Automotive LiDAR Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Automotive LiDAR Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

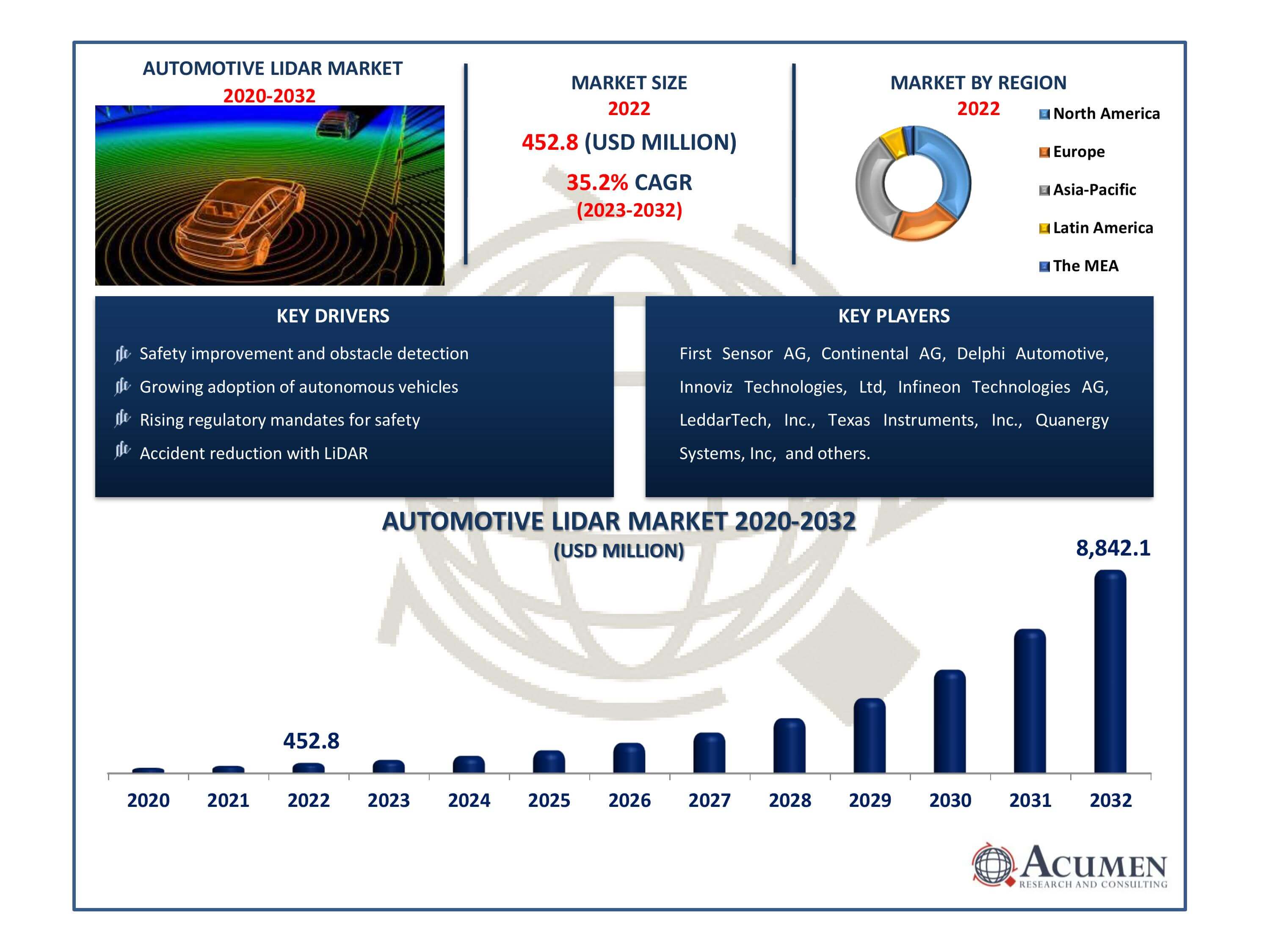

The Automotive LiDAR Market Size accounted for USD 452.8 Million in 2022 and is estimated to achieve a market size of USD 8,842.1 Million by 2032 growing at a CAGR of 35.2% from 2023 to 2032.

Automotive LiDAR Market Highlights

- The global automotive LiDAR market is set to achieve revenue of USD 8,842.1 Million by 2032

- The PEF market is experiencing a CAGR of 35.2% from 2023 to 2032

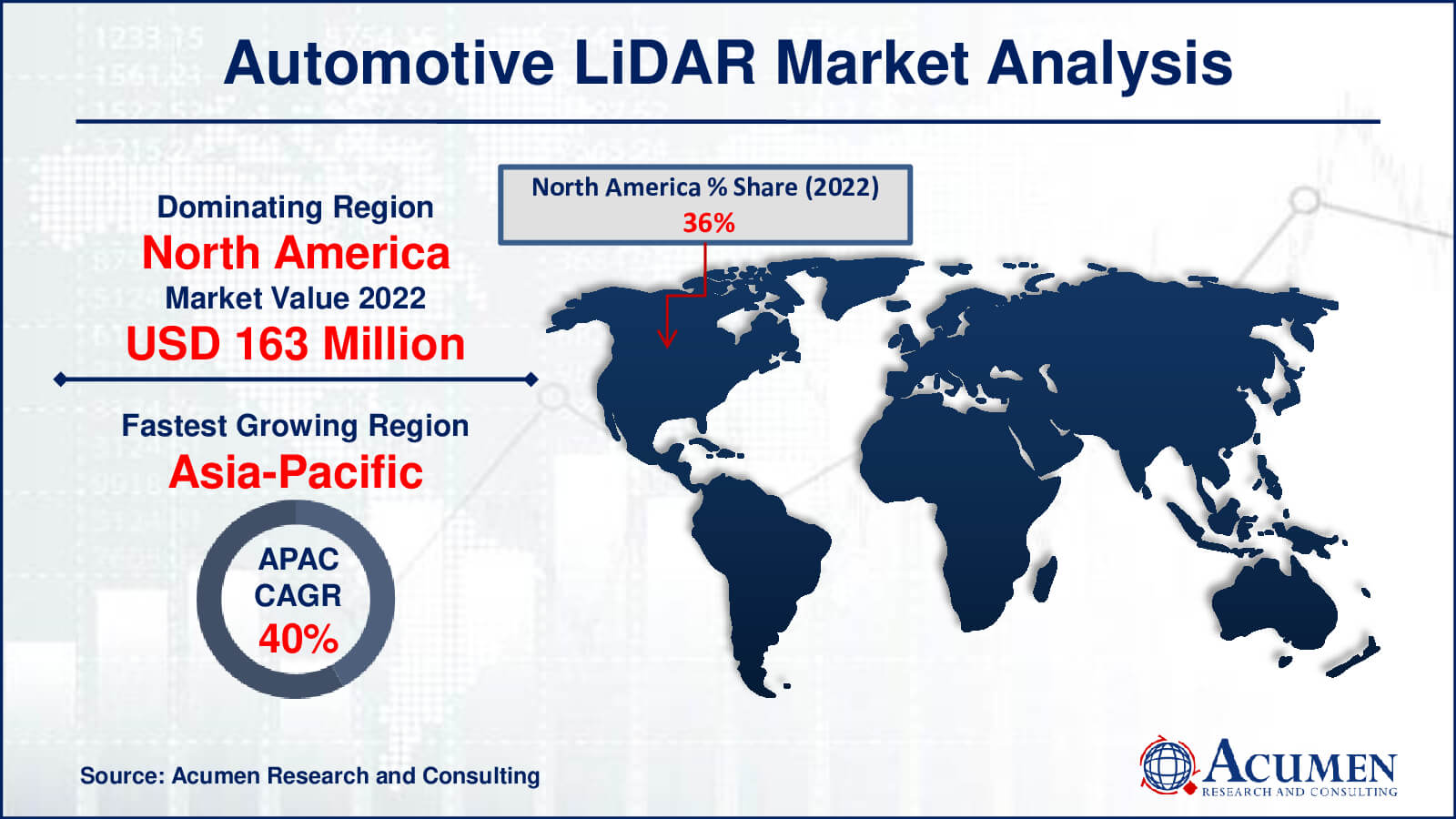

- In 2022, North America dominated the automotive LiDAR market with USD 163 million in revenue

- The Asia-Pacific market is likely to witness growth of over 40% from 2023 to 2032

- Among technology, the solid-state LiDAR sub-segment generated revenue exceeding USD 289.8 million in 2022

- In terms of application, the bottles sub-segment accounted for approximately 55% of the market share in 2022

- Collaborative industry innovation is a notable automotive LiDAR market trend

Automotive LiDAR, which stands for light detection and ranging, is a cutting-edge technology that allows vehicles to see and comprehend their environment. It works by producing laser pulses and monitoring how long it takes for these pulses to bounce back after colliding with objects in the surroundings. LiDAR systems may produce highly comprehensive 3D maps of the vehicle's surroundings, including the precise location and movement of other cars, pedestrians, and numerous obstructions, by analyzing the data gathered from these laser reflections. This technology is critical for improving vehicle safety and allowing advanced driver assistance systems (ADAS), as well as for the development of self-driving or autonomous cars because it gives the vehicle real-time, high-precision spatial awareness.

Automotive LiDAR has the potential to transform the transportation sector by increasing road safety, decreasing accidents, and allowing more efficient and automated driving. It enables cars to "see" in ways that traditional sensors like as cameras and radar cannot since it works successfully in a variety of lighting and weather conditions. LiDAR technology is projected to play a major part in the future of mobility as it evolves and becomes more inexpensive, making it a vital tool for automakers, tech firms, and researchers in their drive to produce safer and more efficient transportation solutions.

Global Automotive LiDAR Market Dynamics

Market Drivers

- Safety improvement and obstacle detection

- Growing adoption of autonomous vehicles

- Rising regulatory mandates for safety

- Accident reduction with LiDAR

Market Restraints

- High initial costs inhibit adoption

- Weather impacts LiDAR performance

- Integration complexity in vehicles

- Challenges with data processing

Market Opportunities

- Growing LiDAR market

- Synergy with electric vehicles

- Aftermarket retrofit demand

Automotive LiDAR Market Report Coverage

| Market | Automotive LiDAR Market |

| Automotive LiDAR Market Size 2022 | USD 452.8 Million |

| Automotive LiDAR Market Forecast 2032 | USD 8,842.1 Million |

| Automotive LiDAR Market CAGR During 2023 - 2032 | 35.2% |

| Automotive LiDAR Market Analysis Period | 2020 - 2032 |

| Base Year |

2022 |

| Forecast Data | 2023 - 2032 |

| Segments Covered | By Technology, By Range, By Vehicle Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | First Sensor AG, Continental AG, Delphi Automotive, Innoviz Technologies, Ltd, Infineon Technologies AG, LeddarTech, Inc., Texas Instruments, Inc., Quanergy Systems, Inc, Velodyne LiDAR, Inc., and ZF Friedrichshafen AG. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Automotive LiDAR Market Insights

The provided passage explains the concept of LiDAR (Light Detection and Ranging) technology, highlighting its applications across various industries, including self-driving cars, archaeology, agriculture, forestry, and pollution modeling. It mentions that the global automotive LiDAR market is primarily driven by the growing demand for speed and accuracy, as well as increasing research and development (R&D) efforts aimed at enhancing LiDAR technology for autonomous vehicles. Furthermore, the passage suggests that the broader adoption of LiDAR technology in industries like aerospace, agriculture, and civil engineering has led to economies of scale, resulting in a reduction in the manufacturing costs of LiDAR sensors, which has subsequently increased demand in the automotive sector.

However, the passage also points out a significant challenge: building consumer trust. This challenge arises from the rise in incidents involving self-driven cars, potentially negatively impacting the market's growth in the forecast period.

Automotive LiDAR Market Segmentation

The worldwide market for automotive LiDAR sensors is segmented technology, range, vehicle type, application, and geography.

Automotive LiDAR Technologies

- Mechanical LiDAR

- Solid-state LiDAR

As per the automotive LiDAR industry analysis, solid-state LiDAR is expected to experience significant growth within the market due to its advantages in offering high-resolution and cost-effective solutions.

Unlike their mechanical counterparts, solid-state automotive LiDAR systems do not rely on the movement of objects in their vicinity to obtain precise measurements. This non-mechanical nature makes them more durable, less prone to wear and tear, and allows for a wider range of applications. These attributes have positioned solid-state LiDAR as a compelling choice for the automotive industry, especially in the development of autonomous vehicles where reliability, precision, and long-term performance are of paramount importance. The cost-effectiveness and enhanced performance of solid-state LiDAR technology are contributing to its growing popularity and adoption in the automotive sector.

Automotive LiDAR Ranges

- Short & Mid-Range

- Long-Range

According to the automotive LiDAR market forecast, Long-range LiDAR is expected to dominate the automotive LiDAR market. Long-range LiDAR systems are crucial for advanced driver assistance systems (ADAS) and autonomous vehicles as they can detect objects and obstacles at a considerable distance from the vehicle. These systems provide the necessary information for safe and efficient autonomous driving, making them a central component in the development of self-driving cars. As the demand for autonomous features and self-driving technology continues to grow, long-range LiDAR will play a pivotal role in shaping the future of the automotive industry.

Automotive LiDAR Vehicle Types

- Internal Combustion Engine (ICE)

- Electric & Hybrid

In 2022, internal combustion engine (ICE) vehicles were the largest vehicle type operating in the automotive market. However, the automotive industry has been rapidly evolving with a growing focus on electric and hybrid vehicles due to environmental concerns and government regulations. The market share of electric and hybrid vehicles has been steadily increasing. Therefore, the current status may have changed, and electric and hybrid vehicles could have gained a larger market share. I recommend checking the most recent market reports and statistics for the latest information on the market share of these vehicle types.

Automotive LiDAR Applications

- Semi-Autonomous Vehicle

- Autonomous Vehicles

According automotive LiDAR market analysis, semi-autonomous vehicles had gathered the largest share in the market. Semi-autonomous vehicles, which include vehicles with advanced driver assistance systems (ADAS) like adaptive cruise control and lane-keeping assistance, were more common and widely adopted at that time. Fully autonomous vehicles, while promising, were still in the development and testing phase, and their commercial deployment was limited.

However, the landscape of the automotive industry can change rapidly, and the adoption of autonomous vehicles may have increased since then. I recommend consulting the latest market reports and industry statistics to get the most up-to-date information on the market share of semi-autonomous and autonomous vehicles.

Automotive LiDAR Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Automotive LiDAR Market Regional Analysis

North America dominates the global automotive LiDAR market due to its continuous technological advancements, extensive research and development activities, and mass production of LiDAR sensors within the region. Furthermore, North America's automotive LiDAR market is thriving with established providers, particularly in key countries like the US and Canada. The early adoption of advanced driver assistance systems (ADAS) and the pursuit of autonomous vehicle technology in commercial vehicles are major drivers that have propelled market growth in this region.

The European automotive industry is a robust and strategic sector that drives economic growth across the region. Europe is actively working on building a connected and automated driving system by introducing self-driven LiDAR-based autonomous vehicles. France and Germany are leading countries in driving the growth of the automotive LiDAR market in the region. The increasing demand for autonomous vehicles, coupled with research and development support from governments in developing automated driving systems, is expected to further boost the automotive LiDAR market in this region.

Asia-Pacific stands as the fastest-growing region in the automotive LiDAR market, driven by the surging demand for advanced technology and autonomous vehicles in developing economies. China plays a pivotal role in the automotive LiDAR market in this region, driven by a rising demand for mobility services such as robo-taxis. Additionally, the growing need for infrastructural development and increased R&D activities for autonomous vehicles are key drivers of the automotive LiDAR market in the APAC region.

On the other hand, Latin American and Middle Eastern countries, including Saudi Arabia, the United Arab Emirates (UAE), and Kuwait, are projected to drive the LAMEA market. The increasing demand for self-driven cars and the flourishing automotive sector in the Middle East, along with strong economies in Latin American countries like Brazil and Mexico, have significantly contributed to market growth. However, Africa is anticipated to experience moderate growth in the automotive LiDAR market.

Automotive LiDAR Market Players

Some of the top automotive LiDAR companies offered in our report include First Sensor AG, Continental AG, Delphi Automotive, Innoviz Technologies, Ltd, Infineon Technologies AG, LeddarTech, Inc., Texas Instruments, Inc., Quanergy Systems, Inc, Velodyne LiDAR, Inc., and ZF Friedrichshafen AG.

The LiDAR manufacturing industry benefits from financial backing by major automotive market players. For instance, Velodyne LiDAR Inc. is supported by Ford Motor Co., Luminar Technologies Inc. is funded by AB Volvo, and Innoviz Technologies Ltd. has signed an agreement with BMW AG to supply LiDAR sensors for their level 3-5 autonomous vehicles, as the company prepares to launch self-driving cars in 2021.

Frequently Asked Questions

How big is the automotive LiDAR market?

The automotive LiDAR market is valued at USD 452.8 million in 2022.

What is the CAGR of the automotive LiDAR market from 2023 to 2032?

The CAGR of automotive LiDAR is 35.2% during the analysis period of 2023 to 2032.

Which are the key players in the automotive LiDAR market?

The key players operating in the global market are First Sensor AG, Continental AG, Delphi Automotive, Innoviz Technologies, Ltd, Infineon Technologies AG, LeddarTech, Inc., Texas Instruments, Inc., Quanergy Systems, Inc, Velodyne LiDAR, Inc., and ZF Friedrichshafen AG.

Which region dominated the global automotive LiDAR market share?

North America held the dominating position in automotive LiDAR Industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of automotive LiDAR during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global automotive LiDAR Industry?

The current trends and dynamics in the automotive LiDAR industry include safety improvement and obstacle detection, growing adoption of autonomous vehicles, and rising regulatory mandates for safety.

Which application held the maximum share in 2022?

The semi-autonomous application held the maximum share of the automotive LiDAR Industry.