Residential Air Purifier Market Analysis - Global Industry Size, Share, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

Residential Air Purifier Market Analysis - Global Industry Size, Share, Trends and Forecast 2022 - 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

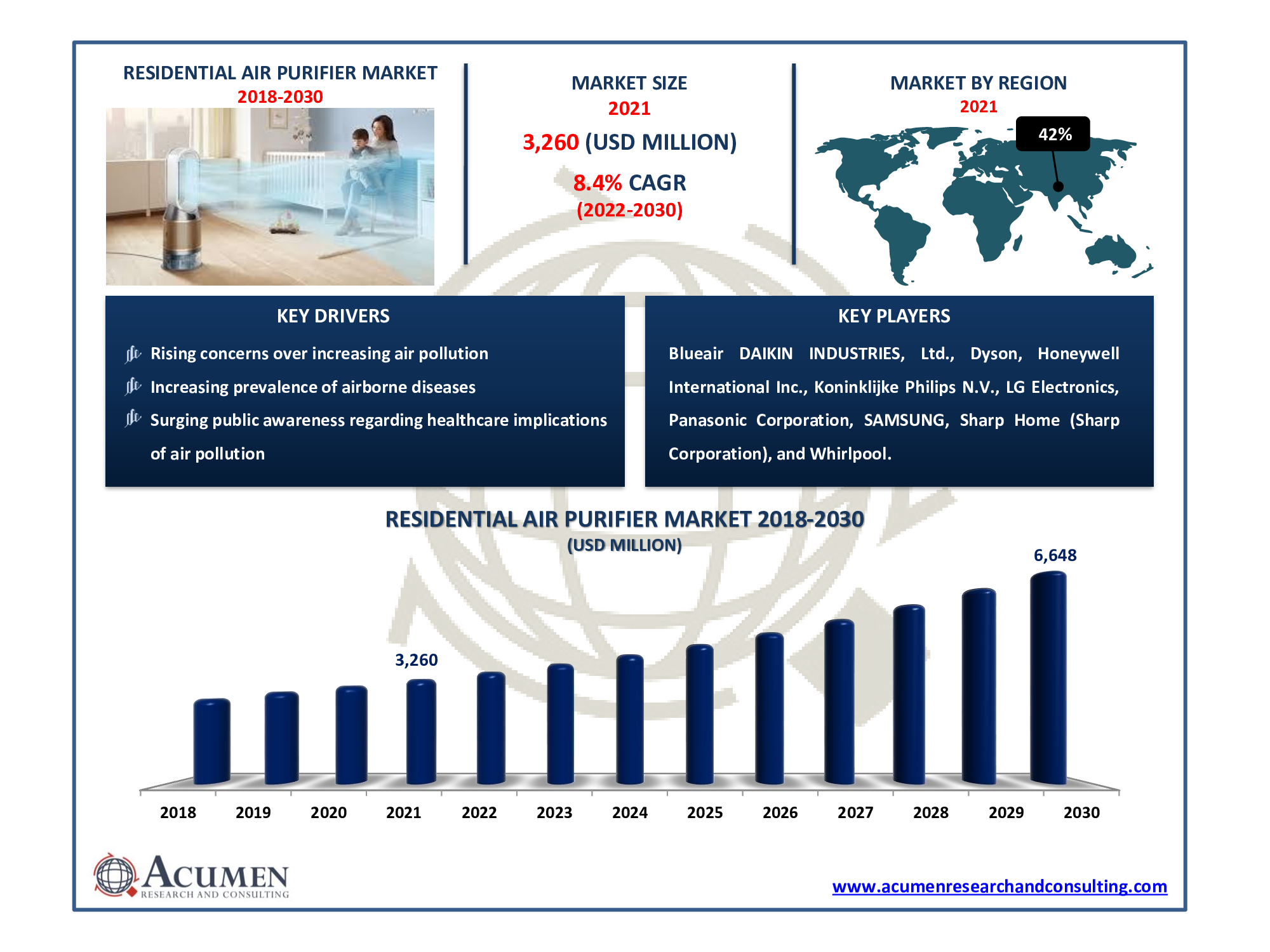

The Global Residential Air Purifier Market size accounted for USD 3,260 Million in 2021 and is estimated to reach USD 6,648 Million by 2030.

According to our residential air purifier industry analysis, the increase in indoor air pollution levels is the primary aspect driving the demand. In addition, the implementation of HEPA technology in air purifiers is one of the leading trends in the residential air purifier market. The worldwide residential air purifier market forecast that the industry is expected to register a CAGR of 8.4% throughout the projected years from 2022 to 2030. Air purifiers can refresh stale air, lowering the risk of health problems caused by indoor pollutants, which might cause respiratory infections, neurological issues, or aggravate asthma symptoms. Residential air purifiers are capable to remove multiple kinds of indoor air pollutants, thereby keeping the body healthy.

Residential Air Purifier Market Dynamics

Market Growth Drivers:

- Rising concerns over increasing air pollution

- Growing respiratory disorders due to polluted air

- Increasing prevalence of airborne diseases

- Surging public awareness regarding healthcare implications of air pollution

Market Restraints:

- High cost of these devices

- Complex nature of indoor pollutants

Market Opportunities:

- Favorable government regulations for effective air pollution monitoring & control

- Growing technological advancements in air purifiers

Report Coverage

| Market | Residential Air Purifier Market |

| Market Size 2021 | USD 3,260 Million |

| Market Forecast 2030 | USD 6,648 Million |

| CAGR During 2022 - 2030 | 8.4% |

| Analysis Period | 2018 - 2030 |

| Base Year | 2021 |

| Forecast Data | 2022 - 2030 |

| Segments Covered | By Type, By Technology, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Blueair (Unilever), DAIKIN INDUSTRIES, Ltd., Dyson, Honeywell International Inc., Koninklijke Philips N.V., LG Electronics, Panasonic Corporation, SAMSUNG, Sharp Home (Sharp Corporation), and Whirlpool. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

| Customization Scope |

10 hrs of free customization and expert consultation |

The worldwide residential air purifier market revenue is mainly generated by the rising concerns over increasing air pollution. According to the Environmental Protection Agency (EPA) report 2021, indoor air pollution is two to five times worse than outdoor pollution. This implies that indoor air can hold up to five times as many pollutants as outdoor air, such as pesticides, mold, and particulates. Allergens such as dust, pollen, and pet dander present in the air inside rooms can severely affect human respiratory systems. Thus, the demand for home air purifiers is high these days and is expected to continue this trend in the coming future.

The rising cases of respiratory disorders are expected to surge the residential air purifiers market growth. Air pollution is one of the most serious environmental threats to human health. Countries can reduce the burden of diseases caused by lung cancer, heart disease, stroke, and both acute and chronic respiratory diseases, including asthma, by lowering air pollution levels. In 2019, 99 percent of the world's population lived in areas where air quality guidelines set by the World Health Organization (WHO) were not met. Ambient (outdoor air pollution) was estimated to have caused 4.2 million premature deaths worldwide in 2016. Approximately 91% of that premature mortality occurred in low- and middle-income countries, with the greatest number occurring in the WHO South-East Asia and Western Pacific regions. As a result, there is growing awareness regarding indoor pollution, which eventually escalates the worldwide residential air purifier sales.

However, the high cost of these devices might be a constraint, especially in low and medium-income countries. In addition to that, the complex nature of indoor air pollutants makes them difficult for some home-based air purifiers, thereby creating a negative impact on the industry. Therefore, surging research & development activities to develop technologically advanced air purifiers are anticipated to provide lucrative growth opportunities for the market throughout the forecast timeframe from 2022 to 2030. For instance, in February 2022 - Panasonic unveiled its latest air purifier called as WhisperAir Repair Spot’. The device is easy to set up and requires no maintenance. WhisperAir Repair, which is portable and simple to use, keeps indoor air clean and fresh. Furthermore, during the COVID-19 pandemic, demand for residential air purifiers skyrocketed due to stay-at-home and work-from-home policies, though sales were halted in 2020 due to limited stock. However, it created significant awareness among the public from all over the world and after the lockdown lifted and manufacturing companies started their operations, the supply and demand for air purifiers normalized and started to increase rapidly.

Residential Air Purifier Market Segmentation

The global residential air purifier market segmentation is based on type, technology, and region.

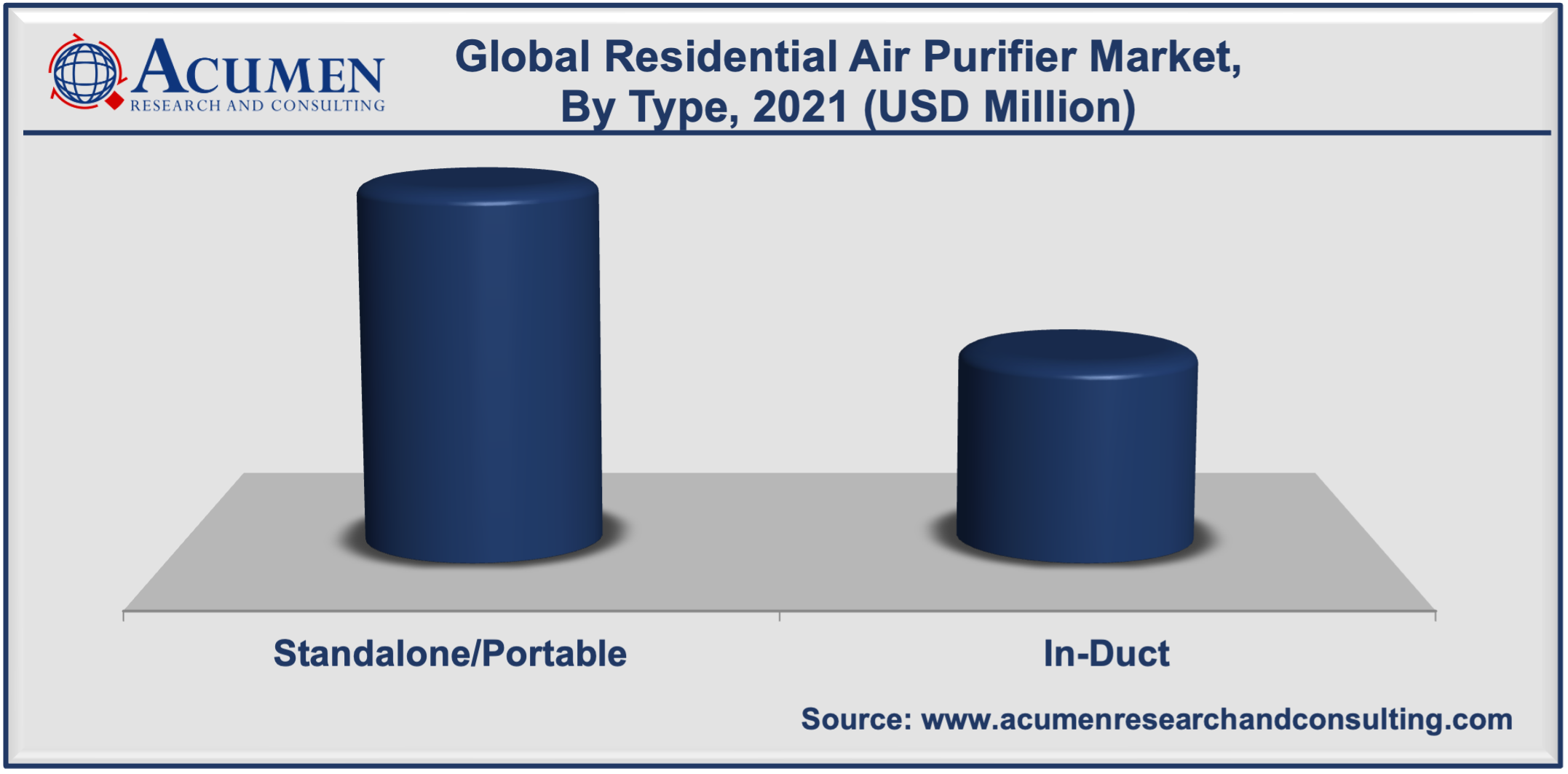

Residential Air Purifier Market By Type

- Standalone/Portable

- In-Duct

Based on types, the standalone/portable dominated the global residential air purifier market share in 2021. A standalone/portable air purifier allows people to breathe clean, sanitized air wherever they are. Portable air purifiers are ideal for people with asthma and allergies who must be on the go due to their job or lifestyle. Unlike large air purifiers that must be installed in specific locations, portable air purifiers are more adaptable because they do not require installation at all. Furthermore, portable air purifiers are simpler to clean and maintain since they are lightweight and not permanently installed.

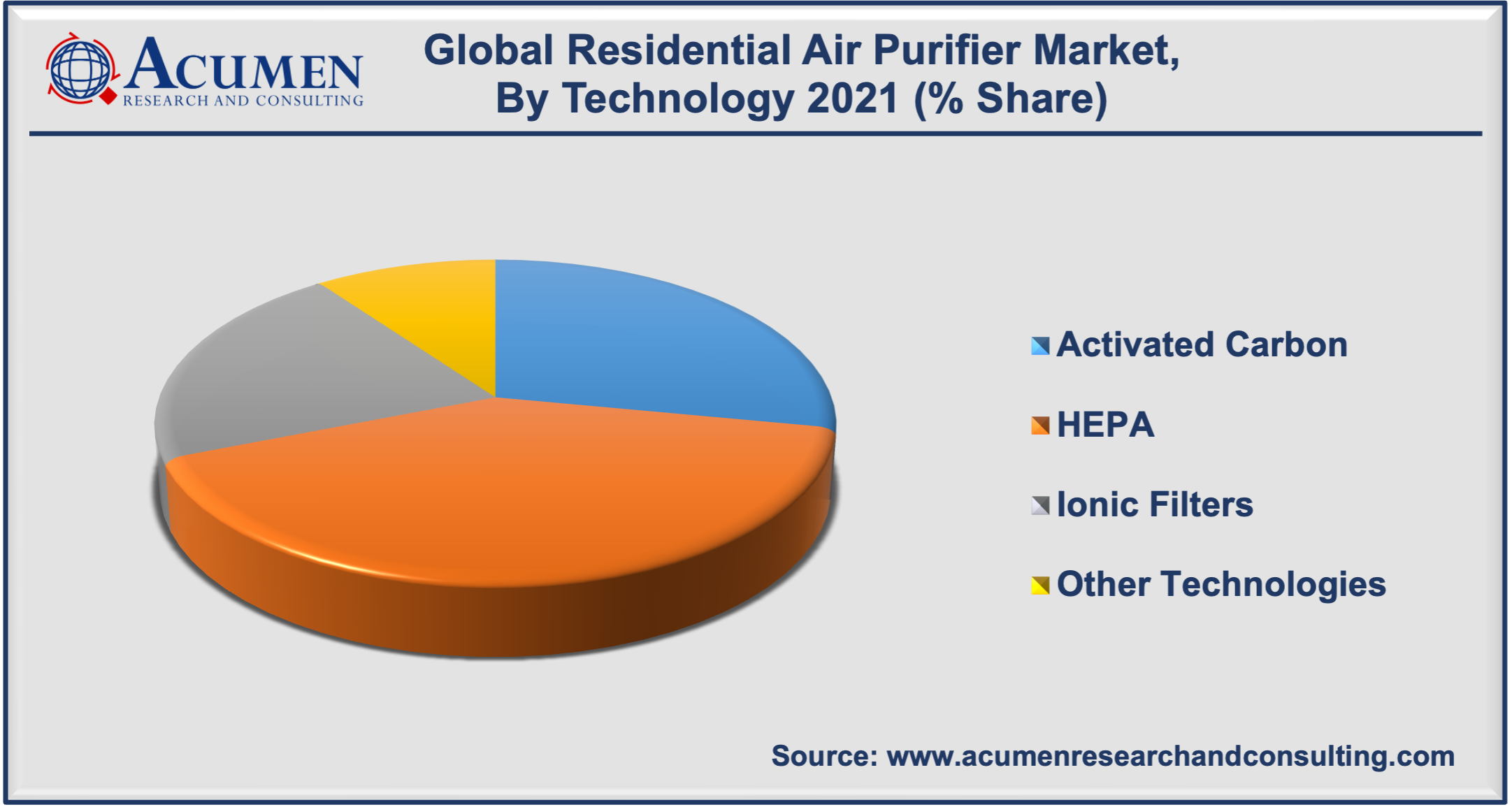

Residential Air Purifier Market By Technology

- Activated Carbon

- HEPA

- Ionic Filters

- Other Technologies

The High-efficiency Particulate Absorbing (HEPA)technology generated significant residential air purifier market revenue in 2021. Air purifiers with HEPA technology can eliminate 99.7% of the airborne particulate matter (PM) that circulates in your home. Most home air purifiers comprise HEPA filters, which are designed to catch all of these pollutants and enable to breathe clean air. HEPA filters are multi-layered meshes prepared of quality fiberglass threads as thin as hair strands. HEPA filters in air purifiers can capture pollutants as small as 0.3 microns. Human eyes cannot even see these tiny particles. The smallest visible particles are at least 50 or 60 microns in size.

Residential Air Purifier Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Latin America

- Mexico

- Brazil

- Rest of Latin America

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

The Middle East & Africa (MEA)

- Gulf Cooperation Council (GCC)

- South Africa

- Rest of the Middle East & Africa

Asia-Pacific Region Accumulated the Leading Market Share In 2021 Due To Rapid Urbanization And Industrialization

According to the residential air purifier regional outlook, Asia-Pacific holds a significant market share due to higher disposable income, environmental protection laws, massive industrialization, and increased pollution awareness. Additionally, the increasing manufacturing, transportation, processing, and many other industries that are polluting the region's air quality is also likely to create a significant impetus for the Asia-Pacific residential air purifier market. However, the North America region is expected to grow at a rapid pace over the forecast period.

Residential Air Purifier Market Players

Some of the top Residential Air Purifier companies offered in the professional report include Blueair (Unilever), DAIKIN INDUSTRIES, Ltd., Dyson, Honeywell International Inc., Koninklijke Philips N.V., LG Electronics, Panasonic Corporation, SAMSUNG, Sharp Home (Sharp Corporation), and Whirlpool.

Frequently Asked Questions

What was the market size of global residential air purifier market in 2021?

The global residential air purifier market size in 2021 accounted for USD 3,260 Million.

What will be the projected CAGR for global residential air purifier market during forecast period of 2022 to 2030?

The projected CAGR residential air purifier market during the analysis period of 2022 to 2030 is 8.4%.

Which are the prominent competitors operating in the market?

The prominent players of the global residential air purifier market involve Blueair (Unilever), DAIKIN INDUSTRIES, Ltd., Dyson, Honeywell International Inc., Koninklijke Philips N.V., LG Electronics, Panasonic Corporation, SAMSUNG, Sharp Home (Sharp Corporation), and Whirlpool.

Which region held the dominating position in the global residential air purifier market?

Asia-Pacific held the dominating share for residential air purifier during the analysis period of 2022 to 2030.

Which region exhibited the fastest growing CAGR for the forecast period of 2022 to 2030?

North America region exhibited fastest growing CAGR for residential air purifier during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global residential air purifier market?

Rising concerns over increasing air pollution, increasing prevalence of airborne diseases, and surging public awareness regarding healthcare implications of air pollution drives the growth of global residential air purifier market.

By segment type, which sub-segment held the maximum share?

Based on type, standalone/portable sub-segment held the maximum share for residential air purifier market in 2021.