Surgical Equipment Market

Published :

Report ID:

Pages :

Format :

Surgical Equipment Market

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

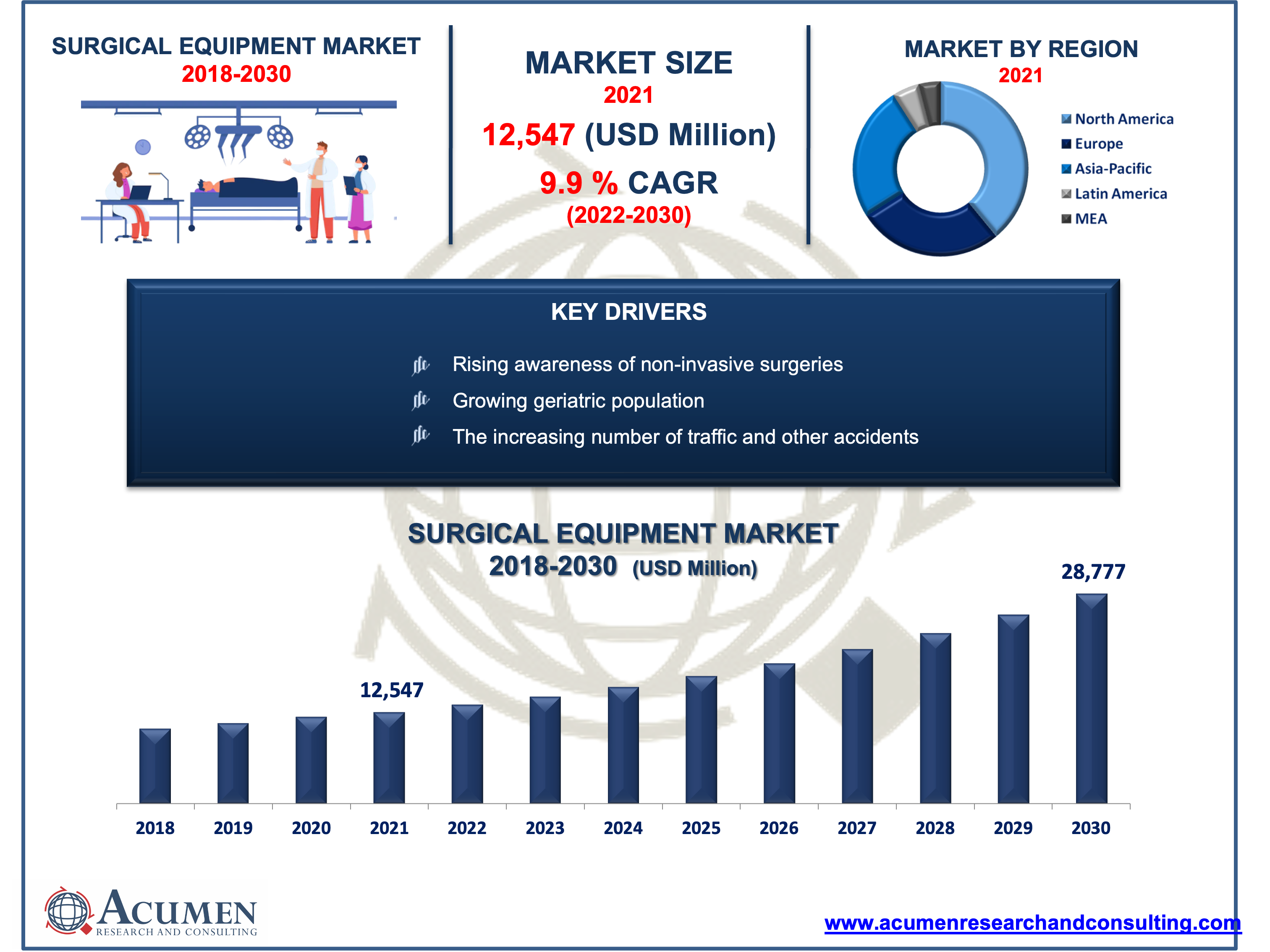

Request Sample Report

The Global Surgical Equipment Market accounted for US$ 12,547 Mn in 2021 and is expected to reach US$ 28,777 Mn by 2030 with a considerable CAGR of 9.9% during the forecast timeframe of 2022 to 2030.

Surgical instruments allow doctors to open the tissue, dissect and isolate the lesion, remove the bone, and remove or obliterate the abnormal structures as a treatment. Surgical equipment is used to assist in the operation of the patient or during surgeries. Products such as handheld surgical instruments, surgical sutures and staplers, and electrosurgical equipment are used as surgical equipment. Surgical equipment is used to treat a wide range of conditions, including obstetrics and gynecology, cardiology, wound care, neurosurgery, plastic and reconstructive surgery, and orthopedics.

There are two different types of equipment tools: larger tools for initial exposure and finer tools for encountering delicate structures. Stainless steel is used to make the vast majority of surgical instruments. In addition to stainless steel, other metals used include titanium, vanadium, chromium, and molybdenum. Furthermore, surgical instruments are in high demand as the number of reconstructive surgeries increases and healthcare facilities' quality of care becomes more stringent. As a result, this helps to grow the surgical instruments industry.

Drivers

· Rising awareness of non-invasive surgeries

· Growing geriatric population

· The increasing number of traffic and other accidents

Restraints

· Infections caused by reused equipment

· Stringent regulations for equipment

Opportunity

· The increasing number of surgeries in hospitals, clinics, and ambulatory surgical centers

Report Coverage

| Market | Surgical Equipment Market |

| Market Size 2021 | US$ 12,547 Mn |

| Market Forecast 2030 | US$ 28,777 Mn |

| CAGR | 9.9% During 2022 - 2030 |

| Analysis Period | 2018 - 2030 |

| Base Year | 2021 |

| Forecast Data | 2021 - 2028 |

| Segments Covered | By Product Type, By Application,By Usability And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Smith & Nephew plc, Ethicon, Inc., B. Braun Melsungen AG, Medtronic PLC, Zimmer Biomet Holdings, Inc., Entrhal Medical GmbH, Stryker Corporation, Alcon Laboratories, Inc., Aspen Surgical Products, Inc., Conmed Corporation, Boston Scientific Corporation, and Johnson & Johnson. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

| Customization Scope |

10 hrs of free customization and expert consultation |

Surgical Equipment Market Dynamics

The global surgical equipment growth is mainly driven by an ageing population, rising chronic disease prevalence, and a rise in the number of vehicle accident cases worldwide. There is a growing demand for innovative and advanced surgical equipment throughout the healthcare industry. Furthermore, rising public awareness of non-invasive surgeries is increasing demand for the procedures, fueling the global surgical equipment market's growth in the coming years. One of the major factors driving patient demand for surgeries is a growing understanding of the cost benefits of early surgical intervention. In the coming years, technological developments in surgical instruments, as well as significant investments by industry players, are expected to provide growth opportunities. Moreover, People in their golden years are more likely to suffer from chronic diseases, which may increase demand for surgical treatments and, consequently, surgical equipment.

Market Segmentation

Market by Product

· Surgical Sutures & Staplers

· Handheld Surgical Devices

o Forceps & Spatulas

o Dilators

o Retractors

o Auxiliary Instruments

o Graspers

o Cutter Instruments

o Others

· Electrosurgical Devices

Based on the product, the electrosurgical devices segment is expected to grow significantly in the market over the next few years. Electrosurgical devices are used in a wide range of surgical procedures, including gynecology surgery, cardiovascular surgery, and general surgery. These devices use an electric current to destroy the targeted tissues thermally. The rise in the number of surgical procedures worldwide, the rise in the incidence of chronic diseases, the high proportion of the geriatric population, and technological advancements are driving the market growth of the electrosurgical devices segment. Furthermore, the advantages of electrosurgical devices include low risk to patients, ease of use, faster recovery time, and a low risk of infection, all of which contribute to their increased adoption.

Market by Application

· Neurosurgery

· Plastic & Reconstructive Surgery

· Obstetrics & Gynecology

· Wound Closure

· Cardiovascular

· Orthopedic

· Others

The Obstetrics & Gynecology segment is expected to account for the largest market share in 2021, owing to an increase in the number of baby births. Obstetrics and gynecology is a broad and diverse field of medicine that includes surgery, prenatal care management, oncology, gynecologic care, and primary health care for women. Furthermore, the increasing number of childbirths and the increasing penetration of female reproductive body part illnesses have contributed to an increase in the number of gynecologic surgeries, which has aided segment growth.

Furthermore, the orthopedic surgery market will grow rapidly during the forecast period due to an increase in the prevalence of orthopedic disorders worldwide. The burden of musculoskeletal diseases is increasing as the population ages. As a result, rising musculoskeletal disorders, combined with an aging population, will drive segment growth.

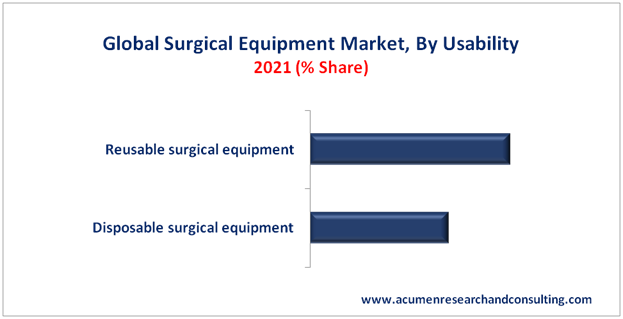

Market by Usability

· Disposable Surgical Equipment

· Reusable Surgical Equipment

In terms of usability, the reusable surgical equipment segment will account for more than half of the market in 2021. Reusable surgical instruments are those that can be reused and recycled by healthcare providers and have been used to treat multiple patients. Endoscopes, surgical forceps, and stethoscopes are examples of reusable medical devices. Furthermore, an increase in the global senior population is expected to drive demand for reusable surgical instruments as the incidence of diseases and disorders among the population rises, resulting in an increase in the number of surgeries performed.

Surgical Equipment Market Regional Overview

North America

· U.S.

· Canada

Europe

· U.K.

· France

· Germany

· Spain

· Rest of Europe

Latin America

· Mexico

· Brazil

· Rest of Latin America

Asia-Pacific

· India

· China

· Japan

· Australia

· South Korea

· Rest of Asia-Pacific

Middle East & Africa

· South Africa

· GCC

· Rest of Middle East & Africa

The North American surgical equipment market will grow as healthcare spending increases in order to provide better public services in healthcare organizations. The United States held the largest share of the North American surgical instrument market. This is due to a large patient population, an aging society, and an increase in the number of various surgical procedures, as surgical equipment is widely used in areas such as abdominal surgery, gynecology, cardiothoracic, and orthopedic surgeries, among others. Furthermore, factors such as globalization, rapid technological advancements, and rising healthcare expenditure are driving the global surgical equipment market in North America. Furthermore, growing awareness of the benefits of minimally invasive surgical procedures has increased the demand for surgical equipment significantly. In addition, the availability of large and developed healthcare infrastructure in the region benefits the market due to the increased penetration of hospitals, diagnostic centers, and ambulatory services.

Key Players

Some of the prominent players in global surgical equipmentmarket are Smith & Nephew plc, Ethicon, Inc., B. Braun Melsungen AG, Medtronic PLC, Zimmer Biomet Holdings, Inc., Entrhal Medical GmbH, Stryker Corporation, Alcon Laboratories, Inc., Aspen Surgical Products, Inc., Conmed Corporation, Boston Scientific Corporation, and Johnson & Johnson.

Frequently Asked Questions

How much was the estimated value of the global surgical equipment market in 2021?

The estimated value of global surgical equipment market in 2021 was accounted to be US$12,547 Mn.

What will be the projected CAGR for global surgical equipment market during forecast period of 2022 to 2030?

The projected CAGR of surgical equipment during the analysis period of 2022 to 2030 is 9.9%.

Which are the prominent competitors operating in the market?

The prominent players of the global surgical equipment market involve Smith & Nephew plc, Ethicon, Inc., B. Braun Melsungen AG, Medtronic PLC, Zimmer Biomet Holdings, Inc., Entrhal Medical GmbH, Stryker Corporation, Alcon Laboratories, Inc., Aspen Surgical Products, Inc., Conmed Corporation, Boston Scientific Corporation, and Johnson & Johnson.

Which region held the dominating position in the global surgical equipment market?

North America held the dominating share for surgical equipment during the analysis period of 2022 to 2030.

Which region exhibited the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for surgical equipment during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global surgical equipment market?

Rising number of surgeries, technological advancements, and a growing geriatric population are the prominent factors that fuel the growth of global surgical equipment market.

By segment product, which sub-segment held the maximum share?

Based on product, surgical sutures & staplers segment held the maximum share for surgical equipment market in 2021.