GPU Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

GPU Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

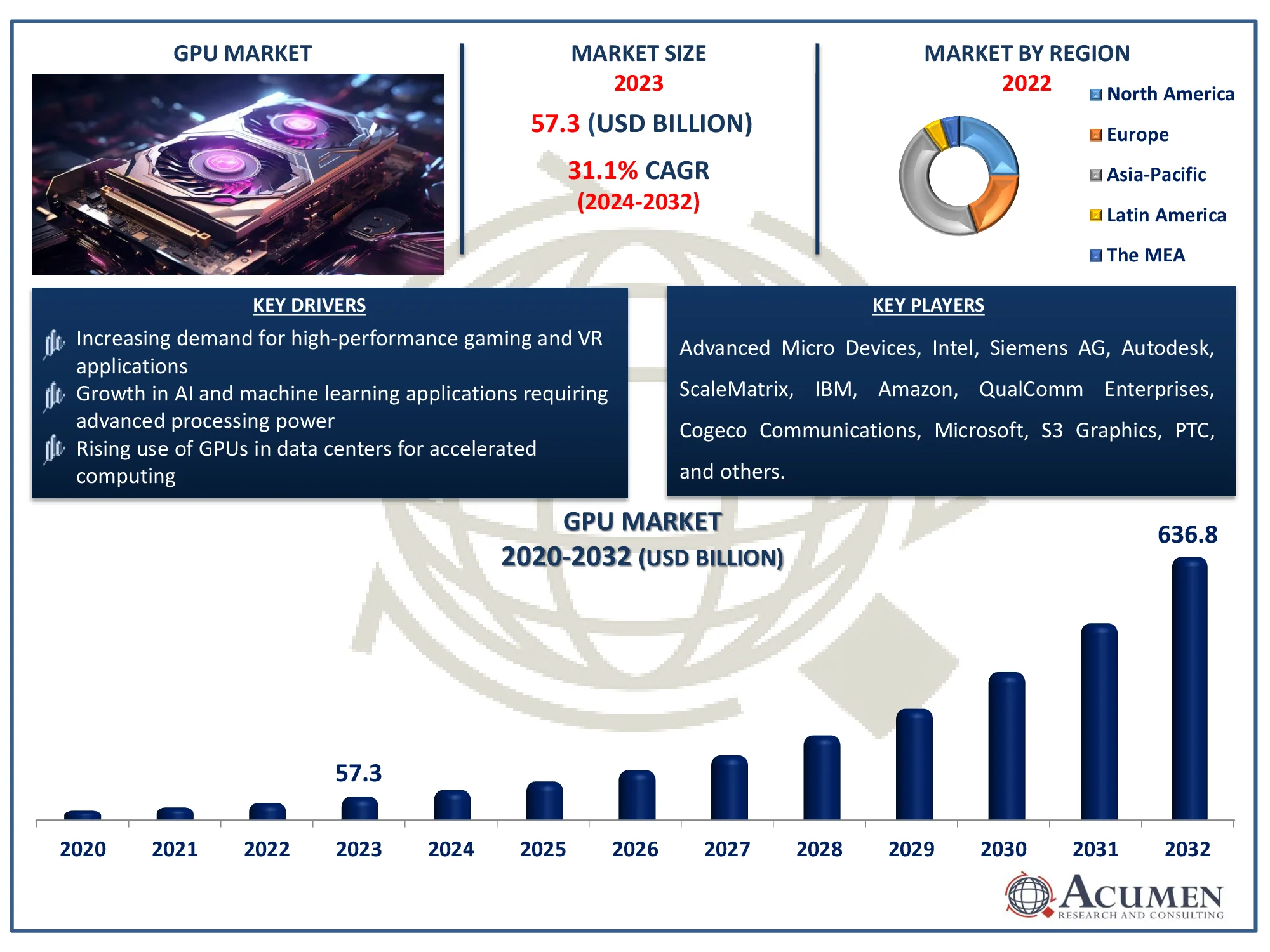

The Global GPU Market Size accounted for USD 57.3 Billion in 2023 and is estimated to achieve a market size of USD 636.8 Billion by 2032 growing at a CAGR of 31.1% from 2024 to 2032.

GPU Market Highlights

- The global GPU market revenue is projected to reach USD 636.8 billion by 2032, growing at a CAGR of 31.1% from 2024 to 2032

- The Asia-Pacific GPU market was valued at approximately USD 25.8 billion in 2023

- The North America GPU market is expected to grow at a CAGR of over 32% from 2024 to 2032

- In 2023, the hardware component sub-segment accounted for 64% of the GPU market share

- The cloud deployment model sub-segment generated a significant market share in the GPU market in 2023

- Cloud gaming services are boosting the demand for high-performance GPUs in data centers is the GPU market trend that fuels the industry demand

A graphics processing unit (GPU) is a type of electronic circuit that accelerates the processing of images and videos. GPUs were originally developed to render graphics in computer games, but they are now used in a variety of applications other than visual processing. Their parallel processing capabilities enable them to tackle numerous tasks at once, making them excellent for sophisticated computations in domains like as artificial intelligence, machine learning, and scientific modeling. In addition to gaming and graphics rendering, GPUs are useful for data analysis, cryptocurrency mining, and video editing. Their capacity to process enormous amounts of data quickly has resulted in their use in high-performance computing and real-time data processing applications.

Global GPU Market Dynamics

Market Drivers

- Increasing demand for high-performance gaming and VR applications

- Growth in AI and machine learning applications requiring advanced processing power

- Rising use of GPUs in data centers for accelerated computing

Market Restraints

- High cost of advanced GPU hardware

- Supply chain disruptions affecting GPU availability

- Competition from emerging technologies like specialized AI chips

Market Opportunities

- Expansion in the automotive industry for autonomous driving technologies

- Advancements in GPU architecture for enhanced performance and efficiency

- Growing adoption of GPUs in edge computing and IoT applications

GPU Market Report Coverage

| Market | GPU Market |

| GPU Market Size 2022 |

USD 57.3 Billion |

| GPU Market Forecast 2032 | USD 636.8 Billion |

| GPU Market CAGR During 2023 - 2032 | 31.1% |

| GPU Market Analysis Period | 2020 - 2032 |

| GPU Market Base Year |

2022 |

| GPU Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Component, By Deployment Model, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Advanced Micro Devices (AMD), Intel, Siemens AG, Autodesk, ScaleMatrix, IBM, Amazon Web Services, QualComm Enterprises, Cogeco Communications, Microsoft, S3 Graphics, PTC, Dassault Systems, Penguin Computing, Google, Nimbix, and NVIDIA. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

GPU Market Insights

The graphics processing unit market is expected to grow rapidly from 2024-2032 due to an increase in the selection of GPUs for advanced processing applications in industries such as real estate, automotive, healthcare, and design and manufacturing. The healthcare industry is expected to see an increase in the adoption of GPU solutions due to the growing requirement for real-time analytics to improve decision-making processes.

Another element fueling graphics processing unit market growth is the increasing use of cell phones, tablets, and consoles for gaming purposes. For instance, according to the World Economic Forum, as of January 2023, India has more over 700 Million smartphone users, 425 Million of whom lived in rural areas. More than half of individuals now use smartphones, and the number of active internet users has increased by 45 percent. Because gaming applications are graphics-intensive, they require powerful realistic processors to solve complex network calculations and 3D picture rendering. This will increase demand for GPUs in order to achieve high-quality rendering execution and provide customers with a visually appealing background.

The growing popularity of virtual reality (VR) will also increase the demand for next-generation graphics processors to aid in the development of serious VR applications. For instance, In December 2022, Meta revealed 7% greater computational power for Meta Quest 2 devices, resulting in improved application performance on VR headsets. The increased GPU power allows the developer to use higher pixel density without significantly reducing the resolution required at the goal frame rate.

GPU Market Segmentation

The worldwide market for GPU is split based on component, deployment model, application, and geography.

Graphics Processing Unit (GPU) Market By Component

- Software

- ICAD/CAM

- Simulation

- Imaging

- Digital Video

- Modelling And Animation

- Others

- Service

- Training & Consulting

- Integration & Maintenance

- Managed Service

- Hardware

- GPU type(integrated, and discrete )

- Device type (computer, tablet, gaming console, and television)

According to the graphics processing unit industry analysis, hardware is key component of dominance because of their critical role in graphic and computational processing. High-performance GPUs with sophisticated core and memory architectures are required for gaming, AI, and data-intensive applications. GPU hardware innovations, such as increasing core counts and enhanced cooling systems, are constantly pushing the performance envelope. This technical innovation assures that hardware remains the primary emphasis in both the consumer and professional markets.

Graphics Processing Unit (GPU) Market By Deployment Model

- On-Premise

- Cloud

According to the GPU industry analysis, the cloud deployment sector is expected to grow in the GPU market. The demand for cloud-based models will increase as organizations demands to manage large datasets grow, ensuring improved performance and lower costs. When compared to on-premises GPU organizations, GPU-based cloud stages provide high dependability and promise lower support. The growing adoption of cloud models will increase the demand for GPUs in the cloud to achieve high performance.

Graphics Processing Unit (GPU) Market By Application

- Gaming

- Design And Manufacturing

- Healthcare

- Automobile

- Real-Estate

- Others

According to the GPU market forecast, the automotive GPU applicaton will grow at the fastest rate due to an increase in the use of GPUs to accelerate planning and design applications. As the industry focuses on developing new cars with improved design and functionality, GPUs are widely used in CAD/CAM programming to initiate the analysis of complicated informative indexes and the use of queries to structure new models and instances. As demand for this product increases, the realistic handling unit (GPU) market is expected to grow over the forecast period.

GPU Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

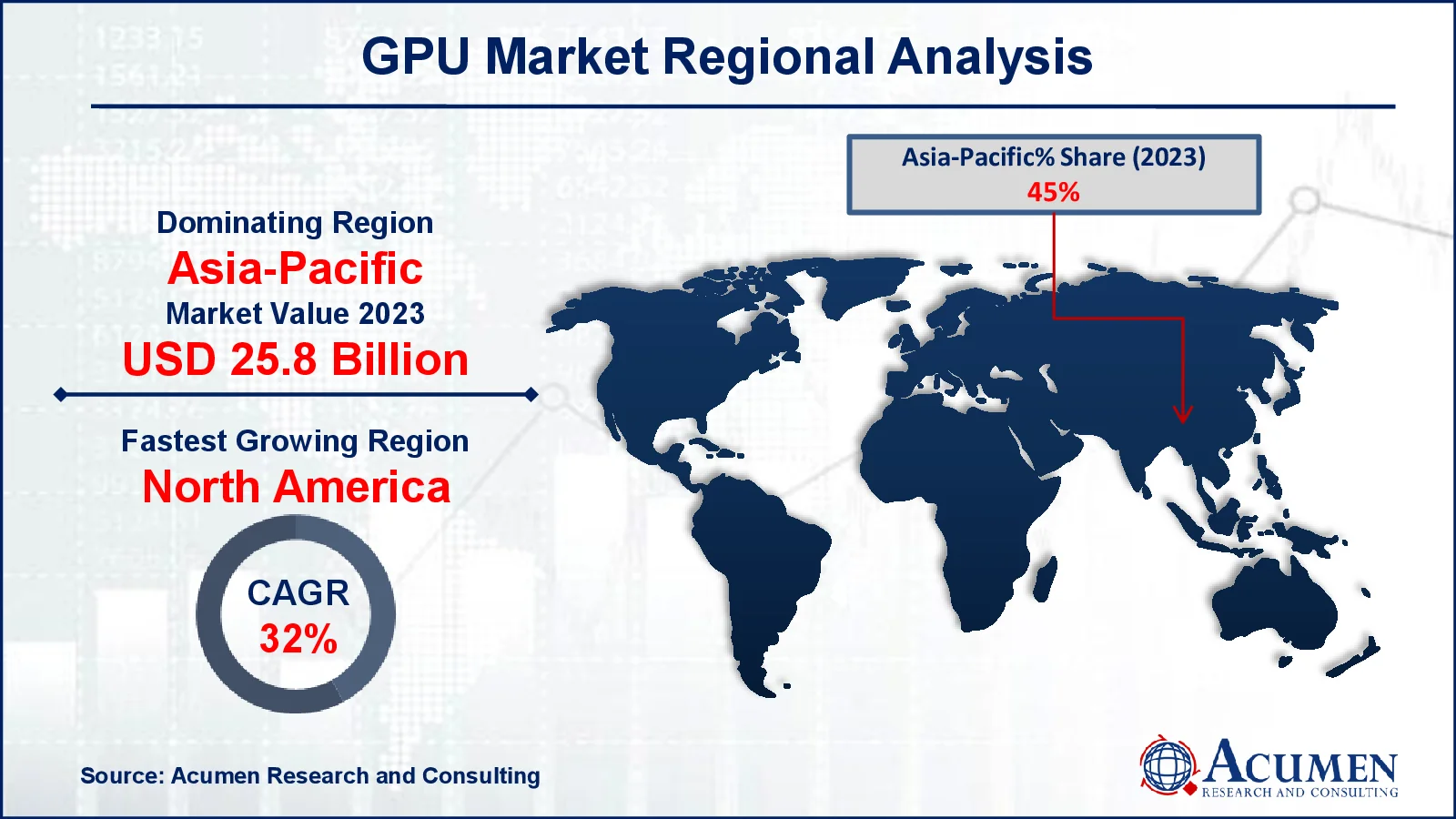

GPU Market Regional Analysis

For several reasons, in 2023, the Asia Pacific GPU market accounted for 45% of total market share. The need for GPUs is expected to rise in the region as the gaming industry expands rapidly in countries such as China, Japan, and India. According to the Netherlands Enterprise Agency Report, Japan's gaming industry is the world's third largest, with overall revenue. Developing breakthroughs, such as AR and VR, as well as the growing trend of premium games, will push the use of GPUs to provide a higher gaming experience. Furthermore, the increased usage of AI in developing areas such as social insurance and manufacturing will drive up demand for GPUs. Artificial intelligence applications make use of deep learning computations to prepare neural systems. In order to accelerate the difficult computational process and discover critical bits of knowledge, frameworks demand GPU-accelerated machines.

North America expected to shows noteworthy growth in graphics processing unit market due to expanding gaming industry in the countries like U.S, and Canada. Increasing demand for VR applications in high-performance gaming in North American region further accelerates growth of industry in forecast year.

GPU Market Players

Some of the top GPU companies offered in our report include Advanced Micro Devices (AMD), Intel, Siemens AG, Autodesk, ScaleMatrix, IBM, Amazon Web Services, QualComm Enterprises, Cogeco Communications, Microsoft, S3 Graphics, PTC, Dassault Systems, Penguin Computing, Google, Nimbix, and NVIDIA.

Frequently Asked Questions

How big is the GPU market?

The GPU market size was valued at USD 57.3 billion in 2023.

What is the CAGR of the global GPU market from 2024 to 2032?

The CAGR of GPU is 31.1% during the analysis period of 2024 to 2032.

Which are the key players in the GPU market?

The key players operating in the global market are including Advanced Micro Devices (AMD), Intel, Siemens AG, Autodesk, ScaleMatrix, IBM, Amazon Web Services, QualComm Enterprises, Cogeco Communications, Microsoft, S3 Graphics, PTC, Dassault Systems, Penguin Computing, Google, Nimbix, and NVIDIA.

Which region dominated the global GPU market share?

Asia-Pacific held the dominating position in GPU industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of GPU during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global GPU industry?

The current trends and dynamics in the GPU industry include increasing demand for high-performance gaming and VR applications, growth in AI and machine learning applications requiring advanced processing power, and rising use of GPUs in data centers for accelerated computing.

Which component held the maximum share in 2023?

The hardware component held the maximum share of the GPU industry.