Edge Computing Technology Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Edge Computing Technology Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

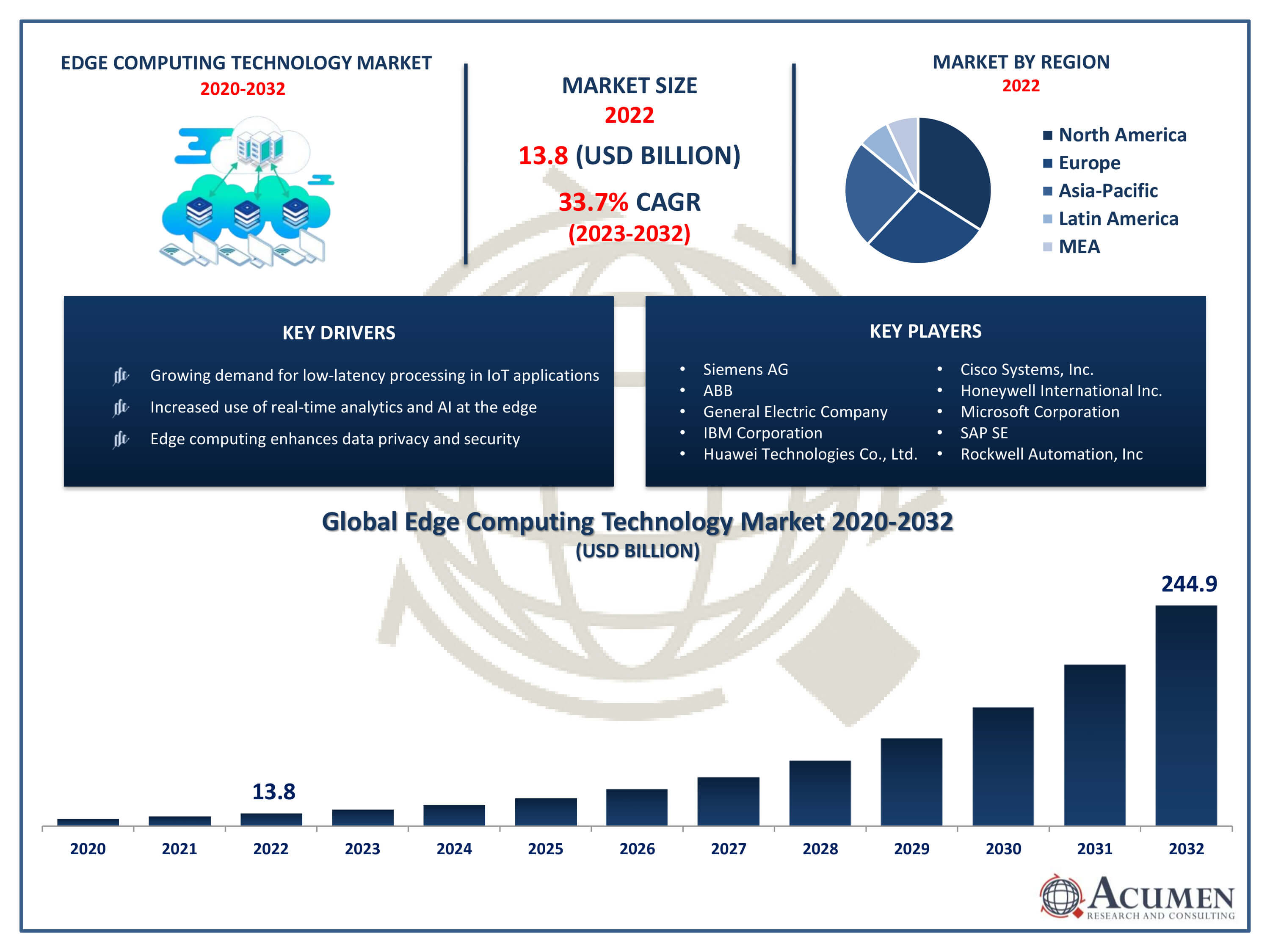

The Global Edge Computing Technology Market Size accounted for USD 13.8 Billion in 2022 and is projected to achieve a market size of USD 244.9 Billion by 2032 growing at a CAGR of 33.7% from 2023 to 2032.

Edge Computing Technology Market Highlights

- Global Edge Computing Technology Market revenue is expected to increase by USD 244.9 Billion by 2032, with a 33.7% CAGR from 2023 to 2032

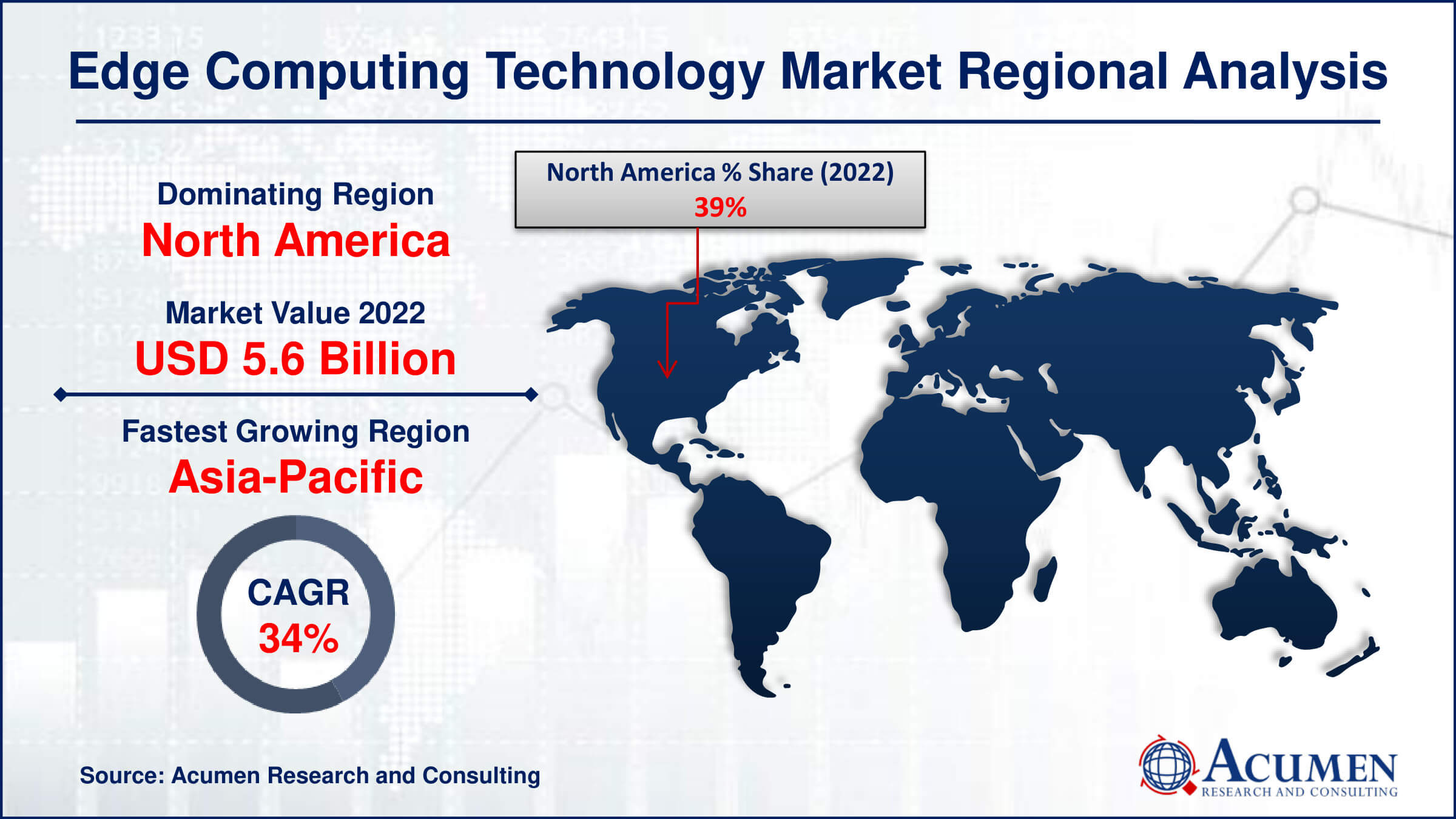

- North America region led with more than 39% of Edge Computing Technology Market share in 2022

- Asia-Pacific Edge Computing Technology Market growth will record a CAGR of more than 34.3% from 2023 to 2032

- By application, the IIoT segment captured more than 29% of revenue share in 2022.

- By industry verticals, the manufacturing segment is anticipated to grow at a remarkable CAGR of 34.1% between 2023 and 2032

- Increasing demand for automation and Growing number of litigations in the legal industry, drives the Edge Computing Technology Market value

Edge computing is a decentralized computing paradigm that brings computational capabilities closer to the data source or "edge" of the network, rather than relying on a centralized cloud infrastructure. This approach aims to reduce latency, enhance real-time processing, and alleviate bandwidth constraints by performing data processing and analysis closer to where it is generated. Edge computing is particularly relevant in scenarios where low-latency and real-time processing are critical, such as in the Internet of Things (IoT), autonomous vehicles, and industrial automation.

The market for edge computing has been experiencing significant growth in recent years, driven by the increasing demand for faster and more efficient data processing. As the number of connected devices continues to rise and applications requiring low-latency responses become more prevalent, edge computing is becoming an integral part of the technology landscape. The market growth is fueled by industries like healthcare, manufacturing, retail, and telecommunications, which are leveraging edge computing to improve operational efficiency and deliver enhanced user experiences. Edge computing is expected to play a crucial role in the evolution of technology ecosystems, offering a distributed computing model that complements traditional cloud computing and addresses the evolving needs of diverse applications and industries.

Global Edge Computing Technology Market Trends

Market Drivers

- Growing demand for low-latency processing in IoT applications

- Increased use of real-time analytics and AI at the edge

- Edge computing enhances data privacy and security

- Escalating adoption of edge computing in autonomous vehicles for real-time decision-making

Market Restraints

- Infrastructure challenges in deploying and managing edge computing

- Concerns about standardization and interoperability

Market Opportunities

- Expansion of 5G networks enabling faster edge computing capabilities.

- Rise in edge-native applications and services

Edge Computing Technology Market Report Coverage

| Market | Edge Computing Technology Market |

| Edge Computing Technology Market Size 2022 | USD 13.8 Billion |

| Edge Computing Technology Market Forecast 2032 | USD 244.9 Billion |

| Edge Computing Technology Market CAGR During 2023 - 2032 | 33.7% |

| Edge Computing Technology Market Analysis Period | 2020 - 2032 |

| Edge Computing Technology Market Base Year |

2022 |

| Edge Computing Technology Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Component, By Application, By Industry Verticals, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Amazon Web Services (AWS), Inc., Siemens AG, ABB, General Electric Company, IBM Corporation, Huawei Technologies Co., Ltd., Cisco Systems, Inc., Honeywell International Inc., Microsoft Corporation, SAP SE, Rockwell Automation, Inc, and Intel Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Unlike traditional cloud computing, where data is sent to a centralized server for analysis, edge computing processes data locally, at or near the source of data generation. This approach is particularly valuable in scenarios where low-latency responses are critical, such as in the Internet of Things (IoT), autonomous vehicles, and industrial automation. By moving computation closer to the edge of the network, edge computing minimizes the time it takes for data to travel, enabling quicker decision-making and more efficient use of network resources. The applications of edge computing span various industries and use cases. In IoT, edge computing allows for real-time data processing, making it ideal for applications like smart homes, wearable devices, and connected industrial machinery. In autonomous vehicles, edge computing enables rapid analysis of sensor data for immediate decision-making, enhancing safety and performance.

The edge computing technology market has been experiencing robust growth, driven by the increasing demand for low-latency processing, real-time analytics, and decentralized computing capabilities. As more devices become connected to the internet and generate vast amounts of data, there is a growing need to process and analyze this data closer to its source. Edge computing addresses this demand by bringing computation capabilities to the edge of the network, reducing latency and improving the efficiency of data processing. Industries such as manufacturing, healthcare, and transportation are leveraging edge computing to enhance operational efficiency, enable faster decision-making, and support emerging technologies like IoT and autonomous vehicles. The market growth is further accelerated by the expansion of 5G infrastructure market, enabling faster and more reliable connectivity that complements the capabilities of edge computing.

Edge Computing Technology Market Segmentation

The global Edge Computing Technology Market segmentation is based on component, application, industry verticals, and geography.

Edge Computing Technology Market By Component

- Hardware

- Sensors

- Nodes

- Others

- Software

- Service

- Support & Maintenance

- Training & Education

According to the edge computing technology industry analysis, the hardware segment accounted for the largest market share in 2022. Edge computing hardware encompasses a variety of components, including edge servers, gateways, edge devices, and sensors. One of the key drivers of this growth is the need for high-performance computing at the edge to handle the increasing volume of data generated by IoT devices and other edge applications. The deployment of edge servers and gateways closer to the data source enables faster processing, reduced latency, and improved overall system performance. Moreover, the advent of edge-optimized processors and accelerators has further fueled hardware segment growth. These specialized processors are designed to handle the unique requirements of edge workloads, such as real-time analytics and AI processing. The demand for robust, energy-efficient, and compact hardware solutions has prompted innovations from hardware manufacturers, driving the development of edge-specific hardware that can operate in diverse environments, including edge devices in industrial settings or on the edge of 5G networks.

Edge Computing Technology Market By Application

- IIoT

- Content Delivery

- Remote Monitoring

- AR/VR

- Video Analytics

- Others

In terms of applications, the Industrial Internet of Things (IIoT) segment is expected to witness significant growth in the coming years. IIoT involves the integration of sensors, devices, and machinery in industrial processes, generating vast amounts of data that require quick and localized processing for real-time insights. Edge computing plays a crucial role in addressing the unique requirements of IIoT by enabling data processing at the source, reducing latency and ensuring timely actions in response to critical events. One key factor contributing to the growth of the IIoT segment in the edge computing market is the rising adoption of edge analytics and machine learning algorithms. These technologies allow industrial organizations to extract actionable insights directly from the data generated by sensors and devices, facilitating predictive maintenance, quality control, and process optimization. As industries continue to embrace IIoT for improved operational visibility and control, the demand for edge computing solutions tailored to industrial use cases is poised for significant growth.

Edge Computing Technology Market By Industry Verticals

- BFSI

- IT & Telecom

- Utility

- Manufacturing

- Retail

- Healthcare

- Government

- Others

According to the edge computing technology market forecast, the manufacturing segment is expected to witness significant growth in the coming years. Edge computing is playing a pivotal role in addressing the unique challenges of the manufacturing environment, where real-time data processing, low-latency analytics, and reliable connectivity are crucial. By deploying edge computing solutions within manufacturing facilities, organizations can enhance production processes, optimize supply chain management, and improve overall operational efficiency. One key driver of edge computing growth in the manufacturing segment is the increasing integration of Industrial Internet of Things (IIoT) devices. These devices, including sensors and actuators, generate vast amounts of data that can be processed at the edge to enable real-time monitoring and decision-making. Edge computing also facilitates predictive maintenance, reducing downtime and enhancing the overall equipment effectiveness (OEE) in manufacturing plants.

Edge Computing Technology Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Edge Computing Technology Market Regional Analysis

North America has emerged as a dominant force in the edge computing technology market, showcasing robust growth driven by a confluence of factors. The region's leadership can be attributed to the presence of established technology giants, a thriving ecosystem of startups, and a proactive approach toward adopting emerging technologies. The United States, in particular, has been a key contributor to North America's dominance, boasting a highly developed IT infrastructure and a culture of innovation that has propelled the rapid adoption of edge computing solutions across various industries. One of the primary reasons for North America's leadership in the edge computing technology market is the region's early recognition of the potential benefits offered by edge computing. Industries such as healthcare, finance, manufacturing, and telecommunications in North America have been quick to leverage edge computing for low-latency processing, real-time analytics, and improved overall system performance. The dynamic nature of the technology landscape in North America, coupled with significant investments in research and development, has positioned the region at the forefront of innovation, driving the development and deployment of cutting-edge edge computing solutions.

Edge Computing Technology Market Player

Some of the top edge computing technology market companies offered in the professional report include Amazon Web Services (AWS), Inc., Siemens AG, ABB, General Electric Company, IBM Corporation, Huawei Technologies Co., Ltd., Cisco Systems, Inc., Honeywell International Inc., Microsoft Corporation, SAP SE, Rockwell Automation, Inc, and Intel Corporation.

Frequently Asked Questions

How big is the edge computing technology market?

The edge computing technology market size was USD 13.8 Billion in 2022.

What is the CAGR of the global edge computing technology market from 2023 to 2032?

The CAGR of edge computing technology is 33.7% during the analysis period of 2023 to 2032.

Which are the key players in the edge computing technology market?

The key players operating in the global market are including Amazon Web Services (AWS), Inc., Siemens AG, ABB, General Electric Company, IBM Corporation, Huawei Technologies Co., Ltd., Cisco Systems, Inc., Honeywell International Inc., Microsoft Corporation, SAP SE, Rockwell Automation, Inc, and Intel Corporation.

Which region dominated the global edge computing technology market share?

North America held the dominating position in edge computing technology industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of edge computing technology during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global edge computing technology industry?

The current trends and dynamics in the edge computing technology industry include growing demand for low-latency processing in IoT applications, and increased use of real-time analytics and AI at the edge.

Which application held the maximum share in 2022?

The industrial internet of things (IIoT) application held the maximum share of the edge computing technology industry.