Breast Cancer Liquid Biopsy Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Breast Cancer Liquid Biopsy Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

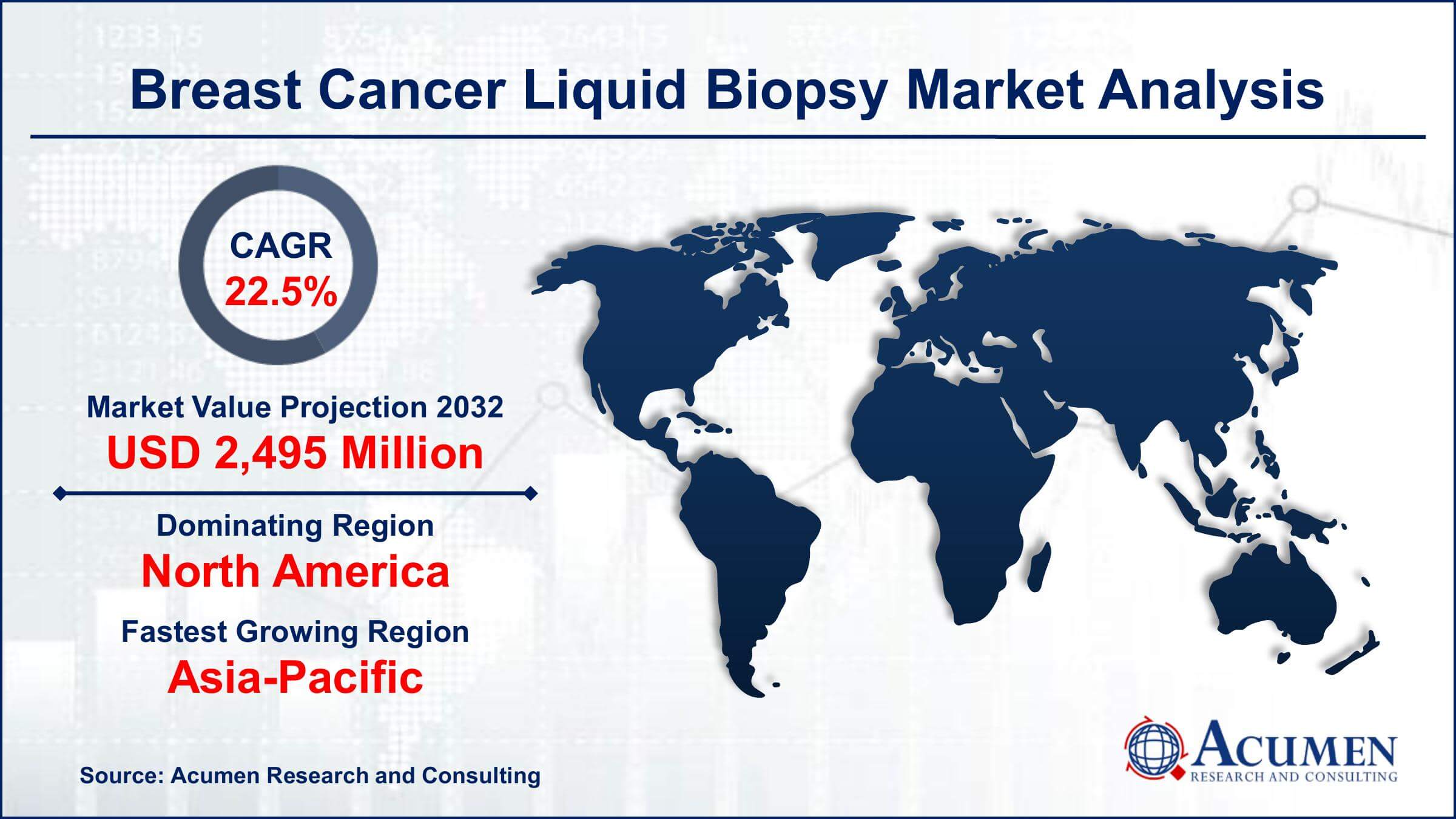

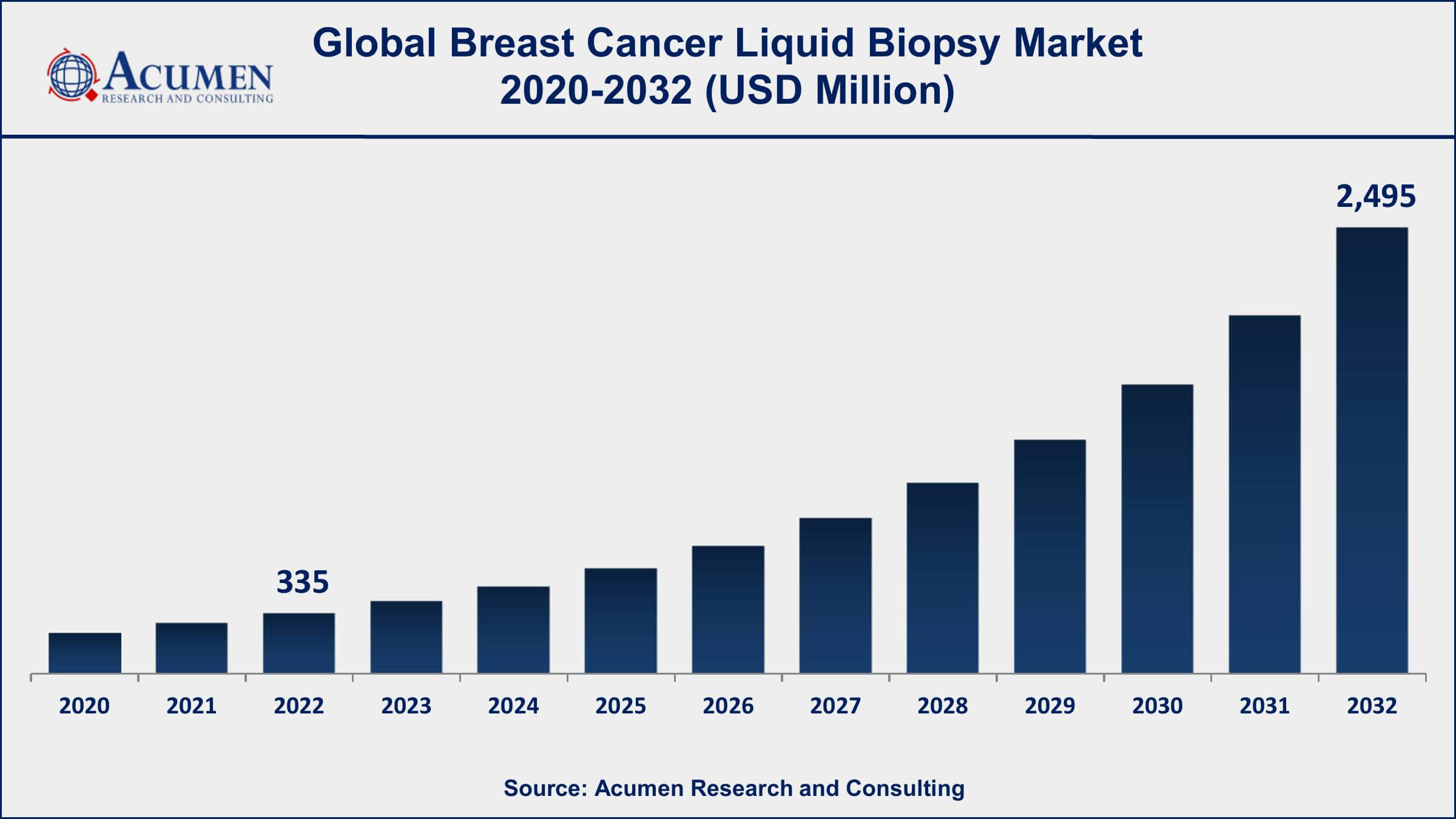

The Global Breast Cancer Liquid Biopsy Market Size accounted for USD 335 Million in 2022 and is projected to achieve a market size of USD 2,495 Million by 2032 growing at a CAGR of 22.5% from 2023 to 2032.

Breast Cancer Liquid Biopsy Market Highlights

- Global breast cancer liquid biopsy market revenue is expected to increase by USD 2,495 Million by 2032, with a 22.5% CAGR from 2023 to 2032

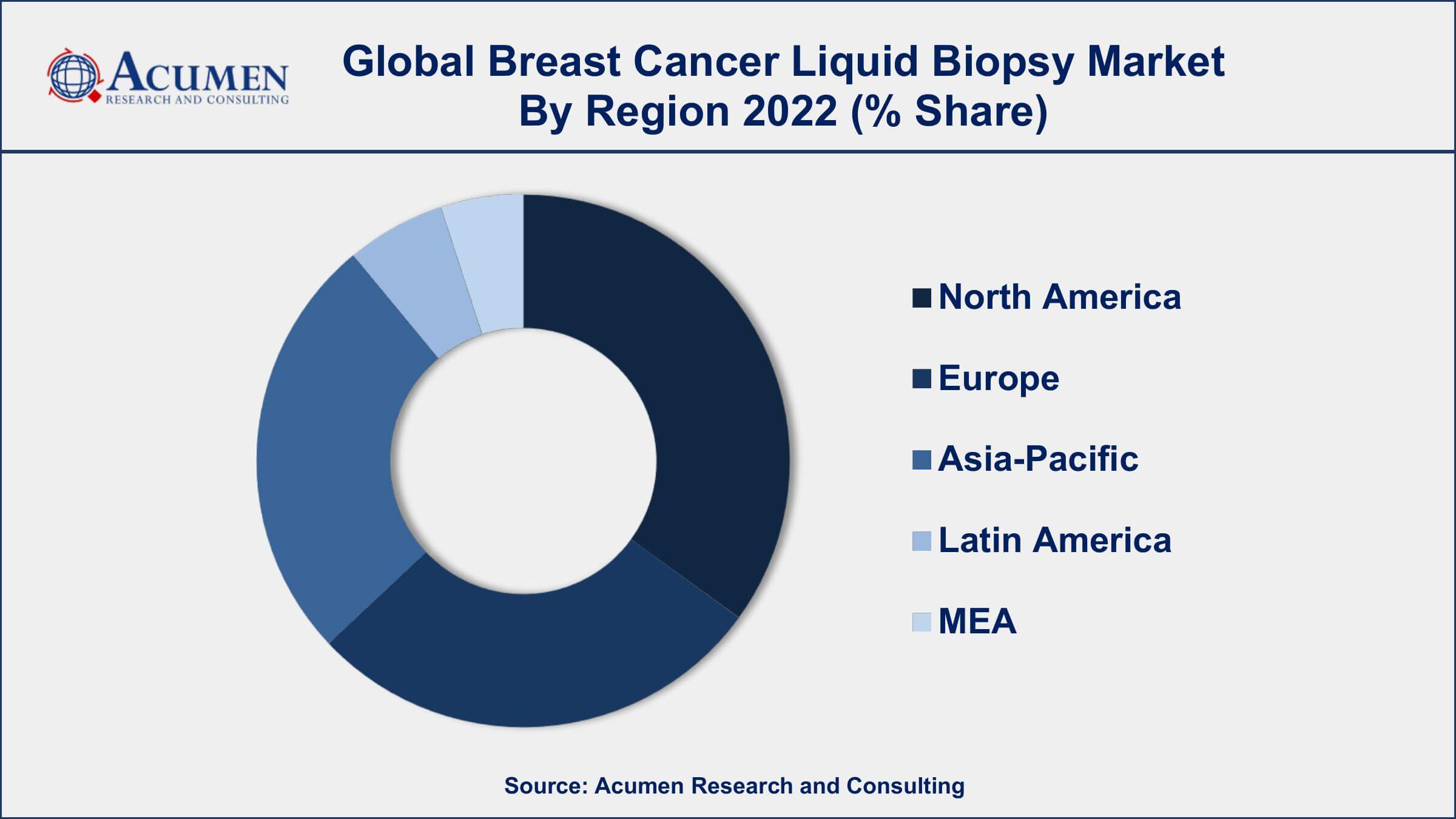

- North America region led with more than 35% of breast cancer liquid biopsy market share in 2022

- Asia-Pacific region is expected to be the fastest-growing market for breast cancer liquid biopsy, with a CAGR of 23% from 2021 to 2028

- Breast cancer is the most common cancer in women worldwide, and it accounts for about 30% of all new cancer diagnoses in women

- According to a study published in the journal Cancer Cell, liquid biopsy can detect breast cancer in its early stages with a sensitivity of up to 95%

- By circulating biomarkers, the circulating cell-free DNA is the largest segment of the market, accounting for over 47% of the global market share

- Increasing prevalence of breast cancer, drives the breast cancer liquid biopsy market value

Breast cancer liquid biopsy is a non-invasive diagnostic tool that detects cancer cells or DNA fragments in the bloodstream. It involves the collection of blood samples and the analysis of circulating tumor cells (CTCs), circulating tumor DNA (ctDNA), or extracellular vesicles (EVs) to identify mutations, copy number alterations, and epigenetic changes associated with cancer. The liquid biopsy is a promising alternative to traditional tissue biopsies, which are invasive and often associated with complications. It also provides a dynamic view of cancer evolution, allowing physicians to monitor disease progression, detect resistance to therapy, and tailor treatment plans accordingly.

The global market for liquid biopsy is expected to grow significantly in the coming years, particularly in the field of breast cancer. The rising prevalence of breast cancer, increasing demand for non-invasive diagnostic tools, and growing awareness of personalized medicine are some of the key factors driving the growth of the market. In addition, technological advancements in liquid biopsy platforms and the development of novel biomarkers are expected to boost market growth.

Several companies are investing in the development of liquid biopsy tests for breast cancer. For example, Guardant Health offers the Guardant360 test, which analyzes ctDNA from a blood sample to detect mutations in 73 genes associated with cancer. The test is used to guide treatment decisions for advanced-stage breast cancer patients.

Global Breast Cancer Liquid Biopsy Market Trends

Market Drivers

- Increasing prevalence of breast cancer

- Demand for non-invasive diagnostic tools

- Technological advancements in liquid biopsy platforms

- Growing awareness of personalized medicine

Market Restraints

- Limited sensitivity and specificity of liquid biopsy tests

- Lack of standardization and validation of liquid biopsy assays

Market Opportunities

- Development of novel biomarkers for liquid biopsy tests

- Increasing focus on early cancer detection

Breast Cancer Liquid Biopsy Market Report Coverage

| Market | Breast Cancer Liquid Biopsy Market |

| Breast Cancer Liquid Biopsy Market Size 2022 | USD 335 Million |

| Breast Cancer Liquid Biopsy Market Forecast 2032 | USD 2,495 Million |

| Breast Cancer Liquid Biopsy Market CAGR During 2023 - 2032 | 22.5% |

| Breast Cancer Liquid Biopsy Market Analysis Period | 2020 - 2032 |

| Breast Cancer Liquid Biopsy Market Base Year | 2022 |

| Breast Cancer Liquid Biopsy Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Circulating Biomarkers, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Guardant Health, Inc., Freenome Holdings, Inc., Biocept, Inc., Illumina, Inc., GRAIL, Inc., Qiagen N.V., Roche Holding AG, Thermo Fisher Scientific Inc., Exact Sciences Corporation, and Natera, Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Breast cancer liquid biopsy is a minimally invasive diagnostic technique that involves the analysis of blood samples to detect cancer cells or DNA fragments in the bloodstream. The liquid biopsy approach offers a less painful and more convenient alternative to traditional tissue biopsies, which are invasive and associated with complications.

The applications of breast cancer liquid biopsy are broad and expanding rapidly. Liquid biopsy can be used for early cancer detection, disease monitoring, and personalized treatment planning. By analyzing circulating tumor cells (CTCs), circulating tumor DNA (ctDNA), or extracellular vesicles (EVs), liquid biopsy can detect mutations, copy number alterations, and epigenetic changes associated with cancer. This information can be used to guide treatment decisions, monitor response to therapy, and identify resistance to treatment. Liquid biopsy can also provide insights into tumor heterogeneity and clonal evolution, enabling physicians to tailor treatment plans to individual patients. In addition, liquid biopsy can be used for cancer surveillance, detecting the recurrence of cancer after treatment, and monitoring patients for the development of new tumors. Overall, the applications of breast cancer liquid biopsy are numerous, offering a promising tool for cancer diagnosis, treatment, and surveillance.

Breast Cancer Liquid Biopsy Market Segmentation

The global breast cancer liquid biopsys market segmentation is based on circulating biomarkers, application, and geography.

Breast Cancer Liquid Biopsy Market By Circulating Biomarkers

- Circulating Tumor Cells (CTCs)

- Extracellular Vesicles (EVs)

- Circulating Cell-free DNA (cfDNA)

- Others

In terms of circulating biomarkers, the circulating cell-free DNA (cfDNA) segment has seen significant growth in recent years. cfDNA refers to DNA fragments that are released into the bloodstream by cells undergoing apoptosis or necrosis. These fragments can be analyzed to identify mutations and genetic alterations associated with cancer. The cfDNA segment is expected to experience significant growth due to the non-invasive nature of the test and the ability to detect disease progression and treatment resistance. Moreover, the development of next-generation sequencing (NGS) technologies and the increasing focus on personalized medicine are expected to drive the growth of the cfDNA segment. NGS allows for the simultaneous analysis of multiple genes and mutations, providing a more comprehensive view of the tumor profile. Personalized medicine approaches, such as the use of targeted therapies and immunotherapies, require accurate and real-time monitoring of the tumor, making cfDNA analysis a valuable tool in treatment decision-making.

Breast Cancer Liquid Biopsy Market By Application

- Early Detection/Screening

- Treatment Selection

- Diagnosis

- Monitoring

According to the breast cancer liquid biopsy market forecast, the diagnosis segment is expected to witness significant growth in the coming years. Liquid biopsy tests can detect genetic alterations and biomarkers associated with cancer, providing a less invasive alternative to traditional tissue biopsies. The diagnosis segment is expected to experience significant growth due to the increasing prevalence of breast cancer and the demand for non-invasive diagnostic tools. Moreover, the increasing adoption of personalized medicine approaches and the development of novel biomarkers is expected to drive the growth of the diagnosis segment. Liquid biopsy tests can identify mutations, copy number alterations, and epigenetic changes associated with cancer, providing a comprehensive view of the tumor profile. This allows physicians to tailor treatment plans to the specific characteristics of a patient's tumor, improving patient outcomes.

Breast Cancer Liquid Biopsy Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Breast Cancer Liquid Biopsy Market Regional Analysis

Geographically, North America dominates the breast cancer liquid biopsy market due to several factors. The region has a well-established healthcare infrastructure and high awareness about breast cancer, leading to early diagnosis and treatment. Moreover, the presence of major players in the liquid biopsy market and the availability of advanced technologies for liquid biopsy tests are driving the market growth. Additionally, the increasing focus on personalized medicine and precision oncology in the region is expected to drive the breast cancer liquid biopsy market growth. Personalized medicine approaches require accurate and real-time monitoring of the tumor, making liquid biopsy tests a valuable tool in treatment decision-making. The presence of leading research institutions and academic medical centers in the region also contributes to the development and adoption of liquid biopsy technologies. Overall, North America is expected to continue to dominate the breast cancer liquid biopsy market in the coming years, providing a valuable tool in the fight against breast cancer.

Breast Cancer Liquid Biopsy Market Player

Some of the top breast cancer liquid biopsy market companies offered in the professional report include Guardant Health, Inc., Freenome Holdings, Inc., Biocept, Inc., Illumina, Inc., GRAIL, Inc., Qiagen N.V., Roche Holding AG, Thermo Fisher Scientific Inc., Exact Sciences Corporation, and Natera, Inc.

Frequently Asked Questions

What was the market size of the global breast cancer liquid biopsy in 2022?

The market size of breast cancer liquid biopsy was USD 335 Million in 2022.

What is the CAGR of the global breast cancer liquid biopsy market from 2023 to 2032?

The CAGR of breast cancer liquid biopsy is 22.5% during the analysis period of 2023 to 2032.

Which are the key players in the breast cancer liquid biopsy market?

The key players operating in the global market are including Guardant Health, Inc., Freenome Holdings, Inc., Biocept, Inc., Illumina, Inc., GRAIL, Inc., Qiagen N.V., Roche Holding AG, Thermo Fisher Scientific Inc., Exact Sciences Corporation, and Natera, Inc.

Which region dominated the global breast cancer liquid biopsy market share?

North America held the dominating position in breast cancer liquid biopsy industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of breast cancer liquid biopsy during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global breast cancer liquid biopsy industry?

The current trends and dynamics in the breast cancer liquid biopsy market growth include increasing prevalence of breast cancer, demand for non-invasive diagnostic tools, and technological advancements in liquid biopsy platforms.

Which circulating biomarkers held the maximum share in 2022?

The circulating cell-free DNA biopsy circulating biomarkers held the maximum share of the breast cancer liquid biopsy industry.