Compound Semiconductor Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Compound Semiconductor Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

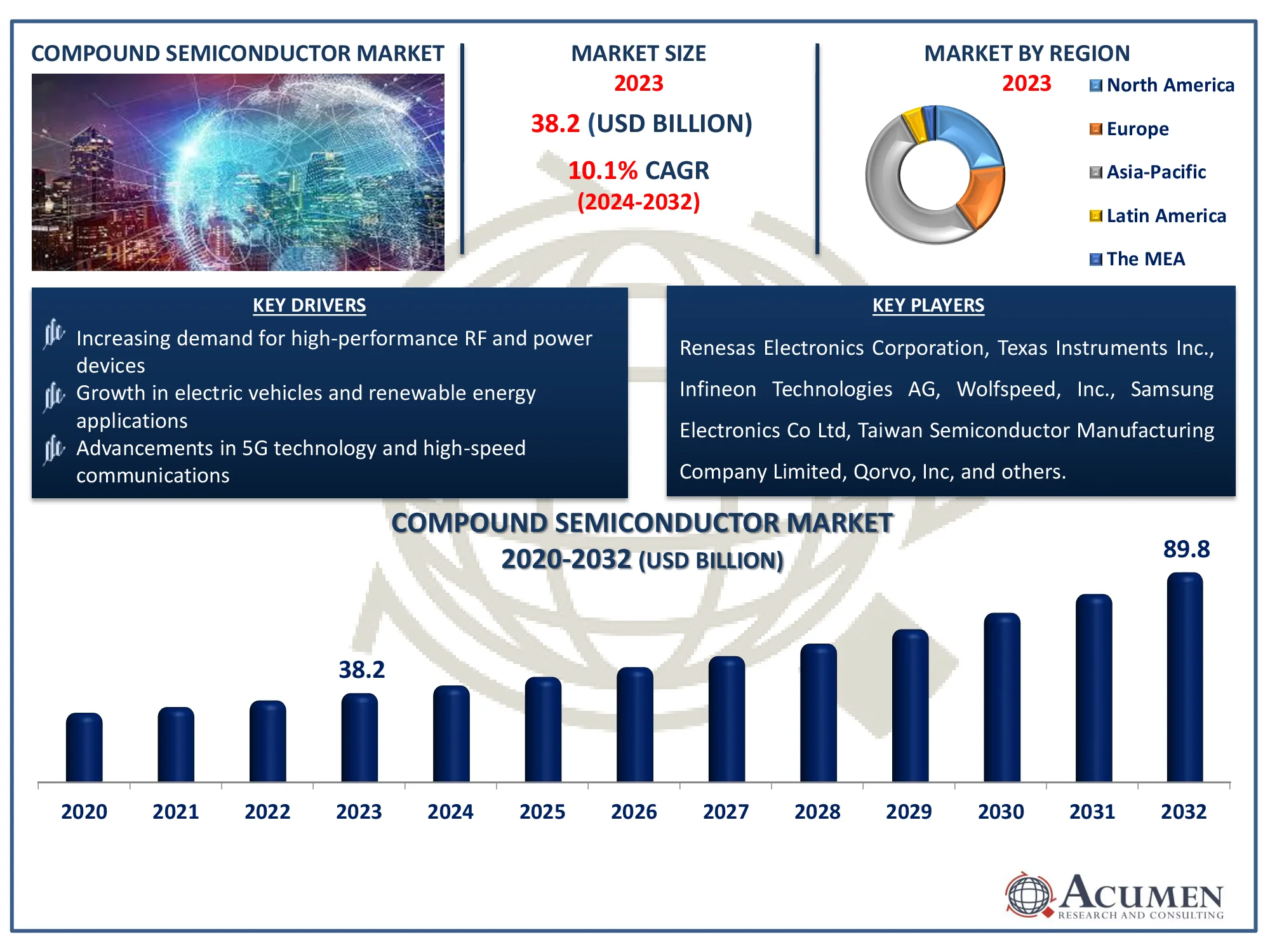

The Global Compound Semiconductor Market Size accounted for USD 38.2 Billion in 2023 and is estimated to achieve a market size of USD 89.8 Billion by 2032 growing at a CAGR of 10.1% from 2024 to 2032.

Compound Semiconductor Market Highlights

- The global compound semiconductor market is expected to reach USD 89.8 billion by 2032, growing at a CAGR of 10.1% from 2024 to 2032

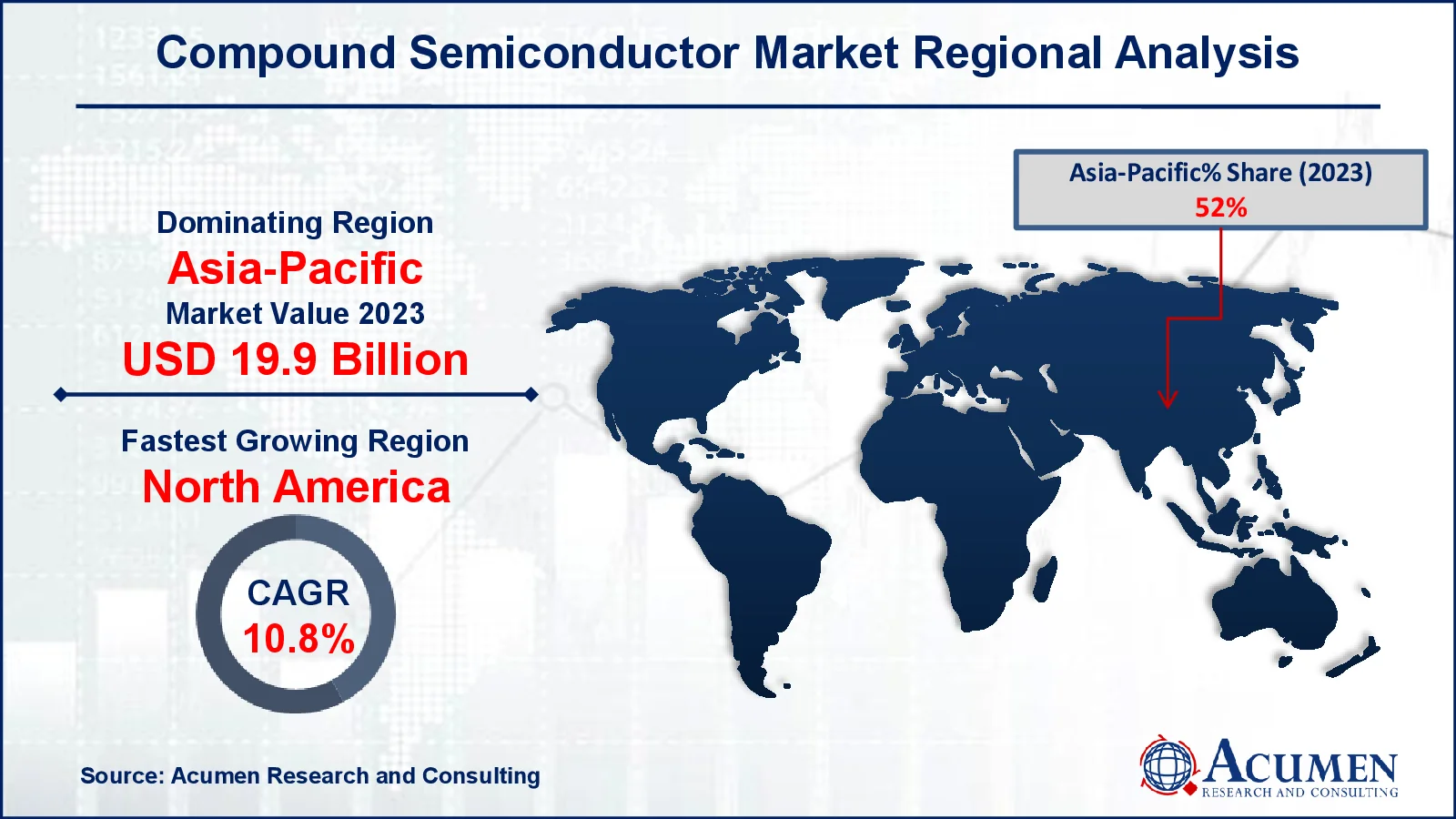

- The Asia-Pacific compound semiconductor market was valued at approximately USD 19.9 billion in 2023

- North America's compound semiconductor market is projected to grow at a CAGR of over 10.8% from 2024 to 2032

- The III-V compound semiconductor sub-segment accounted for 55% of the market share in 2023

- The IT and telecom application sub-segment generated 42% of the market share in 2023

- Increasing demand for energy-efficient technologies is boosting the adoption of III-V semiconductors in power electronics and renewable energy applications is the compound semiconductor market trend that fuels the industry demand

The compound semiconductor consists of two or more components. The compound semiconductor is created utilizing a variety of deposition processes, including atomic layer deposition and chemical vapour deposition, among others. They have a wide range of properties, including high band gap and temperature resistance, quick operation, increased frequency, and optoelectronic features. These advantages are projected to enhance the compound semiconductor market throughout the forecast period. Many compound semiconductor producers are working on providing cost-effective bespoke devices for specific applications. The compound semiconductor's capacity to consume less power and have high electron mobility is expected to increase its demand.

Global Compound Semiconductor Market Dynamics

Market Drivers

- Increasing demand for high-performance RF and power devices

- Growth in electric vehicles and renewable energy applications

- Advancements in 5G technology and high-speed communications

Market Restraints

- High manufacturing and material costs of compound semiconductors

- Complex manufacturing processes and limited supply chains

- Competition from silicon-based alternatives in some applications

Market Opportunities

- Expanding applications in autonomous vehicles and AI-driven devices

- Growing adoption in defense and aerospace for radar and satellite communication

- Rising demand for energy-efficient lighting and power systems

Compound Semiconductor Market Report Coverage

| Market | Compound Semiconductor Market |

| Compound Semiconductor Market Size 2022 |

USD 38.2 Billion |

| Compound Semiconductor Market Forecast 2032 | USD 89.8 Billion |

| Compound Semiconductor Market CAGR During 2023 - 2032 | 10.1% |

| Compound Semiconductor Market Analysis Period | 2020 - 2032 |

| Compound Semiconductor Market Base Year |

2022 |

| Compound Semiconductor Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Product, By Deposition Technology, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Renesas Electronics Corporation, Texas Instruments Inc., Infineon Technologies AG, Qorvo, Inc, Wolfspeed, Inc., Samsung Electronics Co Ltd, Taiwan Semiconductor Manufacturing Company Limited, NXP Semiconductors, STMicroelectronics, and Nichia Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Compound Semiconductor Market Insights

Increased government backing, as well as increased funding from stakeholders, has resulted in increased demand for compound semiconductor systems. For instance, according to the Press Information Bureau, the Union Cabinet, chaired by Prime Minister Narendra Modi, approved the establishment of three semiconductor units under the 'Development of Semiconductors and Display Manufacturing Ecosystems in India' on February 29, 2024.

Furthermore, the use of compound semiconductors in numerous applications, particularly in LEDs, has resulted in an increase in demand for compound semiconductor systems, which has fueled the compound semiconductor market. Smartphone adoption has increased dramatically over the last few years. This has resulted in tremendous expansion in the compound semiconductor sector. However, the utilization of compound semiconductors presents compatibility concerns when compared to materials such as silicon. This has proven to be a key impediment to the expansion of the compound semiconductor sector.

High fabrication costs are also expected to stymie the expansion of the compound semiconductor market throughout the projected period. Increasing knowledge of the benefits of employing compound semiconductors can open up new chances for the leading players in the compound semiconductor industry. Compound semiconductors offer a wide range of applications, including automotive, telecommunications, energy and power. Growth in these markets is also expected to open up new prospects in the compound semiconductor business.

Furthermore, the usage of compound semiconductors in aerospace, military and defense applications is likely to represent a significant market opportunity. For instance, the Union Budget 2023-24 allocates Rs 45.03 lakh crore in total, with Rs 5.93 lakh crore (13.18%) for the Ministry of Defence, including Rs 1.38 lakh crore for pensions. This marks a 13% increase (Rs 68,371.49 crore) from the previous year's defense budget. The increased defense expenditure in India's Union expenditure 2023-24 most probably indicates a greater interest in sophisticated technology, particularly the usage of compound semiconductors in military and defense applications.

Moreover, many competitors have pursued various strategies for the development of the compound semiconductor industry which is expected to fuel the industry. For instance, in March 2024, Wolfspeed, Inc. finished the building phase of SiC's John Palmour Manufacturing Center, a $5 billion project. Senator Thom Tillis (R-NC) attended the occasion with community partners, native officials, and employees. The JP manufacturing center, located in Chatham County, North Carolina, will focus on the production of 200mm silicon carbide wafers. This would considerably increase Wolfspeed's material's ability to meet the growing demand for next-generation semiconductors, which are critical to AI and the energy transition.

Compound Semiconductor Market Segmentation

The worldwide market for compound semiconductor is split based on type, product, deposition technology, application, and geography.

Compound Semiconductor Types

- II-VI Compound Semiconductor

- Cadmium Slenenide

- Cadmium Telluride

- Zinc Selenide

- Sapphire

- III-V Compound Semiconductor

- Gallium Nitride

- Gallium Phosphide

- Gallium Arsenide

- Indium Phosphide

- Indium Antimonide

- Others

- Aluminum Gallium Arsenide

- Aluminum Indium Arsenide

- Aluminum Gallium Nitride

- Aluminum Gallium Phosphide

- Indium Gallium Nitride

- Cadmium Zinc Telluride

- Mercury Cadmium Telluride

According to the compound semiconductor industry analysis, III-V compound semiconductors dominate the market due to their better electrical and optical features, including strong electron mobility and a broad bandgap. Materials like gallium arsenide (GaAs) and indium phosphide (InP) are frequently employed in high-frequency and high-power applications such as 5G, optical communication, and satellites. Their capacity to work at high speeds and efficiency makes them critical for next-generation electronic and communication technology. This dominance is fueled by the growing need for high-performance devices in a variety of industries.

Compound Semiconductor Products

- Power Semiconductor

- Transistor

- HEMT

- MOSFET

- MESFET

- Integrated Circuits

- MMIC

- RFIC

- Diodes and Rectifiers

- PIN Diode

- Zener Diode

- Schokkty Diode

- Light-Emitting Diode

- Others

According to the compound semiconductor industry analysis, power semiconductors shows notable growth industry because they play a key role in controlling high voltages and currents, particularly in energy-efficient applications. These components are used in critical industries such as electric vehicles, renewable energy, and industrial automation due to their high performance and endurance. Power semiconductor materials such as silicon carbide (SiC) and gallium nitride (GaN) outperform standard silicon in terms of energy efficiency, switching speeds, and thermal stability. This growth is being driven by the global trend toward sustainable energy solutions and the growing need for high-performance devices.

Compound Semiconductor Deposition Technologies

- Chemical Vapor Deposition

- Molecular Beam Epitaxy

- Hydride Vapor Phase Epitaxy

- Ammonothermal

- Atomic Layer Deposition

- Others

According to the compound semiconductor industry analysis, chemical vapor deposition (CVD) technology expected to grow in market as it enables precise layering of materials, essential for producing high-quality semiconductors. CVD is particularly suited for creating thin films of compounds like gallium nitride (GaN) and silicon carbide (SiC), which is critical in power electronics, LED manufacturing, and advanced microelectronics. The technology’s accuracy and scalability make it ideal for high-volume production, supporting the rising demand for efficient and high-performance devices.

Compound Semiconductor Applications

- IT and Telecom

- Signal amplifiers and Switching System

- Satellite Communication

- Radar

- Radio Frequency

- Industry and Energy and Power

- Industry and Energy and Power

- Smart Grid

- Wind Turbine and Wind Power System

- Photovoltaic Invertors

- Motor Drives

- Aerospace and Defense

- Combat Vehicles

- Ships and Vessels

- Microwave Radiation

- Automotive

- Automotive

- Electric Vehicles and Hybrid Electric Vehicles

- Automotive Braking System

- Rail Traction

- Automobile Motor Drives

- Consumer Electronics

- Inverters

- LED Lighting

- SMPS

- Healthcare

- Implantable Medical Devices

- Biomedical Electronics

According to the compound semiconductor market forecast, the industry is dominated by the IT and telecom sectors, which require high-speed, high-frequency devices to boost data transfer and communication. Gallium arsenide (GaAs) and indium phosphide (InP) semiconductors are critical for 5G and satellite communications, as they provide high-speed data while using minute power. This dominance is fueled by increased digitalization and the global adoption of advanced network technologies such as 5G. For instance, By April 2024, initiatives to expand digital access in India have resulted in significant growth in connectivity, thereby closing the digital gap. BharatNet, one of the world's largest rural telecom projects, intends to connect every village council (Gram Panchayat) in India with high-speed internet using Optical Fibre Cable (OFC), increasing access to digital services in rural areas.

Compound Semiconductor Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Compound Semiconductor Market Regional Analysis

For several reasons, Asia-Pacific is one of the world's top markets for compound semiconductors. The top companies in the compound semiconductor market have a dominant presence in the Asia-Pacific region. China and Japan are among the leading countries in the use of LEDs. Asia Pacific is also expected to experience the fastest increase during the predicted period. Countries such as China, South Korea, and Japan are also projected to benefit significantly from the implementation of 5G technology.

North America is also likely to be a key region in the global compound semiconductor market during the forecast period. The compound semiconductor industry is expected to be driven by increased government assistance and key players initiatives in R&D for nest generation. For instance, May 2022, Qorvo introduces a new generation of 1200V SiCFETs. The new UF4C/SC series of 1200V Gen 4 SiCFETs (from recently acquired UnitedSiC) is intended for 800V bus architectures in onboard chargers for electric vehicles, industrial battery chargers, industrial power supplies, DC/DC solar inverters, welding machines, uninterruptible power supplies, and induction heating applications.

France and Germany are the major contributors to Europe's market growth, due to increased investment in these regions. For instance, Wolfspeed and ZF Friedrichshafen, a major German auto manufacturer, planned to build a USD 3 billion wafer plant in Germany to make semiconductors for electric vehicles and other applications. One of the primary causes for the market's expansion is the quick adoption of innovation and technology in these countries.

However, Latin American and Middle Eastern countries such as Saudi Arabia, the UAE, and Kuwait are expected to drive the LAMEA industry. On the other hand, Africa is expected to experience moderate development in the compound semiconductor industry.

Compound Semiconductor Market Players

Some of the top compound semiconductor companies offered in our report include Renesas Electronics Corporation, Texas Instruments Inc., Infineon Technologies AG, Qorvo, Inc, Wolfspeed, Inc., Samsung Electronics Co Ltd, Taiwan Semiconductor Manufacturing Company Limited, NXP Semiconductors, STMicroelectronics, and Nichia Corporation.

Frequently Asked Questions

How big is the compound semiconductor market?

The compound semiconductor market size was valued at USD 38.2 billion in 2023.

What is the CAGR of the global compound semiconductor market from 2024 to 2032?

The CAGR of compound semiconductor is 10.1% during the analysis period of 2024 to 2032.

Which are the key players in the compound semiconductor market?

The key players operating in the global market are including Renesas Electronics Corporation, Texas Instruments Inc., Infineon Technologies AG, Qorvo, Inc, Wolfspeed, Inc., Samsung Electronics Co Ltd, Taiwan Semiconductor Manufacturing Company Limited, NXP Semiconductors, STMicroelectronics, and Nichia Corporation.

Which region dominated the global compound semiconductor market share?

Asia-Pacific held the dominating position in compound semiconductor industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of compound semiconductor during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global compound semiconductor industry?

The current trends and dynamics in the compound semiconductor industry include increasing demand for high-performance rf and power devices, growth in electric vehicles and renewable energy applications, and advancements in 5g technology and high-speed communications.

Which type held the maximum share in 2023?

The III-V compound semiconductor type held the maximum share of the compound semiconductor industry.