Personal Mobility Devices Market | Acumen Research and Consulting

Personal Mobility Devices Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format : ![]()

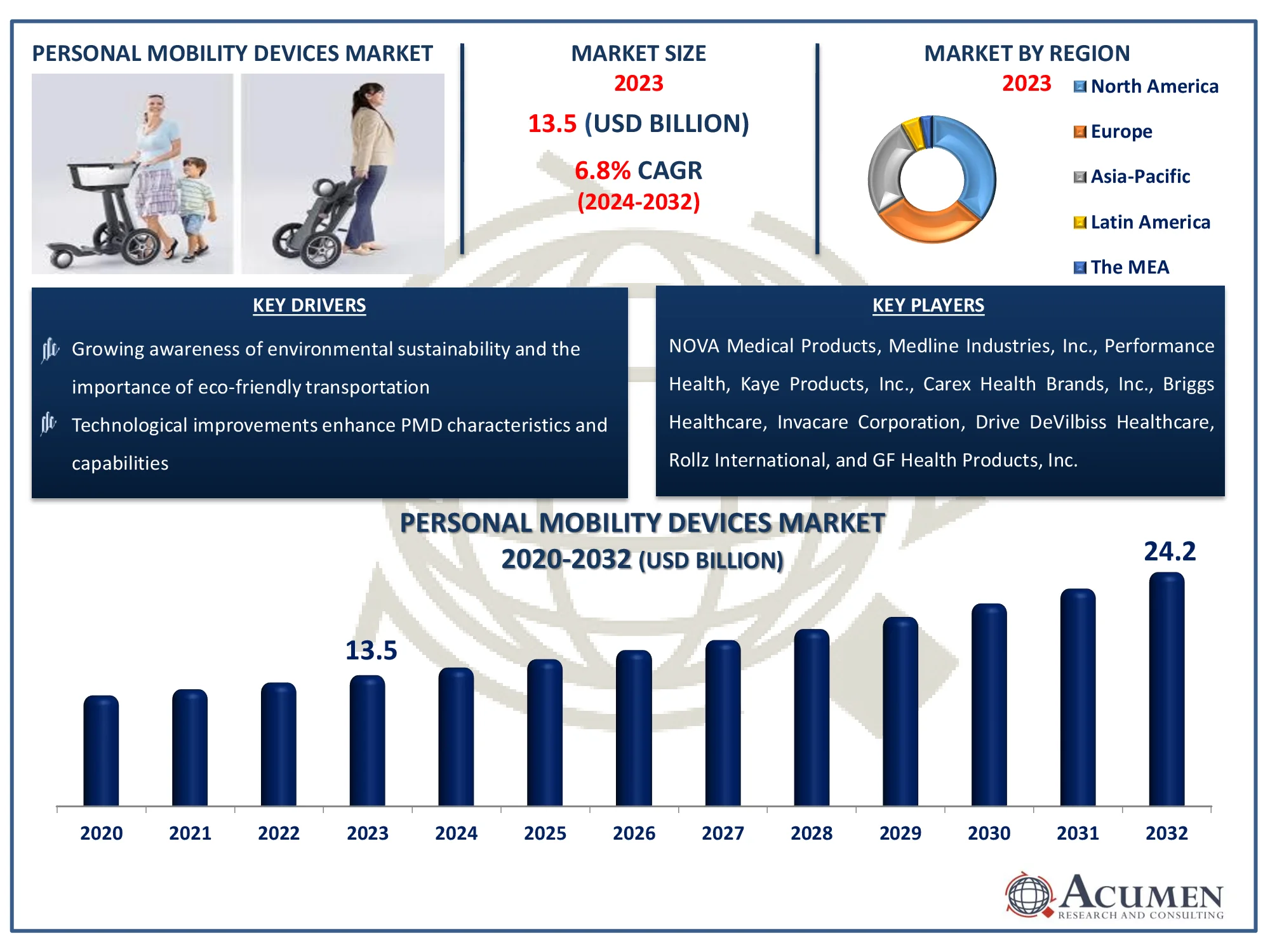

The Personal Mobility Devices Market Size accounted for USD 13.5 Billion in 2023 and is estimated to achieve a market size of USD 24.2 Billion by 2032 growing at a CAGR of 6.8% from 2024 to 2032.

Personal Mobility Devices Market Highlights

- Global personal mobility devices market revenue is poised to garner USD 24.2 billion by 2032 with a CAGR of 6.8% from 2024 to 2032

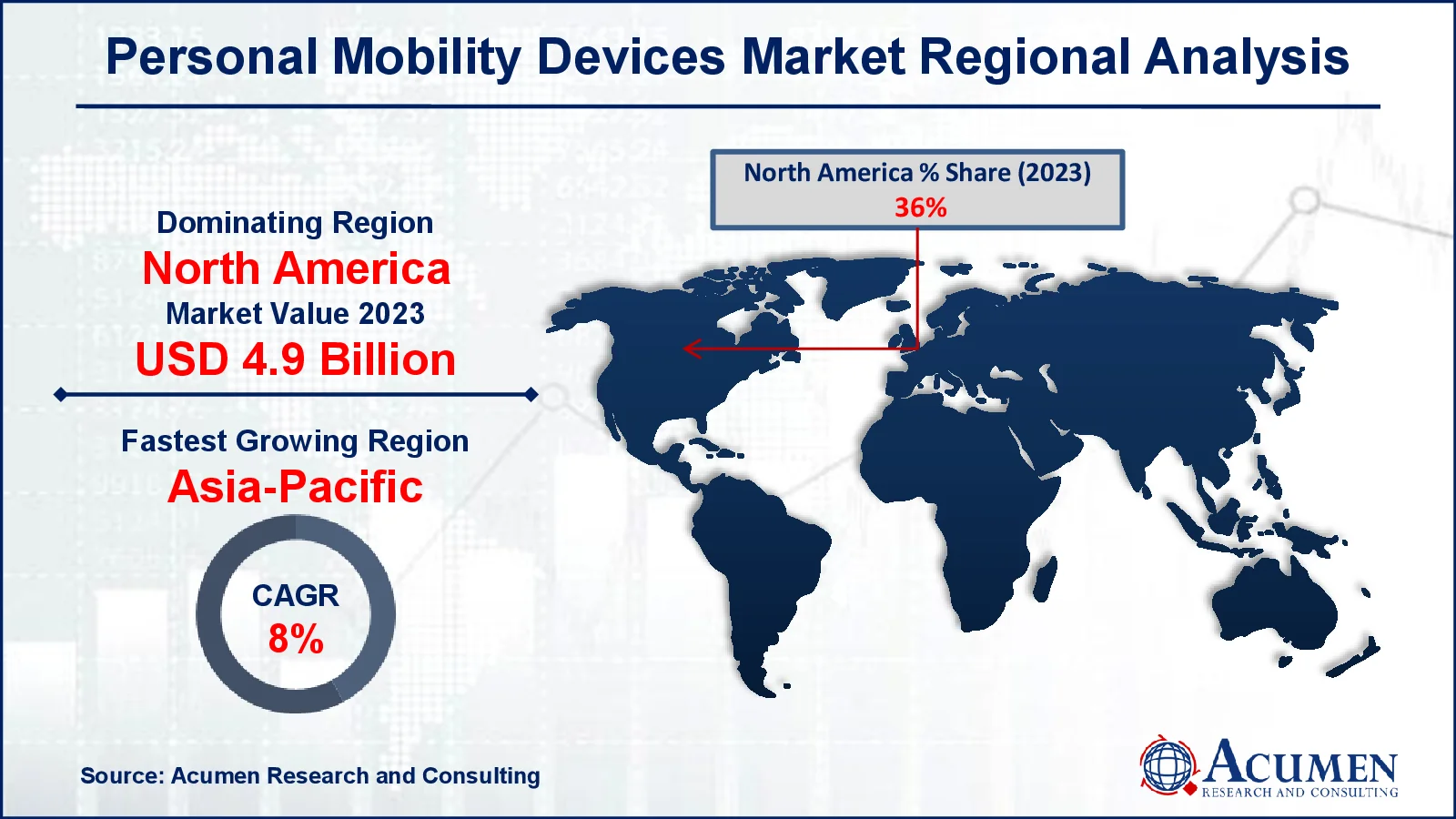

- North America personal mobility devices market value occupied around USD 4.9 billion in 2023

- Asia-Pacific personal mobility devices market growth will record a CAGR of more than 8% from 2024 to 2032

- Among product, the wheelchair sub-segment generated noteworthy revenue in 2023

- Based on end use, the home care settings sub-segment generated notable personal mobility devices market share in 2023

- Growth of shared mobility services incorporating PMDs is a popular personal mobility devices market trend that fuels the industry demand

Personal mobility devices (PMDs) have been increasingly popular in recent years, offering a convenient and ecologically beneficial alternative to traditional modes of transportation. With technical advancements, PMDs have grown to include a wide range of functions and capabilities. Aside from the well-known electric scooters, bikes, and hover boards, there are several additional PMD categories that are pushing the boundaries of mobility. For example, self-balancing unicycles have increased in popularity among riders seeking a unique and challenging riding experience. Furthermore, electric skateboards offer a more nimble and sporty alternative for people who enjoy slashing through the streets.

One lesser-known feature of PMDs is their potential for accessibility. While PMDs are commonly linked with recreational use, they can also be tailored to the needs of people with impairments. For example, wheelchair-accessible electric scooters allow autonomous transportation for people who have trouble walking. As PMD technology advances, we should expect to see more inventive and customized devices emerge. From foldable designs for convenient storage to improved safety features such as collision avoidance systems, the future of personal mobility is bright and full of opportunities.

Global Personal Mobility Devices Market Dynamics

Market Drivers

- Rising urbanization drives more demand for last-mile transportation

- Growing awareness of environmental sustainability and the importance of eco-friendly transportation

- Technological improvements enhance PMD characteristics and capabilities

- The elderly and those with disabilities are adopting PMDs at an increasing rate

Market Restraints

- The high cost of sophisticated PMDs limits widespread usage

- Regulatory issues and diverse legislative frameworks across geographies

- Safety risks arise as a result of the lack of standardized safety procedures

Market Opportunities

- Expansion of PMD usage in emerging markets

- Development of new and innovative PMD models catering to diverse consumer needs

- Integration of smart technologies, such as IoT and AI, in PMDs

Personal Mobility Devices Market Report Coverage

| Market | Personal Mobility Devices Market |

| Personal Mobility Devices Market Size 2022 |

USD 13.5 Billion |

| Personal Mobility Devices Market Forecast 2032 | USD 24.2 Billion |

| Personal Mobility Devices Market CAGR During 2023 - 2032 | 6.8% |

| Personal Mobility Devices Market Analysis Period | 2020 - 2032 |

| Personal Mobility Devices Market Base Year |

2022 |

| Personal Mobility Devices Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By End Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | NOVA Medical Products, Medline Industries, Inc., Performance Health, Kaye Products, Inc., Carex Health Brands, Inc., Briggs Healthcare, Invacare Corporation, Drive DeVilbiss Healthcare, Rollz International, and GF Health Products, Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Personal Mobility Devices Market Insights

The rise in geriatric demographics and age-related diseases, the number of people living with disabilities around the world and the increased prevalence of osteoporosis and rheumatoid arthritis are some of the key factors which are anticipated to fuel demand for personal mobility equipment and drive the market development of global personal mobility equipment. Additionally supportive reimbursement policies for purchasing and leasing personal mobility equipment for enhancing disabled individual’s lifestyles, particularly in various developing countries are factors anticipated to spur demand growth for a longer term. Nevertheless, the high price and lack of expertise on the quality of the equipment as well as the lack of training are some of the key factors which can impede the growth of the world personal mobility devices market.

Furthermore, the lack of adoption of certain digitalized products and certain recalls by the FDA in developing and underdeveloped countries are other significant factors which may conflict with target market growth. Nonetheless, in delivering preparation and offering after-sales services for personal mobility system customers, businesses are projected to build prospects for global industry vendors for large-scale customer base and increase in revenues. Public services are equipped with personal mobility systems aimed at encouraging active living and reducing the severity of disability. Mobility computer technical innovation is one of the key drivers of personal mobility devices market. This will greatly increase the use of mobile devices by adding transfer elevators, portable scooters, and automatic rollers.

A few examples of technologic advances in the field of mobile mobility systems include Segway 's personal elevator, Toppro laser-activated rollers for people with alzheimer's disease and the M300 Corpus HD Power wheelchairs.

The most common aid for handicapped persons has been walking sticks and wheelchairs. The true dawn of the demand for personal mobility devices can however be dated back to the 20th century, when the idea of blurring the actual obstacles started to spread. The use of personal mobility devices has increased, growing in quantity and popularity, as consumers have risen above the social stigma. The production of personal mobility devices has recently been driven by the introduction of sophisticated technologies. As a popular tool, manufacturers demonstrate an interest in the production of new technology wheelchairs, contributing to the introduction of electric and efficient wheelchairs. Nonetheless, laser-related, AI, GPS, and IoT technologies are expected to remain available for the future of personal mobility instruments.

COVID-19 Impact

Pandemic situation across the globe has disrupted the business flow worldwide. In 2020 every industry vertical in its 2nd, 3rd, 4th quarter has witnessed substantial drop on production and revenue, this was majorly due to lockdown. The restriction on the operations is impacting the production side and also impacting the supply chain of products. The disrupted supply of raw materials and low operational factories efficiency has contributed in the slower growth of the global personal mobility devices market. Moreover, there is an urgent need for a rapid acceleration in the manufacturing process at high operational efficiency, better supply chain models, and effective distribution network. These factors to some extent will help the industry vertical to flourish and aid personal mobility devices market growth.

Personal Mobility Devices Market Segmentation

The worldwide market for personal mobility devices is split based on product, end use, and geography.

Personal Mobility Devices Market By Products

- Medical Furniture & Bathroom Safety Products

- Mobility Scooters

- Wheelchair

- Crutches

- Walkers & Canes

- Medical Mobility Aids & Ambulatory Devices

- Stair Lifts

- Medical Beds

- Patient Lifts

- Commodes

- Bars and Railings

According to personal mobility devices industry analysis, the wheelchair segment taking maximum share in the market. Wheelchair is one of the most common personal mobility aid. Developments in wheelchairs, such as the advent of electronic wheelchairs and wheelchairs that can store the medical records and make phone calls and supervise the health of a individual, are among the reasons which are driving the demand.

Personal Mobility Devices Market By End Uses

- Home Care Settings

- Hospitals and Clinics

- Ambulatory Surgical Centers

- Others

The home care settings segment within end use category is expected to be the significant during the personal mobility devices market forecast period. This growth is being driven by an aging population and the rising frequency of chronic conditions that necessitate long-term care at home. Furthermore, the demand for home healthcare over institutionalized care has increased, driven by a desire for comfort, cost-effectiveness, and tailored care. Advancements in mobility equipment designed for home usage, such as lightweight and foldable designs, contribute to this trend. As healthcare shifts to home-based care, the demand for personal mobility devices in this category is likely to skyrocket.

Personal Mobility Devices Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Personal Mobility Devices Market Regional Analysis

In terms of personal mobility devices market analysis, North America has dominated this industry, owing to reasons such as an aging population, greater healthcare spending, and favorable government regulations. The region has seen a substantial increase in PMD use, particularly in metropolitan areas where they provide a handy and efficient mobility solution.

Asia-Pacific is emerging as a rapidly growing market for PMDs over the personal mobility devices industry forecast period, owing to the region's huge and growing population, increased urbanization, and rising disposable income. Countries such as China and India are seeing an increase in PMD usage, notably electric scooters and bikes.

personal mobility devices market adoption has also been steadily increasing in Europe, owing to reasons like as government measures supporting sustainable transportation and a growing understanding of PMDs' benefits for urban mobility.

Personal Mobility Devices Market Players

Some of the top personal mobility devices companies offered in our report includes NOVA Medical Products, Medline Industries, Inc., Performance Health, Kaye Products, Inc., Carex Health Brands, Inc., Briggs Healthcare, Invacare Corporation, Drive DeVilbiss Healthcare, Rollz International, and GF Health Products, Inc.

Frequently Asked Questions

How big is the personal mobility devices market?

The personal mobility devices market size was valued at USD 13.5 Billion in 2023.

What is the CAGR of the global personal mobility devices market from 2024 to 2032?

The CAGR of personal mobility devices is 6.8% during the analysis period of 2024 to 2032.

Which are the key players in the Personal Mobility Devices market?

The key players operating in the global market are including NOVA Medical Products, Medline Industries, Inc., Performance Health, Kaye Products, Inc., Carex Health Brands, Inc., Briggs Healthcare, Invacare Corporation, Drive DeVilbiss Healthcare, Rollz International, and GF Health Products, Inc.

Which region dominated the global personal mobility devices market share?

North America held the dominating position in personal mobility devices industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of personal mobility devices during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global personal mobility devices industry?

The current trends and dynamics in the personal mobility devices industry include rising urbanization drives more demand for last-mile transportation, growing awareness of environmental sustainability and the importance of eco-friendly transportation, technological improvements enhance PMD characteristics and capabilities, and the elderly and those with disabilities are adopting PMDs at an increasing rate

Which product held the maximum share in 2023?

The wheelchair product held the maximum share of the personal mobility devices industry.