Pressure Sensitive Tapes Market | Acumen Research and Consulting

Pressure Sensitive Tapes Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

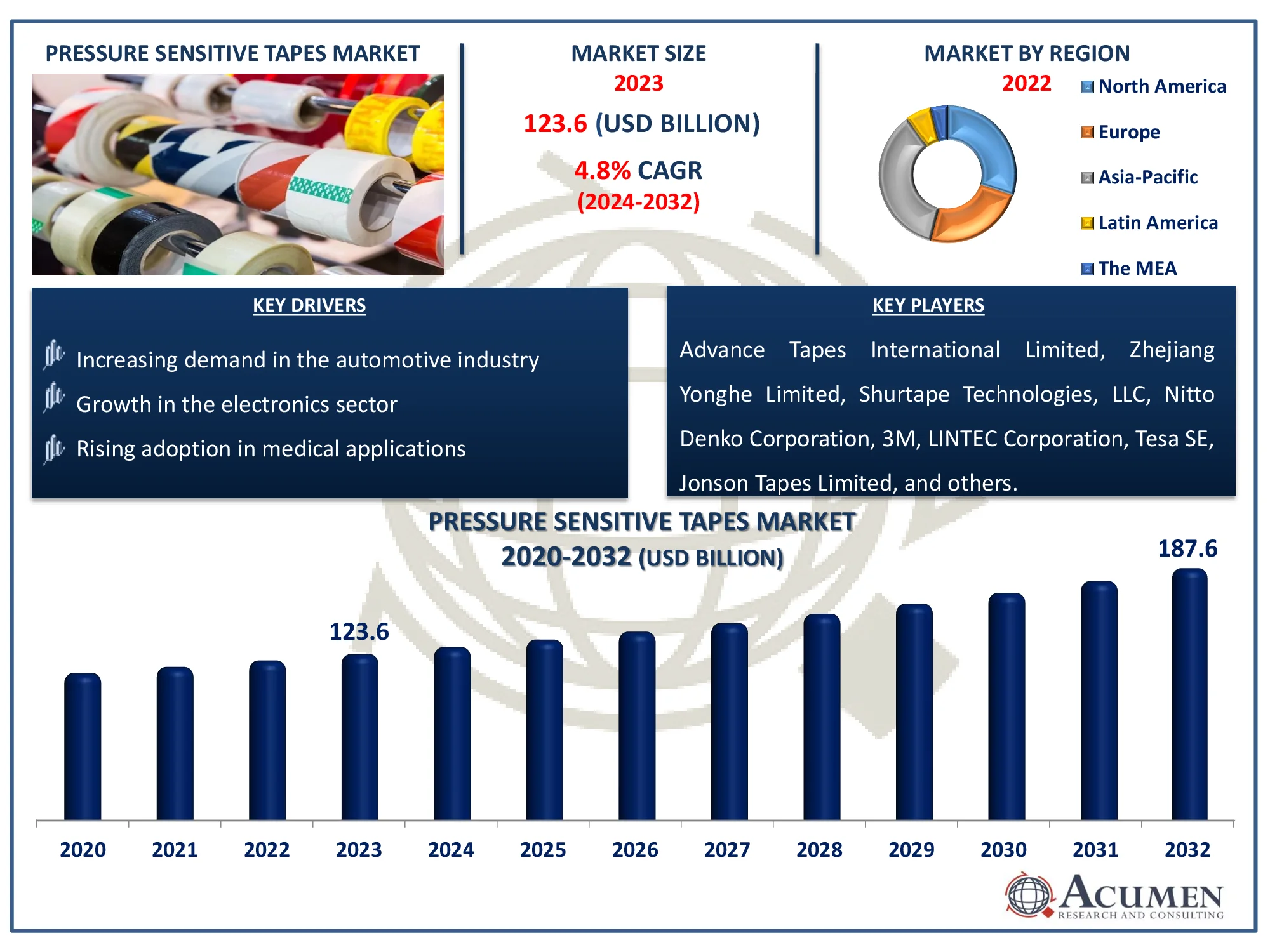

The Global Pressure Sensitive Tapes Market Size accounted for USD 123.6 Billion in 2023 and is estimated to achieve a market size of USD 187.6 Billion by 2032 growing at a CAGR of 4.8% from 2024 to 2032.

Pressure Sensitive Tapes Market Highlights

- Global pressure sensitive tapes market revenue is poised to garner USD 187.6 billion by 2032 with a CAGR of 4.8% from 2024 to 2032

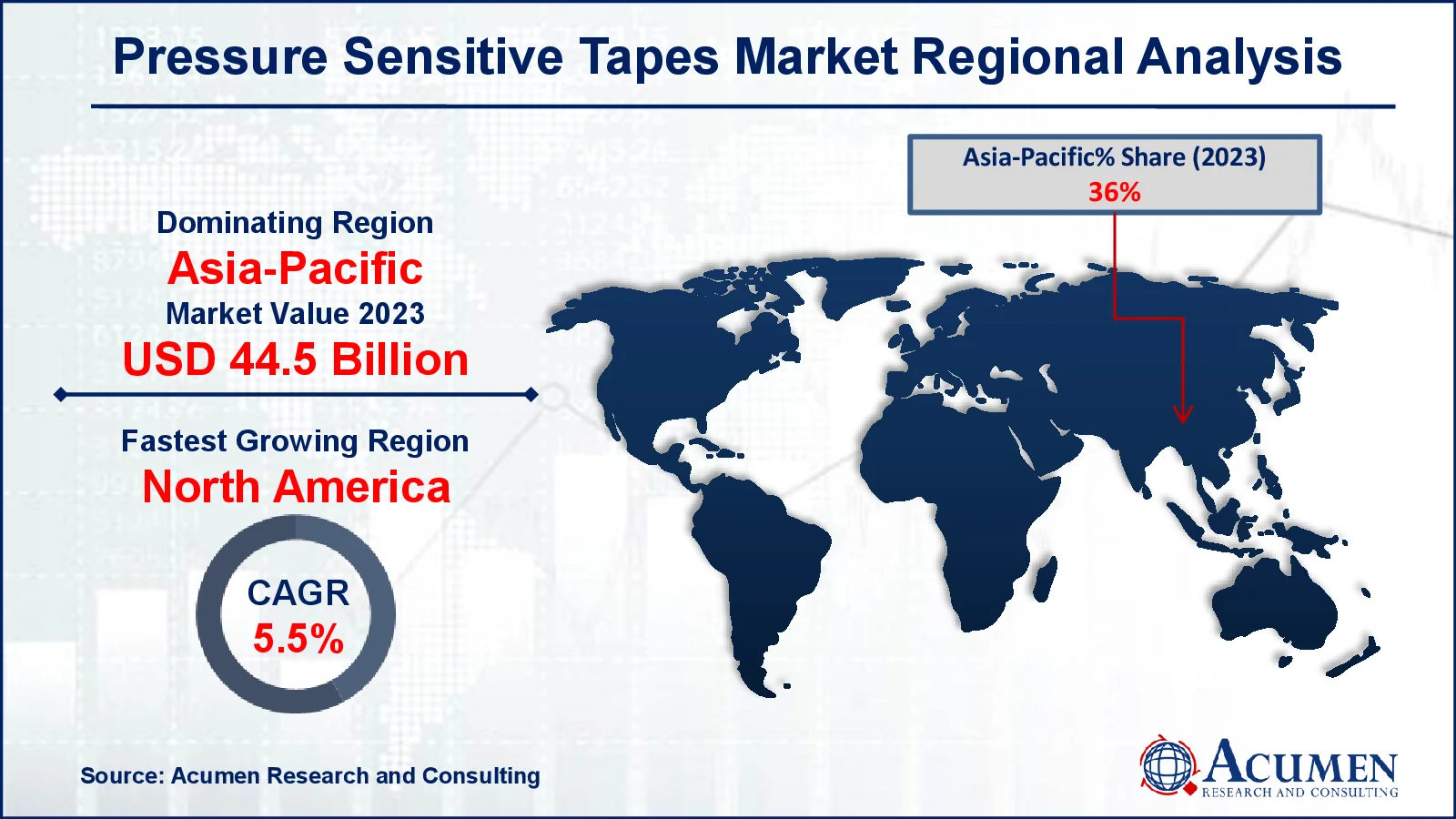

- Asia-Pacific pressure sensitive tapes market value occupied around USD 44.5 billion in 2023

- North America pressure sensitive tapes market growth will record a CAGR of more than 5.5% from 2024 to 2032

- Among product, the packaging tapes sub-segment generated 48% of share in 2023

- Based on technology, the hot melt sub-segment generated 41% of pressure sensitive tapes market share in 2023

- As per by backing material, woven/nonwoven gives 24% of share of pressure sensitive tapes market in 2023

- Advances in adhesive technologies improving tape performance is a popular pressure sensitive tapes market trend that fuels the industry demand

Pressure-sensitive tapes are sticky tapes that adhere to surfaces with just a gentle touch, eliminating the need for water, heat, or solvents. They are composed of a backing material, such as paper, plastic, film, or metal foil, which is coated with a sticky adhesive at room temperature. These tapes are typically classified as single-sided, double-sided, masking, or duct tape. This technology is used in a wide range of industries, including packaging, automotive, electronics, healthcare, and construction. PSTs are used in packaging to secure boxes and bundles, and in automobiles to connect trims and insulate wiring. They are used in medical to manufacture bandages and surgical drapes, and in electronics to shield and connect components.

Global Pressure Sensitive Tapes Market Dynamics

Market Drivers

- Increasing demand in the automotive industry

- Growth in the electronics sector

- Rising adoption in medical applications

Market Restraints

- Fluctuating raw material prices

- Environmental regulations

- High competition among manufacturers

Market Opportunities

- Expansion in emerging markets

- Development of eco-friendly tapes

- Advances in adhesive technologies

Pressure Sensitive Tapes Market Report Coverage

| Market | Pressure Sensitive Tapes Market |

| Pressure Sensitive Tapes Market Size 2022 |

USD 123.6 Billion |

| Pressure Sensitive Tapes Market Forecast 2032 | USD 187.6 Billion |

| Pressure Sensitive Tapes Market CAGR During 2023 - 2032 | 4.8% |

| Pressure Sensitive Tapes Market Analysis Period | 2020 - 2032 |

| Pressure Sensitive Tapes Market Base Year |

2022 |

| Pressure Sensitive Tapes Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Technology, By Backing Material, By Adhesive Chemistry, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Advance Tapes International Limited, Zhejiang Yonghe Limited, Shurtape Technologies, LLC, Nitto Denko Corporation, 3M Company, LINTEC Corporation, Tesa SE, Jonson Tapes Limited, Berry Plastics Corporation, Adchem Corporation, Intertape Polymer Group, American Biltrite Inc., and Avery Dennison Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Pressure Sensitive Tapes Market Insights

The market is likely to expand significantly as growing uses in healthcare and automotive industries. The packaging industry is a prominent driver, owing to high volume application in vehicle board and holder assembly. Packaging tapes are preferred over alternatives such as glues and sealants due to their convenience of use, which is expected to drive up demand in end-use industries.

The industry's innovation focuses on providing high-quality products. Advancement of redid item intended for use in specific applications alongside ascend being used of silicone-based glues is expected to be a major trend for tape makers worldwide.

Fluctuations in raw material pricing cause considerable changes in production expenses for manufacturers, which can have a detrimental impact on market growth. These cost variations are frequently linked to fluctuations in crude oil prices, and import restrictions on crude oil are likely to further limit the market's potential.

Regulations governing the use of adhesives and supporting materials in diverse applications have also become more complex. For instance, National governments in Europe and North America now mandate detailed lists of the materials used in pressure-sensitive tape production, increasing the regulatory burden.

Furthermore, the market's growth may be limited by the availability of replacements such as adhesives, sealants, and fasteners. The widespread adoption of these alternatives in areas such as automotive, construction, and aerospace is projected to limit market growth.

Innovation in the industry is focused on producing high-quality products with superior performance. The development of customized products for specific applications, along with the increasing use of silicone-based adhesives, is anticipated to be a key trend for tape manufacturers globally.

Pressure Sensitive Tapes Market Segmentation

The worldwide market for pressure sensitive tapes is split based on product, technology, backing material, adhesive chemistry, application, and geography.

Pressure Sensitive Tape Market by Product

- Specialty Tapes

- Packaging Tapes

- Consumer Tapes

According to pressure-sensitive tapes industry analysis, packaging tapes dominates the market in 2023. This is because they are necessary for sealing and securing goods during transit and storage. Their high adhesive capabilities, durability, and resilience to a variety of climatic conditions make them suitable for both industrial and consumer applications. Furthermore, packaging tapes come in a variety of shapes and sizes to meet a wide range of packaging requirements, increasing their market penetration. The rise of e-commerce and logistics has increased demand for these tapes.

Pressure Sensitive Tape Market by Technology

- Hot Melt

- Water-Based

- Solvent-Based

- Radiation-Cured

Hot melt has long been a market leader in the pressure sensitive tapes industry, due to its fast curing times and strong adhesive properties. This technology offers superior bonding on various surfaces and is cost-effective, enhancing manufacturing efficiency. Its ability to provide a clean application without requiring additional solvents or curing agents makes it highly desirable. As a result, hot melt adhesives are favored for their reliability and ease of use in a wide range of tape applications.

Pressure Sensitive Tape Market by Backing Material

- Woven/Nonwoven

- Polyvinylchloride (PVC)

- Polypropylene (pp)

- Polyethylene Terephthalate (pet)

- Foam

- Metal

- Other Backing Materials

In the pressure sensitive tapes market, woven and nonwoven solutions dominate due to their versatility and performance characteristics. Woven tapes offer durability and strength, making them ideal for demanding applications, while nonwoven tapes provide flexibility and conformability for diverse surfaces and intricate shapes. The choice between them often depends on specific requirements like adhesion strength, environmental resistance, and application method. Together, these solutions cater to a broad range of industries and needs.

Pressure Sensitive Tape Market by Adhesive Chemistry

- Acrylic

- Rubber

- Silicone

- Other Adhesive Chemistry

Historically, acrylic adhesives are poised to dominate the pressure-sensitive tapes market due to their superior adhesion properties and versatility. Their resistance to UV light, temperature extremes, and aging makes them ideal for various applications, from automotive to electronics. Additionally, acrylic adhesives offer excellent clarity and low yellowing over time, which enhances the aesthetic and functional performance of tapes. Their growing use in high-tech and industrial sectors is driving their market leadership.

Pressure Sensitive Tape Market by Application

- Automotive

- Aerospace

- White goods

- Electronics

- Semiconductors

- Electrical

- Paper & printing

- Construction

- Medical

- Hygiene

- Retail & Graphics

- Other Applications

In the pressure sensitive tapes market, the medical application dominates the market due to its critical role in various healthcare settings. These tapes are essential for securing dressings, bandages, and medical devices, as well as for patient monitoring and wound care. Their ability to adhere securely to skin while being gentle enough to prevent irritation makes them indispensable in medical applications. Additionally, the increasing demand for advanced healthcare solutions and the growing focus on patient safety and comfort further drive the prominence of medical-grade pressure-sensitive tapes.

Pressure Sensitive Tapes Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Pressure Sensitive Tapes Market Regional Analysis

Regional analysis of pressure sensitive tapes market, Asia-Pacific dominates the regional sector due to its booming manufacturing sector and increasing demand from industries like automotive, electronics, and construction. This dominance is fueled by rapid industrialization, urbanization, and the presence of major market players in the region.

North America is projected to become the second-largest market for pressure-sensitive tapes after the Asia Pacific during the forecast period. The robust growth in Mexico's medical, electronics, automotive, and electrical sectors, which are key consumers of these products, is expected to drive demand over the forecast period.

The market in Europe is anticipated to grow during the same period. The rising demand for these tapes in the packaging industry is expected to spur the regional market's growth in the coming years. Additionally, the replacement of adhesives with tapes is likely to positively influence market expansion.

Pressure Sensitive Tapes Market Players

Some of the top pressure sensitive tapes companies offered in our report includes Advance Tapes International Limited, Zhejiang Yonghe Limited, Shurtape Technologies, LLC, Nitto Denko Corporation, 3M Company, LINTEC Corporation, Tesa SE, Jonson Tapes Limited, Berry Plastics Corporation, Adchem Corporation, Intertape Polymer Group, American Biltrite Inc., and Avery Dennison Corporation.

Frequently Asked Questions

How big is the pressure sensitive tapes market?

The pressure sensitive tapes market size was valued at USD 123.6 billion in 2023.

What is the CAGR of the global pressure sensitive tapes market from 2024 to 2032?

The CAGR of pressure sensitive tapes is 4.8% during the analysis period of 2024 to 2032.

Which are the key players in the pressure sensitive tapes market?

The key players operating in the global market are including Advance Tapes International Limited, Zhejiang Yonghe Limited, Shurtape Technologies, LLC, Nitto Denko Corporation, 3M Company, LINTEC Corporation, Tesa SE, Jonson Tapes Limited, Berry Plastics Corporation, Adchem Corporation, Intertape Polymer Group, American Biltrite Inc., and Avery Dennison Corporation.

Which region dominated the global pressure sensitive tapes market share?

Asia-Pacific held the dominating position in pressure sensitive tapes industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of pressure sensitive tapes during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global pressure sensitive tapes industry?

The current trends and dynamics in the pressure sensitive tapes industry include increasing demand in the automotive industry, growth in the electronics sector, and rising adoption in medical applications.

Which technology held the maximum share in 2023?

The hot melt held the maximum share of the pressure sensitive tapes industry.