Chemical Vapor Deposition Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Chemical Vapor Deposition Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

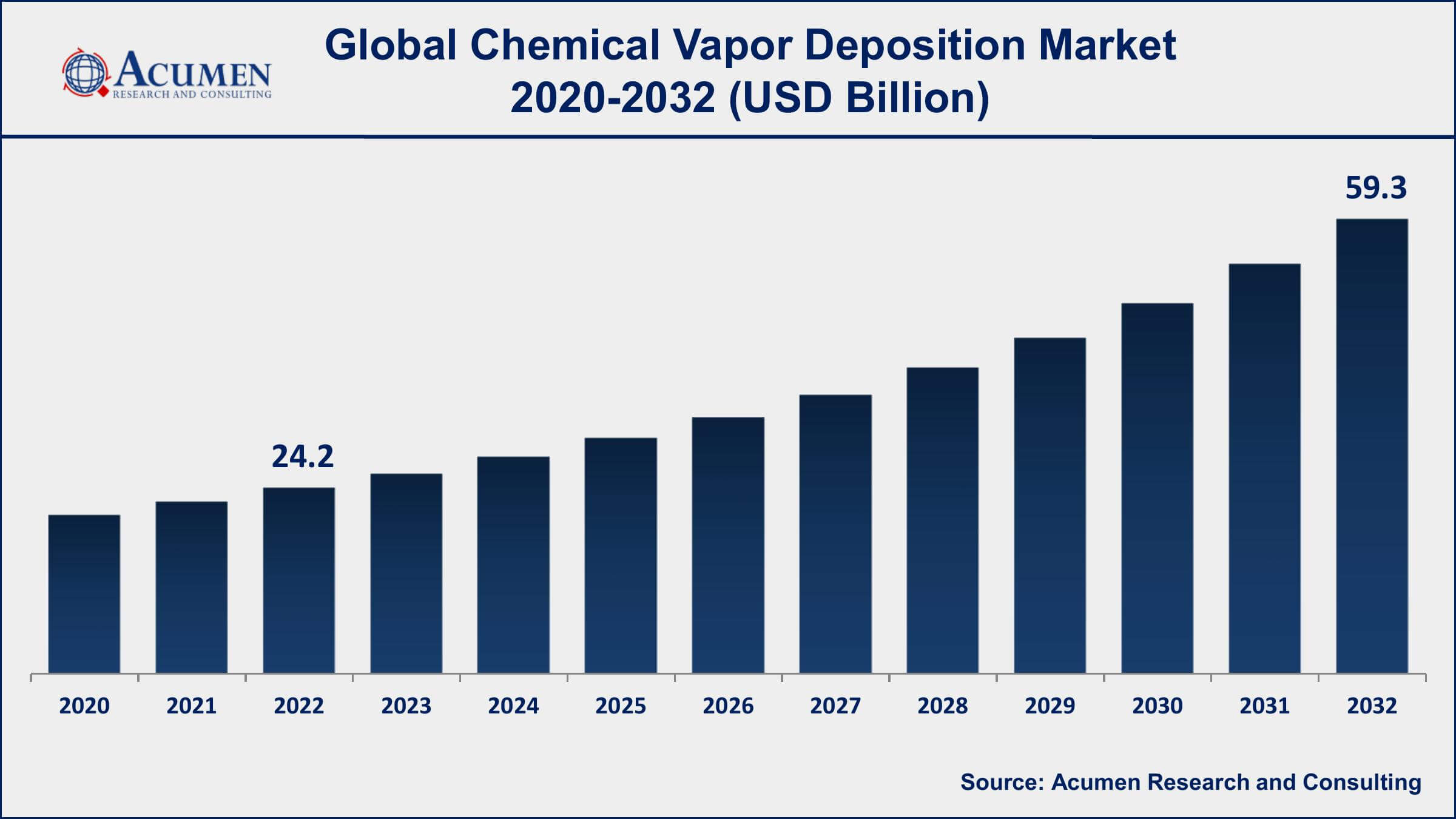

The Global Chemical Vapor Deposition (CVD) Market Size accounted for USD 24.2 Billion in 2022 and is projected to achieve a market size of USD 59.3 Billion by 2032 growing at a CAGR of 9.5% from 2023 to 2032.

Chemical Vapor Deposition Market Highlights

- Global chemical vapor deposition market revenue is expected to increase by USD 59.3 Billion by 2032, with a 9.5% CAGR from 2023 to 2032

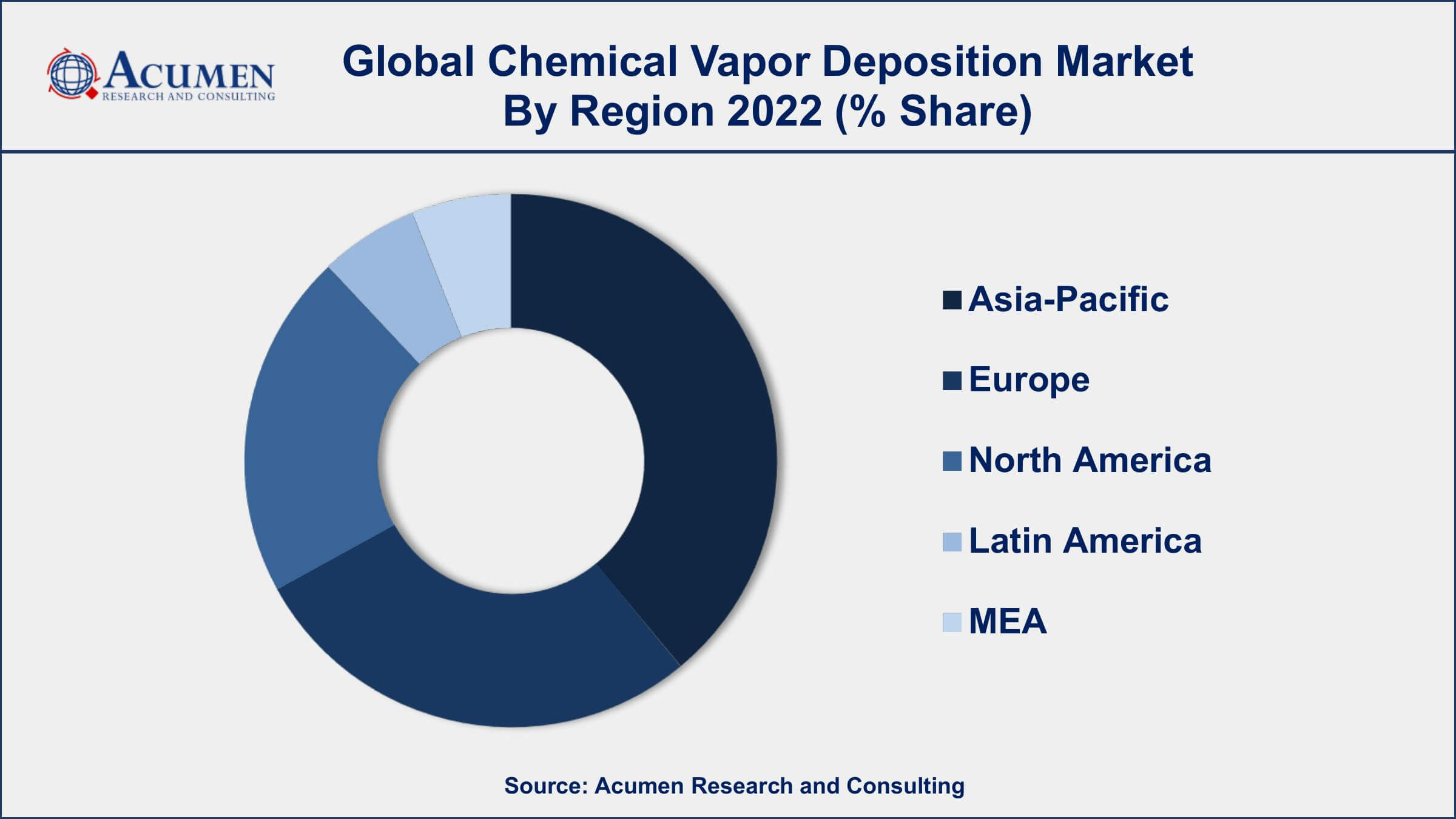

- Asia-Pacific region led with more than 52% of chemical vapor deposition market share in 2022

- Europe chemical vapor deposition market growth will record a CAGR of more than 9% from 2023 to 2032

- By product, the CVD equipment segment has held a revenue share of 65% in 2022

- By application, the semiconductor & microelectronics segment is observed to witness a significant increase in the upcoming period

- Growing demand for smart devices and IoT technology, drives the chemical vapor deposition market value

Chemical Vapor Deposition (CVD) is a process in which a thin film of material is deposited on a substrate by introducing a reactive gas or vapor into a chamber where it reacts on the surface of the substrate, forming a solid film. The reaction is typically initiated by heating the substrate to a temperature high enough to cause a chemical reaction between the gas and the surface. CVD is widely used in the semiconductor industry to produce thin films for microelectronic devices such as transistors, capacitors, and resistors.

The market for CVD has been growing steadily in recent years due to the increasing demand for microelectronic devices, including smartphones, computers, and other electronic devices. The CVD market is also driven by the growing demand for high-performance coatings for a variety of applications such as automotive, aerospace, and medical devices. The increasing use of CVD for advanced applications such as thin film solar cells, LEDs, and fuel cells is expected to further boost the growth of the market. The market is expected to continue to grow at a rapid pace in the coming years, driven by the increasing demand for high-performance materials and devices in various industries.

Global Chemical Vapor Deposition Market Trends

Market Drivers

- Growing demand for microelectronic devices

- Increasing use of CVD for advanced applications

- Increasing demand for high-performance coatings in various industries

- Growing adoption of renewable energy sources

Market Restraints

- High equipment and maintenance costs

- Lack of skilled workforce

Market Opportunities

- Growing demand for smart devices and IoT technology

- Increasing demand for CVD in medical and healthcare applications

Chemical Vapor Deposition Market Report Coverage

| Market | Chemical Vapor Deposition Market |

| Chemical Vapor Deposition Market Size 2022 | USD 24.2 Billion |

| Chemical Vapor Deposition Market Forecast 2032 | USD 59.3 Billion |

| Chemical Vapor Deposition Market CAGR During 2023 - 2032 | 9.5% |

| Chemical Vapor Deposition Market Analysis Period | 2020 - 2032 |

| Chemical Vapor Deposition Market Base Year | 2022 |

| Chemical Vapor Deposition Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Category, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Applied Materials, Inc., Lam Research Corporation, Tokyo Electron Limited, ASM International N.V., Aixtron SE, Veeco Instruments Inc., CVD Equipment Corporation, Plasma-Therm LLC, ULVAC Technologies, Inc., SPTS Technologies Limited, Oxford Instruments plc, and IHI Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Chemical vapor deposition (CVD) is used in refining the superiority of products by means of chemical processes such as monolithic components, fiber, and ceramic powder. This chemical procedure is regularly used in the manufacturing of electronic components, semiconductors, and others to produce wear-resistant parts, bearings, thin films, etc. CVD procedure encompasses the decomposition or reaction of one or more predecessor gases in a compartment for varnishing products. Likewise, CVD is also used in microfabrication processes to deposit constituents in numerous forms such as polycrystalline, epitaxial, monocrystalline, and amorphous.

Increasing demand for microelectronics such as mobiles, storage devices, laptops, and other electronic products is majorly driving the growth of the chemical vapor deposition (CVD) market value. However, the lack of skilled operators and the high cost of setup are key factors detaining the growth of this market. Furthermore, rapid industrialization in emerging economies and administrative support for private financing at the domestic level are some of the factors anticipated to propel the growth of the chemical vapor deposition (CVD) market revenue in the coming years.

Chemical Vapor Deposition Market Segmentation

The global chemical vapor deposition market segmentation is based on category, application, and geography.

Chemical Vapor Deposition Market By Category

- CVD Equipment

- CVD Services

- CVD Materials

In terms of categories, the CVD equipment segment has seen significant growth in recent years. The CVD equipment segment is a crucial component of the market, as it is responsible for the deposition of thin films on substrates. The equipment used in the CVD process includes reactors, gas delivery systems, vacuum systems, temperature control systems, and other accessories. The demand for CVD equipment is directly linked to the growth of the CVD market as a whole, as the equipment is required for the deposition of thin films on substrates. The CVD equipment segment is expected to witness significant growth in the coming years, driven by the increasing demand for high-performance coatings and the growing use of CVD in advanced applications. The demand for CVD equipment is also expected to be driven by the increasing adoption of renewable energy sources and the growing demand for microelectronic devices. Technological advancements in CVD equipment, such as the development of atomic layer deposition (ALD) systems and plasma-enhanced CVD (PECVD) systems, are also expected to drive the growth of the market.

Chemical Vapor Deposition Market By Application

- Semiconductor & microelectronics

- Cutting Tools

- Data Storage

- Medical Equipment

- Solar Products

- Other

According to the chemical vapor deposition market forecast, the semiconductor & microelectronics segment is expected to witness significant growth in the coming years. CVD is widely used in the semiconductor industry to produce thin films for microelectronic devices such as transistors, capacitors, and resistors. The demand for microelectronic devices such as smartphones, computers, and other electronic devices is increasing rapidly, and CVD is a crucial process for producing these devices. The increasing demand for high-performance microelectronic devices is expected to continue to drive the growth of the semiconductor and microelectronics segment in the CVD market. Moreover, the use of CVD is also expanding in the semiconductor and microelectronics industry. For example, CVD is being used to produce advanced materials such as graphene, carbon nanotubes, and quantum dots, which have applications in various fields, including electronics, energy, and healthcare. The growing use of CVD in advanced applications is expected to drive the growth of the semiconductor and microelectronics segment in the CVD market.

Chemical Vapor Deposition Market Regional Outlook

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Chemical Vapor Deposition Market Regional Analysis

The Asia-Pacific region dominates the chemical vapor deposition market due to the presence of major semiconductor and electronics manufacturers in the region. Countries such as China, Japan, South Korea, and Taiwan are major producers of electronic devices, and the demand for CVD equipment and services in these countries is driven by the increasing demand for high-performance electronic devices. The presence of a large number of semiconductor foundries and wafer fabs in the region is also driving the demand for CVD equipment and services. Moreover, the Asia-Pacific region has a large population and a growing middle class, which is driving the demand for electronic devices such as smartphones, tablets, and laptops. The growing adoption of IoT technology and smart devices is also driving the demand for CVD equipment and services in the region. Additionally, the increasing use of CVD in renewable energy applications such as thin-film solar cells and fuel cells is driving the demand for CVD equipment and services in the region.

Chemical Vapor Deposition Market Player

Some of the top chemical vapor deposition market companies offered in the professional report include Applied Materials, Inc., Lam Research Corporation, Tokyo Electron Limited, ASM International N.V., Aixtron SE, Veeco Instruments Inc., CVD Equipment Corporation, Plasma-Therm LLC, ULVAC Technologies, Inc., SPTS Technologies Limited, Oxford Instruments plc, and IHI Corporation.

Frequently Asked Questions

What was the market size of the global chemical vapor deposition in 2022?

The market size of chemical vapor deposition was USD 24.2 Billion in 2022.

What is the CAGR of the global chemical vapor deposition market from 2023 to 2032?

The CAGR of chemical vapor deposition is 9.5% during the analysis period of 2023 to 2032.

Which are the key players in the chemical vapor deposition market?

The key players operating in the global market are including Applied Materials, Inc., Lam Research Corporation, Tokyo Electron Limited, ASM International N.V., Aixtron SE, Veeco Instruments Inc., CVD Equipment Corporation, Plasma-Therm LLC, ULVAC Technologies, Inc., SPTS Technologies Limited, Oxford Instruments plc, and IHI Corporation.

Which region dominated the global chemical vapor deposition market share?

Asia-Pacific held the dominating position in chemical vapor deposition industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Europe region exhibited fastest growing CAGR for market of chemical vapor deposition during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global chemical vapor deposition industry?

The current trends and dynamics in the chemical vapor deposition industry include increasing demand for electric vehicles, and growth in renewable energy storage solutions.

Which category held the maximum share in 2022?

The CVD equipment category held the maximum share of the chemical vapor deposition industry.