Personalized Medicine Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

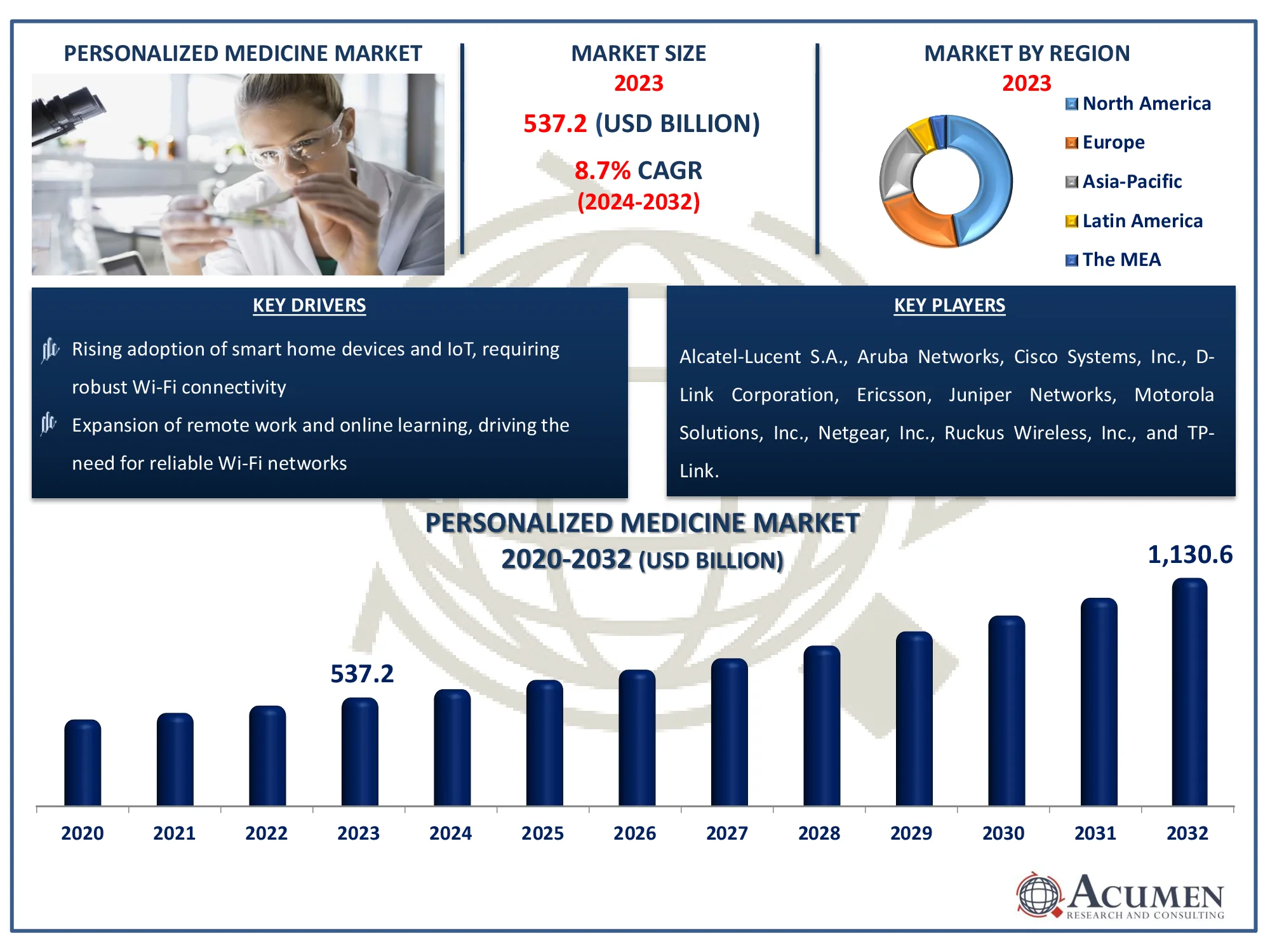

The Global Personalized Medicine Market Size accounted for USD 537.2 Billion in 2022 and is estimated to achieve a market size of USD 1,130.6 Billion by 2032 growing at a CAGR of 8.7% from 2024 to 2032.

Personalized Medicine Market Highlights

- Global personalized medicine market revenue is poised to garner USD 1,130.6 billion by 2032 with a CAGR of 8.7% from 2024 to 2032

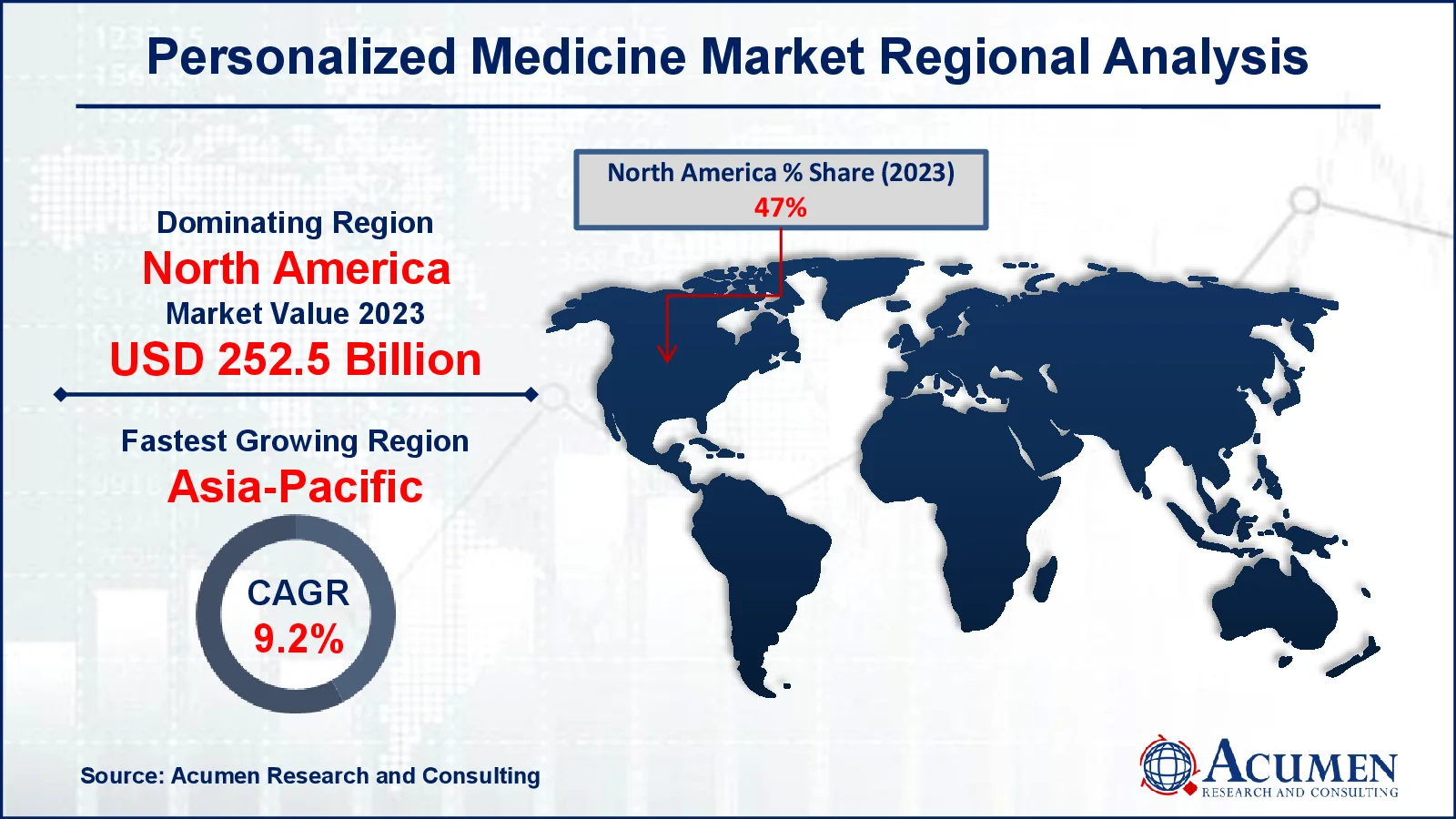

- North America personalized medicine market value occupied around USD 252.5 billion in 2022

- Asia-Pacific personalized medicine market growth will record a CAGR of more than 9.2% from 2024 to 2032

- Among application, the oncology sub-segment generated more than USD 220.2 billion revenue in 2022

- Based on end-use, the hospitals sub-segment generated around 39% market share in 2022

- Collaboration between pharmaceutical companies and diagnostic firms accelerates product development is a popular personalized medicine market trend that fuels the industry demand

Personalized medicines are medicines that are based on individual patients or planned patient groups with certain biomarkers and are designed to meet the patient's needs depending on the patient's reaction to a specific disease. Personalized medications presently concentrate on their efficacy in rare genetic diseases and cancer patients. The ability to end the one-sized strategy contributes to anticipation of greater therapy efficiency by customizing prevention, prediction, and therapy. The EU invested EUR 1 million in this respect as of 2015, through its seventh framework program for research and technological innovation, centered on the growth of personalized medicine. The EU is also known to coordinate Health Technology Assessment with its Member States to gain a better understanding of the cost-effectiveness of incorporating personalized medications into their respective health systems. Building dialogue between worldwide parties involved could simplify procedures and laws for clinical trials over the next few years.

Global Personalized Medicine Market Dynamics

Market Drivers

- Rising prevalence of chronic diseases necessitates tailored therapeutic approaches

- Increasing demand for targeted therapies fosters personalized medicine development

- Growing adoption of companion diagnostics enhances treatment efficacy and safety

- Government initiatives to support personalized medicine research propel innovation and investment

Market Restraints

- High costs associated with personalized treatments limit accessibility

- Limited reimbursement policies hinder widespread adoption of personalized medicine

- Ethical and privacy concerns regarding genetic data usage pose regulatory challenges

Market Opportunities

- Expansion of precision medicine initiatives globally drives market growth

- Integration of artificial intelligence in personalized medicine enhances treatment decision-making

- Development of innovative biomarkers for disease diagnosis enables more accurate patient stratification

Personalized Medicine Market Report Coverage

| Market | Personalized Medicine Market |

| Personalized Medicine Market Size 2022 |

USD 537.2 Billion |

| Personalized Medicine Market Forecast 2032 | USD 1,130.6 Billion |

| Personalized Medicine Market CAGR During 2023 - 2032 | 8.7% |

| Personalized Medicine Market Analysis Period | 2020 - 2032 |

| Personalized Medicine Market Base Year |

2022 |

| Personalized Medicine Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Application, By End-use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Abbott, ASURAGEN, INC., Cepheid, Inc. (Danaher Corporation), Dako A/S, Decode Genetics, Inc., Exact Sciences Corporation, Exagen Inc., GE Healthcare, Illumina, Inc., and QIAGEN. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Personalized Medicine Market Insights

Personalized medical markets are anticipated to grow rapidly due to the increased incidence of disease and a strong focus on developing treatments for cancer patients with greater efficacy than other therapies. Quick results and customized effects, along with reduced probabilities of medicinal defects and adverse reactions to drugs, are additional factors that could drive R&D and the adoption of these treatments. Governments will also have increased opportunities to support this market in favor of personalized medicine. Recent advances in pharmacogenomics should create the ideal environment for patient-specific or group-specific medications. The development of genetic databases could further boost the market. However, some constraints that could hinder the revenue growth of the personalized medicine market in the coming years include the complex nature of these drugs, high development costs, a suboptimal development infrastructure, and variability in intermediate effects.

Personalized medicine promises to change the paradigm of diagnosis and therapy because therapy is based on information obtained from an individual patient's overall viewpoint. The decrease in sequencing costs and the growth of the Human Genome Project are anticipated to drive the market in sequencing methodologies, particularly in Next Generation Sequencing (NGS). NGS technology provides information on patient genetic composition and drug reactions, thus promoting the creation of precise disease treatment medications. In addition, NGS, together with companion diagnostics (CDx), will play an important role in advancing customer-friendly diagnostics and therapeutics in the coming years. New CDx and biomarkers have compelled businesses to enhance their precision portfolios for non-oncological therapeutic applications, with a focus on infectious and cardiovascular disorders.

This provides a powerful incentive to scale CDx trials into personalized medicine for non-oncology cases. One of the main factors driving industry development is the increased incidence of cancer, which stimulates demand for personalized cancer diagnostics and therapies. The worldwide burden of cancer has grown to 18.1 million new cases in 2018, according to GLOBOCAN 2018 data. Increasing expenditure on cancer treatment is also driving development. Key businesses in the personalized medicine market are participating in numerous precision medicine investment programs. As a result, major pharmaceutical companies have increased their commitment to this industry. Additionally, molecular decision support systems are combining genomics with clinical information to minimize gaps in the practice of precision medicine.

Personalized Medicine Market Segmentation

The worldwide market for personalized medicine is split based on product, application, end-use, and geography.

Personalized Medicine Products

- Personalized Medicine Therapeutics

- Pharmaceutical

- Genomic Medicine

- Medical Devices

- Personalized Medicine Diagnostics

- Genetic Testing

- Direct-To-Consumer (DTC) Diagnostics

- Esoteric Lab Services

- Esoteric Lab Tests

- Personalized Nutrition & Wellness

- Retail Nutrition

- Complementary & Alternative Medicine

- Personalized Medical Care

- Telemedicine

- Health Information Technology

According to personalized medicine industry analysis, the biggest product segment in 2023 was personalized nutrition & wellness. Over-the-counter (OTC) sales of these products are an important factor in boosting segment development, alongside a broad variety of nutrition & wellness goods and enhanced sales. Companies undertake several market competition sustainability projects. For example, by combining artificial intelligence (AI) technology, DSM partnered with Mixfit in March 2018 to provide personalized nutrient alternatives. The objective of this strategic partnership was to offer a personalized approach to nutrition for customers. Personalized medicine (PM) therapy involves medicinal products for individual therapy, genomics, and medical devices, and is expected to demonstrate the greatest CAGR over the self-expanding stents industry forecast period. The development of high-capacity, quick sequencing platforms and the reduction in sequencing costs for entire human genomes play a significant role in the segment's growth.

Genomics has become a major component of PM therapy. Large genomic information databases allow scientists to create precise and efficient therapeutic products for various medical conditions. As a result, human genome sequencing technologies have been highly utilized in genomics.

Personalized Medicine Applications

- Oncology

- Infectious disease

- Neurology or Psychiatry

- Cardiovascular

- Others

The oncology category dominates the personalized medicine industry for a variety of reasons. Cancer therapy benefits considerably from personalized methods, since medicines customized to specific genetic profiles can dramatically enhance patient results. The rising global prevalence of cancer creates a desire for more effective and focused therapies. Advanced technologies such as Next Generation Sequencing (NGS) and companion diagnostics enable the exact identification of genetic alterations and biomarkers linked with specific malignancies, allowing for the creation of tailored medicines. Furthermore, significant investment in cancer research and the availability of financing for precision oncology programs contribute to the segment's growth. As a result, cancer is at the vanguard of the personalized medicine industry, with the potential for improved effectiveness and patient-specific treatment approaches.

Personalized Medicine End-Uses

- Hospitals

- Diagnostic Centers

- Research & Academic Institutes

- Others

The hospital sector is capturing the biggest proportion of the personalized medicine industry for a number of strong reasons. Hospitals serve as the major healthcare providers, providing a wide variety of medical services, including cutting-edge therapeutic and diagnostic techniques. Customized treatment regimens based on each patient's unique genetic profile are made possible by the integration of personalized medicine into hospital settings, improving patient outcomes and raising the standard of care. Additionally, hospitals have access to cutting-edge tools and technology like precision diagnostics and Next Generation Sequencing (NGS) that are essential for personalized therapy. Moreover, the integration of hospitals and research institutes expedites the conversion of state-of-the-art research into clinical applications. Hospitals are positioned as the primary end-users in the personalized medicine industry due to these aspects as well as their capacity to manage complicated and crucial situations.

Personalized Medicine Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Personalized Medicine Market Regional Analysis

In terms of personalized medicine market analysis, North America was led by the United States, the dominant global industry. The continuing use and supportive public policies and financing of NGS techniques and healthcare IT systems in the clinical workflow are boosting the regional market. For instance, in September 2018, three U.S. Genome Centers were granted funding of USD 28.6 million through the All of Us Research Program initiated by the National Institutes of Health (NIH). This funding supports genomic information generation by these centers from biosamples, which are a critical part of discoveries in precision medicine. However, Asia Pacific is expected to have the highest CAGR during the forecast period, as newly developed medical and diagnostic products will have lower costs for clinical trials. Additionally, increasing disposable incomes and evolving economies will further boost the market.

Personalized Medicine Market Players

Some of the top personalized medicine companies offered in our report includes Abbott, ASURAGEN, INC., Cepheid, Inc. (Danaher Corporation), Dako A/S, Decode Genetics, Inc., Exact Sciences Corporation, Exagen Inc., GE Healthcare, Illumina, Inc., and QIAGEN.

Frequently Asked Questions

How big is the personalized medicine market?

The personalized medicine market size was valued at USD 537.2 billion in 2022.

What is the CAGR of the global personalized medicine market from 2024 to 2032?

The CAGR of personalized medicine is 8.7% during the analysis period of 2024 to 2032.

Which are the key players in the personalized medicine market?

The key players operating in the global market are including Abbott, ASURAGEN, INC., Cepheid, Inc. (Danaher Corporation), Dako A/S, Decode Genetics, Inc., Exact Sciences Corporation, Exagen Inc., GE Healthcare, Illumina, Inc., and QIAGEN.

Which region dominated the global personalized medicine market share?

North America held the dominating position in personalized medicine industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of personalized medicine during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global personalized medicine industry?

The current trends and dynamics in the personalized medicine industry include rising prevalence of chronic diseases necessitates tailored therapeutic approaches, increasing demand for targeted therapies fosters personalized medicine development, growing adoption of companion diagnostics enhances treatment efficacy and safety, and government initiatives to support personalized medicine research propel innovation and investment.

Which application held the maximum share in 2022?

The oncology application held the maximum share of the personalized medicine industry.

Select Licence Type

Connect with our sales team

Why Acumen Research And Consulting

100%

Customer Satisfaction

24x7

Availability - we are always there when you need us

200+

Fortune 50 Companies trust Acumen Research and Consulting

80%

of our reports are exclusive and first in the industry

100%

more data and analysis

1000+

reports published till date