Autonomous Vehicle Sensors Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Autonomous Vehicle Sensors Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

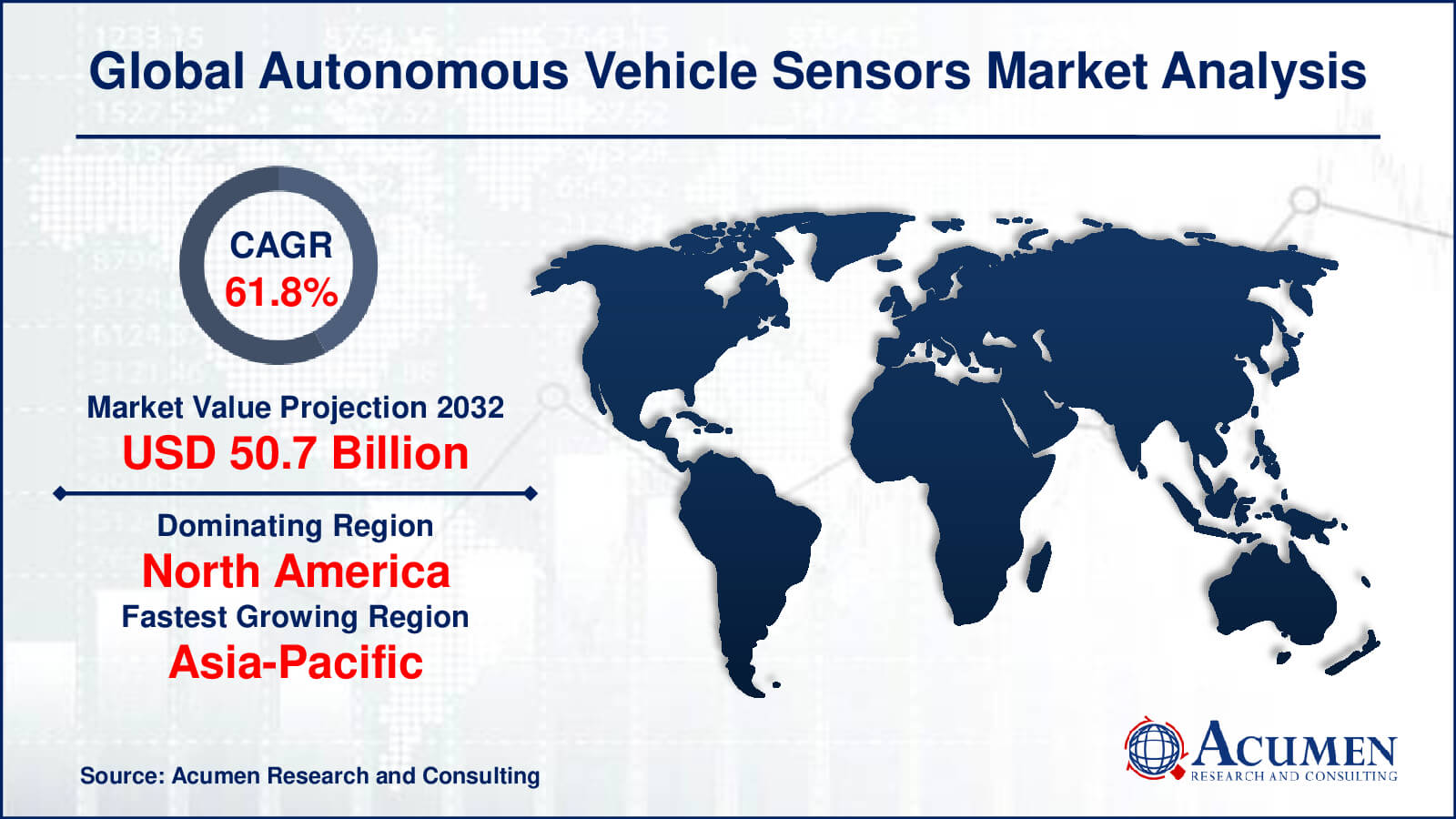

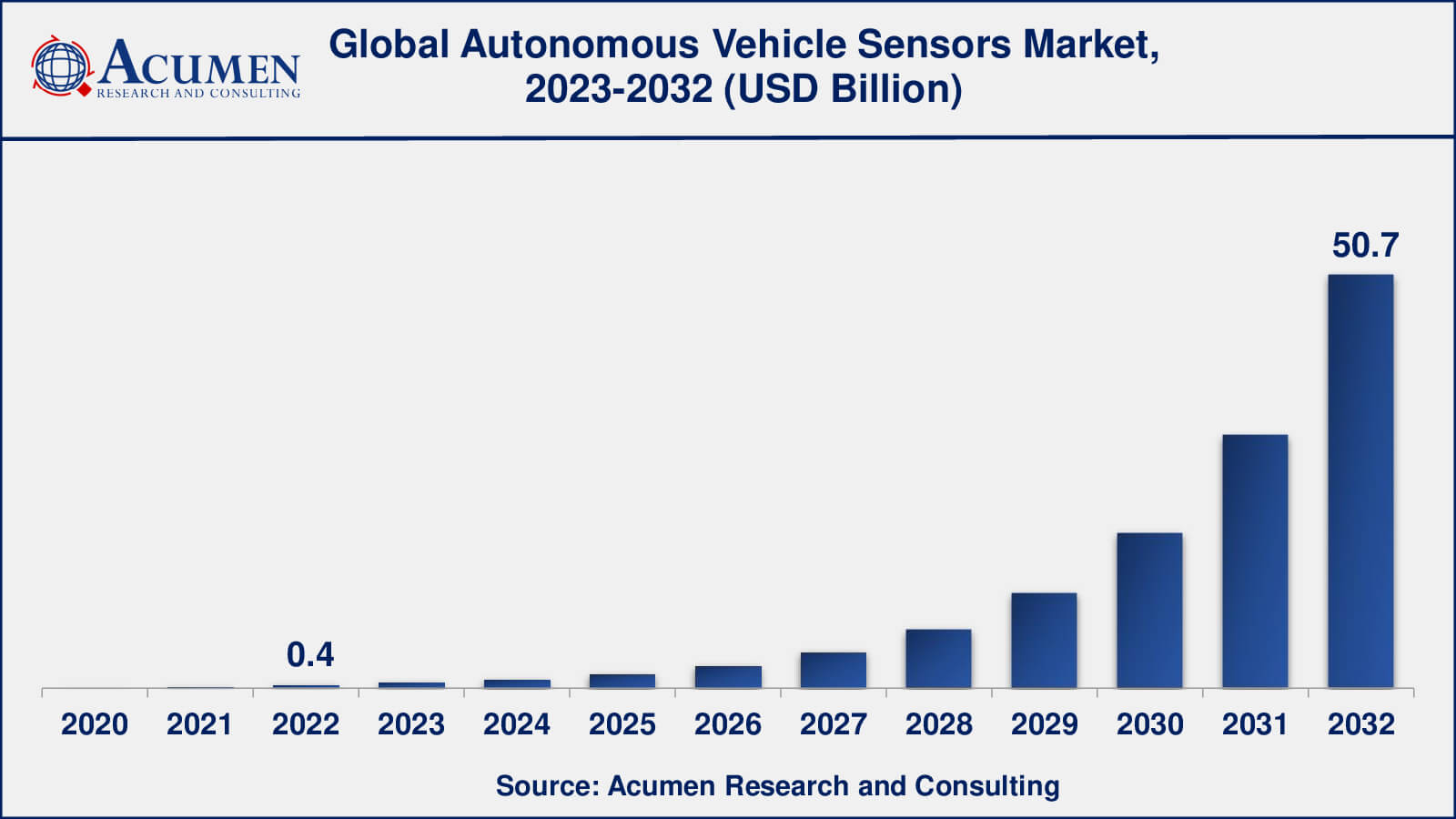

The Global Autonomous Vehicle Sensors Market Size accounted for USD 0.41 Billion in 2022 and is estimated to achieve a market size of USD 50.7 Billion by 2032 growing at a CAGR of 61.8% from 2023 to 2032.

Autonomous Vehicle Sensors Market Highlights

- Global autonomous vehicle sensors market revenue is poised to garner USD 50.7 billion by 2032 with a CAGR of 61.8% from 2023 to 2032

- North America autonomous vehicle sensors market value occupied almost USD 142 million in 2022

- Asia-Pacific autonomous vehicle sensors market growth will record a CAGR of over 62% from 2023 to 2032

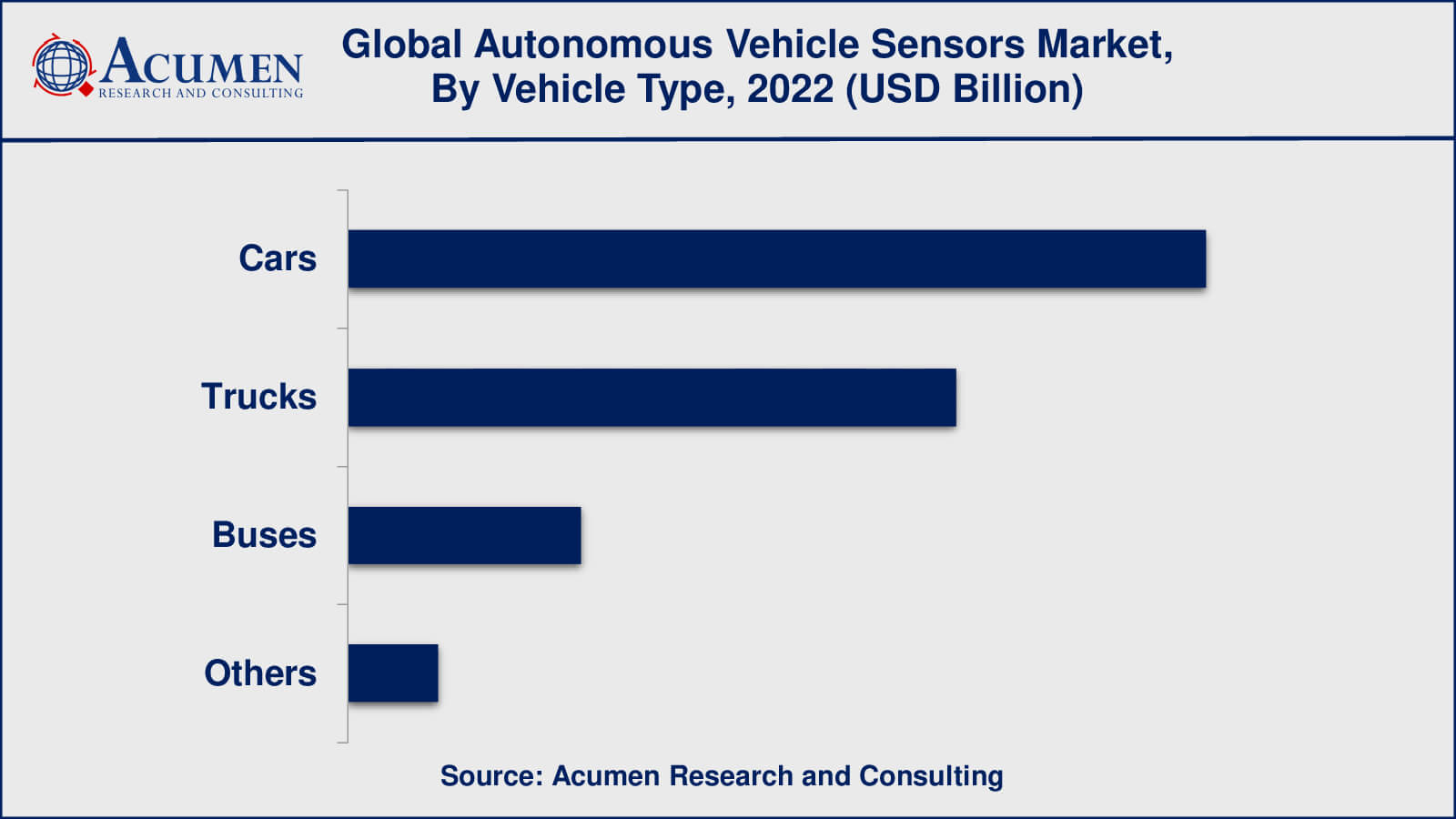

- Among vehicle type, the cars sub-segment generated over US$ 201 million revenue in 2022

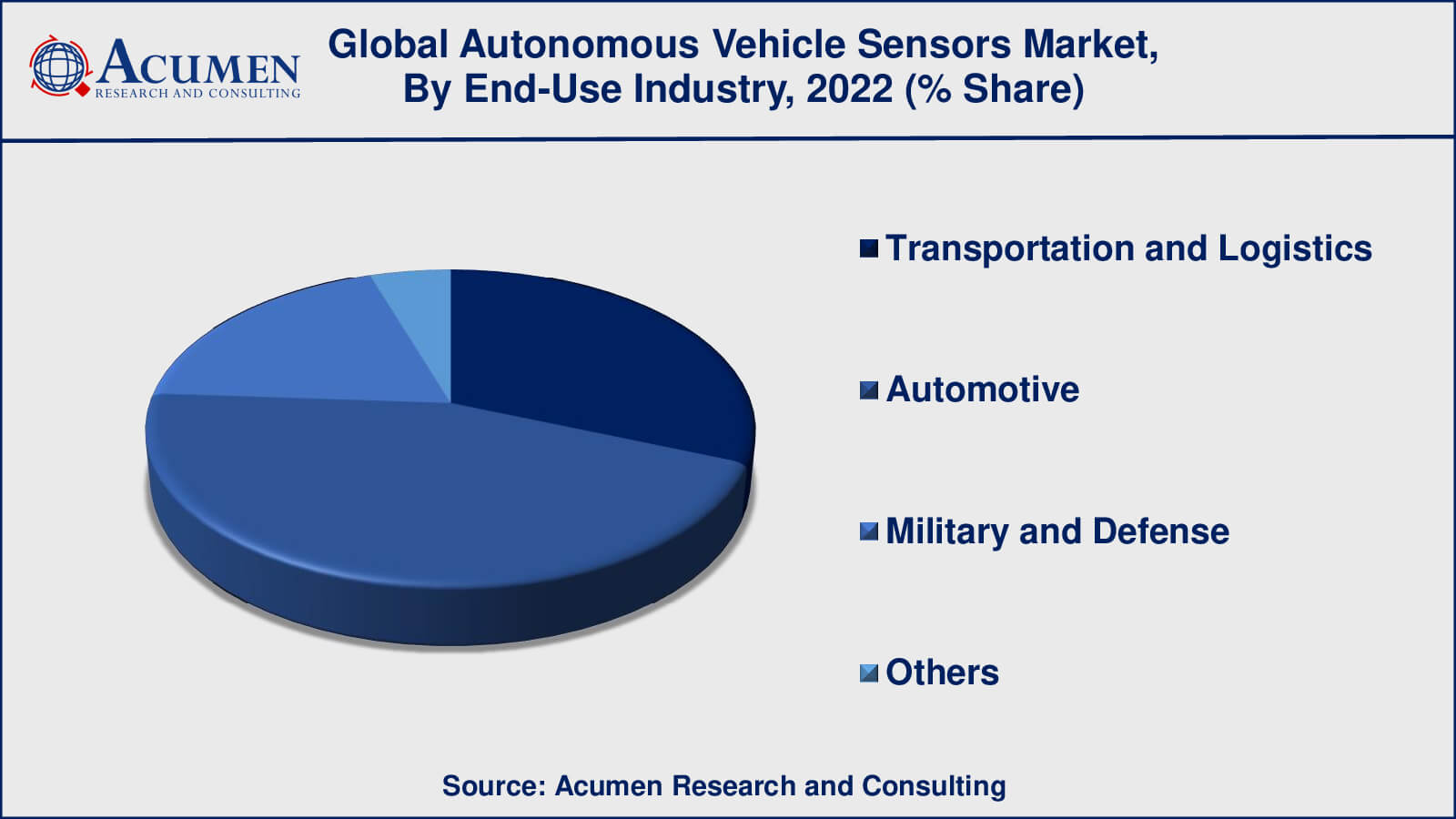

- Based on end-use industry, the automotive sub-segment generated around 45% share in 2022

- Integration of sensors is a popular autonomous vehicle sensors market trend that fuels the industry demand

Autonomous vehicle sensors are electronic devices that constantly monitor their surrounding areas and generate information. Sensors are the primary part of autonomous vehicles. As sensors play a vital role, without them it is not possible for a vehicle to navigate its spot dangers and environment, and safely drive along a road. There are numerous sensors present in an autonomous vehicle that have their aspects of driving; they usually have three categories – Radio Detection And Ranging (RADAR), cameras, and Light Detection And Ranging (LiDAR) sensors. This vehicle uses Light Detection & Ranging (LiDAR), artificial intelligence (AI) software, and RADAR sensing technology, which can monitor a 60-meter range around the car and it is also used to form a 3D map of the current environment. Additionally, sensors also help the vehicle to provide a suitable response as these responses can range from emergency stopping and accelerating/decelerating to turning and evasive maneuverers. Furthermore, at the same time, the response is determined by a central software component after that, those sensors provide the data for such actions to be taken. The autonomous vehicle is mainly designed to travel between destinations without an operator as it is a well-known self-driving vehicle.

Global Autonomous Vehicle Sensors Market Dynamics

Market Drivers

- Increasing demand for advanced driver assistance systems (ADAS) and autonomous vehicles

- Rising investments in autonomous driving technology

- Growing focus on road safety and reducing traffic congestion

- Technological advancements

Market Restraints

- Limited testing and development facilities

- Complex regulatory environment

- Cybersecurity concerns

Market Opportunities

- Advancements in LiDAR technology

- Shift towards in-house sensor development

- Opportunities in emerging markets

Autonomous Vehicle Sensors Market Report Coverage

| Market | Autonomous Vehicle Sensors Market |

| Autonomous Vehicle Sensors Market Size 2022 | USD 0.41 Billion |

| Autonomous Vehicle Sensors Market Forecast 2032 | USD 50.7 Billion |

| Autonomous Vehicle Sensors Market CAGR During 2023 - 2032 | 61.8% |

| Autonomous Vehicle Sensors Market Analysis Period | 2020 - 2032 |

| Autonomous Vehicle Sensors Market Base Year | 2022 |

| Autonomous Vehicle Sensors Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type of Sensor, By Vehicle Type, By Level of Automation, By Application, By End-Use Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | NXP Semiconductors, Fujitsu, Delphi Transportation and Logistics, Asahi Kasei Corporation, Tele Tracking Technologies, Trilumina, Continental AG, Brigade Electronics, Valeo, and Teledyne Optech. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Autonomous Vehicle Sensors Market Insights

The key factors fuelling growth in the global autonomous vehicle sensors market due to increasing government promotion through the different sources to adopt LiDAR sensors in vehicles and increasing technological advancements in autonomous vehicles. Furthermore, advanced technologies in sensors are the contributing factor to ensure the growth of the autonomous vehicles market as it requires a large number of technologies and infrastructures to operate properly. However, factors restraining the growth of the global autonomous vehicle sensor market during the forecast period due to system malfunction and high vehicle and infrastructure costs.

Autonomous Vehicle Sensors Market, By Segmentation

The worldwide market for autonomous vehicle sensors is split based on type of sensor, vehicle type, level of automation, application, end-use industry, and geography.

Automated Vehicle Sensors Market, By Type of Sensor

- LiDAR

- RADAR

- Camera

- Ultrasound

- Others

According to autonomous vehicle sensors industry analysis, LiDAR sensors dominated the autonomous vehicle sensors market. LiDAR sensors create a 3D map of the environment using laser technology, allowing autonomous vehicles to accurately perceive and interpret their surroundings. LiDAR sensors are highly accurate and dependable, making them an essential component of autonomous driving technology.

Other sensors, such as RADAR, camera, ultrasound, and others, play important roles in enabling autonomous driving technology. RADAR sensors detect objects and their movements using radio waves, whereas camera sensors identify objects and obstacles using image recognition technology. Ultrasound sensors detect nearby objects using sound waves, while other sensors such as GPS and inertial sensors provide additional information on the vehicle's location and movement.

Automated Vehicle Sensors Market, By Vehicle Type

- Cars

- Trucks

- Buses

- Others

As per the the autonomous vehicle sensors market forecast, autonomous sensors for cars are expected to dominate the market. This is due to the fact that the development of autonomous driving technology has primarily focused on passenger cars, with a number of automotive manufacturers and technology companies investing heavily in the development of autonomous vehicles.

However, the use of autonomous sensors in other types of vehicles, such as trucks, buses, and other commercial vehicles, is becoming more common. Autonomous driving technology, in particular, has the potential to revolutionise the logistics and transportation industries by enabling more efficient and cost-effective delivery systems.

Automated Vehicle Sensors Market, By Level of Automation

- Level 2

- Level 3

- Level 4

- Level 5

Level 2 automation dominated the market for autonomous vehicle sensors. Advanced driver assistance systems (ADAS) which provide partial automation, such as lane keeping assistance, adaptive cruise control, and automated parking, are considered Level 2 automation. These systems necessitate constant driver supervision and intervention, but they can help with driving tasks and improve driver safety and comfort.

While some manufacturers and technology companies have developed and tested Level 3 automation, which enables for conditional automation in certain situations, and Level 4 automation, that also allows for high automation in specific driving conditions, they have not yet been widely adopted.

Level 5 automation, which represents complete automation with no human intervention, is still in development and testing and is not yet available for consumer use.

Automated Vehicle Sensors Market, By Application

- Navigation

- Obstacle Detection

- Collision Avoidance

- Others

In terms of applications, obstacle detection dominated the market for autonomous vehicle sensors. Obstacle detection sensors, such as LiDAR, RADAR, and camera sensors, are critical for autonomous vehicles to accurately perceive and interpret their surroundings, allowing them to avoid collisions with obstacles like pedestrians, other vehicles, and road objects.

Navigation sensors, such as GPS and inertial sensors, are also critical for enabling autonomous driving technology because they provide information on the location and movement of the vehicle. Collision avoidance systems, such as automatic emergency braking, are intended to detect potential collisions and take appropriate action to avoid them.

Automated Vehicle Sensors Market, By End-Use Industry

- Transportation and Logistics

- Automotive

- Military and Defense

- Others

In terms of end-use industries, the automotive industry dominated the autonomous vehicle sensors market. This is because the automotive industry has primarily driven the development of autonomous driving technology, with a number of automotive manufacturers investing largely in developing automated driving and integrating autonomous driving technology into their vehicles.

However, autonomous vehicle sensors have important applications in other industries, such as transportation and logistics, where autonomous vehicles can be used to improve delivery system efficiency and cost-effectiveness. Furthermore, the military and defence industries are investigating the use of autonomous vehicles for a variety of applications, including unmanned ground vehicles for reconnaissance and surveillance.

Autonomous Vehicle Sensors Market Regional Outlook

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Autonomous Vehicle Sensors Market Regional Analysis

North America is currently the most important market for autonomous vehicle sensors, followed by Europe and Asia-Pacific. The presence of significant automotive manufacturers and technology providers in North America and Europe, as well as the widespread adoption of advanced driver assistance systems (ADAS) and self-driving vehicles in these regions, has aided market growth.

The Asia-Pacific region, on the other hand, is expected to grow the fastest during the forecast period. The region's market is expected to grow due to the increasing implementation of autonomous vehicles in countries such as China, Japan, and South Korea, as well as increased investments in the development of advanced sensors.

Furthermore, rising demand for self-driving vehicles in emerging economies such as India and Brazil is expected to drive market growth in the coming years. Overall, the global market for autonomous vehicle sensors is expected to grow significantly in the coming years, owing to rising demand for advanced driver assistance systems and autonomous vehicles in various regions.

Autonomous Vehicle Sensors Market Players

Some of the top autonomous vehicle sensors companies offered in the professional report includes NXP Semiconductors, Fujitsu, Delphi Automotive, Asahi Kasei Corporation, Tele Tracking Technologies, Trilumina, Continental AG, Brigade Electronics, Valeo, and Teledyne Optech.

Frequently Asked Questions

What was the market size of the global autonomous vehicle sensors in 2022?

The market size of autonomous vehicle sensors was USD 0.41 billion in 2022.

What is the CAGR of the global autonomous vehicle sensors market from 2023 to 2032?

The CAGR of autonomous vehicle sensors is 61.8% during the analysis period of 2023 to 2032.

Which are the key players in the autonomous vehicle sensors market?

The key players operating in the global autonomous vehicle sensors market are including NXP Semiconductors, Fujitsu, Delphi Automotive, Asahi Kasei Corporation, Tele Tracking Technologies, Trilumina, Continental AG, Brigade Electronics, Valeo, and Teledyne Optech.

Which region dominated the global autonomous vehicle sensors market share?

North America held the dominating position in autonomous vehicle sensors industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of autonomous vehicle sensors during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global autonomous vehicle sensors industry?

The current trends and dynamics in the autonomous vehicle sensors industry include increasing demand for advanced driver assistance systems (ADAS) and autonomous vehicles, rising investments in autonomous driving technology, and growing focus on road safety and reducing traffic congestion.

Which type of sensor held the maximum share in 2022?

The LiDAR type of sensor held the maximum share of the autonomous vehicle sensors industry.