Smart Coating Market Size - Global Industry Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

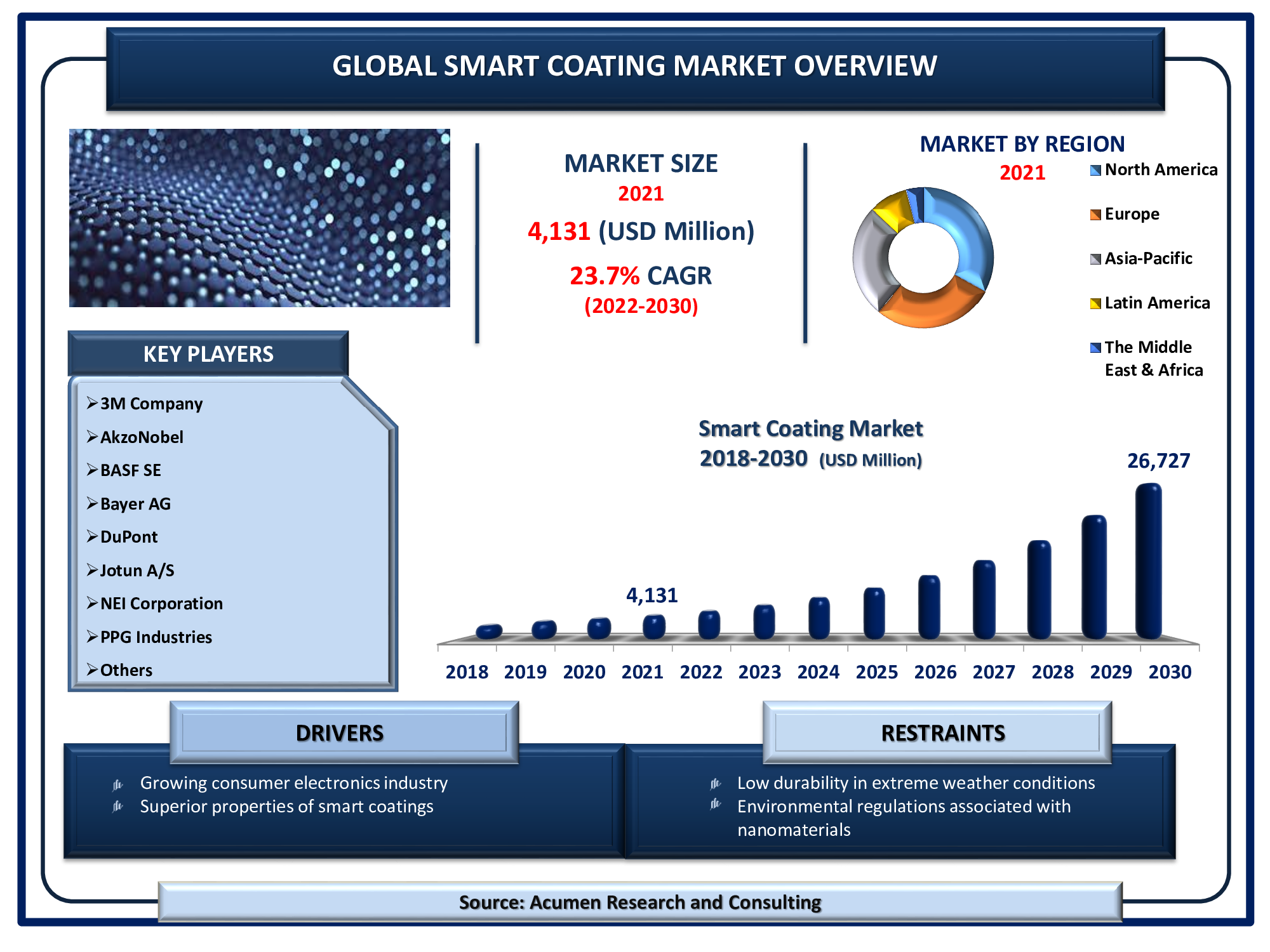

The Global Smart Coating Market Size was valued at USD 4,131 Million in 2021 and is estimated to achieve a market size of USD 26,727 Million by 2030; growing at a CAGR of 23.7%.

Smart coatings are made of materials that can be programmed to have a variety of chemical, physical, electrical, and mechanical properties. Smart coatings react to external conditions such as temperature, pressure, light, chemical, and other stimuli. Continuous demand for higher performance to stretch product lifetime and minimize maintenance is the primary factor boosting the smart coating market revenue. The increasing adoption of new and lightweight materials along with the growing need to enhance efficiency both for cost and environmental reasons are some of the recent smart coating market trends that are fueling the industry growth.

Global Smart Coating Market DRO’s:

Market Drivers:

- Growing consumer electronics industry

- Superior properties of smart coatings

- Increasing demand from end-use industries

Market Restraints:

- Environmental regulations associated with nanomaterials

- Low durability in extreme weather conditions

Market Opportunities:

- Growing military spending in emerging economies

- Growing R&D in the field of nanomaterials

Smart Coating Market Report Coverage

| Market | Smart Coating Market |

| Smart Coating Market Size 2021 | USD 4,131 Million |

| Smart Coating Market Forecast 2030 | USD 26,727 Million |

| Smart Coating Market CAGR | 23.7% During 2022 - 2030 |

| Analysis Period | 2018 - 2030 |

| Base Year | 2021 |

| Forecast Data | 2022 - 2030 |

| Segments Covered | By Type, By Function, By Application And By Region |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | 3M Company, AkzoNobel, BASF SE, Bayer AG, DuPont, Jotun A/S, NEI Corporation, PPG Industries, The Dow Chemical Co., and The Sherwin-Williams Company. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

The high demand for smart coatings in a variety of end-use industries is expected to increase market share. The growing use of smart coatings in the construction and residential sectors is driving up product demand. Smart coatings are used on a wide range of surfaces in homes, including electronic devices, glass panels, lighting fixtures, photo frames, and tabletops. Because smart coatings are more durable than traditional coatings, they are regarded as the coatings industry's future. For instance, smart nanotech coatings on surfaces can improve durability, handling, and oxidation resistance without compromising performance.

Smart coatings have smart properties such as self-healing, self-cleaning, and corrosion resistance, which has increased the demand for exterior applications in the automotive and aerospace industries. These coatings, when applied to aircraft, can detect damage to the engine or the aircraft's body. The main reason for the market's numerous industrial players is that they are deeply involved in extensive research and development processes, which ensures the factors essential for smart coating.

Extensive demand from military applications is expected to open up numerous growth opportunities for the market in the coming years. For example, they are used to improve the performance, reliability, and durability of a variety of components; to resist erosion, sliding and fretting wear, or to improve surface quality; and to enable corrosion-resistant coatings to resist exfoliation, oxidation, pitting, and hot corrosion. Over the last few years, a plethora of novel technologies has been introduced. Nanotechnologies, MEMS, polymers, composites, flexible electronics, and other advancements enable the Department of Defense to improve and develop faster, lighter, and more lethal systems.

Smart Coating Market Segmentation

The worldwide smart coating market is split based on type, function, application, and geography.

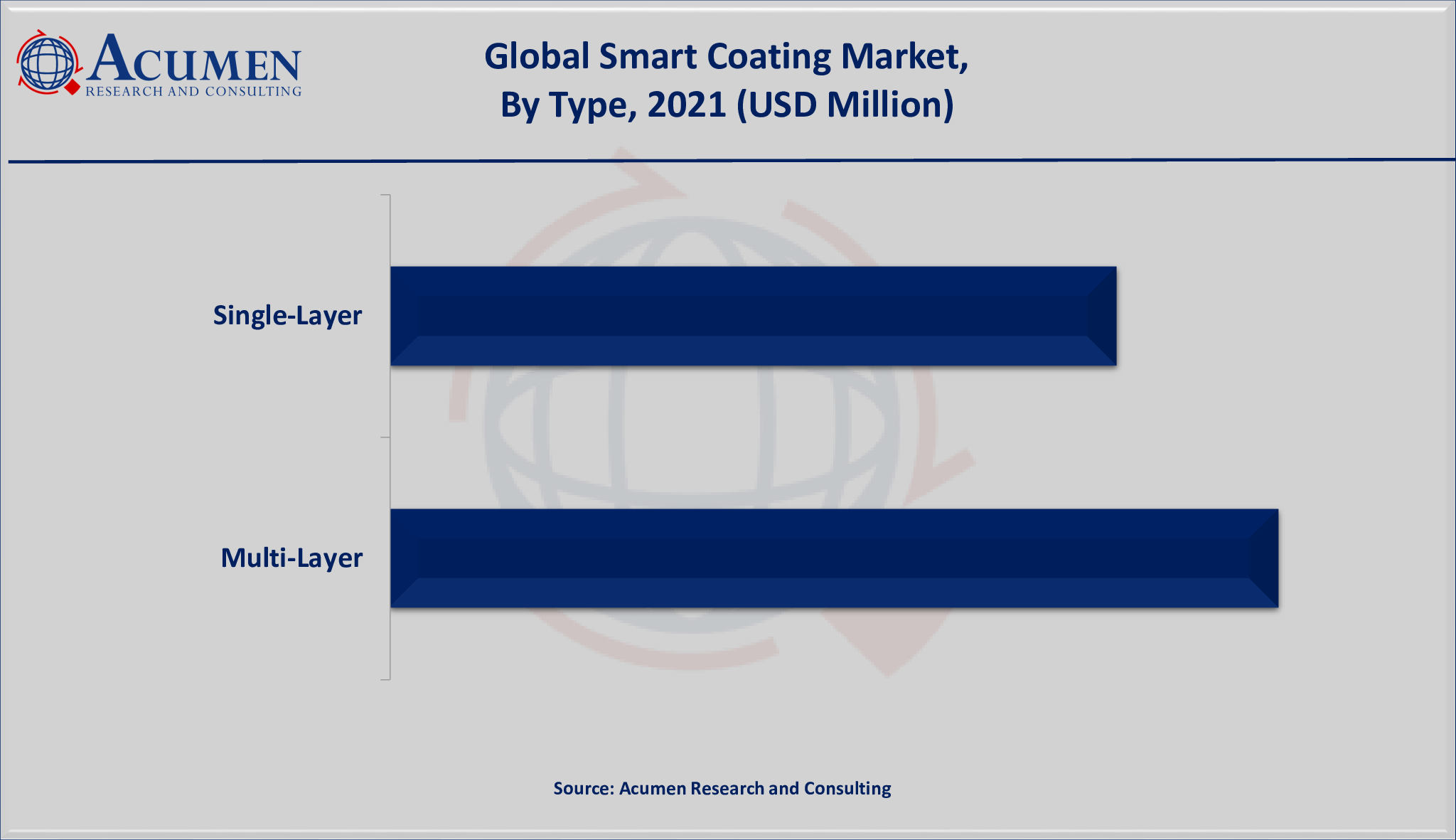

Market by Type

- Single-Layer

- Multi-Layer

Based on our smart coatings industry analysis, the multi-layer type sub-segment is anticipated to lead the market with significant shares in 2021 and will continue to do so in the coming years. The increasing implementation of multi-layer coats for exterior applications in aerospace and automotive is expected to boost the growth of the segment. In addition to that, the growing automotive industry in emerging countries along with the technological advancements and intense research & development activities in multi-layer smart coatings are also supporting the industry growth in the coming years.

Market by Function

- Anti-Icing

- Anti-Corrosion

- Anti-Microbial

- Anti-Fouling

- Self-Healing

- Self-Cleaning

- Others

Anti-corrosion is a critical function in the global smart coatings industry. Self-cleaning and self-healing functions are also driving the smart coatings industry. Self-healing coatings are best suited to corrosion prevention, making them more applicable to surfaces that require corrosion or barrier protection. Furthermore, self-cleaning or easy-to-clean coatings based on nanotechnology have a high potential in commercial products and have the ability to reduce cleaning labor costs.

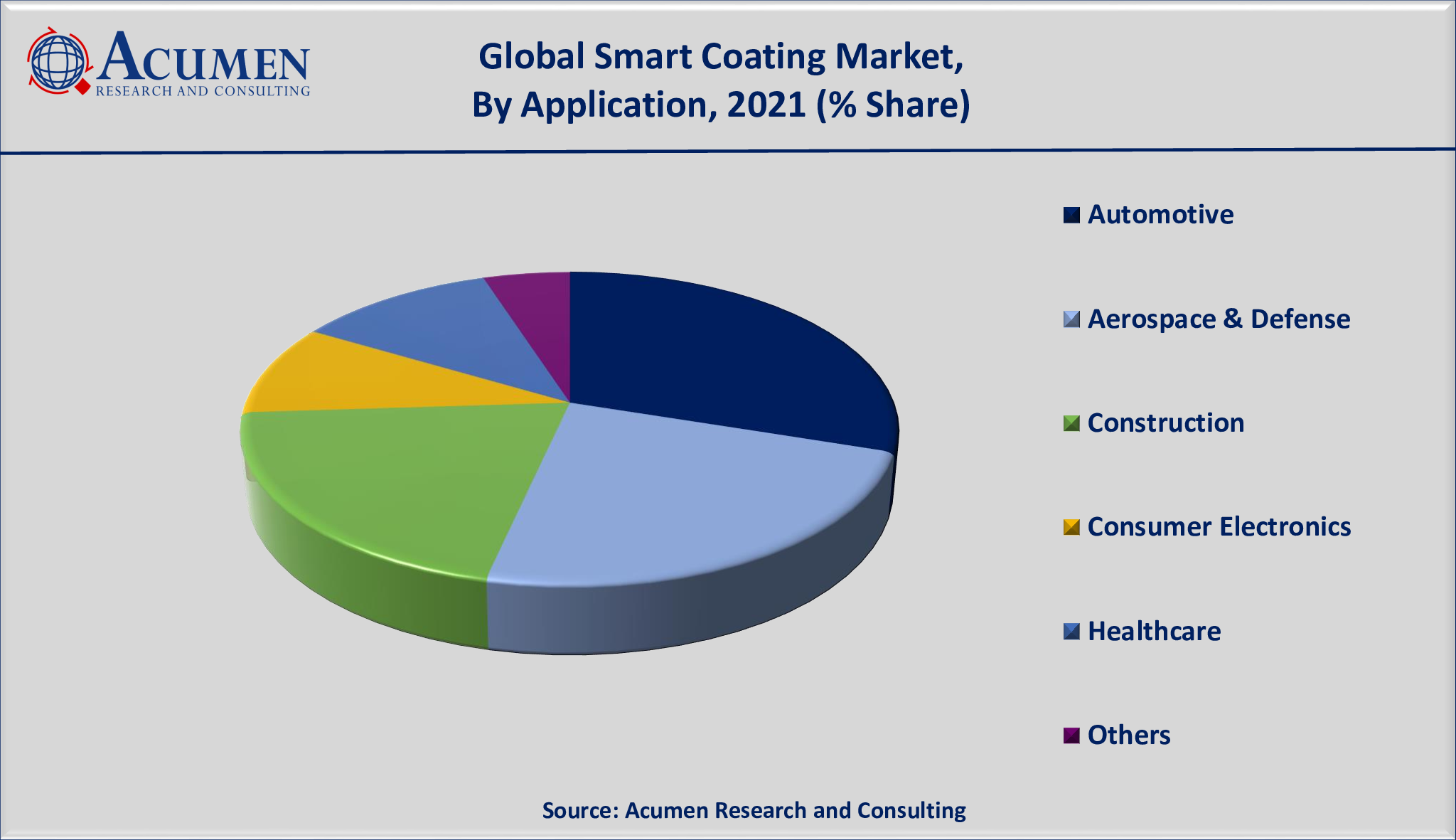

Market by Application

- Automotive

- Aerospace & Defense

- Construction

- Consumer Electronics

- Healthcare

- Others

According to our smart coating market forecast, automotive and aerospace & defense will gain a significant impetus in the coming years. Smart coatings may enable scratched or rusted military vehicles to detect and repair themselves. Vehicles are also likely to change color on the battlefield, providing instant camouflage and making tanks and other military vehicles difficult to detect. On the other hand, the application in construction sectors are expected to register the fastest growth rate in the coming years.

Smart Coating Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Latin America

- Mexico

- Brazil

- Rest of Latin America

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

The Middle East & Africa (MEA)

- Gulf Cooperation Council (GCC)

- South Africa

- Rest of the Middle East & Africa

The presence of key players in North America fuels the regional smart coating market growth

North America is one of the leading regions in the regional industry and is likely to do so in the coming future. The increasing adoption of nanotechnology, rising application of nanomaterials, and presence of key players in the region are the supporting factors of the North American smart coating market. In addition, the use of advanced technology in infrastructure development, including industries such as military, consumer electronics, healthcare, and automotive is the main reason for the dominance of North America in the global smart coatings market.

Asia-Pacific is also one of the significant regions in the global market. The rapidly developing construction industry, increasing applications of smart coatings in the automotive industry, and surging investments in the military sector are driving the Asia-Pacific smart coating industry.

Smart Coating Market Players

Some of the top smart coating companies offered in the professional report includes 3M Company, AkzoNobel, BASF SE, Bayer AG, DuPont, Jotun A/S, NEI Corporation, PPG Industries, The Dow Chemical Co., and The Sherwin-Williams Company.

Frequently Asked Questions

How much was the estimated value of the global smart coating market in 2021?

The estimated value of global smart coating market in 2021 was accounted to be USD 4,131 Million.

What will be the projected CAGR for global smart coating market during forecast period of 2022 to 2030?

The projected CAGR smart coating market during the analysis period of 2022 to 2030 is 23.7%.

Which are the prominent competitors operating in the market?

The prominent players of the global smart coating market are 3M Company, AkzoNobel, BASF SE, Bayer AG, DuPont, Jotun A/S, NEI Corporation, PPG Industries, The Dow Chemical Co., and The Sherwin-Williams Company.

Which region held the dominating position in the global smart coating market?

North America held the dominating smart coating during the analysis period of 2022 to 2030.

Which region exhibited the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for smart coating during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global smart coating market?

Growing consumer electronics industry, superior properties of smart coatings, and increasing demand from end-use industries drives the growth of global smart coating market.

By function segment, which sub-segment held the maximum share?

Based on function, anti-corrosion segment held the maximum share smart coating market in 2021.