Safety Controller Market | Acumen Research and Consulting

Safety Controller Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

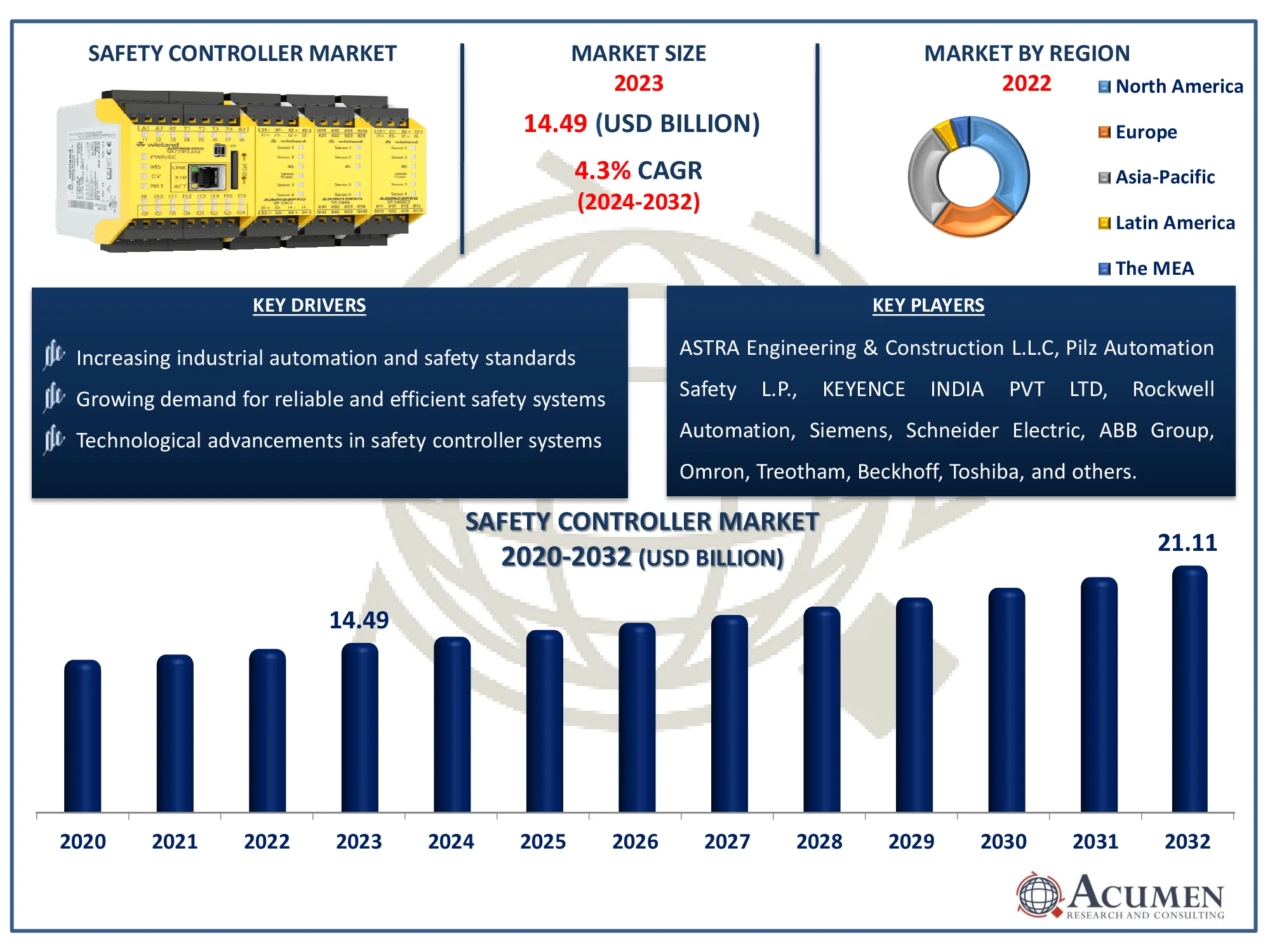

The Global Safety Controller Market Size accounted for USD 14.49 Billion in 2023 and is estimated to achieve a market size of USD 21.11 Billion by 2032 growing at a CAGR of 4.3% from 2024 to 2032.

Safety Controller Market Highlights

- Global safety controller market revenue is poised to garner USD 21.11 billion by 2032 with a CAGR of 4.3% from 2024 to 2032

- North America safety controller market value occupied around USD 5.21 billion in 2023

- Asia Pacific safety controller market growth will record a CAGR of more than 5% from 2024 to 2032

- Among type, the compact sub-segment generated significant market share in 2023

- Safety controllers are increasingly incorporating AI to enhance predictive maintenance and real-time risk assessment capabilities is the safety controller market trend that fuels the industry demand

Safety controllers are essential devices in constructing safety circuits for equipment and facilities, ensuring the protection of various machinery. These controllers require the configuration of appropriate circuits to detect input and output faults effectively. They offer flexible, straightforward, and scalable solutions for implementing intelligent machine designs. Comprising both hardware and software components, safety controllers are utilized across numerous fields, including manufacturing, pharmaceutical, semiconductors, food and beverage, oil and gas, automotive, electronics, aerospace & defense, and others.

Global Safety Controller Market Dynamics

Market Drivers

- Increasing industrial automation and safety standards

- Growing demand for reliable and efficient safety systems

- Technological advancements in safety controller systems

Market Restraints

- High initial costs and maintenance expenses

- Complexity in integrating with existing systems

- Limited awareness and understanding among small and medium enterprises

Market Opportunities

- Expansion in emerging markets

- Integration of IoT and AI for smarter safety solutions

- Rising demand in new applications such as autonomous vehicles and smart factories

Safety Controller Market Report Coverage

| Market | Safety Controller Market |

| Safety Controller Market Size 2022 |

USD 14.49 Billion |

| Safety Controller Market Forecast 2032 | USD 21.11 Billion |

| Safety Controller Market CAGR During 2023 - 2032 | 4.3% |

| Safety Controller Market Analysis Period | 2020 - 2032 |

| Safety Controller Market Base Year |

2022 |

| Safety Controller Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, End Users, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | ASTRA Engineering & Construction L.L.C, Pilz Automation Safety L.P., KEYENCE INDIA PVT LTD, Rockwell Automation, Siemens, Schneider Electric, ABB Group, Omron, Treotham, Beckhoff, Toshiba, Panasonic, Mitsubishi, IDEC Corporation, and B&R Industrial. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Safety Controller Market Insights

The growth of the safety controller market is driven by increasing industrial automation and stringent safety standards. For instance, according to Association for Advancing Automation, deal volume in industrial automation has surged, rising by 85% in Q1 2023 compared to the same period in 2022. This increase is largely driven by the growing demand for advanced technologies like the Industrial Internet of Things (IIoT), which are creating substantial growth prospects. As industries adopt automated systems to enhance efficiency and productivity, the demand for advanced safety controllers to ensure safe operations rises. Stringent regulations and standards mandate the implementation of robust safety measures, further boosting the market.

The safety controller market faces significant restraints due to high initial costs and ongoing maintenance expenses. These financial barriers can deter smaller companies from investing in advanced safety systems, limiting market growth. Moreover, the need for regular updates and specialized technical support adds to the long-term financial burden. Consequently, these cost factors hinder widespread adoption and implementation of safety controllers across various industries.

The integration of IoT and AI in safety solutions enhances real-time monitoring and predictive analytics, leading to smarter and more responsive safety controllers. This advancement enables automated hazard detection, quick response to safety incidents, and improved decision-making. For instance, according to INDIAai, the integration of AI has emerged as a potent tool for enhancing safety across various industries. AI contributes to proactive safety measures, facilitates rapid response and emergency management. However, its implementation in safety protocols also raises ethical and societal concerns. Consequently, the safety controller market is experiencing significant growth due to the demand for more efficient and reliable safety systems. This trend reflects a broader move towards digitization and intelligent automation in industrial and consumer safety applications.

Safety Controller Market Segmentation

The worldwide market for safety controller is split based on type, end users, and geography.

Safety Controller Types

- Compact

- Modular

According to the safety controller industry analysis, compact safety controllers is expected to dominate due to their ease of integration and cost-effectiveness, making them suitable for small to mid-sized applications. Their all-in-one design reduces the need for additional components and simplifies the installation process. However, modular safety controllers offer flexibility and scalability, making them ideal for complex and larger systems where customization and future expansion are crucial. The choice between the two often depends on the specific requirements of the application and the scale of the safety system.

Safety Controller End Users

- Manufacturing

- Pharmaceutical

- Semiconductors

- Food and Beverage

- Automotive

- Electronics

- Aerospace & Defense

- Oil & Gas

- Others

According to the safety controller market forecast, the automotive and oil & gas industries shows notable growth in market as a end user. The automotive sector relies heavily on safety controllers for advanced driver assistance systems and autonomous driving technologies, ensuring vehicle safety and compliance with stringent regulations. Similarly, the oil and gas industry utilizes safety controllers to manage complex and hazardous processes, preventing accidents and ensuring operational integrity. Both sectors prioritize safety and regulatory compliance, driving significant demand for sophisticated safety control solutions.

Safety Controller Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

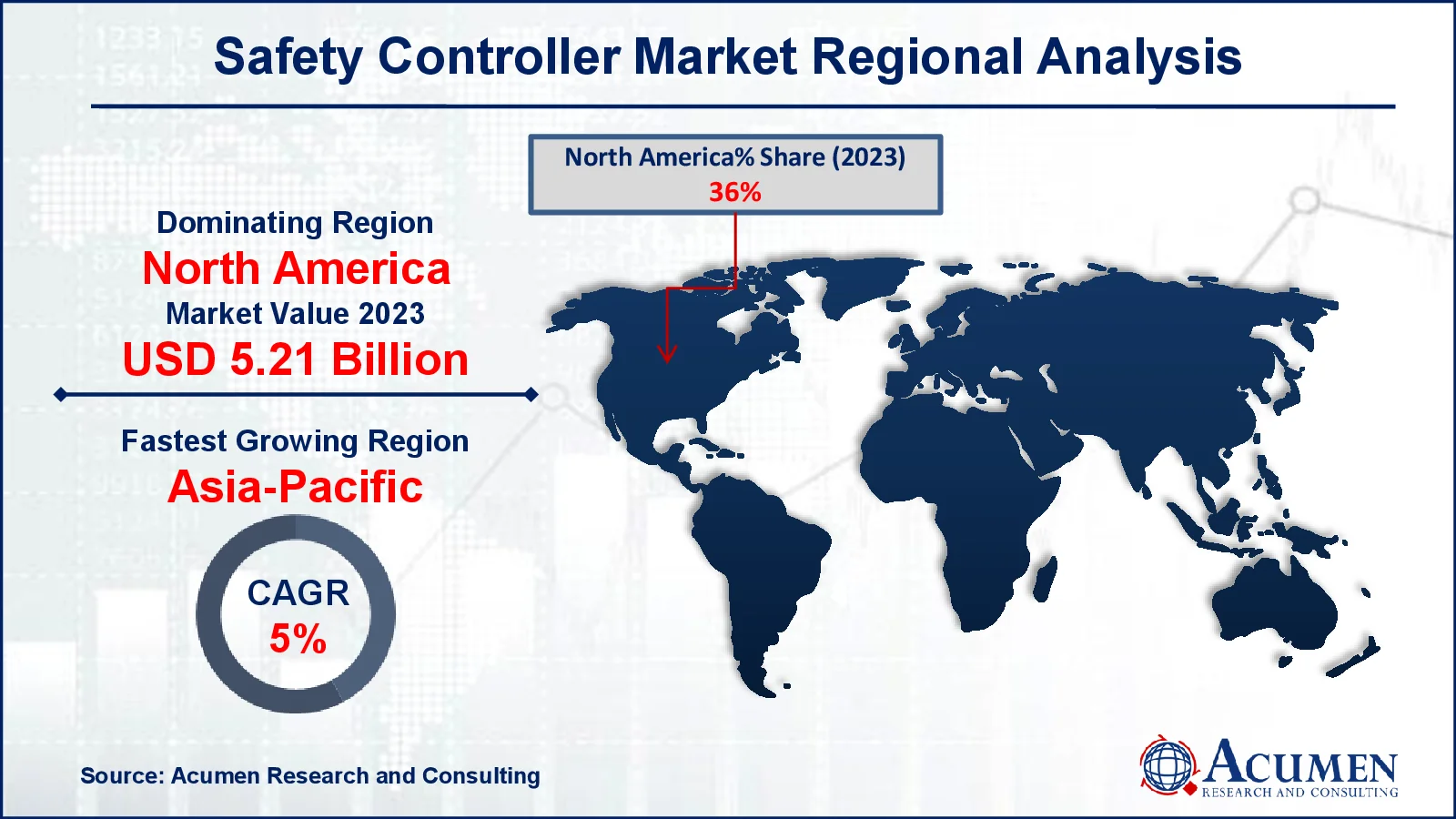

Safety Controller Market Regional Analysis

For several reasons, North America leads the safety controller market due to stringent industrial safety regulations and investment on U.S manufacturing infrastructure. For instance, according to Association of Advancing Automation, Siemens has revealed plans to invest over $500 Million in U.S. manufacturing focused on critical infrastructure in 2023. Specifically, the company will allocate $150 Million toward establishing a cutting-edge manufacturing facility in Dallas-Fort Worth, aimed at supporting American data centers and essential infrastructure needs. The region's focus on worker safety drives demand for sophisticated safety controllers that ensure compliance and enhance operational safety across industries. With a strong presence of key players and ongoing technological advancements, North America continues to innovate in safety controller solutions, catering to diverse industrial needs from automotive to pharmaceutical sectors.

In the safety controller market, the Asia-Pacific region has emerged as the fastest-growing due to increasing industrialization and stringent safety regulations. For instance, according to the National Bureau of Statistics (NBS), the value-added industrial output, a significant economic determine, increased by 4.6 percent compared to the previous year in 2023. Countries like China, Japan, and India are pivotal in this growth, driven by a rising focus on workplace safety across manufacturing sectors. This expansion is further fueled by investments in automation technologies aimed at enhancing operational safety and efficiency in industrial environments.

Safety Controller Market Players

Some of the top safety controller companies offered in our report include ASTRA Engineering & Construction L.L.C, Pilz Automation Safety L.P., KEYENCE INDIA PVT LTD, Rockwell Automation, Siemens, Schneider Electric, ABB Group, Omron, Treotham, Beckhoff, Toshiba, Panasonic, Mitsubishi, IDEC Corporation, and B&R Industrial.

Frequently Asked Questions

How big is the safety controller market?

The safety controller market size was valued at USD 14.49 billion in 2023.

What is the CAGR of the global safety controller market from 2024 to 2032?

The CAGR of safety controller is 4.3% during the analysis period of 2024 to 2032.

Which are the key players in the safety controller market?

The key players operating in the global market are including ASTRA Engineering & Construction L.L.C, Pilz Automation Safety L.P., KEYENCE INDIA PVT LTD, Rockwell Automation, Siemens, Schneider Electric, ABB Group, Omron, Treotham, Beckhoff, Toshiba, Panasonic, Mitsubishi, IDEC Corporation, and B&R Industrial.

Which region dominated the global safety controller market share?

North America held the dominating position in safety controller industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia Pacific region exhibited fastest growing CAGR for market of safety controller during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global safety controller industry?

The current trends and dynamics in the safety controller industry include increasing industrial automation and safety standards, growing demand for reliable and efficient safety systems, and technological advancements in safety controller systems.

Which type held the maximum share in 2023?

The compact type expected to hold the maximum share of the safety controller industry.