E-Commerce Logistics Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

E-Commerce Logistics Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

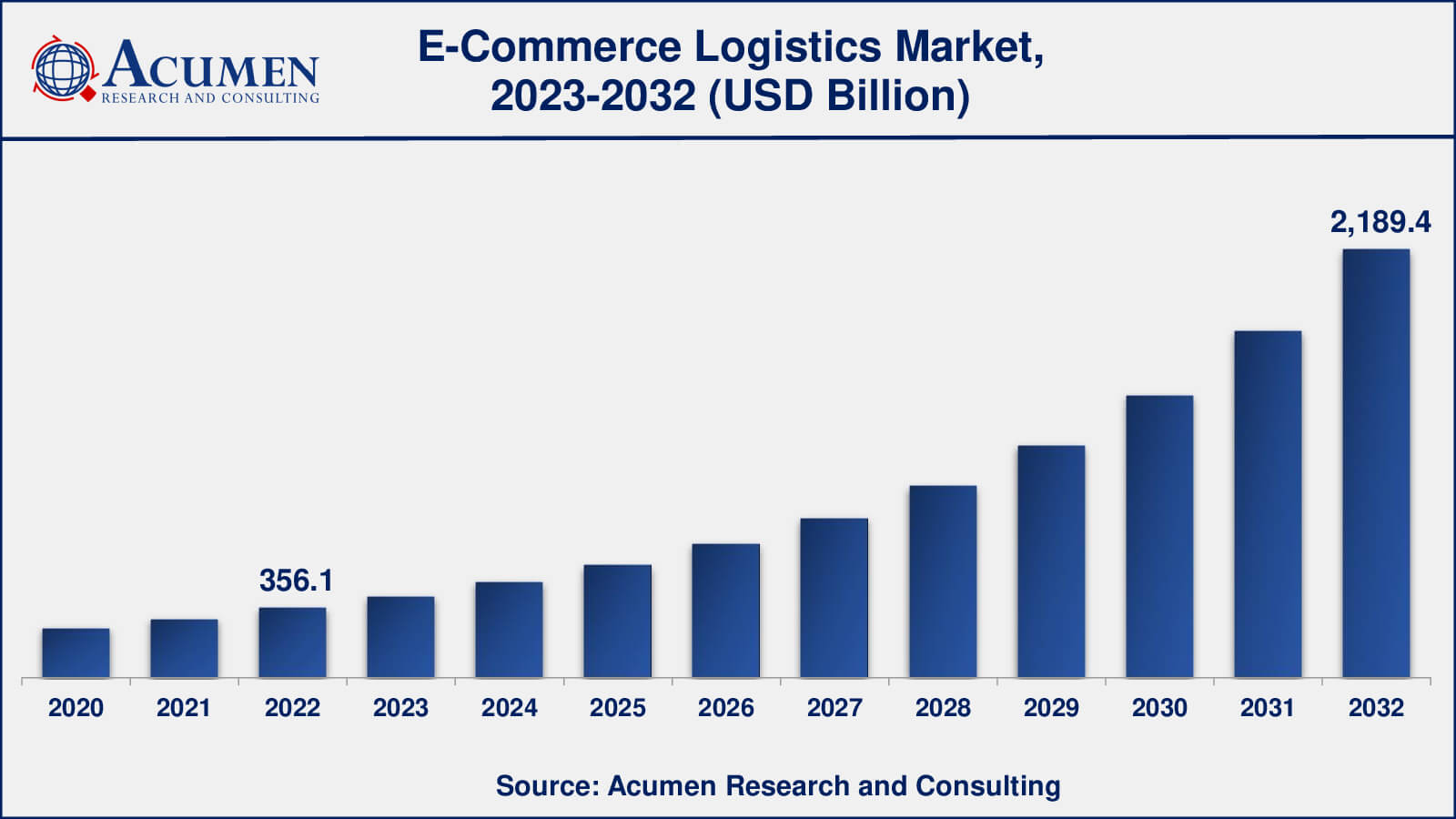

The Global E-Commerce Logistics Market Size accounted for USD 356.1 Billion in 2022 and is estimated to achieve a market size of USD 2,189.4 Billion by 2032 growing at a CAGR of 20.3% from 2023 to 2032.

E-Commerce Logistics Market Highlights

- Global e-commerce logistics market revenue is poised to garner USD 2,189.4 billion by 2032 with a CAGR of 20.3% from 2023 to 2032

- Asia-Pacific e-commerce logistics market value occupied around USD 146 billion in 2022

- North America e-commerce logistics market growth will record a CAGR of more than 21% from 2023 to 2032

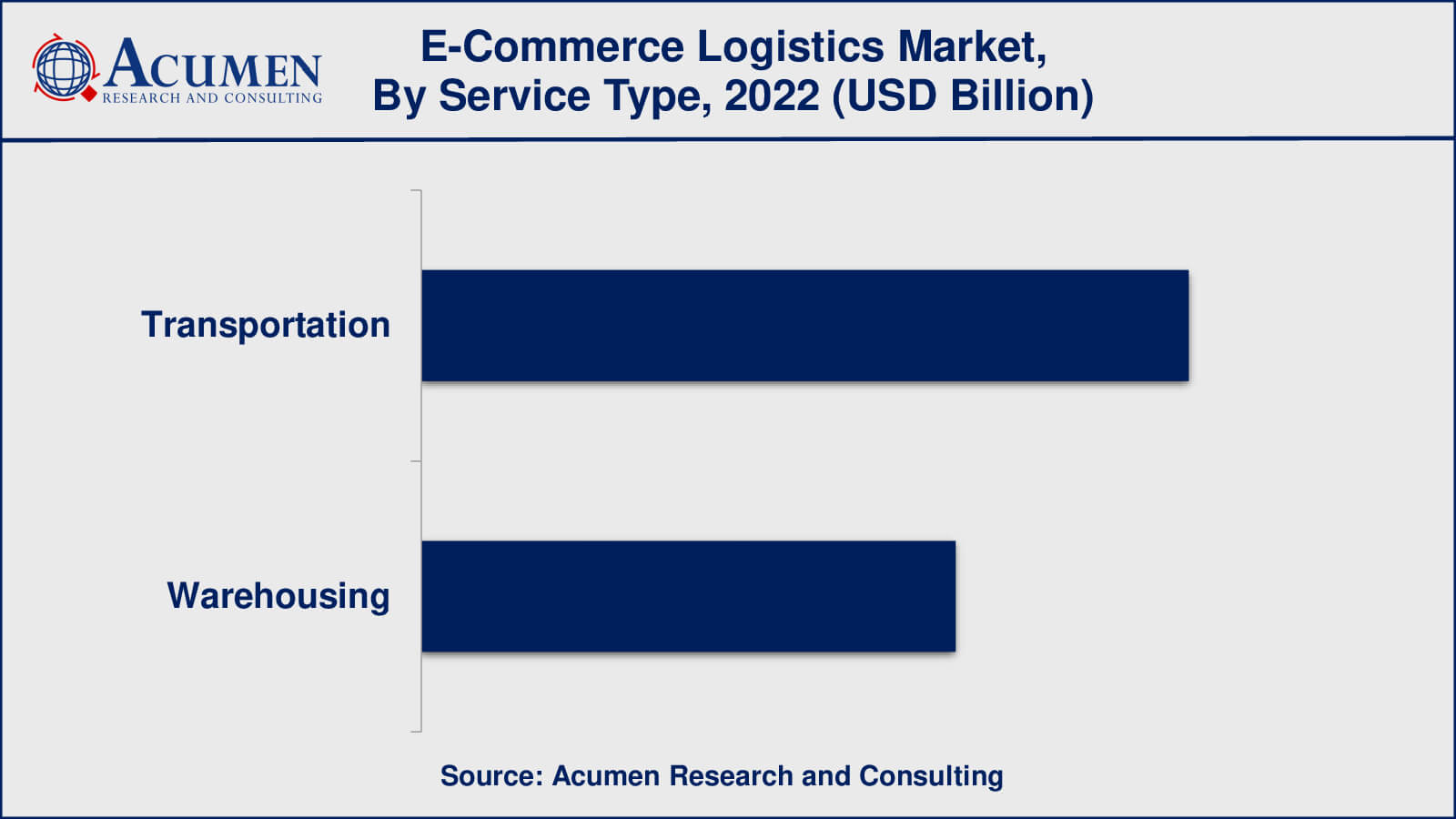

- Among service type, the transportation sub-segment generated over US$ 210 billion revenue in 2022

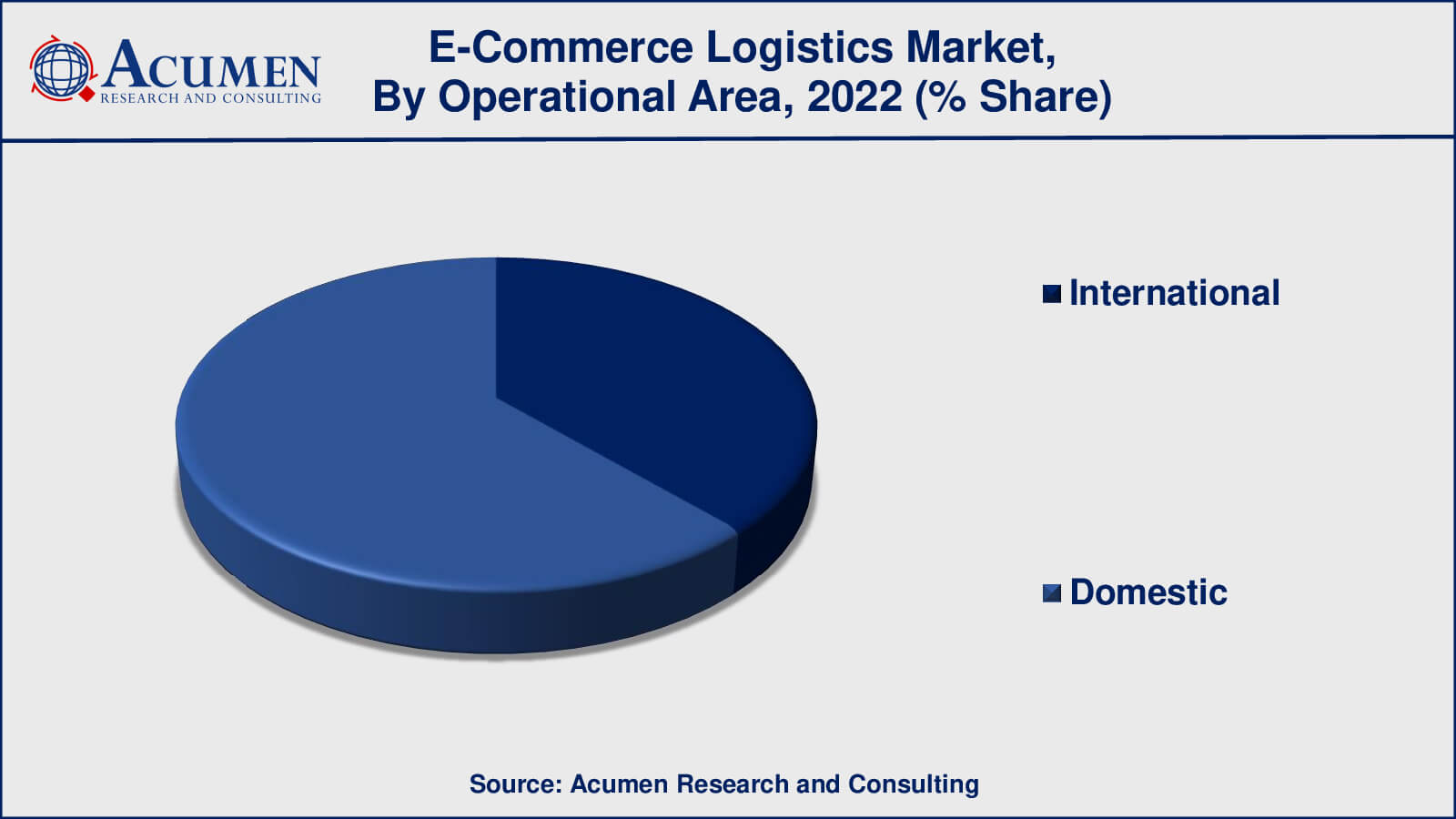

- Based on operational area, the domestic sub-segment generated around 62% share in 2022

- Developing efficient last-mile delivery options is a popular market trend that fuels the industry demand

E-commerce is experiencing robust growth and is projected to evolve over the coming decades, driven by the emergence of a novel business model. As a consequence of the substantial number of businesses participating in e-commerce, logistics has undergone a significant transformation behind the scenes. This domain of logistics specifically catering to online sales is referred to as e-commerce logistics.

E-commerce logistics encompasses a range of activities tied to the management and transportation of inventory for online stores or marketplaces. These activities encompass tasks such as inventory management, order picking, packaging, and the subsequent shipping of online orders. The journey of e-commerce logistics commences with the movement of goods from manufacturers and extends until they reach their ultimate destination, which is the end customer.

In this landscape, effective e-commerce logistics are pivotal for ensuring the seamless flow of products from their point of origin to the hands of the consumer. As the online retail sector flourishes, logistics strategies have evolved to accommodate the unique challenges posed by this digital-driven marketplace. Efficient inventory management ensures that products are available and ready to fulfill customer orders promptly. The process of picking, packaging, and shipping orders must be finely tuned to meet customer expectations for swift deliveries.

Global E-Commerce Logistics Market Dynamics

Market Drivers

- Growing investment in logistics and warehouses

- Growing usage of debit cards for cashless transaction

- The surge in online shopping and cross-border e-commerce

- Adoption of automation, AI, and IoT and demand for real-time tracking and transparency

- Growth in cities beyond metros and increasing cross border e-commerce activity

Market Restraints

- Lack of customer awareness about system and safety

- Stringent Government regulations

- Poor transportation networks

- Varying customs and trade regulations

- Shortage of skilled labor

Market Opportunities

- Growing penetration of smartphone and internet

- Seamlessly blending online and offline channels

- Utilizing automation and data analytics

- Trade liberalization policies and cross-border shipment agreements

E-Commerce Logistics Market Report Coverage

| Market | E-Commerce Logistics Market |

| E-Commerce Logistics Market Size 2022 | USD 356.1 Billion |

| E-Commerce Logistics Market Forecast 2032 | USD 2,189.4 Billion |

| E-Commerce Logistics Market CAGR During 2023 - 2032 | 20.3% |

| E-Commerce Logistics Market Analysis Period | 2020 - 2032 |

| E-Commerce Logistics Market Base Year | 2022 |

| E-Commerce Logistics Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Service Type, By Operational Area, By Vertical, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | FedEx Corporation, XPO Logistics, Inc., DHL International GmbH, Agility Public Warehousing Company K.S.C.P., Ceva, Holdings LLC, Gati Limited, United Parcel Service, Inc., Clipper Logistics Plc., Kenco Group, Inc., Aramex International. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

E-Commerce Logistics Market Insights

Over the projected years, the e-commerce logistics market is poised to be driven by the surge in cross-border e-commerce activities and the proliferation of e-commerce startups. The logistics landscape has undergone significant evolution in recent decades, owing to the rapid expansion and far-reaching impact of e-commerce. The future integration of Internet of Things (IoT), Big Data Analytics, and Cloud Computing is expected to usher in seamless operations for e-commerce logistics. These technological advancements have the potential to enhance and extend the reach of e-commerce logistics, enabling small and medium-sized businesses (SMEs) to tap into the benefits of the e-commerce era.

The escalating presence of digital technology stands out as a pivotal catalyst for ecommerce market growth. The proliferation of digital technology has led to a substantial increase in the number of internet users. The advancement of digital technology is driving a significant demand for e-commerce logistics, particularly fueled by a wide array of e-commerce applications, especially in developing nations. Consumers are now able to purchase products such as clothing, furniture, personal care items, groceries, and more through e-commerce platforms, foregoing the need to physically visit stores. The preference for doorstep deliveries has emerged as a compelling factor propelling these trends, consequently bolstering the demand for e-commerce logistics solutions.

In conclusion, the projected expansion of the e-commerce logistics market is intrinsically tied to the surge in cross-border trade, the rise of e-commerce startups, and the integration of advanced technologies. These dynamics, driven by digital technology and changing consumer behaviors, collectively contribute to the growing prominence of e-commerce logistics on a global scale.

E-Commerce Logistics Market Segmentation

The worldwide market for e-commerce logistics is split based on service type, operational area, vertical, and geography.

E-Commerce Logistics Service Type

- Transportation

- Airways

- Railways

- Roadways

- Waterways

- Warehousing

- Mega Centers

- Hubs/Delivery Centers

- Returns Processing Centers

The e-commerce logistics landscape is intricately categorized into two fundamental service types: warehousing and transportation. Within the warehousing division, the network comprises pivotal elements like returns processing centers, hubs, delivery centers, and mega centers. These cohesive components underpin the effective management of inventory, facilitate seamless returns processing, and ensure the efficient movement of goods, constituting a critical foundation for the e-commerce ecosystem. Simultaneously, the transportation division further subdivides the market, encompassing trucking/over the road, air/express delivery, rail, and maritime transport options. Each mode caters to diverse logistical needs, interweaving a comprehensive tapestry that drives the e-commerce logistics domain.

In recent years, the transportation segment has emerged as a dominant force within the eCommerce logistics market, and this prominence stems from several pivotal factors. Primarily, the exponential growth of e-commerce has brought forth a surge in both domestic and international customers, compelling the need for robust transportation networks to ensure timely and efficient cross-border deliveries. Additionally, the modern consumer's inclination towards swift home deliveries has soared, setting new benchmarks for convenience and promptness in the e-commerce experience. This consumer demand for rapid deliveries has spurred innovation and adaptation within transportation companies, enhancing the overall allure of e-commerce platforms. Moreover, the expanding e-commerce horizon, embracing products like groceries and various goods, has fueled a heightened demand for transportation services that can navigate the intricacies of delivering a diverse range of products, including perishables, to customers' doorsteps with utmost precision. In this evolving landscape, the transportation segment's capacity to align with changing trends and customer preferences stands as a linchpin, firmly positioning it at the forefront of the dynamic eCommerce logistics market.

E-Commerce Logistics Operational Areas

- International

- Domestic

The operational landscape of e-commerce logistics is delineated by the distinction between domestic and international segments. Notably, the domestic segment has commanded the lion's share of the market in preceding years. This supremacy is intricately linked to the pervasive trend of online shopping, buoyed by the surging popularity of home delivery services and the steady patronage of daily household users. The amalgamation of these factors has propelled the domestic e-commerce logistics market forward, reshaping the way products are sourced and delivered within a national boundary.

Central to this growth trajectory is the presence of international marketplace giants like Amazon, eBay, and Alibaba, which have fiercely competed within the domestic e-commerce sector. Their involvement has galvanized a competitive environment, where innovation and efficiency have become paramount. Notably, the convenience proffered by these industry titans resonates deeply with domestic users, amplifying their appeal and solidifying their position as favored platforms for online shopping. The amalgamation of user-friendly interfaces, expedited deliveries, and an extensive range of products has collectively contributed to their widespread popularity among the domestic consumer base.

In essence, the domestic operational area of e-commerce logistics is a dynamic realm that thrives on the evolving behaviors of consumers and the strategic maneuvers of market leaders. The amalgamation of convenience, product variety, and efficient deliveries has propelled the domestic market's growth trajectory, while the competitive landscape shaped by international marketplace players continues to redefine the contours of this vibrant sector.

E-Commerce Logistics Verticals

- Apparels

- Consumer Electronics

- Automotive

- Healthcare

- Food and Beverage

- Others

According to the e-commerce logistics market forecast, the apparel segment has maintained its dominance in terms of market share and is expected to retain this position throughout the projected timeframe from 2023 to 2032. This segment has consistently held a substantial 39% share of the market in recent years. The surge in the online fashion market's popularity can be attributed to the availability of easy viewing options, enticing discounts, and favorable return policies.

In terms of growth rate, the consumer electronics segment is currently witnessing the swiftest revenue expansion, marked by a high compound annual growth rate (CAGR) during the forecast period. Furthermore, the food and beverage subsegment is poised for growth over the same period. The escalating demand for online food delivery, along with groceries, packaged food and beverages, and other culinary offerings, underscores the anticipated growth in the food and beverages segment of the market in the near future.

E-Commerce Logistics Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

E-Commerce Logistics Market Regional Analysis

The Asia-Pacific region has exerted its dominance over the e-commerce logistics market in recent years, claiming a significant share of the global market. This trend is poised to persist throughout the forecast period, owing to the region's burgeoning e-commerce landscape and the substantial consumer demand for both domestic and international retail offerings. The confluence of factors, including the upsurge in online shopping, well-coordinated government policies, the increasing penetration of smartphones and the internet, and the burgeoning cross-border e-commerce market, collectively propel the e-commerce logistics market in the Asia-Pacific.

Notably, the adoption of technology, particularly in the context of e-commerce, is taking root across the region. Moreover, the rising middle-class population's gradual acclimatization to e-commerce practices is stoking the demand for door-to-door services and modern logistics facilities, effectively propelling the e-commerce logistics market. Leading the forefront of this regional market are countries like China, India, and Japan. In China, for instance, JingDong stands as the largest e-commerce company, supported by a comprehensive supply network consisting of 166 substantial warehouses across 44 cities and 7 logistics centers, covering the entire nation. JingDong offers a range of logistics services, including the innovative 211 programs, next-day delivery, and even 3-hour delivery services. These initiatives contribute significantly to the expansion of the e-commerce logistics market in China.

E-Commerce Logistics Market Players

Some of the top e-commerce logistics companies offered in our report includes FedEx Corporation, XPO Logistics, Inc., DHL International GmbH, Agility Public Warehousing Company K.S.C.P., Ceva, Holdings LLC, Gati Limited, United Parcel Service, Inc., Clipper Logistics Plc., Kenco Group, Inc., and Aramex International.

- In October 2021, Clipper Logistics partnered with Wilko to establish a new warehouse in South Wales. This move aligns with Wilko's ongoing company growth and strategic ambitions, and the new facility will be situated within the existing Magor complex.

- In February 2019, FedEx unveiled the prototype of the FedEx SameDay Bot Roxo, an autonomous delivery device developed in response to the rapid growth of e-commerce. Roxo is designed for operation within a three-to-five-mile radius of a retailer's location, utilizing sidewalks, bike lanes, and roadways.

Frequently Asked Questions

What was the market size of the global e-commerce logistics in 2022?

The market size of e-commerce logistics was USD 356.1 billion in 2022.

What is the CAGR of the global e-commerce logistics market from 2023 to 2032?

The CAGR of e-commerce logistics is 20.3% during the analysis period of 2023 to 2032.

Which are the key players in the e-commerce logistics market?

The key players operating in the global market are including FedEx Corporation, XPO Logistics, Inc., DHL International GmbH, Agility Public Warehousing Company K.S.C.P., Ceva, Holdings LLC, Gati Limited, United Parcel Service, Inc., Clipper Logistics Plc., Kenco Group, Inc., and Aramex International.

Which region dominated the global e-commerce logistics market share?

Asia-Pacific held the dominating position in e-commerce logistics industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

North America region exhibited fastest growing CAGR for market of e-commerce logistics during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global e-commerce logistics industry?

The current trends and dynamics in the e-commerce logistics industry include growing investment in logistics and warehouses, growing usage of debit cards for cashless transaction, and growth in cities beyond metros and increasing cross border e-commerce activity.

Which service type held the maximum share in 2022?

The transportation service type held the maximum share of the e-commerce logistics industry.