Silicon Carbide Ceramics Market | Acumen Research and Consulting

Silicon Carbide Ceramics Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

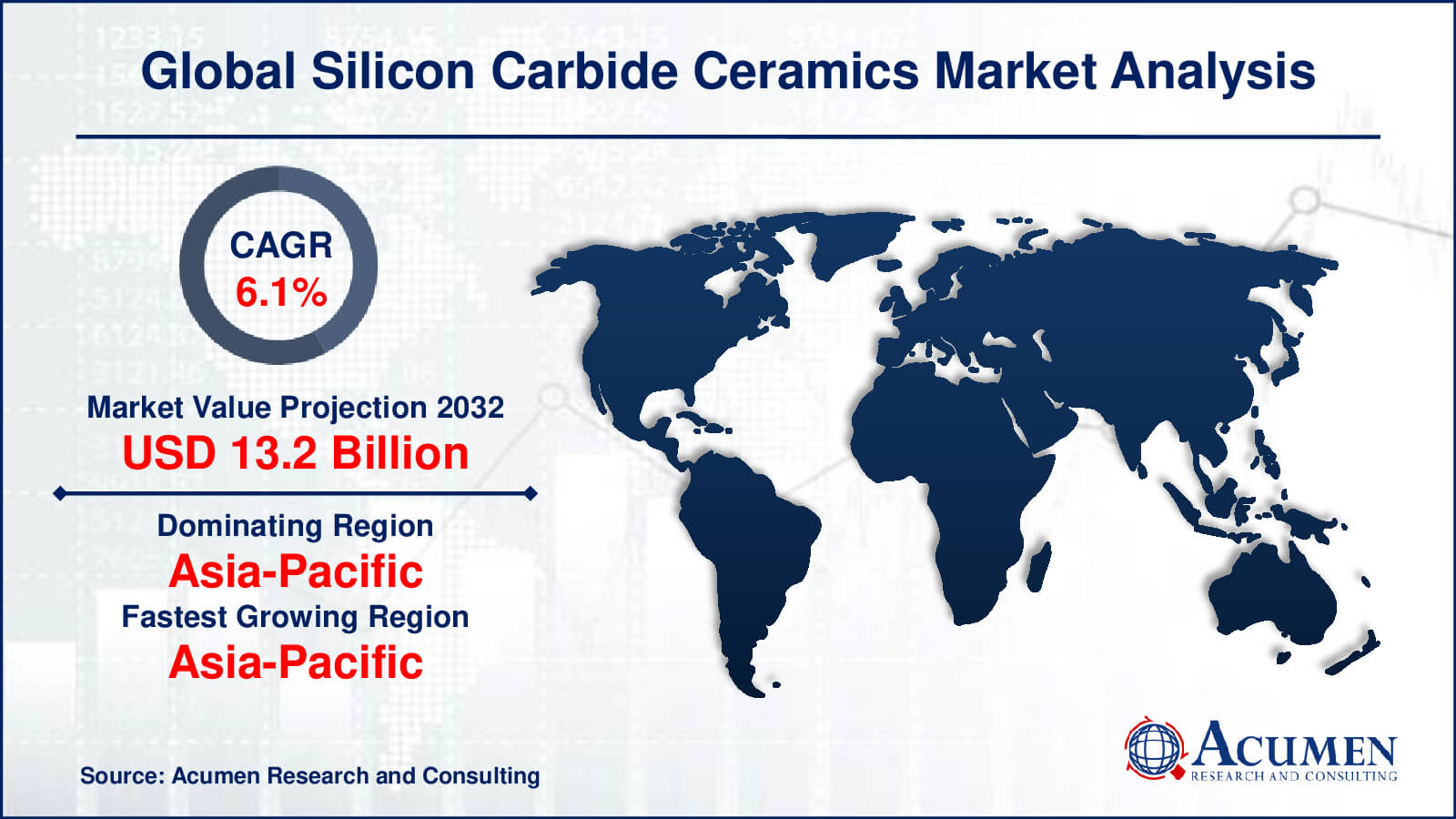

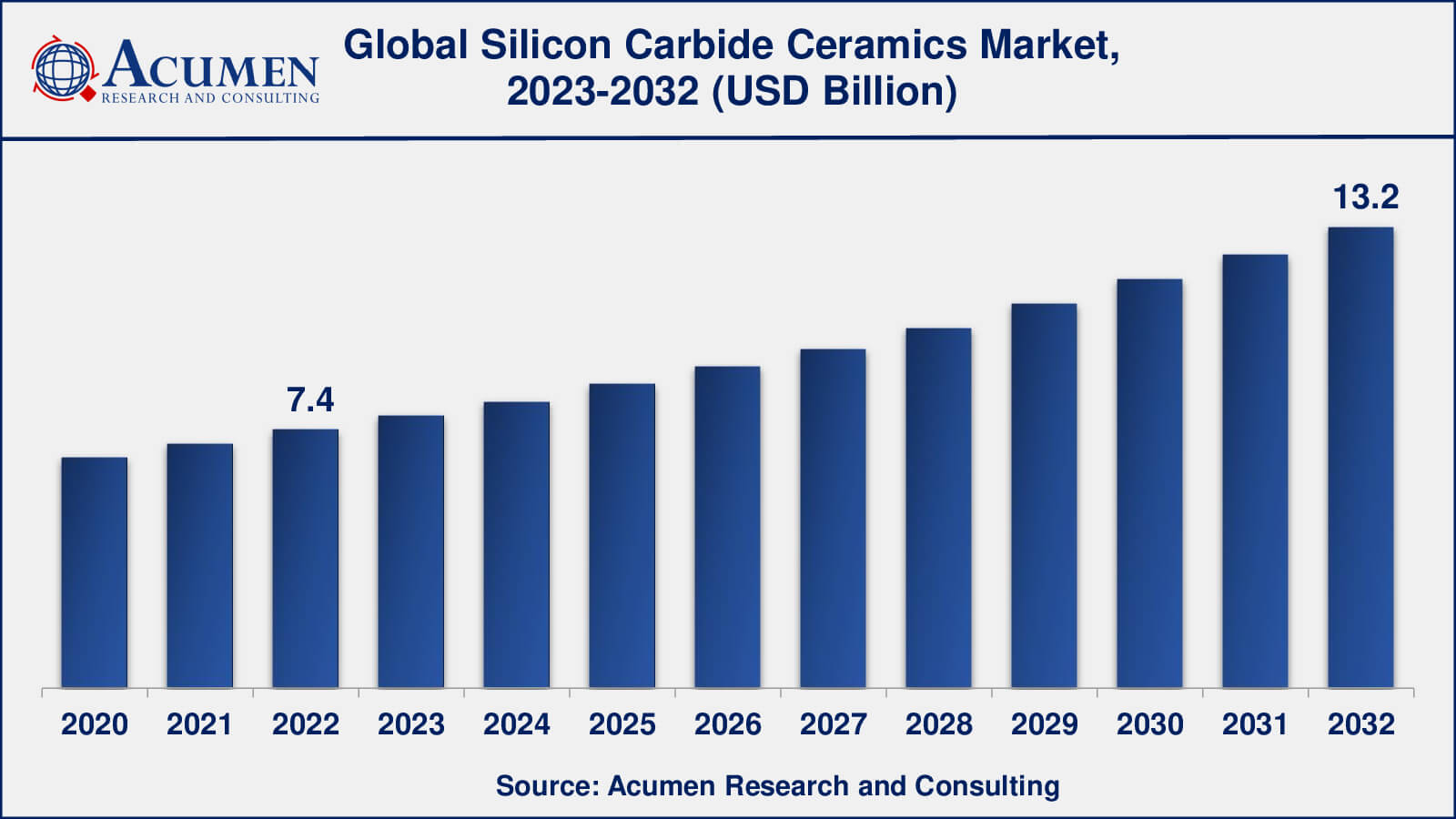

The Global Silicon Carbide Ceramics Market Size accounted for USD 7.4 Billion in 2022 and is estimated to achieve a market size of USD 13.2 Billion by 2032 growing at a CAGR of 6.1% from 2023 to 2032.

Silicon Carbide Ceramics Market Highlights

- Global silicon carbide ceramics market revenue is poised to garner USD 13.2 billion by 2032 with a CAGR of 6.1% from 2023 to 2032

- Asia-Pacific silicon carbide ceramics market value occupied almost USD 2.6 billion in 2022

- Asia-Pacific silicon carbide ceramics market growth will record a CAGR of over 7% from 2023 to 2032

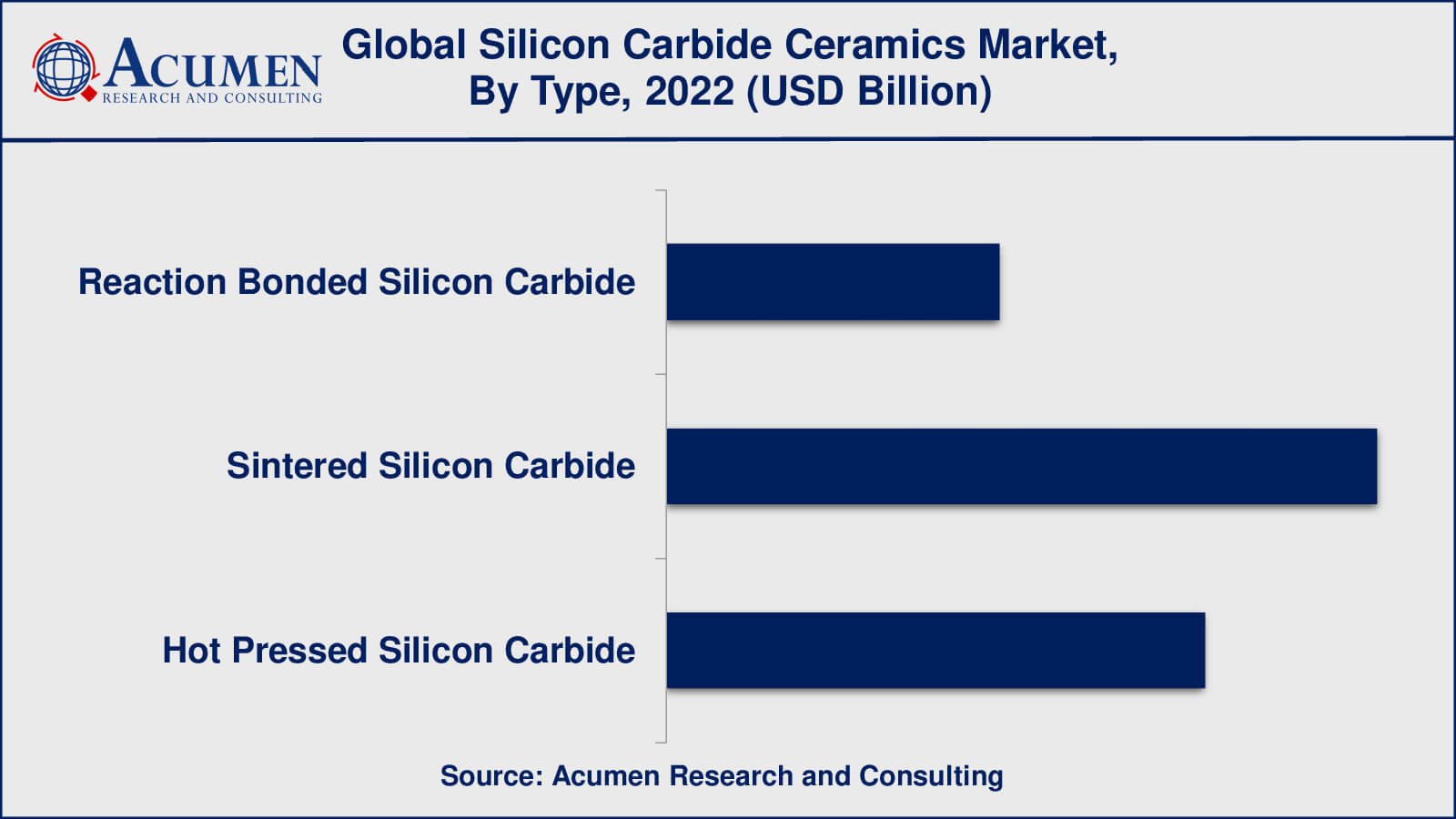

- Among type, the sintered silicon carbide (SSC) sub-segment generated over US$ 3.3 billion revenue in 2022

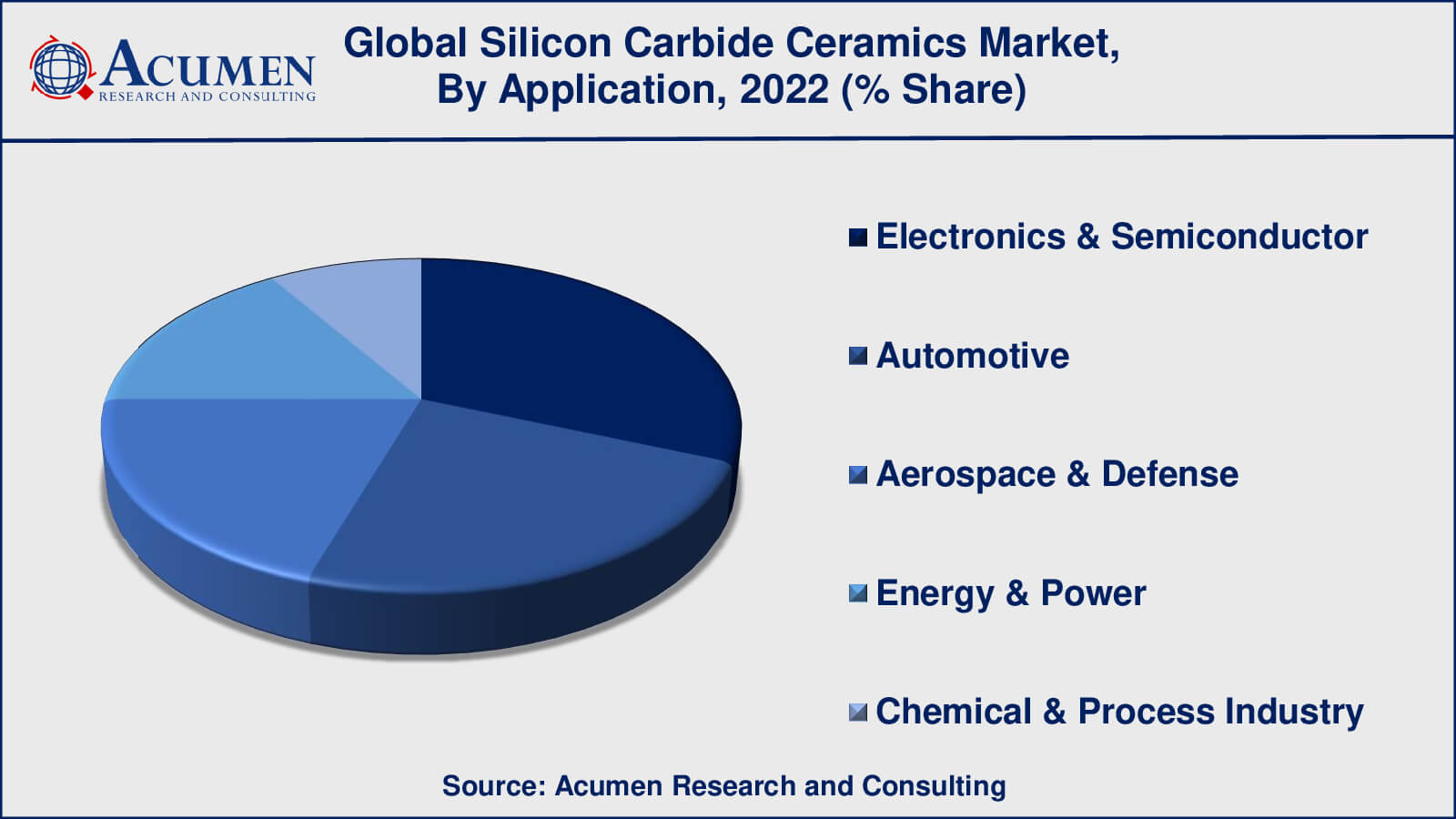

- Based on application, the electronics & semiconductor sub-segment generated around 36% share in 2022

- Growing research and development activities is a popular silicon carbide ceramics market trend that fuels the industry demand

Silicon carbide is a corrosion-resistant ceramic used in mechanical seals and pump parts. It is a powder or grain-form element, produced from the carbon reduction of silica. Silicon carbide is manufactured as either fine powder or a large bonded mass, which is crushed for further processes. Silicon carbide maintains its strength even at temperatures up to 1400°C. Due to its better corrosion resistance property, it is used in bushings, nozzles, sealing rings, friction bearings, and special components. The silicon carbide group deals with process developments and materials in reaction-bonded and re-crystallized ceramics, oxide-bonded silicon carbide, ceramics with controlled porosity, sintered ceramics (pressure-less, pressure sintered), and carbides from organic precursors.

Global Silicon Carbide Ceramics Market Dynamics

Market Drivers

- Increasing demand for high-performance materials

- Growing adoption in power electronics

- Need for lightweight and durable materials

Market Restraints

- High production cost

- Limited availability of raw materials

Market Opportunities

- Increasing demand for electric vehicles

- Emerging applications in 5G technology

- Increasing focus on sustainability

- Advancements in manufacturing technologies

Silicon Carbide Ceramics Market Report Coverage

| Market | Silicon Carbide Ceramics Market |

| Silicon Carbide Ceramics Market Size 2022 | USD 7.4 Billion |

| Silicon Carbide Ceramics Market Forecast 2032 | USD 13.2 Billion |

| Silicon Carbide Ceramics Market CAGR During 2023 - 2032 | 6.1% |

| Silicon Carbide Ceramics Market Analysis Period | 2020 - 2032 |

| Silicon Carbide Ceramics Market Base Year | 2022 |

| Silicon Carbide Ceramics Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Saint Gobain, 3M Company, Ceramtec, IBIDEN Co., Ltd., Kyocera, Schunk Ingenieurkeramik, Kyocera Corporation, CoorsTek Inc., Morgan Advanced Materials plc, CeramTec GmbH, DowDuPont Inc., and Carborundum Universal Limited. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Silicon Carbide Ceramics Market Insights

The silicon carbide ceramics market is primarily driven by its properties such as high thermal conductivity and electrical semi-conductivity. The demand for silicon carbide ceramics has increased owing to its outstanding thermal shock resistance and intensive hardness characteristics. The refractive index of silicon carbide ceramics is greater than that of a diamond; this factor is anticipated to boost the demand for silicon carbide ceramics in machining components. However, the higher cost of silicon carbide ceramics as compared to metals and alloys is restraining the silicon carbide ceramics market growth.

Silicon Carbide Ceramics Market, By Segmentation

The worldwide market for silicon carbide ceramics is split based on type, application, and geography.

Silicon Carbide Ceramics Types

- Reaction Bonded Silicon Carbide (RBSC)

- Sintered Silicon Carbide (SSC)

- Hot Pressed Silicon Carbide (HPSC)

According to our silicon carbide ceramics industry research, sintered silicon carbide is expected to dominate the market in 2022. Because of its excellent mechanical properties, high thermal conductivity, and superior wear resistance, sintered silicon carbide (SSC) is a popular product type. It is made by sintering silicon carbide powder at high temperatures, resulting in a dense and long-lasting ceramic material with high strength and excellent electrical as well as thermal properties. SSC is commonly used in industries such as automotive, aerospace, energy, and electronics for cutting tools, wear parts, seals, and bearings.

Other product types, such as reaction bonded silicon carbide (RBSC) and hot pressed silicon carbide (HPSC), have their own distinct advantages and applications in specific industries. RBSC, for example, is known for its high thermal shock resistance and is used in applications requiring rapid temperature changes, such as kiln furniture and burner nozzles. In contrast, HPSC is known for its high density and outstanding mechanical characteristics, making it suitable for demanding applications such as ballistic armour and cutting tools.

Silicon Carbide Ceramics Applications

- Electronics & Semiconductor

- Automotive

- Aerospace & Defense

- Energy & Power

- Chemical & Process Industry

The electronics & semiconductor application is expected to dominate the silicon carbide ceramics market, according to the silicon carbide ceramics market forecast. Silicon carbide ceramics have outstanding properties such as high thermal conductivity, superior electrical properties, and high temperature stability, making them ideal for a wide range of electronics and semiconductor applications.

Silicon carbide ceramics are used to make power electronic devices like diodes, MOSFETs (Metal-Oxide-Semiconductor Field-Effect Transistors), and other high-voltage, high-temperature, and high-frequency devices. These ceramics are also used in semiconductor components such as substrates, heat sinks, and wafer handling fixtures. Electric vehicles (EVs), renewable energy systems, and high-power electronics are driving demand for silicon carbide ceramics in the Electronics & Semiconductor application.

Silicon Carbide Ceramics Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Silicon Carbide Ceramics Market Regional Analysis

North America is expected to be a significant market for silicon carbide ceramics, owing to increased demand for advanced ceramics in industries such as automotive, aerospace, electronics, and energy. The region has a well-established industrial base and serves as a hub for technological innovations and advancements, which drives demand for silicon carbide ceramics. Furthermore, the growing emphasis on energy efficiency, renewable energy, and electric vehicles is driving up demand for silicon carbide ceramics in North America.

The Asia-Pacific market for silicon carbide ceramics is expected to be the largest and fastest-growing. The area is a major manufacturing centre for a variety of industries, including automotive, electronics, aerospace, and energy. Rapid industrialization, urbanization, and infrastructure development in countries such as China, Japan, South Korea, and India are driving demand for silicon carbide ceramics in the region. Furthermore, the growing emphasis on electric vehicles, renewable energy, and high-performance electronics is driving up demand for silicon carbide ceramics in Asia-Pacific.

Silicon Carbide Ceramics Market Players

Some of the top silicon carbide ceramics companies offered in the professional report Saint Gobain, 3M Company, Ceramtec, IBIDEN Co., Ltd., Kyocera, Schunk Ingenieurkeramik, Kyocera Corporation, CoorsTek Inc., Morgan Advanced Materials plc, CeramTec GmbH, DowDuPont Inc., and Carborundum Universal Limited.

Frequently Asked Questions

What was the market size of the global silicon carbide ceramics in 2022?

The market size of silicon carbide ceramics was USD 7.4 billion in 2022.

What is the CAGR of the global silicon carbide ceramics market from 2023 to 2032?

The CAGR of silicon carbide ceramics is 6.1% during the analysis period of 2023 to 2032.

Which are the key players in the silicon carbide ceramics market?

The key players operating in the global silicon carbide ceramics market is includes Saint Gobain, 3M Company, Ceramtec, IBIDEN Co., Ltd., Kyocera, Schunk Ingenieurkeramik, Kyocera Corporation, CoorsTek Inc., Morgan Advanced Materials plc, CeramTec GmbH, DowDuPont Inc., and Carborundum Universal Limited.

Which region dominated the global silicon carbide ceramics market share?

North America held the dominating position in silicon carbide ceramics industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of silicon carbide ceramics during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global silicon carbide ceramics industry?

The current trends and dynamics in the silicon carbide ceramics industry include increasing demand for high-performance materials, growing adoption in power electronics, and need for lightweight and durable materials.

Which type held the maximum share in 2022?

The sintered silicon carbide (SSC) types held the maximum share of the silicon carbide ceramics industry.