Infectious Disease Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Infectious Disease Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

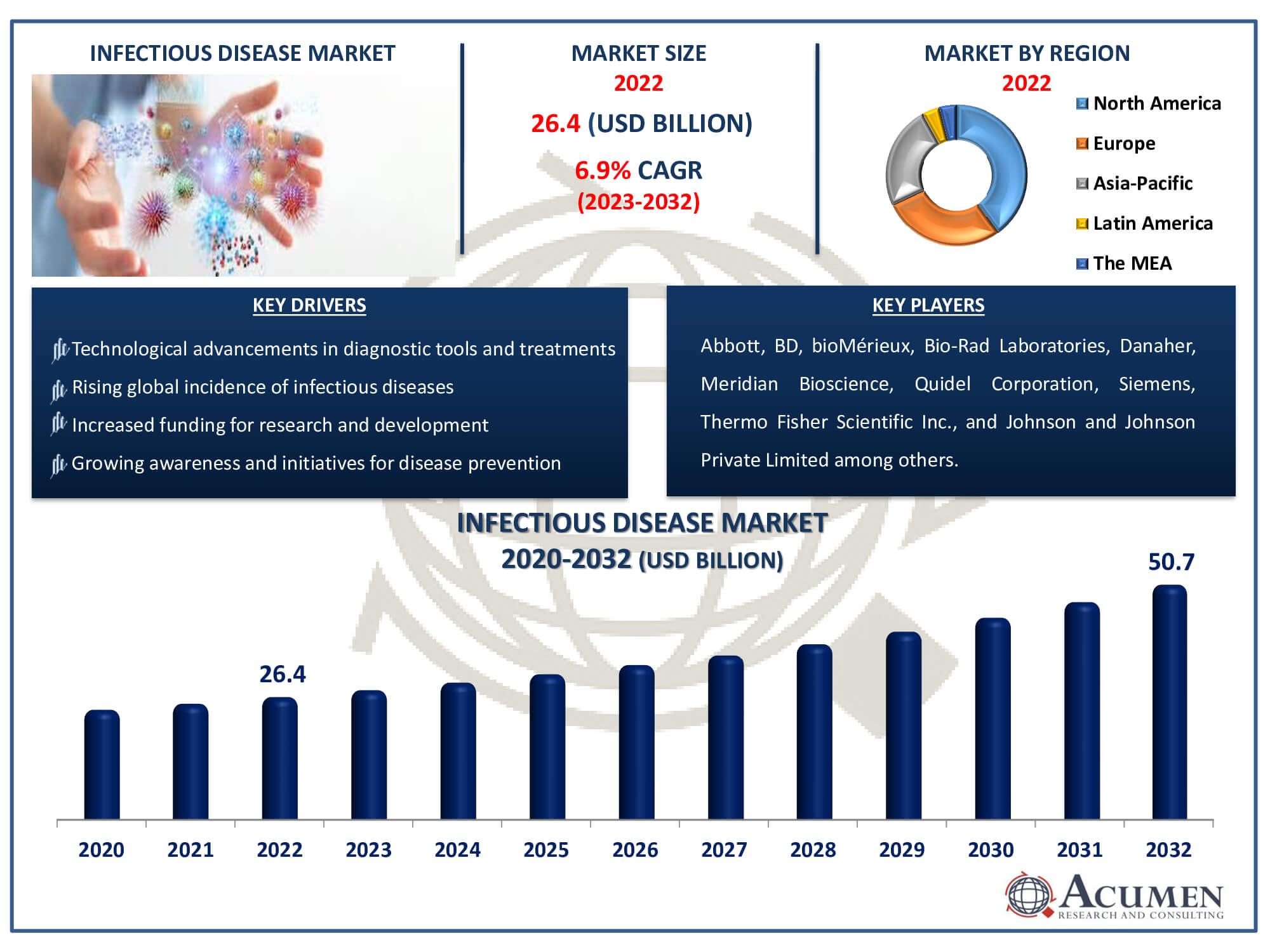

The Infectious Disease Market Size accounted for USD 26.4 Billion in 2022 and is estimated to achieve a market size of USD 50.7 Billion by 2032 growing at a CAGR of 6.9% from 2023 to 2032.

Infectious Disease Market Highlights

- Global infectious disease market revenue is poised to garner USD 50.7 billion by 2032 with a CAGR of 6.9% from 2023 to 2032

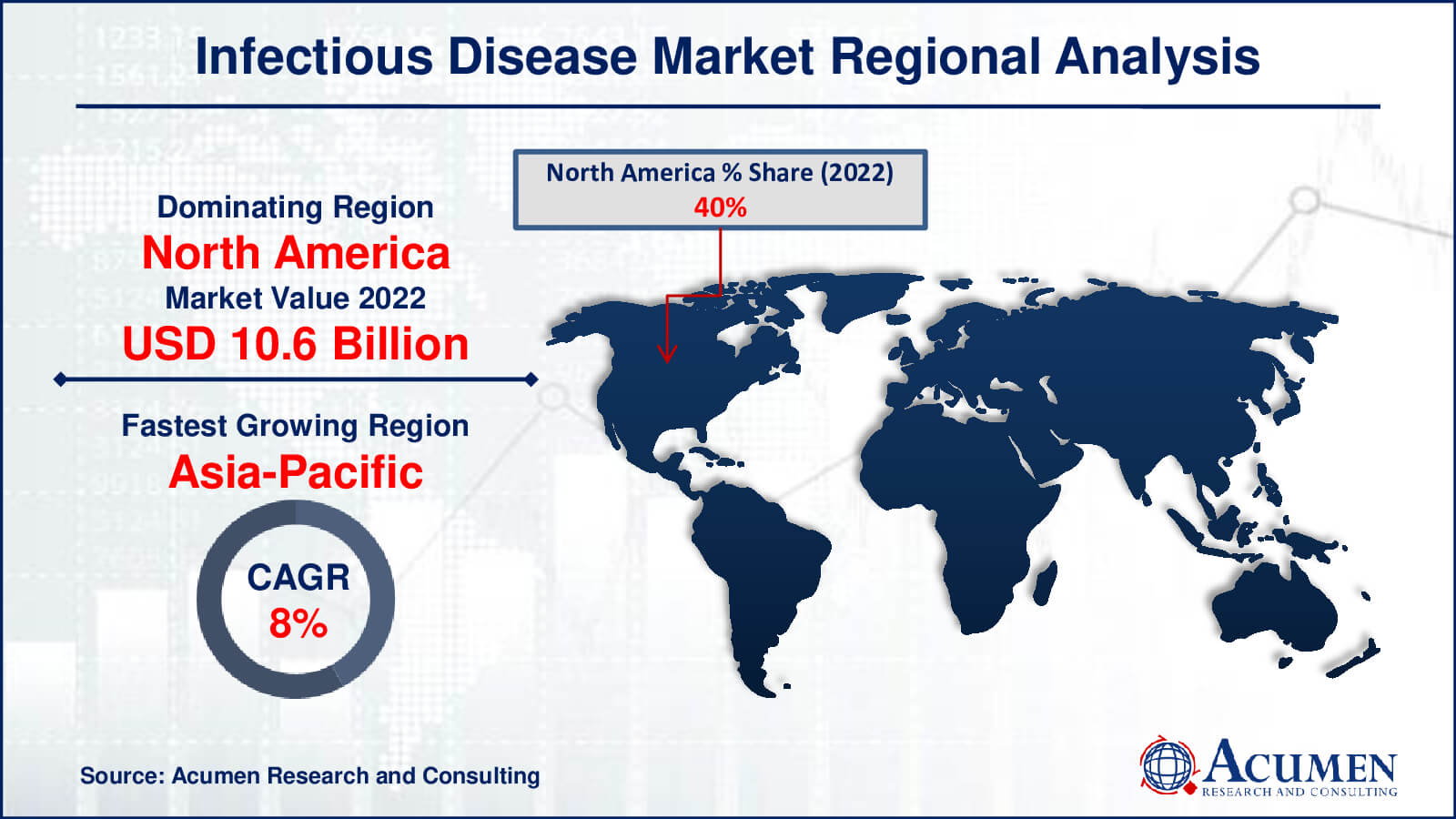

- North America infectious disease market value occupied around USD 10.6 billion in 2022

- Asia-Pacific infectious disease market growth will record a CAGR of more than 8% from 2023 to 2032

- Among product, the assays and reagents sub-segment generated over US$ 16.9 billion revenue in 2022

- Based on end-user, the hospitals and clinics sub-segment generated noteworthy share in 2022

- Integration of AI and data analytics in disease management strategies is a popular infectious disease market trend that fuels the industry demand

Infectious diseases are caused by microorganisms such as viruses, bacteria, fungi, or parasites and can be transmitted from person to person. Infectious diseases can be passed from person to person through contact with bodily fluids, aerosols (coughing and sneezing), or a vector, such as a mosquito. An infectious disease can affect anyone. People who have a compromised immune system (an immune system that does not function properly) are more vulnerable to certain types of infections. Infectious diseases are extremely common all over the world. Certain infectious diseases are more common than others. According to a Cleveland Clinic report, one out of every five people in the United States is infected with influenza (flu) virus each year.

Global Infectious Disease Market Dynamics

Market Drivers

- Technological advancements in diagnostic tools and treatments

- Rising global incidence of infectious diseases

- Increased funding for research and development

- Growing awareness and initiatives for disease prevention

Market Restraints

- Antibiotic resistance and evolving pathogens

- Stringent regulatory requirements for drug approvals

- High cost of treatments and diagnostic procedures

Market Opportunities

- Expansion of emerging markets for infectious disease management

- Development of novel therapies and vaccines

- Collaborations and partnerships among pharmaceutical companies

Infectious Disease Market Report Coverage

| Market | Infectious Disease Market |

| Infectious Disease Market Size 2022 | USD 26.4 Billion |

| Infectious Disease Market Forecast 2032 | USD 50.7 Billion |

| Infectious Disease Market CAGR During 2023 - 2032 | 6.9% |

| Infectious Disease Market Analysis Period | 2020 - 2032 |

| Infectious Disease Market Base Year |

2022 |

| Infectious Disease Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Technology, By Application, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Abbott, BD, bioMérieux, Bio-Rad Laboratories Inc., Danaher, DiaSorin S.p.A., Meridian Bioscience Inc., Quidel Corporation, Siemens, Thermo Fisher Scientific Inc., Johnson and Johnson Private Limited, F. Hoffmann-La Roche Ltd, Cepheid, Qiagen, and OraSure Technologies, Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Infectious Disease Market Insights

The rising prevalence of infectious diseases is bolstering the growth of the global infectious disease diagnostics market. According to the Australian Institute of Health and Welfare, over 593,000 cases of notifiable diseases were reported to the NNDSS in 2019. Among these notifications to Australian health authorities, four infectious diseases accounted for 82%. Additionally, non-notifiable diseases comprised 89% of the nearly 447,000 communicable disease hospitalizations in 2017-18. From 2000-01 to 2017-18, the hospitalization rate for non-notifiable communicable diseases peaked at 15.3 per 1,000 people in 2016-17, leading to almost 400,000 hospital separations. Lower respiratory tract infections, such as pneumonia and bronchitis, emerged as the most commonly diagnosed infectious causes of hospitalization in 2017-18, totaling nearly 145,000 hospitalizations. In 2018, communicable diseases accounted for almost 6,000 deaths in Australia, with the majority (89%) of infections-related deaths attributed to non-notifiable diseases, primarily lower respiratory infections caused by various bacteria and viruses.

Rising demand for point-of-care testing supports the growth of the global infectious disease market. Point-of-care (POC) tests hold the potential to significantly improve infectious disease management, especially in resource-limited settings where healthcare infrastructure is inadequate, and timely medical care is challenging to access. These tests provide rapid results, enabling the timely initiation of appropriate therapy and facilitating connections to care and referral services. According to the AdvaMed report, infectious diseases alone caused an economic burden exceeding US$120 billion in the United States in 2014. Point-of-care (POC) testing allows for patient diagnosis in various settings, such as the doctor's office, ambulance, patient's home, field, or hospital, enabling faster treatment.

In infectious disease diagnostics market during the recent Ebola outbreak, test manufacturers accelerated the development of new point-of-care rapid diagnostic tests to avoid multi-day delays in diagnosing affected patients. The World Health Organization approved four such tests between November 2014 and December 2015, while the US Food and Drug Administration authorized ten tests for emergency use. Researchers estimate that if these POC tests had been employed during the epidemic, the scale of the outbreak might have been reduced by more than a third.

Infectious Disease Market Segmentation

The worldwide market for infectious disease is split based on product, technology, application, end-user, and geography.

Infectious Disease Products

- Instruments

- Assays and Reagents

- Services

According to infectious disease industry analysis, by product, the assays and reagents sector leads the market and is essential to research and diagnosis. This section covers a wide range of biochemical substances and testing components that are necessary for the identification and analysis of infectious pathogens. Because they make illness diagnosis, monitoring, and research more precise and efficient, assays and reagents play a major role in the market's expansion. They are vital resources for academics and healthcare practitioners due to their versatility and specificity, which spurs innovation and improvements in the management of infectious diseases. This section, which forms the basis of diagnostic procedures, plays a crucial role in determining how infectious disease is controlled and treated.

Infectious Disease Technologies

- Clinical In Situ Hybridization

- Polymerase chain reaction (PCR)

- In Situ Hybridization

- Isothermal Nucleic Acid Amplification Technology (INAAT)

- Immunodiagnostics

- Other technology

The infectious diseases diagnostics market is expected to dominated by polymerase chain reaction (PCR) technology, which has emerged as the largest category. PCR, which is well known for its accuracy in amplifying DNA sequences, is essential for the highly sensitive diagnosis of infectious illnesses. The second-largest area, immunodiagnostics, which uses antibodies and antigens to diagnose illnesses, is closely behind. Immunodiagnostics is highly valued for its adaptability and capacity to recognise a wide range of infectious agents. When combined, PCR and immunodiagnostics technologies highlight the dynamic nature of the business, spurring innovation and making a substantial contribution to infectious diseases market.

Infectious Disease Applications

- Hepatitis

- Human Immunodeficiency Virus

- Chlamydia Trachomatis Genital Infection and Gonorrhea

- Hospital-Acquired Infections

- Human Papillomavirus

- Tuberculosis

- Influenza

- COVID-19

- Others

With a significant share, the human immunodeficiency virus (HIV) application emerges as a noteworthy segment in the market, and it is expected to continue growing over the infectious disease industry forecast period. The continued emphasis on HIV/AIDS prevention, treatment, and research on a global scale is responsible for this prominence. With the impact of the recent pandemic being so great, the COVID-19 application comes in second place, albeit not by much. The increased need for COVID-19 diagnosis, treatments, and preventive measures has driven the expansion of infectious disease diagnostics market. These two apps together control the majority of the market, demonstrating how crucial it is to address both persistent infectious diseases and new risks in order to provide full healthcare solutions.

Infectious Disease End-Users

- Hospitals and Clinics

- Research Institutes

- Pharmaceutical Companies

In terms of infectious disease market analysis, the primary role of hospitals and clinics in patient care, diagnosis, and treatment has made them the largest end-user segment in the market, accounting for a sizable proportion. Due to their engagement in vaccine development, medicine development, and general contributions to the management of infectious diseases, pharmaceutical companies are in second place and make up the largest segment. Collaboration between medical facilities, clinics, research centres, and pharmaceutical firms highlights the need of a multidisciplinary strategy in combating infectious diseases and highlights the critical role that every end-user plays in advancing healthcare solutions and fighting global health issues.

Infectious Disease Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Infectious Disease Market Regional Analysis

North America is the largest region in the infectious disease diagnostics market, which can be attributed to its advanced research capabilities, proactive disease management policies, and well-established healthcare infrastructure. The area is at the forefront of the fight against infectious diseases thanks to its sophisticated diagnostic and treatment techniques and significant investments in healthcare. North America's strong healthcare system and innovative culture play a major role in the region's market domination.

As a result of rising healthcare awareness, rising infrastructure investments, and expanding population, Asia-Pacific is now the region with the fastest rate of growth. Asia-Pacific is a major player in the market's rapid expansion because of the region's dynamic epidemiological landscape, government efforts, and growing attention on infectious disease solutions.

Infectious Disease Market Players

Some of the top infectious disease companies offered in our report includes Abbott, BD, bioMérieux, Bio-Rad Laboratories Inc., Danaher, DiaSorin S.p.A., Meridian Bioscience Inc., Quidel Corporation, Siemens, Thermo Fisher Scientific Inc., Johnson and Johnson Private Limited, F. Hoffmann-La Roche Ltd, Cepheid, Qiagen, and OraSure Technologies, Inc.

Frequently Asked Questions

How big is the infectious disease market?

The infectious disease market size was USD 26.4 billion in 2022.

What is the CAGR of the global infectious disease market from 2023 to 2032?

The CAGR of infectious disease is 6.9% during the analysis period of 2023 to 2032.

Which are the key players in the infectious disease market?

The key players operating in the global market are including Abbott, BD, bioM�rieux, Bio-Rad Laboratories Inc., Danaher, DiaSorin S.p.A., Meridian Bioscience Inc., Quidel Corporation, Siemens, Thermo Fisher Scientific Inc., Johnson and Johnson Private Limited, F. Hoffmann-La Roche Ltd, Cepheid, Qiagen, and OraSure Technologies, Inc.

Which region dominated the global infectious disease market share?

North America held the dominating position in infectious disease industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of infectious disease during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global infectious disease industry?

The current trends and dynamics in the infectious disease industry include technological advancements in diagnostic tools and treatments, rising global incidence of infectious diseases, increased funding for research and development, and growing awareness and initiatives for disease prevention.

Which product held the maximum share in 2022?

The assays and reagents product held the maximum share of the infectious disease industry.