Polypropylene Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Polypropylene Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

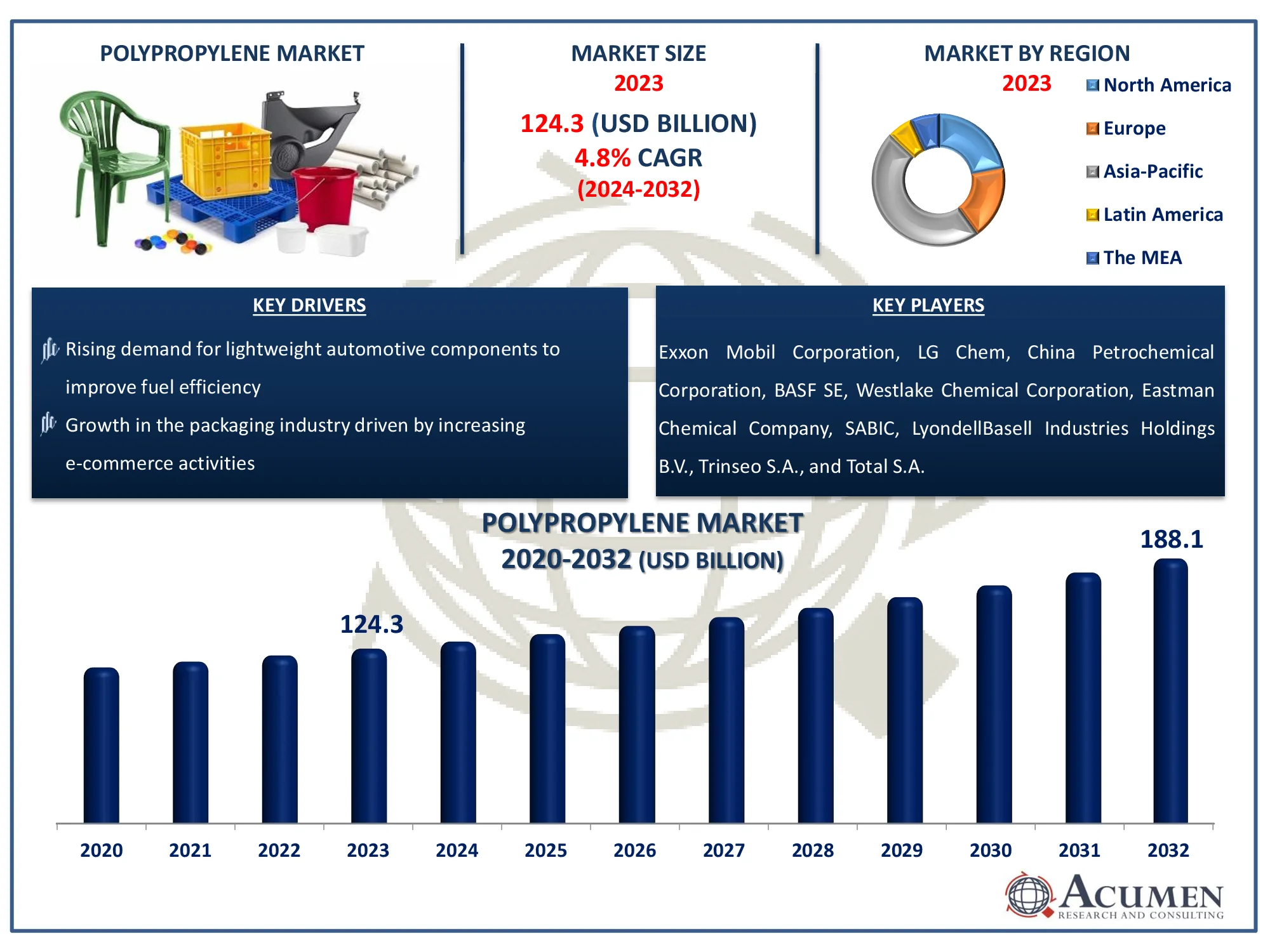

The Global Polypropylene Market Size accounted for USD 124.3 Billion in 2023 and is estimated to achieve a market size of USD 188.1 Billion by 2032 growing at a CAGR of 4.8% from 2024 to 2032.

Polypropylene Market Highlights

- Global polypropylene market revenue is poised to garner USD 188.1 billion by 2032 with a CAGR of 4.8% from 2024 to 2032

- Asia-Pacific polypropylene market value occupied around USD 58.4 billion in 2023

- Asia-Pacific polypropylene market growth will record a CAGR of more than 5.6% from 2024 to 2032

- Among type, the homopolymer sub-segment generated more than USD 95.7 billion revenue in 2023

- Based on application, the automotive sub-segment generated around 29% polypropylene market share in 2023

- Rising investments in emerging markets to enhance polypropylene production capacities is a popular polypropylene market trend that fuels the industry demand

Polypropylene is one of the largest and single most organic resins in the world, commonly known as polypropene. It is a synthetic thermoplastic polymer of high molecular weight, which can easily be produced by catalytic propylene polymerization. Because of its high quality, demand is on the increase, especially in the automotive and consumer goods industries. This has offered the global polypropylene industry countless possibilities. In the worldwide polypropylene industry, the pattern of replacement with polypropylene in various sectors is also a contributing factor.

Global Polypropylene Market Dynamics

Market Drivers

- Rising demand for lightweight automotive components to improve fuel efficiency

- Growth in the packaging industry driven by increasing e-commerce activities

- Expanding use of polypropylene in medical devices and healthcare applications

- Advancements in polypropylene recycling technologies promoting sustainability

Market Restraints

- Volatility in raw material prices impacting production costs

- Environmental concerns regarding non-biodegradability of polypropylene

- Strict regulations limiting the use of single-use plastics

Market Opportunities

- Growing adoption of bio-based polypropylene as an eco-friendly alternative

- Increasing applications in 3D printing for industrial manufacturing

- Expansion of polypropylene usage in renewable energy systems like solar panels

Polypropylene Market Report Coverage

|

Market |

Polypropylene Market |

|

Polypropylene Market Size 2023 |

USD 124.3 Billion |

|

Polypropylene Market Forecast 2032 |

USD 188.1 Billion |

|

Polypropylene Market CAGR During 2024 - 2032 |

4.8% |

|

Polypropylene Market Analysis Period |

2020 - 2032 |

|

Polypropylene Market Base Year |

2023 |

|

Polypropylene Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Type, By Process, By Application, By End User, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Exxon Mobil Corporation, LG Chem, China Petrochemical Corporation, BASF SE, Westlake Chemical Corporation, Eastman Chemical Company, SABIC, LyondellBasell Industries Holdings B.V., Trinseo S.A., and Total S.A. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Polypropylene Market Insights

A significant factor in the global polypropylene (PP) market growth is growing demand for polypropylene from diverse end-use sectors, especially the food packaging and automotive industries. Convenient access to polypropylene, as well as strong demand for certain plastic forms that don't produce BisphenolA (BPA), endokrine disruptor that can contribute to specific health problems such as diabetes, heart diseases are the additional factors are expected to drive growth of the global polypropylene market over the forecast period.

Fluctuating propylene costs is a significant factor limiting growth in the world's polypropylene industry. Strict environmental legislation on plastics disposal and the availability of substitutes will, also hamper the development of the global polypropylene industry in the forecast timeframe.

The growing trend toward sustainable practices has expedited the introduction of bio-based polypropylene in a variety of industries. Bio-based polypropylene, derived from renewable feedstocks such as sugarcane or maize, performs similarly to conventional polypropylene while having a much lower environmental effect. Industries such as automotive, packaging, and consumer goods are investigating its application to meet regulatory requirements and consumer demand for environmentally friendly products. This trend is consistent with worldwide efforts to minimize carbon emissions and reliance on fossil fuels. Companies investing in bio-based polypropylene are benefiting on its growing popularity as a green alternative, which not only decreases their environmental impact but also gives them a competitive advantage in markets that are more focused on sustainability and circular economy practices.

Polypropylene Market Segmentation

Polypropylene Market Segmentation

The worldwide market for polypropylene is split based on type, process, application, end user, and geography.

Polypropylene Types

- Copolymer

- Homopolymer

According to polypropylene industry analysis, homopolymer polypropylene dominates the market because of its superior characteristics and versatility. Its high tensile strength, stiffness, and superior chemical resistance make it popular in industries like as packaging, automotive, textiles, and healthcare. The sector is especially popular in rigid packaging applications like containers and caps, where toughness and lightweight properties are essential. Homopolymer's strong temperature resistance makes it perfect for hot-fill applications and microwaveable containers. Furthermore, its lower cost compared to other polymer kinds boosts its popularity, particularly in underdeveloped countries. With rising demand for sustainable and high-performance materials, homopolymer polypropylene maintains its global leadership, bolstered by consistent innovation and expanding industrial applications.

Polypropylene Processes

- Injection Molding

- Extrusion Molding

- Blow Molding

- Others

Injection molding hold the maximum share in the polypropylene market forecast period, due to its efficiency and versatility in making complex and high-precision products. This technology is frequently utilized in the automotive, packaging, consumer goods, and healthcare industries to create components including as automobile interiors, food containers, bottle caps, and medical equipment. The process has several advantages, including low material waste, rapid production cycles, and the capacity to construct elaborate shapes with high dimensional precision. Polypropylene's lightweight and resilient properties make it ideal for injection molding, accelerating its adoption. Furthermore, developments in injection molding technology, including as automation and improved tooling, have increased production efficiency, ensuring that the technique remains the favored method for mass producing polypropylene goods around the world.

Polypropylene Applications

- Fiber

- Raffia

- Film & Sheet

- Others

The film & sheet category provides the most revenue in the polypropylene market due to its widespread use in packaging, agriculture, and industrial applications. Polypropylene films are light, strong, and resistant to moisture and chemicals, making them excellent for flexible food packaging, laminating, and protective layers. Polypropylene sheets are used in agriculture for mulching and greenhouse covers, which increase crop output while using less water. The segment also benefits from the growing need for sustainable and recyclable packaging solutions, as polypropylene films are simple to recycle. Demand for protective packaging materials is increasing as e-commerce grows rapidly. Innovations such as biaxially oriented polypropylene (BOPP) films continue to extend uses, ensuring the company's strong market position.

Polypropylene End Users

- Automotive

- Packaging

- Medical

- Building & Construction

- Electrical & Electronics

- Others

The automotive industry largest in the polypropylene market due to the material's lightweight, durability, and cost-effectiveness, all of which are critical for improving vehicle fuel efficiency and lowering emissions. Polypropylene is widely utilized in automotive applications, including interior components (dashboard, seat, and trim), external parts (bumpers, fenders), and under-the-hood uses (battery boxes, air filters). Its ability to tolerate high temperatures, impact resistance, and ease of molding make it excellent for producing complicated, lightweight, and durable components. As automakers focus more on decreasing vehicle weight to meet rigorous environmental standards, demand for polypropylene in the automotive sector is likely to stay robust, resulting in ongoing growth in this category.

Polypropylene Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Polypropylene Market Regional Analysis

Polypropylene Market Regional Analysis

Asia-Pacific is the world's largest and fastest growing polypropylene market, owing to the region's rapid industrialization, rising manufacturing base, and growing population. China, India, and Southeast Asia are important polypropylene manufacturing and consumption hubs because of their large-scale industries and rapid economic expansion. The growing demand for lightweight and durable materials in automobiles, packaging, and consumer goods supports regional market growth.

China leads the market with its vast production capacity and strong presence in the packaging and automotive industries, while India is witnessing significant growth as a result of expanded infrastructure projects and rising consumer markets. For instance according to the India Brand Equity Foundation the packaging industry is India's fifth-largest sector. It is one of the country's fastest-growing industries, developing at a rate of 22-25 percent each year, and India is emerging as a vital packaging powerhouse.. The region's packaging industry, particularly flexible and rigid packaging, benefits from increased e-commerce and a growing demand for affordable, recyclable materials.

Furthermore, government efforts to attract foreign investment, as well as the availability of low-cost raw materials and labor, help to boost polypropylene manufacturing in Asia-Pacific. The region's dedication to sustainability and circular economy policies has hastened advancements in recycling technologies, boosting the usage of polypropylene as an environmentally friendly alternative. Overall, Asia-Pacific's dominance in the polypropylene market is bolstered by its strategic location as a global manufacturing hub, increased industrial activity, and rising disposable incomes, all of which will assure continuous market growth in coming years.

Polypropylene Market Players

Some of the top polypropylene companies offered in our report include Exxon Mobil Corporation, LG Chem, China Petrochemical Corporation, BASF SE, Westlake Chemical Corporation, Eastman Chemical Company, SABIC, LyondellBasell Industries Holdings B.V., Trinseo S.A., and Total S.A.

Frequently Asked Questions

How big is the polypropylene market?

The polypropylene market size was valued at USD 124.3 Billion in 2023.

What is the CAGR of the global polypropylene market from 2024 to 2032?

The CAGR of polypropylene is 4.8% during the analysis period of 2024 to 2032.

Which are the key players in the Polypropylene market?

The key players operating in the global market are including Exxon Mobil Corporation, LG Chem, China Petrochemical Corporation, BASF SE, Westlake Chemical Corporation, Eastman Chemical Company, SABIC, LyondellBasell Industries Holdings B.V., Trinseo S.A., and Total S.A.

Which region dominated the global polypropylene market share?

Asia-Pacific held the dominating position in polypropylene industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of polypropylene during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global polypropylene industry?

The current trends and dynamics in the polypropylene industry include rising demand for lightweight automotive components to improve fuel efficiency, and growth in the packaging industry driven by increasing e-commerce activities.

Which process held the maximum share in 2023?

The injection molding process held the maximum share of the polypropylene industry.