Automated Truck Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Automated Truck Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

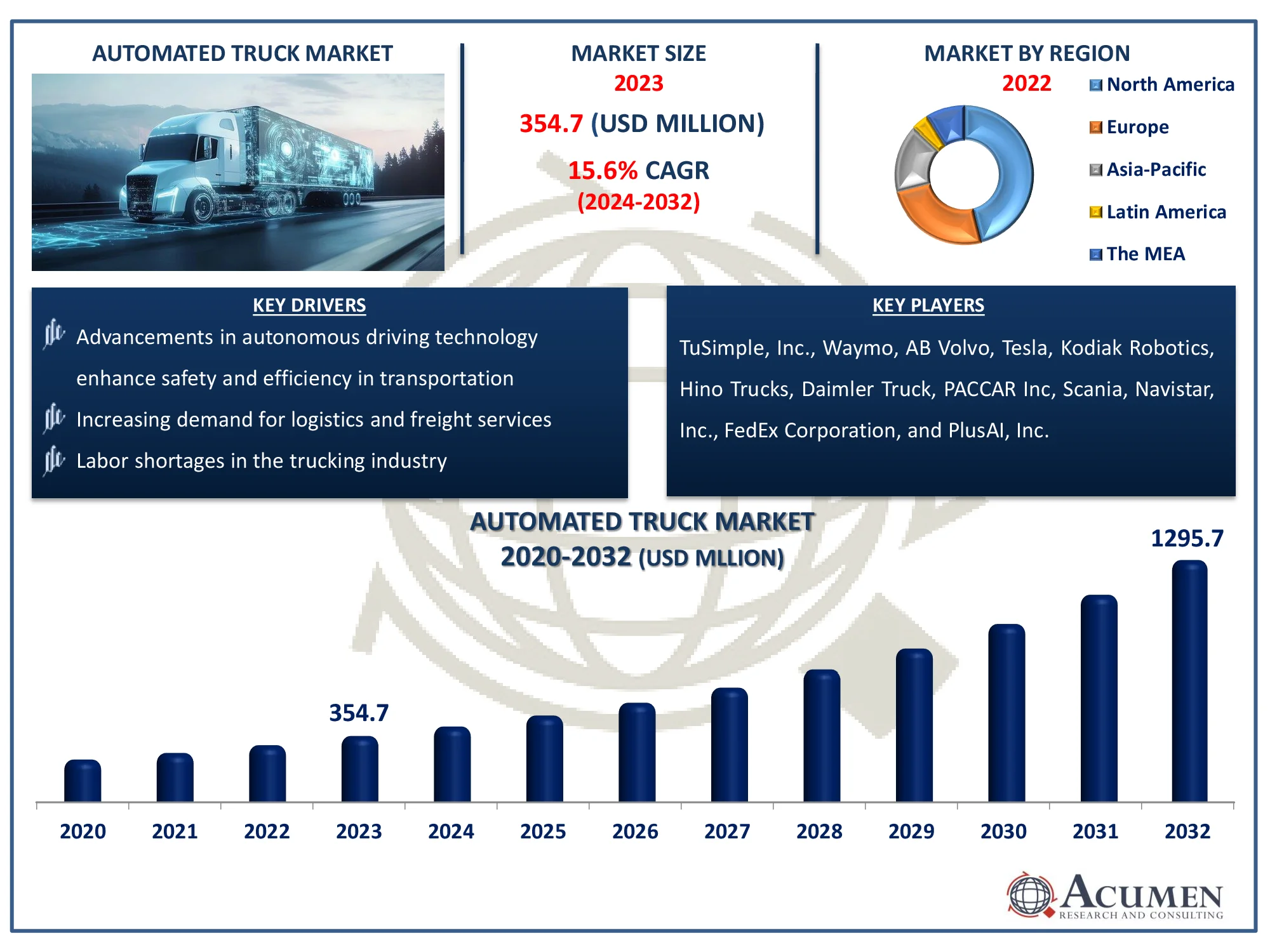

Request Sample Report

The Global Automated Truck Market Size accounted for USD 354.7 Million in 2023 and is estimated to achieve a market size of USD 1,295.7 Million by 2032 growing at a CAGR of 15.6% from 2024 to 2032.

Automated Truck Market Highlights

- The global automated truck market is anticipated to reach USD 1,295.7 million by 2032, with a CAGR of 15.6% from 2024 to 2032

- In 2023, the automated truck market in North America was valued at approximately USD 163.2 million

- The Asia-Pacific automated truck market is expected to experience a CAGR exceeding 16.4% from 2024 to 2032

- Level 1 autonomy accounted for 90% of the market share by type in 2023

- Diesel propulsion type held a 70% market share in 2023

- Shift towards electric-powered automated trucks for sustainable transportation is a popular automated truck market trend that fuels the industry demand

The autonomous truck is a commercial vehicle that uses a variety of technologies to sense its surroundings and navigate without the need for human intervention. Satellites, guided systems, and ground sensors rely largely on autonomous vehicles. These technologies recognize boundaries and appropriate signage, allowing trucks to navigate safely.

Global Automated Truck Market Dynamics

Market Drivers

- Advancements in autonomous driving technology enhance safety and efficiency in transportation

- Increasing demand for logistics and freight services boosts the need for automated trucking solutions

- Labor shortages in the trucking industry drive the adoption of automated vehicles to maintain supply chain operations

Market Restraints

- High initial investment costs for automated trucking technology can hinder market entry

- Regulatory challenges and lack of comprehensive legislation slow down the deployment of automated trucks

- Public skepticism regarding the safety and reliability of autonomous vehicles limits acceptance

Market Opportunities

- Expansion of e-commerce creates new avenues for automated delivery solutions

- Collaborations between technology firms and traditional trucking companies can accelerate innovation

- Growing focus on reducing carbon emissions presents opportunities for electric automated trucks

Automated Truck Market Report Coverage

| Market | Automated Truck Market |

| Automated Truck Market Size 2022 |

USD 354.7 Million |

| Automated Truck Market Forecast 2032 | USD 1,295.7 Million |

| Automated Truck Market CAGR During 2023 - 2032 | 15.6% |

| Automated Truck Market Analysis Period | 2020 - 2032 |

| Automated Truck Market Base Year |

2022 |

| Automated Truck Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Sensor, By Level Of Autonomy, By Propulsion Type, By Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | TuSimple, Inc., Waymo, AB Volvo, Tesla, Kodiak Robotics, Hino Trucks, Daimler Truck, PACCAR Inc, Scania, Navistar, Inc., FedEx Corporation, and PlusAI, Inc |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Automated Truck Market Insights

The global autonomous truck market has witnessed substantial development and is expected to increase in forecast year. Self-employed trucks are primarily caused by a scarcity of drivers and increased distribution of items and equipment to various end sources. It is expected that increased cargo volumes at a rapid pace would result in the sale of independent vehicles and encourage producers or new investors. Increasing labor costs for drivers, particularly in emerging countries, will allow independent trucks to avoid mistakes and harms by relying on minimal human intervention methods.

Furthermore, a shift in manufacturing to developing countries and higher economic growth would result in increased sales of self-sufficient trucks. New entrants to the market will so have opportunities. However, the most significant problem for industrial makers is the growing need for fuel efficiency and stringent regulation of bad fuel emissions. Autonomous trucks are developed using cutting-edge satellite and software technology. This increases the danger of system hacking, which can be extremely harmful to systems. In addition, new entrants would face constraints in self-driving truck market.

However, in the industrialized world, the lack of drivers has exacerbated many industries' struggles with autonomous cars, which is expected to remain a primary driver of their growing adoption rate. A fast surge in autonomous truck sales necessitates a thorough assessment of the overall landscape's development prospects. As a result, the ARC's most recent research exposes vital patterns in support of stakeholder development of sustainable growth strategies via predictions, offering important indicators for upcoming changes that match the advancements of the self-driving truck market.

The autonomous truck market has been and will continue to be driven by innovation and substantial advances over the predicted period. With the logistics industry seeing waves of automation and digitization, autonomous trucks are critical to the sector's expansion to meet increased demand.

Throughout the prediction, the adoption of automated vehicles will remain high, as numerous industries aim for process efficiency with minimal human intervention. Manufacturers anticipate expansion, enhance traffic management, reduce fuel consumption, and secure the security of automated cars while increasing economy. At a speed of 5 G, it will be nearly instantaneously estimated to improve process effectiveness for end-use sectors for drive decisions in automated cars. High infrastructure costs associated with automated truck growth are likely to provide an entrance barrier for new competitors in the autonomous truck market.

Automated Truck Market Segmentation

The worldwide market for automated truck is split based on type, sensor, level of autonomy, propulsion type, industry, and geography.

Automated Truck Types

- Light-duty Trucks

- Medium-duty Trucks

- Heavy-duty Trucks

According to automated truck industry analysis, heavy-duty trucks shows robust growth in industry due to their importance in long-haul transportation, where automation improves efficiency and reduces costs. These vehicles are perfect for incorporating autonomous technology, reducing driver fatigue, and increasing fuel efficiency on lengthy routes. Growing demand for logistics, combined with developments in sensors and AI, has accelerated the use of automation in this sector. Heavy-duty vehicles benefit the most from these advancements, making them the primary drivers.

Automated Truck Sensors

According to automated truck industry analysis, RADAR sensors is most popular sensor due to its dependability in a variety of weather situations and capacity to identify things over vast distances. They provide critical data for adaptive cruise control, collision avoidance, and lane keeping assistance. While LIDAR and cameras give high-resolution imaging, heavy-duty trucks prefer RADAR because to its inexpensive cost and performance in low visibility circumstances.

Automated Truck Level of Autonomy

- Level 1

- Level 2

- Level 3

- Level 4

According to automated truck industry analysis, level 1 autonomy, which includes basic driver aid systems such as adaptive cruise control and lane-keeping, leads the autonomous truck market due to its early adoption and legal approval. These systems improve safety and efficiency while still require human monitoring, making them a viable option for fleet managers. With simpler technology than higher autonomy levels, Level 1 is a more cost-effective choice for self-driving truck market. Its extensive adoption is evident in its 90% market domination by 2023.

Automated Truck Propulsion Type

- Diesel

- Electric

- Hybrid

According to automated truck market forecast, diesel propulsion is expected to dominate the industry due to its extensive infrastructure, dependability, and capacity to meet long-distance, heavy-duty transportation requirements. Diesel-powered trucks are still used by the majority of fleets because they are efficient and cost-effective in long-haul operations. While electric and hybrid trucks are gaining popularity as a result of environmental concerns and regulatory pressures, diesel remains the preferred option due to its existing technology and fueling network.

Automated Truck Industry

- Manufacturing

- Construction & Mining

- Military

- FMCG

- Others

According to automated truck market forecast, the mining sector is expected to remain an appealing end-use sector in 2023, with mining companies planning to enhance production capacity to meet increased demand for minerals in the manufacturing sector. After, e-commerce portals are predicted to grow fast, and the demand for logistics will erode the mining sector's market share in value terms. In the mining industry, level 5 autonomous trucks remain immensely favored since they operate without the assistance of drivers and make use of cloud data and artificial intelligence. At the conclusion of the prediction period, automated lorries of tier 3 will override the acceptance rate of automated lorries at level 5, due to car platooning, which is a component of automated lorries. The increased cost of automated trucks at Level 5 will also affect earnings from automated trucks at Level 3.

Automated Truck Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

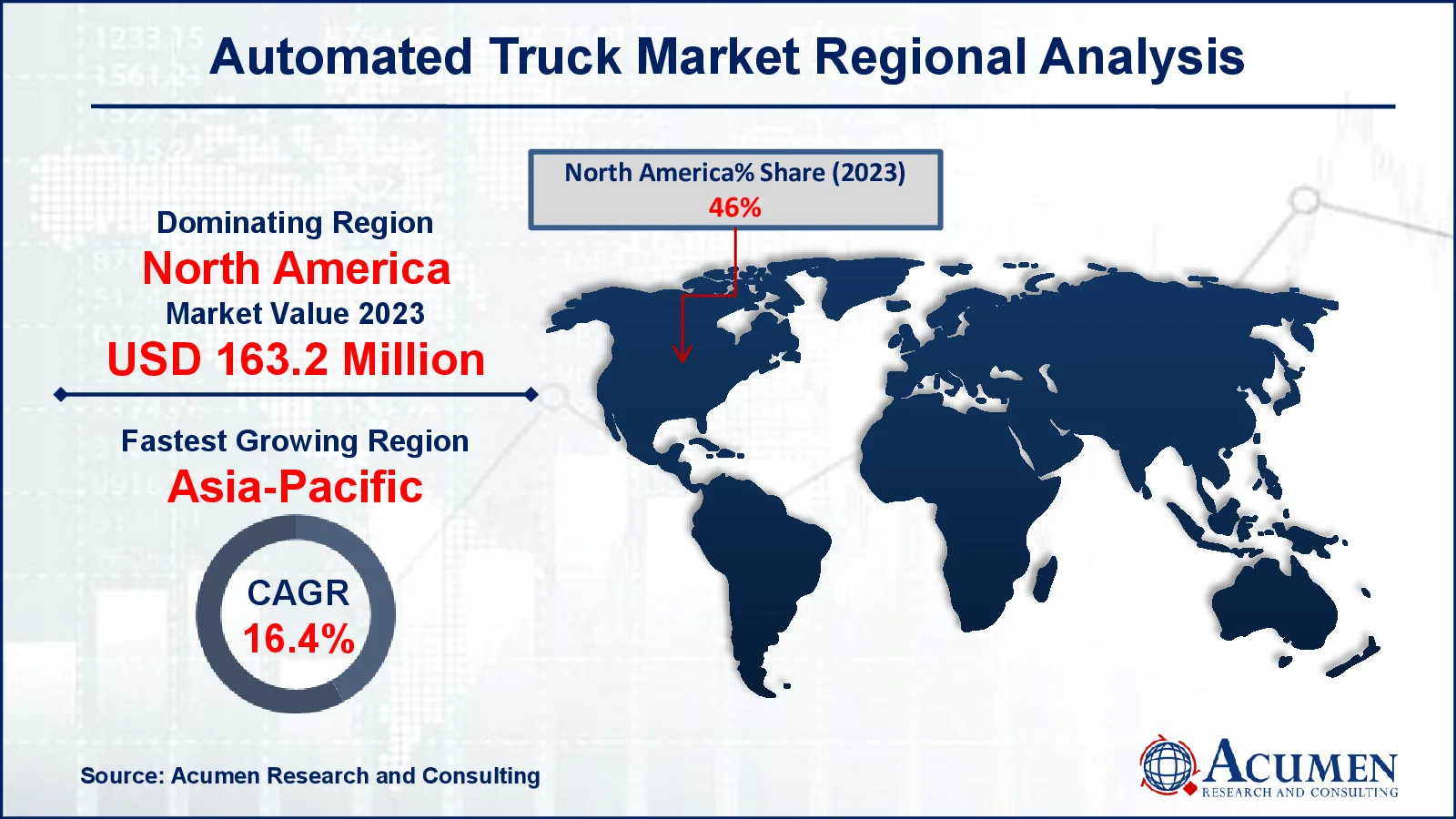

Automated Truck Market Regional Analysis

Regional analysis of automated truck market, North America's market is dominating as a result of significant investments in autonomous driving technologies and supportive legislative frameworks. The region's well-established transportation infrastructure, combined with a significant need for efficient logistics solutions, and presence of key players drives adoption. For instance, April 2023, Kodiak Robotics, Inc., a prominent autonomous trucking company, announced its fifth-generation self-driving truck hardware platform, which improves GPU processing power and sensor redundancy.

Asia-Pacific is predicted to remain a fastest-growing autonomous truck market, as demand for automated trucks for mining activity in Australia grows and improved road infrastructure increases revenues in the logistics business. Furthermore, the scarcity of drivers in sophisticated countries such as the United States and Japan will continue to be an essential opportunity for the spread of automated vehicles. For instance, TuSimple, a self-driving truck firm, began regular testing on Tomei, a Japanese road, in June 2023, signaling its debut into the island nation. This move underlines TuSimple's commitment to growing its autonomous trucking operations into the Japanese market. Despite the fact that the automatic truck sector is growing at an unprecedented rate, truck driver committees and associations are likely to protest. However, proper training is required, as automated trucks replace duties rather than jobs. If interpreted correctly, this will reduce the drivers' reluctance.

Automated Truck Market Players

Some of the top automated truck companies offered in our report include TuSimple, Inc., Waymo, AB Volvo, Tesla, Kodiak Robotics, Hino Trucks, Daimler Truck, PACCAR Inc, Scania, Navistar, Inc., FedEx Corporation, and PlusAI, Inc.

Frequently Asked Questions

How big is the automated truck market?

The automated truck market size was valued at USD 354.7 million in 2023.

What is the CAGR of the global automated truck market from 2024 to 2032?

The CAGR of automated truck is 15.6% during the analysis period of 2024 to 2032.

Which are the key players in the automated truck market?

The key players operating in the global market are including TuSimple, Inc., Waymo, AB Volvo, Tesla, Kodiak Robotics, Hino Trucks, Daimler Truck, PACCAR Inc, Scania, Navistar, Inc., FedEx Corporation, and PlusAI, Inc

Which region dominated the global automated truck market share?

North America held the dominating position in automated truck industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of automated truck during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global automated truck industry?

The current trends and dynamics in the automated truck industry include advancements in autonomous driving technology enhance safety and efficiency in transportation and increasing demand for logistics and freight services boosts the need for automated trucking solutions.

Which level of autonomy held the maximum share in 2023?

The level 1 held the maximum share of the automated truck industry