Medical Equipment Rental Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Medical Equipment Rental Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

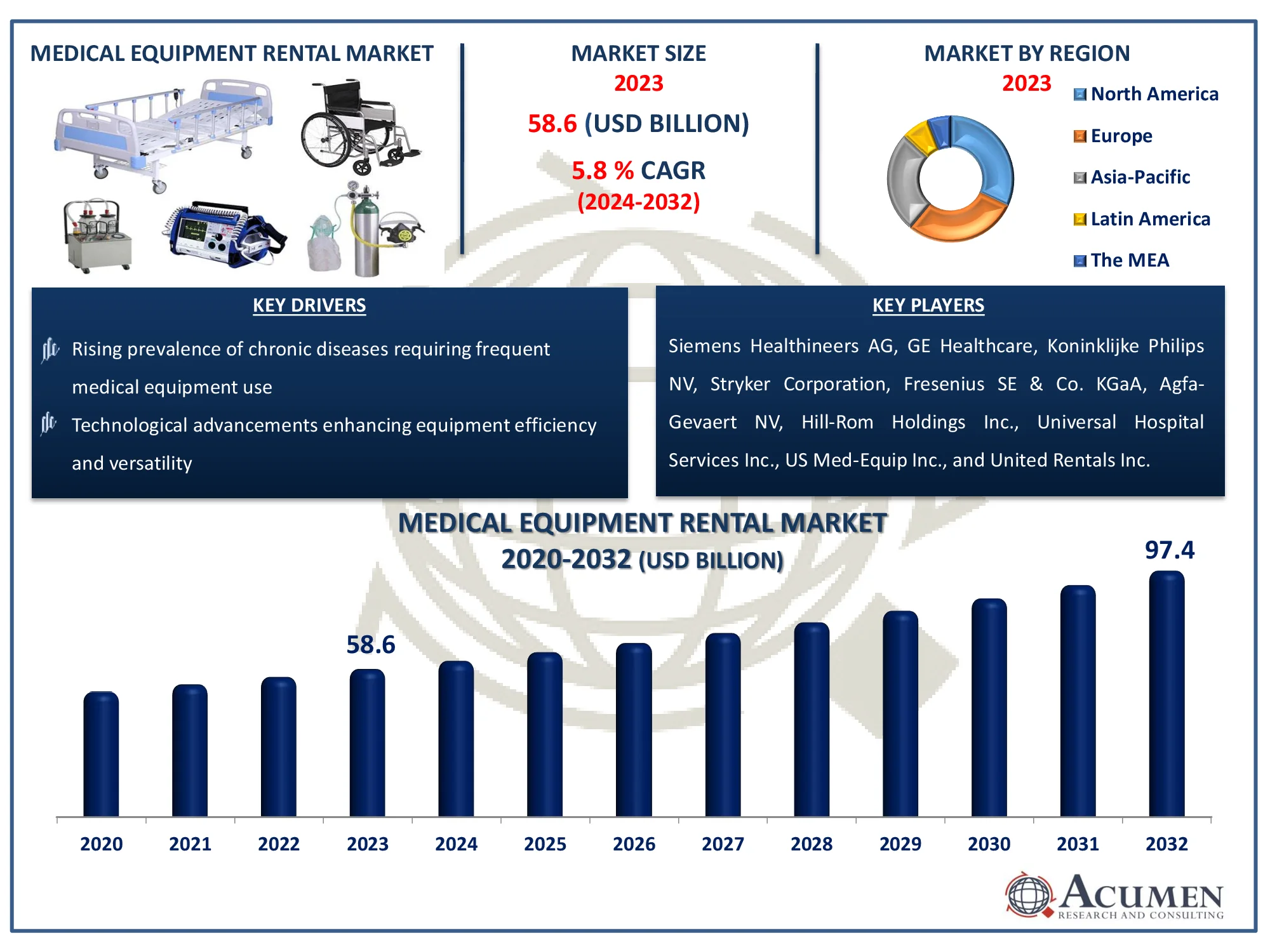

The Global Medical Equipment Rental Market Size accounted for USD 58.6 Billion in 2023 and is estimated to achieve a market size of USD 97.4 Billion by 2032 growing at a CAGR of 5.8% from 2024 to 2032.

Medical Equipment Rental Market Highlights

- Global medical equipment rental market revenue is poised to garner USD 97.4 billion by 2032 with a CAGR of 5.8% from 2024 to 2032

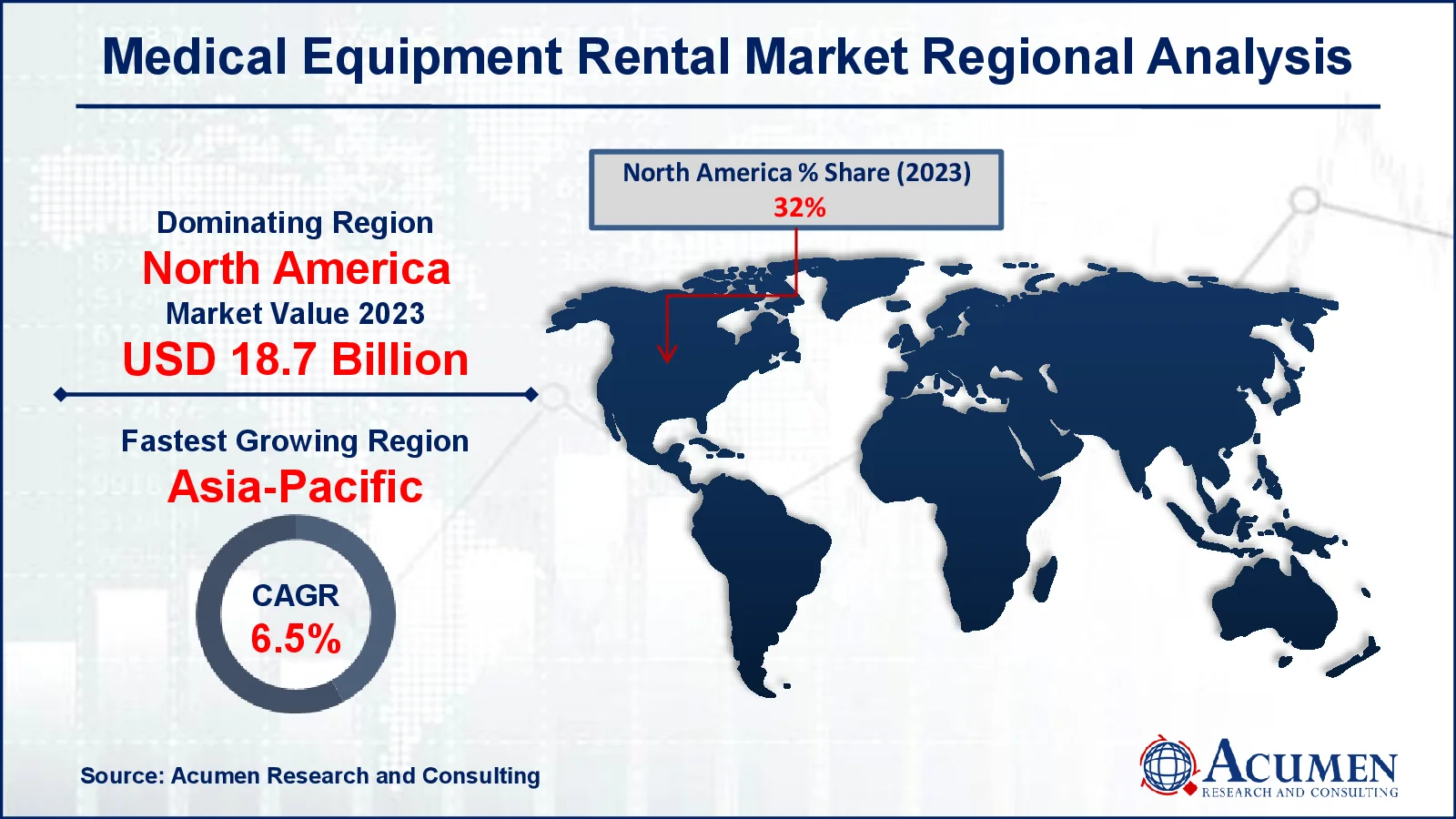

- North America medical equipment rental market value occupied around USD 18.7 billion in 2023

- Asia-Pacific medical equipment rental market growth will record a CAGR of more than 6.5% from 2024 to 2032

- Among product, the durable medical equipment sub-segment generated noteworthy revenue in 2023

- Based on end-user, the hospitals sub-segment generated 41% medical equipment rental market share in 2023

- Technological innovations in remote monitoring and telemedicine is a popular medical equipment rental market trend that fuels the industry demand

Medical equipment rental involves leasing medical devices and equipment rather than purchasing them outright. This approach offers several benefits, including cost savings, flexibility, and access to the latest technology without the significant capital expenditure required for ownership. It is commonly used by hospitals, clinics, and home care providers to obtain equipment like imaging machines, ventilators, infusion pumps, and mobility aids. Rental agreements can be short-term or long-term, depending on the needs of the healthcare provider. This model allows for equipment upgrades and maintenance to be managed by the rental company, reducing operational hassles. Additionally, it helps in managing cash flow and adapting to changing medical demands. The rental service often includes support and training, ensuring that users can operate the equipment safely and effectively.

Global Medical Equipment Rental Market Dynamics

Market Drivers

- Increasing demand for cost-effective medical solutions

- Rising prevalence of chronic diseases requiring frequent medical equipment use

- Technological advancements enhancing equipment efficiency and versatility

- Growing preference for short-term equipment usage in healthcare facilities

Market Restraints

- High initial cost of purchasing medical equipment

- Stringent regulatory requirements for equipment rental services

- Limited availability of specialized equipment for rent

Market Opportunities

- Expansion of healthcare facilities in emerging markets

- Increase in home healthcare services driving rental demand

- Development of new rental models and services tailored to specific needs

Medical Equipment Rental Market Report Coverage

| Market | Medical Equipment Rental Market |

| Medical Equipment Rental Market Size 2022 |

USD 58.6 Billion |

| Medical Equipment Rental Market Forecast 2032 | USD 97.4 Billion |

| Medical Equipment Rental Market CAGR During 2023 - 2032 | 5.8% |

| Medical Equipment Rental Market Analysis Period | 2020 - 2032 |

| Medical Equipment Rental Market Base Year |

2022 |

| Medical Equipment Rental Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Siemens Healthineers AG, GE Healthcare, Koninklijke Philips NV, Stryker Corporation, Fresenius SE & Co. KGaA, Agfa-Gevaert NV, Hill-Rom Holdings Inc., Universal Hospital Services Inc., US Med-Equip Inc., and United Rentals Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Medical Equipment Rental Market Insights

The strength of durable medical equipment (DME) can be credited to the increasing adoption of personal mobility aids and assistive devices by disabled individuals. Additionally, the growing need for monitoring and therapeutic instruments due to a rising patient pool and constant technological upgrades in these devices are encouraging the development of the DME rental market. The rise of financial services for renting healthcare equipment in the past few years has been a boon for institutes, hospitals, and other healthcare providers. Additionally, leasing equipment provides cost-saving advantages to end users, as it reduces ownership costs and enables these players to acquire advanced product modules.

The rising demand for home healthcare, attributable to reduced hospital stays and an expanding geriatric and disabled patient pool, is boosting the need for rental devices. Increasing incidents such as spinal malfunctions, brain or skeletal injuries/disorders, and muscular dystrophy are leading to a growth in the disabled population. All these factors are working in favor of the medical equipment rental market. However, the availability of various grants and government programs for the disabled population is anticipated to hinder the medical equipment rental market growth. Programs that provide financial assistance for the acquisition of equipment and resources for building infrastructure for the disabled are reducing the need for leasing equipment. This, in turn, is expected to limit the medical equipment rental market from realizing its maximum potential.

Medical Equipment Rental Market Segmentation

The worldwide market for medical equipment rental is split based on product, end-user, and geography.

Medical Equipment Rental Market By Products

- Surgical Equipment

- Durable Medical Equipment

- Personal Mobility Devices

- Bathroom Safety and Medical Furniture

- Monitoring and Therapeutic Devices

- Storage and Transport

According to medical equipment rental industry analysis, the market is segmented into products such as surgical equipment, durable medical equipment (DME), and storage and transport equipment. Among these, durable medical equipment generates the maximum revenue. This segment's dominance can be attributed to the high demand for essential medical devices like wheelchairs, hospital beds, and respiratory equipment, which are crucial for patient care both in hospitals and home settings.

Durable medical equipment is vital for individuals with chronic illnesses, disabilities, and aging-related conditions, driving continuous demand. The convenience and cost-effectiveness of renting DME over purchasing make it an attractive option for healthcare providers and patients. Renting DME allows access to the latest technology and high-quality equipment without the significant upfront investment, thereby easing budget constraints for hospitals and clinics.

Technological advancements and innovations in DME, such as improved mobility aids and advanced monitoring devices, also contribute to the segment's revenue growth. Furthermore, the growing emphasis on home healthcare due to shorter hospital stays and an increasing geriatric population further propels the demand for durable medical equipment rentals. These factors collectively ensure that the DME segment remains the leading revenue generator in the medical equipment rental market.

Medical Equipment Rental Market By End-Users

- Personal/Home care

- Institutional

- Hospitals

The hospital segment is the largest end-user throughout the medical equipment rental market forecast period. Hospitals have a constant need for a wide range of medical equipment to provide comprehensive care to patients. Renting equipment offers hospitals flexibility and cost-efficiency, enabling them to manage their resources more effectively without the burden of large capital expenditures. Hospitals often require advanced and specialized equipment for diagnostic, therapeutic, and surgical purposes. By renting, they can access the latest technology and high-quality devices, ensuring they deliver the best possible patient care. This is particularly important for hospitals that handle a high volume of patients and need to frequently update or replace their equipment.

Additionally, renting equipment allows hospitals to respond quickly to changing demands, such as sudden surges in patient numbers during epidemics or emergencies. This flexibility is crucial for maintaining high standards of care and operational efficiency. Furthermore, the maintenance and servicing of rented equipment are typically handled by the rental companies, reducing the logistical and financial burden on hospital management.

Medical Equipment Rental Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Medical Equipment Rental Market Regional Analysis

In terms of medical equipment rental market analysis, North America dominated the industry in 2024. The presence of numerous service providers and the high demand for technically advanced products are driving the growth of the regional medical equipment rental market. The region faces issues with extra spending on purchasing the latest therapeutic devices or equipment, which can be mitigated by leasing.

Europe followed North America in terms of revenue. The rising occurrence of chronic diseases, such as Parkinson's, Huntington's disease, and atherosclerosis, along with the expansion of home healthcare and the rapidly growing geriatric population, are boosting the market in Europe. Additionally, educational institutes and research labs are looking to reduce operational and procurement costs, leading to greater adoption of rental equipment globally.

Asia-Pacific is the fastest-growing region in the medical equipment rental industry forecast period due to increasing healthcare expenditure, a large and aging population, and the rising prevalence of chronic diseases. The expanding middle class and improving healthcare infrastructure contribute to the growing demand for rental medical equipment. The region's focus on cost-effective healthcare solutions and the adoption of advanced medical technologies further propel the market's rapid growth.

Medical Equipment Rental Market Players

Some of the top medical equipment rental companies offered in our report includes Siemens Healthineers AG, GE Healthcare, Koninklijke Philips NV, Stryker Corporation, Fresenius SE & Co. KGaA, Agfa-Gevaert NV, Hill-Rom Holdings Inc., Universal Hospital Services Inc., US Med-Equip Inc., and United Rentals Inc.

Frequently Asked Questions

How big is the medical equipment rental market?

The medical equipment rental market size was valued at USD 58.6 billion in 2023.

What is the CAGR of the global medical equipment rental market from 2024 to 2032?

The CAGR of medical equipment rental is 5.8% during the analysis period of 2024 to 2032.

Which are the key players in the medical equipment rental market?

The key players operating in the global market are including Siemens Healthineers AG, GE Healthcare, Koninklijke Philips NV, Stryker Corporation, Fresenius SE & Co. KGaA, Agfa-Gevaert NV, Hill-Rom Holdings Inc., Universal Hospital Services Inc., US Med-Equip Inc., and United Rentals Inc.

Which region dominated the global medical equipment rental market share?

North America held the dominating position in medical equipment rental industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of medical equipment rental during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global medical equipment rental industry?

The current trends and dynamics in the medical equipment rental industry include increasing demand for cost-effective medical solutions, rising prevalence of chronic diseases requiring frequent medical equipment use, technological advancements enhancing equipment efficiency and versatility, and growing preference for short-term equipment usage in healthcare facilities.

Which end-user held the maximum share in 2023?

The hospitals end-user held the maximum share of the medical equipment rental industry.