Recycled Polyethylene Terephthalate Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Recycled Polyethylene Terephthalate Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

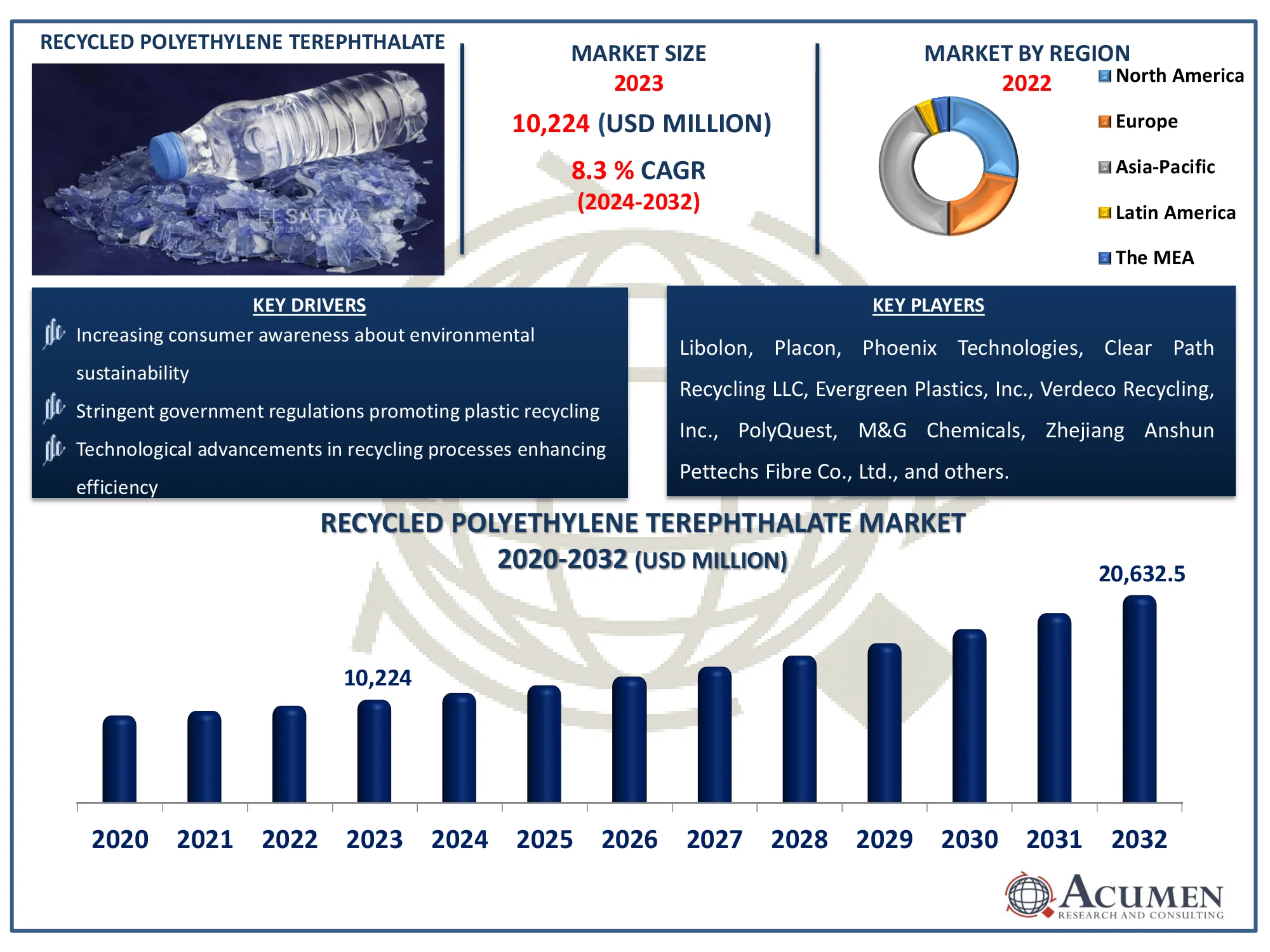

Request Sample Report

The Global Recycled Polyethylene Terephthalate Market Size accounted for USD 10,224 Million in 2023 and is estimated to achieve a market size of USD 20,632.5 Million by 2032 growing at a CAGR of 8.3 % from 2024 to 2032.

Recycled Polyethylene Terephthalate Market Highlights

- Global recycled polyethylene terephthalate market revenue is poised to garner USD 20,632.5 million by 2032 with a CAGR of 8.3% from 2024 to 2032

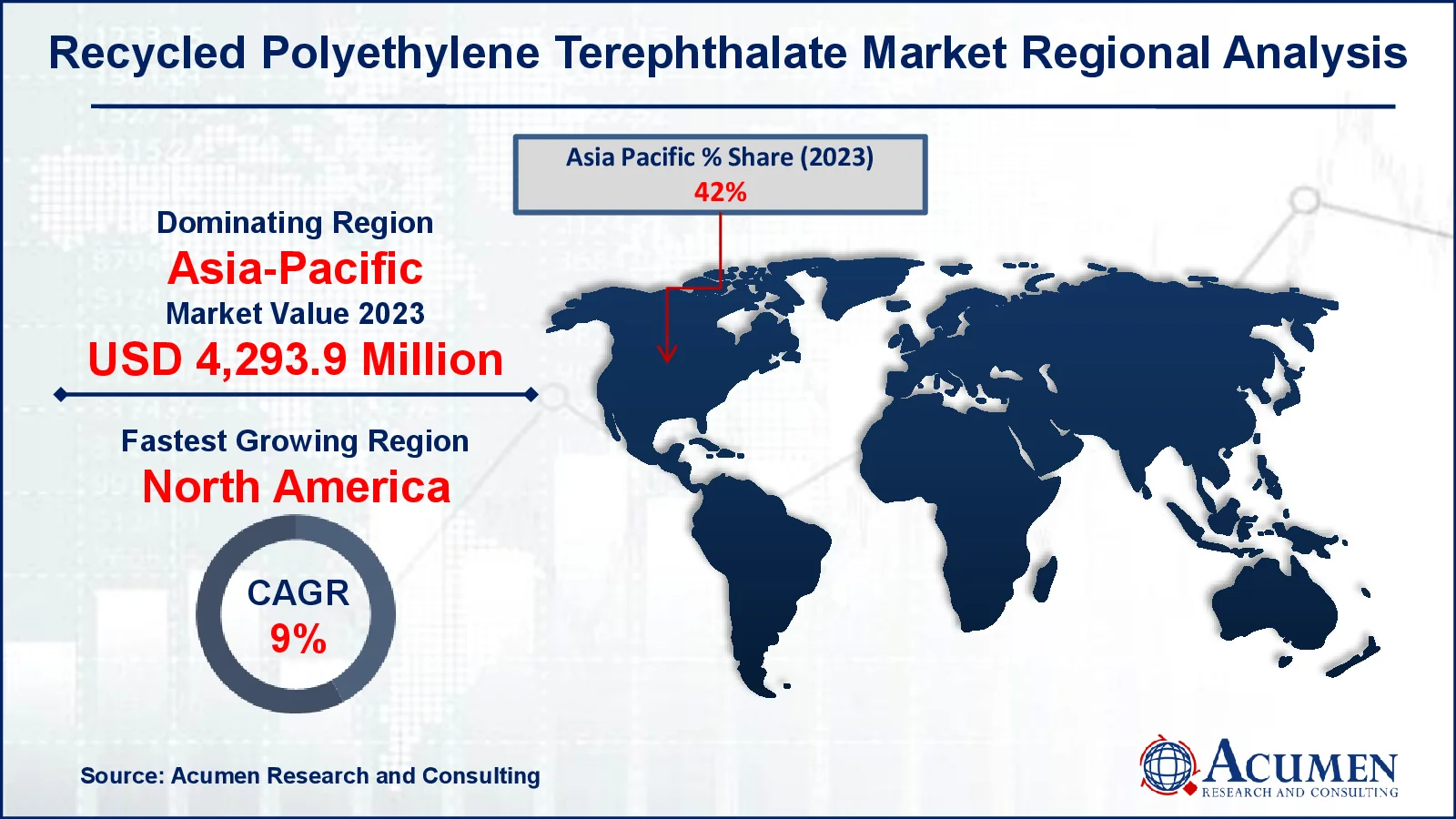

- Asia-Pacific recycled polyethylene terephthalate market value occupied around USD 4,293.93 million in 2023

- North America recycled polyethylene terephthalate market growth will record a CAGR of more than 9% from 2024 to 2032

- Among product, the clear sub-segment generated 75% of the market share in 2023

- Based on source, the bottles & containers sub-segment generated significant market share in 2023

Increasing environmental awareness and growing focus on sustainable packaging is the recycled polyethylene terephthalate market trend that fuels the industry demand

Recycled polyethylene terephthalate (rPET) is a sustainable material derived from post-consumer PET products, such as plastic bottles. The recycling process involves collecting, cleaning, and reprocessing PET waste into new materials, which helps reduce environmental impact and resource consumption. rPET retains the beneficial properties of virgin PET, including durability, clarity, and resistance to moisture and chemicals. It is widely used in the production of new bottles, food packaging, textiles, automotive parts, and construction materials, reducing plastic pollution.

Global Recycled Polyethylene Terephthalate Market Dynamics

Market Drivers

- Increasing consumer awareness about environmental sustainability

- Stringent government regulations promoting plastic recycling

- Technological advancements in recycling processes enhancing efficiency

Market Restraints

- High initial investment costs for recycling infrastructure

- Contamination issues affecting the quality of recycled PET

- Limited supply of high-quality post-consumer PET waste

Market Opportunities

- Expansion into new applications such as automotive and textiles

- Growing demand for recycled PET in packaging due to its eco-friendly nature

- Innovations in recycling technologies to improve cost-effectiveness and quality

Recycled Polyethylene Terephthalate Market Report Coverage

|

Market |

Recycled Polyethylene Terephthalate Market |

|

Recycled Polyethylene Terephthalate Market Size 2023 |

USD 10,224 Million |

|

Recycled Polyethylene Terephthalate Market Forecast 2032 |

USD 20,632.5 Million |

|

Recycled Polyethylene Terephthalate Market CAGR During 2024 - 2032 |

8.3% |

|

Recycled Polyethylene Terephthalate Market Analysis Period |

2020 - 2032 |

|

Recycled Polyethylene Terephthalate Market Base Year |

2023 |

|

Recycled Polyethylene Terephthalate Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Product, By Source, By Grade, By Form, By End Use, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Libolon, Placon, Phoenix Technologies, Clear Path Recycling LLC, Evergreen Plastics, Inc., Verdeco Recycling, Inc., PolyQuest, M&G Chemicals, Zhejiang Anshun Pettechs Fibre Co., Ltd., and Indorama Ventures Public Ltd. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Recycled Polyethylene Terephthalate Market Insights

The increasing consumer awareness about environmental sustainability is significantly driving the growth of the recycled polyethylene terephthalate (rPET) market. For instance, Far Eastern New Century Corporation (FENC) in Malaysia's Malacca state has stated that its green PET resin production facility, FE GREEN PET (M) SDN BHD, will expand beginning in April 2024. This highlights FENC's commitment to environmental sustainability and innovative plastic solutions. FENC aims to begin operations at FE GREEN PET (M) SDN BHD in mid-2025, following an investment in a food-grade recycled pet resin line. As individuals become more conscious of the ecological impact of their consumption choices, there is a heightened demand for sustainable packaging solutions. rPET, derived from recycled plastic bottles, addresses this demand by reducing plastic waste and lowering carbon emissions compared to virgin PET. Companies are responding by incorporating more rPET in their products for environmentally friendly practices, thus driving market growth.

However, contamination issues affecting the quality of recycled pet hampers the recycled polyethylene terephthalate market growth by reducing the quality and usability of recycled materials. Contaminants such as food residue, non-PET plastics, labels, and adhesives can complicate the recycling process, leading to higher costs and lower yields of high-quality rPET. This contamination often requires more intensive sorting and cleaning procedures, which increases operational expenses and reduces the economic possibility of recycling PET. As a result, the availability of high-grade rPET is limited, thereby slowing market expansion and reducing the appeal of rPET products for manufacturers seeking sustainable alternatives.

The rising demand for recycled polyethylene terephthalate (rPET) in packaging is driven by increasing environmental awareness and stringent regulations promoting sustainability. Consumers and companies are prioritizing eco-friendly solutions, leading to a surge in the adoption of rPET due to its lower carbon footprint and recyclability. This trend presents significant opportunities for the rPET market, as businesses search to meet their sustainability goals and reduce plastic waste. The packaging industry, in particular, benefits from rPET's ability to provide high-quality, durable, and safe materials that align with environmental objectives, thereby driving market growth.

Recycled Polyethylene Terephthalate Market Segmentation

The worldwide market for recycled polyethylene terephthalate is split based on product, source, grade, form, end use, and geography.

Recycled Polyethylene Terephthalate (rPET) Market By Product

- Clear

- Colored

According to the recycled polyethylene terephthalate industry analysis, clear rPET type dominates the rPET market due to its superior quality and versatility. It maintains clarity and strength through reprocessing, making it ideal for various applications such as packaging, textiles, and consumer goods. The demand for sustainable materials boosts its popularity, as clear R-PET is easier to recycle and reuse compared to colored variants. For instance, according to a Coco-Cola Company news story, Sprite will soon offer a 13.2-oz bottle made of 100% rPET clear in the Northeast, California, and Florida. By the end of 2022, all Sprite packaging will be clear, making it easier to recycle and reuse in new bottles.As a result, its compliance with food-grade and high-performance standards further solidifies its market dominance.

Recycled Polyethylene Terephthalate (rPET) Market By Source

- Bottles & Containers

- Films & Sheets

- Others

The bottles & containers segment is the largest source category in the recycled polyethylene terephthalate market and it is expected to increase over the industry due to its widespread applications in packaging. For instance, according to the PET Resin Association, polyethylene terephthalate is the world's most recycled plastic. Each year, about 680 kilotons of old PET bottles and containers are recycled in the United States. PET's exceptional properties, including clarity, strength, and recyclability, make it an ideal choice for beverage bottles, food containers, and personal care products. With the growing demand for convenient and sustainable packaging solutions, PET continues to be the material of choice for manufacturers across various industries. Its versatility and cost-effectiveness further maintain its position as the leading segment in the PET market.

Recycled Polyethylene Terephthalate (rPET) Market By Grade

- Grade A

- Grade B

According to the recycled polyethylene terephthalate industry analysis, grade A type dominates the market due to its superior quality and purity. It undergoes stringent processing, resulting in minimal contaminants and optimal mechanical properties, making it ideal for various applications. Its reliability and consistency meet stringent industry standards, attracting manufacturers seeking high-quality recycled materials for sustainable production practices. Consequently, Grade A PET holds a significant market share, driving the growth of the recycled PET market.

Recycled Polyethylene Terephthalate (rPET) Market By Form

- rPET Flakes

- rPET Chips

According to the recycled polyethylene terephthalate market forecast period, rPET flakes form is expected to lead the market throguhout 2024 to 2032. These flakes, derived from post-consumer PET bottles, are extensively utilized in various industries, including textiles, packaging, and automotive, for manufacturing a wide range of products. Their dominance is attributed to their ability to maintain the integrity and quality of the final products while offering environmental sustainability benefits. Additionally, manufacturers further looking for these alternatives which contributes to dominance of flakes. For instance, in August 2020, Indorama Ventures Public Company Limited bought Industrie Maurizio Peruzzo Polowat, a polyethylene terephthalate recycling facility in Poland. The deal included two assets strategically positioned in Leczyca and Bielsko-Biala. The combined capacity of these manufacturing locations was 4,000 tons of rPET pellets and 23,000 tons of rPET flakes. Both companies aimed to increase their recycling capacity to 750,000 tons by 2025. With increasing awareness about plastic pollution and a growing emphasis on circular economy principles, the demand for rPET flakes is expected to continue in the forecast future.

Recycled Polyethylene Terephthalate (rPET) Market By End Use

- Fiber

- Strapping

- Sheet and Film

- Non-Food Containers and Bottles

- Food & Beverage Containers and Bottles

- Others

According to the recycled PET market forecast, fiber segment is gaining significant impetus during the forthcoming years. This is primarily due to its widespread application in the production of textiles, carpets, and non-woven fabrics. The demand for sustainable alternatives in the textile industry has fueled the growth of rPET fibers, as they reducing environmental impact. For instance, H&M and Inditex have established targets for using 100% recycled fibers in ready-made garments (RMG) by 2025-2030. Additionally, stringent regulations and increasing consumer awareness regarding sustainability have further boosted the adoption of rPET fibers across various industries. For instance, the European Union has established numerous targets for the textile industry. As per reports, by 2030, all textile items must be durable, repairable, and recyclable, predominantly made from recycled fibers and free from harmful substances, indicating an increase in the recyclate PET market in the coming year.

Recycled Polyethylene Terephthalate Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Recycled Polyethylene Terephthalate Market Regional Analysis

For several reasons, the Asia Pacific region dominates the recycled PET industry market due to high population density, rapid urbanization, and increased plastic consumption. Strong government regulations promoting sustainability and advanced recycling technologies bolster market growth. Leading manufacturers in countries like China, India, and Japan drive demand for rPET in packaging, textiles, and automotive sectors. For instance, on April 26, 2023, Biffa announced the acquisition of Esterpet Ltd, a PET recycling company situated in North Yorkshire, in order to enhance its PET sector. Besides, on March 16, 2023, the business also signed a purchase deal with Shuye Electronics Co. Ltd., a Chinese company, to begin mass production of recycled PET materials in the Asia-Pacific region. As a result, this combination of factors ensures the region's leading position in the global rPET market.

North America is the fastest-growing region in the recycled PET industry due to increasing consumer awareness and demand for sustainable packaging solutions. Government regulations and incentives promoting recycling practices further drive market growth. For instance, according to the United States Environmental Protection Agency, single-use plastics account for 50% of overall plastic demand in the country. Additionally, advancements in recycling technologies and strong investments from key industry players bolster the region's expansion in the rPET sector.

Recycled Polyethylene Terephthalate Market Players

Some of the top recycled polyethylene terephthalate companies offered in our report include Libolon, Placon, Phoenix Technologies, Clear Path Recycling LLC, Evergreen Plastics, Inc., Verdeco Recycling, Inc., PolyQuest, M&G Chemicals, Zhejiang Anshun Pettechs Fibre Co., Ltd., and Indorama Ventures Public Ltd.

Frequently Asked Questions

Which technology held the maximum share in 2023?

The clear technology held the maximum share of the recycled polyethylene terephthalate industry.

What are the current trends and dynamics in the global recycled polyethylene terephthalate industry?

The current trends and dynamics in the recycled polyethylene terephthalate industry include increasing consumer awareness about environmental sustainability, stringent government regulations promoting plastic recycling, and technological advancements in recycling processes enhancing efficiency.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of recycled polyethylene terephthalate during the analysis period of 2024 to 2032.

Which region dominated the global recycled polyethylene terephthalate market share?

Asia-Pacific held the dominating position in recycled polyethylene terephthalate industry during the analysis period of 2024 to 2032.

Which are the key players in the recycled polyethylene terephthalate market?

The key players operating in the global market are including Libolon, Placon, Phoenix Technologies, Clear Path Recycling LLC, Evergreen Plastics, Inc., Verdeco Recycling, Inc., PolyQuest, M&G Chemicals, Zhejiang Anshun Pettechs Fibre Co., Ltd., and Indorama Ventures Public Ltd.

What is the CAGR of the global recycled polyethylene terephthalate market from 2024 to 2032?

The CAGR of recycled polyethylene terephthalate is 8.3% during the analysis period of 2024 to 2032.

How big is the recycled polyethylene terephthalate market?

The recycled polyethylene terephthalate market size was valued at USD 10,224 million in 2023.