Aviation Cyber Security Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Aviation Cyber Security Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

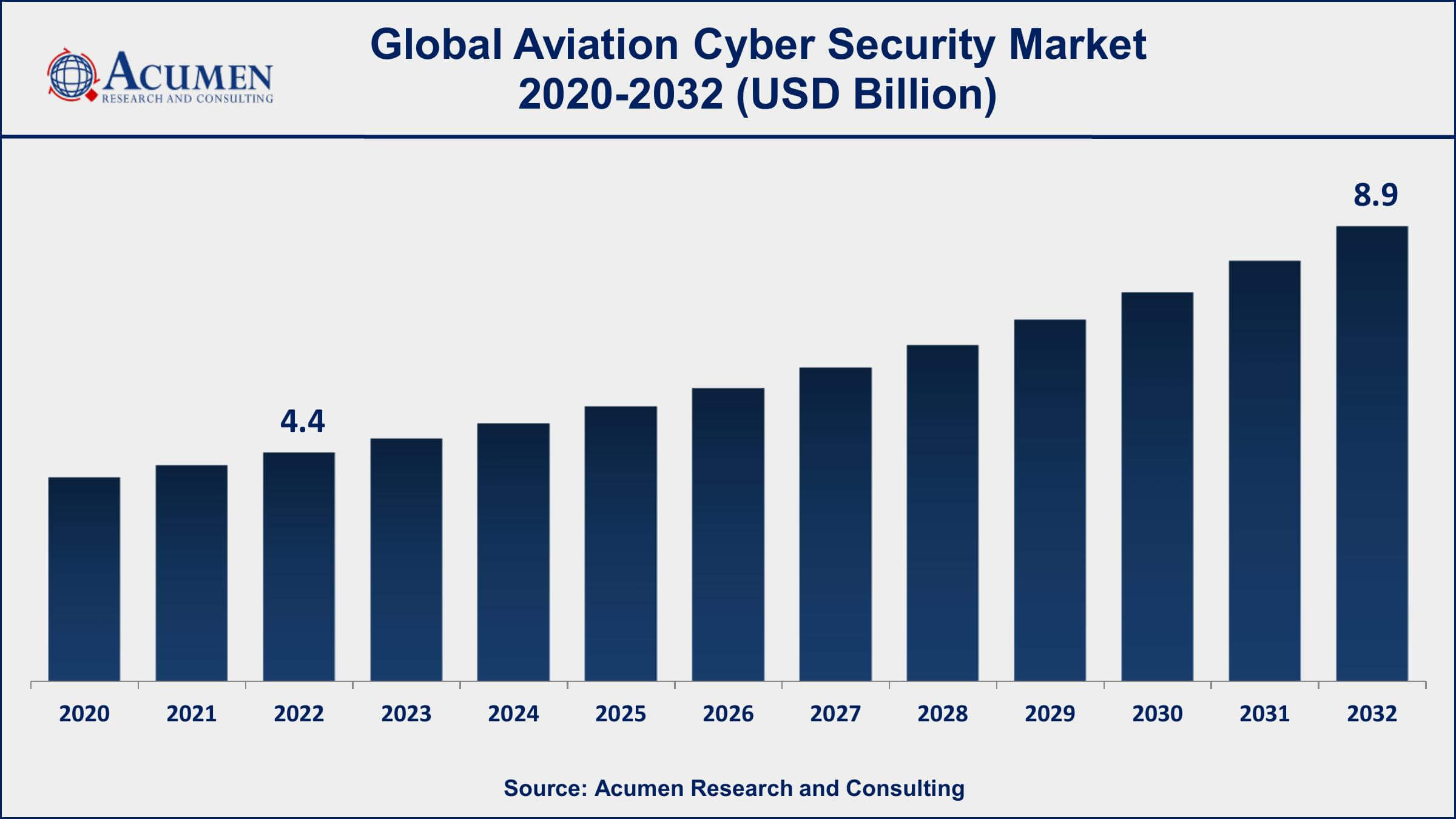

The Global Aviation Cyber Security Market Size accounted for USD 4.4 Billion in 2022 and is projected to achieve a market size of USD 8.9 Billion by 2032 growing at a CAGR of 7.2% from 2023 to 2032.

Aviation Cyber Security Market Highlights

- Global Aviation Cyber Security Market revenue is expected to increase by USD 8.9 Billion by 2032, with a 7.2% CAGR from 2023 to 2032

- According to a research study, the global commercial fleet is to reach 40,000 aircraft by 2030 with 21,000 new deliveries, marking a 3.4% CAGR

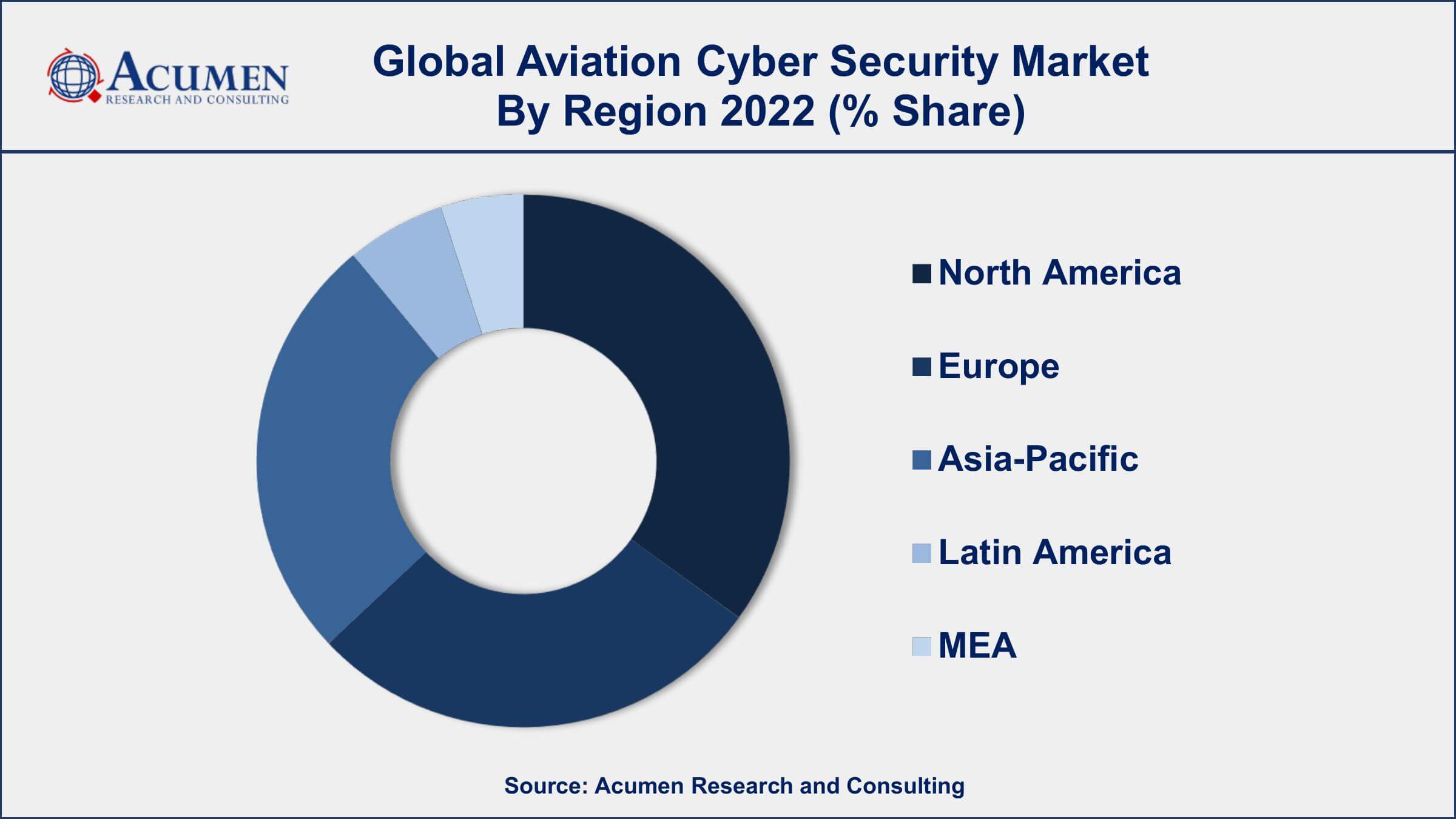

- North America region led with more than 43% of Aviation Cyber Security Market share in 2022

- Asia-Pacific Aviation Cyber Security Market growth will record a CAGR of around 5.3% from 2023 to 2032

- By deployment types, the cloud-based segment is expected to expand at the biggest CAGR of 7.9% from 2023 to 2032

- Increasing frequency and sophistication of cyber-attacks targeting the aviation industry, drives the Aviation Cyber Security Market value

Aviation cyber security refers to the measures and technologies implemented to protect critical aviation infrastructure, systems, and data from cyber threats. With the increasing reliance on digital technologies in the aviation industry, including aircraft communication systems, air traffic control systems, and passenger information databases, the potential risks and vulnerabilities have also risen. The aviation sector faces numerous cyber threats, including data breaches, network intrusions, ransomware attacks, and intellectual property theft. Effective aviation cyber security involves implementing robust security protocols, threat intelligence, encryption, intrusion detection and prevention systems, and regular security audits to safeguard against cyber attacks.

The market for aviation cyber security has experienced significant growth in recent years, driven by the rising awareness of cyber threats and the increasing adoption of digital technologies in aviation operations. The aviation industry's digital transformation, with the integration of Internet of Things (IoT) devices, cloud computing, and connectivity solutions, has expanded the attack surface of potential cyber attacks. As a result, aviation companies, airports, and airlines are investing heavily in cyber security solutions to protect their critical systems and data. Additionally, regulatory bodies and industry associations are imposing stricter security standards and guidelines to ensure the resilience of aviation infrastructure against cyber threats.

Global Aviation Cyber Security Market Trends

Market Drivers

- Increasing frequency and sophistication of cyber attacks targeting the aviation industry

- Growing adoption of digital technologies and connectivity solutions in aviation operations

- Rising awareness of the potential impact of cyber threats on passenger safety and operational integrity

- Growing investments in aviation infrastructure and the need to protect critical systems and data

Market Restraints

- Complex and diverse aviation systems and infrastructure, make cyber security implementation challenging

- Lack of skilled cyber security professionals with expertise in aviation-specific threats and vulnerabilities

Market Opportunities

- Rising demand for cloud-based and managed security services in the aviation sector

- Demand for real-time threat intelligence and predictive analytics to proactively identify and mitigate cyber risks in aviation

Aviation Cyber Security Market Report Coverage

| Market | Aviation Cyber Security Market |

| Aviation Cyber Security Market Size 2022 | USD 4.4 Billion |

| Aviation Cyber Security Market Forecast 2032 | USD 8.9 Billion |

| Aviation Cyber Security Market CAGR During 2023 - 2032 | 7.2% |

| Aviation Cyber Security Market Analysis Period | 2020 - 2032 |

| Aviation Cyber Security Market Base Year | 2022 |

| Aviation Cyber Security Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Solution Type, By Deployment Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Airbus CyberSecurity, Boeing Defense, Space & Security, BAE Systems, Leonardo S.p.A., Raytheon Technologies Corporation, Honeywell International Inc., Thales Group, Harris Corporation (now part of L3Harris Technologies), Northrop Grumman Corporation, Lockheed Martin Corporation, IBM Security, and Cisco Systems, Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Aviation cyber security is the practice of protecting aviation systems, networks, and data from cyber threats and attacks. It involves implementing robust security measures, protocols, and technologies to safeguard critical infrastructure, aircraft systems, air traffic control systems, passenger information, and other sensitive data. With the increasing digitization and interconnectedness of aviation systems, the risk of cyber attacks has grown significantly. Aviation cyber security aims to prevent unauthorized access, data breaches, disruption of services, and other malicious activities that can jeopardize the safety, reliability, and integrity of aviation operations.

The application of aviation cyber security is wide-ranging and covers various aspects of the aviation industry. One of the primary applications is the protection of flight control systems, avionics, and communication networks. These systems are critical for the safe operation of aircraft, and any compromise in their security can have severe consequences. Aviation cyber security also extends to airport infrastructure, including air traffic management systems, baggage handling systems, passenger screening systems, and airport information networks. Ensuring the integrity and security of these systems is essential to maintain the smooth functioning of airports and to prevent disruptions and potential risks to passengers and personnel.

The aviation cyber security market has witnessed significant growth and is expected to continue expanding in the coming years. The increasing digitization and connectivity of aviation systems, coupled with the rising frequency and sophistication of cyber threats, have propelled the demand for robust cyber security solutions in the aviation sector. The market is driven by factors such as the need to protect critical infrastructure, compliance with stringent regulations, and the growing awareness of cyber risks in the industry. Additionally, advancements in technologies like AI, ML, and behavioral analytics are empowering aviation cyber security solutions to detect and respond to threats in real-time, further driving market growth.

Aviation Cyber Security Market Segmentation

The global Aviation Cyber Security Market segmentation is based on solution type, deployment type, application, and geography.

Aviation Cyber Security Market By Solution Type

- Threat Intelligence and Response

- Data Loss Prevention

- Identity and Access Management

- Managed Security

- Security and Vulnerability Management

- Others

According to the aviation cyber security industry analysis, the threat intelligence and response segment accounted for the largest market share in 2022. As the aviation industry becomes more interconnected and digitized, the attack surface for potential cyber threats expands. This has led to a rising demand for advanced threat intelligence and response capabilities in the aviation sector. Organizations are investing in technologies that leverage AI, ML, and big data analytics to gather and analyze vast amounts of security-related information from diverse sources. These solutions help aviation companies identify potential vulnerabilities, detect anomalous activities, and respond effectively to cyber incidents. The growing adoption of these technologies, coupled with the collaboration between industry stakeholders and cyber security vendors, is fueling the growth of the threat intelligence and response segment in the aviation cyber security market.

Aviation Cyber Security Market By Deployment Type

- Cloud-Based

- On-Premises

In terms of deployment types, the cloud-based segment is expected to witness significant growth in the coming years. Cloud-based cyber security solutions offer numerous advantages, including scalability, flexibility, cost-effectiveness, and centralized management. These factors have led to a rising demand for cloud-based security services in the aviation industry, where the need for robust protection of critical systems, data, and applications is paramount. One key driver of the growth of the cloud-based segment is the expanding adoption of cloud infrastructure and services in the aviation sector. The aviation industry is leveraging cloud computing to streamline operations, enhance data storage and processing capabilities, and facilitate collaboration across different locations. Cloud-based cyber security solutions provide the ability to secure these cloud environments, protecting against threats such as data breaches, unauthorized access, and malware attacks.

Aviation Cyber Security Market By Application

- Airline Management

- Airport Management

- Air Cargo Management

- Air Traffic Control Management

According to the aviation cyber security market forecast, the airline management segment is expected to witness significant growth in the coming years. Airline management systems encompass various critical functions, including flight operations, passenger reservations, cargo management, and maintenance. The digitization and interconnectedness of these systems create potential vulnerabilities that cyber criminals can exploit. As a result, airlines are increasingly investing in robust cyber security solutions to safeguard their operations and maintain the trust of passengers. One of the key drivers for the growth of the airline management segment is the increasing adoption of digital technologies and the integration of airline systems with the Internet of Things (IoT). These advancements enable real-time data sharing, automation, and connectivity across different airline functions.

Aviation Cyber Security Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Aviation Cyber Security Market Regional Analysis

Geographically, North America is dominating the aviation cyber security market in 2022. North America has a robust and technologically advanced aviation industry, with a significant presence of major airlines, airports, and aviation infrastructure. This region is home to some of the world's busiest airports and hosts a large number of air travel operations. As a result, the aviation sector in North America is a prime target for cyber attacks, prompting a strong emphasis on cyber security measures and solutions. The awareness of cyber threats and the potential impact on passenger safety and operational integrity has driven significant investments in cyber security within the region. Moreover, North America has a well-established and mature cyber security ecosystem. The region is known for its strong technological capabilities, extensive research and development activities, and a large pool of skilled cyber security professionals. This ecosystem fosters the development and adoption of innovative cyber security solutions specifically tailored for the aviation industry. North American cyber security vendors have been at the forefront of providing advanced technologies and services to protect critical aviation infrastructure and systems. Their expertise and experience in addressing cyber threats in the aviation sector have contributed to the dominance of North America in the aviation cyber security market.

Aviation Cyber Security Market Player

Some of the top aviation cyber security market companies offered in the professional report include Airbus CyberSecurity, Boeing Defense, Space & Security, BAE Systems, Leonardo S.p.A., Raytheon Technologies Corporation, Honeywell International Inc., Thales Group, Harris Corporation (now part of L3Harris Technologies), Northrop Grumman Corporation, Lockheed Martin Corporation, IBM Security, and Cisco Systems, Inc.

Frequently Asked Questions

What was the market size of the global aviation cyber security in 2022?

The market size of aviation cyber security was USD 4.4 Billion in 2022.

What is the CAGR of the global aviation cyber security market from 2023 to 2032?

The CAGR of Aviation Cyber Security is 7.2% during the analysis period of 2023 to 2032.

Which are the key players in the aviation cyber security market?

The key players operating in the global market are including Airbus Cyber Security, Boeing Defense, Space & Security, BAE Systems, Leonardo S.p.A., Raytheon Technologies Corporation, Honeywell International Inc., Thales Group, Harris Corporation (now part of L3Harris Technologies), Northrop Grumman Corporation, Lockheed Martin Corporation, IBM Security, and Cisco Systems, Inc.

Which region dominated the global aviation cyber security market share?

North America held the dominating position in aviation cyber security industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of aviation cyber security during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global aviation cyber security industry?

The current trends and dynamics in the aviation cyber security industry include increasing frequency and sophistication of cyber attacks targeting the aviation industry, and growing adoption of digital technologies and connectivity solutions in aviation operations.

Which deployment type held the maximum share in 2022?

The on-premises deployment type held the maximum share of the aviation cyber security industry.