Durable Medical Equipment Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Durable Medical Equipment Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

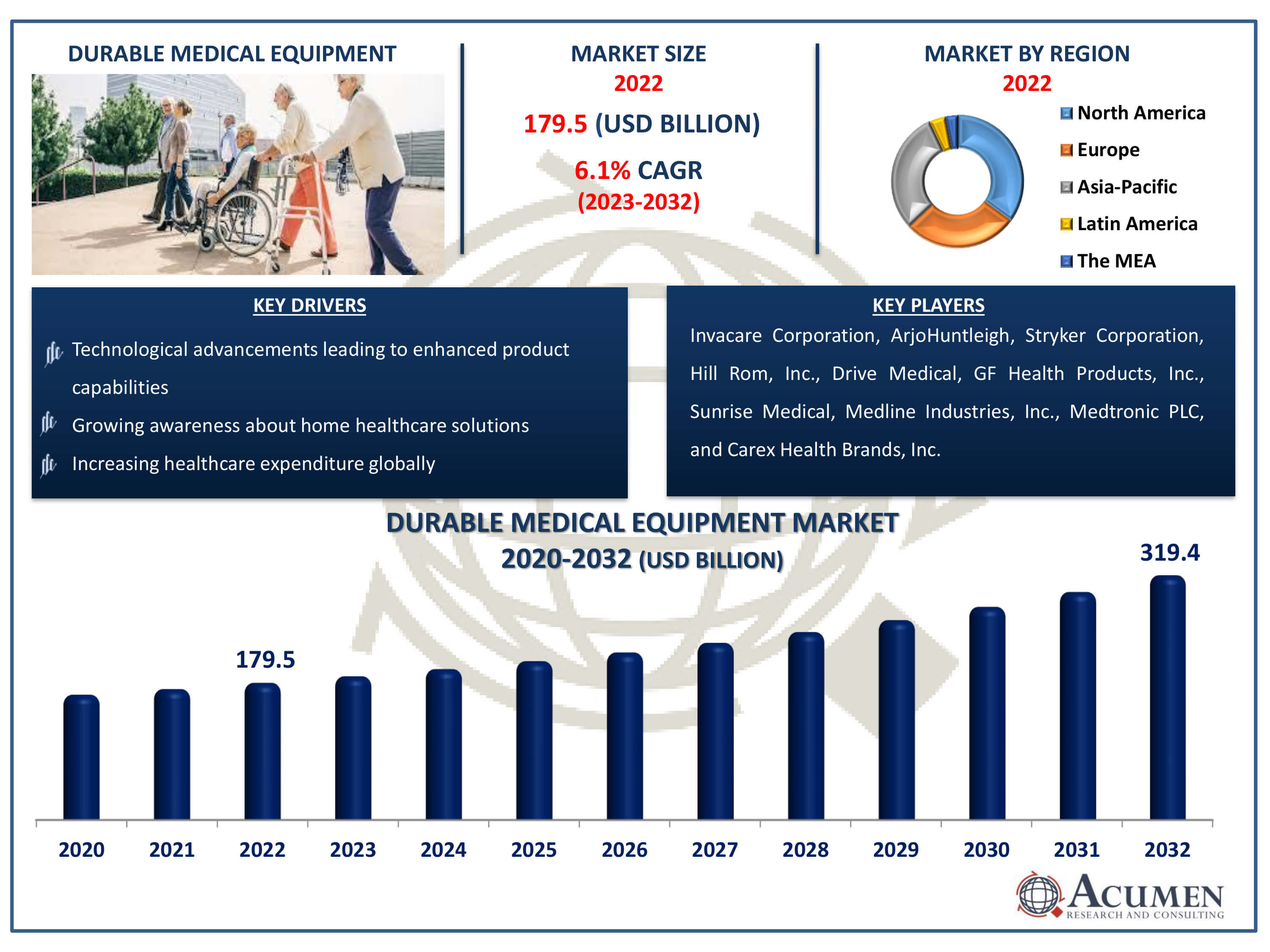

The Durable Medical Equipment Market Size accounted for USD 179.5 Billion in 2022 and is estimated to achieve a market size of USD 319.4 Billion by 2032 growing at a CAGR of 6.1% from 2023 to 2032.

Durable Medical Equipment Market Highlights

- Global durable medical equipment market revenue is poised to garner USD 319.4 billion by 2032 with a CAGR of 6.1% from 2023 to 2032

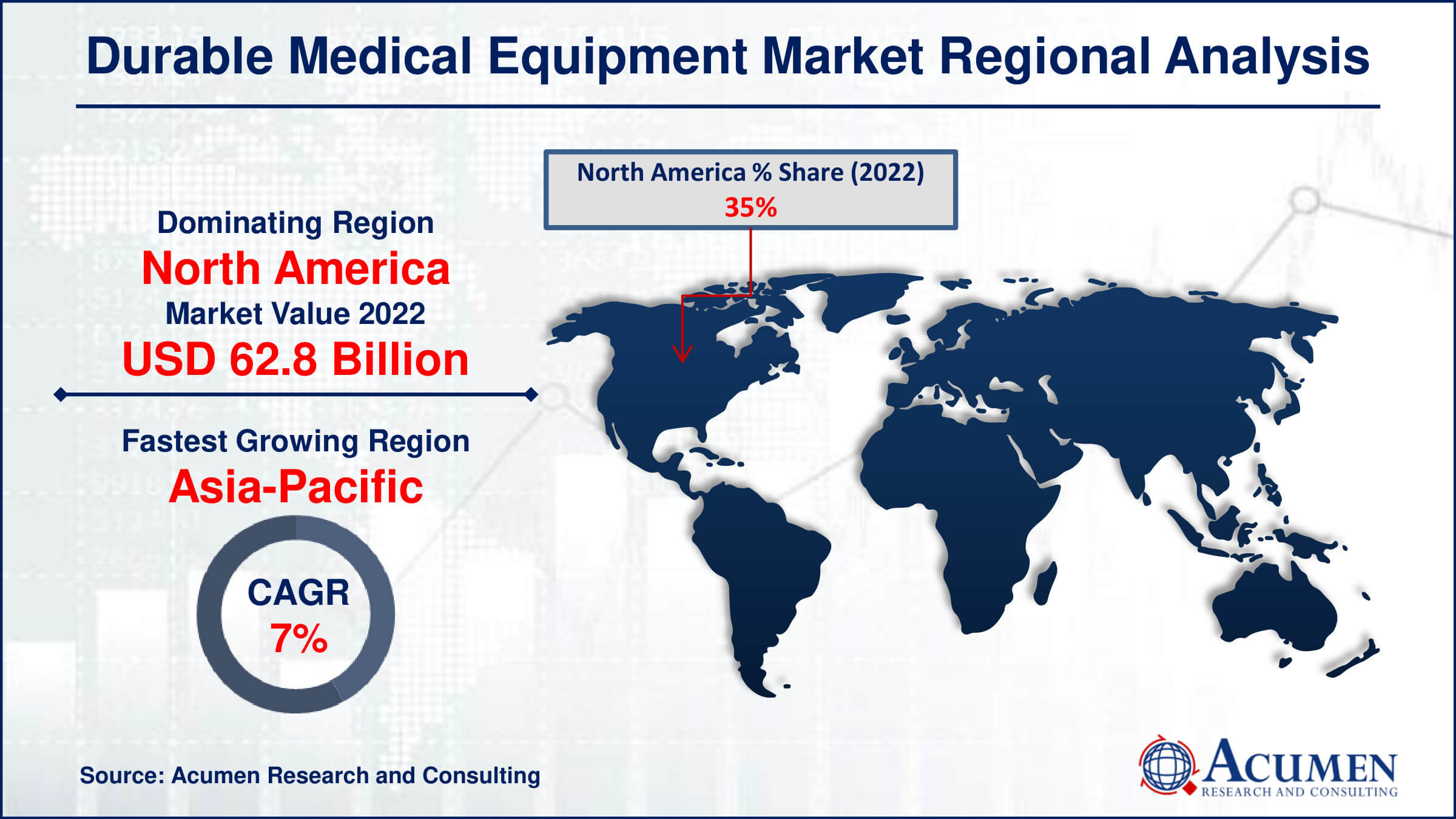

- North America durable medical equipment market value occupied around USD 62.8 billion in 2022

- Asia-Pacific durable medical equipment market growth will record a CAGR of more than 7% from 2023 to 2032

- Among product, the monitoring and therapeutic devices sub-segment generated around USD 159.8 billion revenue in 2022

- Based on end use, the hospitals sub-segment generated more than 34% share in 2022

- Shift towards value-based healthcare models emphasizing patient outcomes is a popular durable medical equipment market trend that fuels the industry demand

Medical devices such as wheelchairs, oxygen tanks, or hospital beds that are prescribed by medical professionals for long-term use to help patients manage various health conditions or impairments are referred to as durable medical equipment (DME). These products are made to be durable and give patients the crucial support they need in their everyday lives.

The healthcare industry's durable medical equipment (DME) market is a crucial sector that includes a range of items designed to enhance the quality of life for patients who have ongoing medical requirements. The need for dependable and long-lasting equipment is growing as medical technology develops and the ageing population rises, spurring innovation and investment in the DME industry.

Global Durable Medical Equipment Market Dynamics

Market Drivers

- Aging population and rising prevalence of chronic diseases

- Technological advancements leading to enhanced product capabilities

- Increasing healthcare expenditure globally

- Growing awareness about home healthcare solutions

Market Restraints

- Stringent regulations and compliance requirements

- Reimbursement challenges in certain regions

- High initial costs associated with DME procurement

Market Opportunities

- Expansion of telemedicine and remote patient monitoring

- Emerging markets offering untapped growth potential

- Collaborations and partnerships for product development and distribution

Durable Medical Equipment Market Report Coverage

| Market | Durable Medical Equipment (DME) Market |

| Durable Medical Equipment (DME) Market Size 2022 | USD 179.5 Billion |

| Durable Medical Equipment (DME) Market Forecast 2032 | USD 319.4 Billion |

| Durable Medical Equipment (DME) Market CAGR During 2023 - 2032 | 6.1% |

| Durable Medical Equipment (DME) Market Analysis Period | 2020 - 2032 |

| Durable Medical Equipment (DME) Market Base Year |

2022 |

| Durable Medical Equipment (DME) Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Invacare Corporation, ArjoHuntleigh, Stryker Corporation, Hill Rom, Inc., Drive Medical, GF Health Products, Inc., Sunrise Medical, Medline Industries, Inc., Medtronic PLC, and Carex Health Brands, Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Durable Medical Equipment Market Insights

The gradual increase in the number of patients suffering from various disorders such as cancer, cardiac disorders, ophthalmic ailments, neurological conditions, and gynecological complications, along with the rising demand for advanced monitoring and therapeutic devices, is a major factor expected to drive the growth of the global market.

According to the American Heart Association, Inc., the prevalence of obesity was 39.6 percent among U.S. adults and 18.5 percent among youth, with severe obesity affecting 7.7 percent of adults and 5.6 percent of youth.

High government spending on healthcare infrastructure development, coupled with the growing home healthcare approach and the availability of favorable policies, is resulting in the adoption of durable medical equipment, another important factor expected to support the growth of the target market.

Major players' approach towards business expansion through strategic mergers and acquisitions, along with innovative product offerings, is a factor responsible for augmenting the growth of the target market.

In 2020, AdaptHealth Corp., a provider of home medical equipment, acquired Healthline Medical Equipment, Inc. This acquisition is expected to help the company strengthen its position in the Southeast and Southwest US and increase profit margins. Additionally, in 2020, Gerresheimer AG launched a wearable micro-infusion pump called D-mine, used to administer apomorphine in the advanced stages of Parkinson’s treatment, expected to expand the product portfolio and increase revenue share.

However, factors such as technological glitches and durability issues are expected to hamper the growth of the global durable medical equipment market. Additionally, the lack of developed infrastructure to support the adoption of advanced devices is another factor expected to challenge the growth of the target market.

According to the durable medical equipment industry analysis, rapid technological advancements in medical equipment, coupled with the introduction of innovative products, are factors expected to create new opportunities for players operating in the target market over the durable medical equipment industry forecast period. Furthermore, major players' approach towards collaborative work is expected to further support the revenue traction of the target market.

Durable Medical Equipment Market Segmentation

The worldwide market for durable medical equipment is split based on product, end-use, and geography.

Durable Medical Equipment Products

- Personal Mobility Devices

- Wheelchairs

- Scooters

- Walker and Rollators

- Cranes and Crutches

- Door Openers

- Other Devices

- Bathroom Safety Devices and Medical Furniture

- Commodes and Toilets

- Mattress & Bedding Devices

- Monitoring and Therapeutic Devices

- Blood Sugar Monitors

- Continuous Passive Motion (CPM)

- Infusion Pumps

- Nebulizers

- Oxygen Equipment

- Continuous Positive Airway Pressure (CPAP)

- Suction Pumps

- Traction Equipment

- Others Equipment

The market for durable medical equipment (DME) is dominated by the monitoring and therapeutic devices segment. This category includes a broad range of vital medical equipment that is used to track patients' health and administer treatments. This category includes devices including glucose metres, pulse oximeters, blood pressure monitors, and respiratory therapy equipment. These goods are essential for controlling long-term illnesses, guaranteeing prompt interventions, and enhancing patient outcomes. The global ageing population and growing incidence of chronic illnesses are driving up demand for sophisticated therapeutic and monitoring solutions. The capabilities and accuracy of these devices have been further improved by technological developments, which has accelerated their acceptance in homes and hospital settings. The monitoring and therapeutic devices category is expected to increase further as healthcare systems place a greater emphasis on remote monitoring and preventative care. This will have a substantial impact on the overall growth of the DME market.

Durable Medical Equipment End-Uses

- Hospitals

- Nursing Homes

- Home Healthcare

- Other

The durable medical equipment (DME) markets largest end-use category is undoubtedly the hospitals segment. As the main centre for acute and critical care, hospitals accommodate a wide variety of patients with different medical needs. Durable medical equipment is essential to the diagnosis, treatment, and rehabilitation procedures that take place in hospital environments. Hospitals depend significantly on a broad range of durable medical equipment to provide the best possible patient care, from life-saving tools like ventilators and defibrillators to mobility aids like hospital beds and wheelchairs. Furthermore, the sheer number of patients receiving care in hospitals, along with the requirement for ongoing observation and assistance, fuels the market for long-lasting medical equipment. Investments in cutting-edge and novel DME solutions within hospital settings are steadily rising as healthcare institutions work to improve patient outcomes and operational effectiveness. This is solidifying the hospitals segment's leadership in the DME market landscape.

Durable Medical Equipment Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Durable Medical Equipment Market Regional Analysis

Durable medical equipment market analysis, due to the huge number of patients in North America who are coping with a wide range of medical diseases, the market for durable medical equipment (DME) is expected to rise significantly in the durable medical equipment market forecast period. North America offers the perfect setting for the spread of DME thanks to its sophisticated healthcare systems and strong infrastructure. Favorable reimbursement regulations also encourage patients and healthcare providers to invest in durable medical equipment solutions. Deeply ingrained in the area, major industry players constantly develop and introduce cutting-edge technologies, propelling market progress.

In the meantime, the DME market is about to see a notable acceleration in growth in the Asia Pacific area. Significant government investments intended to support the region's healthcare infrastructure are responsible for this increase. The need for cutting-edge medical equipment to meet changing healthcare demands is growing as developing countries place a higher priority on healthcare development. Because of the enormous unrealized potential these developing markets provide, major players in the industry are deliberately focusing on them. These firms hope to take advantage of the increasing demand and create a solid presence in the quickly growing Asia Pacific durable medical equipment market by using their knowledge and resources.

Durable Medical Equipment Market Players

Some of the top durable medical equipment companies offered in our report include Invacare Corporation, ArjoHuntleigh, Stryker Corporation, Hill Rom, Inc., Drive Medical, GF Health Products, Inc., Sunrise Medical, Medline Industries, Inc., Medtronic PLC, and Carex Health Brands, Inc.

Frequently Asked Questions

How big is the durable medical equipment market?

The durable medical equipment market size was valued at USD 179.5 billion in 2022.

What is the CAGR of the global durable medical equipment market from 2023 to 2032?

The CAGR of durable medical equipment is 6.1% during the analysis period of 2023 to 2032.

Which are the key players in the durable medical equipment market?

The key players operating in the global market are including Invacare Corporation, ArjoHuntleigh, Stryker Corporation, Hill Rom, Inc., Drive Medical, GF Health Products, Inc., Sunrise Medical, Medline Industries, Inc., Medtronic PLC, and Carex Health Brands, Inc.

Which region dominated the global durable medical equipment market share?

North America held the dominating position in durable medical equipment industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of durable medical equipment during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global durable medical equipment industry?

The current trends and dynamics in the durable medical equipment industry include aging population and rising prevalence of chronic diseases, technological advancements leading to enhanced product capabilities, increasing healthcare expenditure globally, and growing awareness about home healthcare solutions

Which product held the maximum share in 2022?

The monitoring and therapeutic devices product expected to hold the maximum share of the durable medical equipment industry.