Pharmaceutical Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Pharmaceutical Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

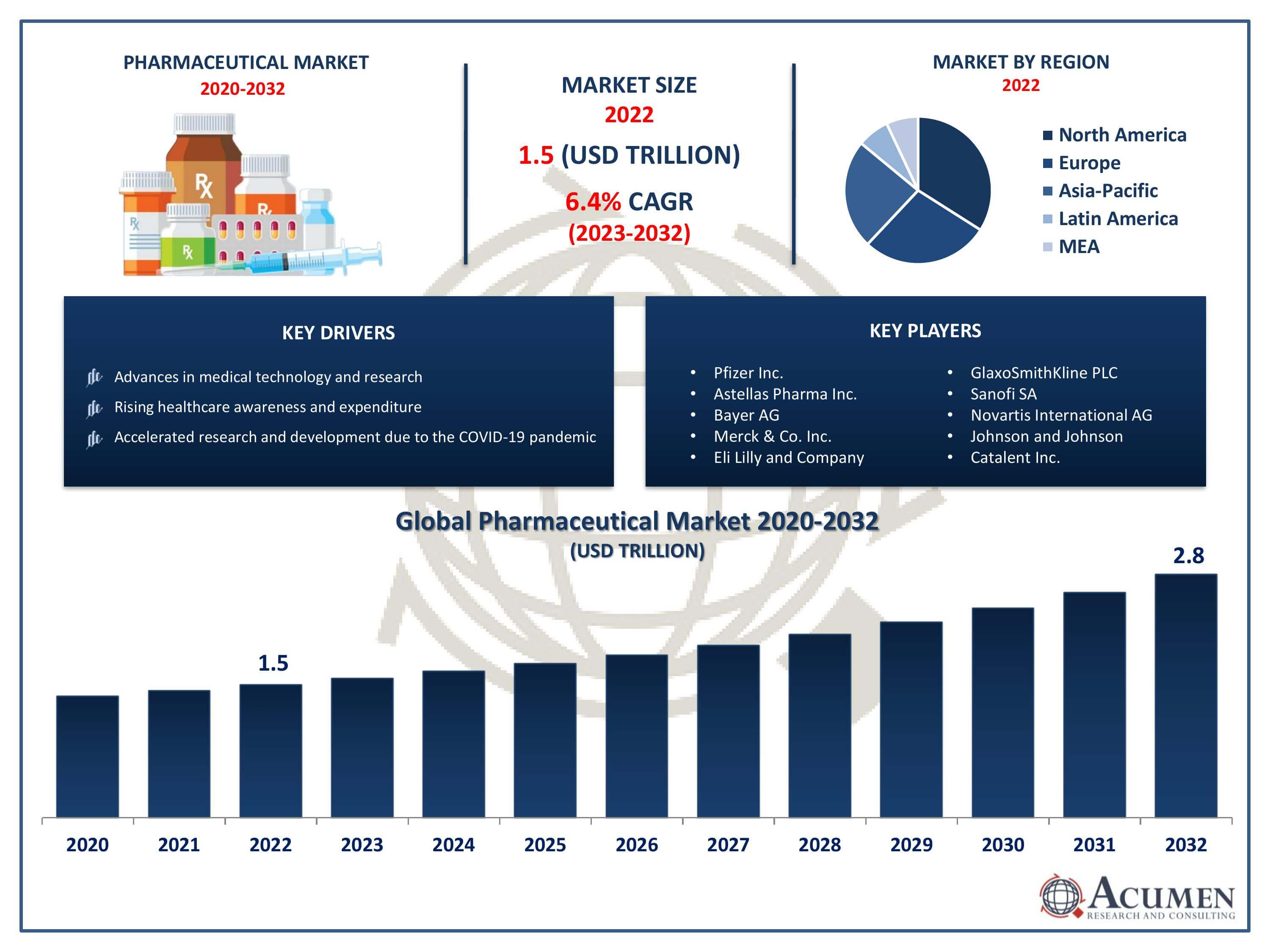

The Pharmaceutical Market Size accounted for USD 1.5 Trillion in 2022 and is projected to achieve a market size of USD 2.8 Trillion by 2032 growing at a CAGR of 6.4% from 2023 to 2032.

Pharmaceutical Market Highlights

- Global Pharmaceutical Market revenue is expected to increase by USD 2.8 Trillion by 2032, with a 6.4% CAGR from 2023 to 2032

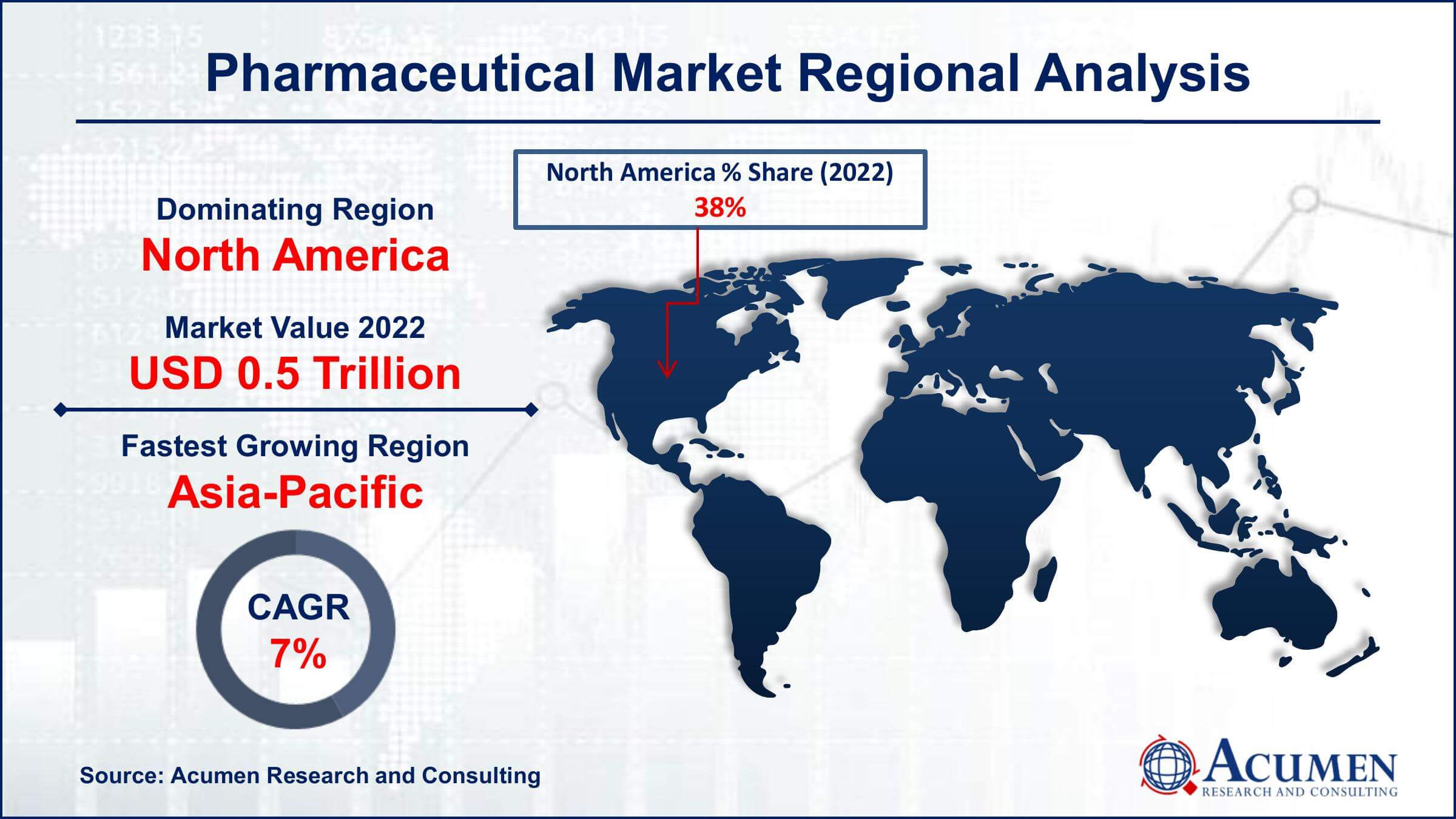

- North America region led with more than 38% of Pharmaceutical Market share in 2022

- Asia-Pacific Pharmaceutical Market growth will record a CAGR of more than 7.1% from 2023 to 2032

- By therapeutic category, the anti-diabetic segment is anticipated to grow at a CAGR of 6.7% during the forecast period

- By prescription type, the OTC drugs segment is projected to expand at the fastest CAGR over the projected period

- Rising geriatric population and increasing burden of chronic diseases, drives the Pharmaceutical Market value

Pharmaceuticals refer to drugs and medications used for the prevention, treatment, and diagnosis of diseases and medical conditions. The pharmaceutical industry plays a crucial role in healthcare by researching, developing, producing, and marketing these drugs. It encompasses a wide range of products, including prescription medications, over-the-counter drugs, vaccines, and biopharmaceuticals. The industry is characterized by stringent regulations, long research and development timelines, high investment in innovation, and a continuous quest for new and improved therapeutic solutions.

The pharmaceutical market has experienced significant growth in recent years, driven by factors such as an aging global population, increasing prevalence of chronic diseases, advancements in medical technology, and rising healthcare awareness and expenditure. Emerging markets, particularly in Asia and Latin America, have become key drivers of growth, with expanding middle-class populations seeking better access to healthcare. Additionally, the COVID-19 pandemic has accelerated research and development efforts, leading to the rapid approval and distribution of vaccines and therapeutics. However, the industry also faces challenges, including patent expirations, pricing pressures, and the need to address global health disparities. Overall, the pharmaceutical industry is expected to continue evolving as it adapts to new technologies, regulatory changes, and the ongoing demand for innovative healthcare solutions.

Global Pharmaceutical Market Trends

Market Drivers

- Aging global population and increasing prevalence of chronic diseases

- Advances in medical technology and research

- Rising healthcare awareness and expenditure

- Accelerated research and development due to the COVID-19 pandemic

Market Restraints

- Patent expirations and generic competition

- Pricing pressures and reimbursement challenges

Market Opportunities

- Innovation in biopharmaceuticals and personalized medicine

- Expanding digital health and telemedicine market

Pharmaceutical Market Report Coverage

| Market | Pharmaceutical Market |

| Pharmaceutical Market Size 2022 | USD 1.5 Trillion |

| Pharmaceutical Market Forecast 2032 | USD 2.8 Trillion |

| Pharmaceutical Market CAGR During 2023 - 2032 | 6.4% |

| Pharmaceutical Market Analysis Period | 2020 - 2032 |

| Base Year |

2022 |

| Forecast Data | 2023 - 2032 |

| Segments Covered | By Therapeutic Category, By Drug Type, By Prescription Type, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Takeda Pharmaceutical Company Limited, Pfizer Inc., Astellas Pharma Inc., Bayer AG, Merck & Co. Inc., Eli Lilly and Company, GlaxoSmithKline PLC, Sanofi SA, Novartis International AG, Johnson and Johnson, Catalent Inc., and Aspen Holdings. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Pharmaceuticals are substances used for medical purposes, encompassing a wide range of drugs, medications, and biologics designed to prevent, treat, or alleviate symptoms of diseases and medical conditions. These substances undergo rigorous research, development, testing, and regulatory approval processes to ensure their safety, efficacy, and quality. Pharmaceuticals can include prescription drugs, over-the-counter medications, vaccines, and biopharmaceuticals, with each category serving specific therapeutic purposes. The applications of pharmaceuticals are vast and diverse. They play a crucial role in maintaining and improving public health by addressing a multitude of medical conditions. Pharmaceuticals are used for pain management, infection control, chronic disease treatment, and prevention of illnesses through vaccines. They also contribute to advancements in personalized medicine, where treatments are tailored to an individual's genetic makeup for more effective and targeted results.

The pharmaceutical market has witnessed robust growth in recent years, driven by various factors that have shaped the industry landscape. One significant contributor to this growth is the increasing prevalence of chronic diseases and the aging global population. As people live longer, there is a higher demand for medications to manage and treat conditions such as cardiovascular diseases, diabetes, and cancer. This demographic shift, coupled with advancements in medical research and technology, has led to the development of innovative drugs and therapies, further propelling market expansion. Moreover, the COVID-19 pandemic has underscored the importance of the pharmaceutical industry, prompting accelerated research and development efforts. The rapid development and distribution of vaccines and therapeutics to combat the virus have showcased the industry's agility and responsiveness. This heightened focus on healthcare and the urgent need for medical solutions have not only addressed the immediate challenges posed by the pandemic but also highlighted the crucial role of pharmaceuticals in global public health.

Pharmaceutical Market Segmentation

The global Pharmaceutical Market segmentation is based on therapeutic category, drug type, prescription type, and geography.

Pharmaceutical Market By Therapeutic Category

- Anti-Infectives

- Gastrointestinal

- Cardiovascular

- Respiratory

- Anti Diabetic

- Dermatologicals

- Nervous System

- Musculo-Skeletal System

- Others

According to the pharmaceutical industry analysis, the anti-infectives segment accounted for the largest market share in 2022. One key contributor is the continual evolution of infectious diseases and the need for effective treatments. The emergence of drug-resistant strains of bacteria and viruses has heightened the demand for innovative anti-infective drugs to combat these evolving threats. The ongoing global efforts to address infectious diseases, including the recent challenges posed by the COVID-19 pandemic, have further underscored the importance of research and development in this segment. Advancements in biotechnology and molecular research have paved the way for the development of novel anti-infective agents, including antibiotics, antivirals, and antifungals. These breakthroughs have not only expanded the treatment options available but have also played a crucial role in addressing public health crises.

Pharmaceutical Market By Drug Type

- Generic

- Branded

In terms of drug types, the generic segment is expected to witness significant growth in the coming years. One of the primary catalysts is the expiration of patents for many branded drugs, leading to the entry of generic equivalents into the market. As patents expire, generic pharmaceutical companies can produce and sell these drugs at a lower cost, providing more affordable alternatives for patients and healthcare systems. This increased accessibility has contributed significantly to the expansion of the generic drug market. Cost containment efforts by healthcare providers, governments, and insurers have also fueled the growth of the generic segment. Generic drugs are often priced lower than their branded counterparts, making them an attractive option for cost-conscious consumers and healthcare systems aiming to reduce expenses.

Pharmaceutical Market By Prescription Type

- OTC Drugs

- Prescription Drugs

According to the pharmaceutical market forecast, the OTC drugs segment is expected to witness significant growth in the coming years. This growth is driven by various factors that cater to changing consumer preferences and healthcare trends. One key contributor to this growth is the increasing inclination towards self-care and the empowerment of consumers in managing their health. OTC drugs, which are available without a prescription, offer individuals the convenience of addressing common ailments and health concerns independently, contributing to the segment's expansion. Rising consumer awareness and education about OTC products, coupled with the ease of access through pharmacies and retail outlets, have further fueled market growth. Common OTC categories include pain relievers, cough and cold medications, digestive aids, and allergy treatments.

Pharmaceutical Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Pharmaceutical Market Regional Analysis

North America stands out as a dominating region in the pharmaceutical market, with several factors contributing to its prominent position. One key factor is the robust research and development infrastructure present in countries like the United States and Canada. These nations are home to numerous pharmaceutical companies, research institutions, and academic centers that consistently drive innovation in drug discovery and development. The high level of investment in cutting-edge technologies, coupled with a favorable regulatory environment, fosters the rapid introduction of new drugs and therapies, solidifying North America's leadership in the global pharmaceutical landscape. Moreover, the region benefits from a large and well-established healthcare system, with a substantial portion of healthcare expenditure allocated to pharmaceuticals. The high purchasing power of consumers and a strong focus on healthcare quality contribute to the widespread adoption of advanced and often more expensive pharmaceutical treatments. Additionally, North America has been at the forefront of responding to global health challenges, as demonstrated by its quick and comprehensive efforts during the COVID-19 pandemic.

Pharmaceutical Market Player

Some of the top pharmaceutical market companies offered in the professional report include Takeda Pharmaceutical Company Limited, Pfizer Inc., Astellas Pharma Inc., Bayer AG, Merck & Co. Inc., Eli Lilly and Company, GlaxoSmithKline PLC, Sanofi SA, Novartis International AG, Johnson and Johnson, Catalent Inc., and Aspen Holdings.

Frequently Asked Questions

How big is the pharmaceutical market?

The market size of pharmaceutical was USD 1.5 Trillion in 2022.

What is the CAGR of the global pharmaceutical market from 2023 to 2032?

The CAGR of pharmaceutical is 6.4% during the analysis period of 2023 to 2032.

Which are the key players in the pharmaceutical market?

The key players operating in the global market are including Takeda Pharmaceutical Company Limited, Pfizer Inc., Astellas Pharma Inc., Bayer AG, Merck & Co. Inc., Eli Lilly and Company, GlaxoSmithKline PLC, Sanofi SA, Novartis International AG, Johnson and Johnson, Catalent Inc., and Aspen Holdings.

Which region dominated the global pharmaceutical market share?

North America held the dominating position in pharmaceutical industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of pharmaceutical during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global pharmaceutical industry?

The current trends and dynamics in the pharmaceutical industry include aging global population and increasing prevalence of chronic diseases, advances in medical technology and research, and rising healthcare awareness and expenditure.

Which drug type held the maximum share in 2022?

The generic drug type held the maximum share of the pharmaceutical industry.