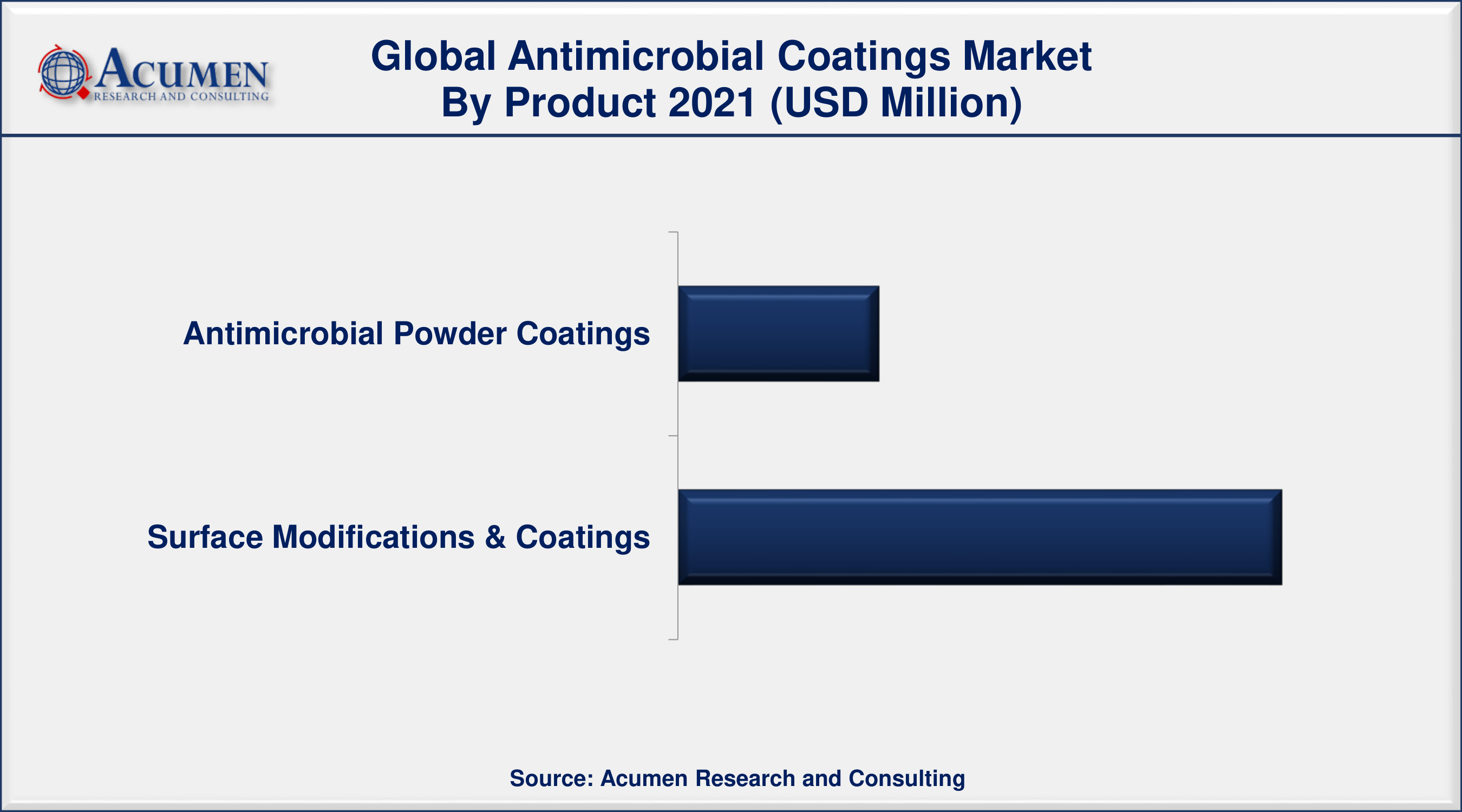

Antimicrobial Coatings Market By Product

- Antimicrobial Powder Coatings

- Copper

- Silver

- Others

- Surface Modifications & Coatings

- Pseudomonas

- E. Coli

- Listeria

- Others

According to the antimicrobial coatings industry analysis, the surface modifications and coatings product segment is expected to dominate the market in the coming years. This high share is attributed to the product's ability to modify the surface of a material by introducing physical, chemical, or biological characteristics that differ from those found on the material's original surface.

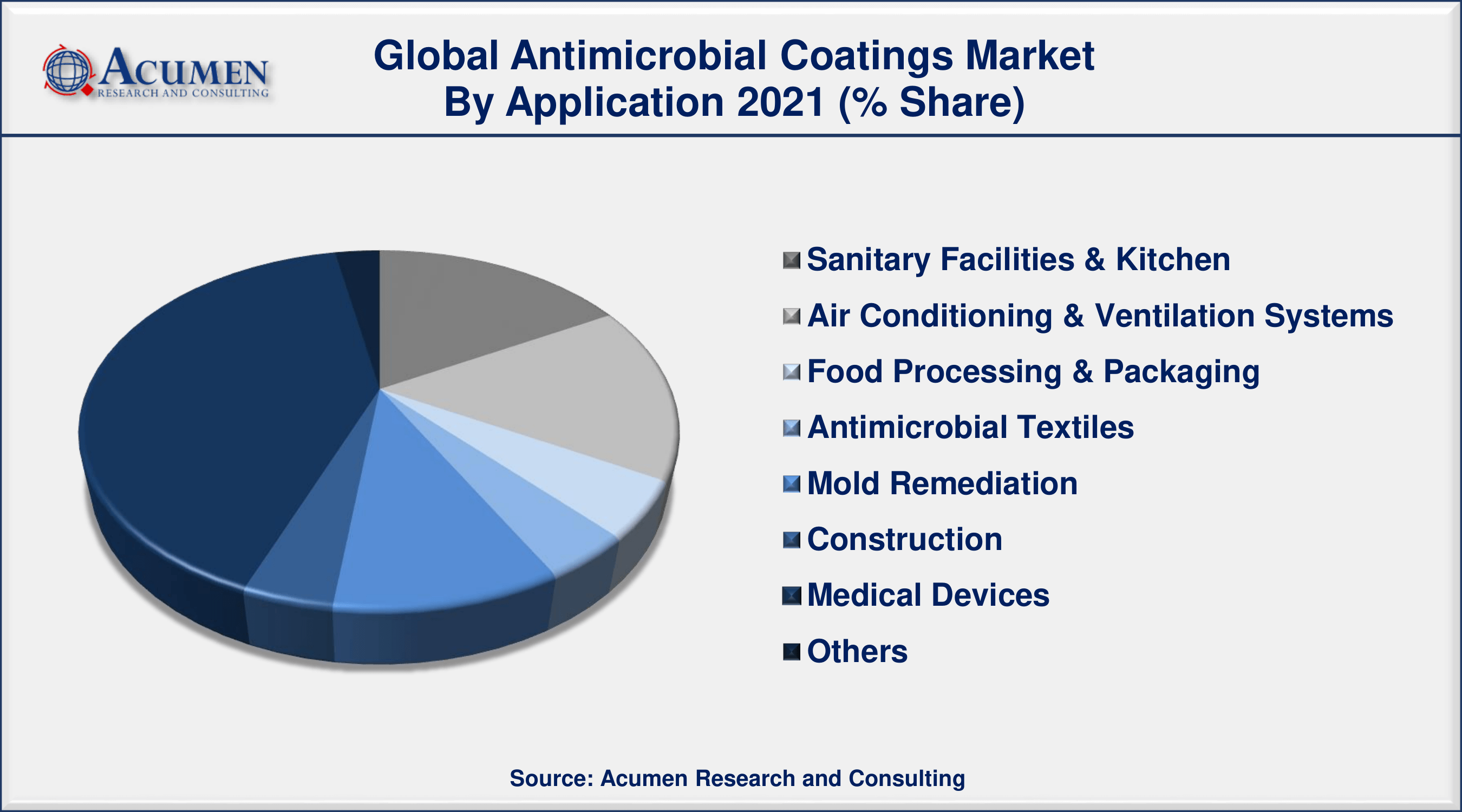

Antimicrobial Coatings Market By Application

- Sanitary Facilities & Kitchen

- Food Processing & Packaging

- Air Conditioning & Ventilation Systems

- Mold Remediation

- Antimicrobial Textiles

- Medical Devices

- Construction

- Others

According to the antimicrobial coatings market forecast, the medical device segment will hold the lion's share of the market during the forecast period. One of the major industries that make extensive use of smart antimicrobial coatings is healthcare. These coatings are mostly used on surgical instruments because they help to prevent the spread of germs and bacteria among patients, doctors, and caregivers. AMCs contain active ingredients that prevent microorganisms from growing on a surface. This aids in the formation of a toxic or non-toxic barrier for harmful microorganisms. Anti-microbial coatings are also used in the healthcare industry for surgical masks, gloves, bandages, wound dressing, and hospital textiles (woven and non-woven), among other things.

Antimicrobial Coatings Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Latin America

- Mexico

- Brazil

- Rest of Latin America

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

The Middle East & Africa (MEA)

- Gulf Cooperation Council (GCC)

- South Africa

- Rest of the Middle East & Africa

North America dominates the antimicrobial coatings market, Asia-Pacific fastest growing regional market

The North American region controlled the majority of the global market. The region's growth has been fueled in large part by continuous innovation in the healthcare industry and increased production of processed foods. The United States has a high demand for anti-microbial coatings among North American countries, as it is one of the most affected by COVID-19. The construction and healthcare industries account for the majority of the demand. The preference for anti-microbial coated medical equipment is growing in the United States as a result of the various initiatives undertaken by the government as well as the country's hospitals to prevent nosocomial infections. There is also an increase in the use of anti-microbial coatings in public and high-traffic areas to prevent the spread of pathogens that can cause disease, which adds to the country's demand for anti-microbial coatings. As a result, the factors listed above are expected to have a significant impact on the antimicrobial coatings market in the coming years.

On the other hand, Asia-Pacific will exhibit the fastest growing CAGR in the coming years. The Asia-Pacific is projected to observe a significant amount of growth in the antimicrobial coatings market because of the development of the major end-use industries, like healthcare, construction, and food processing and packaging. Furthermore, the strong manufacturing base of the packaging products industry in China, Japan, and India, as well as increased sales of e-commerce and packaged food products, is expected to drive the growth of the antimicrobial coatings market in the coming years.

Antimicrobial Coatings Market Players

Some of the top antimicrobial coatings market companies offered in the professional report include Akzo Nobel N.V., DuPont de Nemours, Nippon Paint Holdings Co., Ltd., BASF SE, PPG Industries, Inc., Burke Industrial Coatings LLC, RPM International Inc., Axalta Coating Systems, Koninklijke DSM N.V., and The Sherwin Williams Company.

Frequently Asked Questions

What is the size of global antimicrobial coatings market in 2021?

The estimated value of global antimicrobial coatings market in 2021 was accounted to be USD 3,798 Million.

What is the CAGR of global Antimicrobial Coatings market during forecast period of 2022 to 2030?

The projected CAGR antimicrobial coatings market during the analysis period of 2022 to 2030 is 10.8%.

Which are the key players operating in the market?

The prominent players of the global antimicrobial coatings market are Akzo Nobel N.V., DuPont de Nemours, Nippon Paint Holdings Co., Ltd., BASF SE, PPG Industries, Inc., Burke Industrial Coatings LLC, RPM International Inc., Axalta Coating Systems, Koninklijke DSM N.V., and The Sherwin Williams Company.

Which region held the dominating position in the global antimicrobial coatings market?

North America held the dominating antimicrobial coatings during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for antimicrobial coatings during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global antimicrobial coatings market?

Increasing application in the healthcare sector, and growing adoption in the consumer goods industry drives the growth of global antimicrobial coatings market.

By application segment, which sub-segment held the maximum share?

Based on application, medical devices segment is expected to hold the maximum share of the antimicrobial coatings market.