WLAN Module Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

WLAN Module Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

The Global WLAN Module Market Size accounted for USD 51.2 Billion in 2023 and is estimated to achieve a market size of USD 164.0 Billion by 2032 growing at a CAGR of 14.2% from 2024 to 2032.

WLAN Module Market Highlights

- Global WLAN Module market revenue is poised to garner USD 164.0 billion by 2032 with a CAGR of 14.2% from 2024 to 2032

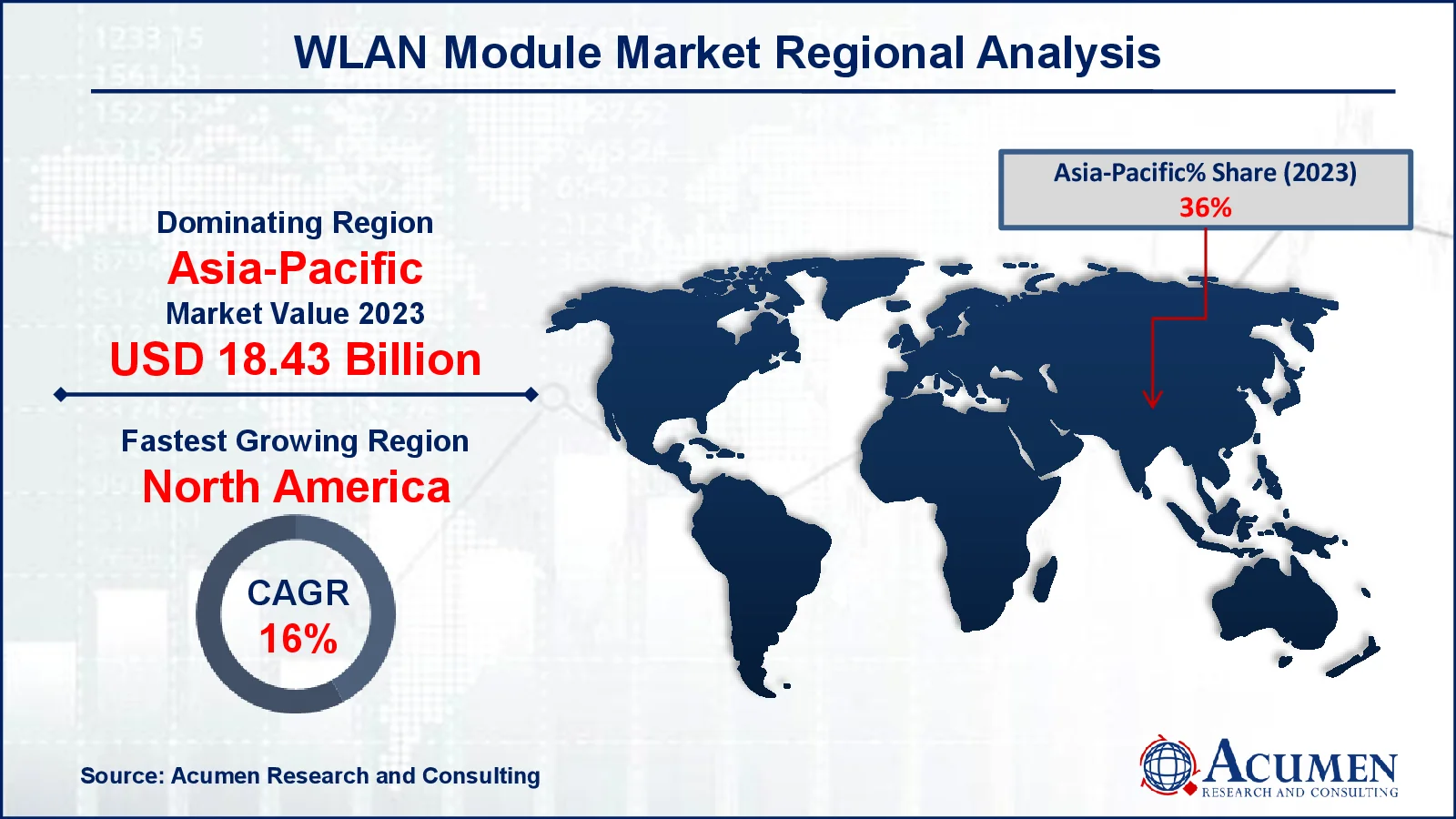

- Asia-Pacific WLAN Module market value occupied around USD 18.43 billion in 2023

- North America WLAN Module market growth will record a CAGR of more than 16% from 2024 to 2032

- Based on application, the smart grid & smart appliances sub-segment shows 40% growth in 2023

- Growing adoption of Wi-Fi 6 and Wi-Fi 7 standards for faster connectivity is the WLAN module market trend that fuels the industry demand

Wireless local area network (WLAN) can either complement or replace traditional wired networks, offering data transmission rates ranging from 1 Mbps to 54 Mbps, with some proprietary solutions providing speeds up to 108 Mbps. WLANs can cover areas as small as a single office or as large as an entire campus, delivering wireless connectivity within a typical range of 65 to 300 meters. WLAN modules are compact hardware components that enable devices to connect to a wireless network seamlessly, often integrated into IoT, healthcare, industrial automation, and consumer devices. They are designed to support multiple wireless standards, including Wi-Fi (802.11), ensuring compatibility with existing network infrastructure.

Global WLAN Module Market Dynamics

Market Drivers

- Growing demand for IoT-enabled devices across various industries

- Increasing adoption of smart home and smart city technologies

- Rising internet penetration and expansion of high-speed wireless networks

Market Restraints

- High initial deployment costs and compatibility issues

- Vulnerability to cybersecurity threats and data breaches

- Limited connectivity in remote and rural areas

Market Opportunities

- Advancements in Wi-Fi standards such as Wi-Fi 6 and Wi-Fi 7

- Integration of WLAN modules in autonomous vehicles and industrial automation

- Rising adoption of edge computing and cloud-based applications

WLAN Module Market Report Coverage

|

Market |

WLAN Module Market |

|

WLAN Module Market Size 2023 |

USD 51.2 Billion |

|

WLAN Module Market Forecast 2032 |

USD 164.0 Billion |

|

WLAN Module Market CAGR During 2024 - 2032 |

14.2% |

|

WLAN Module Market Analysis Period |

2020 - 2032 |

|

WLAN Module Market Base Year |

2023 |

|

WLAN Module Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Type, By Application, and By Geography |

|

Regional Scope |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Zcomax Technologies, Panasonic, Fujitsu, Advantech, Vishay, LG, ZYGO, Lesswire, HY-LINE, Cisco, WhizNets, Alps, Sollae Systems, and Intel. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

WLAN Module Market Insights

The increasing demand for WLAN modules across various industries, including research, automotive, commercial, and home appliances, is expected to drive significant market growth during the forecast period. The rising adoption of cloud computing and telecommunications, along with advancements in home and enterprise applications, is influencing consumer development. For instance, according to the Telecom Regulatory Authority of India’s Indian Telecom Services Performance Indicators, India’s tele-density, representing the number of telephones per 100 people, reached 84.15% as of March 31, 2023, marking a nearly 10% increase since March 2014. The telecom sector is a vital component of the Indian economy, contributing 6.5% to the nation’s GDP. The integration of IoT and automation necessitates compact, high-performance modules, further boosting the demand for Wi-Fi modules during this period. For instance, The Institute of Electrical and Electronics Engineers (IEEE) Xplore reported the development of a factory automation WLAN system that is compatible with asynchronous industrial Ethernet. This indicates advancements in connecting wireless technologies with industrial Ethernet protocols, which are widely used for automation and real-time communication in industrial environments. However, market growth may be hindered by heightened concerns over privacy and security. Nevertheless, ongoing efforts by companies to enhance R&D activities and explore new applications are anticipated to create lucrative growth opportunities in the market.

Smart city initiatives have significantly boosted construction activities for infrastructure vendors and service providers. Policies and environmental strategies have prioritized innovative approaches centered on computational modules for designing and developing urban infrastructure. The successful implementation of smart city programs heavily depends on technologies such as electronic communications, cloud computing, automation, and IoT sensors, which serve as the foundation for advanced urban projects. For instance, IMD Organization states that cities are rapidly becoming "smart," transforming daily life. In Singapore, smart traffic cameras adjust traffic based on volume, improving commutes. Kaunas, Lithuania, automatically deducts parking fees from drivers’ bank accounts. Many cities now provide precise bus schedules at each stop, and free WiFi is available in cities like Buenos Aires and Ramallah. Rapid technological advancements in recent years have enhanced interconnectivity, fostering the creation of more intelligent and integrated ecosystems.

WLAN Module Market Segmentation

The worldwide market for WLAN Module is split based on type, application, and geography.

WLAN Module Market By Type

- Wi-Fi Modules for Routers/Access Points

- Embedded Wi-Fi Modules

According to the WLAN Module industry analysis, embedded Wi-Fi modules are used in IoT applications, smart devices, and industrial automation. Their compact size, ease of integration, and ability to support high-performance connectivity make them highly suitable for smart home devices, healthcare equipment, and automotive applications. The growing demand for connected devices across various sectors further strengthens their market position. Furthermore, Wi-Fi modules for routers and access points play a crucial role in enabling high-speed wireless connectivity for enterprise and residential networks. Their demand is driven by the increasing need for reliable internet access and expanding network infrastructures globally.

WLAN Module Market By Application

- Smart Grid & Smart Appliances

- Handheld Mobile Devices

- Medical, Industrial Testing & Monitoring Instruments

- Routers

- Smart Home Devices

- Industrial IoT (IIoT)

- Automotive

According to the WLAN module industry analysis, smart grid and smart appliances are key drivers in industry due to their increasing reliance on wireless communication for real-time data transfer and automation. Smart grids utilize WLAN modules to enable efficient energy management, monitoring, and distribution. Similarly, smart appliances integrate WLAN technology to provide remote control, monitoring, and seamless connectivity with other devices in a smart home ecosystem. This growing demand for connected solutions fuels the expansion of WLAN module applications, making them essential for both energy management and consumer convenience.

WLAN Module Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

WLAN Module Market Regional Analysis

For several reasons, the Asia-Pacific region dominates in the WLAN module market, fueled by increasing urbanization and smart city initiatives across countries like China, India, and Japan. For instance, according to Center for Strategic and International Studies (CSIS), China is promoting the adoption of smart city infrastructure throughout Africa, with investments in areas such as traffic management, energy-efficient building technologies, waste and water management, and advanced healthcare systems. Furthermore, government supports for digitalization and the growing adoption of IoT in industries and households make Asia-Pacific a high-potential market.

North America experiencing robust growth due to its well-established technology infrastructure and high adoption of advanced connectivity solutions. The region’s strong presence of key market players and significant investments in IoT and smart home technologies further drive market growth. For instance, in October 2022, Roku partnered with Walmart to introduce a new range of smart home devices, such as video doorbells, plugs, security cameras, and lighting solutions. This collaboration facilitated Roku's business growth by deploying its smart devices in 3,500 Walmart stores across the U.S. Additionally, widespread implementation of WLAN modules in industrial automation and enterprise applications contributes to the region's leadership.

WLAN Module Market Players

Some of the top WLAN module companies offered in our report include Zcomax Technologies, Panasonic, Fujitsu, Advantech, Vishay, LG, ZYGO, Lesswire, HY-LINE, Cisco, WhizNets, Alps, Sollae Systems, and Intel.

Frequently Asked Questions

How big is the WLAN Module market?

The WLAN module market size was valued at USD 51.2 billion in 2023.

What is the CAGR of the global WLAN Module market from 2024 to 2032?

The CAGR of WLAN module is 14.2% during the analysis period of 2024 to 2032.

Which are the key players in the WLAN Module market?

The key players operating in the global market are including Zcomax Technologies, Panasonic, Fujitsu, Advantech, Vishay, LG, ZYGO, Lesswire, HY-LINE, Cisco, WhizNets, Alps, Sollae Systems, and Intel.

Which region dominated the global WLAN Module market share?

Asia-Pacific held the dominating position in WLAN module industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of WLAN module during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global WLAN Module industry?

The current trends and dynamics in the WLAN Module industry include growing demand for IoT-enabled devices across various industries, increasing adoption of smart home and smart city technologies, and rising internet penetration and expansion of high-speed wireless networks

Which application held the maximum share in 2023?

The smart grid & smart appliances expected to hold the maximum share of the WLAN module industry.