Tumor Ablation Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Tumor Ablation Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

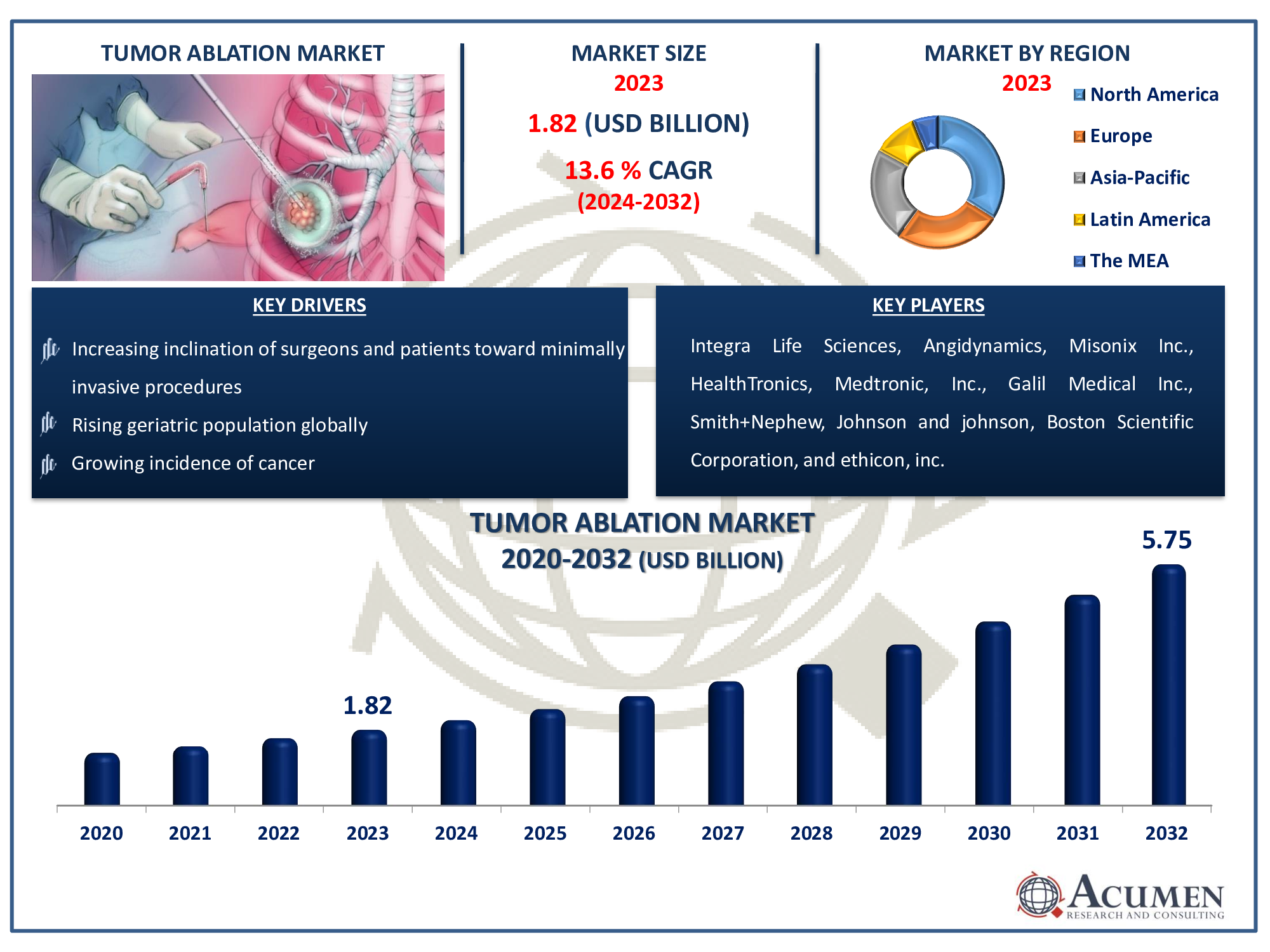

The Global Tumor Ablation Market Size accounted for USD 1.82 Billion in 2023 and is estimated to achieve a market size of USD 5.75 Billion by 2032 growing at a CAGR of 13.6% from 2024 to 2032.

Tumor Ablation Market Highlights

- Global tumor ablation market revenue is poised to garner USD 5.75 billion by 2032 with a CAGR of 13.6% from 2024 to 2032

- North America tumor ablation market value occupied around USD 618.6 million in 2023

- Asia-Pacific tumor ablation market growth will record a CAGR of more than 15% from 2024 to 2032

- Among technology, the radiofrequency sub-segment generated over US$ 600.4 million revenue in 2023

- Based on treatment, the percutaneous sub-segment generated around 56% share in 2023

- Increasing R&D activities is a popular market trend that fuels the industry demand

The tumor ablation market is a fast expanding section of the healthcare business that is dedicated to the treatment of various types of tumors using minimally invasive treatments. This industry has grown in popularity due to its capacity to provide effective cancer treatment alternatives with lower risk and quicker recovery times than traditional surgical approaches. Radiofrequency ablation (RFA), microwave ablation, cryoablation, and high-intensity focused ultrasound (HIFU) are tumor ablation procedures that precisely target and eliminate malignant tissues. The variety of curable tumors has broadened as medical technology and imaging have advanced, including illnesses such as liver, lung, kidney, and bone tumors. As cancer incidence rises internationally, the tumor ablation market is predicted to expand significantly, driven by the desire for minimally invasive, cost-effective, and patient-friendly procedures.

Global Tumor Ablation Market Dynamics

Market Drivers

- Increasing inclination of surgeons and patients toward minimally invasive procedures

- Rising geriatric population globally

- Growing incidence of cancer

- Continuous advancements in medical technology

Market Restraints

- Cost containment measures taken by various governments

- Stringent regulations & approvals

- Limited access to advanced technologies

Market Opportunities

- Favorable reimbursement scenario

- Growth potential offered by emerging markets

- Expanding range of treatable tumors

Tumor Ablation Market Report Coverage

| Market | Tumor Ablation Market |

| Tumor Ablation Market Size 2022 |

USD 1.82 Billion |

| Tumor Ablation Market Forecast 2032 | USD 5.75 Billion |

| Tumor Ablation Market CAGR During 2023 - 2032 | 13.6% |

| Tumor Ablation Market Analysis Period | 2020 - 2032 |

| Tumor Ablation Market Base Year |

2022 |

| Tumor Ablation Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Technology, By Treatment, By Application, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Integra Life sciences, Angidynamics, Misonix Inc., HealthTronics, Galil Medical Inc., Smith+Nephew, Medtronic, Inc., Johnson and johnson, Boston Scientific Corporation, and ethicon, inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Tumor Ablation Market Insights

The primary driver of market growth is the rising incidence of cancer. According to data from the World Health Organization (WHO), approximately 13.0% of the global population is affected by cancer, and a 70.0% increase in disease incidence is anticipated in the coming years. As a result, the demand for tumor ablation, which is required for more than 100 types of cancer, is expected to increase, further driving market growth. Additionally, technological advancements in thermal ablation technologies are expected to contribute to market growth. The increasing geriatric population is also likely to bolster market expansion. The primary factor driving the growth of this industry is the increasing incidence of cancer worldwide. According to statistics from the World Health Organization (WHO), approximately 14.0% of the global population suffers from cancer each year.

The demand for minimally invasive procedures, driven by advantages such as speedy recovery and reduced trauma, is also expected to contribute to market growth. Additionally, technological advancements in the field of thermal ablation have further fueled market development. For example, the use of cooled radiofrequency denervation methods, which utilize radiofrequency thermal energy to ablate sensory nerve fibers of the sacroiliac joint, is being enhanced with the integration of internally cooled radiofrequency probes to increase the lesion size.

Tumor Ablation Market Segmentation

The worldwide market for tumor ablation is split based on technology, treatment, application, end-user, and geography.

Tumor Ablation Market By Technology

- Radiofrequency

- Microwave

- Cryoablation

- Irreversible Electroporation

- Other Technologies

Based on the tumor ablation industry analysis, the radiofrequency is the leading technology sector. This supremacy is partly owing to its long track record, widespread acceptability, and efficacy in treating numerous types of tumors. Radiofrequency ablation is a versatile and frequently used procedure that uses electromagnetic waves to generate heat and destroy malignant tissues. Its effectiveness in treating cancers such as the liver, lung, kidney, and bone has cemented its place as the leading technological segment. Furthermore, ongoing developments in RF technology have enhanced its precision and outcomes, leading to its market leadership.

Tumor Ablation Market By Treatment

- Surgical

- Laparoscopic

- Percutaneous

In previous years, the percutaneous category expected to hold largest share of the market within the treatment section.. Percutaneous ablation methods involve the minimally invasive insertion of needles or probes through the skin straight into the tumor. This method is preferred because of its minimally invasive nature, lower risk, faster recovery times, and applicability for a wide range of tumor types, including those in the liver, kidney, and lung. patients prefer percutaneous therapies because they cause less trauma and need fewer hospital stays.

Surgical segment is hold second largest share in the market. Surgical ablation entails open surgical techniques to remove tumors. While it provides precision, it is often used when percutaneous procedures are impractical due to tumor size, location, or other issues. Because of its effectiveness in handling difficult situations that cannot be handled percutaneously, surgical ablation is the second largest sector.

Tumor Ablation Market By Application

The Liver cancer sector dominates the tumor ablation market. Several reasons contribute to this supremacy. Liver cancer is one of the most common and difficult types of cancer in the world. Tumor ablation techniques, particularly radiofrequency and microwave ablation, have demonstrated great success in the treatment of liver tumors, including hepatocellular carcinoma. Furthermore, the liver's regenerating capacity renders it amenable to ablation, providing hope for people who may not be surgical candidates. As a result of the high incidence and promising outcomes in liver cancer treatment, the tumor ablation market has positioned it as the largest segment.

Tumor Ablation Market By End-User

- Hospitals

- Oncology Centers

- Others

The hospitals category dominates the industry and it is expected to grow over the tumor ablation market forecast period. This is due, in large part, to hospitals serving as focal centres for comprehensive cancer care and treatment. They provide a wide range of medical services, including tumor ablation operations, and are therefore the preferred option for many patients. Furthermore, hospitals frequently contain cutting-edge equipment, a diverse team of healthcare professionals, and the required infrastructure to carry out these surgeries properly. The availability and accessibility of tumor ablation services in hospitals contribute to their market dominance.

Tumor Ablation Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

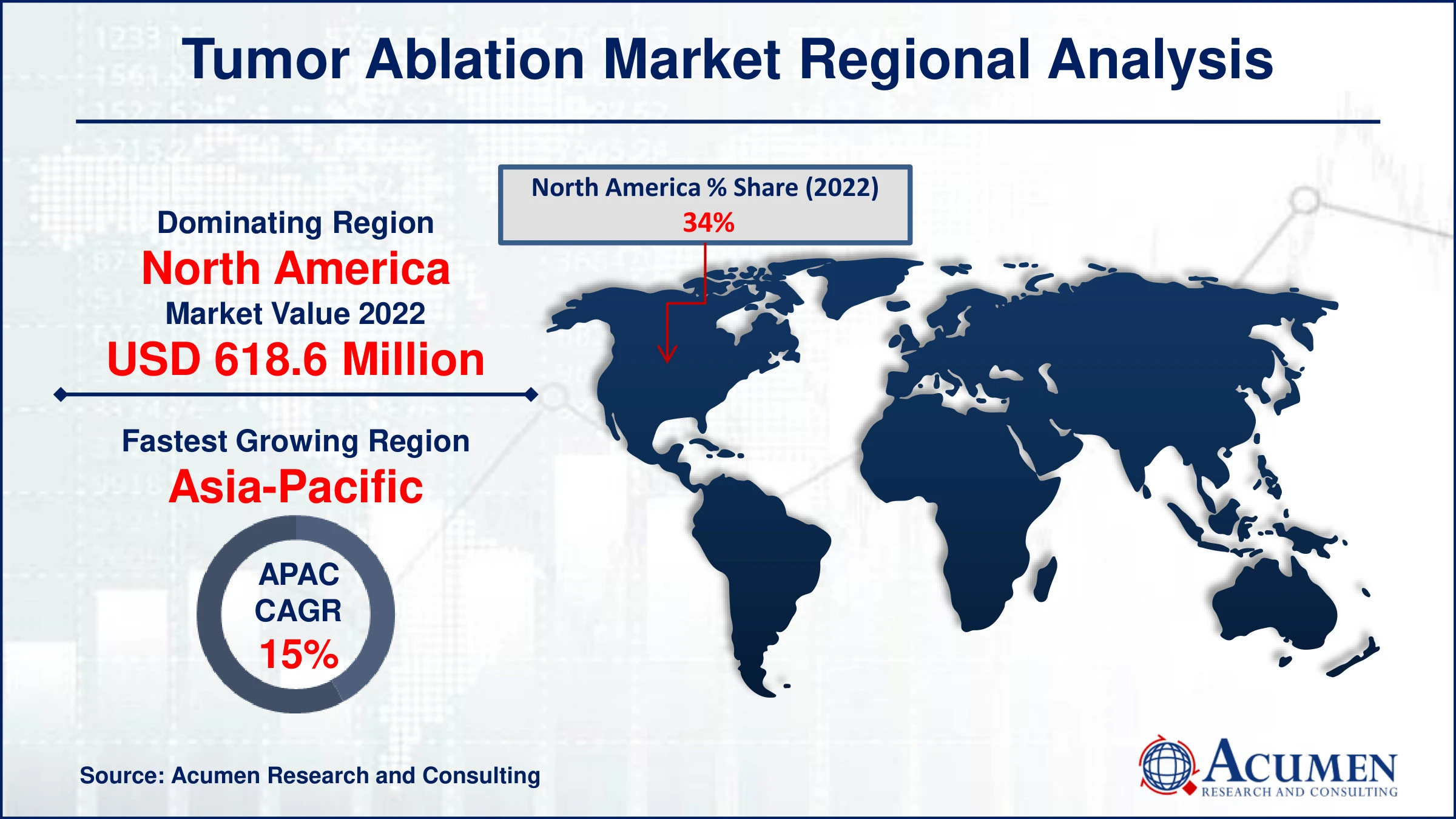

Tumor Ablation Market Regional Analysis

North America is the largest market for tumor ablation due to its advanced healthcare infrastructure, high cancer incidence rates, and early embrace of cutting-edge medical technologies. The region's well-established healthcare systems and significant R&D investments contribute to its dominance. Furthermore, a more proactive approach to cancer diagnosis and treatment, combined with an ageing population, drives demand for tumor ablation techniques.

In terms of tumor ablation market analysis, Europe is the second-largest region. This is largely due to an ageing population and an increase in cancer prevalence. European countries have strong healthcare systems, which makes tumor ablation procedures more widely available. The emphasis on early cancer detection and management, combined with a supportive regulatory environment, strengthens Europe's market position.

Asia-Pacific is the fastest-growing region throughout the tumor ablation industry forecast period. Improving healthcare access, increased cancer awareness, and considerable investments in healthcare infrastructure, notably in China and India, are driving this growth. Because of lifestyle changes and a rising population, the region is seeing an increase in cancer cases, necessitating increased use of tumor ablation procedures. Furthermore, favorable government efforts and an increasing emphasis on healthcare modernization contribute to Asia-Pacific's rapid industry expansion.

Tumor Ablation Market Players

Some of the top Tumor Ablation companies offered in our report include Integra Life sciences, Angidynamics, Misonix Inc., HealthTronics, Galil Medical Inc., Smith+Nephew, Medtronic, Inc., Johnson and johnson, Boston Scientific Corporation, and ethicon, inc.

Frequently Asked Questions

What was the market size of the global tumor ablation in 2023?

The market size of tumor ablation was USD 1.82 Billion in 2023.

What is the CAGR of the global tumor ablation market from 2024 to 2032?

The CAGR of tumor ablation is 13.6% during the analysis period of 2024 to 2032.

Which are the key players in the tumor ablation market?

The key players operating in the global market are including Integra Life sciences, Angidynamics, Misonix Inc., HealthTronics, Galil Medical Inc., Smith+Nephew, Medtronic, Inc., Johnson and johnson, Boston Scientific Corporation, and ethicon, inc.

Which region dominated the global tumor ablation market share?

North America held the dominating position in tumor ablation industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of tumor ablation during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global tumor ablation industry?

The current trends and dynamics in the tumor ablation industry increasing inclination of surgeons and patients toward minimally invasive procedures, rising geriatric population globally, growing incidence of cancer, continuous advancements in medical technology.

Which technology held the maximum share in 2023?

The radiofrequency technology held the maximum share of the tumor ablation industry.