Sustainable Packaging Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Sustainable Packaging Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

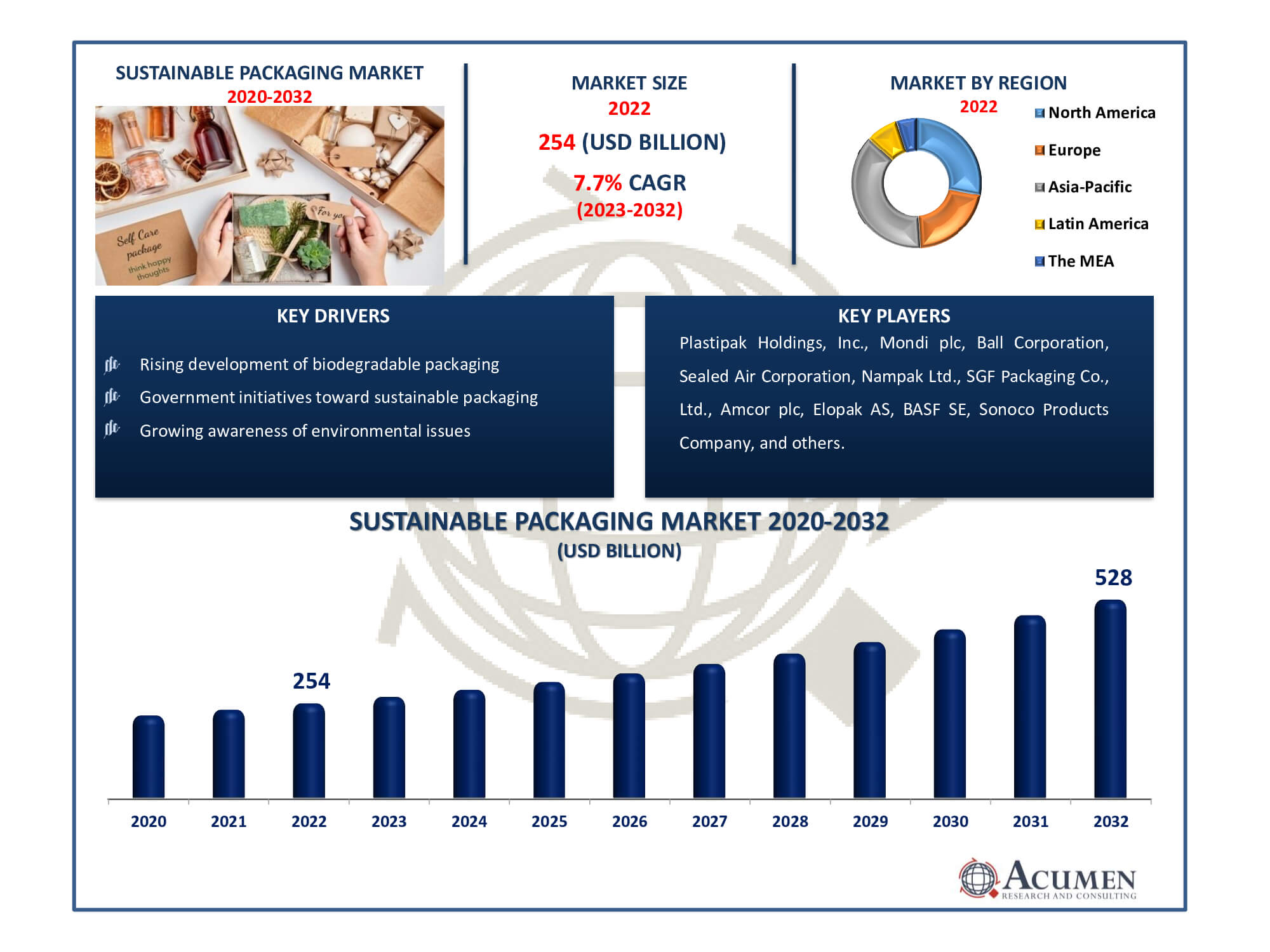

The Sustainable Packaging Market Size accounted for USD 254 Billion in 2022 and is estimated to achieve a market size of USD 528 Billion by 2032 growing at a CAGR of 7.7% from 2023 to 2032.

Sustainable Packaging Market Highlights

- Global sustainable Packaging market revenue is poised to garner USD 528 billion by 2032 with a CAGR of 7.7% from 2023 to 2032

- Asia-Pacific sustainable Packaging market value occupied around USD 96 billion in 2022

- Asia-Pacific sustainable Packaging market growth will record a CAGR of more than 8.2% from 2023 to 2032

- Among product, the recycled sub-segment generated over US$ 187.6 billion revenue in 2022

- Based on material, the paper & paperboard sub-segment generated around 40% share in 2022

- Continuous research and development is a popular sustainable Packaging market trend that fuels the industry demand

Sustainable packaging is product design and use resulting in increased sustainability. Packaging is generally expected to be a major part of the manufacturing, logistics and consumer industries. Growing problems associated with waste generation, industrial pollution, unproductive asset and material use are expected to be the main problem for sustainable growth in the long term. Sustainable solutions to these problems have formed the main goal of communities, organizations and enterprises.

In response to growing environmental concerns, sustainable packaging has emerged as a critical facet of product design, production, and distribution within the manufacturing, logistics, and consumer industries. As issues related to waste generation, industrial pollution, and inefficient resource utilization continue to escalate, the pursuit of sustainable solutions has become a paramount objective for communities, organizations, and enterprises. The sustainable packaging market addresses these challenges, offering innovative approaches to reduce the environmental impact of packaging materials and practices.

Global Sustainable Packaging Market Dynamics

Market Drivers

- Rising development of biodegradable Packaging

- A shift in consumer preferences toward recyclable and eco-friendly materials

- Government Initiatives Toward Sustainable Packaging

- Growing awareness of environmental issues

Market Restraints

- High cost of sustainable Packaging

- Capacity constraint of manufacturing plants

- Limited availability of material

Market Opportunities

- Collaborations between companies, recyclers, and government bodies

- Development of innovative materials

- Supply chain optimization

Sustainable Packaging Market Report Coverage

| Market | Sustainable Packaging Market |

| Sustainable Packaging Market Size 2022 | USD 254 Billion |

| Sustainable Packaging Market Forecast 2032 | USD 528 Billion |

| Sustainable Packaging Market CAGR During 2023 - 2032 | 7.7% |

| Sustainable Packaging Market Analysis Period | 2020 - 2032 |

| Base Year |

2022 |

| Forecast Data | 2023 - 2032 |

| Segments Covered | By Packaging Type, By Product, By Material, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Plastipak Holdings, Inc., Mondi plc, Ball Corporation, Sealed Air Corporation, Nampak Ltd., SGF Packaging Co., Ltd., Amcor plc, Elopak AS, BASF SE, Sonoco Products Company, Crown Holdings, Inc., Ardagh Group S.A., DS Smith plc, Smurfit Kappa Group PLC |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Sustainable Packaging Market Insights

Heightened public awareness of environmental concerns has driven a surge in demand for sustainable packaging and processing practices. Sustainability initiatives have made significant strides, prompting companies to reduce source materials through measures like downsizing, creating thinner and lighter packaging, and ultimately minimizing waste. Non-biodegradable plastics have been found to pose significant environmental risks, including water contamination, waste accumulation, and soil fertility degradation, which has been a driving force behind the recent social and legal changes.

Many countries have introduced stringent regulations to curb plastic bag and carrier usage. Additionally, the rising consumer demand for green packaging, particularly for organic foods, has influenced companies worldwide to introduce innovations like bread packaging made from recycled polyethylene, as seen with companies like Hovis.

However, industry growth faces obstacles such as high recycling rates, limited awareness of the value of sustainable packaging, and underdeveloped recycling facilities. Key market leaders are focusing on brand development and investing in research and development (R&D) to address these challenges.

Consumer preferences are changing, environmental rules are becoming more rigorous, and there is a greater emphasis on R&D for creative, eco-friendly packaging materials. Market leaders are constantly adapting to evolving sustainability needs while attempting to improve their brand image.

Sustainable Packaging Market Segmentation

The worldwide market for sustainable packaging is split based on packaging type, product, material, application, and geography.

Sustainable Packaging Type

- Tubes

- Bags & Pouches

- Corrugated Box

As per the sustainable packaging market analysis, the corrugated box category is often the largest. This is due to its extensive use throughout industries for a variety of reasons. Corrugated boxes are versatile because they can accommodate a wide range of product sizes and forms. Their resilience guarantees that commodities are well-protected throughout shipping, lowering the danger of damage. Furthermore, because corrugated materials are recyclable and biodegradable, they match with sustainability ideals. Corrugated boxes are also cost-effective, allowing firms to decrease packaging costs while embracing environmentally responsible practises.

Sustainable Packaging Product

- Recycled

- Degradable

- Re-usable

The recycled category is often the largest among the product segments in the sustainable packaging industry. This is primarily due to the widespread availability and low cost of recycled materials. Environmental concerns drive the market for recycled packaging, which helps minimise the consumption of virgin materials, energy consumption, and greenhouse gas emissions. Furthermore, it is consistent with the worldwide shift towards circular economies. Recycled packaging is adaptable, with applications ranging from food to consumer items. Because of its ease of integration into current supply chains and manufacturing processes, it is a popular solution for firms looking to decrease their environmental footprint and satisfy sustainability goals.

Sustainable Packaging Material

- Paper & Paperboard

- Metal

- Plastic

- Glass

The paper & paperboard segment is frequently the largest in the sustainable packaging market due to its eco-friendliness and general popularity. Paper & Paperboard packing is preferred for a variety of reasons. to begin with, it is renewable and biodegradable, which aligns with growing environmental concerns. Second, it is versatile and adjustable, making it suited for a wide range of product kinds, from food to consumer goods. Third, it strikes a compromise between strength and weight, offering enough protection while staying lightweight for low-cost transportation. Finally, the recyclability of Paper & Paperboard is well proven, which contributes to its popularity. As consumers and businesses prioritise sustainability, the need for Paper & Paperboard-based sustainable packaging continues to rise. Plastic segment is expected to second largest segment in the market.

Sustainable Packaging Application

- Healthcare

- Food & Beverages

- Personal care

- Others

The food & beverages section is often the largest as per our sustainable packaging market forecast, owing to a variety of causes. For starters, the food and beverage industry is one of the largest consumer industries, resulting in a significant demand for packaging. In this market, sustainable packaging satisfies consumers' growing environmental concerns while preserving product safety and freshness. Furthermore, the food industry's regulatory environment frequently emphasises sustainable packaging to prevent food waste and increase shelf life. As a result, the food & beverages area leads since it provides a sizable market for sustainable packaging solutions that meet both industry and consumer requirements..

Sustainable Packaging Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Sustainable Packaging Market Regional Analysis

The Asia-Pacific region dominates the sustainable packaging market due to a variety of significant factors. First, the region's rapid economic expansion has raised consumer awareness of environmental issues and increased demand for environmentally friendly products. Second, the expanding middle-class population with greater purchasing power increases this desire even more. Third, governments in China and India are enacting rigorous regulations to decrease plastic waste and promote sustainable practices, creating a favorable atmosphere for sustainable packaging solutions.

The Asia-Pacific region is the fastest-growing in the sustainable packaging market due to a convergence of variables. Its strong economic growth and expanding middle-class population have resulted in higher consumer spending. Furthermore, there is a growing awareness of environmental issues and sustainable practices. Government activities and policies supporting environmentally friendly packaging solutions to solve environmental challenges, particularly those connected to plastic waste, are hastening the region's adoption of sustainable packaging.

North America ranks second in the sustainable packaging market due to its strong commitment to environmental sustainability and well-established eco-conscious practices. Environmental rules in the United States and Canada are stringent, forcing businesses to use sustainable packaging solutions. Consumer awareness of environmental issues, as well as a willingness to pay a premium for sustainable products, drives demand even higher. Furthermore, North America's developed infrastructure and strong corporate sustainability initiatives add to the region's large market presence.

Sustainable Packaging Market Players

Some of the top sustainable packaging companies offered in our report includes Plastipak Holdings, Inc., Mondi plc, Ball Corporation, Sealed Air Corporation, Nampak Ltd., SGF Packaging Co., Ltd., Amcor plc, Elopak AS, BASF SE, Sonoco Products Company, Crown Holdings, Inc., Ardagh Group S.A., DS Smith plc, Smurfit Kappa Group PLC.

Frequently Asked Questions

How big is the sustainable packaging market?

The sustainable packaging market was almost USD 254 billion in 2022.

What is the CAGR of the global sustainable packaging market from 2023 to 2032?

The CAGR of sustainable packaging is 7.7% during the analysis period of 2023 to 2032.

Which are the key players in the sustainable packaging market?

The key players operating in the global market are including Plastipak Holdings, Inc., Mondi plc, Ball Corporation, Sealed Air Corporation, Nampak Ltd., SGF Packaging Co., Ltd., Amcor plc, Elopak AS, BASF SE, Sonoco Products Company, Crown Holdings, Inc., Ardagh Group S.A., DS Smith plc, and Smurfit Kappa Group PLC.

Which region dominated the global sustainable packaging market share?

Asia-Pacific held the dominating position in sustainable packaging industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of sustainable packaging during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global sustainable packaging industry?

The current trends and dynamics in the sustainable packaging industry include rising development of biodegradable packaging, shift in consumer preferences toward recyclable and eco-friendly materials, government initiatives toward sustainable packaging, and growing awareness of environmental issues.

Which packaging product held the maximum share in 2022?

The recycled product type held the maximum share of the sustainable packaging industry.