Gallium Nitride Semiconductor Devices Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Gallium Nitride Semiconductor Devices Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

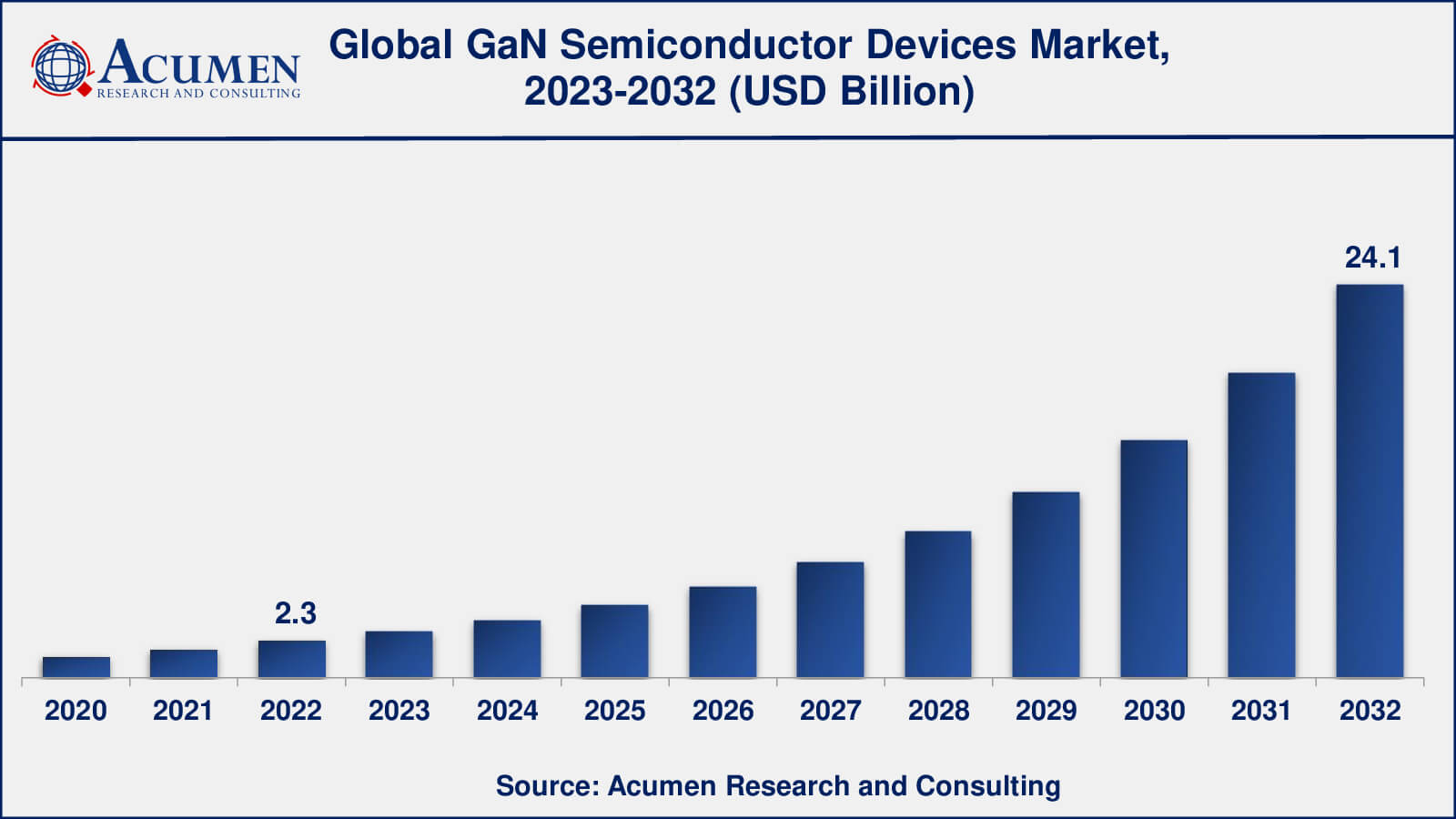

The Global Gallium Nitride Semiconductor Devices Market Size accounted for USD 2.3 Billion in 2022 and is estimated to achieve a market size of USD 24.1 Billion by 2032 growing at a CAGR of 26.9% from 2023 to 2032.

Gallium Nitride Semiconductor Devices Market Highlights

- Global gallium nitride semiconductor devices market revenue is poised to garner USD 24.1 billion by 2032 with a CAGR of 26.9% from 2023 to 2032

- North America gallium nitride semiconductor devices market value occupied around USD 745 million in 2022

- Asia-Pacific gallium nitride semiconductor devices market growth will record a CAGR of more than 28% from 2023 to 2032

- Among product type, the opto semiconductors sub-segment generated over US$ 858 million revenue in 2022

- Based on application, the ICT sub-segment generated around 24% share in 2022

- Growth in wireless charging and fast-charging technologies is a popular GaN semiconductor devices market trend that fuels the industry demand

Gallium Nitride (GaN) is a wide bandgap semiconductor material that is largely used in high-speed power semiconductors and optical devices and has gained traction over recent years. GaN is used in manufacturing high-voltage power transistors with a range of over 600V and is the best alternative to bipolar silicon devices used in electric vehicles. Other important features of GaN material include high-brightness emission and intensity when used in opto-semiconductors, high power efficiency, superior high-frequency handling capacity, and flexibility to be used alongside various substrates such as Si, sapphire, and SiC. Gallium Nitride is mainly used in power semiconductors and opto-semiconductors. GaN is a hard material that possesses different chemical properties, making it suitable for manufacturing semiconductor devices. The popularity of GaN semiconductor devices is expected to increase with the growth in its application areas. The emergence of new technologies and rising application areas are the major drivers of the GaN market. GaN semiconductor devices find significant opportunities in electric vehicles (EVs) and hybrid electric vehicles (HEVs); however, the high cost of manufacturing pure GaN remains a key challenge for manufacturers.

Global Gallium Nitride Semiconductor Devices Market Dynamics

Market Drivers

- Continuous emergence of technologies in GaN ecosystem

- Growing usage of GaN semiconductors in electric vehicles

- Increasing push towards renewable energy forms

- Risig adoption in 5G infrastructure for high-speed data transmission

Market Restraints

- Competition from silicon carbide technology

- High cost of bulk Gallium Nitride (GaN)

- Complex fabrication processes leading to yield and scalability challenges

Market Opportunities

- Application in electric and hybrid electric vehicles

- Potential use of GaN in 5G infrastructure development

Gallium Nitride Semiconductor Devices Market Report Coverage

| Market | Gallium Nitride Semiconductor Devices Market |

| Gallium Nitride Semiconductor Devices Market Size 2022 | USD 2.3 Billion |

| Gallium Nitride Semiconductor Devices Market Forecast 2032 | USD 24.1 Billion |

| Gallium Nitride Semiconductor Devices Market CAGR During 2023 - 2032 | 26.9% |

| Gallium Nitride Semiconductor Devices Market Analysis Period | 2020 - 2032 |

| Gallium Nitride Semiconductor Devices Market Base Year | 2022 |

| Gallium Nitride Semiconductor Devices Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product Type, By Wafer Size, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Cree, Inc., Efficient Power Conversion Corporation (EPC), Fujitsu Ltd., GaN Systems, Infineon, Infineon Technologies AG, Microsemi Corporation (now part of Microchip Technology), Mitsubishi Electric, NexgenPowerSystems, NXP Semiconductor, Qorvo, Inc., Samsung, Sumitomo Electric, Texas Instruments, and Toshiba Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Gallium Nitride Semiconductor Devices Market Insights

The rapid development of gallium nitride (GaN) technology, coupled with the expanding range of applications for GaN, is expected to significantly fuel the growth of the GaN semiconductor devices market. When compared to Si and GaAs, GaN stands out as a robust technology with superior performance characteristics. GaN-based devices exhibit high electron mobility, excellent thermal conductivity, saturation velocity, and elevated breakdown voltages. These attributes have facilitated the integration of GaN into numerous high-frequency RF devices and LEDs resulting in a tremendous growth in the gallium nitrite GaN semiconductor devices market.

Furthermore, GaN has found utility in various high-power application areas such as home appliances, power converter circuits, heavy electrical systems, and hybrid vehicles. The continuous advancement in GaN technology has led to the introduction of innovative, cost-effective products with enhanced design and performance by several companies. The increasing demand for high-power and high-temperature applications has contributed to the rising adoption of gallium nitride (GaN) semiconductor devices market.

Gallium Nitride semiconductors are extensively used in the production of radio frequency amplifiers, light-emitting diodes (LEDs), and high-voltage applications, primarily owing to their capability to operate at high temperatures, frequencies, and power densities while maintaining superior efficiency and linearity.

Gallium Nitride Semiconductor Devices Market Segmentation

The worldwide market for gallium nitride semiconductor devices is split based on product type, wafer size, application, and geography.

Gallium Nitride Semiconductor Devices Product Types

- Power Semiconductors

- Schottky Diode

- High Electron Mobility Transistors (HEMTs)

- Integrated Circuit (IC)

- Radio Frequency Devices

- Opto Semiconductors

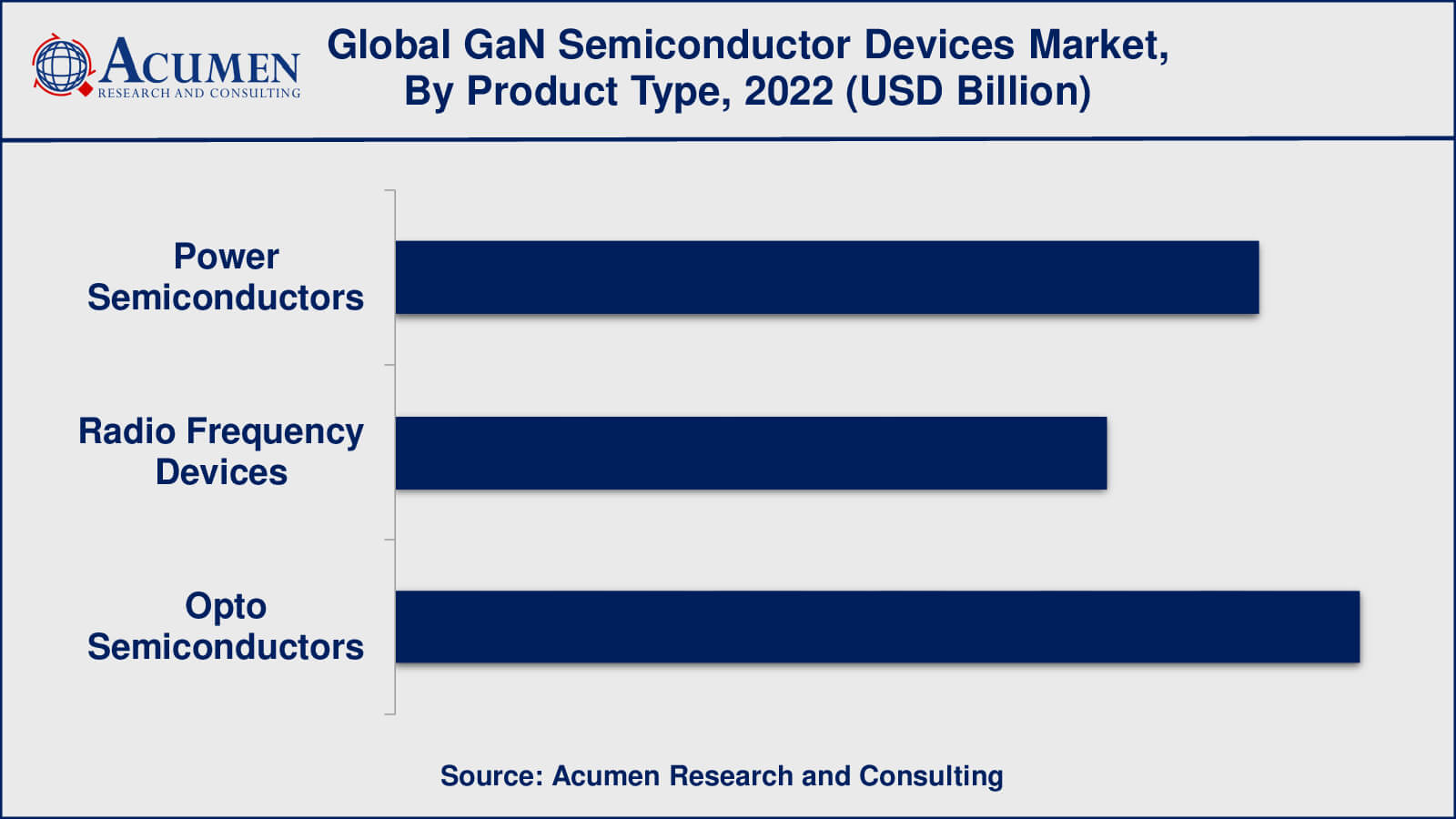

Based on the product types the gallium nitride semiconductor market is segmented into power semiconductors, radio frequency devices, and opto semiconductors. As per our gallium nitride semiconductor devices market forecast, the opto semiconductors is expected to held the largest market share in coming years from 2023 to 2032. Opto semiconductors find application in solar cells, photodiodes, LEDs, lasers, optoelectronics, and other areas, leading to an increased demand that will drive growth within this segment. Notably, opto semiconductors play a pivotal role in pulsed lasers and LiDAR (light detection and ranging), which is a critical application for this technology. These factors collectively contribute to the rising demand in the GaN market. Furthermore, the RF semiconductor segment is expected to exhibit significant growth at the highest compound annual growth rate (CAGR) during the forecast period, primarily attributed to the growing usage of RF semiconductors in mobile applications. Power semiconductors, on the other hand, find application in aircraft, space shuttles, satellites, and various other contexts.

Gallium Nitride Semiconductor Devices Wafer Sizes

- 2 Inch

- 4 Inch

- 6 Inch

- 8 Inch

The market is categorized into different wafer sizes, namely 2-inch, 4-inch, 6-inch, and 8-inch. Among these wafer size segments, the 4-inch category emerged as the leader in terms of revenue share in previous years. This dominance was underscored by the 4-inch segment's capture of over 39% of the market share, attributed to its extensive production of semiconductor devices. The increasing demand for GaN applications in high-power amplifiers, telecom frontends, and optoelectronics devices using the 4-inch wafer size is poised to drive this segment's growth in the coming years.

Concurrently, the 8-inch wafer size segment is anticipated to experience the highest compound annual growth rate (CAGR) over the forecast period. Additionally, the 6-inch wafer size segment offers distinct advantages such as precise current control and uniform voltage supply, factors that will likely propel the growth of the 6-inch wafer size segment.

Gallium Nitride Semiconductor Devices Applications

- Automotive

- Consumer Electronics

- Defense & Aerospace

- Healthcare

- Industrial & Power

- Information & Communication Technology

- Others

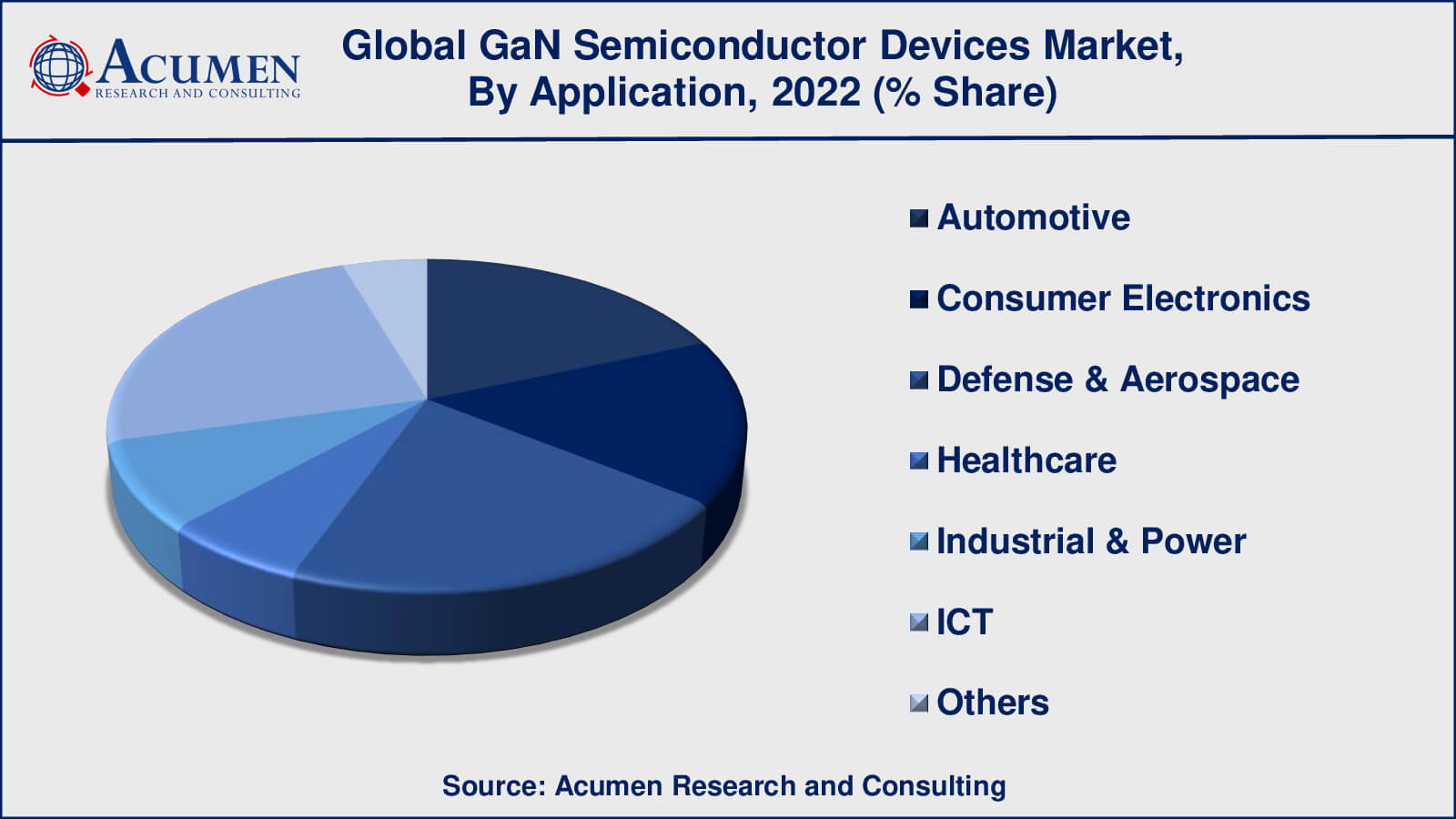

In terms of applications, the market is segmented into information and communication technology, consumer electronics, defense and aerospace, automotive, and other sectors. According to our gallium nitride semiconductor devices industry analysis, the defense and aerospace segment has emerged as the dominant application category within the gallium nitride semiconductor devices market. This dominance is attributed to gallium nitride's high-power density, efficiency, and reliability, driving a rapid surge in demand for GaN technology in the defense and aerospace sector. A key driving factor for the defense and aerospace segment is the increasing need for enhanced bandwidth and performance reliability in areas such as communications, electronic warfare, and radar systems. This demand is instrumental in propelling the growth of this segment.

The information and communication technology subsegment is also expected to experience growth in the GaN semiconductor devices market during the forecast period, having accounted for approximately 24% of the market share. This growth can be attributed to the global rise in adoption of the Internet of Things (IoT), which is expected to contribute to an increase in the market share of this particular segment.

Gallium Nitride Semiconductor Devices Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Gallium Nitride Semiconductor Devices Market Regional Analysis

North America held the largest market share for gallium nitride GaN semiconductor devices in 2022, accounting for over 33% of the total market share. This growth can be attributed to the demand arising from military and defense applications. Additionally, the region's expanding utilization of GaN in consumer electronic devices, such as personal computers, laptops, televisions, mobile phones, and tablet PCs, driven by its power efficiency, contributes to the market's growth in the area. Manufacturers in North America are concentrating on innovating new, power-efficient, and cost-effective products, thereby laying the foundation for the future growth potential of GaN semiconductor-based devices in the region.

On the other hand, Asia-Pacific emerges as the fastest-growing market for GaN semiconductor devices, with China being a significant driver of this growth. In 2022, China held the largest share of the Asia-Pacific GaN semiconductor devices market, primarily fueled by demand from consumer electronics sectors, particularly in mobile, communication, and computing segments. High-performance GaN-based transistors are expected to bolster growth in the telecommunications sector across Asia-Pacific. The electronics market is rapidly expanding in countries like China and India to cater to growing local demand, positioning them as potential markets for GaN semiconductor devices. Additionally, the surge in cloud computing is set to drive new power architectures in data centers. This scenario, coupled with the availability of skilled labor and raw materials and the growing economies, prompts several companies to consider relocating their manufacturing units to the APAC region. Considering these factors, the GaN semiconductor devices market is poised to experience steady growth throughout the forecast period.

Gallium Nitride Semiconductor Devices Market Players

Some of the top gallium nitride semiconductor devices companies offered in our report include Cree, Inc., Efficient Power Conversion Corporation (EPC), Fujitsu Ltd., GaN Systems, Infineon, Infineon Technologies AG, Microsemi Corporation (now part of Microchip Technology), Mitsubishi Electric, NexgenPowerSystems, NXP Semiconductor, Qorvo, Inc., Samsung, Sumitomo Electric, Texas Instruments, and Toshiba Corporation.

Frequently Asked Questions

What was the market size of the global gallium nitride semiconductor devices in 2022?

The market size of gallium nitride semiconductor devices was USD 2.3 Billion in 2022.

What is the CAGR of the global gallium nitride semiconductor devices market from 2023 to 2032?

The CAGR of gallium nitride semiconductor devices is 26.9% during the analysis period of 2023 to 2032.

Which are the key players in the gallium nitride semiconductor devices market?

The key players operating in the global market are including Cree, Inc., Efficient Power Conversion Corporation (EPC), Fujitsu Ltd., GaN Systems, Infineon, Infineon Technologies AG, Microsemi Corporation (now part of Microchip Technology), Mitsubishi Electric, NexgenPowerSystems, NXP Semiconductor, Qorvo, Inc., Samsung, Sumitomo Electric, Texas Instruments, and Toshiba Corporation.

Which region dominated the global gallium nitride semiconductor devices market share?

North America held the dominating position in gallium nitride semiconductor devices industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of gallium nitride semiconductor devices during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global Gallium Nitride Semiconductor Devices industry?

The current trends and dynamics in the gallium nitride semiconductor devices industry include continuous emergence of technologies in GaN ecosystem, increasing usage of GaN semiconductors in electric vehicles, and increasing push towards renewable energy forms.

Which product type held the maximum share in 2022?

The opto semiconductors product type held the maximum share of the gallium nitride semiconductor devices industry.