Medical Devices Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Medical Devices Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

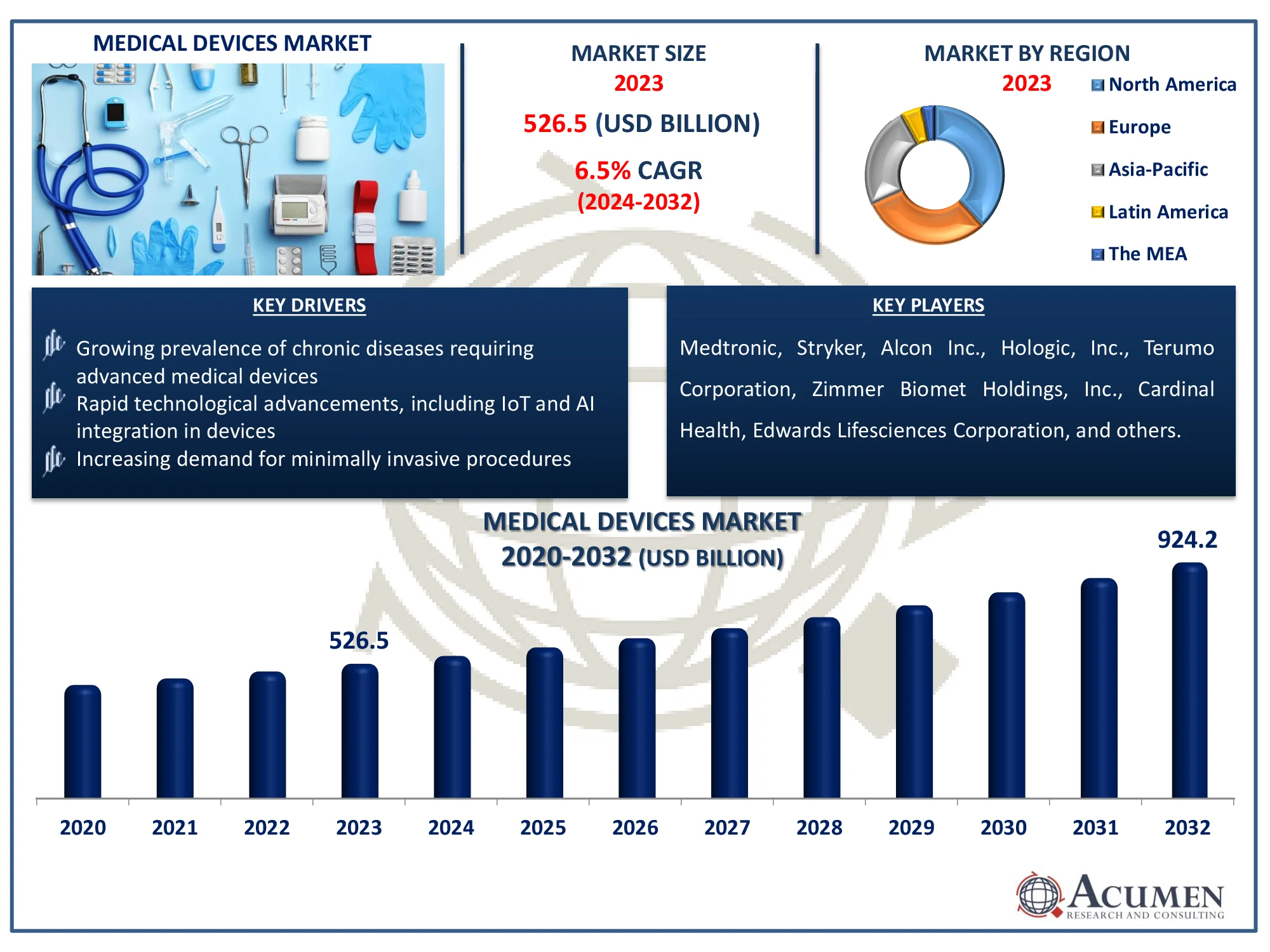

The Global Medical Devices Market Size accounted for USD 526.5 Billion in 2023 and is estimated to achieve a market size of USD 924.2 Billion by 2032 growing at a CAGR of 6.5% from 2024 to 2032.

Medical Devices Market Highlights

- The global medical devices market is projected to reach USD 924.2 billion by 2032, growing at a CAGR of 6.5% from 2024 to 2032

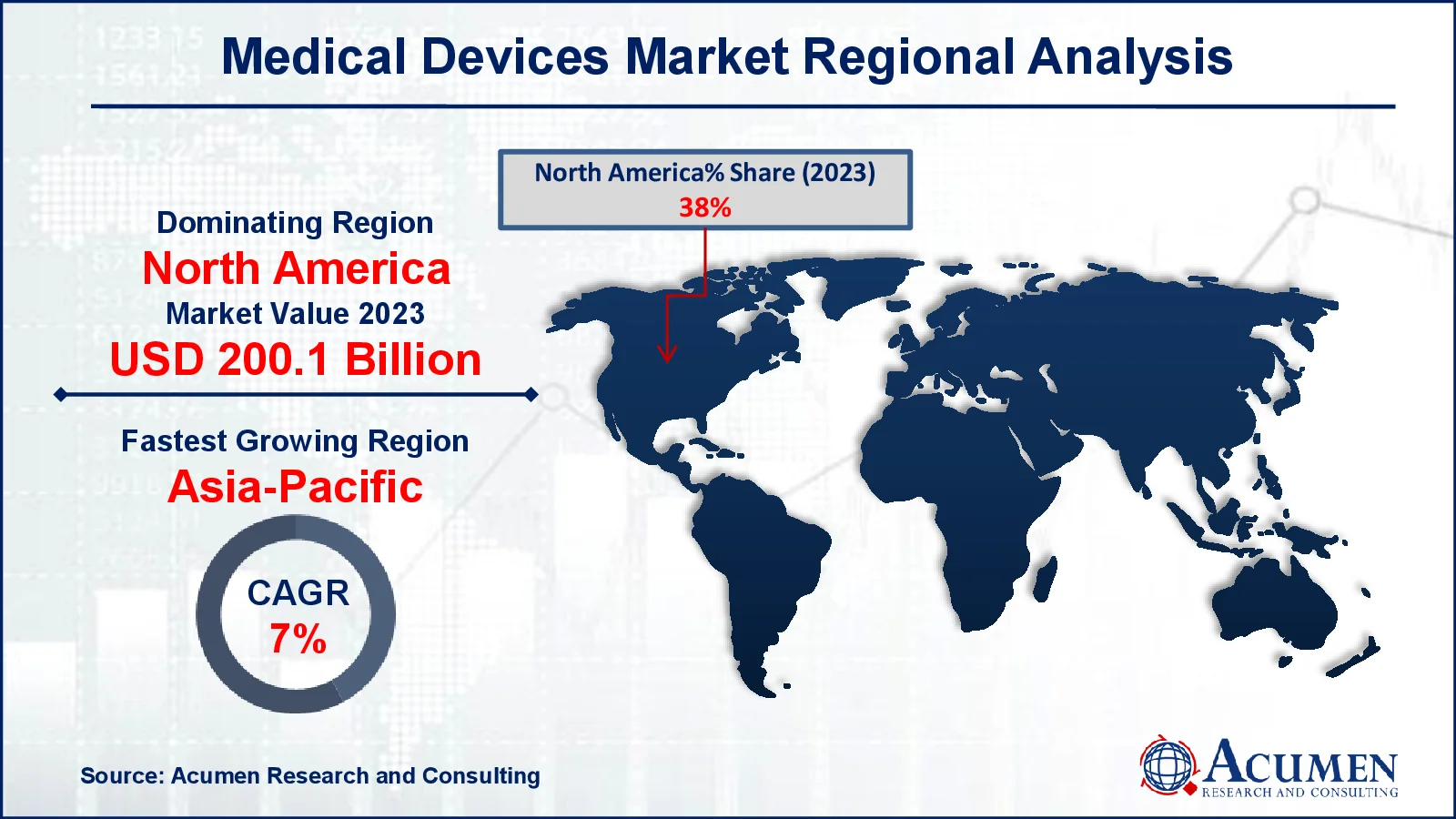

- North America's medical devices market accounted for approximately USD 200.1 billion in 2023

- The Asia-Pacific medical devices market is expected to grow at a CAGR exceeding 7% from 2024 to 2032

- Hospitals and clinics as an end-user segment achieved 86% market share in 2023

- Rising focus on minimally invasive and robotic-assisted surgical devices is the medical devices market trend that fuels the industry demand

A medical device is any item that is used to diagnose, prevent, relieve, or treat diseases, disabilities, injuries, and other conditions without causing chemical action in any area of the body. Patients gain from medical devices because they assist health care practitioners in diagnosing and treating patients, as well as helping people overcome illness and improve their quality of life. It requires calibration, repair, maintenance, and user training, all of which are primarily administered by clinical engineers. It can be used alone or in conjunction with any accessory or other piece of medical equipment.

Global Medical Devices Market Dynamics

Market Drivers

- Growing prevalence of chronic diseases requiring advanced medical devices

- Rapid technological advancements, including IoT and AI integration in devices

- Increasing demand for minimally invasive procedures

Market Restraints

- High costs associated with advanced medical devices and procedures

- Stringent regulatory requirements and prolonged approval processes

- Limited access to healthcare in low-income regions

Market Opportunities

- Rising adoption of wearable and remote monitoring devices

- Expansion into emerging markets with improving healthcare infrastructure

- Advancements in 3D printing technology for customized medical devices

Medical Devices Market Report Coverage

| Market | Medical Devices Market |

| Medical Devices Market Size 2022 |

USD 526.5 Billion |

| Medical Devices Market Forecast 2032 | USD 924.2 Billion |

| Medical Devices Market CAGR During 2023 - 2032 | 6.5% |

| Medical Devices Market Analysis Period | 2020 - 2032 |

| Medical Devices Market Base Year |

2022 |

| Medical Devices Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Type, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Medtronic, Stryker, Alcon Inc., Hologic, Inc., Terumo Corporation, Zimmer Biomet Holdings, Inc., Cardinal Health, Edwards Lifesciences Corporation, Fresenius Medical Care AG & Co. Merck KGaA, BD, Johnson & Johnson Services Inc., Abbott Laboratories, Roche Diagnostics, Baxter International Inc., Thermo Fisher Scientific Inc., Coloplast A/S, Smith & Nephew plc, Siemens Healthineers AG, Boston Scientific Corporation, GE Healthcare, and Koninklijke Philips N.V. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Medical Devices Market Insights

The rising geriatric population, the increasing incidence of chronic diseases such as AIDS, diabetes, cancer, and cardiovascular diseases, complicated surgeries and an increase in surgical procedures, the growing interest of medical technology organizations in investing in research and development for the manufacturing of new medical devices, and the green light from government authorities for their approval are all driving the growth of the medical devices market. According to Economic and Social Commission for Asia and the Pacific, in 2023, an estimated 697 million older people (60 and up) would live in Asia and the Pacific, accounting for roughly 60% of the world's older population. Currently, approximately one in every seven people in the region is 60 years or older, and by 2050, one in every four people will be of this age.

Furthermore, technological advancements and the increased need for innovative medicines to overcome unmet healthcare needs are expected to fuel the medical devices market during the forecast period. For instance, in January 2024, Medtronic got FDA approval for their Percept RC Deep Stimulation System with sophisticated BrainSense technology for tailored treatment of Parkinson's disease, epilepsy, and other conditions.

However, changes in government policies that may raise production costs for medical device manufacturers, high costs and long payback periods for investment in new technology, anticipated interest rate increases, and data security issues related to medical devices are expected to stymie the growth of the medical device market in the coming years.

Rising adoption of wearable and remote monitoring devices becomes opportunity for medical devices industry. For instance, January 2024, Fitbit Inc. partnered with Quest Diagnostics, a pioneer in diagnostic information services, to enhance their study on the use of wearable devices to promote metabolic health in the general public. Additionally, STAT Health launches a first-in-ear wearable in June 2023 that detects blood flow to the head and allows patients to better understand their health. This growing product innovations and collaborations in between key manufacturers further enhance market growth in forecast year.

Medical Devices Market Segmentation

The worldwide market for medical devices is split based on type, end-user, and geography.

Medical Device Market By Type

- Orthopedic

- Cardiovascular

- IVD

- MIS

- Wound Management

- Diabetes Care

- Ophthalmic

- Dental

- Nephrology

- Diagnostic Imaging

- Others

According to the medical devices industry analysis, the IVD (in-vitro diagnostic device) segment is expected to show notable growth throughout the forecast period. IVD is used to diagnose diseases and can also be used to assess a person's overall health in order to treat, cure, or prevent diseases. The primary drivers of growth in this market include efficient and precise illness testing for cancer, diabetes, sexually transmitted diseases (STDs), and AIDS/HIV. For instance, In October 2022, Qiagen got CE clearance for its in-vitro diagnostic kit and fully automated NeuMoDx platforms under the European Union's new In-Vitro Devices Regulation (IVDR), expanding its product line. This clearance enhances the reliability and compliance of its products, boosting demand for automated diagnostic solutions.

Medical Device Market By End-User

- Hospitals and Clinics

- Diagnostic Centers

- Homecare

According to the medical devices market forecast, the hospitals and clinics category held the greatest market share throughout the period 2024 to 2032. The primary drivers driving the expansion of this category include rising healthcare expenditure, the development of healthcare infrastructures, the growing prominence of better patient outcomes, and profitable reimbursement schemes. This is likely to increase the dominance of the hospitals and clinics sector in the global market over the forecast period.

Medical Devices Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Medical Devices Market Regional Analysis

For several reasons, North America accounted for the largest market share in the medical devices industry, and the region is likely to maintain its dominance during the forecast period. The region's primary drivers in the global market are well-developed healthcare centers, increased disposable income, the availability of health insurance, investment in medical device R&D, and the rapid adoption of medical innovations. As per Centers for Medicare & Medicaid Services, in 2022, U.S. health-care spending increased by 4.1% to $4.5 trillion, or $13,493 per person. Health spending made for 17.3 percent of the nation's GDP.

Europe is predicted to be the world's second-largest market throughout the projection period. An increase in a number of healthcare facilities such as diagnostic centers, hospitals, and specialized facilities, as well as an increase in the number of patients, and growth in private and public investment in medical equipment, are predicted to promote the regional market growth.

Asia-Pacific is predicted to have the greatest CAGR in the global market over the forecast period. The aging population, rising per capita income, improved healthcare infrastructure, increased disease awareness, low labor costs, significant profit margins for investors, and business expansion policies in emerging countries such as China, India, and others are expected to drive market growth in the global medical devices market during the forecast period. According to data issued by the National Health Commission (NHC), China's medical and healthcare industry made significant development in 2023, with important health indicators putting it ahead of middle- and high-income countries. China has also established nearly 18,000 medical consortia of various sorts by the end of 2023 as part of its efforts to strengthen community healthcare infrastructure and accessibility, according to NHC figures.

Additionally, India is Asia's fourth largest market for medical equipment and one of the top 20 internationally. The size of the Indian medical devices industry is assessed at $11 billion and is predicted to rise to $50 billion by 2025. The sector has been developing gradually at a CAGR of 15% over the last three years. This growth enhances medical devices market in Asian region in forecast year.

Medical Devices Market Players

Some of the top medical devices companies offered in our report include Medtronic, Stryker, Alcon Inc., Hologic, Inc., Terumo Corporation, Zimmer Biomet Holdings, Inc., Cardinal Health, Edwards Lifesciences Corporation, Fresenius Medical Care AG & Co. Merck KGaA, BD, Johnson & Johnson Services Inc., Abbott Laboratories, Roche Diagnostics, Baxter International Inc., Thermo Fisher Scientific Inc., Coloplast A/S, Smith & Nephew plc, Siemens Healthineers AG, Boston Scientific Corporation, GE Healthcare, and Koninklijke Philips N.V.

Frequently Asked Questions

How big is the medical devices market?

The medical devices market size was valued at USD 526.5 billion in 2023.

What is the CAGR of the global medical devices market from 2024 to 2032?

The CAGR of medical devices is 6.5% during the analysis period of 2024 to 2032.

Which are the key players in the medical devices market?

The key players operating in the global market are including Medtronic, Stryker, Alcon Inc., Hologic, Inc., Terumo Corporation, Zimmer Biomet Holdings, Inc., Cardinal Health, Edwards Lifesciences Corporation, Fresenius Medical Care AG & Co. Merck KGaA, BD, Johnson & Johnson Services Inc., Abbott Laboratories, Roche Diagnostics, Baxter International Inc., Thermo Fisher Scientific Inc., Coloplast A/S, Smith & Nephew plc, Siemens Healthineers AG, Boston Scientific Corporation, GE Healthcare, and Koninklijke Philips N.V.

Which region dominated the global medical devices market share?

North America held the dominating position in medical devices industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of medical devices during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global medical devices industry?

The current trends and dynamics in the medical devices industry include growing prevalence of chronic diseases requiring advanced medical devices, rapid technological advancements, including IoT and AI integration in devices, and increasing demand for minimally invasive procedures

Which type held the maximum share in 2023?

The hospitals and clinics expected to hold the maximum share of the medical devices industry.