Radiofrequency Ablation Devices Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Radiofrequency Ablation Devices Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

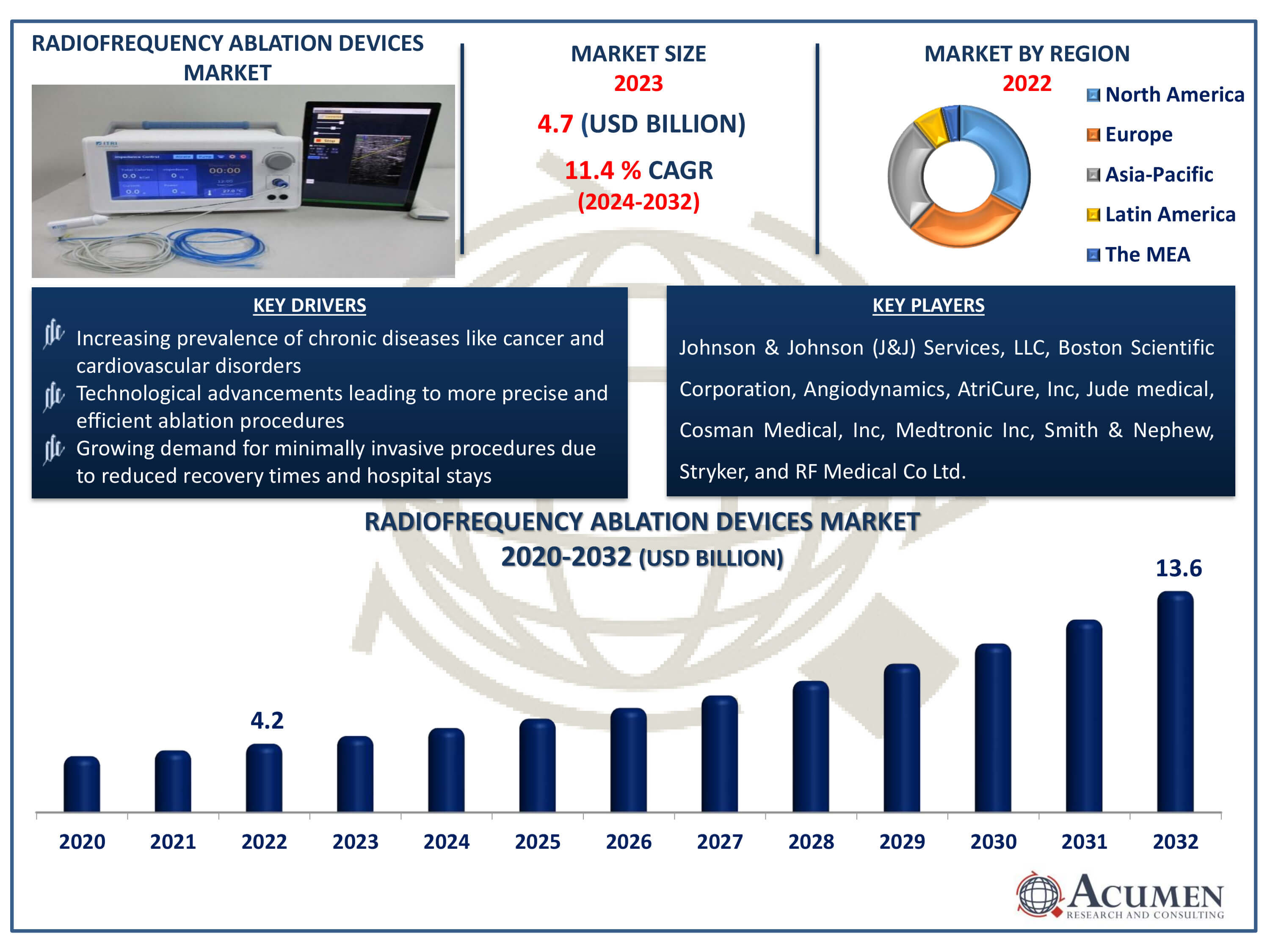

The Radiofrequency Ablation Devices Market Size accounted for USD 4.7 Billion in 2023 and is estimated to achieve a market size of USD 13.6 Billion by 2032 growing at a CAGR of 11.4% from 2024 to 2032.

Radiofrequency Ablation Devices Market Highlights

- Global radiofrequency ablation devices market revenue is poised to garner USD 13.6 billion by 2032 with a CAGR of 11.4% from 2024 to 2032

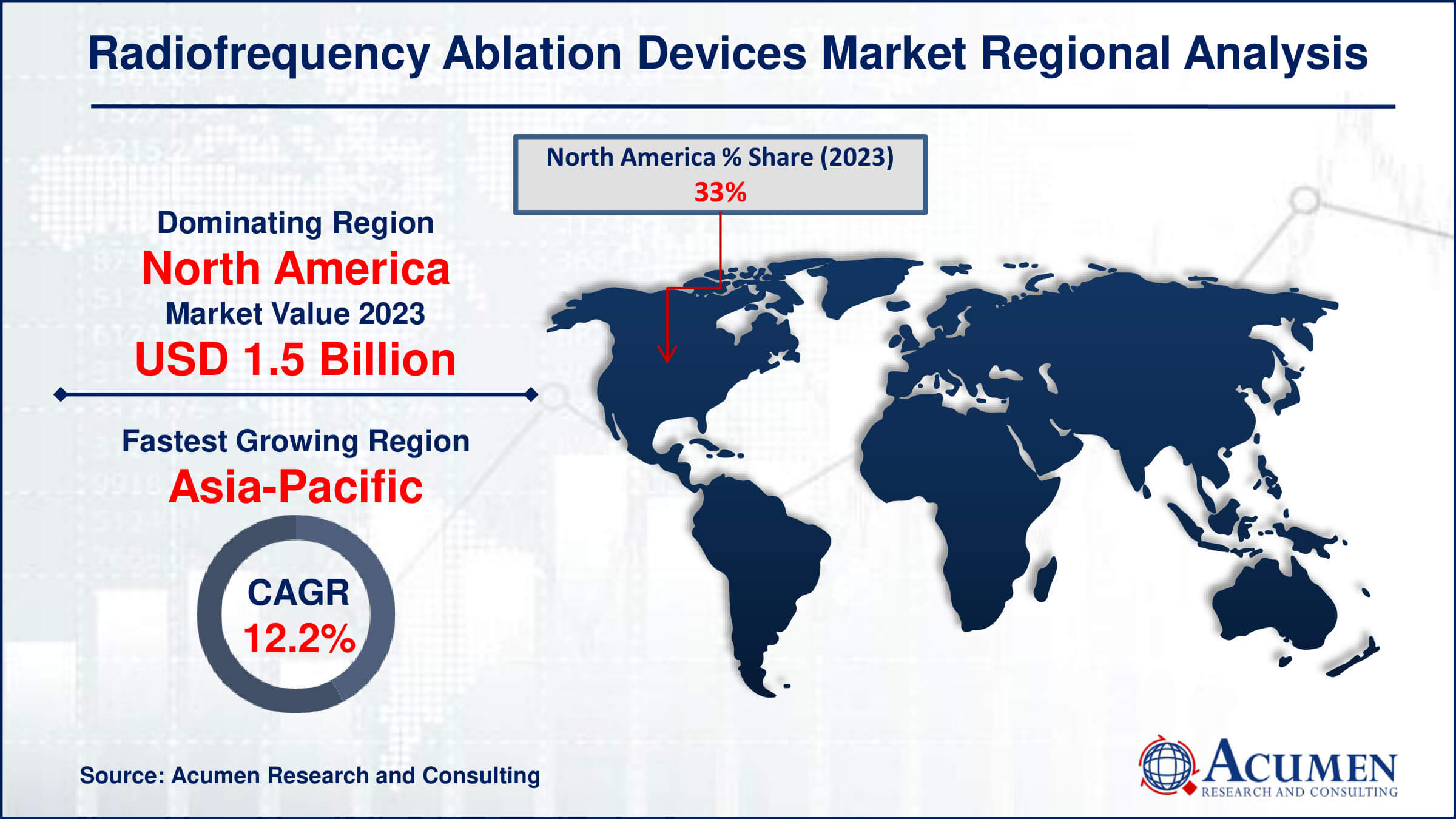

- North America radiofrequency ablation devices market value occupied around USD 1.5 billion in 2023

- Asia Pacific radiofrequency ablation devices market growth will record a CAGR of more than 12.2% from 2024 to 2032

- Among product, the disposable equipment sub-segment generated 43% of the market share in 2023

- Based on application, the surgical oncology sub-segment generated significant market share in 2023

- Technological advancements are enhancing the precision and efficacy of radiofrequency ablation treatments is the radiofrequency ablation devices market trend that fuels the industry demand

Radiofrequency ablation (RFA) devices use high-frequency electrical currents to generate heat and destroy abnormal tissue. These devices are commonly used in medical procedures to treat conditions such as cardiac arrhythmias, liver tumors, and certain types of chronic pain. RFA is minimally invasive, typically performed using image guidance such as ultrasound or CT scans to precisely target the tissue. The procedure involves inserting a thin needle or probe into the affected area, which then delivers the radiofrequency energy to heat and destroy the targeted tissue. RFA is known for its effectiveness in reducing pain and improving quality of life for patients with conditions like osteoid osteoma and varicose veins. Its applications continue to expand in various medical fields due to its precision and minimal risk compared to traditional surgical methods.

Global Radiofrequency Ablation Devices Market Dynamics

Market Drivers

- Increasing prevalence of chronic diseases like cancer and cardiovascular disorders

- Technological advancements leading to more precise and efficient ablation procedures

- Growing demand for minimally invasive procedures due to reduced recovery times and hospital stays

Market Restraints

- High costs associated with radiofrequency ablation devices and procedures

- Lack of skilled professionals proficient in using advanced RF ablation technologies

- Stringent regulatory requirements and approvals for new devices, limiting market entry

Market Opportunities

- Expanding applications of RF ablation beyond oncology to treat chronic pain and other medical conditions

- Rising healthcare expenditure in emerging markets, increasing access to advanced medical technologies

- Development of next-generation RF ablation devices with improved safety and efficacy profiles

Radiofrequency Ablation Devices Market Report Coverage

| Market | Radiofrequency Ablation Devices Market |

| Radiofrequency Ablation Devices Market Size 2022 | USD 4.7 Billion |

| Radiofrequency Ablation Devices Market Forecast 2032 | USD 13.6 Billion |

| Radiofrequency Ablation Devices Market CAGR During 2023 - 2032 | 11.4% |

| Radiofrequency Ablation Devices Market Analysis Period | 2020 - 2032 |

| Radiofrequency Ablation Devices Market Base Year |

2022 |

| Radiofrequency Ablation Devices Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Application, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Johnson & Johnson (J&J) Services, LLC, Angiodynamics, Boston Scientific Corporation, AtriCure, Inc, Jude medical, Cosman Medical, Inc, Medtronic Inc, Smith & Nephew, Stryker, and RF Medical Co Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Radiofrequency Ablation Devices Market Insights

The increasing prevalence of chronic diseases such as cancer and cardiovascular disorders is a significant driver for the growth of the RFA devices industry. For instance, according to the US Department of Health and Human Services, an estimated 129 million people in the United States have at least one major chronic condition; examples include heart disease, cancer, diabetes, obesity, and hypertension. Radiofrequency ablation devices are crucial in treating these conditions through minimally invasive procedures that offer reduced recovery times and lower risks compared to traditional surgery. As the global population ages and lifestyle factors contribute to rising disease burdens, the demand for effective, less invasive treatment options like radiofrequency ablation continues to grow. This trend underscores the market's expansion as healthcare systems worldwide seek innovative solutions to manage and treat chronic illnesses more effectively.

The high costs associated with radiofrequency ablation (RFA) devices and procedures pose significant barriers to the growth of the RFA devices market. These costs include not only the initial purchase price of the devices but also expenses related to maintenance, training, and operation. Additionally, reimbursement challenges and varying healthcare policies across different regions further complicate market expansion. As a result, healthcare providers and facilities may hesitate to invest in RFA technology, limiting its adoption and hindering market growth despite its proven effectiveness in treating various medical conditions. Addressing these cost-related challenges is crucial for fostering broader acceptance and utilization of RFA devices in clinical practice.

Expanding the application of radiofrequency (RF) ablation beyond oncology to include treatments for chronic pain and other medical conditions presents a significant growth opportunity for the RF ablation devices market. For instance, Medtronic will introduce its new Symplicity System, a radiofrequency ablation device for the treatment of atrial fibrillation (AFib), in November 2023. The Symplicity System is meant to give clinicians with a safe and effective method of treating patients with AFib. Atrial fibrillation is a heart condition characterized by an irregular and often rapid heart rate that can increase the risk of stroke, heart failure, and other heart-related complications. RF ablation, known for its precision in targeting and destroying tissue through heat generated by radiofrequency waves, has shown promise in managing chronic pain conditions such as arthritis and back pain. This broader application is driven by advancements in device technology, which allow for more accurate and minimally invasive procedures. The market is poised to benefit from increasing demand as healthcare providers and patients try to find effective alternatives to traditional therapies and surgeries. Moreover, ongoing research and development efforts are likely to further expand the therapeutic capabilities of RF ablation for treating various medical conditions beyond pain management.

Radiofrequency Ablation Devices Market Segmentation

The worldwide market for radiofrequency ablation devices is split based on product, application, end-use, and geography.

Radiofrequency Ablation Device Market By Products

- Disposable Equipment

- Capital Equipment

- Reusable Equipment

According to the radiofrequency ablation devices industry analysis, disposable equipment dominates the radiofrequency ablation devices market due to several key factors. Firstly, disposables offer convenience by eliminating the need for sterilization and maintenance, thereby reducing procedural time and costs. Secondly, they ensure consistent performance and minimize the risk of cross-contamination between patients. Thirdly, advancements in materials and manufacturing have led to disposable devices that are both efficient and cost-effective. Moreover, healthcare providers prefer disposables for their ease of use and reduced risk of complications further maintain its dominance.

Radiofrequency Ablation Device Market By Application

- Surgical Oncology

- Cardiology & Cardiac Rhythm Management

- Cosmetology

- Gynecology

- Pain Management

Surgical oncology is the largest category in the radiofrequency ablation devices market, due to its effectiveness in treating various types of tumors. These devices are crucial tools in the hands of surgical oncologists, offering precise and minimally invasive treatment options for cancer patients. The rising global incidence of cancer has increased demand for radiofrequency ablation devices, which allow for targeted tumor suppression while minimizing injury to adjacent healthy tissues.. This technology is particularly valued for its ability to treat tumors in difficult-to-reach areas with fewer complications compared to traditional surgical methods. As a result, surgical oncology remains at the forefront of adopting radiofrequency ablation technology in the fight against cancer.

Radiofrequency Ablation Device Market By End-use

- Hospital

- Ambulatory Surgery Centers

- Research Laboratories

According to the radiofrequency ablation devices market forecast, hospital segment by end users is expected to dominate the industry throughout 2024 to 2032. Hospitals typically have the infrastructure and resources to support complex medical procedures like radiofrequency ablation. They also house specialized departments such as interventional radiology and cardiology, where these devices are frequently used. Moreover, hospitals tend to attract a large volume of patients requiring treatments that utilize radiofrequency ablation, thereby driving demand. Additionally, the presence of skilled healthcare professionals in hospital settings ensures safe and effective use of these devices, further maintaining their pivotal role in the market. As a result, the hospital segment is expected to maintain a significant share in the radiofrequency ablation devices market.

Radiofrequency Ablation Devices Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Radiofrequency Ablation Devices Market Regional Analysis

For several reasons, North America leads the RFA devices industry due to several factors. The region benefits from advanced healthcare infrastructure and high healthcare expenditure, facilitating widespread adoption of cutting-edge medical technologies. Additionally, a favorable regulatory environment and strong presence of key market players contribute to the dominance. For instance, in April 2022, AtriCure introduced the EnCompass Clamp as a component of its Isolator Synergy ablation system. This platform incorporates uniform pressure, parallel closure, and customized power using synergy radiofrequency. It is designed for ablating cardiac tissue during cardiac surgery to enhance the effectiveness of simultaneous surgical ablations. The increasing prevalence of chronic diseases, such as cardiovascular disorders and cancer, further drives demand for radiofrequency ablation devices in the region. Overall, North America's leadership underscores its pivotal role in shaping the global market landscape for these medical devices.

The Asia-Pacific region has emerged as the fastest-growing market for radiofrequency ablation devices, driven by increasing prevalence of chronic diseases such as cardiovascular disorders and cancer. Rapid urbanization and improving healthcare infrastructure in countries like China, India, and Japan are contributing to the market expansion. Furthermore, rising healthcare expenditures and growing awareness about minimally invasive treatments among both patients and healthcare providers are fueling demand for these devices. Technological advancements in radiofrequency ablation techniques are also enhancing treatment outcomes and widening the adoption of these devices across the region. For instance, on June 19, 2023, Avanos Medical, Inc., a medical device company, revealed that it has finalized an agreement to acquire Diros Technology Inc., a prominent manufacturer of advanced Radio Frequency (RF) products designed for the treatment of chronic pain conditions. As a result, Asia-Pacific is witnessing significant growth in the adoption and market penetration of radiofrequency ablation devices.

Radiofrequency Ablation Devices Market Players

Some of the top radiofrequency ablation devices companies offered in our report include Johnson & Johnson (J&J) Services, LLC, Angiodynamics, Boston Scientific Corporation, AtriCure, Inc, Jude medical, Cosman Medical, Inc, Medtronic Inc, Smith & Nephew, Stryker, and RF Medical Co Ltd.

Frequently Asked Questions

How big is the radiofrequency ablation devices market?

The radiofrequency ablation devices market size was valued at USD 4.7 Billion in 2023.

What is the CAGR of the global radiofrequency ablation devices market from 2024 to 2032?

The CAGR of radiofrequency ablation devices is 11.4% during the analysis period of 2024 to 2032.

Which are the key players in the radiofrequency ablation devices market?

The key players operating in the global market are including Johnson & Johnson (J&J) Services, LLC, Angiodynamics, Boston Scientific Corporation, AtriCure, Inc, Jude medical, Cosman Medical, Inc, Medtronic Inc, Smith & Nephew, Stryker, and RF Medical Co Ltd.

Which region dominated the global radiofrequency ablation devices market share?

North America held the dominating position in radiofrequency ablation devices industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia Pacific region exhibited fastest growing CAGR for market of radiofrequency ablation devices during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global radiofrequency ablation devices industry?

The current trends and dynamics in the radiofrequency ablation devices industry include increasing prevalence of chronic diseases like cancer and cardiovascular disorders, technological advancements leading to more precise and efficient ablation procedures, and growing demand for minimally invasive procedures due to reduced recovery times and hospital stays.

Which Product held the maximum share in 2023?

The disposable equipment held the maximum share of the radiofrequency ablation devices industry.