Cloud Computing Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Cloud Computing Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

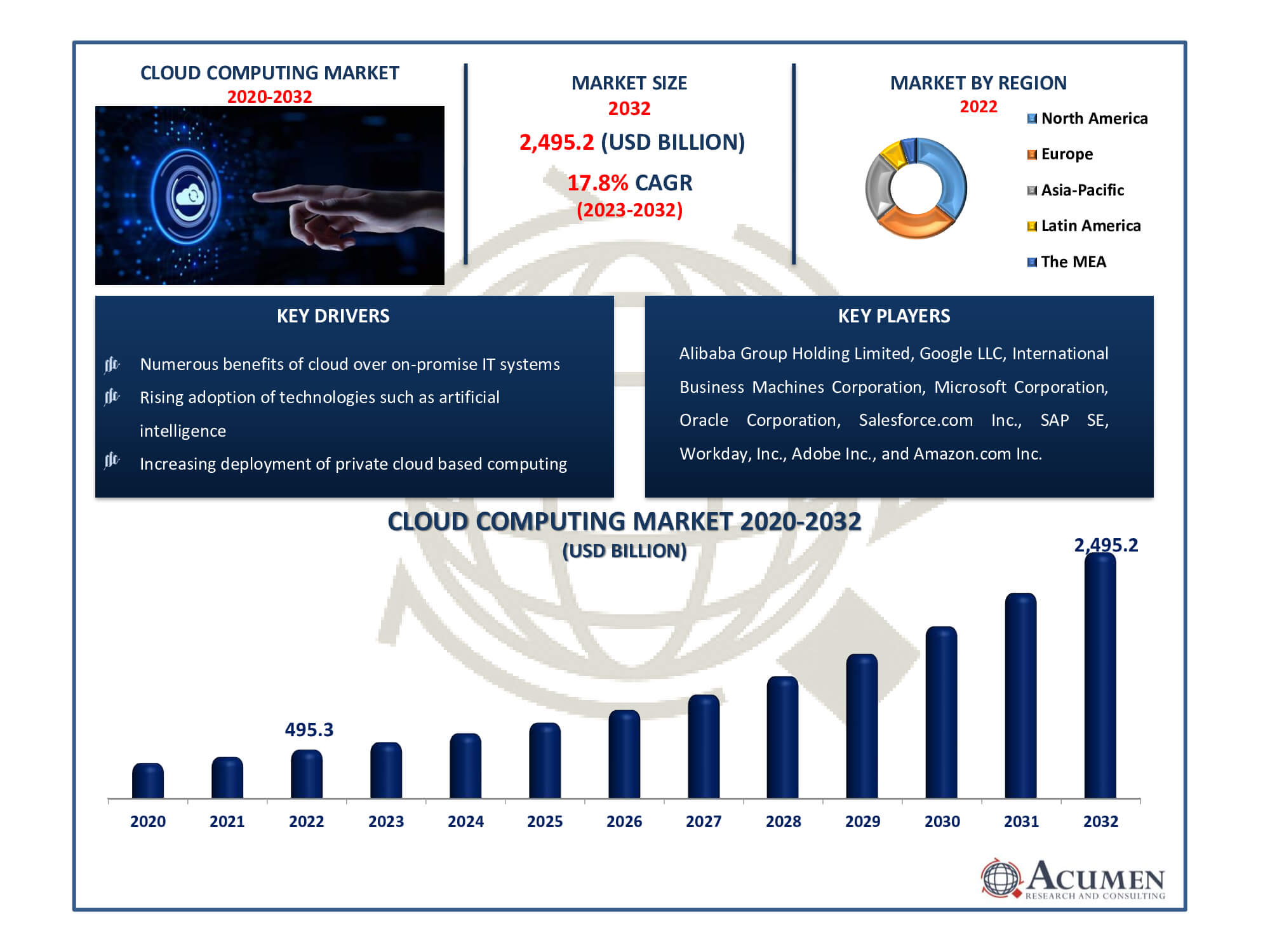

The Global Cloud Computing Market Size accounted for USD 495.3 Billion in 2022 and is estimated to achieve a market size of USD 2,495.2 Billion by 2032 growing at a CAGR of 17.8% from 2023 to 2032.

Cloud Computing Market Highlights

- Global cloud computing market revenue is poised to garner USD 2,495.2 Billion by 2032 with a CAGR of 17.8% from 2023 to 2032

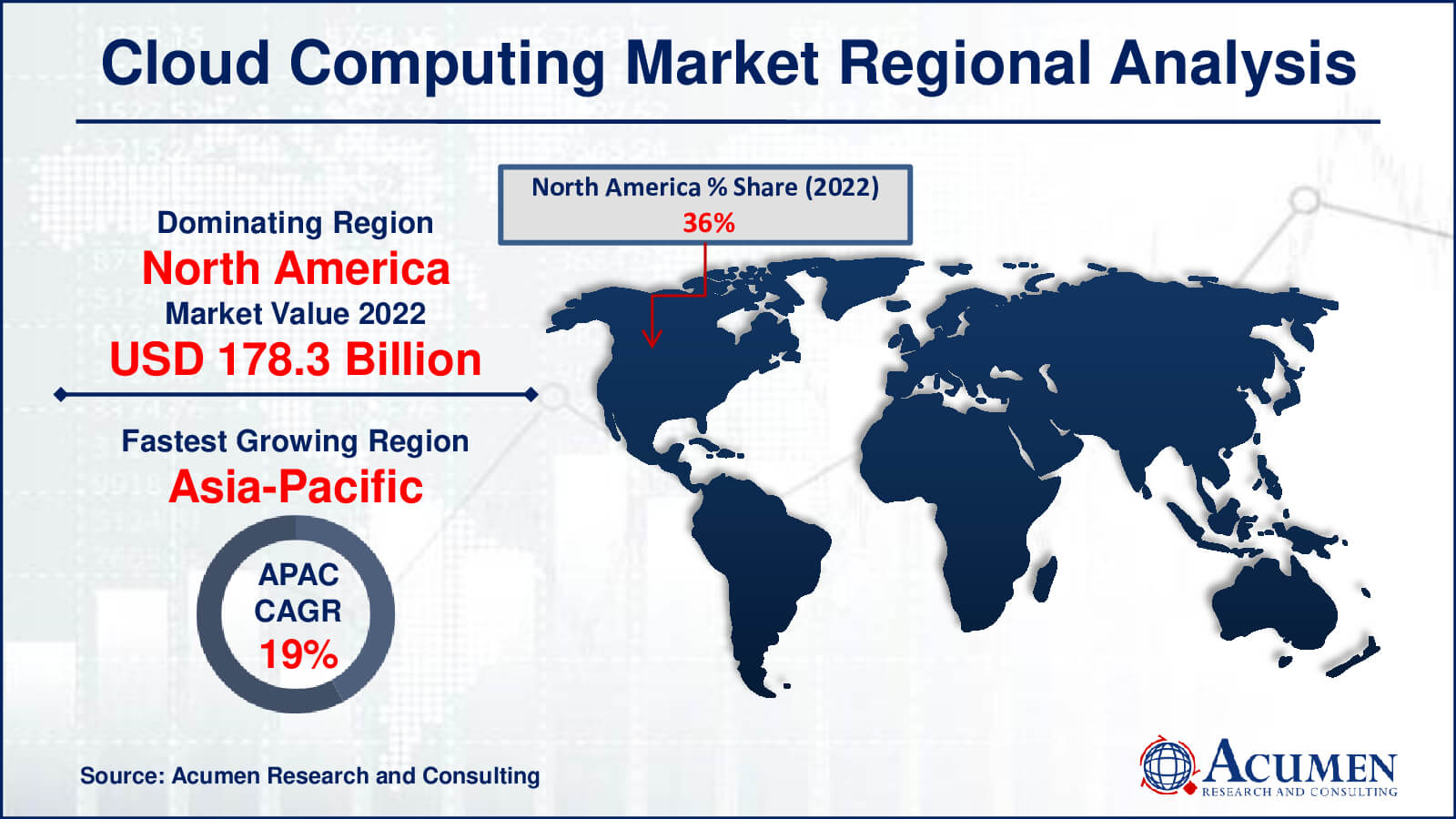

- North America cloud computing market value occupied around USD 178.3 billion in 2022

- Asia-Pacific cloud computing market growth will record a CAGR of more than 19% from 2023 to 2032

- Among service, the software as a service (PaaS) sub-segment generated over US$ 257.5 billion revenue in 2022

- Based on type, the private cloud sub-segment generated around 46% share in 2022

- Rapid shift toward automation and agility is a popular market trend that fuels the industry demand

Cloud computing has emerged as a trending technology in educational institutions, corporate industries, organizations, and various other sectors. It allows users to access platforms, infrastructure, or software of their choice through any network. The advancements in cloud computing security and its cost-effectiveness have encouraged widespread adoption. Cloud computing eliminates the need for significant capital expenses associated with purchasing software and services and maintaining on-site data centers. The cloud computing market is exploding due to its ability to revolutionize data management and IT infrastructure. It provides a scalable, on-demand model that eliminates operational complications while increasing agility. This market is characterized by fierce competition, with tech behemoths such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud ruling the roost. As organizations seek new solutions to remain competitive in the digital age, the cloud computing market is poised to continue its spectacular growth, impacting the future of IT services and data management across a wide range of industries.

Global Cloud Computing Market Dynamics

Market Drivers

- Numerous benefits of cloud over on-promise IT systems

- Rising adoption of technologies such as artificial intelligence, machine learning, 5G, and IoT

- Personalized customer experience

- Increasing deployment of private cloud based computing

Market Restraints

- Data security and privacy concerns

- Issues associated with cloud-based computing

Market Opportunities

- Rising demand for AI and IoT

- Increasing adoption of technologies such as artificial intelligence, machine learning, 5G, and IoT

Cloud Computing Market Report Coverage

| Market | Cloud Computing Market |

| Cloud Computing Market Size 2022 | USD 495.3 Billion |

| Cloud Computing Market Forecast 2032 | USD 2,495.2 Billion |

| Cloud Computing Market CAGR During 2023 - 2032 | 17.8% |

| Cloud Computing Market Analysis Period | 2020 - 2032 |

| Cloud Computing Market Base Year |

2022 |

| Cloud Computing Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Service, By Type, By Enterprise Size, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Alibaba Group Holding Limited, Google LLC, International Business Machines Corporation, Microsoft Corporation, Oracle Corporation, Salesforce.com Inc., SAP SE, Workday, Inc., Adobe Inc., and Amazon.com Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Cloud Computing Market Insights

Cloud computing offers a cost-effective solution, allowing users to access infrastructure, platforms, or private cloud hybrid cloud from their preferred locations. It simplifies data management, storage, and processing, contributing to its global market growth. However, challenges persist due to limited awareness among the general population about cloud-based technology. Additionally, small and medium-sized enterprises (SMEs) often prioritize traditional data storage methods due to perceived security concerns. Despite these challenges, the cloud computing market is expected to flourish in the coming years, driven by significant investments from the corporate sector and the growing popularity of cloud technology, especially among the younger generation.

Persistent data security issues are a major impediment in the cloud computing market. When shifting to the cloud, organizations, particularly those in sensitive industries, are concerned about data breaches and privacy risks. Building trust among potential users and unlocking the full potential of cloud adoption requires ensuring effective security measures and resolving these issues.

Extending cloud hybrid cloud into emerging markets is an opportunity. As technology advances and digitization increases in these locations, there is an increasing demand for cloud-based solutions. Cloud providers can tap into new customer bases and promote market growth by adapting products to match the specific needs and difficulties of these markets.

Cloud Computing Market Segmentation

The worldwide market for cloud computing is split based on service, type, enterprise size, end-user, and geography.

Cloud Computing Services

- Platform as a Service (PaaS)

- Infrastructure as a Service (IaaS)

- Private Cloud as a Service (SaaS)

The private cloud as a service (SaaS) segment is the largest in the cloud computing industry due to its accessibility and variety. SaaS provides cloud-based private cloud applications that are ready to use, reducing the need for customers to manage infrastructure or private cloud updates. This simplicity, combined with its low cost and ease of setup, appeals to a wide spectrum of users, from individuals to businesses. Moreover, The second largest market is Infrastructure as a Service (IaaS), which provides scalable virtualized computer resources. IaaS enables businesses to manage their infrastructure without incurring the cost and complexity of real public cloud. This adaptability appeals to enterprises wishing to modify their IT systems to unique requirements, making IaaS a key participant in the cloud computing market.

Cloud Computing Types

- Public Cloud

- Private Cloud

- Hybrid Cloud

- Community Cloud

The Private Cloud category is the largest in the cloud computing industry because to its dedication and security. Private clouds are appropriate for businesses that have stringent data security and regulatory needs. They provide exclusive usage of resources, ensuring that data remains under the control of the organisation. Because of this level of protection and control, private clouds are favoured by industries such as finance and healthcare. In additionally the second largest category is expected to the public cloud, which provides scalability and cost-effectiveness. Public clouds are widely available to a diverse range of customers and are frequently used for general-purpose computing and cost savings.

Cloud Computing Enterprise Sizes

- Large Enterprises

- Small & Medium Enterprises

As per the cloud computing market forecast, large enterprises are expected to dominate the industry from 2023 to 2032. Several reasons contribute to this supremacy. For starters, large organisations have huge IT budgets, allowing them to spend heavily in cloud services. Second, they frequently have complex IT infrastructures that benefit from the scalability and flexibility provided by cloud solutions. Furthermore, large organizations often prioritise digital transformation and innovation, which cloud computing enables. Finally, these organisations can afford specialised cloud solutions suited to their individual needs, such as private and hybrid clouds. As a result, major organizations fuel market demand for and growth in cloud computing services.

Cloud Computing End-Users

- BFSI

- IT & Telecom

- Retail & Consumer Goods

- Manufacturing

- Energy & Utilities

- Healthcare

- Media & Entertainment

- Government & Public Sector

- Others

In the cloud computing market, the IT & Telecom sector is the anitipate to the largest end-user segment. The industry's substantial reliance on cloud technologies for data storage, processing, and administration is ascribed to its dominance. Cloud services enable IT and telecom organisations to improve agility, scale infrastructure, and efficiently deploy new technologies, making it a foundation for their operations and innovation.

The second largest end-user segment is expected to the BFSI industry. Cloud computing is being used by financial institutions and insurance businesses to improve client experiences, optimise operations, and maintain data security. Cloud solutions in the financial services business provide cost-effective scalability, real-time data analytics, and compliance adherence, making them a vital component for industry growth.

Cloud Computing Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Cloud Computing Market Regional Analysis

North America, led by the United States, is the world's largest and most mature cloud computing market. Its supremacy is due to a well-developed IT ecosystem, extensive adoption of cloud technology across multiple industries, and the existence of major cloud service providers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud. Businesses in the region prioritise cloud adoption to improve agility, decrease infrastructure costs, and boost innovation. Furthermore, North American corporations' proactive commitment to digital transformation and data-driven decision-making contributes to the region's leadership in cloud computing.

Europe, specifically Western Europe, has the second-largest cloud computing market. The region benefits from a robust economy, well-established regulatory frameworks like GDPR, and an increasing emphasis on digitization. European businesses, especially those in finance, healthcare, and manufacturing, are progressively migrating to the cloud to improve operational efficiency and meet regulatory obligations. While Europe may not be as large as North America, it accounts for a sizable portion of the global cloud market.

The Asia-Pacific region has the fastest-growing cloud computing market, with nations such as China, India, and Singapore leading the way. Expansion of IT infrastructure, booming start-up ecosystems, increased digitalization initiatives, and a spike in demand for data-intensive applications are factors driving this rapid expansion. Cloud solutions are being used by enterprises in the region to improve scalability, cost efficiency, and competitiveness. Furthermore, government backing and investments in cloud technology contribute to its explosive expansion, establishing Asia-Pacific as a prominent player in the global cloud scene.

Cloud Computing Market Players

Some of the top cloud computing companies offered in our report include Alibaba Group Holding Limited, Google LLC, International Business Machines Corporation, Microsoft Corporation, Oracle Corporation, Salesforce.com Inc., SAP SE, Workday, Inc., Adobe Inc., and Amazon.com Inc.

Frequently Asked Questions

What was the market size of the global cloud computing in 2022?

The market size of cloud computing was USD 495.3 billion in 2022.

What is the CAGR of the global cloud computing market from 2023 to 2032?

The CAGR of cloud computing is 17.8% during the analysis period of 2023 to 2032.

Which are the key players in the cloud computing market?

The key players operating in the global market are including Alibaba Group Holding Limited, Google LLC, International Business Machines Corporation, Microsoft Corporation, Oracle Corporation, Salesforce.com Inc., SAP SE, Workday, Inc., Adobe Inc., and Amazon.com Inc.

Which region dominated the global cloud computing market share?

North America held the dominating position in cloud computing industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of cloud computing during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global cloud computing industry?

The current trends and dynamics in the cloud computing industry include numerous benefits of cloud over on-promise it systems, rising adoption of technologies such as artificial intelligence, machine learning, 5G, and IoT, personalized customer experience, and increasing deployment of private cloud based computing.

Which service held the maximum share in 2022?

The software as a service (SaaS) service held the maximum share of the cloud computing industry.