Air Pollution Control System Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Air Pollution Control System Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

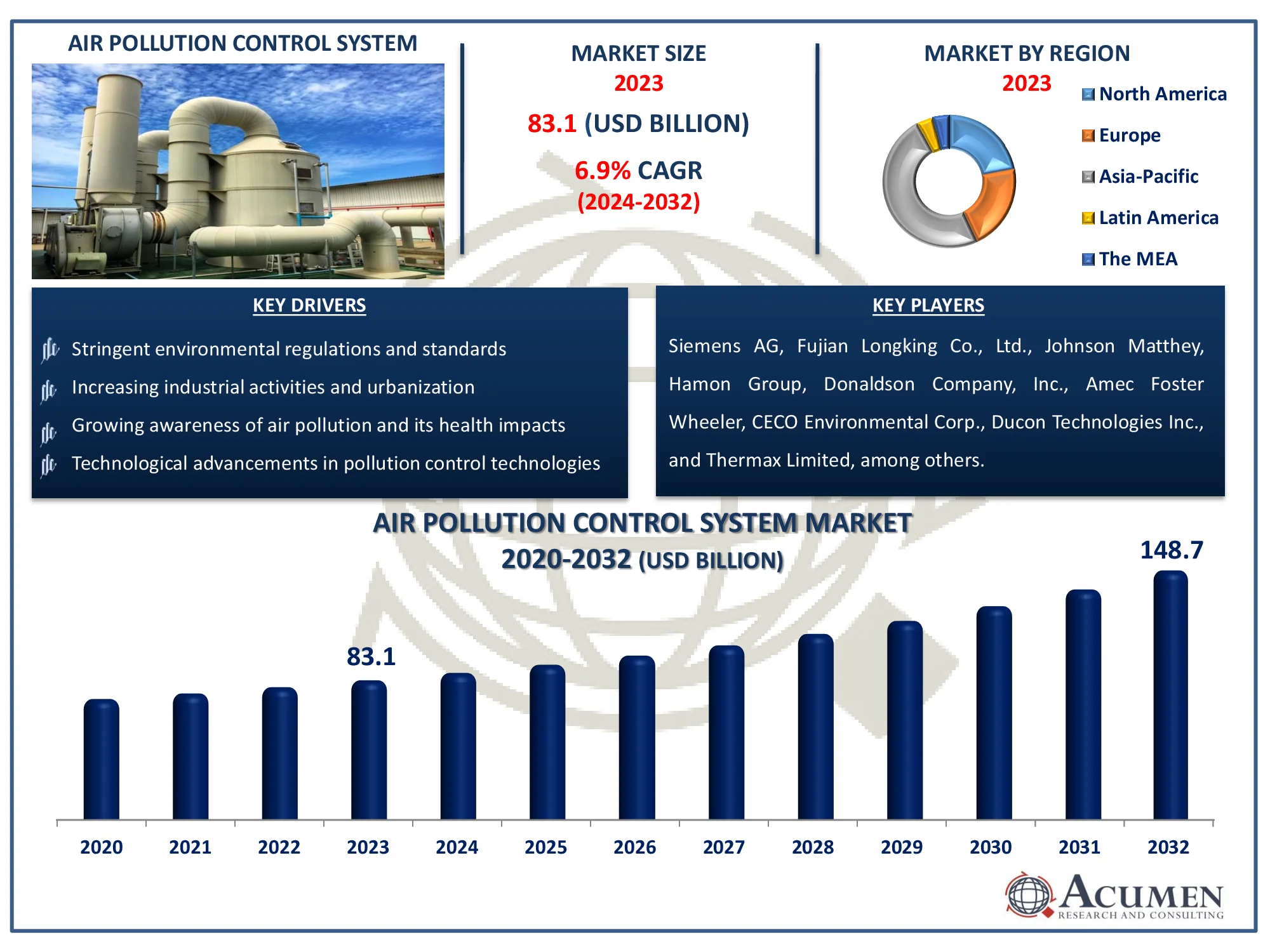

The Global Air Pollution Control System Market Size accounted for USD 83.1 Billion in 2023 and is estimated to achieve a market size of USD 148.7 Billion by 2032 growing at a CAGR of 6.9% from 2024 to 2032.

Air Pollution Control System Market Highlights

- Global air pollution control system market revenue is poised to garner USD 148.7 billion by 2032 with a CAGR of 6.9% from 2024 to 2032

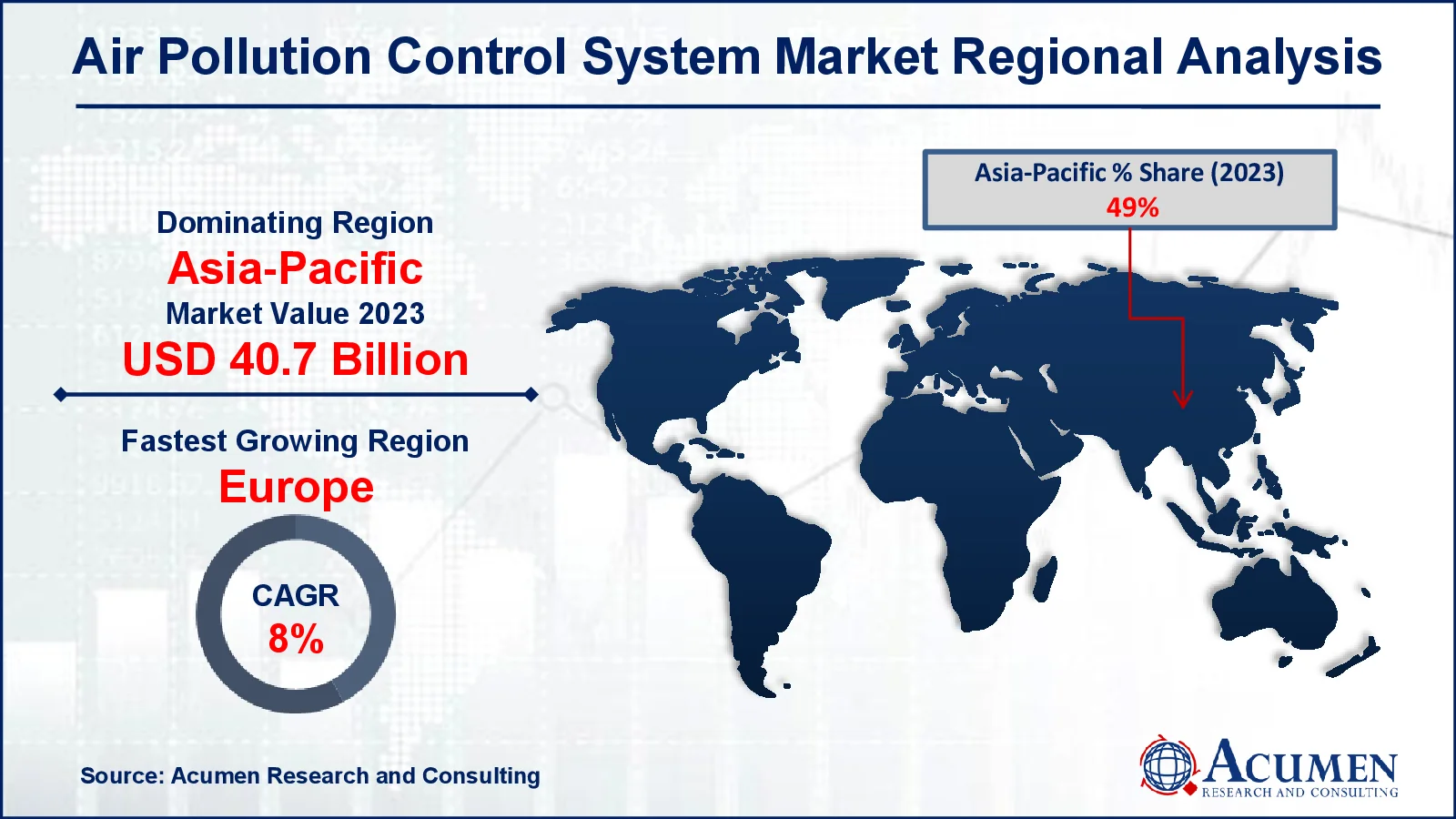

- Asia-Pacific air pollution control system market value occupied around USD 40.7 billion in 2023

- Europe air pollution control system market growth will record a CAGR of more than 8% from 2024 to 2032

- Among product, the electrostatic precipitators sub-segment generated noteworthy revenue in 2023

- Based on application, the power generation sub-segment generated significant air pollution control system market share in 2023

- Innovations in low-cost and efficient air pollution control technologies is a popular air pollution control system market trend that fuels the industry demand

An air pollution control system (APCS) is designed to manage and reduce pollutants emitted into the air from various industrial and commercial processes. These systems play a crucial role in minimizing the environmental impact of operations and ensuring compliance with regulatory standards aimed at protecting air quality. One common component of an APCS is the scrubber, which uses a liquid to absorb or neutralize airborne contaminants. Scrubbers are effective in removing gases and particulate matter from exhaust streams. Electrostatic precipitators are another key technology that employs electrical charges to collect and remove particulate matter from the air. These devices are particularly useful for capturing fine dust and smoke.

Baghouse filters are another essential component of APCS, utilizing fabric filters to capture particulate matter from exhaust gases. These filters are highly efficient in removing various types of particulates. Catalytic converters facilitate chemical reactions to convert harmful gases, such as nitrogen oxides (NOx) and carbon monoxide (CO), into less harmful substances like nitrogen and carbon dioxide. Cyclones are used to separate particulate matter from gas streams using centrifugal force, which helps in the effective collection of larger particles. Additionally, activated carbon systems are employed to absorb and remove volatile organic compounds (VOCs) and other pollutants from the air. These systems are effective in treating gases that are challenging to capture by other means.

Global Air Pollution Control System Market Dynamics

Market Drivers

- Stringent environmental regulations and standards

- Increasing industrial activities and urbanization

- Growing awareness of air pollution and its health impacts

- Technological advancements in pollution control technologies

Market Restraints

- High initial investment and maintenance costs

- Complex installation and operational requirements

- Limited availability of skilled personnel for system management

Market Opportunities

- Expansion of industrial and power generation sectors in emerging markets

- Growing demand for retrofit solutions in existing plants

- Rising focus on renewable energy and sustainable practices

Air Pollution Control System Market Report Coverage

| Market | Air Pollution Control System Market |

| Air Pollution Control System Market Size 2022 |

USD 83.1 Billion |

| Air Pollution Control System Market Forecast 2032 | USD 148.7 Billion |

| Air Pollution Control System Market CAGR During 2023 - 2032 | 6.9% |

| Air Pollution Control System Market Analysis Period | 2020 - 2032 |

| Air Pollution Control System Market Base Year |

2022 |

| Air Pollution Control System Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Siemens AG, Fujian Longking Co., Ltd., Johnson Matthey, Hamon Group, Donaldson Company, Inc., Amec Foster Wheeler, CECO Environmental Corp., Ducon Technologies Inc., Thermax Limited, Babcock & Wilcox Enterprises, Mitsubishi Hitachi Power Systems, and General Electric Company. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Air Pollution Control System Market Insights

Stringent Environmental Regulations and Standards

Air pollution control system market is the enforcement of stringent environmental regulations and standards. Governments and regulatory bodies worldwide have established strict guidelines to limit the amount of pollutants that can be emitted by industries and power plants. These regulations require companies to adopt advanced pollution control technologies to meet compliance. As a result, there is a growing demand for APCS solutions to help businesses adhere to these regulations. The increasing emphasis on reducing air pollution and protecting public health drives the adoption of effective air pollution control systems, leading to market growth.

High Initial Investment and Maintenance Costs

A significant restraint in the air pollution control system market is the high initial investment and maintenance costs associated with these systems. Installing advanced air pollution control technologies can require substantial capital expenditure, which can be a barrier for some companies, especially small and medium-sized enterprises. Additionally, maintaining these systems involves ongoing costs for repairs, replacements, and operation. The high financial commitment can discourage some businesses from investing in APCS, impacting the market's overall growth. The complexity and expense of these systems can be a challenge for industries looking to balance cost with environmental compliance.

Expansion of Industrial and Power Generation Sectors in Emerging Markets

An important opportunity for the air pollution control system market lies in the expansion of industrial and power generation sectors in emerging markets. As these regions experience rapid economic growth and industrialization, there is an increasing need for air pollution control technologies to manage the rising levels of emissions. Emerging markets are investing in infrastructure development and modernizing their industrial processes, which creates a significant demand for advanced APCS solutions. This expansion offers a lucrative opportunity for companies to enter new markets and provide their pollution control technologies to support sustainable growth and environmental protection in these regions.

Air Pollution Control System Market Segmentation

The worldwide market for air pollution control system is split based on product, application, and geography.

Air Pollution Control System (APCS) Market By Product

- Scrubbers

- Thermal Oxidizers

- Catalytic Converters

- Electrostatic Precipitators

- Others

According to air pollution control system industry analysis, electrostatic precipitators (ESPs) are expected to be the largest segment. ESPs are highly efficient filtration devices that remove fine particulates from gas streams. They are widely used in industries such as power generation, cement, steel, and paper, where there is a high emission of particulate matter. Their ability to handle large volumes of gas and remove up to 99% of particulates makes them a preferred choice for heavy industries. Additionally, stringent environmental regulations and growing awareness about air quality control further drive the demand for ESPs. The advancement in technology has also led to the development of more efficient and cost-effective ESPs, contributing to their dominant market position. The increasing industrialization and urbanization, especially in developing regions, are expected to boost the demand for ESPs, making this segment the largest in the air pollution control system market.

Air Pollution Control System (APCS) Market By Application

- Chemical

- Iron & Steel

- Power Generation

- Cement

- Others

In the air pollution control system market, the power generation segment is poised to hold a notable share. This is primarily driven by the sector's significant contribution to air pollution due to the combustion of fossil fuels. Power plants emit a range of pollutants, including sulfur dioxide (SO2), nitrogen oxides (NOx), and particulate matter, necessitating effective air pollution control systems to comply with stringent environmental regulations. The demand for clean energy solutions and the transition towards more sustainable practices have led to the adoption of advanced air pollution control technologies within this sector. Additionally, the growth of renewable energy sources, while reducing overall emissions, still requires efficient control systems for backup and auxiliary power generation processes. The increasing investments in upgrading and retrofitting existing power plants to meet environmental standards further enhance the market share of the power generation segment in the air pollution control system market.

Air Pollution Control System Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Air Pollution Control System Market Regional Analysis

In terms of air pollution control system market analysis, Asia-Pacific holds the leading position, primarily due to its rapid industrialization and urbanization. Countries such as China and India are major contributors to air pollution, driven by their extensive manufacturing sectors, coal-based power generation, and large-scale construction activities. The increasing awareness of environmental health impacts and stringent government regulations to control emissions has spurred significant investments in air pollution control technologies in this region. Moreover, the growing adoption of advanced air pollution control systems in response to rising public concern over air quality further cements Asia-Pacific's dominance in the air pollution control system market.

Europe is anticipated to be the fastest-growing region during the air pollution control system market forecast period. The region has long been at the forefront of environmental protection initiatives, driven by stringent regulations set by the European Union. The EU's commitment to reducing greenhouse gas emissions and improving air quality has led to substantial investments in air pollution control technologies across various industries. The transition towards renewable energy sources, coupled with strict emission standards for industrial and automotive sectors, has accelerated the demand for advanced air pollution control systems. Additionally, ongoing research and development activities and the implementation of innovative technologies contribute to the region's rapid growth. The focus on achieving carbon neutrality and sustainable development goals further propels Europe's expansion in the air pollution control system market.

Air Pollution Control System Market Players

Some of the top air pollution control system companies offered in our report includes Siemens AG, Fujian Longking Co., Ltd., Johnson Matthey, Hamon Group, Donaldson Company, Inc., Amec Foster Wheeler, CECO Environmental Corp., Ducon Technologies Inc., Thermax Limited, Babcock & Wilcox Enterprises, Mitsubishi Hitachi Power Systems, and General Electric Company.

Frequently Asked Questions

How big is the air pollution control system market?

The air pollution control system market size was valued at USD 83.1 billion in 2023.

What is the CAGR of the global air pollution control system market from 2024 to 2032?

The CAGR of air pollution control system is 6.9% during the analysis period of 2024 to 2032.

Which are the key players in the air pollution control system market?

The key players operating in the global market are including Siemens AG, Fujian Longking Co., Ltd., Johnson Matthey, Hamon Group, Donaldson Company, Inc., Amec Foster Wheeler, CECO Environmental Corp., Ducon Technologies Inc., Thermax Limited, Babcock & Wilcox Enterprises, Mitsubishi Hitachi Power Systems, and General Electric Company.

Which region dominated the global air pollution control system market share?

Asia-Pacific held the dominating position in air pollution control system industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Europe region exhibited fastest growing CAGR for market of air pollution control system during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global air pollution control system industry?

The current trends and dynamics in the air pollution control system industry include stringent environmental regulations and standards, increasing industrial activities and urbanization, growing awareness of air pollution and its health impacts, and technological advancements in pollution control technologies.

Which application held the maximum share in 2023?

The power generation application held the notable share of the air pollution control system industry.