Thermal Spray Coatings Market | Acumen Research and Consulting

Thermal Spray Coatings Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

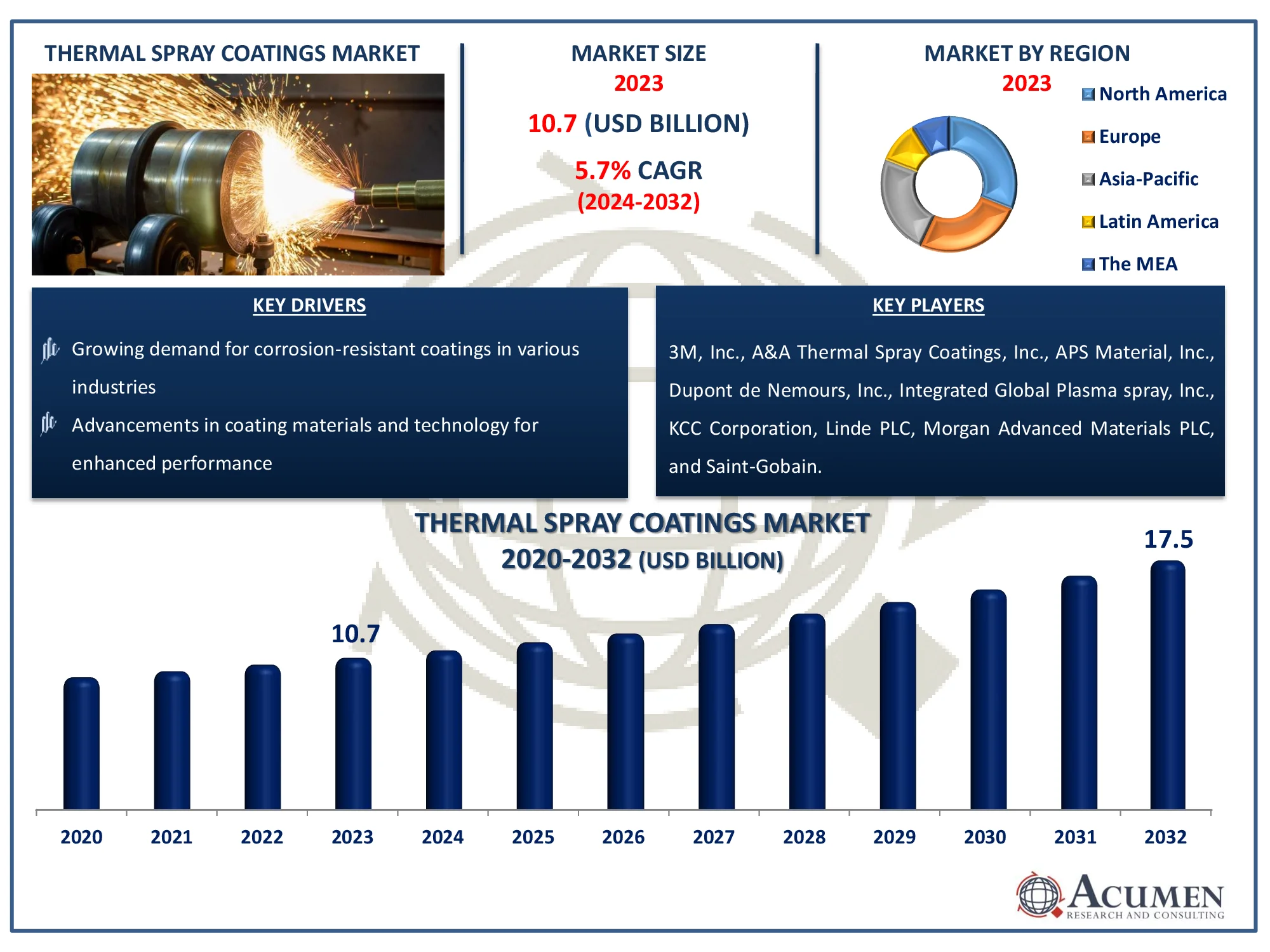

The Global Thermal Spray Coatings Market Size accounted for USD 10.7 Billion in 2023 and is estimated to achieve a market size of USD 17.5 Billion by 2032 growing at a CAGR of 5.7% from 2024 to 2032.

Thermal Spray Coatings Market Highlights

- Global thermal spray coatings market revenue is poised to garner USD 17.5 billion by 2032 with a CAGR of 5.7% from 2024 to 2032

- North America thermal spray coatings market value occupied around USD 3.3 billion in 2023

- Asia-Pacific thermal spray coatings market growth will record a CAGR of more than 7% from 2024 to 2032

- Among product, the ceramics sub-segment generated over US$ 3.4 billion revenue in 2023

- Based on application, the aerospace sub-segment generated around 32% share in 2023

- Integration of smart coatings with sensor technologies for new functionalities is a popular market trend that fuels the industry demand

Thermal spray coatings are protective layers applied to surfaces using a high-temperature method that successfully shields against corrosion and wear while also providing practical benefits such as thermal insulation. This adaptable technology is used in a variety of industries, including aerospace, automotive, healthcare, and energy, to meet severe performance requirements. Because of its adaptability in providing solutions for enhanced surface qualities, extending component lifespan, and satisfying rigorous industrial standards, the thermal spray coatings market has grown significantly. Its continuous innovation in providing innovative materials and technologies, combined with rising demand for long-lasting, high-performance coatings, has propelled the market's steady growth and incorporation into a wide range of industrial processes around the world.

Global Thermal Spray Coatings Market Dynamics

Market Drivers

- Growing demand for corrosion-resistant coatings in various industries

- Advancements in coating materials and technology for enhanced performance

- Increasing applications in aerospace and automotive sectors

- Rising focus on extending equipment lifespan and reducing maintenance costs

Market Restraints

- High initial setup costs and equipment investment

- Environmental and health concerns related to certain coating materials

- Stringent regulations governing coating compositions and emissions

Market Opportunities

- Expanding applications in the medical and electronics industries

- Development of eco-friendly and bio-based coatings

- Surge in demand for thermal barrier coatings in power generation

Thermal Spray Coatings Market Report Coverage

| Market | Thermal Spray Coatings Market |

| Thermal Spray Coatings Market Size 2022 |

USD 10.7 Billion |

| Thermal Spray Coatings Market Forecast 2032 | USD 17.5 Billion |

| Thermal Spray Coatings Market CAGR During 2023 - 2032 | 5.7% |

| Thermal Spray Coatings Market Analysis Period | 2020 - 2032 |

| Thermal Spray Coatings Market Base Year |

2022 |

| Thermal Spray Coatings Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Technology, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Carpenter Technology Corp., Castolin Eutectic, Durum Verschleiss-Schutz GmbH, Fujimi Incorporated, GTV Verschleißschutz GmbH, H.C. Starck Inc., Höganäs AB, Kennametal Stellite, Montreal Carbide Co. Ltd, Oerlikon Metco, Powder Alloy Corp., Praxair Surface Technologies, Inc., Saint-Gobain S.A., and Wall Colmonoy Corp. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Thermal Spray Coatings Market Insights

Rapid technological advancements in coatings and the growing demand for advanced and superior coating methods have led to increased interest in thermal spray coatings across various industries such as medical, automotive, and aerospace. This surge is a major driving force behind the global market's growth. The automotive industry is experiencing rapid advancements worldwide as manufacturers aim to meet evolving vehicle standards, prioritizing the delivery of higher-quality vehicles. Thermal spray coatings find wide application in critical vehicle components, including piston rings, cylinder liners, synchronizing rings, crankshaft repairs, exhaust pipes, turbochargers, and more, aiming to extend the product life cycle.

The government's increased spending on healthcare sector development, coupled with device manufacturers' focus on delivering higher-quality medical devices, is expected to drive increased demand for thermal spray coatings. This surge in demand is anticipated to further support the growth of the target market. Nevertheless, factors like fluctuating raw material prices and stringent government regulations concerning product approval are anticipated to impede the growth of the global thermal spray coatings market. Additionally, limited investments by major industry players in research and development activities pose another challenge to the market's expansion.

However, substantial investments by major players, coupled with a growing focus on emerging economies to boost profits, are expected to create new opportunities for companies operating within the target market during the thermal spray coatings industry forecast period.

Thermal Spray Coatings Market Segmentation

The worldwide market for thermal spray coatings is split based on product, technology, application, and geography.

Thermal Spray Coatings Market By Products

According to thermal spray coatings industry analysis, the ceramics subsegment is the greatest revenue generator among product categories. Ceramics have outstanding qualities that include great thermal insulation, wear resistance, and corrosion resistance. Their vast application in a variety of industries, including aerospace, automotive, and healthcare, contributes significantly to their revenue contribution. With uses in important components such as turbine engines, medical implants, and electronic devices, ceramics' durability and thermal qualities position them as a key choice in thermal spray coatings, accounting for the product segment's large revenue dominance.

Thermal Spray Coatings Market By Technology

- Cold Spray

- Flame Spray

- Plasma Spray

- HVOF

- Electric Arc Spray

- Others

In the thermal spray coatings market, the plasma spray technology subsegment has the biggest share. Plasma spray, known for its versatility, provides accurate, high-quality coatings on a variety of surfaces. Its ability to work with a wide range of materials, from ceramics to metals, while providing outstanding bond strength, durability, and corrosion resistance, has driven it to the top of the industry. Plasma spray is widely utilized in aerospace, automotive, and industrial applications due to its versatility and ability to build thick coatings with fine microstructures. The tremendous capabilities of this technology have cemented its position as the market leader in thermal spray coatings.

Thermal Spray Coatings Market By Applications

- Aerospace

- Industrial Gas Turbine

- Automotive

- Medical

- Printing

- Oil & Gas

- Steel

- Pulp & Paper

- Others

In recent years, according to the thermal spray coatings market analysis, Within the industry, the aerospace subsegment is at the forefront. Its popularity stems from the vital need for high-performance coatings in aircraft applications, where durability, heat resistance, and corrosion resistance are critical. Thermal spray coatings serve an important role in extending the life of aviation components and maintaining reliability under harsh conditions. These coatings provide better wear resistance and thermal insulation on anything from engine components to airframes. As the aircraft industry seeks lighter, stronger materials, demand for advanced thermal spray coatings remains high, cementing the aircraft subsegment's market leadership.

Thermal Spray Coatings Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Thermal Spray Coatings Market Regional Analysis

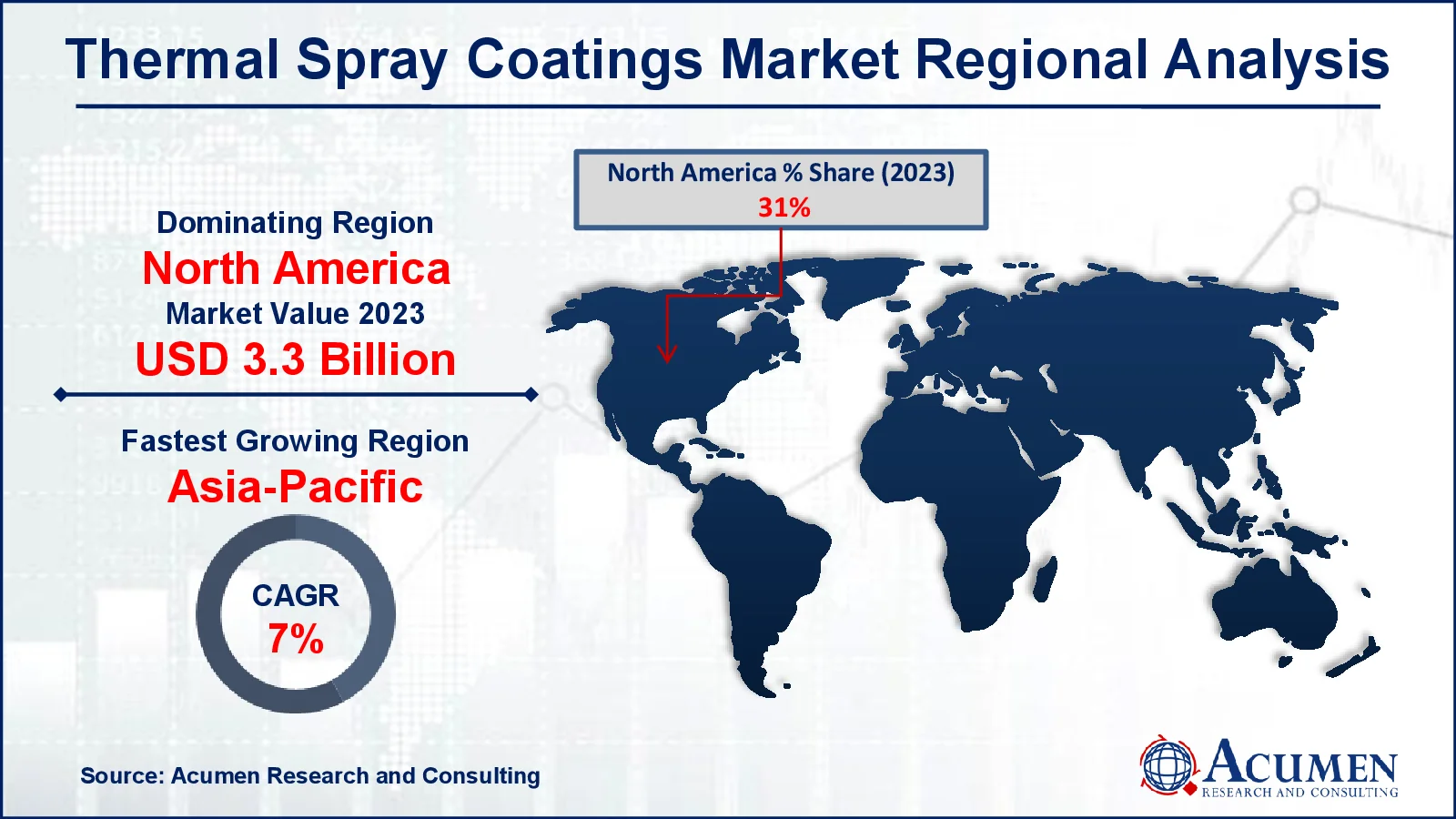

The thermal spray coatings market is dominated by North America, which generates the most revenue among all regions. This supremacy stems from its developed industrial landscape, particularly in the aerospace, automotive, and healthcare industries. North America's market leadership is propelled by rigorous technological innovation, significant R&D investments, and a strong focus on advanced coatings. Furthermore, high quality standards and a strong regulatory framework strengthen the region's trustworthiness, supporting market expansion even further.

In contrast, the Asia-Pacific region appears as the fastest-growing market due to rapid industrial expansion and robust manufacturing operations. Booming infrastructure development, particularly in China and India, along with soaring automotive manufacturing, drives the region's increased demand for thermal spray coatings. Asia-Pacific benefits from increased investments in novel technology, which fosters a competitive landscape and propels the region's strong economic trajectory.

Europe maintains its second-largest position in the thermal spray coatings market. Europe maintains significant demand for these coatings due to its strong manufacturing base, particularly in the automotive and aerospace industries. The region's concentration on environmentally friendly coatings, adherence to high quality standards, and a strong emphasis on technological improvements consolidate its market presence and contribute to its position as a significant participant in the global market landscape.

Thermal Spray Coatings Market Players

Some of the top thermal spray coatings companies offered in our report includes Carpenter Technology Corp., Castolin Eutectic, Durum Verschleiss-Schutz GmbH, Fujimi Incorporated, GTV Verschleißschutz GmbH, H.C. Starck Inc., Höganäs AB, Kennametal Stellite, Montreal Carbide Co. Ltd, Oerlikon Metco, Powder Alloy Corp., Praxair Surface Technologies, Inc., Saint-Gobain S.A., and Wall Colmonoy Corp.

Frequently Asked Questions

How big is the thermal spray coatings market?

The market size of thermal spray coatings was USD 10.7 billion in 2023.

What is the CAGR of the global thermal spray coatings market from 2024 to 2032?

The CAGR of thermal spray coatings is 5.7% during the analysis period of 2024 to 2032.

Which are the key players in the thermal spray coatings market?

The key players operating in the global market are including Carpenter Technology Corp., Castolin Eutectic, Durum Verschleiss-Schutz GmbH, Fujimi Incorporated, GTV Verschleißschutz GmbH, H.C. Starck Inc., Höganäs AB, Kennametal Stellite, Montreal Carbide Co. Ltd, Oerlikon Metco, Powder Alloy Corp., Praxair Surface Technologies, Inc., Saint-Gobain S.A., and Wall Colmonoy Corp.

Which region dominated the global thermal spray coatings market share?

North America held the dominating position in thermal spray coatings industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of thermal spray coatings during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global thermal spray coatings industry?

The current trends and dynamics in the thermal spray coatings industry include growing demand for corrosion-resistant coatings in various industries, advancements in coating materials and technology for enhanced performance, increasing applications in aerospace and automotive sectors, and rising focus on extending equipment lifespan and reducing maintenance costs.

Which product held the maximum share in 2023?

The ceramics product held the maximum share of the thermal spray coatings industry.