Cardiology Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Cardiology Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

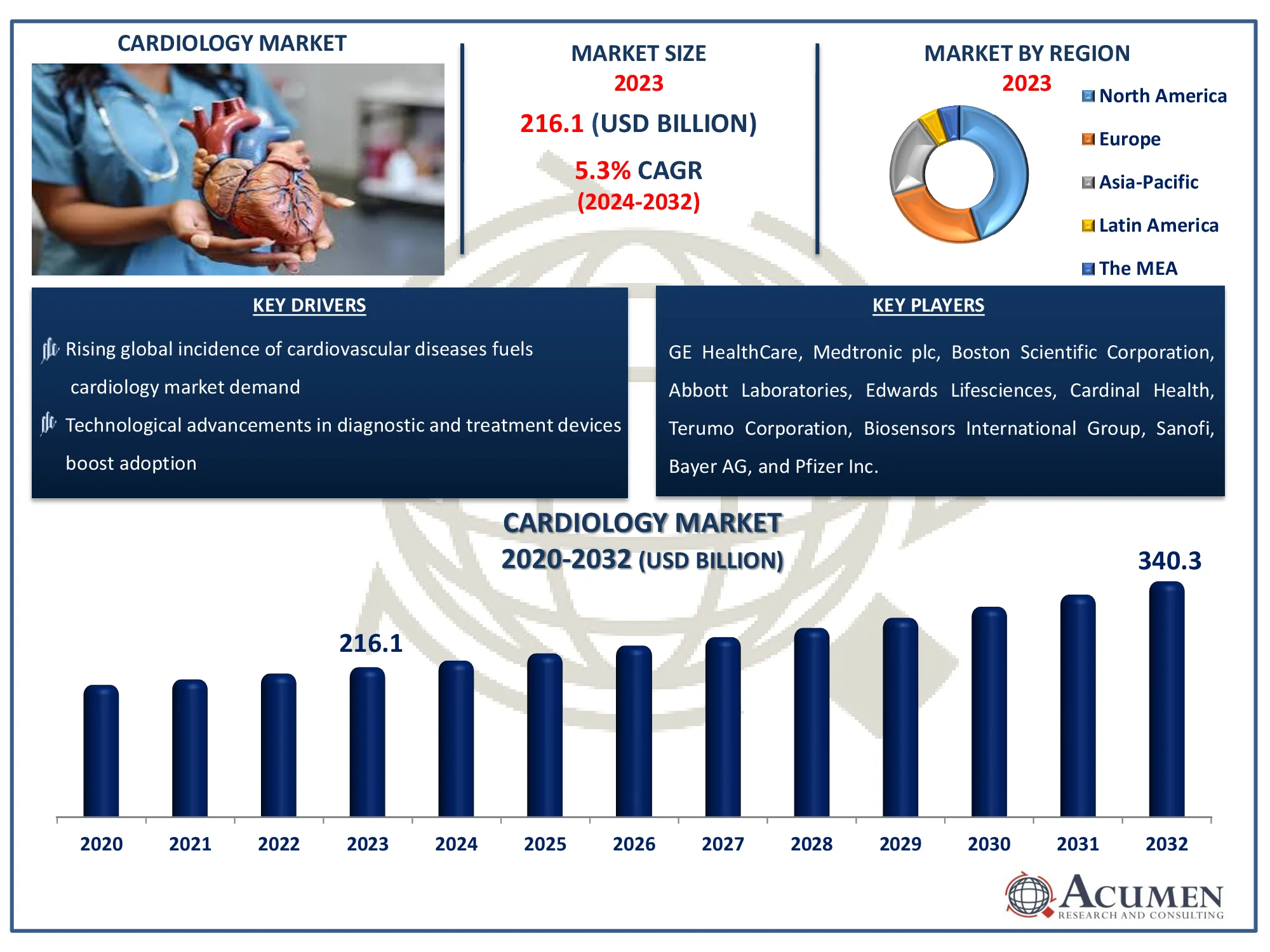

The Global Cardiology Market Size accounted for USD 216.1 Billion in 2023 and is estimated to achieve a market size of USD 340.3 Billion by 2032 growing at a CAGR of 5.3% from 2024 to 2032.

Cardiology Market Highlights

- Global cardiology market revenue is poised to garner USD 340.3 billion by 2032 with a CAGR of 5.3% from 2024 to 2032

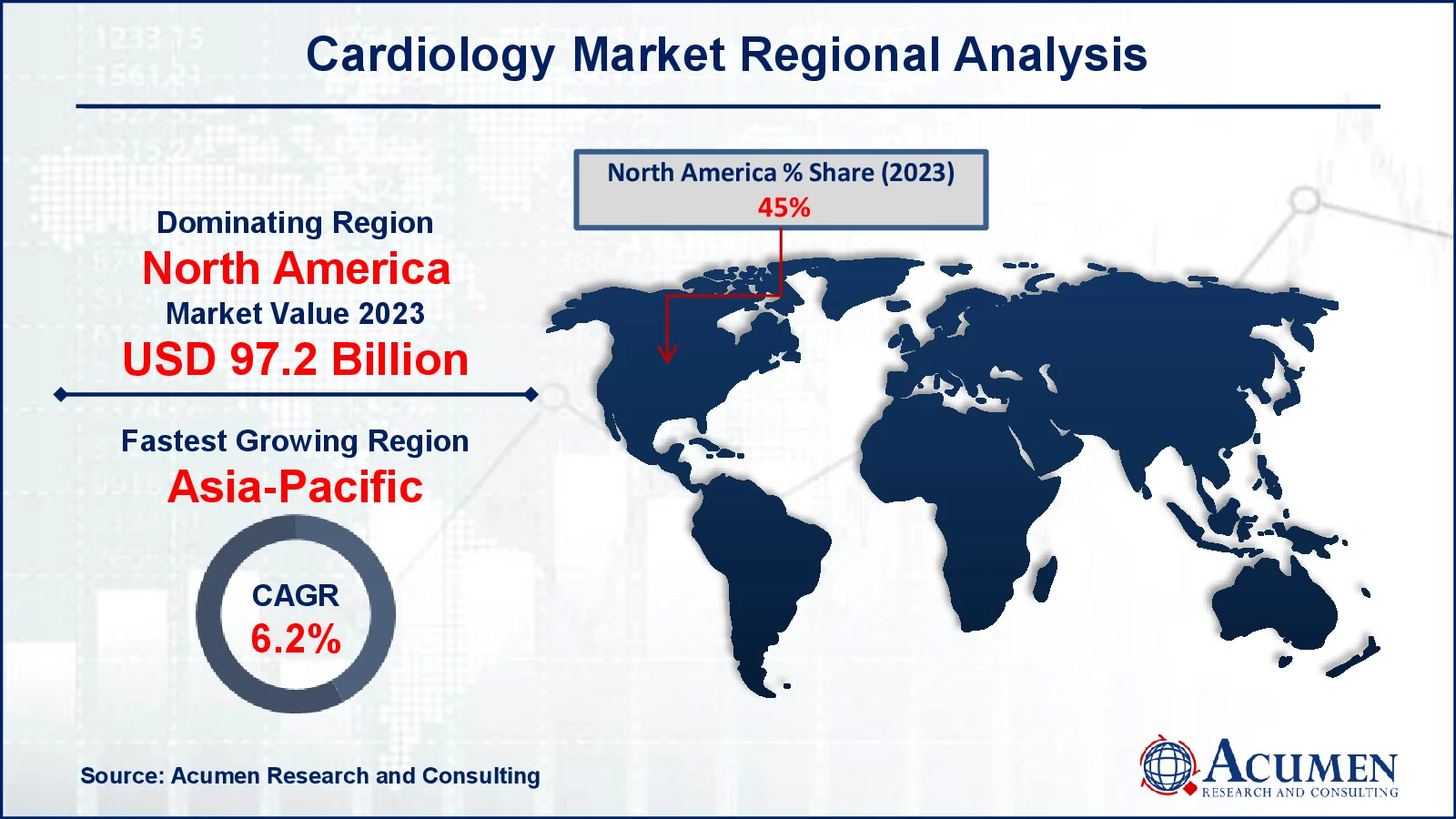

- North America cardiology market value occupied around USD 97.2 billion in 2023

- Asia-Pacific cardiology market growth will record a CAGR of more than 6.2% from 2024 to 2032

- Among product type, the drugs sub-segment generated more than USD 155.6 billion revenue in 2023

- Based on application, the coronary artery disease sub-segment generated around 35% cardiology market share in 2023

- Preventive cardiology initiatives drive demand for early detection tools is a popular cardiology market trend that fuels the industry demand

Cardiology is a medical specialty and a branch of internal medicine focused on diagnosing and treating disorders of the heart and blood vessels in a patient’s body. It encompasses a wide range of conditions, including congenital heart defects, coronary artery disease, electrophysiology, heart failure, and valvular heart disease. Echocardiograms, stress tests, and cardiac catheterization are among the diagnostic procedures used by cardiologists to assess heart function. Treatment options include lifestyle improvements, medicines, minimally invasive procedures, and surgery. Cardiology also includes subspecialties such cardiac electrophysiology, echocardiography, interventional cardiology, and nuclear cardiology, which allow doctors to treat specific heart disorders. This field is crucial for preventing cardiac diseases, improving heart health, and enhancing patients' quality of life.

Global Cardiology Market Dynamics

Market Drivers

- Rising global incidence of cardiovascular diseases fuels cardiology market demand

- Technological advancements in diagnostic and treatment devices boost adoption

- Aging populations worldwide increase the prevalence of heart-related conditions

- Higher healthcare spending enhances accessibility to cardiology solutions

Market Restraints

- High costs of advanced cardiology treatments restrict cardiology market penetration

- Regulatory challenges delay product approvals and market entry

- Limited availability of trained cardiologists hinders effective care delivery

Market Opportunities

- Untapped potential in developing regions offers significant growth prospects

- AI integration in cardiology enables advanced diagnostics and predictive care

- Expansion of telemedicine enhances access to cardiovascular consultations

Cardiology Market Report Coverage

|

Market |

Cardiology Market |

|

Cardiology Market Size 2023 |

USD 216.1 Billion |

|

Cardiology Market Forecast 2032 |

USD 340.3 Billion |

|

Cardiology Market CAGR During 2024 - 2032 |

5.3% |

|

Cardiology Market Analysis Period |

2020 - 2032 |

|

Cardiology Market Base Year |

2023 |

|

Cardiology Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Product Type, By Application, By End-User, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

GE HealthCare, Medtronic plc, Boston Scientific Corporation, Abbott Laboratories, Edwards Lifesciences, Cardinal Health, Terumo Corporation, Biosensors International Group, Sanofi, Bayer AG, and Pfizer Inc. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Cardiology Market Insights

Big Calls For "Digital Health In General Cardiology"

According to the European Society of Cardiology, three major pillars of digital health are telemedicine, smart phone apps, and wearable sensors. These domains of e-health have developed quickly over the past few years but got accelerated during the COVID-19 pandemic. E-Health ECG portable devices act as well suited devices for ECG monitoring aiming to document symptoms such as syncope and palpitations. Additionally, patch ECG monitoring allows recording within 14 days and external loop recorders store ECG segments of fixed duration. Smartphone and smart watches applications detect and classify rthym as regular or irregular. Moreover, by utility of telemedicine in heart failure patients that comprises of non-invasive and invasive home measuring devices to transfer vital parameters from the patient's home to care givers. These tools strongly support the conventional care service to the outpatient clinics or cardiology practice rather than face-to-face contact. Furthermore, through integration of new technologies specifically to novel ethical issues related to data quality, patient-physician relationship, equity of access to healthcare services, and implementation of artificial intelligence (AI). Such a major shift towards digital health will gain huge prominence in the coming years.

Wait, How Cell Transplantation Assist In Repairing Injured Myocardium?

Despite the recent advances in the treatment of acute myocardial infarction, the ability to repair extensive myocardial damage is limited. Current treatment for acute myocardial infarction and subsequent heart failure involves mechanical support using ventricular assist devices, and ultimate cardiac transplantation. However, these treatments have limitations such as rejection, infection, and organ donor shortages. Cell transplantation will open new doors coupled with enormous potential to repair or regenerate the injured myocardium in the patient’s body. Cellular cardiomyoplasty (Cell transplantation for cardiac repair) has been attempted with several types of cells involving fetal cardiomyocytes, autologous skeletal myoblasts, adult cardiac-derived cells, embryonic stem cells, and bone marrow stem cells. These cell types have shown promising results in animal studies among that skeletal myoblasts have been the first choice by the researchers to be evaluated in clinical settings.

Medical Technology: Top Investment Pocket For Cardiology Market

Innovations in technology for treatment of heart diseases offer lucrative opportunities for the growth of global cardiology devices market. Involvement of miniature ventricular assist device (VAD) is gaining high prominence in the global patient care supported for advanced heart failures. By incorporating VAD it has shown promising results for improving the quality of life and act as an alternative in donor heart shortages for patient care. Supportive innovations by improvement in device size, battery reliability, and even wireless charging technologies make this device gain attention in the worldwide cardiology devices market in the coming years and decrease patient susceptibility to infections. Also, novel device based technologies supported for prevention of stroke have evolved rapidly. There has been a strong focus of the companies towards development of newer devices such as carotid implants, these devices are designed for continuous embolic filtration at the level of the common aortic pathway. These devices are currently being tested in preclinical studies and will provide a new gateway as a treatment option for patients suffering from bleeding associated problems. Such technological innovations supported by medical devices enhance the growth of global cardiology market. Also, several devices have been developed to provide other advanced measures for circulatory support. Through incorporation of extracorporeal oxygenation (ECMO), it offers patients the opportunity to avoid mechanical ventilation. This helps to possible decrease blood pressure anesthesia and reduction in venous return. Currently, there is a high focus on the development of small portable devices aiming to offer ventilator circulatory support for critical cases.

Cardiology Market Segmentation

Cardiology Market Segmentation

The worldwide market for cardiology is split based on product type, application, end-user, and geography.

Cardiology Market By Product Type

- Devices

- Diagnostic Devices

- Electrocardiogram (ECG)

- Echocardiography

- Cardiac Monitors

- Others

- Therapeutic Devices

- Pacemakers

- Implantable Cardioverter Defibrillators (ICDs)

- Stents (Drug-Eluting, Bare-Metal, etc.)

- Ventricular Assist Devices (VADs)

- Cardiac Ablation Devices

- Others

- Diagnostic Devices

- Drugs

- Antihypertensive

- Anticoagulants

- Antihyperlipidemic

- Antiplatelet Drugs

- Others (e.g., ACE Inhibitors, ARBs)

According to cardiology industry analysis, the drugs segment accounts for the majority of the market revenue because of the broad occurrence of cardiovascular illnesses and the crucial role that medications play in treatment and management. Cardiovascular drugs, such as antihypertensives, antiplatelets, anticoagulants, and cholesterol-lowering compounds, are widely used to treat hypertension, arrhythmias, and coronary artery disease. The expanding geriatric population and sedentary lifestyles have resulted in an increase in chronic heart diseases, driving up demand for these medications. Furthermore, advances in pharmacological research, particularly the introduction of innovative treatments like PCSK9 inhibitors, have increased therapy possibilities. Accessibility via prescription and over-the-counter sales ensures their cardiology drugs market domination, resulting in a steady cash generator.

Cardiology Market By Application

- Coronary Artery Disease

- Arrhythmia

- Heart Failure

- Hypertension

- Hyperlipidemia

- Stroke

- Others

Coronary artery disease is the biggest in the cardiology drugs market due to its broad occurrence and serious health effects. CAD, caused by plaque buildup in the arteries, reduces blood flow to the heart and is one of the top causes of death worldwide. Unhealthy diets, sedentary lives, smoking, and rising obesity rates all contribute to the disease's increased prevalence. The section has access to a diverse variety of therapeutic choices, including statins and antiplatelets, as well as interventional procedures such as angioplasty and stent implantation. Furthermore, ongoing advances in diagnostic technologies and minimally invasive therapies for CAD contribute to its cardiovascular devices market domination, ensuring its position as the leading segment.

Cardiology Market By End-User

- Hospitals

- Cardiac Centers

- Ambulatory Surgical Centers

- Research Institutes

- Home Care Settings

The cardiology market serves a wide range of end users, including hospitals, cardiac centers, ambulatory surgery centers, research institutes, and home care facilities. While hospitals and cardiac centers continue to be major consumers, the home care settings category is expected to develop significantly. Several factors contributes to this growth, including an increase in the prevalence of chronic cardiovascular diseases, a demand for convenient and cost-effective care, and advancements in telemedicine and remote patient monitoring technologies. Home care environments enable patients to get necessary care and support in the comfort of their own homes, thereby increasing their quality of life and lowering pressure on healthcare services.

Cardiology Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Cardiology Market Regional Analysis

Cardiology Market Regional Analysis

North America presently gets the leading position, due to a number of crucial factors. To begin, the region has a highly modern healthcare infrastructure, which includes cutting-edge technology and well-established medical institutions. Second, cardiovascular disorders, such as heart disease and stroke, are common in North America, resulting in a significant demand for diagnostic and therapeutic measures. Finally, significant research and development efforts in the region encourage constant innovation and the creation of novel cardiac treatments. This solid basis has enabled the development of a vibrant cardiology products and services market, with several significant cardiovascular devices market participants based in North America.

The Asia-Pacific region is predicted to grow significantly in the cardiology devices and drugs market forecast period. Several major factors contribute to this increase. First and foremost, the region is experiencing fast demographic shift, with a sizable and growing senior population. This demographic transition is associated with an increase in the prevalence of age-related cardiovascular illnesses. Second, healthcare spending in the Asia-Pacific area is gradually rising, providing more access to advanced medical care. Third, rising public awareness of cardiovascular diseases and risk factors is driving up demand for preventative measures and appropriate treatment. Finally, the region is witnessing substantial investments in healthcare infrastructure, leading to improved access to quality healthcare services. These factors collectively contribute to a burgeoning cardiovascular drugs market for cardiology products and services in the Asia-Pacific region, presenting significant opportunities for market players.

Cardiology Market Players

Some of the top cardiology market companies offered in our report includes GE HealthCare, Medtronic plc, Boston Scientific Corporation, Abbott Laboratories, Edwards Lifesciences, Cardinal Health, Terumo Corporation, Biosensors International Group, Sanofi, Bayer AG, and Pfizer Inc.

Frequently Asked Questions

How big is the cardiology market?

The cardiology market size was valued at USD 216.1 billion in 2023.

What is the CAGR of the global cardiology market from 2024 to 2032?

The CAGR of cardiology is 5.3% during the analysis period of 2024 to 2032.

Which are the key players in the cardiology market?

The key players operating in the global market are including GE HealthCare, Medtronic plc, Boston Scientific Corporation, Abbott Laboratories, Edwards Lifesciences, Cardinal Health, Terumo Corporation, Biosensors International Group, Sanofi, Bayer AG, and Pfizer Inc.

Which region dominated the global cardiology market share?

North America held the dominating position in cardiology industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of cardiology during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global cardiology industry?

The current trends and dynamics in the cardiology industry include aging population’s worldwide increase the prevalence of heart-related conditions, and higher healthcare spending enhances accessibility to cardiology solutions.

Which end-user held the maximum share in 2023?

The hospitals end-user held the notable share of the cardiology industry.