Direct To Consumer Genetic Testing Market | Acumen Research and Consulting

Direct-to-Consumer Genetic Testing Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

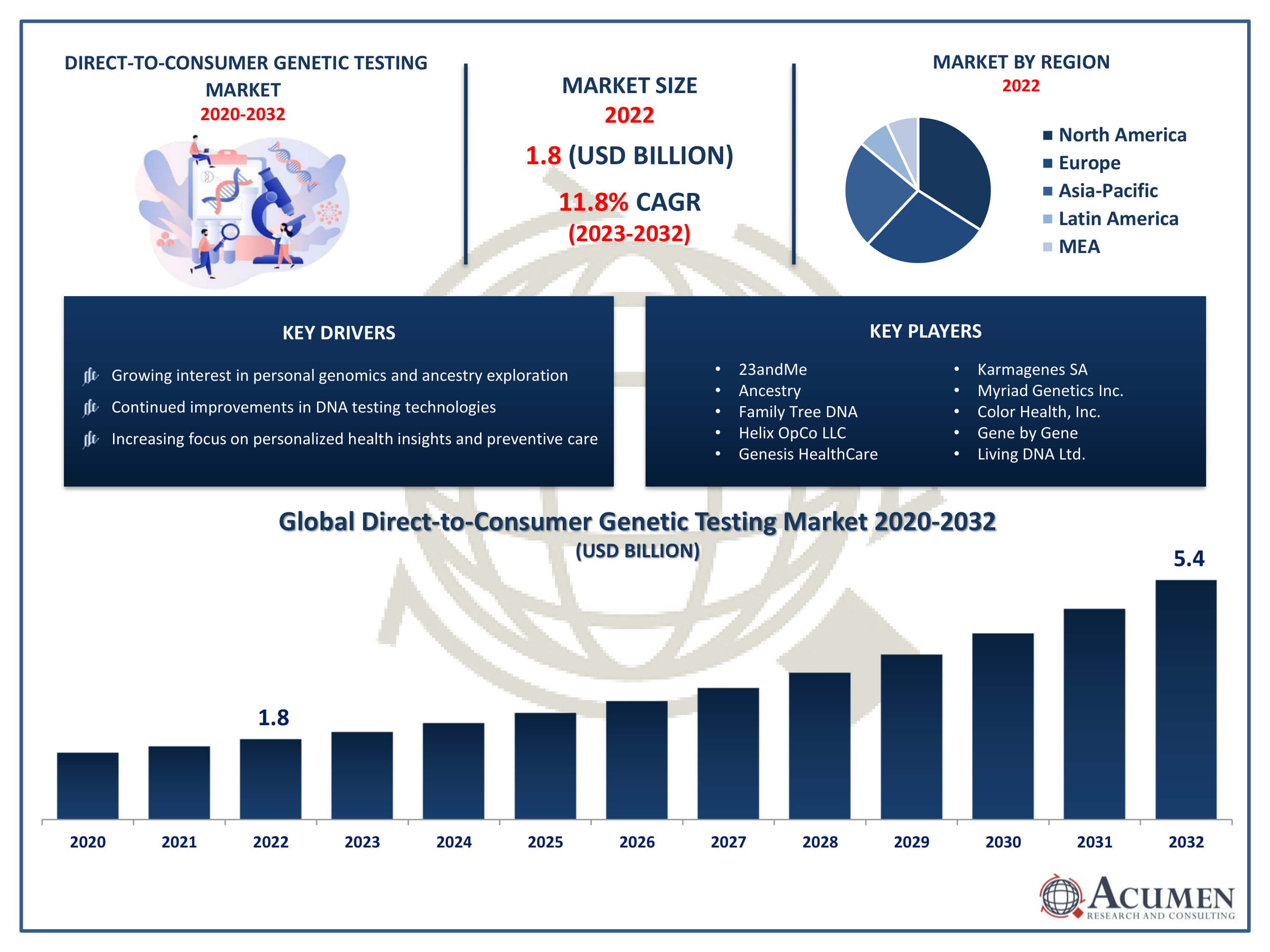

The Direct-to-Consumer Genetic Testing Market Size accounted for USD 1.8 Billion in 2022 and is projected to achieve a market size of USD 5.4 Billion by 2032 growing at a CAGR of 11.8% from 2023 to 2032.

Direct-to-Consumer Genetic Testing Market Highlights

- Global direct-to-consumer genetic testing market revenue is expected to increase by USD 5.4 billion by 2032, with a 11.8% CAGR from 2023 to 2032

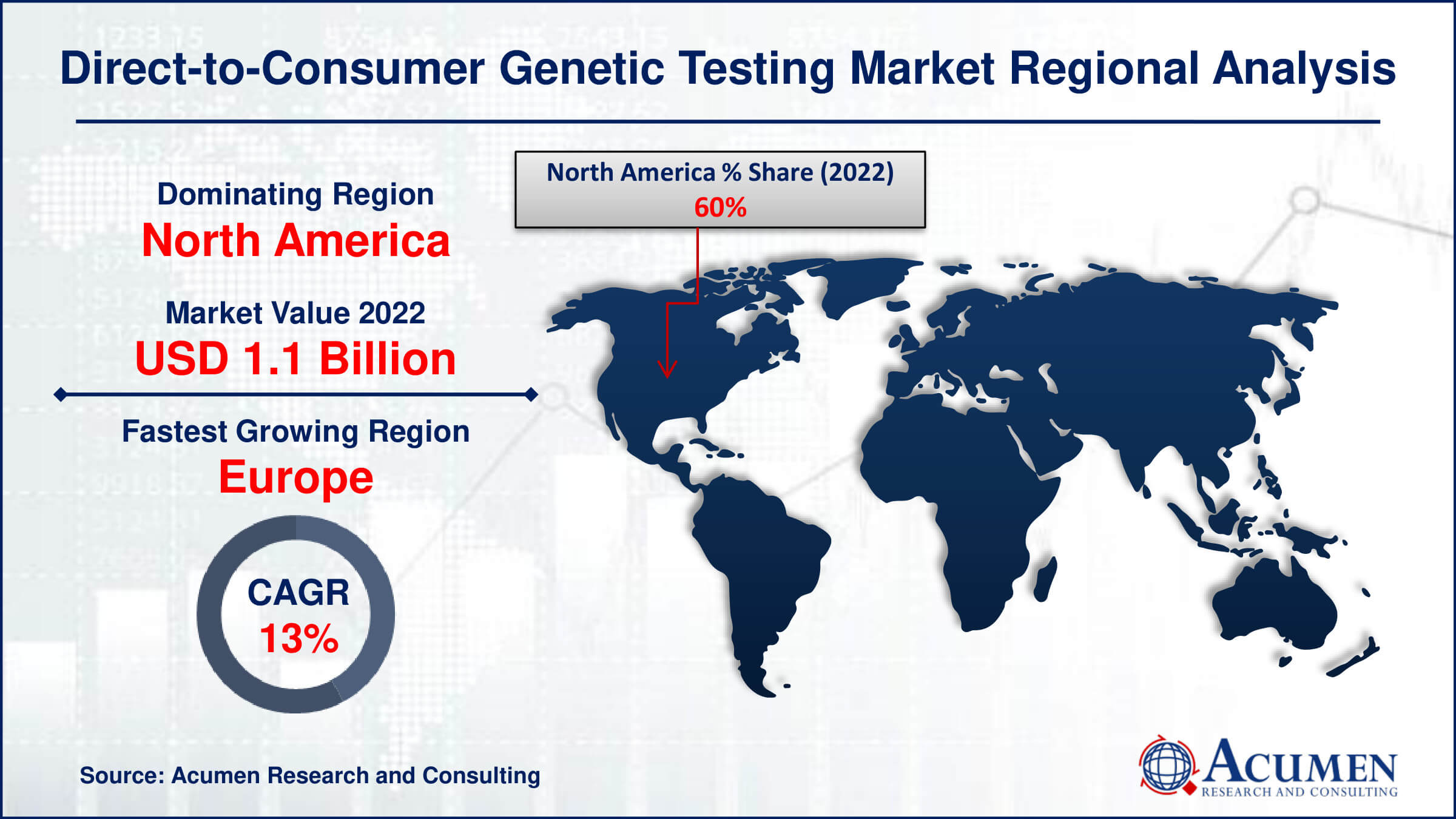

- North America region led with more than 60% of direct-to-consumer genetic testing market share in 2022

- Europe direct-to-consumer genetic testing market growth will record a CAGR of more than 13% from 2023 to 2032

- By test type, the predictive testing segment captured more than 38% of revenue share in 2022.

- By technology, the whole genome sequencing segment has held the largest market share of 39% in 2022

- Growing consumer interest in personalized health and ancestry information, drives the direct-to-consumer genetic testing market value

Direct-to-consumer (DTC) genetic testing is the practice of individuals acquiring genetic information about themselves directly from commercial testing businesses, rather than through healthcare experts. These tests look for particular markers in a person's DNA to reveal information about their ancestry, health predispositions, and characteristics. DTC genetic testing has grown in popularity due to its ease of use, low cost, and ability to provide personal genetic information without the need for a healthcare provider. For instance, as reported by the MIT Technology Review, over 26 million individuals in the United States have undergone DNA testing.

Direct-to-consumer (DTC) genetic testing is the practice of individuals acquiring genetic information about themselves directly from commercial testing businesses, rather than through healthcare experts. These tests look for particular markers in a person's DNA to reveal information about their ancestry, health predispositions, and characteristics. DTC genetic testing has grown in popularity due to its ease of use, low cost, and ability to provide personal genetic information without the need for a healthcare provider. For instance, as reported by the MIT Technology Review, over 26 million individuals in the United States have undergone DNA testing.

The market for DTC genetic testing has surged in recent years, driven by a growing public interest in uncovering genetic heritage, health risks, and personalized wellness. Companies offering DTC genetic testing services have expanded their product offerings to include comprehensive insights into nutrition, fitness, and lifestyle recommendations based on genetic data. This growth is fueled by advancements in genomic research and testing technologies, alongside increasing awareness and acceptance of genetic testing in mainstream society. However, the industry faces challenges such as data privacy concerns and the interpretation of genetic information, necessitating continued regulatory oversight and consumer education.

Global Direct-to-Consumer Genetic Testing Market Dynamics

Market Drivers

- Growing consumer interest in personalized health and ancestry information

- Technological advancements in genetic testing, enhancing accuracy and expanding test offerings

- Increased awareness and acceptance of genetic testing in mainstream society

- Expansion of product portfolios to include lifestyle and wellness insights

- Rising demand for proactive healthcare and preventive measures based on genetic insights

Market Restraints

- Concerns over data privacy and security in handling sensitive genetic information

- Challenges in accurately interpreting complex genetic data and conveying results to consumers

Market Opportunities

- Continued advancements in genomic research creating opportunities for new testing applications

- Customization of genetic testing offerings for niche markets and specialized healthcare needs

Direct-to-Consumer Genetic Testing Market Report Coverage

| Market | Direct-to-Consumer Genetic Testing Market |

| Direct-to-Consumer Genetic Testing Market Size 2022 | USD 1.8 Billion |

| Direct-to-Consumer Genetic Testing Market Forecast 2032 | USD 5.4 Billion |

| Direct-to-Consumer Genetic Testing Market CAGR During 2023 - 2032 | 11.8% |

| Direct-to-Consumer Genetic Testing Market Analysis Period | 2020 - 2032 |

| Direct-to-Consumer Genetic Testing Market Base Year |

2022 |

| Direct-to-Consumer Genetic Testing Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Test Type, By Technology, By Distributional Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | 23andMe, Ancestry, Family Tree DNA, Helix OpCo LLC, Genesis HealthCare, Full Genomes Corporation, Inc, Karmagenes SA, Myriad Genetics Inc., The SkinDNA Company Pty Ltd, Color Health, Inc., Gene by Gene, and Living DNA Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

DTC genetic testing enables individuals to directly access genetic testing services, analyzing specific markers in their DNA to unveil various aspects of their genetic makeup. These tests cover a wide range of areas, including ancestry and genealogy, health predispositions, carrier status for genetic conditions, and traits related to physical characteristics or behaviors. Applications extend across diverse domains; beyond ancestry, individuals can explore health-related insights to empower proactive healthcare decisions. Additionally, personalized nutrition and fitness plans are increasingly incorporating genetic data for tailored recommendations. Despite advancements, concerns persist regarding data privacy and result accuracy, emphasizing the importance of ongoing regulatory oversight and consumer education in the rapidly evolving DTC genetic testing landscape. The Australian Medical Association Limited (AMA) announced in June 2020 that genetic testing holds the potential to revolutionize healthcare services, promising more cost-effective treatments and enhanced patient outcomes. This endorsement is anticipated to drive global demand for direct-to-consumer (DTC) genetic tests.

The direct-to-consumer (DTC) genetic testing market has experienced remarkable expansion lately, driven by a convergence of influential factors. At the heart of this surge lies a burgeoning curiosity among consumers to unlock the mysteries of their genetic composition, ancestry, and potential health susceptibilities. As individuals increasingly take charge of their well-being, the desire for direct access to personalized genetic insights without intermediaries has surged. This growing demand has spurred a proliferation of companies offering DTC genetic testing services, ensuring convenient and cost-effective avenues for individuals to delve into their genetic blueprint. Bolstered by relentless technological strides in genomics and the consistent decline in DNA sequencing costs, the landscape has been primed for growth. Enhanced capabilities in analyzing and interpreting genetic data have empowered companies to provide comprehensive and precise revelations. Moreover, the market has witnessed an expansion in product offerings, transcending the realms of mere genetic exploration to include nuanced insights into traits, nutritional guidance, and lifestyle recommendations tailored to individual genetic profiles. This multifaceted approach has not only widened the appeal of DTC genetic testing but has also cemented its position as an indispensable tool in the pursuit of personalized health and wellness.

Direct-to-Consumer Genetic Testing Market Segmentation

The global direct-to-consumer genetic testing market segmentation is based on test type, technology, distributional channel, and geography.

Direct-to-Consumer Genetic Testing Market By Test Type

- Nutrigenomics Testing

- Carrier Testing

- Predictive Testing

- Ancestry & Relationship Testing

- Others

According to the direct-to-consumer genetic testing industry analysis, in 2022, the predictive testing segment emerged as the dominant force in the market, capturing the largest share. This method entails scrutinizing specific genetic markers to gauge an individual's likelihood of developing particular diseases or ailments in the future. The surge in popularity of predictive testing stems from consumers' growing interest in understanding their health predispositions, enabling them to take proactive steps and tailor healthcare strategies accordingly. Predictive testing's allure lies in its capacity to pinpoint genetic vulnerabilities to ailments such as cardiovascular diseases, select cancers, and neurodegenerative disorders. As genomic research and technological breakthroughs progress, the predictive testing sector is poised for expansion, offering more precise and comprehensive diagnostics. Within the direct-to-consumer genetic testing arena, companies are anticipated to refine the scope and accuracy of their predictive tests, furnishing users with increasingly nuanced insights into their health risks.

Direct-to-Consumer Genetic Testing Market By Technology

- Whole Genome Sequencing

- Targeted Analysis

- Single Nucleotide Polymorphism Chips

In the forthcoming years, significant growth is anticipated within the whole genome sequencing (WGS) segment in terms of technology and it is expected to gow over the direct-to-consumer genetic Testing market forecast period. WGS involves deciphering an individual's entire DNA, furnishing a comprehensive analysis of their genetic composition. This method offers a more exhaustive assessment compared to targeted genetic testing, potentially revealing a broader spectrum of information encompassing susceptibility to various diseases, carrier status for genetic conditions, and ancestral insights. The expansion of the WGS segment is fueled by advancements in sequencing technologies, which have driven down the cost of whole genome sequencing. As the affordability hurdle diminishes, an increasing number of consumers are inclined to opt for the comprehensive insights that WGS can furnish. Moreover, the burgeoning knowledge base of the human genome and ongoing research endeavors contribute to the heightened value and precision of WGS outcomes.

Direct-to-Consumer Genetic Testing Market By Distributional Channel

- Over-the-counter

- Online Platform

According to the direct-to-consumer genetic testing market forecast period, in the upcoming years, significant growth is anticipated within the online platform segment. These platforms offer a convenient and accessible avenue for consumers to order, receive, and interpret their genetic testing results from the comfort of their homes. This trend reflects the broader adoption of digital health solutions and the increasing embrace of telemedicine and remote healthcare services. The surge in the online platform segment is driven by factors such as accessibility, user-friendly interfaces, and the capacity to reach a global audience. Consumers can effortlessly explore various genetic testing options, place orders, and securely access their results through online portals. Additionally, the integration of these platforms with digital health ecosystems facilitates seamless data management, empowering users to store, track, and share their genetic information with healthcare providers and other pertinent stakeholders.

Direct-to-Consumer Genetic Testing Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Direct-to-Consumer Genetic Testing Market Regional Analysis

In terms of direct-to-consumer (DTC) genetic testing market analysis, several significant factors contribute to the industry dominance in North America. The region has an established healthcare infrastructure that enables the delivery and uptake of genetic testing services. According to Globocon 2020, the United States was expected to witness 2,281,658 new cancer cases and 612,390 cancer-related deaths in 2020. Among these, breast cancer had the highest incidence with 253,465 cases, followed by lung cancer (227,875 cases), prostate cancer (209,512 cases), and colon cancer (101,809 cases). Additionally, increased consumer awareness fuels demand, particularly in the United States, where a substantial population actively seeks personalized health insights and ancestral information via DTC genetic testing. Moreover, North America's legislative framework ensures that genetic testing services are provided in a responsible and ethical manner, establishing consumer trust and promoting further exploration and adoption of these services.

In contrast, Europe's DTC genetic testing market is expanding rapidly, driven by various dynamics. Increased consumer knowledge, fueled by advances in healthcare education and information accessibility, has a substantial impact on demand for genetic testing services. Favorable legislative conditions in different European nations also help to expand the market by establishing clear rules for the ethical and responsible delivery of direct-to-consumer genetic testing. Furthermore, Europe's diversified population, along with the increasing adoption of digital health technologies, underscores the region's potential as the fastest-growing market segment for genetic testing services. This combination of factors promises transformational improvements in genetic testing accessibility and utilization across Europe

Direct-to-Consumer Genetic Testing Market Player

Some of the top direct-to-consumer genetic testing market companies offered in the professional report include 23andMe, Ancestry, Family Tree DNA, Helix OpCo LLC, Genesis HealthCare, Full Genomes Corporation, Inc, Karmagenes SA, Myriad Genetics Inc., The SkinDNA Company Pty Ltd, Color Health, Inc., Gene by Gene, and Living DNA Ltd.

Frequently Asked Questions

How big is the direct-to-consumer genetic testing market?

The direct-to-consumer genetic testing market size was USD 1.8 Billion in 2022.

What is the CAGR of the global direct-to-consumer genetic testing market from 2023 to 2032?

The CAGR of direct-to-consumer genetic testing is 11.8% during the analysis period of 2023 to 2032.

Which are the key players in the direct-to-consumer genetic testing market?

The key players operating in the global market are including 23andMe, Ancestry, Family Tree DNA, Helix OpCo LLC, Genesis HealthCare, Full Genomes Corporation, Inc, Karmagenes SA, Myriad Genetics Inc., The SkinDNA Company Pty Ltd, Color Health, Inc., Gene by Gene, and Living DNA Ltd.

Which region dominated the global direct-to-consumer genetic testing market share?

North America held the dominating position in direct-to-consumer genetic testing industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Europe region exhibited fastest growing CAGR for market of direct-to-consumer genetic testing during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global direct-to-consumer genetic testing industry?

The current trends and dynamics in the direct-to-consumer genetic testing industry include growing consumer interest in personalized health and ancestry information, technological advancements in genetic testing, and increased awareness and acceptance of genetic testing in mainstream society.

Which technology held the maximum share in 2022?

The whole genome sequencing technology held the maximum share of the direct-to-consumer genetic testing industry.

Select Licence Type

Connect with our sales team

Why Acumen Research And Consulting

100%

Customer Satisfaction

24x7

Availability - we are always there when you need us

200+

Fortune 50 Companies trust Acumen Research and Consulting

80%

of our reports are exclusive and first in the industry

100%

more data and analysis

1000+

reports published till date