Automotive Radar Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

Automotive Radar Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

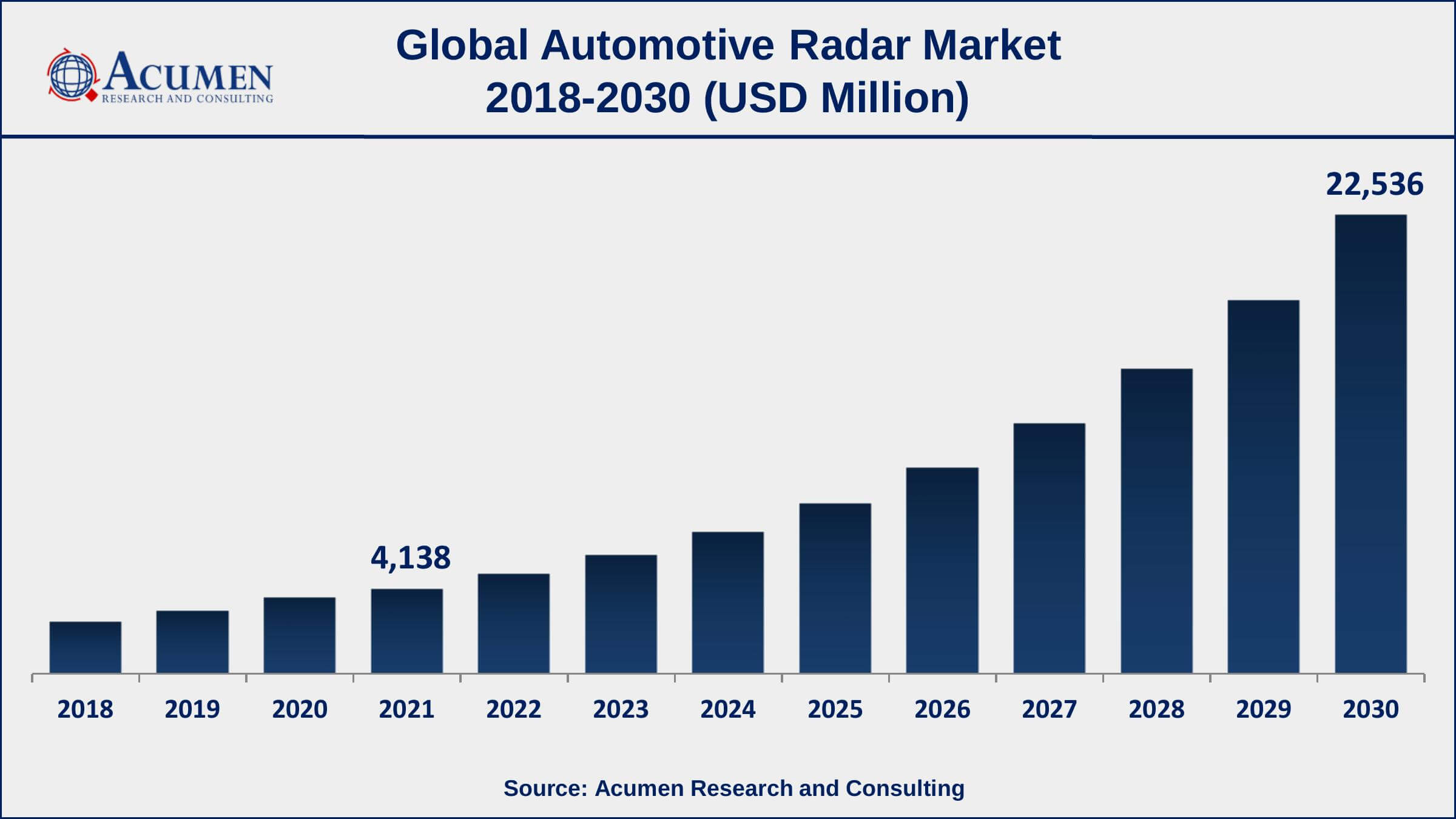

The Global Automotive Radar Market Size accounted for USD 4,138 Million in 2021 and is estimated to achieve a market size of USD 22,536 Million by 2030 growing at a CAGR of 21.1% from 2022 to 2030. The rising number of road accidents and casualties has led to a rise in the demand for advanced safety systems in vehicles driving the automotive radar market growth. Furthermore, the advancement of new radar technologies, such as frequency-modulated continuous wave (FMCW) radar, is propelling the automotive radar market value upward in the coming years.

Automotive Radar Market Report Key Highlights

- Global automotive radar market revenue intended to gain USD 22,536 million by 2030 with a CAGR of 21.1% from 2022 to 2030

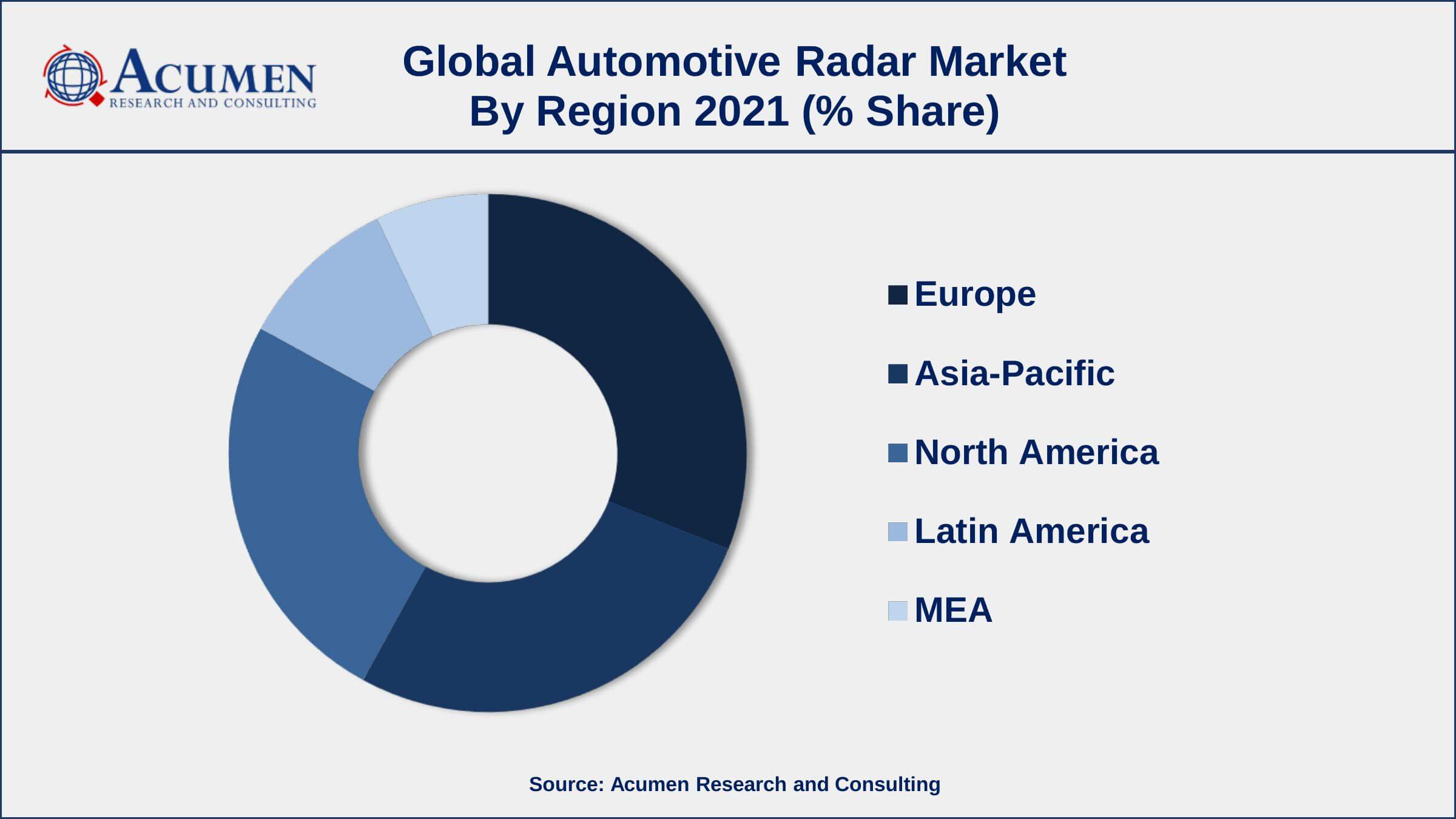

- Europe region led with more than 31% automotive radar market share in 2021

- Asia-Pacific automotive radar market growth will observe strongest CAGR from 2022 to 2030

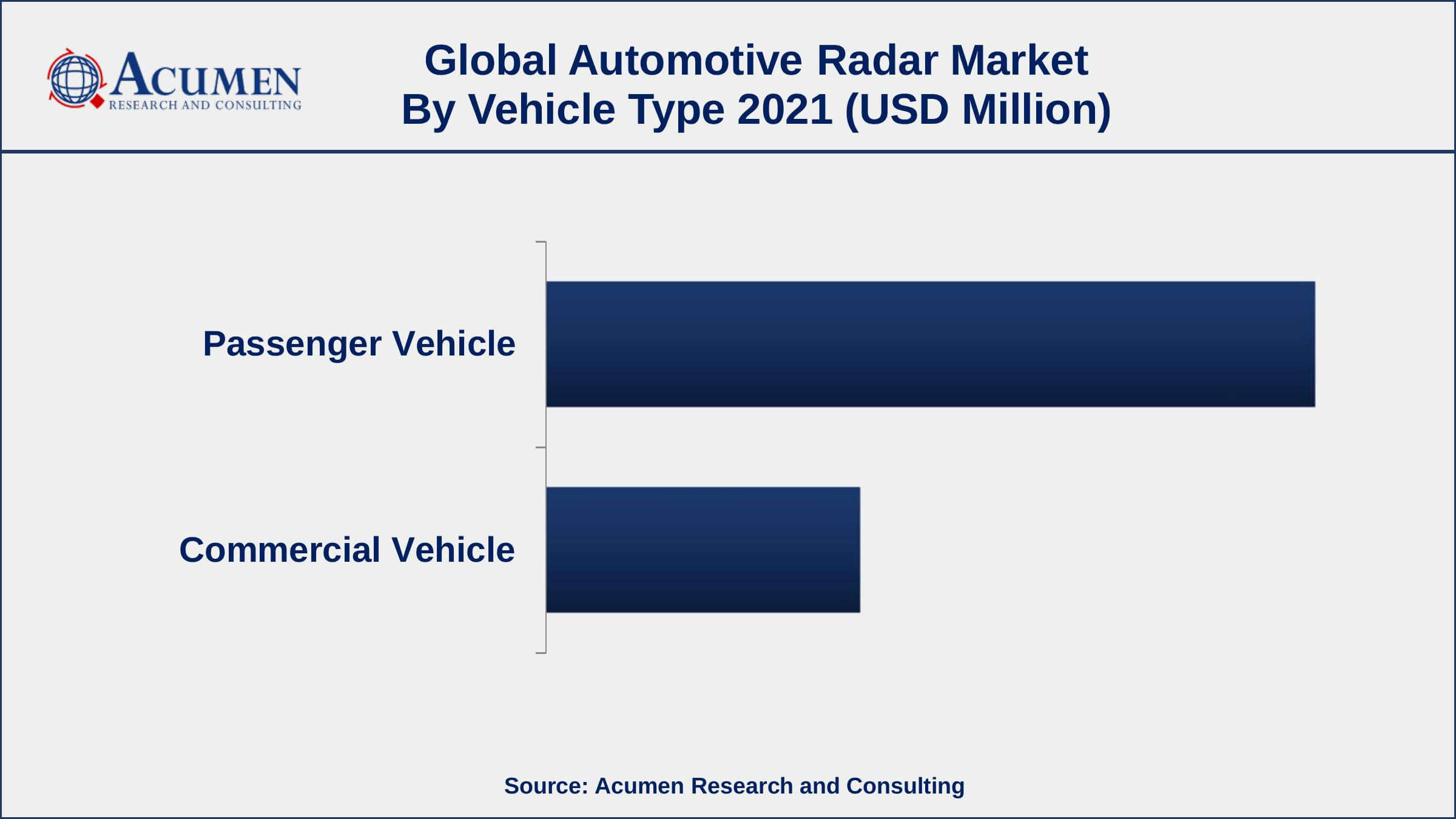

- By vehicle type, passenger vehicle segment generated about 72% market share in 2021

- By range type, the medium range RADAR engaged more than 60% of the total market share in 2021

- Increasing number of road accidents and fatalities, drives the automotive radar market size

Radio Detection and ranging also known as RADAR, is electronic equipment that is used for tracing any object. The system which detects any objects within its radius by the use of radio waves in order to determine the spread angle, area and speed is called automotive RADAR. This system was initially developed for defense and military purposes, but it has witnessed a massive increase in use in the automobile sector as a result of ongoing technological innovations. These devices are installed in passenger vehicles in the form of radar sensors for delivering information such as angle, range, and Doppler velocity and also to help the drivers to avoid the collision.

Global Automotive Radar Market Trends

Market Drivers

- Increasing demand for advanced driver assistance systems (ADAS)

- Implementing stricter safety regulations for vehicles

- Increasing number of road accidents and fatalities

- Growing adoption of autonomous vehicles

Market Restraints

- High cost of radar systems

- Complex integration into vehicles

Market Opportunities

- Technological advancement and development of new radar technology

- Increasing electric vehicle development

Automotive Radar Market Report Coverage

| Market | Automotive Radar Market |

| Automotive Radar Market Size 2021 | USD 4,138 Million |

| Automotive Radar Market Forecast 2030 | USD 22,536 Million |

| Automotive Radar Market CAGR During 2022 - 2030 | 21.1% |

| Automotive Radar Market Analysis Period | 2018 - 2030 |

| Automotive Radar Market Base Year | 2021 |

| Automotive Radar Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Frequency, By Vehicle Type, By Range Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Continental AG, Robert Bosch GmbH, Infineon Technologies AG, Texas Instruments, NXP Semiconductors, Autoliv Inc., ZF Friedrichshafen, DENSO Corporation, Delphi Automotive Company, and Valeo S.A. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Stringent government regulations pertaining to vehicle safety and has led to an increase in demand for automotive RADAR systems. In addition to this, the adoption of ADAS technology (Advance Driver Assistance System)by OEMs has led to an augment in demand for automotive RADAR systems which in turn has driven the automotive RADAR market. In the past few years, there has been a significant increase in the number of radar sensors used per vehicle. This in turn has led to rapid growth in the automotive RADAR market. However, the use of these systems is considered illegal in some countries. This has proven to be a major restraint for the growth of the automotive RADAR market. Some of the Acts supporting this ban include the Communications Act of 1934 in the U.S. and the Wireless Telegraphy Act of 1949 in the U.K. In Australia, except Western Australia, the use of a RADAR detector is Illegal in all states. However, increasing awareness pertaining to the benefits of using these systems can bring in new opportunities for the major players in the automotive RADAR market. Some of the major trends in the automotive radar market include object identification, a high focus on safety with the inclusion of 360 degrees of vehicle surveillance, CAR2X (car 2 car and car 2 infrastructure communication), and rear-end crash avoidance.

A number of system and chip manufacturing companies are involved in the automotive RADAR market. Many players have adopted a different strategies for the development of the market. For instance, in June 2019, Vayyar Imaging from Tel Aviv launched its first automotive 4D point cloud application on a single radar chip. 4D point cloud transforms radar technology by constructing a real-time, high-resolution 4D visualization of both in-cabin and car exterior environments. The company’s Radar on a Chip (ROC) consists of 48 transceivers at 76-81GHz which allows over 2,000 virtual channels.

Automotive Radar Market Segmentation

The worldwide automotive radar market segmentation is based on the frequency, vehicle type, range type, application, and geography.

Automotive Radar Market By Frequency

- 24 GHz

- 77 GHz

- 79 GHz

According to an automotive radar industry analysis, the 77 GHz frequency segment is gaining significant attention in 2021. 77 GHz radar works at a frequency range of 76-81 GHz and is utilized for short-range applications such as collision warning, adaptive cruise control, and lane departure warning. It has great accuracy and resolution but it is vulnerable to interference from other electrical components in the car. Due to its capacity to detect objects with high accuracy & function in a wide range of weather conditions, 77 GHz radar is becoming increasingly popular in the automotive industry.

Automotive Radar Market By Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

According to the automotive radar market forecast, the commercial vehicle category is expected to expand the market in the coming years. The adoption of advanced driver assistance systems (ADAS) in commercial vehicles is increasing due to the advantages they provide in terms of efficiency and safety. The automotive radar market in this segment is predicted to increase due to the increasing need for ADAS in commercial vehicles.

Automotive Radar Market By Range Type

- Short Range RADAR

- Medium Range RADAR

- Long Range RADAR

In terms of range type, the medium-range segment leads the market in 2021. Medium-range radar refers to radar systems that can detect objects up to 250 meters away. Medium-range radar is mostly utilized for blind spot identification, lane change assistance, as well as rear cross-traffic alert. These systems employ radar to detect automobiles or other obstacles in the vehicle's blind spot or rear, alerting the driver to potential crashes. The growing need for advanced driver assistance systems (ADAS) is propelling the medium-range radar industry forward.

Automotive Radar Market By Application

- Autonomous Emergency Braking (AEB)

- Blind Spot Detection (BSD)

- Forward Collision Warning System

- Adaptive Cruise Control (ACC)

- Intelligent Park Assist

- Others

In terms of applications, the adaptive cruise control (ACC) segment is one of the leading segments in the market. ACC is a driver assistance technology that employs radar to keep a safe following distance between the vehicle in front. ACC detects the distance and velocity of the car in front using radar and changes the vehicle's speed accordingly. This can help reduce the risk of rear-end collisions while also improving driving efficiency.

Automotive Radar Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Europe Holds Dominating Share of Automotive Radar Market

Geographically, the Europe region is leading the market in 2021. The European market is expected to grow significantly due to the region's rising adoption of ADAS and autonomous vehicle systems. The presences of significant manufacturers, as well as the execution of stringent safety standards, are projected to drive growth in the European automotive radar market.

The Asia-Pacific market is expected to witness the highest growth due to the increasing demand for vehicles and the presence of a large number of manufacturers in the region. The region's increasing adoption of ADAS and autonomous driving technology is likely to fuel the growth of the Asia-Pacific automotive radar market.

Automotive Radar Market Players

Some of the top automotive radar market companies offered in the professional report include Continental AG, Robert Bosch GmbH, Infineon Technologies AG, Texas Instruments, NXP Semiconductors, Autoliv Inc., ZF Friedrichshafen, DENSO Corporation, Delphi Automotive Company, and Valeo S.A.

Frequently Asked Questions

What is the size of global automotive radar market in 2021?

The estimated value of global automotive radar market in 2021 was accounted to be USD 4,138 Million.

What is the CAGR of global automotive radar market during forecast period of 2022 to 2030?

The projected CAGR automotive radar market during the analysis period of 2022 to 2030 is 21.1%.

Which are the key players operating in the market?

The prominent players of the global automotive radar market are Continental AG, Robert Bosch GmbH, Infineon Technologies AG, Texas Instruments, NXP Semiconductors, Autoliv Inc., ZF Friedrichshafen, DENSO Corporation, Delphi Automotive Company, and Valeo S.A.

Which region held the dominating position in the global automotive radar market?

Europe held the dominating automotive radar during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for automotive radar during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global automotive radar market?

Increasing demand for advanced driver assistance systems and growing adoption of autonomous vehicles drives the growth of global automotive radar market.

By vehicle type segment, which sub-segment held the maximum share?

Based on vehicle type, passenger vehicle segment is expected to hold the maximum share automotive radar market.