Liver Cancer Diagnostic Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Liver Cancer Diagnostic Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

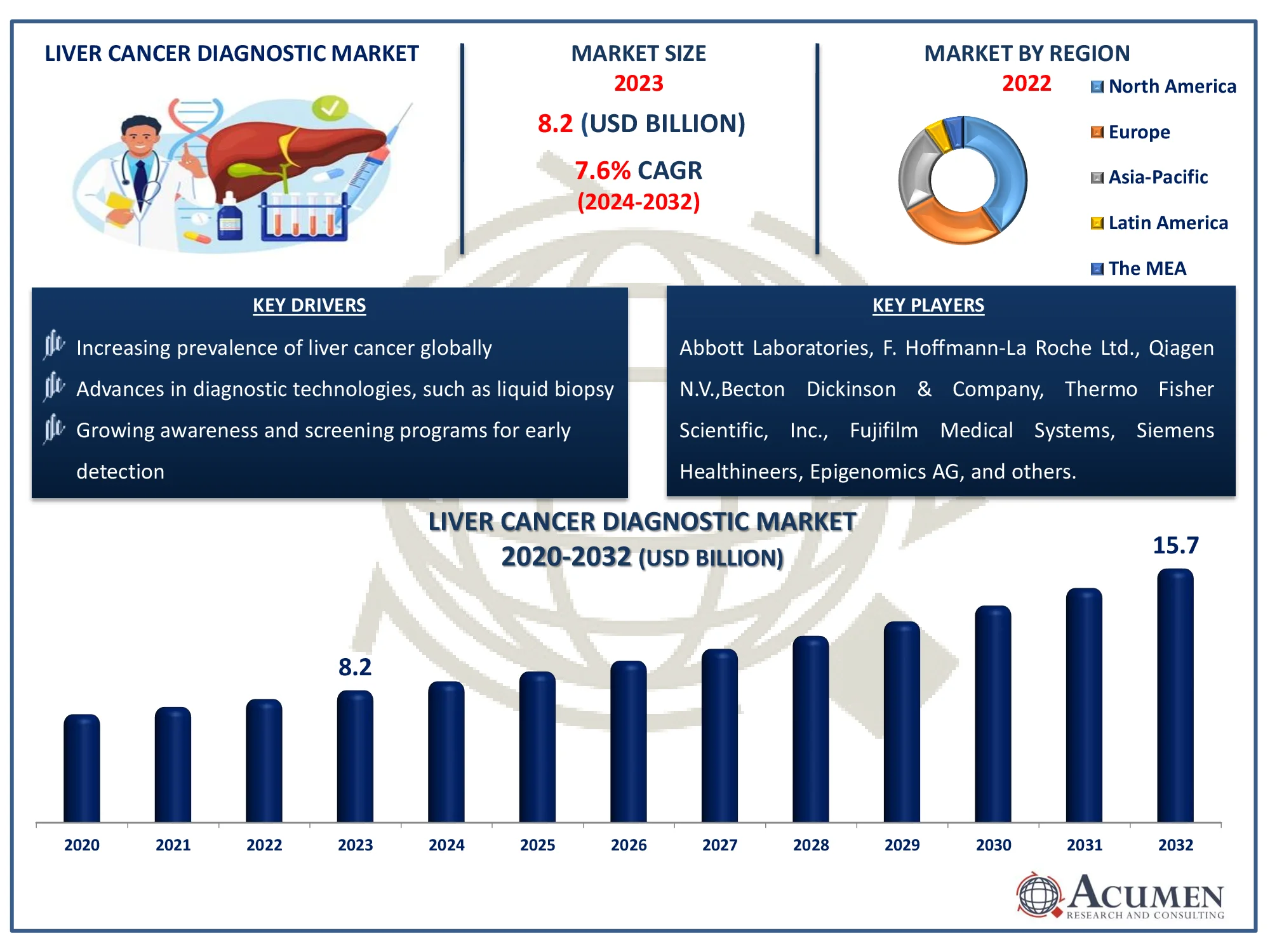

The Global Liver Cancer Diagnostic Market Size accounted for USD 8.2 Billion in 2023 and is estimated to achieve a market size of USD 15.7 Billion by 2032 growing at a CAGR of 7.6% from 2024 to 2032.

Liver Cancer Diagnostic Market Highlights

- Global liver cancer diagnostic market revenue is poised to garner USD 15.7 billion by 2032 with a CAGR of 7.6% from 2024 to 2032

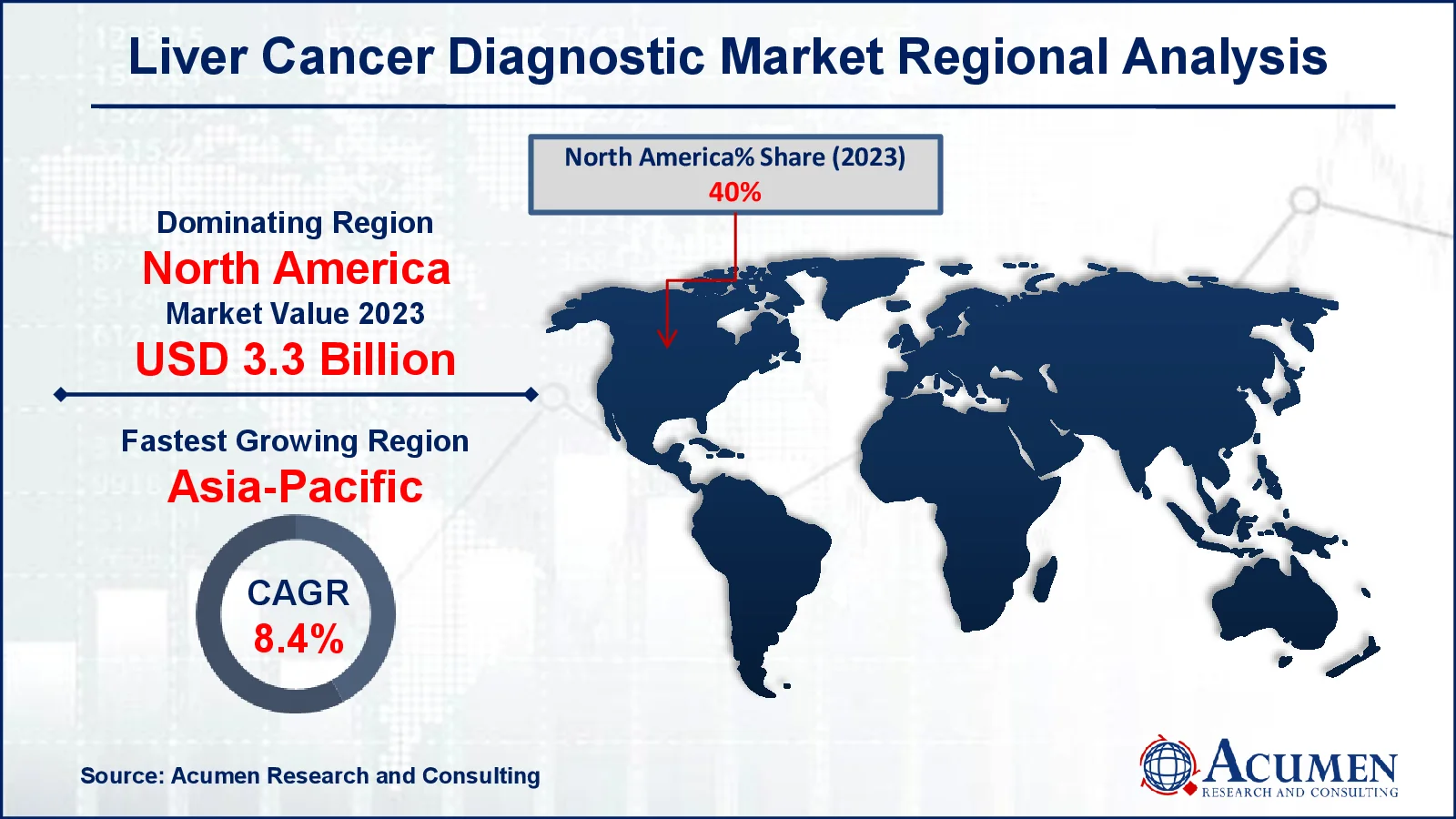

- North America liver cancer diagnostic market value occupied around USD 3.3 billion in 2023

- Asia-Pacific liver cancer diagnostic market growth will record a CAGR of more than 8.4% from 2024 to 2032

- Based on test type, the laboratory tests sub-segment generated 34% market share in 2023

- Based on end-user, the hospitals & diagnostic laboratories sub-segment shows 49% growth in 2023

- Growing use of liquid biopsies for non-invasive diagnosis is the liver cancer diagnostic market trend that fuels the industry demand

Liver cancer diagnostics use a variety of approaches and assays to determine the existence and stage of the malignancy. Imaging procedures such as ultrasound, CT scans, and MRIs can assist liver cancer. Blood tests can also detect certain biomarkers, such as alpha-fetoprotein (AFP), which are symptomatic of liver cancer. In clinical settings, liver cancer diagnostics are critical for early detection, which greatly improves treatment outcomes. They influence the selection of treatment options, such as surgery, chemotherapy, and targeted therapies. These diagnostics also help to evaluate the efficacy of ongoing therapy and detect any recurrence of cancer after treatment. Advanced diagnostics, such as genetic and molecular testing, provide information about the cancer's unique traits, allowing for more individualized treatment strategies.

Global Liver Cancer Diagnostic Market Dynamics

Market Drivers

- Increasing prevalence of liver cancer globally

- Advances in diagnostic technologies, such as liquid biopsy

- Growing awareness and screening programs for early detection

Market Restraints

- High cost of advanced diagnostic tests

- Limited access to healthcare in developing regions

- Stringent regulatory requirements for diagnostic tools

Market Opportunities

- Expansion of personalized medicine and targeted therapies

- Rising investments in healthcare infrastructure and research

- Development of non-invasive diagnostic methods

Liver Cancer Diagnostic Market Report Coverage

| Market | Liver Cancer Diagnostic Market |

| Liver Cancer Diagnostic Market Size 2022 |

USD 8.2 Billion |

| Liver Cancer Diagnostic Market Forecast 2032 | USD 15.7 Billion |

| Liver Cancer Diagnostic Market CAGR During 2023 - 2032 | 7.6% |

| Liver Cancer Diagnostic Market Analysis Period | 2020 - 2032 |

| Liver Cancer Diagnostic Market Base Year |

2022 |

| Liver Cancer Diagnostic Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Test Type, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Abbott Laboratories, F. Hoffmann-La Roche Ltd., Qiagen N.V.,Becton Dickinson & Company, Thermo Fisher Scientific, Inc., Fujifilm Medical Systems U.S.A., Inc., Siemens Healthineers, Epigenomics AG, and Koninklijke Philips N.V. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Liver Cancer Diagnostic Market Insights

The increased prevalence of cancer, adoption of new detection systems, and availability of effective cancer medications are also driving the market. For instance, according to National Institute of Health, in 2023, it is estimated that there will be 1,958,310 new cancer cases and 609,820 cancer-related deaths in the United States. Furthermore, strong government initiatives that help raise awareness about the disease and favorable reimbursement policies under the Affordable Care Act are boosting market growth. Accurate identification of cancer progression is crucial for selecting an appropriate treatment regimen. Currently, the available tests sometimes yield false positive results, necessitating confirmatory tests, which increase the financial burden on patients.

Tests using specific biomarkers and tumor markers yield increasingly precise results, providing a significant opportunity for industry players to develop tumor-specific biomarkers and advanced diagnostic methods for liver carcinoma. The unmet need for medications that offer complete remission and sustained response in the HCC space highlights a strong potential to create groundbreaking, first-in-class diagnostic techniques and treatments.

Additionally, expanding healthcare infrastructure creates a potential in the anticipated year in liver cancer diagnostics market. For instance, according to NITI Aayog, since 2016, India's healthcare industry has grown at a CAGR of approximately 22%. At this rate, it is estimated to reach USD 372 billion by 2022. Consequently, key manufacturers advancements and growing cancer cases lead to boost market demand.

Liver Cancer Diagnostic Market Segmentation

The worldwide market for liver cancer diagnostic is split based on test type, end-user, and geography.

Liver Cancer Diagnostics Market By Test Type

- Laboratory Tests

- Biomarkers

- Oncofetal and Glycoprotein Antigens

- Enzymes and Isoenzymes

- Growth Factors and Receptors

- Molecular Markers

- Pathological Biomarkers

- Blood Tests

- Imaging

- Endoscopy

- Biopsy

- Others

- Biomarkers

According to the liver cancer diagnostics market analysis, laboratory tests type dominates market due to their high accuracy, cost-effectiveness, and convenience of use. These procedures, which include blood testing for biomarkers such as alpha-fetoprotein (AFP), are critical for the early detection and monitoring of liver cancer. Their non-invasive nature makes them a popular choice among both patients and healthcare practitioners. Furthermore, advances in laboratory technology have improved the accuracy and efficiency of many diagnostic approaches.

Liver Cancer Diagnostics Market By End-User

- Hospitals & Diagnostic Laboratories

- Academic & Research Institutes

- Pharmaceutical & CRO Laboratories

According to the liver cancer diagnostics industry analysis, hospitals and diagnostic laboratories dominate the market because of their advanced diagnostic technology and skilled healthcare experts, which allow for accurate and timely detection. They offer extensive testing services, including as imaging, biopsies, and molecular testing, which are necessary for accurate diagnosis and therapy planning. Furthermore, these centers frequently participate in clinical studies, which broaden their skills and provide access to cutting-edge diagnostic techniques. Their established infrastructure and experience place them as the key providers in the liver cancer diagnostic landscape.

Liver Cancer Diagnostic Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Liver Cancer Diagnostic Market Regional Analysis

For several reasons, North America dominated the global liver cancer diagnostics market. This region is likely to maintain its leading position during the projection period, owing to superior healthcare coverage and technological improvements. The United States controls the North American market. For instance, in October 2023, Qiagen formed a partnership with Myriad Genetics to jointly develop and distribute laboratory-developed cancer test kits for the US market. Key factors contributing to the region's considerable share include a strong demand for diagnostic care, modern technology, and rapid adoption of novel medicines and diagnostic technologies.

Asia Pacific is predicted to see the fastest increase in liver cancer diagnostics market due to the rising incidence of liver cancer and the growing relevance of lowering cancer treatment costs in developing nations such as India and China. The expanding medical tourism business in these nations is expected to increase demand for diagnostic procedures for liver cancer. For instance, in January 2023, Fujifilm Corporation announced the acquisition of Inspirata, Inc., a digital pathology firm. This strategic acquisition enabled Fujifilm to improve care delivery for oncology patients and provider teams, expand its research and development capabilities, and drive revenue growth. Furthermore, rising investment in R&D and favorable government regulations for healthcare equipment manufacturers are likely to accelerate the region's growth.

Liver Cancer Diagnostic Market Players

Some of the top liver cancer diagnostic companies offered in our report include Abbott Laboratories, F. Hoffmann-La Roche Ltd., Qiagen N.V.,Becton Dickinson & Company, Thermo Fisher Scientific, Inc., Fujifilm Medical Systems U.S.A., Inc., Siemens Healthineers, Epigenomics AG, and Koninklijke Philips N.V.

Frequently Asked Questions

How big is the liver cancer diagnostic market?

The liver cancer diagnostic market size was valued at USD 8.2 billion in 2023.

What is the CAGR of the global liver cancer diagnostic market from 2024 to 2032?

The CAGR of liver cancer diagnostic is 7.6% during the analysis period of 2024 to 2032.

Which are the key players in the Liver Cancer Diagnostic market?

The key players operating in the global market are including Abbott Laboratories, F. Hoffmann-La Roche Ltd., Qiagen N.V.,Becton Dickinson & Company, Thermo Fisher Scientific, Inc., Fujifilm Medical Systems U.S.A., Inc., Siemens Healthineers, Epigenomics AG, and Koninklijke Philips N.V

Which region dominated the global Liver Cancer Diagnostic market share?

North America held the dominating position in liver cancer diagnostic industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of liver cancer diagnostic during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global Liver Cancer Diagnostic industry?

The current trends and dynamics in the liver cancer diagnostic industry include increasing prevalence of liver cancer globally, advances in diagnostic technologies, such as liquid biopsy, and growing awareness and screening programs for early detections.

Which Test Type held the maximum share in 2023?

The laboratory tests expected to hold the maximum share of the liver cancer diagnostic industry.