5G Infrastructure Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

5G Infrastructure Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

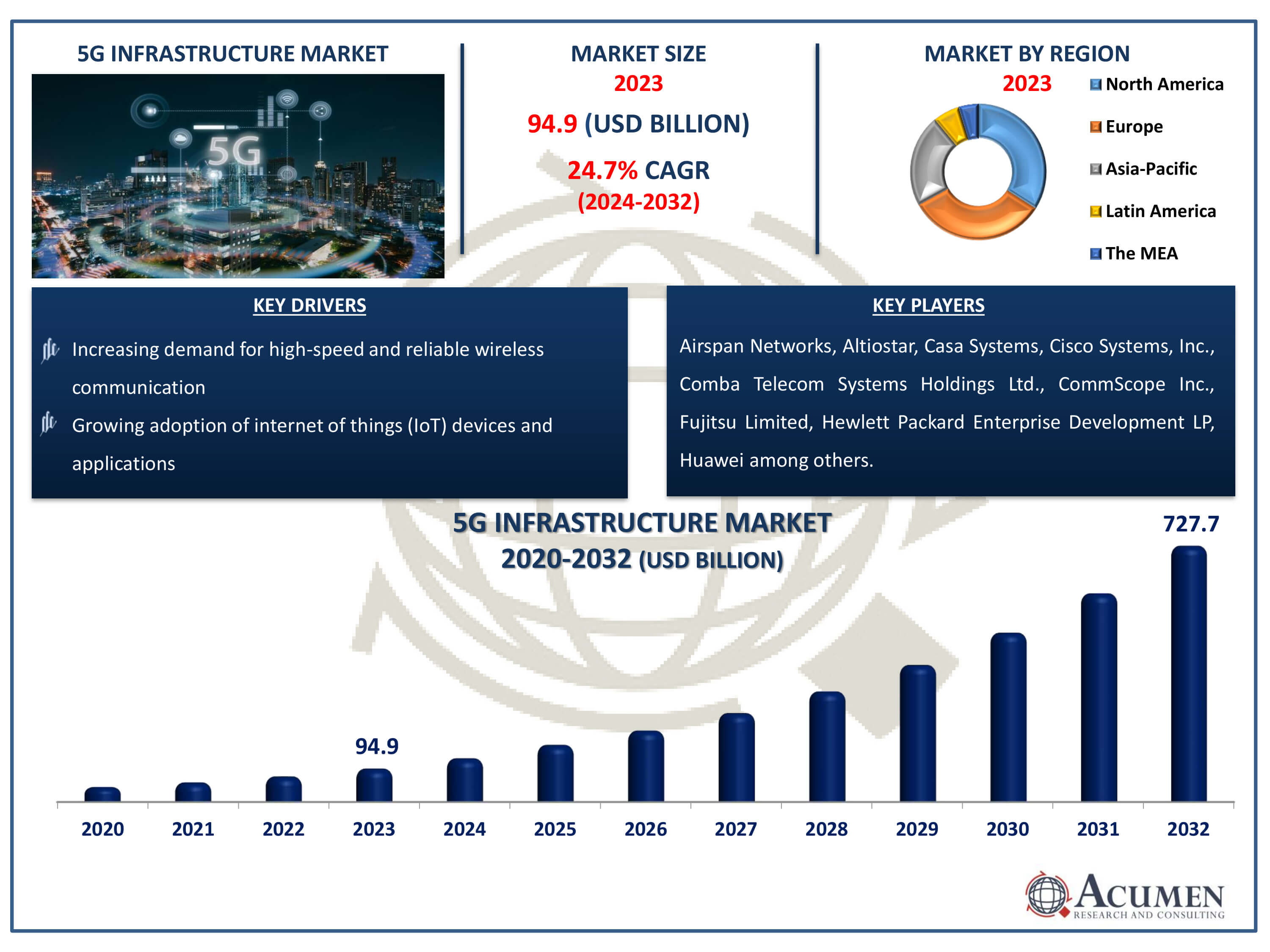

The 5G Infrastructure Market Size accounted for USD 94.9 Billion in 2023 and is estimated to achieve a market size of USD 727.7 Billion by 2032 growing at a CAGR of 24.7% from 2024 to 2032.

5G Infrastructure Market Highlights

- Global 5G Infrastructure market revenue is poised to garner USD 727.7 Billion by 2032 with a CAGR of 24.7% from 2024 to 2032

- As per 5G Americas statistics, global 5G connections reached 1.6 billion by Q3 2023 growing at rapid pace of 71% annually

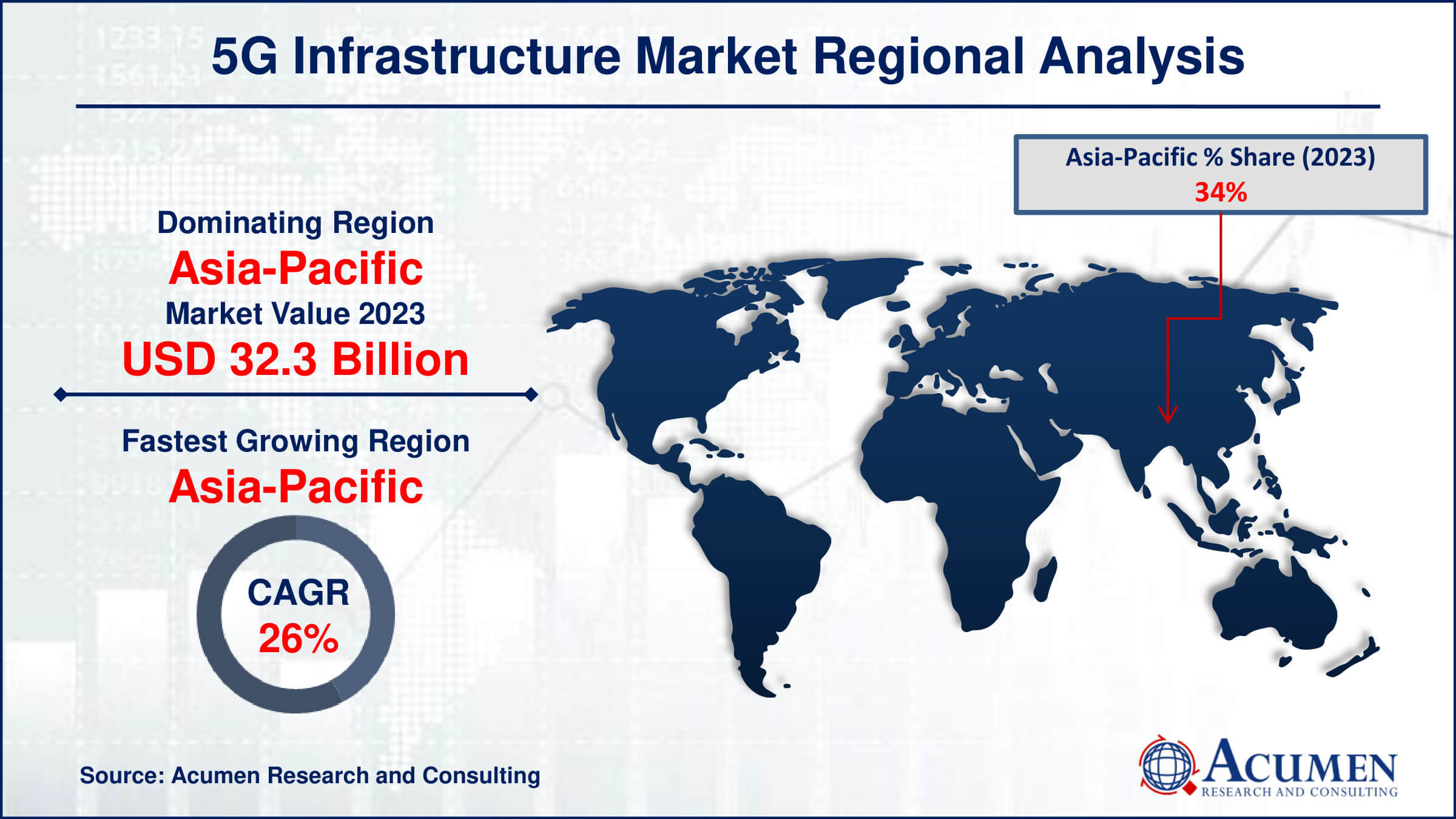

- Asia-Pacific 5G infrastructure market value occupied around USD 32.8 billion in 2023

- Asia-Pacific 5G infrastructure market growth will record a CAGR of more than 26% from 2024 to 2032

- Among component, the hardware sub-segment generated over USD 72 billion revenue in 2023

- Based on vertical, the enterprise/corporate sub-segment occupied around 20% market share in 2023

- Increasing deployment of private 5G networks is a popular 5G infrastructure market trend that fuels the industry demand

5G infrastructure represents the most recent generation of cellular network technology, with significantly higher speed, capacity, and reliability than its predecessors. This advanced infrastructure provides high-speed wireless connectivity through a combination of new technologies such as millimeter-wave spectrum, massive MIMO (Multiple Input Multiple Output) antennas, and small cell networks. 5G networks, which can reach speeds of up to 10 gigabits per second (Gbps), have the potential to revolutionize a variety of industries, including telecommunications, healthcare, automotive, and manufacturing. The deployment of 5G infrastructure includes the installation of new base stations and antennas, as well as the optimization of existing network infrastructure to meet the increased data traffic and connectivity demands of modern digital applications.

One of the most important features of 5G infrastructure is its low latency, which refers to the time it takes for data to travel between devices and servers. With latency as low as one millisecond, 5G networks enable real-time communication and responsiveness, making them ideal for applications requiring immediate feedback, such as autonomous vehicles, remote surgery, and industrial automation. Furthermore, 5G infrastructure enables a massive increase in the number of connected devices, allowing the Internet of Things (IoT) to realize its full potential. This connectivity ecosystem allows for the seamless integration of smart devices, sensors, and actuators, resulting in the development of smart cities, smart homes, and intelligent transportation systems.

Global 5G Infrastructure Market Dynamics

Market Drivers

- Increasing demand for high-speed and reliable wireless communication

- Growing adoption of internet of things (IoT) devices and applications

- Expansion of digital transformation initiatives across various industries

- Rising investments in 5G infrastructure development by governments and telecom operators

Market Restraints

- High initial deployment costs and infrastructure investments

- Spectrum allocation challenges and regulatory constraints

- Security and privacy concerns related to 5G network vulnerabilities

Market Opportunities

- Emergence of new use cases and applications enabled by 5G technology

- Development of innovative business models and revenue streams for telecom operators

- Integration of 5G with emerging technologies like edge computing and artificial intelligence for enhanced capabilities

5G Infrastructure Market Report Coverage

| Market | 5G Infrastructure Market |

| 5G Infrastructure Market Size 2022 | USD 94.9 Billion |

| 5G Infrastructure Market Forecast 2032 |

USD 727.7 Billion |

| 5G Infrastructure Market CAGR During 2024 - 2032 | 24.7% |

| 5G Infrastructure Market Analysis Period | 2020 - 2032 |

| 5G Infrastructure Market Base Year |

2022 |

| 5G Infrastructure Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Component, By Type, By Spectrum, By Network Architecture, By Vertical, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Airspan Networks, Altiostar, Casa Systems, Cisco Systems, Inc., Comba Telecom Systems Holdings Ltd., CommScope Inc., Fujitsu Limited, Hewlett Packard Enterprise Development LP, Huawei Technologies Co., Ltd., Mavenir, NEC Corporation, Nokia Corporation, Samsung Electronics Co., Ltd., Telefonaktiebolaget LM Ericsson, and ZTE Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

5G Infrastructure Market Insights

The global market for 5G infrastructure is witnessing significant growth, driven by several key factors. Firstly, there's a rising demand for enhanced communication systems across various industries, spurred by the need for faster and more reliable connectivity. This demand is particularly pronounced in developing countries undergoing rapid digitalization, where investments in telecommunications infrastructure are high. For instance in March 2023, AT&T revealed plans to enhance its 5G and fiber network, aiming to provide better connectivity to communities, whether urban or rural, across the globe. With a mission-critical approach, the company has invested over US$140 billion in the past five years to strengthen network resilience. Moreover, governments worldwide are allocating substantial funds to develop their telecommunications sectors, further propelling market growth. Additionally, collaborative efforts between governments and private players to develop smart cities are driving demand for advanced communication technologies.

However, the market is not without its challenges. The lack of standardization of spectrum and the high cost of deployment pose significant hurdles to market expansion. Design and coverage-related challenges also limit the growth potential of the 5G infrastructure market. Overcoming these obstacles will be crucial for unlocking the full potential of 5G technology and ensuring widespread adoption.

Despite these challenges, the market presents numerous opportunities for growth. Major players are investing heavily in technological advancements to improve infrastructure and enhance service offerings. The U.S. National Science Foundation (NSF), specifically its Directorate for Technology, Innovation, and Partnerships (TIP), is addressing challenges related to 5G communication infrastructure and operations. To do this, they are investing $25 million to support the progress of five convergent teams from Phase 1 to Phase 2 of the NSF Convergence Accelerator Track G program. The program, titled "Securely Operating Through 5G Infrastructure," aims to advance research and innovation in the secure operation of 5G networks. By supporting these teams through the different phases of the program, the NSF aims to foster collaboration and accelerate the development of solutions to enhance the security and efficiency of 5G infrastructure.

The rising adoption of IoT devices is also creating new opportunities for players in the 5G infrastructure market. The 5G IoT market was valued at USD 3.7 billion in 2022 and is forecasted to reach USD 643.4 billion by 2032, exhibiting a remarkable CAGR of 67.8% from 2023 to 2032. In recent years, the 5G IoT market has grown dramatically, driven by widespread adoption of IoT devices across a wide range of industries. The increase in demand for high-speed, low-latency connectivity, combined with advances in IoT technology, has been a major driver. Manufacturing, healthcare, transportation, and agriculture are using 5G IoT to streamline operations, increase efficiency, and improve customer experiences. Furthermore, the ongoing global development of 5G infrastructure, aided by government support and investments from telecommunications behemoths, has significantly contributed to the rapid growth of the 5G IoT market.

Furthermore, increasing partnerships and agreements between regional and international players are expected to drive revenue growth and foster innovation in the market. For example, on July 25, 2023, Intel and Ericsson entered into a strategic collaboration pact. The aim is to leverage Intel's cutting-edge 18A process and manufacturing technology for Ericsson's upcoming next-generation optimized 5G infrastructure. Under this agreement, Intel will produce customized 5G System-on-Chips (SoCs) for Ericsson, paving the way for the development of highly distinctive and pioneering products for future 5G infrastructure solutions. Additionally, on April 26, 2024, India and El Salvador initiated a collaborative effort aimed at advancing 5G telecommunications and infrastructure development.

5G Infrastructure Market Segmentation

The worldwide market for 5G infrastructure is split based on component, type, spectrum, network architecture, vertical, and geography.

5G Infrastructure Market By Component

- Hardware

- Radio Access Network (RAN)

- Core Network

- Backhaul & Transport

- FrontHaul

- MidHaul

- Services

- Consulting

- Implementation & Integration

- Support & Maintenance

- Training & Education

According to the 5G infrastructure industry analysis, the hardware component, specifically the radio access network (RAN), dominated the 5G infrastructure market due to its critical role in enabling 5G network deployment and operation. RAN is critical for connecting end-user devices to the core network, enabling high-speed data transfer, and ensuring low-latency communication, all of which are key characteristics of 5G technology. The widespread demand for new base stations, antennas, and other RAN-related hardware to support 5G's dense network architecture contributed significantly to its dominance. Furthermore, telecom operators' significant investments in RAN infrastructure to improve coverage and capacity strengthened their market leadership.

5G Infrastructure Market By Type

- Pubic

- Private

As per the 5G infrastructure market forecast, the public type is expected to achieve significant traction throughout 2024 to 2032. This growth is ascribed due to widespread adoption and deployment by major telecom operators with the goal of providing extensive network coverage and high-speed connectivity to the general population. Public 5G networks are critical for delivering consumer mobile services, enabling smart city applications, and improving connectivity across industries. Governments and private telecom companies have made significant investments to build and expand public 5G networks, which has contributed to this dominance. Furthermore, the public 5G infrastructure is critical for meeting the growing demand for mobile data and enabling the proliferation of IoT devices, cementing the company's market leadership.

5G Infrastructure Market By Spectrum

- Sub-6 GHz

- Low Band

- Mid Band

- mmWave

In the 5G infrastructure market, the Sub-6 GHz spectrum, particularly the Mid Band, dominated due to its balanced coverage and capacity. The Mid Band spectrum strikes a good balance between the broad range of low band frequencies and the high-speed capabilities of millimeter wave (mmWave) frequencies. This makes it ideal for delivering widespread 5G services that require both reasonable coverage and significant bandwidth, which are critical in urban and suburban areas. As a result, telecom operators have made significant investments in Mid Band spectrum for their 5G networks to ensure reliable and efficient service delivery across multiple regions.

5G Infrastructure Market By Network Architecture

- Standalone

- Non-Standalone

In the 5G infrastructure market, the non-standalone (NSA) network architecture was dominant. This dominance stems primarily from NSA, which enables telecom operators to leverage their existing 4G LTE infrastructure, resulting in a more cost-effective and faster deployment of 5G services. NSA architecture enables operators to provide enhanced mobile broadband services and meet initial 5G demand without the need for a completely new network buildout. This approach allows for a smoother and faster transition to 5G, making it the preferred option for many operators during the early stages of 5G deployment.

5G Infrastructure Market By Vertical

- Residential

- Enterprise/Corporate

- Smart City

- Industrial

- Energy & Utility

- Transportation & Logistics

- Public Safety and Defense

- Healthcare Facilities

- Retail

- Agriculture

- Others

In the 5G infrastructure market, the enterprise/corporate vertical was dominant. This sector's leadership is driven by the significant demand for 5G's enhanced connectivity, low latency, and high-speed data transfer. Enterprises and corporations are using 5G technology to support digital transformation initiatives, improve operational efficiency, enable advanced applications like IoT and AI, and maintain a competitive edge. The enterprise/corporate sector has become a major adopter and driver of 5G infrastructure deployment due to the demand for dependable and high-performance connectivity in activities such as remote work, virtual collaboration, and data-intensive processes.

5G Infrastructure Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

5G Infrastructure Market Regional Analysis

North America is expected to dominate the 5G infrastructure market in terms of revenue, owing to significant government investment in the development of advanced and secure communication networks. The region's governments are actively promoting the creation of smart cities, which rely heavily on reliable 5G infrastructure to support a wide range of applications ranging from traffic management to public safety. The emphasis on providing enhanced solutions such as Radio Access Networks (RAN) and core networks is bolstered by public-private partnerships aimed at speeding up the deployment of 5G technology.

The region's commitment to innovation, along with regulatory support and significant funding for research and development, ensures a conducive environment for the rapid expansion and adoption of 5G infrastructure. According to 5G Americas statistics, North American 5G growth is not slowing down, with 176 million total connections and a 47% penetration rate in Q3 2023. This reflects a 14% increase in the last quarter alone, with 22 million new connections. This strong growth trajectory demonstrates the region's dynamic 5G landscape and readiness to lead the next generation of telecommunications.

5G Infrastructure Market Players

Some of the top 5G infrastructure companies offered in our report includes Airspan Networks, Altiostar, Casa Systems, Cisco Systems, Inc., Comba Telecom Systems Holdings Ltd., CommScope Inc., Fujitsu Limited, Hewlett Packard Enterprise Development LP, Huawei Technologies Co., Ltd., Mavenir, NEC Corporation, Nokia Corporation, Samsung Electronics Co., Ltd., Telefonaktiebolaget LM Ericsson, and ZTE Corporation.

Frequently Asked Questions

How big is the 5G infrastructure market?

The 5G infrastructure market size was valued at USD 94.9 billion in 2023.

What is the CAGR of the global 5G infrastructure market from 2024 to 2032?

The CAGR of 5G infrastructure industry is 24.7% during the analysis period of 2024 to 2032.

Which are the key players in the 5G infrastructure market?

The key players operating in the global market are including Airspan Networks, Altiostar, Casa Systems, Cisco Systems, Inc., Comba Telecom Systems Holdings Ltd., CommScope Inc., Fujitsu Limited, Hewlett Packard Enterprise Development LP, Huawei Technologies Co., Ltd., Mavenir, NEC Corporation, Nokia Corporation, Samsung Electronics Co., Ltd., Telefonaktiebolaget LM Ericsson, and ZTE Corporation.

Which region dominated the global 5G infrastructure market share?

North America held the dominating position in 5G infrastructure industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of 5G infrastructure during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global 5G infrastructure industry?

The current trends and dynamics in the 5G infrastructure industries include increasing demand for high-speed and reliable wireless communication, growing adoption of internet of things (IoT) devices and applications, and expansion of digital transformation initiatives across various industries

Which component held the maximum share in 2023?

The hardware component held the maximum share of the 5G infrastructure industry.